Professional Documents

Culture Documents

Bond Value 849.537 Expected Annual Yield (EAY)

Bond Value 849.537 Expected Annual Yield (EAY)

Uploaded by

Salman MalikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond Value 849.537 Expected Annual Yield (EAY)

Bond Value 849.537 Expected Annual Yield (EAY)

Uploaded by

Salman MalikCopyright:

Available Formats

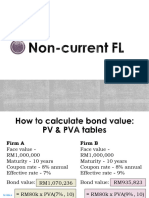

Question 01

Present Value of the coupons 752.315

Present Value of the face / par value 97.222

Bond Value 849.537

Expected Annual Yield (EAY) 12.36%

Question 02

Present Value of the coupons 354.530

Present Value of the face / par value 556.837

Bond Value 911.367

Expected Annual Yield (EAY) 10.25%

Question 03

Yes

No

10%

8%

Question 04

Status

Rate Increase

Bond Value Decrease

Question 05

Present Value of the coupons 449.236

Present Value of the face / par value 422.411

Bond Value 871.647

Question 06

Rate 8.76%

Question 07

Value of coupon paid per period 55.6433

Yield per period 5.564%

Question 08

Present Value of the coupons 636.516

Present Value of the face / par value 444.899

Bond Value 1081.415

Question 09

Yield to Maturity (YTM) 6.69%

compounded semiannually

Question 10

Coupon Rate 7.1276%

compounded semiannually

Question 11

0.1448

Question 12

R (Nominal Rate of Return) 6.605%

Question 13

6.61%

Question 14

r (Real Rate of Return) 8.6538%

Question 15

Bond X value after 1 year 1158.85

Bond Y value after 1 year 856.79

Bond X value after 3 year 1140.47

Bond Y value after 3 year 871.65

Bond X value after 8 year 1082.00

Bond Y value after 8 year 922.21

Bond X value after 12 year 1018.69

Bond Y value after 12 year 981.65

Bond X value after 13 year 1000

Bond Y value after 13 year 1000

Question 16

a

Bond Bob Value 1000

Bond Tom Value 1000

b

Interest Rates rises by 2%

Bond Bob Value

Present Value of the coupon 141.8380201665

Present Value of the Face/Par Valu 822.70247479188

Bond Value 964.54049495838

Bond Tom Value

Present Value of the coupon 614.89804107531

Present Value of the Face/Par Valu 231.37744865586

Bond Value 846.27548973117

Percentage change in prices of bond

Bond Bob Value -3.546%

Bond Tom Value -15.372%

c

Interest Rates falls by 2%

Bond Bob Value

Present Value of the coupon 148.68393611242

Present Value of the Face/Par Valu 888.48704791569

Bond Value 1037.1709840281

Bond Tom Value

Present Value of the coupon 784.01765397879

Present Value of the Face/Par Valu 411.98675951591

Bond Value 1196.0044134947

Percentage change in prices of bond

Bond Bob Value 3.717%

Bond Tom Value 19.6%

Question 17

Bond Bob Valuen j 825.22

Bond Tom Value k 1174.78

Interest Rates rises by 2%

Bond jValue

Present Value of the coupon 270.9484780086

Present Value of the Face/Par Valu 458.1115219914

Bond Value 729.06

Bond k Value

Present Value of the coupon 596.07732580946

Present Value of the Face/Par Valu 458.1115219914

Bond Value 1054.1888478009

Percentage change in prices of bond

Bond j Value -11.65%

Bond k Value -10.26%

Interest Rates falls by 2%

Bond j Value

Present Value of the coupon 314.02755064991

Present Value of the Face/Par Valu 623.16693922011

Bond Value 937.19448987002

Bond k Value

Present Value of the coupon 690.86061142979

Present Value of the Face/Par Valu 623.16693922011

Bond Value 1314.0275506499

Percentage change in prices of bond

Bond j Value 14%

Bond k Value 11.85%

Question 18

APV PMT RATE N

1040 100 9.2120% 14

EFFECTIVE RATE 9.5708%

Question 19

APV PMT RATE N

1095 40 3.3412% 20

20 semi annually 6.6823%

Question 21

APV PMT RATE N

1200 98 9% 12.9875

Question 22

FV PV RATE N

(a) 1000 ($178.43) 9% 20

FV RS COUPON BOUND

(b) 1000 10000000 10000

FV PV RATE N

-1000 $75.37 9% 30

ZERO COUPONBONDS

$132,676.78

TOTAL

$132,676,784.69

You might also like

- Chapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument5 pagesChapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- ChapterDocument7 pagesChapterAhmed Ezzat AliNo ratings yet

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- Uk Sample Tenancy AgreementDocument2 pagesUk Sample Tenancy Agreementkommsu0% (1)

- Serco Ratio AnalysisDocument4 pagesSerco Ratio Analysisfcfroic0% (1)

- Postemployment Benefits: Employee's Employee Employee Obligation DecemberDocument25 pagesPostemployment Benefits: Employee's Employee Employee Obligation DecemberGabriel PanganNo ratings yet

- Duration & ConDocument63 pagesDuration & Consanket patilNo ratings yet

- Chapter 7 Problems Valuation and Characteristics of BondsDocument16 pagesChapter 7 Problems Valuation and Characteristics of Bondsrony_naiduNo ratings yet

- Discounted Cash Flow ValuationDocument72 pagesDiscounted Cash Flow ValuationBussines LearnNo ratings yet

- Bond ValuationDocument14 pagesBond ValuationCorporate Accountant Marayo BankNo ratings yet

- Brenda Rianita Hapsari - 12030119130222 - Tugas Bab 17 Dan 18Document9 pagesBrenda Rianita Hapsari - 12030119130222 - Tugas Bab 17 Dan 18Brenda HapsariNo ratings yet

- 63 22dh202493 Huỳnh Nhật Trường Cf 6.03Document30 pages63 22dh202493 Huỳnh Nhật Trường Cf 6.03taylormit1242003No ratings yet

- Study Plan 4Document43 pagesStudy Plan 4venomstark05No ratings yet

- Bahas Latihan Soal WACCDocument5 pagesBahas Latihan Soal WACCagnesNo ratings yet

- Abdullah Narejo Work Lec 03 Future Value Vs Present ValueDocument8 pagesAbdullah Narejo Work Lec 03 Future Value Vs Present ValueAbdullah NarejoNo ratings yet

- Risk, Cost of Capital, and Capital BudgetingDocument23 pagesRisk, Cost of Capital, and Capital BudgetingBussines LearnNo ratings yet

- Bond Value IntroductionDocument4 pagesBond Value IntroductionNikhil BajoriaNo ratings yet

- FinMan Chapter 56 GitmanDocument13 pagesFinMan Chapter 56 GitmanEarl Daniel RemorozaNo ratings yet

- Bond ValuationDocument22 pagesBond Valuationganesh pNo ratings yet

- Rate 7% 15 40 75 Forever $ (5,500.00) PV $ 50,093.53 $ 73,324.40 $ 78,079.98 $ 78,571.43Document18 pagesRate 7% 15 40 75 Forever $ (5,500.00) PV $ 50,093.53 $ 73,324.40 $ 78,079.98 $ 78,571.43Arpi OrujyanNo ratings yet

- C4 Class Problems-Excel (Answers)Document81 pagesC4 Class Problems-Excel (Answers)ArjhiePalaganasDioquinoNo ratings yet

- Value of Bond (% of Par Value) : 7.34% 105.17 105.17 UndervaluedDocument5 pagesValue of Bond (% of Par Value) : 7.34% 105.17 105.17 UndervaluedJAYRAJ AGRAWALNo ratings yet

- Valuation and Capital Budgeting For The Levered FirmDocument24 pagesValuation and Capital Budgeting For The Levered FirmBussines LearnNo ratings yet

- Solution TVM Assignment 2Document4 pagesSolution TVM Assignment 2prathamesh rokdeNo ratings yet

- FIN 527 - Practice Problems For Test 1 - SOLUTIONDocument40 pagesFIN 527 - Practice Problems For Test 1 - SOLUTIONШоппинг ШопингNo ratings yet

- Simulasi PerhitunganDocument5 pagesSimulasi PerhitunganFendyNo ratings yet

- Priyanshu Kumar (22MS1025)Document13 pagesPriyanshu Kumar (22MS1025)Kumar GautamNo ratings yet

- Bond PricingDocument16 pagesBond PricingAnonymousNo ratings yet

- Credit Management ExerciseDocument5 pagesCredit Management ExerciseSavana AndiraNo ratings yet

- Exercises On Bond ValuationDocument3 pagesExercises On Bond Valuationkean leigh felicanoNo ratings yet

- Bonds: Formulas & ExamplesDocument12 pagesBonds: Formulas & ExamplesAayush sunejaNo ratings yet

- Problems and SolutionsDocument34 pagesProblems and SolutionsBahadır YükselNo ratings yet

- Bond Valuation 22Document8 pagesBond Valuation 22phượng nguyễn thị minhNo ratings yet

- Bond valuationDocument56 pagesBond valuationHarsh pRAJAPATINo ratings yet

- Muskan Valbani PGP/24/456Document6 pagesMuskan Valbani PGP/24/456Muskan ValbaniNo ratings yet

- Chapter 10: Bond Return and Valuation Q. 6. Find Out The Yield To Maturity On A 8 Per Cent 5 Year Bond Selling at Rs 105?Document6 pagesChapter 10: Bond Return and Valuation Q. 6. Find Out The Yield To Maturity On A 8 Per Cent 5 Year Bond Selling at Rs 105?amarprabhu567No ratings yet

- B) Price of Bond When YTM Is 6% 1459.90 Price of BondDocument13 pagesB) Price of Bond When YTM Is 6% 1459.90 Price of BondMasab AsifNo ratings yet

- Chapter 15 PracticeDocument7 pagesChapter 15 PracticeDaniela VelezNo ratings yet

- BondsDocument3 pagesBondsNL HardyNo ratings yet

- NPV & IrrDocument58 pagesNPV & IrrAira DacilloNo ratings yet

- Assignment Ch15&16 Arkawira - 29119255Document9 pagesAssignment Ch15&16 Arkawira - 29119255Arkawira Nul SalamNo ratings yet

- Assignment 3Document88 pagesAssignment 3Manjing WangNo ratings yet

- Corporate Finance1Document23 pagesCorporate Finance1Obaid GhouriNo ratings yet

- Chapter 05Document6 pagesChapter 05Nguyễn Ngọc Hoài ThươngNo ratings yet

- How To Calculate Present Values: Discounted Cash Flow Analysis (Time Value of Money)Document16 pagesHow To Calculate Present Values: Discounted Cash Flow Analysis (Time Value of Money)cypriancourageNo ratings yet

- F Bond Valuation Workings in Class and Solutions 1sGM0gfKLuDocument34 pagesF Bond Valuation Workings in Class and Solutions 1sGM0gfKLudffdf fdfgNo ratings yet

- Session 4 - Classwork Financial and Investment DecisionsDocument13 pagesSession 4 - Classwork Financial and Investment DecisionsCaine MainganyaNo ratings yet

- FINA 4400: Financial Markets and Institutions: Help TopicsDocument17 pagesFINA 4400: Financial Markets and Institutions: Help TopicsMr. Copernicus0% (1)

- Bonds Part 2 SlidesDocument42 pagesBonds Part 2 SlidesTricia MogirlNo ratings yet

- 63 22dh202493 Huynh Nhat Truong CF 5.02Document15 pages63 22dh202493 Huynh Nhat Truong CF 5.02taylormit1242003No ratings yet

- The Immunization Problem: Illustrated For The 30-Year BondDocument18 pagesThe Immunization Problem: Illustrated For The 30-Year BondSyed Ameer Ali ShahNo ratings yet

- ACN3113 2023 T8 - Financial Instruments (S - P2)Document15 pagesACN3113 2023 T8 - Financial Instruments (S - P2)thchecyainie03No ratings yet

- DCF TLKM Full Year 2020Document4 pagesDCF TLKM Full Year 2020i wayan suputraNo ratings yet

- RPS EAA 501 Akuntansi Keuangan Lanjutan 1 Royhisar MartahanDocument11 pagesRPS EAA 501 Akuntansi Keuangan Lanjutan 1 Royhisar MartahanSoniea DianiNo ratings yet

- A2 Mbag183002Document24 pagesA2 Mbag183002Hashim EjazNo ratings yet

- Practice Problems1Document15 pagesPractice Problems1Divyam GargNo ratings yet

- Shorenstein Yale Slides 2Document15 pagesShorenstein Yale Slides 2Anton FortichNo ratings yet

- Convert The Rate and Choose The Correct AnswerDocument40 pagesConvert The Rate and Choose The Correct AnswerWilson Fernandez Lipa AncachiNo ratings yet

- FINA 4400: Financial Markets and Institutions: End of Chapter Question #4Document13 pagesFINA 4400: Financial Markets and Institutions: End of Chapter Question #4Mr. CopernicusNo ratings yet

- Basic Duration Calculation: Year C T C / Price (1+YTM) C T C / Price (1+YTM)Document13 pagesBasic Duration Calculation: Year C T C / Price (1+YTM) C T C / Price (1+YTM)Syed Ameer Ali ShahNo ratings yet

- Financial Management Assignment 1Document2 pagesFinancial Management Assignment 1Komal ModiNo ratings yet

- Math Excel SheetDocument11 pagesMath Excel Sheetbawanpreets59No ratings yet

- Reversion Net Operating Income:: Five Year Leveraged IRR AnalysisDocument15 pagesReversion Net Operating Income:: Five Year Leveraged IRR Analysisalexs617No ratings yet

- Module 8 - Inclusion of Gross IncomeDocument4 pagesModule 8 - Inclusion of Gross IncomeReicaNo ratings yet

- CBC PH TemplateDocument103 pagesCBC PH TemplateJonald NarzabalNo ratings yet

- GR Oup: 1: Mahnoor Naseer (6155129) Khadija Azeem (6155127) Fiza Alvi (6155111) Rabia Malik (615511)Document7 pagesGR Oup: 1: Mahnoor Naseer (6155129) Khadija Azeem (6155127) Fiza Alvi (6155111) Rabia Malik (615511)fiza alviNo ratings yet

- Compound Interest and Present Value: Powerpoint Presentation by Domenic Tavella, MbaDocument33 pagesCompound Interest and Present Value: Powerpoint Presentation by Domenic Tavella, MbaEdal SantosNo ratings yet

- LaborDocument20 pagesLaborHNo ratings yet

- RRB NTPC Sunday Quant (Question) : WWW - Careerpower.inDocument6 pagesRRB NTPC Sunday Quant (Question) : WWW - Careerpower.inRahul SinghNo ratings yet

- Current Liabilities and Payroll Using Excel For Payroll: Use The Blue Shaded Areas On The ENTER-ANSWERS Tab For InputsDocument10 pagesCurrent Liabilities and Payroll Using Excel For Payroll: Use The Blue Shaded Areas On The ENTER-ANSWERS Tab For Inputsbob robNo ratings yet

- Rental Agreement FileDocument3 pagesRental Agreement Filejaspriya17No ratings yet

- Final Pedrosa Excel4Document5 pagesFinal Pedrosa Excel4Madaum Elementary100% (1)

- Pay Slip May Indian Bhushan NathDocument1 pagePay Slip May Indian Bhushan Nathralesh694No ratings yet

- Activity StatementDocument13 pagesActivity StatementElvie BangcoyoNo ratings yet

- Salary Earnings:-: Paid Sum of Rs. 11,309.00Document1 pageSalary Earnings:-: Paid Sum of Rs. 11,309.00Ganesh BiswalNo ratings yet

- APY Chart PDFDocument1 pageAPY Chart PDFRahul TadeNo ratings yet

- Flat Interest RateDocument4 pagesFlat Interest Ratekeo linNo ratings yet

- Non-Taxable Employee Benefits - de MinimisDocument32 pagesNon-Taxable Employee Benefits - de MinimisMariver LlorenteNo ratings yet

- PF & Esi 16.10.21Document13 pagesPF & Esi 16.10.21JatinNo ratings yet

- Interests and Investment CostDocument16 pagesInterests and Investment CostAbdullah RamzanNo ratings yet

- Assignment3 7QsDocument2 pagesAssignment3 7QsavirgNo ratings yet

- 12 PensionDocument4 pages12 PensionMichael BongalontaNo ratings yet

- Oct 22 LDocument4 pagesOct 22 LSuresh DNo ratings yet

- Rent Agreement Format MakaanIQDocument2 pagesRent Agreement Format MakaanIQShikha AroraNo ratings yet

- طرق قياس النشاط الاقتصادي 1Document7 pagesطرق قياس النشاط الاقتصادي 1MassilNo ratings yet

- 2.1 Simple and CompoundDocument42 pages2.1 Simple and CompoundEmmanuel SulitNo ratings yet

- Ayu Nurfitriadi-4111711020Document1,375 pagesAyu Nurfitriadi-4111711020Ayu NurfitriadiNo ratings yet

- Diane Greenfield & David GreenfieldDocument2 pagesDiane Greenfield & David Greenfieldsdasdqw2eqwqeqwNo ratings yet

- Burs Final Tax Table PDFDocument81 pagesBurs Final Tax Table PDFMoabiNo ratings yet

- Hra For Armed Force RuleDocument4 pagesHra For Armed Force RuleDevi Prasad PandaNo ratings yet