Professional Documents

Culture Documents

Note - The Assignment Is Divided Into 2 Sets. You Have To Answer All Questions in Both Sets. Average

Note - The Assignment Is Divided Into 2 Sets. You Have To Answer All Questions in Both Sets. Average

Uploaded by

Simanta Kalita0 ratings0% found this document useful (0 votes)

48 views2 pagesThis document provides an assignment for an MBA program's Security Analysis and Portfolio Management course. The assignment consists of two sets with a total of 30 marks. Set I contains 3 questions worth 10 marks each on topics like business cycles, fundamental analysis, mutual funds, and financial derivatives. Set II contains 3 questions worth 10 marks each, including calculating returns and risk measures for a security, explaining financial ratio criteria, and distinguishing between business and financial risk while discussing industry analysis factors. Students must answer all questions across both sets.

Original Description:

Original Title

FIN 301.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an assignment for an MBA program's Security Analysis and Portfolio Management course. The assignment consists of two sets with a total of 30 marks. Set I contains 3 questions worth 10 marks each on topics like business cycles, fundamental analysis, mutual funds, and financial derivatives. Set II contains 3 questions worth 10 marks each, including calculating returns and risk measures for a security, explaining financial ratio criteria, and distinguishing between business and financial risk while discussing industry analysis factors. Students must answer all questions across both sets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

48 views2 pagesNote - The Assignment Is Divided Into 2 Sets. You Have To Answer All Questions in Both Sets. Average

Note - The Assignment Is Divided Into 2 Sets. You Have To Answer All Questions in Both Sets. Average

Uploaded by

Simanta KalitaThis document provides an assignment for an MBA program's Security Analysis and Portfolio Management course. The assignment consists of two sets with a total of 30 marks. Set I contains 3 questions worth 10 marks each on topics like business cycles, fundamental analysis, mutual funds, and financial derivatives. Set II contains 3 questions worth 10 marks each, including calculating returns and risk measures for a security, explaining financial ratio criteria, and distinguishing between business and financial risk while discussing industry analysis factors. Students must answer all questions across both sets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

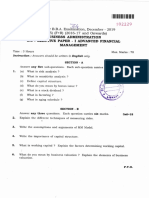

ASSIGNMENT

DRIVE SPRING 2018

PROGRAM MBA

SEMESTER 3

SUBJECT CODE & FIN301- SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT

NAME

BK ID B1754

CREDIT 4

MARKS 30

Note –The Assignment is divided into 2 sets. You have to answer all questions in both sets. Average

score of both assignments scored by you will be considered as your IA score. Kindly note that answers

for 10 marks questions should be approximately of 400 words.

Q.No Questions Marks Total

Marks

SET I

1. Explain the business cycle and leading coincidental & lagging indicators. Analyse the issues

in fundamental analysis.

A Explanation of business cycle-leading 6

coincidental and lagging indicator 10

Analysis and explanation of the issues in 4

fundamental analysis all the four points

2. Explain the Meaning and Benefits of Mutual Fund

A Explain the Meaning of Mutual Fund 5 10

Elucidate the various Benefits of Mutual 5

Funds

3. 1. Briefly explain Financial Derivatives.

2. Differentiate between Stocks and Bonds

1. Meaning and composition 5 10

A 2. Differences between Stocks and Bonds 5

SET II

1. Returns (%)

Probability P M

0.45 30 40

0.20 10 -10

0.35 20 30

This distribution of returns for share P and the market portfolio M is given above.

Calculate the Expected Return of Security P and the market portfolio, the

covariance between the market portfolio and security P and beta for the security.

A 1. Expected Return of Security P and the 5 10

market portfolio,

2. Covariance between the market portfolio 3

and security P

3. Beta for the security. 2

2. Explain the four crucial criteria of Financial Ratio while judging financial

performance.

A Four Crucial Criteria of Financial Ratio 4*2.5=10 10

3. 1. Distinguish between Business Risk and Financial Risk

2. Discuss the Factors affecting Industry analysis

A 1. Describe Business Risk and 2*2.5=5 10

Financial Risk Separately

2. Factors affecting 5

Industry Analysis

# A- ANSWER

You might also like

- TkmaxxDocument4 pagesTkmaxxKevo KarisNo ratings yet

- DLL Applied Econ Week 5Document3 pagesDLL Applied Econ Week 5Rachel Love Alegado Padigos80% (5)

- Wiley Valuation Measuring and Managing The Value of Companies Fourth Edition University Edition 2005Document65 pagesWiley Valuation Measuring and Managing The Value of Companies Fourth Edition University Edition 2005Elie Yabroudi0% (1)

- Lectures on Public Economics: Updated EditionFrom EverandLectures on Public Economics: Updated EditionRating: 5 out of 5 stars5/5 (1)

- Dimension Stone Quarrying KenyaDocument15 pagesDimension Stone Quarrying Kenyawerewaro100% (2)

- Group Project MKT243 2018Document3 pagesGroup Project MKT243 2018Mon Luffy100% (1)

- FIN301Document3 pagesFIN301Smu DocNo ratings yet

- 15A52301 Managerial Economics & Financial AnalysisDocument2 pages15A52301 Managerial Economics & Financial AnalysisGeorgekutty FrancisNo ratings yet

- Note - The Assignment Is Divided Into 2 Sets. You Have To Answer All Questions in Both Sets. AverageDocument1 pageNote - The Assignment Is Divided Into 2 Sets. You Have To Answer All Questions in Both Sets. AverageSimanta KalitaNo ratings yet

- Fin 302 PDFDocument1 pageFin 302 PDFSimanta KalitaNo ratings yet

- Note - The Assignment Is Divided Into 2 Sets. You Have To Answer All Questions in Both Sets. AverageDocument1 pageNote - The Assignment Is Divided Into 2 Sets. You Have To Answer All Questions in Both Sets. AverageJitendra KumarNo ratings yet

- FIN5203 Homework 5 FL22Document2 pagesFIN5203 Homework 5 FL22merly chermonNo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementHTB MoviesNo ratings yet

- Bba 5 Sem Dec 2019Document17 pagesBba 5 Sem Dec 2019Tanmay SinghNo ratings yet

- Security Analysis and Port Folio Management: Question Bank (5years) 2 MarksDocument7 pagesSecurity Analysis and Port Folio Management: Question Bank (5years) 2 MarksVignesh Narayanan100% (1)

- Fin 402 PDFDocument2 pagesFin 402 PDFSimanta KalitaNo ratings yet

- Bba 108 PDFDocument2 pagesBba 108 PDFSimanta KalitaNo ratings yet

- HRM401 Compensation and BenefitsDocument2 pagesHRM401 Compensation and BenefitsM R AlamNo ratings yet

- MBA108CDocument2 pagesMBA108CRohit TushirNo ratings yet

- SMM148 Theory of Finance QuestionsDocument5 pagesSMM148 Theory of Finance Questionsminh daoNo ratings yet

- MBA202Document2 pagesMBA202Sujal SNo ratings yet

- CAF SyllabusDocument89 pagesCAF SyllabusFaheem MajeedNo ratings yet

- CAF SyllabusDocument89 pagesCAF Syllabusmanadish nawazNo ratings yet

- Sample Assignment Question May 2012Document4 pagesSample Assignment Question May 2012Farah ismailNo ratings yet

- SAPM Model PapersDocument8 pagesSAPM Model PapersSrikanth BheemsettiNo ratings yet

- CAF Syllabus PDFDocument88 pagesCAF Syllabus PDFAbdullah AbidNo ratings yet

- BFC 3379 Investment Analysis and Portfolio MNGTDocument4 pagesBFC 3379 Investment Analysis and Portfolio MNGTsumeya.abdi4No ratings yet

- Managerial Economics and Financial AnalysisDocument6 pagesManagerial Economics and Financial AnalysisLalithya Sannitha MeesalaNo ratings yet

- MF0010 - Summer 2014Document2 pagesMF0010 - Summer 2014Rajesh SinghNo ratings yet

- Fin401 - Assignment - Spring 2022Document1 pageFin401 - Assignment - Spring 2022Rajni KumariNo ratings yet

- CH 4 - Portfolio Management (2024) - HandoutDocument21 pagesCH 4 - Portfolio Management (2024) - HandoutMayibongwe MpofuNo ratings yet

- CAF SyllabusDocument88 pagesCAF SyllabusTeen CharaghNo ratings yet

- Fin 402Document2 pagesFin 402Simanta KalitaNo ratings yet

- Gnanamani College of Technology: Ba5012 Security Analysis and Portfolio ManagementDocument2 pagesGnanamani College of Technology: Ba5012 Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- TutorialsDocument28 pagesTutorialsmupiwamasimbaNo ratings yet

- MBA/M-l7: Analysis ManagementDocument2 pagesMBA/M-l7: Analysis ManagementGURJARNo ratings yet

- Strategic Management - KMB301Document2 pagesStrategic Management - KMB301Shubhendu shekhar pandeyNo ratings yet

- Treasury Management PDFDocument2 pagesTreasury Management PDFABCDNo ratings yet

- Unit IV 8.: No. of Printed Pages: 04 Roll No. ......................Document2 pagesUnit IV 8.: No. of Printed Pages: 04 Roll No. ......................Shakib SaifiNo ratings yet

- Mba 103 PDFDocument2 pagesMba 103 PDFSimanta KalitaNo ratings yet

- MBA108CDocument2 pagesMBA108CRohit TushirNo ratings yet

- Assignment Set - 1 QuestionsDocument2 pagesAssignment Set - 1 QuestionsTushar AhujaNo ratings yet

- Fsa 2021-23 PGDMDocument9 pagesFsa 2021-23 PGDMShaz BhuwanNo ratings yet

- 120 - ECO-1 - ENG D18 - CompressedDocument2 pages120 - ECO-1 - ENG D18 - CompressedJdjdj JsjdjdNo ratings yet

- MS-042 Dec 2021Document2 pagesMS-042 Dec 2021chanduNo ratings yet

- 2826295699001Document4 pages2826295699001Yen TsangNo ratings yet

- QP 2012 Managerial - Economics - Financial - Analysis (WWW - Jntulibrary.com)Document4 pagesQP 2012 Managerial - Economics - Financial - Analysis (WWW - Jntulibrary.com)IdrisNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2019Document3 pagesBangalore University Previous Year Question Paper AFM 2019Ramakrishna NagarajaNo ratings yet

- BFC5935 - Tutorial 3 Solutions PDFDocument6 pagesBFC5935 - Tutorial 3 Solutions PDFXue XuNo ratings yet

- I. Strategic Window: AssignmentDocument2 pagesI. Strategic Window: AssignmentJitendra SharmaNo ratings yet

- Module-5 Problems On Performance Evaluation of Mutual FundDocument4 pagesModule-5 Problems On Performance Evaluation of Mutual Fundgaurav supadeNo ratings yet

- Chapter F2: Objectives & Key TermsDocument2 pagesChapter F2: Objectives & Key TermsOsas OmoxxNo ratings yet

- Needles Finman Irm Ch12Document14 pagesNeedles Finman Irm Ch12Dr. M. SamyNo ratings yet

- Assignment: Approximately of 400 Words. Each Question Is Followed by Evaluation SchemeDocument2 pagesAssignment: Approximately of 400 Words. Each Question Is Followed by Evaluation SchemePuja KumariNo ratings yet

- Security AnalysisDocument2 pagesSecurity AnalysisKavish BablaNo ratings yet

- Chinhoyi University of Technology: School of Business Sciences and ManagementDocument8 pagesChinhoyi University of Technology: School of Business Sciences and ManagementDanisa NdhlovuNo ratings yet

- Cm2 Assignment (q and a ) Setted (23.03.2023)Document165 pagesCm2 Assignment (q and a ) Setted (23.03.2023)Aryan RajNo ratings yet

- Question Paper SAPMDocument8 pagesQuestion Paper SAPMBala VigneshNo ratings yet

- Grade 9 Provincial Exam Economic and Management Sciences (English) June 2018 Question PaperDocument12 pagesGrade 9 Provincial Exam Economic and Management Sciences (English) June 2018 Question Papermakhutso.mathaga073No ratings yet

- Fin 404 PDFDocument2 pagesFin 404 PDFSimanta KalitaNo ratings yet

- Fin3020 2211ers1 1 18 PDFDocument4 pagesFin3020 2211ers1 1 18 PDFSteven LiNo ratings yet

- Bba 5th Sem Dec 2018Document13 pagesBba 5th Sem Dec 20188bhgp7bkjsNo ratings yet

- MKT 402Document2 pagesMKT 402Simanta KalitaNo ratings yet

- MKT403Document2 pagesMKT403Simanta KalitaNo ratings yet

- Assignment Drive SPRING 2020 Program MBA Subject Code & Name MKT404-International Marketing BK Id B 1811Document2 pagesAssignment Drive SPRING 2020 Program MBA Subject Code & Name MKT404-International Marketing BK Id B 1811Simanta KalitaNo ratings yet

- Write Short Notes On 7Ps of Service Marketing Mix and Characteristics of ServiceDocument2 pagesWrite Short Notes On 7Ps of Service Marketing Mix and Characteristics of ServiceSimanta KalitaNo ratings yet

- MBA401Document2 pagesMBA401Simanta KalitaNo ratings yet

- Q.No Assignment Set - 1 Questions Marks Total MarksDocument1 pageQ.No Assignment Set - 1 Questions Marks Total MarksSimanta KalitaNo ratings yet

- MCA5142Document1 pageMCA5142Simanta KalitaNo ratings yet

- Assignment: Marks Total MarksDocument1 pageAssignment: Marks Total MarksSimanta KalitaNo ratings yet

- ISM403Document1 pageISM403Simanta KalitaNo ratings yet

- Assignment: Set-IDocument2 pagesAssignment: Set-ISimanta KalitaNo ratings yet

- FIN403Document1 pageFIN403Simanta KalitaNo ratings yet

- Fin 402Document2 pagesFin 402Simanta KalitaNo ratings yet

- Assignment: Drive Program Semester Subject Code & Name Book Id Credit & MarksDocument2 pagesAssignment: Drive Program Semester Subject Code & Name Book Id Credit & MarksSimanta KalitaNo ratings yet

- ISM402Document2 pagesISM402Simanta KalitaNo ratings yet

- Answer All Questions Assignment Set - 1: Describe Static Allocation During Compile Time. Also Point Out Its LimitationsDocument1 pageAnswer All Questions Assignment Set - 1: Describe Static Allocation During Compile Time. Also Point Out Its LimitationsSimanta KalitaNo ratings yet

- BIT503Document1 pageBIT503Simanta KalitaNo ratings yet

- BIT501Document1 pageBIT501Simanta KalitaNo ratings yet

- Answer All Questions Assignment Set - 1Document1 pageAnswer All Questions Assignment Set - 1Simanta KalitaNo ratings yet

- White Box Testing?: AssignmentDocument1 pageWhite Box Testing?: AssignmentSimanta KalitaNo ratings yet

- Market For Currency FuturesDocument35 pagesMarket For Currency Futuresvidhya priyaNo ratings yet

- Investor Complaint Form-310708 - 288Document3 pagesInvestor Complaint Form-310708 - 288friend_foru2121No ratings yet

- Bse Project Class 11Document22 pagesBse Project Class 11Suparn WadhiNo ratings yet

- 1311 Ew TaffDocument10 pages1311 Ew TaffrandeepsNo ratings yet

- Brown Marine Supply CompanyDocument21 pagesBrown Marine Supply CompanyMuiz HassanNo ratings yet

- Sales Research: Dr. Chitranshi VermaDocument25 pagesSales Research: Dr. Chitranshi VermachitranshiNo ratings yet

- Canada Goose - Final Long Form Prospectus (060820) (Quercus)Document261 pagesCanada Goose - Final Long Form Prospectus (060820) (Quercus)Daniel GaoNo ratings yet

- (Case 10) Walmart and AmazonDocument7 pages(Case 10) Walmart and Amazonberliana setyawatiNo ratings yet

- Abbar & Zainy Cold Stores Co Saudi ArabiaDocument435 pagesAbbar & Zainy Cold Stores Co Saudi ArabiaDataGroup Retailer AnalysisNo ratings yet

- Exam in Accounting-FinalsDocument5 pagesExam in Accounting-FinalsIyarna YasraNo ratings yet

- An Introduction To SwapsDocument4 pagesAn Introduction To Swaps777antonio777No ratings yet

- Developing Marketing Strategies and PlansDocument47 pagesDeveloping Marketing Strategies and PlansHere ThereNo ratings yet

- Tech Adoption LifecycleDocument65 pagesTech Adoption LifecycleDeepali PatilNo ratings yet

- Mma Report FinalDocument28 pagesMma Report FinalSnoopyNo ratings yet

- R& DDocument11 pagesR& Dirshad69No ratings yet

- Vivekananda College Thakurpukur KOLKATA-700063: Naac Accredited A' GradeDocument8 pagesVivekananda College Thakurpukur KOLKATA-700063: Naac Accredited A' GradeParamartha BanerjeeNo ratings yet

- What Is The Highly Optimized Manufacturing ProcessDocument3 pagesWhat Is The Highly Optimized Manufacturing ProcessSharmashDNo ratings yet

- Financial Statements 2018 Adidas Ag eDocument86 pagesFinancial Statements 2018 Adidas Ag ewaskithaNo ratings yet

- Chapter Twenty-One: Managing Liquidity RiskDocument20 pagesChapter Twenty-One: Managing Liquidity RiskSagheer MuhammadNo ratings yet

- Captains Dine@ ShamimDocument9 pagesCaptains Dine@ ShamimJahidul karimNo ratings yet

- Midterm L3L4Document2 pagesMidterm L3L4Nicole LukNo ratings yet

- "Assignment" Make Your Own BrandDocument16 pages"Assignment" Make Your Own BrandJeet KaharNo ratings yet

- Brand ResonanceDocument10 pagesBrand ResonanceAŋoop KrīşħŋặNo ratings yet

- Global Strategy of Indian Marketing EnterprisesDocument10 pagesGlobal Strategy of Indian Marketing EnterprisesBindu MadhaviNo ratings yet

- Churchill Ice CreaChurchillDocument20 pagesChurchill Ice CreaChurchillFaisal ImranNo ratings yet

- Nirmal Bang On United SpiritsDocument6 pagesNirmal Bang On United SpiritsamsukdNo ratings yet