Professional Documents

Culture Documents

Ne 05SQ PDF

Ne 05SQ PDF

Uploaded by

chandan kumar SinghCopyright:

Available Formats

You might also like

- Sales 56Document1 pageSales 56mahendar chuphalNo ratings yet

- Taco 200716DF00030038Document1 pageTaco 200716DF00030038Frank Edwin VedamNo ratings yet

- Shope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851Document1 pageShope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851cnanda89No ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnjani KumariNo ratings yet

- Sales 67Document1 pageSales 67mahendar chuphalNo ratings yet

- Taco 0016102052100024Document1 pageTaco 0016102052100024youparthaNo ratings yet

- TCL BillDocument3 pagesTCL BillYoginder SinghNo ratings yet

- 056Document1 page056Dipak KotkarNo ratings yet

- Listing DetailsDocument2 pagesListing DetailsArun DevNo ratings yet

- Inv WBL Insha Hp0099Document4 pagesInv WBL Insha Hp0099digitalseva.japanigateNo ratings yet

- Invoice Geyser 2Document2 pagesInvoice Geyser 2archisman gayenNo ratings yet

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocument3 pagesINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoicemarketbus12No ratings yet

- Invoice 7110200329Document1 pageInvoice 7110200329kaku131295No ratings yet

- 1574 PDFDocument1 page1574 PDFAnonymous APW3d6gfd100% (1)

- Bhawani Polymers (India) 36Document1 pageBhawani Polymers (India) 36Rishab BansalNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Floresta RMC InvoiceDocument1 pageFloresta RMC InvoiceBabuNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Tax Invoice: Easymix Concrete Solution 1 1-Feb-2023Document1 pageTax Invoice: Easymix Concrete Solution 1 1-Feb-2023amit chouguleNo ratings yet

- Sudheer - Haldia Direct Invoice Dtd. 14.02.2022Document1 pageSudheer - Haldia Direct Invoice Dtd. 14.02.2022Amdiyala EnterprisesNo ratings yet

- bjs16 PDFDocument2 pagesbjs16 PDFMayank UkaniNo ratings yet

- HightDocument1 pageHightjaikant.hccNo ratings yet

- HavelsswitchsdfsdfDocument1 pageHavelsswitchsdfsdfDeepakNo ratings yet

- Trio Magic InfraDocument1 pageTrio Magic Infratriomagic.7860No ratings yet

- Accounting VoucherDocument1 pageAccounting Voucheradposting wNo ratings yet

- APPPLDocument2 pagesAPPPLtaxsachin16No ratings yet

- Adobe Scan 29 Jul 2021Document1 pageAdobe Scan 29 Jul 2021VALATHOTTIC KUTTAPATA SAJINo ratings yet

- Original For Recipient Duplicate For Transporter Triplicate For SupplierDocument1 pageOriginal For Recipient Duplicate For Transporter Triplicate For SupplierKarthik TNo ratings yet

- 4087219755Document1 page4087219755devta1111No ratings yet

- Babar - Dna JunDocument1 pageBabar - Dna JunAbhijeetNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPapia ChandaNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- Moksh 171Document1 pageMoksh 171mahajansagar746No ratings yet

- West Bengal - 721432, India Gstin/Uin: 19BDRPR8077B1ZW State Name: West Bengal, Code: 19Document1 pageWest Bengal - 721432, India Gstin/Uin: 19BDRPR8077B1ZW State Name: West Bengal, Code: 19sontupradhan458No ratings yet

- Nandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceDocument1 pageNandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceManish ShawNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- Invoice OR2301228571Document2 pagesInvoice OR2301228571Subhajit BhoiNo ratings yet

- SG112Document1 pageSG112rohanNo ratings yet

- Instronix Process ControlsDocument1 pageInstronix Process Controlsinfo -ADDMASNo ratings yet

- Taco 240408SU00065543Document1 pageTaco 240408SU00065543youparthaNo ratings yet

- InvertedDocument2 pagesInvertedShrikant KeskarNo ratings yet

- 0245 (22-23) (Harshpriya)Document1 page0245 (22-23) (Harshpriya)Ravikant MishraNo ratings yet

- 0269 (22-23) (Harshpriya)Document1 page0269 (22-23) (Harshpriya)Ravikant MishraNo ratings yet

- Bill 1391 PDFDocument1 pageBill 1391 PDFDeep GuptaNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicemanmojilo4 bharwadNo ratings yet

- Rahee Qu 47Document2 pagesRahee Qu 47nikhilNo ratings yet

- Tax Invoice: Amg Polychem PVT - LTDDocument3 pagesTax Invoice: Amg Polychem PVT - LTDARPIT MAHESHWARINo ratings yet

- RLLPB1Document3 pagesRLLPB101shreyaNo ratings yet

- TPI ChargesDocument1 pageTPI ChargesPrem KumarNo ratings yet

- Tax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDDocument1 pageTax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDSrikanth BhaskaraNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherDhananjay PatilNo ratings yet

- 5-Feb Order 2Document1 page5-Feb Order 2Arnav JoshiNo ratings yet

- HSRP1Document2 pagesHSRP1surajbk.ec21No ratings yet

- BBD2446982Document1 pageBBD2446982Shivansh PatelNo ratings yet

- BLR 903 PDFDocument1 pageBLR 903 PDFAthahNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherDIPL MUMBAINo ratings yet

- QTL Inv Q2-2022Document2 pagesQTL Inv Q2-2022irshad khanNo ratings yet

- Accounting Voucher Display - Sales - 658Document1 pageAccounting Voucher Display - Sales - 658renukm07No ratings yet

- Taco 240408PF01089904Document1 pageTaco 240408PF01089904youparthaNo ratings yet

- CWDM Mux-DemuxDocument6 pagesCWDM Mux-Demuxchandan kumar SinghNo ratings yet

- DVC Tender PDFDocument51 pagesDVC Tender PDFchandan kumar SinghNo ratings yet

- Syrotech 80Km CWDM SFP+ Optical Transceiver Goxp-Cwdmxx96-80Document9 pagesSyrotech 80Km CWDM SFP+ Optical Transceiver Goxp-Cwdmxx96-80chandan kumar SinghNo ratings yet

- User Instructions For Sacfa ModuleDocument8 pagesUser Instructions For Sacfa Modulechandan kumar SinghNo ratings yet

- Netengine 8000 M1A Service Router Data SheetDocument11 pagesNetengine 8000 M1A Service Router Data Sheetchandan kumar SinghNo ratings yet

- Recovery Agency List For Housing Finance PDFDocument3 pagesRecovery Agency List For Housing Finance PDFchandan kumar SinghNo ratings yet

- Documents For IPTV Permission - 1Document2 pagesDocuments For IPTV Permission - 1chandan kumar SinghNo ratings yet

Ne 05SQ PDF

Ne 05SQ PDF

Uploaded by

chandan kumar SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ne 05SQ PDF

Ne 05SQ PDF

Uploaded by

chandan kumar SinghCopyright:

Available Formats

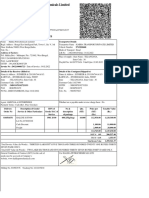

Tax Invoice

Gundecha Infocom Invoice N0. GI/20-21/KV/3022 Dated

Office-Unit NO 402 715 ,HN ,Commercial Complex ,Akurli Road 15-July-2020

Kandivali East Mumbai 400101

Ware House-Unit NO 402 715 ,HN ,Commercial Complex ,Akurli Delivery Note Mode/Terms of Payment

Road Kandivali East Mumbai 400101.Maharashtra GSTIN/UIN: GI/20-21/KV/3022

27AVCPG0105B1ZK

State Name : Maharashtra, Code : 27

E-Mail : raj.gundecha@gundechagroup.net

Supplier's Ref. Other Reference(s)

GI/20-21/KV/3022

Consignee Buyer's Order No. Dated :

MFT INFO SERVICES PVT LTD On mail

46/5,N S Road,Liluah,HOWRAH,West Bangal-711204

GSTIN/UIN : 19AAICM6405G1ZE Despatch Document 15-july-2020

State : Kolkata , Code : 19 No.GI/20-21/KV/3022

Place of supply : Kolkata Direct delivery KV/20-21/Kolkata

Terms of Delivery

Buyer (if other than consignee)

Delivery as percustomer instructions

MFT INFO SERVICES PVT LTD Product warrenty :Standard

46/5,N S Road,Liluah,HOWRAH,West Bangal-711204

GSTIN/UIN : 19AAICM6405G1ZE

State : Kolkata , Code : 19

Place of supply : Kolkata

Sl Description of Goods HSN/SAC GST Quan Rate per Amount

No. Rat tity

e

1 Huawei NE05-SQ 8517 18 % 1 134746.00 Nos 134746.00

2102351QCT10KC000008

18% Output IGST 24254.28

Less :

Sales Round Off 0.28

Total 1 159000.00

Amount Chargable (in words)

INR One lakh Fifty Nine Thousand Only

HSN/SAC Taxable IGST Amount Total

Value 18% Tax Amount

8517 134,476.00 24254.28 24,254.28 24,254.28

Total 134,746.00 24254.28 24,254.28 24,254.28

Tax Amount (in words) :

INR Twenty Four Thousand Two Hundred Fifty Four Rupess and Twenty Eight Paisa Only

PAN : AVCPG0105B

Declaration

"I/We hereby certify that my/our registration certificate under the Maharashtra Value Added Tax Act, 2002 is in

force on the date on

which the sales of goods specified in this tax invoice for Gundecha Infocom

is made by me/us and that the transaction of sale Authorised Signatory

covered by this tax invoice has been effected by me/us

and it shall be accounted for in the turnover of sales

while filling of return and the due tax, if any, payable

on the sale has been paid or shall be paid”

This is a Computer Generated Invoice

You might also like

- Sales 56Document1 pageSales 56mahendar chuphalNo ratings yet

- Taco 200716DF00030038Document1 pageTaco 200716DF00030038Frank Edwin VedamNo ratings yet

- Shope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851Document1 pageShope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851cnanda89No ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnjani KumariNo ratings yet

- Sales 67Document1 pageSales 67mahendar chuphalNo ratings yet

- Taco 0016102052100024Document1 pageTaco 0016102052100024youparthaNo ratings yet

- TCL BillDocument3 pagesTCL BillYoginder SinghNo ratings yet

- 056Document1 page056Dipak KotkarNo ratings yet

- Listing DetailsDocument2 pagesListing DetailsArun DevNo ratings yet

- Inv WBL Insha Hp0099Document4 pagesInv WBL Insha Hp0099digitalseva.japanigateNo ratings yet

- Invoice Geyser 2Document2 pagesInvoice Geyser 2archisman gayenNo ratings yet

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocument3 pagesINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoicemarketbus12No ratings yet

- Invoice 7110200329Document1 pageInvoice 7110200329kaku131295No ratings yet

- 1574 PDFDocument1 page1574 PDFAnonymous APW3d6gfd100% (1)

- Bhawani Polymers (India) 36Document1 pageBhawani Polymers (India) 36Rishab BansalNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Floresta RMC InvoiceDocument1 pageFloresta RMC InvoiceBabuNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Tax Invoice: Easymix Concrete Solution 1 1-Feb-2023Document1 pageTax Invoice: Easymix Concrete Solution 1 1-Feb-2023amit chouguleNo ratings yet

- Sudheer - Haldia Direct Invoice Dtd. 14.02.2022Document1 pageSudheer - Haldia Direct Invoice Dtd. 14.02.2022Amdiyala EnterprisesNo ratings yet

- bjs16 PDFDocument2 pagesbjs16 PDFMayank UkaniNo ratings yet

- HightDocument1 pageHightjaikant.hccNo ratings yet

- HavelsswitchsdfsdfDocument1 pageHavelsswitchsdfsdfDeepakNo ratings yet

- Trio Magic InfraDocument1 pageTrio Magic Infratriomagic.7860No ratings yet

- Accounting VoucherDocument1 pageAccounting Voucheradposting wNo ratings yet

- APPPLDocument2 pagesAPPPLtaxsachin16No ratings yet

- Adobe Scan 29 Jul 2021Document1 pageAdobe Scan 29 Jul 2021VALATHOTTIC KUTTAPATA SAJINo ratings yet

- Original For Recipient Duplicate For Transporter Triplicate For SupplierDocument1 pageOriginal For Recipient Duplicate For Transporter Triplicate For SupplierKarthik TNo ratings yet

- 4087219755Document1 page4087219755devta1111No ratings yet

- Babar - Dna JunDocument1 pageBabar - Dna JunAbhijeetNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPapia ChandaNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- Moksh 171Document1 pageMoksh 171mahajansagar746No ratings yet

- West Bengal - 721432, India Gstin/Uin: 19BDRPR8077B1ZW State Name: West Bengal, Code: 19Document1 pageWest Bengal - 721432, India Gstin/Uin: 19BDRPR8077B1ZW State Name: West Bengal, Code: 19sontupradhan458No ratings yet

- Nandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceDocument1 pageNandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceManish ShawNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- Invoice OR2301228571Document2 pagesInvoice OR2301228571Subhajit BhoiNo ratings yet

- SG112Document1 pageSG112rohanNo ratings yet

- Instronix Process ControlsDocument1 pageInstronix Process Controlsinfo -ADDMASNo ratings yet

- Taco 240408SU00065543Document1 pageTaco 240408SU00065543youparthaNo ratings yet

- InvertedDocument2 pagesInvertedShrikant KeskarNo ratings yet

- 0245 (22-23) (Harshpriya)Document1 page0245 (22-23) (Harshpriya)Ravikant MishraNo ratings yet

- 0269 (22-23) (Harshpriya)Document1 page0269 (22-23) (Harshpriya)Ravikant MishraNo ratings yet

- Bill 1391 PDFDocument1 pageBill 1391 PDFDeep GuptaNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicemanmojilo4 bharwadNo ratings yet

- Rahee Qu 47Document2 pagesRahee Qu 47nikhilNo ratings yet

- Tax Invoice: Amg Polychem PVT - LTDDocument3 pagesTax Invoice: Amg Polychem PVT - LTDARPIT MAHESHWARINo ratings yet

- RLLPB1Document3 pagesRLLPB101shreyaNo ratings yet

- TPI ChargesDocument1 pageTPI ChargesPrem KumarNo ratings yet

- Tax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDDocument1 pageTax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDSrikanth BhaskaraNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherDhananjay PatilNo ratings yet

- 5-Feb Order 2Document1 page5-Feb Order 2Arnav JoshiNo ratings yet

- HSRP1Document2 pagesHSRP1surajbk.ec21No ratings yet

- BBD2446982Document1 pageBBD2446982Shivansh PatelNo ratings yet

- BLR 903 PDFDocument1 pageBLR 903 PDFAthahNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherDIPL MUMBAINo ratings yet

- QTL Inv Q2-2022Document2 pagesQTL Inv Q2-2022irshad khanNo ratings yet

- Accounting Voucher Display - Sales - 658Document1 pageAccounting Voucher Display - Sales - 658renukm07No ratings yet

- Taco 240408PF01089904Document1 pageTaco 240408PF01089904youparthaNo ratings yet

- CWDM Mux-DemuxDocument6 pagesCWDM Mux-Demuxchandan kumar SinghNo ratings yet

- DVC Tender PDFDocument51 pagesDVC Tender PDFchandan kumar SinghNo ratings yet

- Syrotech 80Km CWDM SFP+ Optical Transceiver Goxp-Cwdmxx96-80Document9 pagesSyrotech 80Km CWDM SFP+ Optical Transceiver Goxp-Cwdmxx96-80chandan kumar SinghNo ratings yet

- User Instructions For Sacfa ModuleDocument8 pagesUser Instructions For Sacfa Modulechandan kumar SinghNo ratings yet

- Netengine 8000 M1A Service Router Data SheetDocument11 pagesNetengine 8000 M1A Service Router Data Sheetchandan kumar SinghNo ratings yet

- Recovery Agency List For Housing Finance PDFDocument3 pagesRecovery Agency List For Housing Finance PDFchandan kumar SinghNo ratings yet

- Documents For IPTV Permission - 1Document2 pagesDocuments For IPTV Permission - 1chandan kumar SinghNo ratings yet