Professional Documents

Culture Documents

100%(1)100% found this document useful (1 vote)

540 viewsSubsequent Debit, Delivery Cost and Credit Memo

Subsequent Debit, Delivery Cost and Credit Memo

Uploaded by

Srini VasanThis document provides guidance on processing subsequent debits and credits, delivery costs, invoices without purchase orders, and credit memos in SAP. It explains that subsequent debits and credits are used to process additional invoices or credits after a transaction has been settled. Delivery costs can be planned in a purchase order or unplanned and entered during invoice receipt. Invoices can be created without referencing a purchase order by direct posting. Credit memos are used to adjust amounts due to vendors and can reference a purchase order or goods receipt.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- SAP S/4HANA Retail: Processes, Functions, CustomisingFrom EverandSAP S/4HANA Retail: Processes, Functions, CustomisingRating: 3 out of 5 stars3/5 (1)

- ARM Standard Configuration S4HANADocument11 pagesARM Standard Configuration S4HANAТетяна Яценко100% (1)

- Batch Management FIFO Process in Sap S4 HANADocument17 pagesBatch Management FIFO Process in Sap S4 HANASiva ThungaNo ratings yet

- Sales Order Processing With Invoice List and Collective Billing (BKZ) - Process DiagramsDocument4 pagesSales Order Processing With Invoice List and Collective Billing (BKZ) - Process DiagramsNavjyot Singhvi100% (2)

- Visa Consulting and AnalyticsDocument20 pagesVisa Consulting and AnalyticsKristen NguyenNo ratings yet

- Procedure To Change SAP Product HierarchyDocument5 pagesProcedure To Change SAP Product HierarchymkumarshahiNo ratings yet

- OMRT - Account Key UssageDocument16 pagesOMRT - Account Key Ussageneelam618No ratings yet

- Learn SAP The German WayDocument5 pagesLearn SAP The German WayKris TJ100% (1)

- Earnest Money Deposit Receipt AgreementDocument2 pagesEarnest Money Deposit Receipt AgreementGene Abot100% (2)

- Self Billing 1Document10 pagesSelf Billing 1Oumayma Ben FrajNo ratings yet

- Stock Transfer Order Return of The STOCK in TRANSITDocument6 pagesStock Transfer Order Return of The STOCK in TRANSITbunny_ankur77No ratings yet

- Fdocuments - in Sap MM What Is Unplanned Delivery Cost in Sap MMDocument12 pagesFdocuments - in Sap MM What Is Unplanned Delivery Cost in Sap MMRaghavendra M R100% (1)

- SAP Sales Milestone SnapshotDocument11 pagesSAP Sales Milestone Snapshotvenkatesank100% (7)

- Classic Subcontracting - Outsourcing Production - SAP BlogsDocument10 pagesClassic Subcontracting - Outsourcing Production - SAP BlogswertghjhgrNo ratings yet

- Sap MM PPDocument33 pagesSap MM PPyogeshNo ratings yet

- Complaints & ReturnsDocument10 pagesComplaints & ReturnsmshabnamNo ratings yet

- 16 Fields in Pricing Procedure and Their DescriptionDocument6 pages16 Fields in Pricing Procedure and Their DescriptionSangram Ingle100% (2)

- STO Process YamsaniDocument21 pagesSTO Process YamsaniSatish Yamsani100% (1)

- Status Profile in SAP SDDocument9 pagesStatus Profile in SAP SDNoopur Rai100% (1)

- Stock Transport Order ConfigurationDocument1 pageStock Transport Order ConfigurationdhanahbalNo ratings yet

- How To Configure Make To Order in Easy WaysDocument10 pagesHow To Configure Make To Order in Easy WaysDHANESH SHUKLA100% (1)

- Inter Company Return StoDocument11 pagesInter Company Return Stosandip bhadane100% (1)

- Customization SD LEDocument88 pagesCustomization SD LEKamleshSaroj100% (1)

- Intercompany PurchasingDocument23 pagesIntercompany PurchasingSahil Jadhav100% (1)

- Rebate Process ConfigurationDocument13 pagesRebate Process Configurationshikhar singh100% (1)

- Requirement RoutinesDocument3 pagesRequirement RoutinesRajesh SrinathanNo ratings yet

- Basics of Sap SD ModuleDocument20 pagesBasics of Sap SD ModuleSourav Daruka100% (1)

- Inter Company - Cross Company in SAP - SAP SIMPLE DocsDocument10 pagesInter Company - Cross Company in SAP - SAP SIMPLE DocsAnanthakumar ANo ratings yet

- Sales Scheduling Agreements (3NR - GB) - Test ScriptDocument32 pagesSales Scheduling Agreements (3NR - GB) - Test ScriptFernando MillanNo ratings yet

- Sd1007: Availability Check & Transfer of Requirements V1.0: India Sap Coe, Slide 1Document44 pagesSd1007: Availability Check & Transfer of Requirements V1.0: India Sap Coe, Slide 1SUSMITANo ratings yet

- 03 - Rebates in SAP - CDocument17 pages03 - Rebates in SAP - Csushma_311819No ratings yet

- Special Sals ProcessDocument84 pagesSpecial Sals ProcessSUSMITA100% (1)

- Reverse CalculationDocument7 pagesReverse CalculationKanishka Thomas Kain100% (1)

- Determination Rule in SAP SD # Determination Object Rules For DeterminationDocument7 pagesDetermination Rule in SAP SD # Determination Object Rules For Determinationtrip2ashishNo ratings yet

- Requirement Routines - Output ControlDocument3 pagesRequirement Routines - Output ControlSOUMEN DASNo ratings yet

- 23 Questions On SAP SD ShippingDocument4 pages23 Questions On SAP SD ShippingBalaji_SAPNo ratings yet

- Sap SDDocument9 pagesSap SDSouvik_DasNo ratings yet

- User ExitsDocument3 pagesUser Exitsvenkat100% (1)

- SAP Tips and Tricks v2.0Document27 pagesSAP Tips and Tricks v2.0nbhaskar bhaskar100% (2)

- Copy Control Settings: PurposeDocument4 pagesCopy Control Settings: PurposeLokesh Dora100% (1)

- Sap SD 100Document12 pagesSap SD 100c_subhasis100% (1)

- Automatic Account DeterminationDocument13 pagesAutomatic Account DeterminationmayurNo ratings yet

- Tolerance Usage in Sap MMDocument12 pagesTolerance Usage in Sap MMRajEshwer ReddyNo ratings yet

- Inter-Company Billing Process - SAP BlogsDocument3 pagesInter-Company Billing Process - SAP BlogsNikhil RaviNo ratings yet

- Pricing ProcedureDocument2 pagesPricing ProcedureMehul BazariaNo ratings yet

- Copy Contro in SDDocument4 pagesCopy Contro in SDHuseyn IsmayilovNo ratings yet

- SAP For InterviewDocument14 pagesSAP For Interviewbhaskarrajusa8034100% (1)

- How Can We Manage Stockable Item and Non Stock Item in Sales Cycle. - SAP CommunityDocument2 pagesHow Can We Manage Stockable Item and Non Stock Item in Sales Cycle. - SAP Communitysuku_mca100% (1)

- ThirdPartySales SAP SDDocument14 pagesThirdPartySales SAP SDRaja ShekarNo ratings yet

- V of M Data Transfer RoutinesDocument28 pagesV of M Data Transfer RoutinesSamik Biswas100% (2)

- Mto ProcessDocument14 pagesMto Processrajesh dash100% (2)

- P25 Img Consumption Based PlanningDocument23 pagesP25 Img Consumption Based PlanninglymacsauokNo ratings yet

- Pricing Requirements in Sap-Sd Sales Order ProcessingDocument3 pagesPricing Requirements in Sap-Sd Sales Order ProcessingLaxmi Narsimha Rao MamidalaNo ratings yet

- Process For Stock Transfer With DeliveryDocument9 pagesProcess For Stock Transfer With DeliveryAbhishekSharmaNo ratings yet

- Stock Transfer Between Plants in One StepDocument5 pagesStock Transfer Between Plants in One StepRahul JainNo ratings yet

- Inter-Company STO With SD Delivery, Billing & LIVDocument39 pagesInter-Company STO With SD Delivery, Billing & LIVpraveen adavellyNo ratings yet

- Vf04 Billing Due List What Is The Difference Between Billing Date Fkdat and Vfkdat in The Alv ListDocument5 pagesVf04 Billing Due List What Is The Difference Between Billing Date Fkdat and Vfkdat in The Alv Listpankaj_labh85100% (2)

- ALE SequenceDocument3 pagesALE Sequencesweetu.mNo ratings yet

- Sales Returns ProcessingDocument13 pagesSales Returns ProcessingmeddebyounesNo ratings yet

- 48 SAP Projects and Ticket HandlingDocument16 pages48 SAP Projects and Ticket HandlingSrini VasanNo ratings yet

- 17 Document Release ProcedureDocument21 pages17 Document Release ProcedureSrini VasanNo ratings yet

- 20 Invoice Variances and Blocking ReasonsDocument54 pages20 Invoice Variances and Blocking ReasonsSrini VasanNo ratings yet

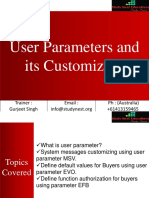

- 14 User Parameters and Its CustomizingDocument13 pages14 User Parameters and Its CustomizingSrini VasanNo ratings yet

- 4 Procurement of Stock Material PDFDocument50 pages4 Procurement of Stock Material PDFSrini VasanNo ratings yet

- (Part - 2) : Email: PH: (Australia) +61413159465 Trainer: Gurjeet SinghDocument32 pages(Part - 2) : Email: PH: (Australia) +61413159465 Trainer: Gurjeet SinghSrini VasanNo ratings yet

- 12 Source DeterminationDocument54 pages12 Source DeterminationSrini VasanNo ratings yet

- 19 Invoice Entry 2Document25 pages19 Invoice Entry 2Srini VasanNo ratings yet

- C Ewm 95-Exam-Questions PDFDocument9 pagesC Ewm 95-Exam-Questions PDFSrini VasanNo ratings yet

- Blue Print WM Agenda 022120A RHDocument4 pagesBlue Print WM Agenda 022120A RHSrini VasanNo ratings yet

- Distribution Center SAP WM OverviewDocument24 pagesDistribution Center SAP WM OverviewSrini VasanNo ratings yet

- Pricing & Condition TechniqueDocument41 pagesPricing & Condition TechniqueSrini VasanNo ratings yet

- COOKIEDocument15 pagesCOOKIEBecca AlmencionNo ratings yet

- Annual Gold Price From 1900Document49 pagesAnnual Gold Price From 1900asignifiesappleNo ratings yet

- 23si0055 - Ace WaterDocument1 page23si0055 - Ace WaterDeshan SingNo ratings yet

- Simafore Whitepaper Customer Lifetime Value Modeling PDFDocument13 pagesSimafore Whitepaper Customer Lifetime Value Modeling PDFsafj,ndsaNo ratings yet

- A. B. C. D. CompletenessDocument3 pagesA. B. C. D. Completenessedrick LouiseNo ratings yet

- 1Document3 pages1Stook01701No ratings yet

- Report 1-3 - Nabil BankDocument33 pagesReport 1-3 - Nabil BankSalım RaıŋNo ratings yet

- Group 2: Dakshayani Biscuits (: Cost Sheet)Document6 pagesGroup 2: Dakshayani Biscuits (: Cost Sheet)Vinu DNo ratings yet

- Modelling Nigerian's FGN BondDocument69 pagesModelling Nigerian's FGN Bondmarthaaugustine2No ratings yet

- Project Financial ServicesDocument71 pagesProject Financial ServicesPardeep YadavNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancegaurav kumarNo ratings yet

- FIN 456 International Financial Management: The Market For Foreign ExchangeDocument35 pagesFIN 456 International Financial Management: The Market For Foreign ExchangeHiếu Nguyễn Minh HoàngNo ratings yet

- B014393 HN in Business L4 SpecificationDocument480 pagesB014393 HN in Business L4 SpecificationRajivVyasNo ratings yet

- The Impact of Foreign Aid On Economic Growth Emperical Evidence From Ethiopia 1974 2011using Ardl ApproachDocument12 pagesThe Impact of Foreign Aid On Economic Growth Emperical Evidence From Ethiopia 1974 2011using Ardl Approachrajan20202000100% (1)

- Republic of The Philippines vs. Sunlife Assurance: GR NO. 158085 OCTOBER 14, 2005Document9 pagesRepublic of The Philippines vs. Sunlife Assurance: GR NO. 158085 OCTOBER 14, 2005dingNo ratings yet

- Prudential Bank v. Martinez - DigestDocument3 pagesPrudential Bank v. Martinez - DigestcinfloNo ratings yet

- Derivative IBBL Stress Testing 2012-16 AatiqDocument56 pagesDerivative IBBL Stress Testing 2012-16 AatiqMD ATIQULLAH KHANNo ratings yet

- Mathematics of Investment 3Document25 pagesMathematics of Investment 3John Luis Masangkay Bantolino100% (1)

- Agricultural EconomicsDocument14 pagesAgricultural EconomicsIzuka ChibuzorNo ratings yet

- Viva On Project and CfsDocument7 pagesViva On Project and CfsCrazy GamerNo ratings yet

- Business and Economic Development - Impact CSRDocument76 pagesBusiness and Economic Development - Impact CSRSIPIROKNo ratings yet

- Sterlite Technologies PDFDocument302 pagesSterlite Technologies PDFbardhanNo ratings yet

- Cash Accounting and Cash Flow Planning With SAP Liquidity PlannerDocument17 pagesCash Accounting and Cash Flow Planning With SAP Liquidity PlannerLTSSILVANo ratings yet

- Ia1 Chapter 9Document3 pagesIa1 Chapter 9Elexie RollonNo ratings yet

- Mechanics of Futures MarketDocument11 pagesMechanics of Futures MarketSUMIT JANKARNo ratings yet

- A131 Tutorial 1 QDocument9 pagesA131 Tutorial 1 QJu RaizahNo ratings yet

- Challenges of State Owned Corporations and Enterprises in AfghanistanDocument11 pagesChallenges of State Owned Corporations and Enterprises in AfghanistanNaseer Ahmad AziziNo ratings yet

- Financial Literacy Test Grade 11 Entrepreneurship Mr. Valley Student NameDocument8 pagesFinancial Literacy Test Grade 11 Entrepreneurship Mr. Valley Student Nameapi-350400617No ratings yet

Subsequent Debit, Delivery Cost and Credit Memo

Subsequent Debit, Delivery Cost and Credit Memo

Uploaded by

Srini Vasan100%(1)100% found this document useful (1 vote)

540 views37 pagesThis document provides guidance on processing subsequent debits and credits, delivery costs, invoices without purchase orders, and credit memos in SAP. It explains that subsequent debits and credits are used to process additional invoices or credits after a transaction has been settled. Delivery costs can be planned in a purchase order or unplanned and entered during invoice receipt. Invoices can be created without referencing a purchase order by direct posting. Credit memos are used to adjust amounts due to vendors and can reference a purchase order or goods receipt.

Original Description:

Subsequent Debit, Delivery Cost and Credit Memo

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides guidance on processing subsequent debits and credits, delivery costs, invoices without purchase orders, and credit memos in SAP. It explains that subsequent debits and credits are used to process additional invoices or credits after a transaction has been settled. Delivery costs can be planned in a purchase order or unplanned and entered during invoice receipt. Invoices can be created without referencing a purchase order by direct posting. Credit memos are used to adjust amounts due to vendors and can reference a purchase order or goods receipt.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

100%(1)100% found this document useful (1 vote)

540 views37 pagesSubsequent Debit, Delivery Cost and Credit Memo

Subsequent Debit, Delivery Cost and Credit Memo

Uploaded by

Srini VasanThis document provides guidance on processing subsequent debits and credits, delivery costs, invoices without purchase orders, and credit memos in SAP. It explains that subsequent debits and credits are used to process additional invoices or credits after a transaction has been settled. Delivery costs can be planned in a purchase order or unplanned and entered during invoice receipt. Invoices can be created without referencing a purchase order by direct posting. Credit memos are used to adjust amounts due to vendors and can reference a purchase order or goods receipt.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 37

Subsequent Debits,

Delivery Costs and

Credit Memos

Trainer : Email : Ph : (Australia)

Gurjeet Singh info@studynest.org +61413159465

Enter additional costs as Subsequent debit.

Account movements during Subsequent debit.

Enter Planned Delivery Cost for an Invoice.

Enter Unplanned Delivery cost during Invoice

receipt.

Add items without reference to a Purchase

Topics Order during Invoicing.

Enter an invoice without reference to a

Covered purchase order.

Enter a Credit memo referencing a Purchase

Order.

Reverse an invoice document.

Enter a Subsequent credit.

Perform GR/IR clearing account maintenance.

Subsequent

Debits/Credits

Occasionally, you receive invoices or

credit memos from your vendors that refer

Business to transactions that have already been

Example settled.

Your company wants to use subsequent

debit/credit to process these documents.

A subsequent debit arises if another invoice or

credit memo is received after a transaction has

already been settled. For example –

A vendor accidently invoices you earlier for a

What is price that is too low, so he send you a second

Subsequent invoice for the difference. You must enter this

Debit/Credit second item as a subsequent debit item if the

? PO item has already been invoiced.

A vendor has accidently invoiced you a price

that is too high so he sends a credit memo for

the difference. You must enter the credit memo

as subsequent credit.

Subsequent

Debit/Credit

Subsequent

Debit/Credit

If you enter a subsequent debit/credit, the

system suggests the entire invoiced quantity, but

no value.

The maximum quantity that you can

Important subsequently debit is the quantity that has already

Points been invoiced.

for You can only enter a subsequent debit/credit for

Subsequent a purchase order item if an invoice has already

Debit/Credit been posted for this item.

A subsequent debit/credit cannot refer to a

particular invoice.

Subsequent debits and credits are listed

separately in the PO history.

Delivery Costs

Freight charges can be planned in the

purchase order.

More often, they are not known in detail

Business when the purchase order is created and

Example are entered only during Invoice

verification.

You need to test both of the above

possibilities.

Delivery

Costs

Type of Delivery Costs –

Planned delivery cost

Unplanned delivery cost

Planned

Delivery Costs

Planned

Delivery

Costs

Planned delivery costs are delivery costs that

are agreed prior to the purchase order with the

vendor and with freight forwarder or custom.

Accounts

Movement

with

Planned

Delivery

Costs

Unplanned

Delivery Costs

Unplanned

Delivery

Costs

Unplanned delivery costs are delivery costs that

were not agreed upon the purchase order and

are entered during Invoice Receipt.

Accounts

Movement

with

Unplanned

Delivery

Costs

Customizing

Unplanned SPRO Material Management Logistic Invoice

Delivery Verification Incoming Invoice Configure How Unplanned

Costs Delivery Costs are Posted

SPRO Material Management Logistic Invoice

verification Incoming Invoice Maintain Default Values for

Tax Codes (OMR2)

SPRO Material Management Valuation and Account

Management Account Determination Account

Determination Without Wizard Configure Automatic

Postings and then Account Assignment (OBYC)

Invoices Without

Referencing to

Purchasing Document

In your company, occasionally you buy

consumable material without creating a

Business purchase order or this item was excluded

Example from the PO during procurement.

You want to Invoice such procured items

without referencing a Purchase Order.

Direct

Posting to

a G/L

OR

Material SPRO Material Management Logistic Invoice

Account Verification Incoming Invoice Activate Direct Posting to

G/L Accounts and Material Accounts

Creating

Invoices

without

Reference

Credit Memos

and

Reversals

Credit Memos

In your company, the accounting people

has to correct occasional data entry errors

Business by reversing a posted Invoice.

Example Credit Memos and subsequent credits

can be used to adjust the amount due to

vendor.

Credit

Memos

You usually receive a credit memo from a vendor if you

were overcharged.

A credit memo can be entered with reference to a PO or

Goods receipt.

Credit Memo –

You post a credit memo if the invoice quantity is too

large.

When you post the credit memo, the total invoiced

quantity in the PO history is reduced by the credit memo

Credit quantity.

Memo The maximum quantity you can make a credit for is the

Vs quantity that has already been invoiced.

Subsequent

Subsequent Credit -

Credit You post subsequent credit if the price in the invoice is

too high.

The total quantity invoiced for the purchase order item

remains the same, but the total value invoiced is

reduced.

Reversal

Reversal

Invoice documents like Invoice or credit memos, can be

subsequently cancelled if, for example, they were posted

incorrectly.

Logistics Material Management Logistic Invoice

Verification Further Processing Cancel Invoice Document

(MR8M)

There are 2 separate cases -

1. If you cancel an Invoice, the system

automatically generates a credit memo.

2. If you cancel a credit memo, the system

More automatically generates an Invoice.

about When you reverse an invoice, all items in the

Reversal document are reversed. You can reverse “part of

an invoice” only by manually entering a credit

memo.

You can not reverse a “reversal document”.

GR/IR Account

Maintenance

The GR/IR clearing account is used for

clearing goods receipts and Invoices.

In case of quantity differences between

goods receipts and invoice receipts, some

Business items remains open in GR/IR clearing

account.

Example If further deliveries, return deliveries,

invoices or credit memos do not clear a

quantity difference for a PO item, you have to

then maintain the GR/IR clearing account for

this item.

Quantity

Variance

Logistics Material Management Logistics Invoice

Verification GR/IR Account Maintenance Maintain GR/IR

Clearing Account (MR11)

Correction for

Tolerance limit in

Vendor Master Data

(Previous Video)

Assignment

Create a Subsequent debit and credit.

Enter Planned Delivery Cost in a Purchase order

and see the affects in Invoice verification.

Enter unplanned delivery cost while invoice

verification.

Assignment Enter an invoice without reference to a purchase

order. What options do you have here when you

have a material master set up and when its not.

Enter a Credit memo referencing a Purchase

Order.

Reverse an invoice document.

a

You might also like

- SAP S/4HANA Retail: Processes, Functions, CustomisingFrom EverandSAP S/4HANA Retail: Processes, Functions, CustomisingRating: 3 out of 5 stars3/5 (1)

- ARM Standard Configuration S4HANADocument11 pagesARM Standard Configuration S4HANAТетяна Яценко100% (1)

- Batch Management FIFO Process in Sap S4 HANADocument17 pagesBatch Management FIFO Process in Sap S4 HANASiva ThungaNo ratings yet

- Sales Order Processing With Invoice List and Collective Billing (BKZ) - Process DiagramsDocument4 pagesSales Order Processing With Invoice List and Collective Billing (BKZ) - Process DiagramsNavjyot Singhvi100% (2)

- Visa Consulting and AnalyticsDocument20 pagesVisa Consulting and AnalyticsKristen NguyenNo ratings yet

- Procedure To Change SAP Product HierarchyDocument5 pagesProcedure To Change SAP Product HierarchymkumarshahiNo ratings yet

- OMRT - Account Key UssageDocument16 pagesOMRT - Account Key Ussageneelam618No ratings yet

- Learn SAP The German WayDocument5 pagesLearn SAP The German WayKris TJ100% (1)

- Earnest Money Deposit Receipt AgreementDocument2 pagesEarnest Money Deposit Receipt AgreementGene Abot100% (2)

- Self Billing 1Document10 pagesSelf Billing 1Oumayma Ben FrajNo ratings yet

- Stock Transfer Order Return of The STOCK in TRANSITDocument6 pagesStock Transfer Order Return of The STOCK in TRANSITbunny_ankur77No ratings yet

- Fdocuments - in Sap MM What Is Unplanned Delivery Cost in Sap MMDocument12 pagesFdocuments - in Sap MM What Is Unplanned Delivery Cost in Sap MMRaghavendra M R100% (1)

- SAP Sales Milestone SnapshotDocument11 pagesSAP Sales Milestone Snapshotvenkatesank100% (7)

- Classic Subcontracting - Outsourcing Production - SAP BlogsDocument10 pagesClassic Subcontracting - Outsourcing Production - SAP BlogswertghjhgrNo ratings yet

- Sap MM PPDocument33 pagesSap MM PPyogeshNo ratings yet

- Complaints & ReturnsDocument10 pagesComplaints & ReturnsmshabnamNo ratings yet

- 16 Fields in Pricing Procedure and Their DescriptionDocument6 pages16 Fields in Pricing Procedure and Their DescriptionSangram Ingle100% (2)

- STO Process YamsaniDocument21 pagesSTO Process YamsaniSatish Yamsani100% (1)

- Status Profile in SAP SDDocument9 pagesStatus Profile in SAP SDNoopur Rai100% (1)

- Stock Transport Order ConfigurationDocument1 pageStock Transport Order ConfigurationdhanahbalNo ratings yet

- How To Configure Make To Order in Easy WaysDocument10 pagesHow To Configure Make To Order in Easy WaysDHANESH SHUKLA100% (1)

- Inter Company Return StoDocument11 pagesInter Company Return Stosandip bhadane100% (1)

- Customization SD LEDocument88 pagesCustomization SD LEKamleshSaroj100% (1)

- Intercompany PurchasingDocument23 pagesIntercompany PurchasingSahil Jadhav100% (1)

- Rebate Process ConfigurationDocument13 pagesRebate Process Configurationshikhar singh100% (1)

- Requirement RoutinesDocument3 pagesRequirement RoutinesRajesh SrinathanNo ratings yet

- Basics of Sap SD ModuleDocument20 pagesBasics of Sap SD ModuleSourav Daruka100% (1)

- Inter Company - Cross Company in SAP - SAP SIMPLE DocsDocument10 pagesInter Company - Cross Company in SAP - SAP SIMPLE DocsAnanthakumar ANo ratings yet

- Sales Scheduling Agreements (3NR - GB) - Test ScriptDocument32 pagesSales Scheduling Agreements (3NR - GB) - Test ScriptFernando MillanNo ratings yet

- Sd1007: Availability Check & Transfer of Requirements V1.0: India Sap Coe, Slide 1Document44 pagesSd1007: Availability Check & Transfer of Requirements V1.0: India Sap Coe, Slide 1SUSMITANo ratings yet

- 03 - Rebates in SAP - CDocument17 pages03 - Rebates in SAP - Csushma_311819No ratings yet

- Special Sals ProcessDocument84 pagesSpecial Sals ProcessSUSMITA100% (1)

- Reverse CalculationDocument7 pagesReverse CalculationKanishka Thomas Kain100% (1)

- Determination Rule in SAP SD # Determination Object Rules For DeterminationDocument7 pagesDetermination Rule in SAP SD # Determination Object Rules For Determinationtrip2ashishNo ratings yet

- Requirement Routines - Output ControlDocument3 pagesRequirement Routines - Output ControlSOUMEN DASNo ratings yet

- 23 Questions On SAP SD ShippingDocument4 pages23 Questions On SAP SD ShippingBalaji_SAPNo ratings yet

- Sap SDDocument9 pagesSap SDSouvik_DasNo ratings yet

- User ExitsDocument3 pagesUser Exitsvenkat100% (1)

- SAP Tips and Tricks v2.0Document27 pagesSAP Tips and Tricks v2.0nbhaskar bhaskar100% (2)

- Copy Control Settings: PurposeDocument4 pagesCopy Control Settings: PurposeLokesh Dora100% (1)

- Sap SD 100Document12 pagesSap SD 100c_subhasis100% (1)

- Automatic Account DeterminationDocument13 pagesAutomatic Account DeterminationmayurNo ratings yet

- Tolerance Usage in Sap MMDocument12 pagesTolerance Usage in Sap MMRajEshwer ReddyNo ratings yet

- Inter-Company Billing Process - SAP BlogsDocument3 pagesInter-Company Billing Process - SAP BlogsNikhil RaviNo ratings yet

- Pricing ProcedureDocument2 pagesPricing ProcedureMehul BazariaNo ratings yet

- Copy Contro in SDDocument4 pagesCopy Contro in SDHuseyn IsmayilovNo ratings yet

- SAP For InterviewDocument14 pagesSAP For Interviewbhaskarrajusa8034100% (1)

- How Can We Manage Stockable Item and Non Stock Item in Sales Cycle. - SAP CommunityDocument2 pagesHow Can We Manage Stockable Item and Non Stock Item in Sales Cycle. - SAP Communitysuku_mca100% (1)

- ThirdPartySales SAP SDDocument14 pagesThirdPartySales SAP SDRaja ShekarNo ratings yet

- V of M Data Transfer RoutinesDocument28 pagesV of M Data Transfer RoutinesSamik Biswas100% (2)

- Mto ProcessDocument14 pagesMto Processrajesh dash100% (2)

- P25 Img Consumption Based PlanningDocument23 pagesP25 Img Consumption Based PlanninglymacsauokNo ratings yet

- Pricing Requirements in Sap-Sd Sales Order ProcessingDocument3 pagesPricing Requirements in Sap-Sd Sales Order ProcessingLaxmi Narsimha Rao MamidalaNo ratings yet

- Process For Stock Transfer With DeliveryDocument9 pagesProcess For Stock Transfer With DeliveryAbhishekSharmaNo ratings yet

- Stock Transfer Between Plants in One StepDocument5 pagesStock Transfer Between Plants in One StepRahul JainNo ratings yet

- Inter-Company STO With SD Delivery, Billing & LIVDocument39 pagesInter-Company STO With SD Delivery, Billing & LIVpraveen adavellyNo ratings yet

- Vf04 Billing Due List What Is The Difference Between Billing Date Fkdat and Vfkdat in The Alv ListDocument5 pagesVf04 Billing Due List What Is The Difference Between Billing Date Fkdat and Vfkdat in The Alv Listpankaj_labh85100% (2)

- ALE SequenceDocument3 pagesALE Sequencesweetu.mNo ratings yet

- Sales Returns ProcessingDocument13 pagesSales Returns ProcessingmeddebyounesNo ratings yet

- 48 SAP Projects and Ticket HandlingDocument16 pages48 SAP Projects and Ticket HandlingSrini VasanNo ratings yet

- 17 Document Release ProcedureDocument21 pages17 Document Release ProcedureSrini VasanNo ratings yet

- 20 Invoice Variances and Blocking ReasonsDocument54 pages20 Invoice Variances and Blocking ReasonsSrini VasanNo ratings yet

- 14 User Parameters and Its CustomizingDocument13 pages14 User Parameters and Its CustomizingSrini VasanNo ratings yet

- 4 Procurement of Stock Material PDFDocument50 pages4 Procurement of Stock Material PDFSrini VasanNo ratings yet

- (Part - 2) : Email: PH: (Australia) +61413159465 Trainer: Gurjeet SinghDocument32 pages(Part - 2) : Email: PH: (Australia) +61413159465 Trainer: Gurjeet SinghSrini VasanNo ratings yet

- 12 Source DeterminationDocument54 pages12 Source DeterminationSrini VasanNo ratings yet

- 19 Invoice Entry 2Document25 pages19 Invoice Entry 2Srini VasanNo ratings yet

- C Ewm 95-Exam-Questions PDFDocument9 pagesC Ewm 95-Exam-Questions PDFSrini VasanNo ratings yet

- Blue Print WM Agenda 022120A RHDocument4 pagesBlue Print WM Agenda 022120A RHSrini VasanNo ratings yet

- Distribution Center SAP WM OverviewDocument24 pagesDistribution Center SAP WM OverviewSrini VasanNo ratings yet

- Pricing & Condition TechniqueDocument41 pagesPricing & Condition TechniqueSrini VasanNo ratings yet

- COOKIEDocument15 pagesCOOKIEBecca AlmencionNo ratings yet

- Annual Gold Price From 1900Document49 pagesAnnual Gold Price From 1900asignifiesappleNo ratings yet

- 23si0055 - Ace WaterDocument1 page23si0055 - Ace WaterDeshan SingNo ratings yet

- Simafore Whitepaper Customer Lifetime Value Modeling PDFDocument13 pagesSimafore Whitepaper Customer Lifetime Value Modeling PDFsafj,ndsaNo ratings yet

- A. B. C. D. CompletenessDocument3 pagesA. B. C. D. Completenessedrick LouiseNo ratings yet

- 1Document3 pages1Stook01701No ratings yet

- Report 1-3 - Nabil BankDocument33 pagesReport 1-3 - Nabil BankSalım RaıŋNo ratings yet

- Group 2: Dakshayani Biscuits (: Cost Sheet)Document6 pagesGroup 2: Dakshayani Biscuits (: Cost Sheet)Vinu DNo ratings yet

- Modelling Nigerian's FGN BondDocument69 pagesModelling Nigerian's FGN Bondmarthaaugustine2No ratings yet

- Project Financial ServicesDocument71 pagesProject Financial ServicesPardeep YadavNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancegaurav kumarNo ratings yet

- FIN 456 International Financial Management: The Market For Foreign ExchangeDocument35 pagesFIN 456 International Financial Management: The Market For Foreign ExchangeHiếu Nguyễn Minh HoàngNo ratings yet

- B014393 HN in Business L4 SpecificationDocument480 pagesB014393 HN in Business L4 SpecificationRajivVyasNo ratings yet

- The Impact of Foreign Aid On Economic Growth Emperical Evidence From Ethiopia 1974 2011using Ardl ApproachDocument12 pagesThe Impact of Foreign Aid On Economic Growth Emperical Evidence From Ethiopia 1974 2011using Ardl Approachrajan20202000100% (1)

- Republic of The Philippines vs. Sunlife Assurance: GR NO. 158085 OCTOBER 14, 2005Document9 pagesRepublic of The Philippines vs. Sunlife Assurance: GR NO. 158085 OCTOBER 14, 2005dingNo ratings yet

- Prudential Bank v. Martinez - DigestDocument3 pagesPrudential Bank v. Martinez - DigestcinfloNo ratings yet

- Derivative IBBL Stress Testing 2012-16 AatiqDocument56 pagesDerivative IBBL Stress Testing 2012-16 AatiqMD ATIQULLAH KHANNo ratings yet

- Mathematics of Investment 3Document25 pagesMathematics of Investment 3John Luis Masangkay Bantolino100% (1)

- Agricultural EconomicsDocument14 pagesAgricultural EconomicsIzuka ChibuzorNo ratings yet

- Viva On Project and CfsDocument7 pagesViva On Project and CfsCrazy GamerNo ratings yet

- Business and Economic Development - Impact CSRDocument76 pagesBusiness and Economic Development - Impact CSRSIPIROKNo ratings yet

- Sterlite Technologies PDFDocument302 pagesSterlite Technologies PDFbardhanNo ratings yet

- Cash Accounting and Cash Flow Planning With SAP Liquidity PlannerDocument17 pagesCash Accounting and Cash Flow Planning With SAP Liquidity PlannerLTSSILVANo ratings yet

- Ia1 Chapter 9Document3 pagesIa1 Chapter 9Elexie RollonNo ratings yet

- Mechanics of Futures MarketDocument11 pagesMechanics of Futures MarketSUMIT JANKARNo ratings yet

- A131 Tutorial 1 QDocument9 pagesA131 Tutorial 1 QJu RaizahNo ratings yet

- Challenges of State Owned Corporations and Enterprises in AfghanistanDocument11 pagesChallenges of State Owned Corporations and Enterprises in AfghanistanNaseer Ahmad AziziNo ratings yet

- Financial Literacy Test Grade 11 Entrepreneurship Mr. Valley Student NameDocument8 pagesFinancial Literacy Test Grade 11 Entrepreneurship Mr. Valley Student Nameapi-350400617No ratings yet