Professional Documents

Culture Documents

ICICI Direct Instinct IDFCLtd PDF

ICICI Direct Instinct IDFCLtd PDF

Uploaded by

johnthomastOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICICI Direct Instinct IDFCLtd PDF

ICICI Direct Instinct IDFCLtd PDF

Uploaded by

johnthomastCopyright:

Available Formats

IDFC Ltd (IDFC)

CMP: | 28 Target: | 42 (50%) Target Period: 12 BUY

months months August 13, 2020

Upside potential led by value unlocking

In 2014, IDFC Ltd received a license to set up a universal bank – IDFC Bank.

To strengthen retail franchise, IDFC Bank, Capital First Ltd engaged in a

I-direct Instinct

merger to form IDFC First Bank in December 2018. Currently, IDFC Ltd holds

40% stake in IDFC First Bank. Apart from banking, IDFC Ltd owns a Mutual Particulars

Fund (100% owned). Its AUM stands at | 103893 crore of which equity AUM Am o u n t

– | 29609 crore as of March 2020). Ma rke t C a pita lisa tio n |4430 cro re

IDFC First Bank has been able to continue its restructuring plan increasing Ne two rth |8321 cro re

the granularity of balance sheet with retail now forming ~55% of advances. 52 we e k H /L 41/13

Continued focused build-up of CASA has increased its proportion to E quity ca pita l | 1596 cro re

upwards of 30%. Prudent provisioning and recent capital raising of | 2000

F a ce va lue |10

crore provides cushion from any hiccups in asset quality. Healthy growth in

the AMC business with strong inflow in debt schemes aided by consistent P ro mo te r (% ) 0

performance bodes well for the future earnings. D II H o lding (% ) 9.24

IDFC Ltd, as a promoter, holds 40% stake in IDFC First Bank with a lock-in F II H o lding (% ) 31.34

period of five years, which is ending as of September 2020. As per their O the rs 59.42

licence, the promoter has to bring down the stake to 15% in the bank within

ess

Key Highlights

15 years from 2014. An internal committee constituted by RBI to suggest

IDFC First Bank (40% stake)

future course for holding companies is scheduled to submit its report in continues to restructure balance

September 2020. IDFC Ltd may seek to collapse the current holding sheet thereby improving

company structure, if allowed by regulators whereby reverse merger into earnings

ICICI Securities – Retail Equity Research

bank will entail current IDFC Ltd shareholders to receive IDFC First bank Gradual uptick in AUM based on

shares and for AMC - cash on the expectation of same being sold off fully. If consistent performance bodes

well for AMC business

the above doesn’t materialise, then selling 25% stake to reach 15% in bank

is likely to bring down holding company discount as majority valuation of Lock-in of promoter stake in

bank ends in September 2020;

IDFC ltd will be driven by it holdings in AMC. In both situations we believe post which value unlocking to

existing shareholders of IDFC Ltd to benefit but may need patience as the lead to upside potential

value unlocking may take sometime. Assign BUY with target price of

| 42 per share

Valuation & Outlook

Post the lock-in ends in September 2020, IDFC Ltd (promoter) can bring

down its stake to 15% as required by the current guidelines or collapse the

current structure of holding company, if permitted by the internal committee

Report. Also, sale of IDFC bank stake and realisation of IDFC AMC true value

can also result in value unlocking. Thus, we believe in future course, the Research Analyst

holding company discount may reduce and one-time sale proceeds adds to Kajal Gandhi

net worth. Valuing the AMC business conservatively at 5% of AUM and kajal.gandhi@icicisecurities.com

providing multiple of 1x to FY22E ABV for IDFC bank for 15% stake held, we

Vishal Narnolia

arrive at a target price of | 42/share in Exhibit 2. Risk to our call will be non-

vishal.narnolia@icicisecurities.com

execution of 25% stake sale in bank holding/ AMC valuations decline

significantly. Yash Batra

yash.batra@icicisecurities.com

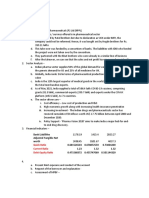

Exhibit 1: In case of sale of 25% stake in IDFC First Bank

H o ld in g B as is S take Mcap V alu e

ID F C F irst B a nk 1x F Y22E AB V 15% 17811.0 2671.7

ID F C AMC 5% o f AU M 100% 5150.0 5150.0

7821.7

H o ld C o disco unt 64%

V alu e p o s t D is co u n t 2815.8

P ro ce e ds fro m 25% sta ke sa le 3900.0

ID F C L im ited 6715.8

V alu e p er s h are 42.1

Source: Company, ICICI Direct Research

I-direct Instinct | IDFC Ltd ICICI Direct Research

Exhibit 2: Current Status at CMP of | 28

H o ld in g B as is S take Mcap V alu e

ID F C F irst B a nk 1x F Y22E AB V 40% 17811.0 7124.4

ID F C AMC 5% of AU M 100% 5150.0 5150.0

12274.4

H old C o discount 64%

ID F C L im ited 4374.0

Source: Company, ICICI Direct Research

Exhibit 3: Key Financials (Consolidated)

F Y17 F Y18 F Y19 F Y20

NII (|crore ) 16.3 9.2 17.6

Tota l R e ve nue (|crore ) 10392.5 670.1 340.7 355.5

Tota l C osts (|crore ) 8610.6 425.2 373.2 284.5

Ne t profit (|crore ) 699.1 779.7 -552.6 -976.5

E P S (|) 4.4 5.5 -5.2 -6.2

Ne tworth (|crore ) 10819.9 11276.0 10384.8 8320.7

Tota l Asse ts (|crore ) 117640.9 15602.3 10557.9 8569.1

B V pe r sha re (|) 67.8 70.6 65.1 52.1

P /E (x) 6.4 5.1 NA NA

P /B V (x) 0.4 0.4 0.4 0.5

R oE (% ) 6.5 6.9 -5.3 -11.7

R oA (% ) 0.6 5.0 -5.2 -11.4

Source: Company, ICICI Direct Research

IDFC First Bank

Exhibit 4: Advances growth to remain healthy for FY22E

140000 127876

120000 110400 112558 111152

107656 106140 107004 104050

100000

80000

60000

40000

20000

0

Q4FY19 Q1FY20 Q2FY20 Q3FY20 Q4FY20 Q1FY21 FY21E FY22E

Advances

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 32

I-direct Instinct | IDFC Ltd ICICI Direct Research

Exhibit 5: Shift towards retail faster than anticipated

100% 0.0 0.0 6.3

14.4 13.5 12.3 11.0 8.7

80%

37.0 39.7 44.7 48.5 63.2 63.5

60% 56.2 62.5

40%

20% 48.6 46.8 43.1 40.5 36.8 36.5 35.1 31.2

0%

Q4FY19 Q1FY20 Q2FY20 Q3FY20 Q4FY20 Q1FY21 FY21E FY22E

Corporate Retail Others

Source: Company, ICICI Direct Research

Exhibit 6: Robust deposit accretion; well ahead of guidance

100000 35.0 40.0

33.7 31.2

90000 31.7 35.0

80000

30.0

70000 24.1

60000 15.1 18.7 25.0

12.9

50000 20.0

40000 15.0

30000

10.0

20000

10000 5.0

0 0.0

Q4FY19 Q1FY20 Q2FY20 Q3FY20 Q4FY20 Q1FY21 FY21E FY22E

Deposits CASA

Source: Company, ICICI Direct Research

Exhibit 7: Asset quality concerns to remain an overhang

3.5 3.1

3.0 2.8 2.8

2.7 2.6 2.6

2.4

2.5

2.0

2.0

1.3 1.4 1.2

1.5 1.2

0.9 1.0

0.9

1.0

0.5

0.5

0.0

Q4FY19 Q1FY20 Q2FY20 Q3FY20 Q4FY20 Q1FY21 FY21E FY22E

GNPA NNPA

Source: Company, ICICI Direct Research

Exhibit 8: Margin improvement to sustain

5 4.53 4.4

4.24 4.3

4.5

3.86

4 3.43

3.5 3.03 3.01

3

2.5

2

1.5

1

0.5

0

Q4FY19 Q1FY20 Q2FY20 Q3FY20 Q4FY20 Q1FY21 FY21E FY22E

NIM

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 33

I-direct Instinct | IDFC Ltd ICICI Direct Research

Exhibit 9: Return ratios to improve gradually

2.0 20.0

14.4

1.5 15.0

1.0 6.7 10.0

0.5 2.3 5.0

0.7 1.5

0.0 0.2 0.0

FY19 -1.3

FY20 FY21E FY22E FY23E

-0.5 -5.0

-1.1

-1.0 -10.0

-13.1

-9.8

-1.5 -15.0

ROA ROE

Source: Company, ICICI Direct Research

IDFC AMC

Exhibit 10: Healthy growth in AUM (| crore)

F Y17 F Y18 F Y19 F Y20

E quity AU M 13773 19943 21995 29609

D e bt AU M 35124 37628 35756 63698

L iquid AU M 11992 12348 11496 10586

Tota l AU M 60636 69919 69248 103893

R e ve nue 310 277 306.1

% of AU M 0.51% 0.40% 0.29%

OPEX 213 210.4 198.7

P AT 97 54 43.7 79.4

% of AU M 0.16% 0.06% 0.08%

Source: Company, ICICI Direct Research

Exhibit 11: Price Chart

80 14000

70 12000

60 10000

50

8000

40

6000

30

20 4000

10 2000

0 0

Aug-17

Aug-18

Aug-19

Aug-20

Feb-18

Feb-19

Feb-20

IDFC Ltd Nifty Index

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 34

I-direct Instinct | IDFC Ltd ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavors to provide objective opinions and recommendations. ICICI Direct assigns ratings to its stocks

according to their notional target price vs. current market price and then categorizes them as Buy, Hold, Reduce and

Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts'

valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 35

I-direct Instinct | IDFC Ltd ICICI Direct Research

RATING CERTIFICATION

ANALYST RATIONALE

We /I, Kajal Gandhi, CA, Vishal Narnolia, MBA and Yash Batra, MBA, Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the

stocks according to their notional target price vs. current market price and then categorises them as Strong Buy,

specific recommendation(s) or view(s) in this report. It is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in

the report in the preceding twelve months and do not serve as an officer, director or employee of the companies mentioned in the report.

Buy, Hold and Sell. The performance horizon is two years unless specified and the notional target price is defined

as the analysts'

Terms valuation

& conditions for other

and a stockdisclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI

Securities Limited is a Sebi registered Research Analyst with Sebi Registration Number – INH000000990. ICICI Securities Limited Sebi Registration is INZ000183631 for stock broker. ICICI

Buy: >10%/15% for large caps/midcaps, respectively;

Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance,

general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com

Hold: Up to +/-10%;

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment

banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons

Sell: -10% or more;

reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly

confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no

obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate

that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where

ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness

guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe

for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat

recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy

is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own

investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign

exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily

a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ

materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Direct Research Desk,

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other

assignment in the past twelve months. ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

Road

for services in respect of managing or co-managing public offerings, Nofinance,

corporate 7, MIDC,investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction.

Andheri (East)

Mumbai

ICICI Securities or its associates might have received any compensation

mentioned in the report in the past twelve months.

– 400

for products 093other than investment banking or merchant banking or brokerage services from the companies

or services

research@icicidirect.com

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did

not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI

Securities nor Research Analysts and their relatives have any material conflict of interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day

of the month preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such

jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come

are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 37

You might also like

- MBF13e Chap10 Pbms - FinalDocument17 pagesMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- General Overview of IDFC FIRST BankDocument6 pagesGeneral Overview of IDFC FIRST Bankkishan kanojiaNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- IDFC First Initial (Key Note)Document26 pagesIDFC First Initial (Key Note)beza manojNo ratings yet

- Edelweiss Financial: Continuous Divestment in Key Subsidiaries ContinuesDocument7 pagesEdelweiss Financial: Continuous Divestment in Key Subsidiaries ContinuesAshish AwasthiNo ratings yet

- Yes Bank (Yes In) : Q3FY20 Result UpdateDocument7 pagesYes Bank (Yes In) : Q3FY20 Result UpdatewhitenagarNo ratings yet

- CA Inter FM ECO QP May 2023 @canotes - Ipcc TelegramDocument7 pagesCA Inter FM ECO QP May 2023 @canotes - Ipcc Telegramsurat49okNo ratings yet

- Seminar 6.1Document2 pagesSeminar 6.1Đạt PhạmNo ratings yet

- Morning 15oct20.15 10 2020 - 01 39 12Document8 pagesMorning 15oct20.15 10 2020 - 01 39 12fathur abrarNo ratings yet

- Mid 1 Questions (Except 405)Document4 pagesMid 1 Questions (Except 405)Raisha LionelNo ratings yet

- Wockhardt Limited: Management Discussion and Analysis ReportDocument5 pagesWockhardt Limited: Management Discussion and Analysis ReportpedrooshkaNo ratings yet

- Super Pack 2021-202012210856352449396Document25 pagesSuper Pack 2021-202012210856352449396QUALITY12No ratings yet

- Hotel Sector - Facing Turbulent TidesDocument5 pagesHotel Sector - Facing Turbulent TidesPaian JainNo ratings yet

- Financial Management and ApplicationDocument4 pagesFinancial Management and ApplicationAhmed Khan WarsiNo ratings yet

- ICICI Securities Power Finance Corporation Initiating CoverageDocument27 pagesICICI Securities Power Finance Corporation Initiating CoverageSudharsanNo ratings yet

- New Year Report 2021 HDFC SecuritiesDocument25 pagesNew Year Report 2021 HDFC SecuritiesSriram RanganathanNo ratings yet

- HDFC Securities Sees 24% UPSIDE in IDFC LTDDocument14 pagesHDFC Securities Sees 24% UPSIDE in IDFC LTDTarunNo ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- Financial-Planning-and-Budgeting-S-22 PaperDocument3 pagesFinancial-Planning-and-Budgeting-S-22 Paperrjyasir1985No ratings yet

- Ten Stock Picks Under 10x P/E: April 3, 2020Document10 pagesTen Stock Picks Under 10x P/E: April 3, 2020Sudhahar SudanthiranNo ratings yet

- CRB FinalsDocument3 pagesCRB FinalsPavitra BhagavatulaNo ratings yet

- Muhammad Mustafa 19051 Cherat Cement Company Limited Research ReportDocument16 pagesMuhammad Mustafa 19051 Cherat Cement Company Limited Research ReportMuhammad “Muhack” MustafaNo ratings yet

- SFM Dawn Merger and AcquisitionDocument29 pagesSFM Dawn Merger and AcquisitionAmnNo ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- L&T Finance Holdings - GeojitDocument4 pagesL&T Finance Holdings - GeojitdarshanmadeNo ratings yet

- Il&Fs Crisis: Failure of Corporate GovernanceDocument9 pagesIl&Fs Crisis: Failure of Corporate GovernanceRahul GargNo ratings yet

- RHB Bank BHD Outperform : Still ResilientDocument4 pagesRHB Bank BHD Outperform : Still ResilientAnn Gee YeapNo ratings yet

- TVS CreditDocument4 pagesTVS CreditAkhil RajNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiatilokiNo ratings yet

- Bec524 and Bec524e Test 2 October 2022Document5 pagesBec524 and Bec524e Test 2 October 2022Walter tawanda MusosaNo ratings yet

- Project FinanceDocument18 pagesProject FinanceJay RanvirNo ratings yet

- InvestmentTheory&PracticeExamJune, 2022FDocument9 pagesInvestmentTheory&PracticeExamJune, 2022Fbabie naaNo ratings yet

- MNCL Diwali PicksDocument12 pagesMNCL Diwali PicksRick DasNo ratings yet

- MPlastics Toys and Engineering Private LimitedDocument9 pagesMPlastics Toys and Engineering Private Limitedshihabshibu105No ratings yet

- MBA (2020-22) Trimester-II, End-Term Exaination, Feruary 2021Document6 pagesMBA (2020-22) Trimester-II, End-Term Exaination, Feruary 2021subhasis mahapatraNo ratings yet

- What We Published: January 2022Document29 pagesWhat We Published: January 2022prassna_kamat1573No ratings yet

- PVR LTD: Strong Fundamentals To Withstand UncertaintiesDocument4 pagesPVR LTD: Strong Fundamentals To Withstand UncertaintiesVinay HonnattiNo ratings yet

- Ramco WordDocument8 pagesRamco WordSomil GuptaNo ratings yet

- MSTC - Quick Bites - 2024-01-15Document5 pagesMSTC - Quick Bites - 2024-01-15Ranjan BeheraNo ratings yet

- IDFC Factsheet December 2019Document58 pagesIDFC Factsheet December 2019Nishant SinhaNo ratings yet

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- B1 B4 B5 MergedDocument64 pagesB1 B4 B5 MergedHussein AbdallahNo ratings yet

- MOCK P4 DecDocument5 pagesMOCK P4 DecHunainNo ratings yet

- Chapter Wise Board Question Mutual Fund: Sapan ParikhDocument6 pagesChapter Wise Board Question Mutual Fund: Sapan ParikhAnkitNo ratings yet

- Fitch Rating Mars 2019Document6 pagesFitch Rating Mars 2019MehdiNo ratings yet

- Adani Power Limited: Project FinanceDocument11 pagesAdani Power Limited: Project FinanceRajarshiRoyChoudhuryNo ratings yet

- Idfc First Bank: IndiaDocument35 pagesIdfc First Bank: IndiaPraveen PNo ratings yet

- Axis - Equity - Research - Report (A)Document1 pageAxis - Equity - Research - Report (A)TEERTH DHAKADNo ratings yet

- Satish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Strategic Financial ManagementDocument5 pagesSatish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Strategic Financial Managementshyam1985No ratings yet

- NBFC'S: Merge To SurviveDocument9 pagesNBFC'S: Merge To Survivekranti000No ratings yet

- BLSTR Q4FY20 ResultsDocument6 pagesBLSTR Q4FY20 ResultsAnkush AgrawalNo ratings yet

- Bharti AXA Life Insurance - R - 30042020Document8 pagesBharti AXA Life Insurance - R - 30042020Abhinav VijayNo ratings yet

- LSA Financial ManagementDocument16 pagesLSA Financial ManagementAlok AgrawalNo ratings yet

- Finance II Mid-Term Exam 2020Document4 pagesFinance II Mid-Term Exam 2020Yash KalaNo ratings yet

- Computer Age Management Services LTD (CAMS) : Mittal School of BusinessDocument25 pagesComputer Age Management Services LTD (CAMS) : Mittal School of BusinessVaishnavi KandukuriNo ratings yet

- Fitch - SBI - Ratings UpdateDocument3 pagesFitch - SBI - Ratings Updaterishi_sparkles100% (2)

- CF Assignment-1Document3 pagesCF Assignment-1atharvkelkar013No ratings yet

- FM RTP Merge FileDocument311 pagesFM RTP Merge FileAritra BanerjeeNo ratings yet

- HDFC AMC Initiation - 9april2019Document31 pagesHDFC AMC Initiation - 9april2019Sunita ShrivastavaNo ratings yet

- Model Test Paper 2023 Master FileDocument21 pagesModel Test Paper 2023 Master FileDinesh BabuNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Akhil StatesDocument2 pagesAkhil StatesjohnthomastNo ratings yet

- Air Water and WeatherDocument2 pagesAir Water and WeatherjohnthomastNo ratings yet

- Self - Reinforcing Business Model?: VP Chintan Baithak 2016Document9 pagesSelf - Reinforcing Business Model?: VP Chintan Baithak 2016johnthomastNo ratings yet

- Importance of Elections in DemocracyDocument1 pageImportance of Elections in DemocracyjohnthomastNo ratings yet

- SageOne Investor Memo Aug 2020 PDFDocument10 pagesSageOne Investor Memo Aug 2020 PDFjohnthomastNo ratings yet

- Spiderman EssayDocument1 pageSpiderman EssayjohnthomastNo ratings yet

- Secret SevenDocument3 pagesSecret SevenjohnthomastNo ratings yet

- Bharat Shah Book PDFDocument244 pagesBharat Shah Book PDFjohnthomastNo ratings yet

- Magical GlassesDocument1 pageMagical GlassesjohnthomastNo ratings yet

- 2015 - Ananth Shenoy-Generics Pharma Pipeline BasicsDocument21 pages2015 - Ananth Shenoy-Generics Pharma Pipeline BasicsjohnthomastNo ratings yet

- 2015 - Art of Investing - Donald FrancisDocument11 pages2015 - Art of Investing - Donald FrancisjohnthomastNo ratings yet

- INVESTMENT JOURNEY - Gaurav Sud - VP CHINTAN BAITHAK - GOA 2015 PDFDocument15 pagesINVESTMENT JOURNEY - Gaurav Sud - VP CHINTAN BAITHAK - GOA 2015 PDFjohnthomastNo ratings yet

- 2015 - INVESTMENT JOURNEY - Davuluri Omprakash PDFDocument10 pages2015 - INVESTMENT JOURNEY - Davuluri Omprakash PDFjohnthomastNo ratings yet

- INVESTMENT JOURNEY - Donald Francis - VP CHINTAN BAITHAK - GOA 2015Document11 pagesINVESTMENT JOURNEY - Donald Francis - VP CHINTAN BAITHAK - GOA 2015johnthomastNo ratings yet

- Diversified Investing - Ayush MittalDocument28 pagesDiversified Investing - Ayush Mittaljohnthomast100% (1)

- Confessions of A Value Investor - A Few Lessons in Behavioral FinanceDocument327 pagesConfessions of A Value Investor - A Few Lessons in Behavioral FinanceZerohedge95% (22)

- Deep Value or Value TrapDocument93 pagesDeep Value or Value TrapjohnthomastNo ratings yet

- Berkshire Reports PDFDocument146 pagesBerkshire Reports PDFjohnthomastNo ratings yet

- Naveen Is The Pet Name of Thomas John. I Am Studying in Hiranandani SchoolDocument1 pageNaveen Is The Pet Name of Thomas John. I Am Studying in Hiranandani SchooljohnthomastNo ratings yet

- Mutual Fund and Insurance SellingDocument39 pagesMutual Fund and Insurance SellingsashumaruNo ratings yet

- Most Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Document2 pagesMost Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Venkatesh W0% (1)

- OVHC Claim Form 102017 PDFDocument3 pagesOVHC Claim Form 102017 PDFtarmudiNo ratings yet

- BWBS3043 Chapter 7 TakafulDocument30 pagesBWBS3043 Chapter 7 TakafulcorinnatsyNo ratings yet

- IGNOU Assignment GURU Page No. 1Document12 pagesIGNOU Assignment GURU Page No. 1Aman VermaNo ratings yet

- Rukato The Adoption of Big Data Analytics in The Medical Insurance IndustryDocument78 pagesRukato The Adoption of Big Data Analytics in The Medical Insurance Industrycouragemutamba3No ratings yet

- Guide To Cargo InsDocument36 pagesGuide To Cargo Insmib_santoshNo ratings yet

- A LifeLinkDocument18 pagesA LifeLinkFathiBestNo ratings yet

- SLR CONSULTING LIMITED Sub-Consultant's Agreement V3.1Document20 pagesSLR CONSULTING LIMITED Sub-Consultant's Agreement V3.1borrowmanaNo ratings yet

- Show MultidocsDocument35 pagesShow MultidocsWCYB DigitalNo ratings yet

- Signature Assign DraftDocument9 pagesSignature Assign Draftapi-589324815No ratings yet

- Report Income Protection and Educational PlanningDocument4 pagesReport Income Protection and Educational PlanningSyai GenjNo ratings yet

- Marine InsuranceDocument8 pagesMarine InsuranceSandeep Kumar BNo ratings yet

- 50 Sun Life Office, Ltd. vs. Court of AppealsDocument4 pages50 Sun Life Office, Ltd. vs. Court of AppealsMae MaihtNo ratings yet

- Stock Price Simulation in RDocument37 pagesStock Price Simulation in Rthcm2011100% (1)

- CB Insights - P&C Insurance BriefingDocument60 pagesCB Insights - P&C Insurance BriefingDipak SahooNo ratings yet

- Transcript: Sit-In Phone Call W/ Sen. Cory Gardner - July 6, 2017Document6 pagesTranscript: Sit-In Phone Call W/ Sen. Cory Gardner - July 6, 2017Indivisible Denver CD1No ratings yet

- Treatment To GST While Assessing A LossDocument3 pagesTreatment To GST While Assessing A LossAmit BakleNo ratings yet

- Compromise Agreement Template FormDocument3 pagesCompromise Agreement Template FormMarycris OrdestaNo ratings yet

- JAMES STOKES vs. MALAYAN INSURANCE CO., INC., G.R. No. L-34768Document2 pagesJAMES STOKES vs. MALAYAN INSURANCE CO., INC., G.R. No. L-34768kent babsNo ratings yet

- 20007CERTIFICATEDocument7 pages20007CERTIFICATEDio Adella Maulana HasanahNo ratings yet

- A Partial Adjusted Trial Balance Follows For Nolet LTD atDocument2 pagesA Partial Adjusted Trial Balance Follows For Nolet LTD atMiroslav GegoskiNo ratings yet

- 2022-11-28PDF 221128 104454Document2 pages2022-11-28PDF 221128 104454Andreea ChiriţăNo ratings yet

- Niramaya FaqDocument4 pagesNiramaya FaqAnonymous TD99UqSLNo ratings yet

- Aircraft Operating Cost ReportDocument20 pagesAircraft Operating Cost ReportFrank Lamparski100% (3)

- Chapter ThreeDocument15 pagesChapter Three108 AnirbanNo ratings yet

- Accommodation in Wolfson CollegeDocument48 pagesAccommodation in Wolfson CollegeAnonymous 84SDqAVLPnNo ratings yet

- Insurance Frauds: Prepared by Jaswanth Singh GDocument28 pagesInsurance Frauds: Prepared by Jaswanth Singh GJaswanth Singh RajpurohitNo ratings yet

- Alfalah Auto Loan: Policy One PagerDocument1 pageAlfalah Auto Loan: Policy One PagerbilalasifNo ratings yet