Professional Documents

Culture Documents

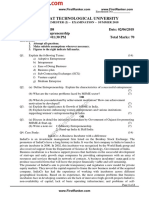

Public Finance

Public Finance

Uploaded by

Amrit KaurCopyright:

Available Formats

You might also like

- Section 8.1 Review Questions (Page 275)Document65 pagesSection 8.1 Review Questions (Page 275)CJ Ngo100% (13)

- Womens Clothing Boutique Business PlanDocument51 pagesWomens Clothing Boutique Business Plansohalsingh1No ratings yet

- Practice Questions - Eqty1Document17 pagesPractice Questions - Eqty1gauravroongtaNo ratings yet

- Bar Business PlanDocument22 pagesBar Business Plansmelissah1100% (2)

- Case Study 2Document27 pagesCase Study 2Amrit Kaur100% (2)

- ACC404 - Chapter 4,6,9Document9 pagesACC404 - Chapter 4,6,9delrisco8No ratings yet

- h1 Public Finance - Meaning Scope DistinctionDocument4 pagesh1 Public Finance - Meaning Scope DistinctionRajiv VyasNo ratings yet

- Chapter-One Overview of Public Finance & TaxationDocument211 pagesChapter-One Overview of Public Finance & Taxationarsen lupinNo ratings yet

- INFOLINK COLLEGE (Public Finance)Document138 pagesINFOLINK COLLEGE (Public Finance)arsen lupin100% (1)

- Chapter One Basics of Public FinanceDocument30 pagesChapter One Basics of Public FinanceAhmedNo ratings yet

- Public Finance NoteDocument6 pagesPublic Finance NotenarrNo ratings yet

- Introduction To Public Finance Meaning of Public FinanceDocument4 pagesIntroduction To Public Finance Meaning of Public FinanceSakshi HaldankarNo ratings yet

- Public FinanceDocument111 pagesPublic Financeyuusufwarsame80No ratings yet

- Public FinanceDocument5 pagesPublic FinanceMhai Penolio100% (1)

- Public Fin CH-1Document49 pagesPublic Fin CH-1Wonde Biru100% (1)

- Adamawa State Polytechnic, Yola: (Department of Consultancy Services)Document30 pagesAdamawa State Polytechnic, Yola: (Department of Consultancy Services)usibrahimNo ratings yet

- Topic 1-Meaning and Nature of Public FinanceDocument12 pagesTopic 1-Meaning and Nature of Public FinanceNiphaNo ratings yet

- Public Finance & IT Law111Document13 pagesPublic Finance & IT Law111Arun ANNo ratings yet

- Reading Material - Unit-1 and 2Document33 pagesReading Material - Unit-1 and 2Nokia PokiaNo ratings yet

- This Chapter For The Course Public Finance Focuses OnDocument19 pagesThis Chapter For The Course Public Finance Focuses OnJamaNo ratings yet

- Public FinanceDocument48 pagesPublic FinanceJorge Labante100% (1)

- 1.meaning and Scope of Public FinanceDocument3 pages1.meaning and Scope of Public FinanceTimothy 328No ratings yet

- Public Finance and Taxation Chapter 1 & 2Document31 pagesPublic Finance and Taxation Chapter 1 & 2adisesegedeNo ratings yet

- CHAPTER ONE Public Finanace (2) - 1Document10 pagesCHAPTER ONE Public Finanace (2) - 1mani per100% (1)

- Public Finance Class PresentationDocument45 pagesPublic Finance Class PresentationnaimaNo ratings yet

- ConceptDocument32 pagesConceptcucba23rdbatchNo ratings yet

- Fiscal Policy 1d78e36d 8f83 4cc4 B1be 45b89069fe1eDocument7 pagesFiscal Policy 1d78e36d 8f83 4cc4 B1be 45b89069fe1eyash agNo ratings yet

- CHAPTER I - Introduction-to-Public-FinanceDocument12 pagesCHAPTER I - Introduction-to-Public-FinanceMaricel GoNo ratings yet

- Meaning and Scope of Public FinanceDocument10 pagesMeaning and Scope of Public Financetanmaya_purohitNo ratings yet

- Course No. AIS 2305 - Theory and Practice of Taxation - Lect Materials - Tax Theory - Jan 2012Document22 pagesCourse No. AIS 2305 - Theory and Practice of Taxation - Lect Materials - Tax Theory - Jan 2012Shariful Islam JoyNo ratings yet

- Public Finance CH1 - PrintDocument6 pagesPublic Finance CH1 - PrintWegene Benti UmaNo ratings yet

- Chapter 1 - Public FinanceDocument7 pagesChapter 1 - Public FinancePeter DundeeNo ratings yet

- Chapter One Mening and Scope of Public FinanceDocument12 pagesChapter One Mening and Scope of Public FinanceHabibuna Mohammed100% (1)

- PFT HandOutDocument14 pagesPFT HandOutyechale tafereNo ratings yet

- UntitledDocument9 pagesUntitledAbebaw DebieNo ratings yet

- PF and Public RevenueDocument16 pagesPF and Public Revenuedeondalmeida17No ratings yet

- Introduction To Public FinanceDocument33 pagesIntroduction To Public FinanceIrene CheronoNo ratings yet

- TaxationDocument23 pagesTaxationsabit hussenNo ratings yet

- h1 Public EconomicsDocument9 pagesh1 Public EconomicsRajiv VyasNo ratings yet

- EconomicsDocument4 pagesEconomicsiNo ratings yet

- Public Finance (Sharbani)Document5 pagesPublic Finance (Sharbani)Sumitava PaulNo ratings yet

- Chap 1 TaxDocument10 pagesChap 1 TaxNatnael MengistuNo ratings yet

- 11 Advanced Taxation Aau MaterialDocument129 pages11 Advanced Taxation Aau MaterialErmi ManNo ratings yet

- Chapter 2Document25 pagesChapter 2Abas Mohamed SidowNo ratings yet

- Public FinanceDocument36 pagesPublic Financeelizabeth nyasakaNo ratings yet

- Introduction To Public FinanceDocument9 pagesIntroduction To Public FinanceJ lodhi50% (2)

- Best Public FinanceDocument12 pagesBest Public FinanceMinaw BelayNo ratings yet

- Public Finance Study GUIDE 2019/2020: Morning/Evening/WeekendDocument67 pagesPublic Finance Study GUIDE 2019/2020: Morning/Evening/Weekendhayenje rebeccaNo ratings yet

- Principles of Public Finance (Notes For Final Exams by Muhammad Ali)Document27 pagesPrinciples of Public Finance (Notes For Final Exams by Muhammad Ali)Muhammad AliNo ratings yet

- Public Finance and TaxationDocument22 pagesPublic Finance and TaxationDj I amNo ratings yet

- Teju's Public Finance Hand Out PDFDocument136 pagesTeju's Public Finance Hand Out PDFሳቢያን-nationNo ratings yet

- Public Finance & Taxations CH 1-4Document177 pagesPublic Finance & Taxations CH 1-4fentawmelaku1993100% (1)

- Govt Budget-NotesDocument4 pagesGovt Budget-NotespuxvapsNo ratings yet

- Basics of Public FinanceDocument6 pagesBasics of Public FinanceAtta Ur Rehman KhanNo ratings yet

- 5th Sem H CC-11 Public Finance Meaning Definition Amitava Sarkar 16-01-2021Document3 pages5th Sem H CC-11 Public Finance Meaning Definition Amitava Sarkar 16-01-2021Victoria777No ratings yet

- Public Finance II Year PDFDocument18 pagesPublic Finance II Year PDFerekNo ratings yet

- CH 2 PF in EthiopiaDocument23 pagesCH 2 PF in EthiopiaNatnael MengistuNo ratings yet

- Social Security, Protection: Electricity, Water Supply, Railways, Heavy Electrical Atomic EnergyDocument46 pagesSocial Security, Protection: Electricity, Water Supply, Railways, Heavy Electrical Atomic EnergyYoseph KassaNo ratings yet

- Public Finance vs. Private FinanceDocument9 pagesPublic Finance vs. Private FinanceYashNo ratings yet

- .Public Finance Notes - 1683175688000Document57 pages.Public Finance Notes - 1683175688000Simon silaNo ratings yet

- Session 4 Fiscal PolicyDocument13 pagesSession 4 Fiscal PolicyThouseef AhmedNo ratings yet

- Chapter One TaxationDocument10 pagesChapter One TaxationEmebet TesemaNo ratings yet

- Economics Final Project Draft by R Phani Krishna Class Xii Sec IDocument21 pagesEconomics Final Project Draft by R Phani Krishna Class Xii Sec Ir.phaniKrishna krishnaNo ratings yet

- Module 1 - No ActivitiesDocument6 pagesModule 1 - No ActivitiesLeah Jane DamegNo ratings yet

- Public Finance and TaxationDocument134 pagesPublic Finance and TaxationyebegashetNo ratings yet

- Lecture 2 Notes Types of EntrepreneursDocument8 pagesLecture 2 Notes Types of EntrepreneursAmrit KaurNo ratings yet

- Case Study 1Document30 pagesCase Study 1Amrit KaurNo ratings yet

- MonographDocument16 pagesMonographAmrit KaurNo ratings yet

- Edp Notes QuestionsDocument6 pagesEdp Notes QuestionsAmrit KaurNo ratings yet

- Unit 1Document92 pagesUnit 1Amrit KaurNo ratings yet

- Burden of Public DebtDocument4 pagesBurden of Public DebtAmrit KaurNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityAmrit KaurNo ratings yet

- Edp NotesDocument11 pagesEdp NotesAmrit KaurNo ratings yet

- Tax SystemDocument5 pagesTax SystemAmrit KaurNo ratings yet

- University School of Business: Class: Sixth Semester Subject: EDP Subject Code:CMD 359Document3 pagesUniversity School of Business: Class: Sixth Semester Subject: EDP Subject Code:CMD 359Amrit KaurNo ratings yet

- Case Study-Steve JobsDocument7 pagesCase Study-Steve JobsAmrit KaurNo ratings yet

- Topics of Advancement-EdpDocument1 pageTopics of Advancement-EdpAmrit KaurNo ratings yet

- Entrepreneurship Multiple Choice QuestionsDocument3 pagesEntrepreneurship Multiple Choice QuestionsAmrit Kaur100% (4)

- Lecture 4 NotesDocument8 pagesLecture 4 NotesAmrit KaurNo ratings yet

- CH-1.3 Monetary & Fiscal PolicyDocument21 pagesCH-1.3 Monetary & Fiscal PolicyAmrit KaurNo ratings yet

- Sources of Finance: Lease FinancingDocument4 pagesSources of Finance: Lease FinancingAmrit KaurNo ratings yet

- Life Skills Curriculum Semester 3: Understanding StressDocument7 pagesLife Skills Curriculum Semester 3: Understanding StressAmrit KaurNo ratings yet

- Institute-University School of Business Department-CommerceDocument14 pagesInstitute-University School of Business Department-CommerceAmrit KaurNo ratings yet

- Lecture 2 Notes: (A) Fixed Capital Requirements: in Order To Start Business, Funds Are Required To Purchase FixedDocument5 pagesLecture 2 Notes: (A) Fixed Capital Requirements: in Order To Start Business, Funds Are Required To Purchase FixedAmrit KaurNo ratings yet

- Financial Sector Reforms - Meaning and ObjectivesDocument9 pagesFinancial Sector Reforms - Meaning and ObjectivesAmrit Kaur100% (1)

- L'Oréal: SECTOR - Consumer StaplesDocument11 pagesL'Oréal: SECTOR - Consumer StaplesMaria AlexandraNo ratings yet

- Final ExamDocument18 pagesFinal ExamHarryNo ratings yet

- Business Policy in Economic SystemDocument30 pagesBusiness Policy in Economic SystemGiri Bargava100% (2)

- NeoGrowth Social Impact Report 2018Document47 pagesNeoGrowth Social Impact Report 2018Krishnanand GaurNo ratings yet

- Clearly Case StudyDocument6 pagesClearly Case StudyParag PardhiNo ratings yet

- Meed Fa Construction Crane-Survey-Dubai 022016 PDFDocument32 pagesMeed Fa Construction Crane-Survey-Dubai 022016 PDFSithick MohamedNo ratings yet

- Chase ManhattanDocument2 pagesChase ManhattanCristie0% (1)

- CY Tax Incentives For Expatriate 2021 NoexpDocument4 pagesCY Tax Incentives For Expatriate 2021 Noexpjose mangas murilloNo ratings yet

- Prof. Jon D. Inocentes, Cpa Lecture January 31, 2018Document8 pagesProf. Jon D. Inocentes, Cpa Lecture January 31, 2018Riza Mae Biad LumaadNo ratings yet

- DepreciationDocument4 pagesDepreciationMadhura KhapekarNo ratings yet

- Asha Insurance CompanyDocument38 pagesAsha Insurance CompanyKamrul Hasan ShaonNo ratings yet

- VP Marketing Business Operations in Portland OR Resume Kathy StrombergDocument3 pagesVP Marketing Business Operations in Portland OR Resume Kathy StrombergKathyStrombergNo ratings yet

- Neighbour Hood PlanningDocument9 pagesNeighbour Hood PlanningNupur MishraNo ratings yet

- Working Capital NikunjDocument82 pagesWorking Capital Nikunjpatoliyanikunj002No ratings yet

- Tally NotesDocument3 pagesTally NotesArchana DeyNo ratings yet

- Assessment of Performance and Critical Success Factors of Rural Road Construction in SouthDocument143 pagesAssessment of Performance and Critical Success Factors of Rural Road Construction in SouthloveahNo ratings yet

- Quality ControlDocument20 pagesQuality ControltasnufaNo ratings yet

- Prioritization and Time Management: Course OutlineDocument1 pagePrioritization and Time Management: Course OutlinesunitaNo ratings yet

- F 13 Financial Accounting CpaDocument9 pagesF 13 Financial Accounting CpaMarcellin MarcaNo ratings yet

- Paper XVI - Management Accounting SyllabusDocument2 pagesPaper XVI - Management Accounting Syllabusrajesh2ndNo ratings yet

- A New Lean Six Sigma Framework For Improving CompetitivenessDocument12 pagesA New Lean Six Sigma Framework For Improving CompetitivenessmaryamNo ratings yet

- Mzfilemanagerv 2 Dorigin 1Document30 pagesMzfilemanagerv 2 Dorigin 1Jorge EchanizNo ratings yet

- ABM MCQ Test Sept 2021Document7 pagesABM MCQ Test Sept 2021Shyam PatelNo ratings yet

- Bata India LTDDocument3 pagesBata India LTDViny GokhruNo ratings yet

- Cuenta Romero Generali InternationalDocument2 pagesCuenta Romero Generali InternationalMaria ClaraNo ratings yet

Public Finance

Public Finance

Uploaded by

Amrit KaurOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Public Finance

Public Finance

Uploaded by

Amrit KaurCopyright:

Available Formats

Lets divide the concept in 2 parts

1. Public

2. Finance

Public can be generally related to government or massess or

population Whereas finance is somewhat related to expenditure

and revenue So we can say that public finance is related with

the income and expenditure of public authorites. Now lets see

the definition given by different authors

According to findlay shirras

“public finance is the study of principles underlying the

spending and raising of funds by public authorities”.

So is the concept clear to you?

Now we are going to study the nature of public finance

This is same as the nature of management

Nature of public finance implies whether it is a science or art or

both.

If we talk about public finance as science , we know that what

science is ?

Science is the systematic study of any subject which studies

relationship between facts. Public finance is considered as

science because it studies the relationship between facts relating

to revenue and expenditure of the government.

And we know the meaning of art also

Art is application of knowledge for achieving definite

objectives. Fiscal policy which is an important instrument of

public finance makes use of the knowledge of government’s

revenue and expenditure to achieve the objectives of full

employment, economic development and equality. Price stability

etc.

Next topic is scope of business finance

1. Public revenue, which deals with the method of raising funds

and the principles of taxation.

2. Public expenditure, which deals with the principles and

problems relating to the allocation of public spendings.

3. Public debt, which deals with the study of the causes and

methods of public loans as well as public debt management.

4. Financial administration, under this the problem of how the

financial machinery is organised and administered is dealt with.

This branch of public finance studies the income and

expenditure of the financial administration of the govt.

Importance of public finance

1. Steady state economic growth:

Government finance is important to achieve sustainable high

economic growth rate. The government uses the fiscal tools in

order to bring increase in both aggregate demand and aggregate

supply. The tools are taxes, public debt, and public expenditure

and so on.

2. Price stability:

The government uses the public finance in order to overcome

form inflation and deflation. During inflation it reduces the

indirect taxes and increase expenditures but increases direct

taxes and capital expenditure. It collects internal public debt and

mobilizes for investment. In case of deflation, the policy is just

reversed.

3. Economic stability:

The government uses the fiscal tools to stabilize the economy.

During prosperity, the government imposes more tax and raises

the internal public debt. The amount is used to repay foreign

debt and invention. The internal expenditures are reduced.

During recession, the case is just reversed.

4. Equitable distribution:

The government uses the revenues and expenditures of itself in

order to reduce inequality. If there is high disparity it imposes

more taxes on income, profit and properties of rich people and

on the goods they consume. The money collected is used for the

benefit of poor people through subsidies, allowance, and other

types of direct and indirect benefits to them.

5. Proper allocation of resources:

The government finance is important for proper utilization of

natural, manmade and human resources. For it, on the

production and sales of less desirable goods, the government

imposes more taxes and provides subsidies or imposes taxes

lightly on more desirable goods.

6. Balanced development:

The government uses the revenues and expenditures in order to

erase the gap between urban and rural and agricultural and

industrial sectors. For it, the government allocates the budget for

infrastructural development in rural areas and direct economic

benefits to the rural people.

7. Promotion of export:

The government promotes the export imposing less tax or

exempting form the taxes or providing subsidies to the export

oriented goods. It may supply the inputs at the subsidized prices.

It imposes more taxes on imports and so on.

8. Infrastructural development:

The government collects revenues and spends for the

construction of infrastructures. It has to keep peace, justice and

security too. It has to bring socio-economic reformation too. For

all these things it uses the revenues and expenditures as fiscal

tools

Difference between private and public finance

So tell me what is the difference between them?

rivate finance Public finance

An individual adjusts his or her The public authority adjusts its income to

xpenditure according to his or her income its expenditure.

A private individual tries to have a surplus A public authority will spend all that it

f income over expenditure i.e. Surplus gets

udget.

inances of individuals are limited Finances of government are flexible

Not a single individual can print notes A state can print currency notes in order to

meet its expenditure in difficult times

t has a narrow scope It has a wider scope

You might also like

- Section 8.1 Review Questions (Page 275)Document65 pagesSection 8.1 Review Questions (Page 275)CJ Ngo100% (13)

- Womens Clothing Boutique Business PlanDocument51 pagesWomens Clothing Boutique Business Plansohalsingh1No ratings yet

- Practice Questions - Eqty1Document17 pagesPractice Questions - Eqty1gauravroongtaNo ratings yet

- Bar Business PlanDocument22 pagesBar Business Plansmelissah1100% (2)

- Case Study 2Document27 pagesCase Study 2Amrit Kaur100% (2)

- ACC404 - Chapter 4,6,9Document9 pagesACC404 - Chapter 4,6,9delrisco8No ratings yet

- h1 Public Finance - Meaning Scope DistinctionDocument4 pagesh1 Public Finance - Meaning Scope DistinctionRajiv VyasNo ratings yet

- Chapter-One Overview of Public Finance & TaxationDocument211 pagesChapter-One Overview of Public Finance & Taxationarsen lupinNo ratings yet

- INFOLINK COLLEGE (Public Finance)Document138 pagesINFOLINK COLLEGE (Public Finance)arsen lupin100% (1)

- Chapter One Basics of Public FinanceDocument30 pagesChapter One Basics of Public FinanceAhmedNo ratings yet

- Public Finance NoteDocument6 pagesPublic Finance NotenarrNo ratings yet

- Introduction To Public Finance Meaning of Public FinanceDocument4 pagesIntroduction To Public Finance Meaning of Public FinanceSakshi HaldankarNo ratings yet

- Public FinanceDocument111 pagesPublic Financeyuusufwarsame80No ratings yet

- Public FinanceDocument5 pagesPublic FinanceMhai Penolio100% (1)

- Public Fin CH-1Document49 pagesPublic Fin CH-1Wonde Biru100% (1)

- Adamawa State Polytechnic, Yola: (Department of Consultancy Services)Document30 pagesAdamawa State Polytechnic, Yola: (Department of Consultancy Services)usibrahimNo ratings yet

- Topic 1-Meaning and Nature of Public FinanceDocument12 pagesTopic 1-Meaning and Nature of Public FinanceNiphaNo ratings yet

- Public Finance & IT Law111Document13 pagesPublic Finance & IT Law111Arun ANNo ratings yet

- Reading Material - Unit-1 and 2Document33 pagesReading Material - Unit-1 and 2Nokia PokiaNo ratings yet

- This Chapter For The Course Public Finance Focuses OnDocument19 pagesThis Chapter For The Course Public Finance Focuses OnJamaNo ratings yet

- Public FinanceDocument48 pagesPublic FinanceJorge Labante100% (1)

- 1.meaning and Scope of Public FinanceDocument3 pages1.meaning and Scope of Public FinanceTimothy 328No ratings yet

- Public Finance and Taxation Chapter 1 & 2Document31 pagesPublic Finance and Taxation Chapter 1 & 2adisesegedeNo ratings yet

- CHAPTER ONE Public Finanace (2) - 1Document10 pagesCHAPTER ONE Public Finanace (2) - 1mani per100% (1)

- Public Finance Class PresentationDocument45 pagesPublic Finance Class PresentationnaimaNo ratings yet

- ConceptDocument32 pagesConceptcucba23rdbatchNo ratings yet

- Fiscal Policy 1d78e36d 8f83 4cc4 B1be 45b89069fe1eDocument7 pagesFiscal Policy 1d78e36d 8f83 4cc4 B1be 45b89069fe1eyash agNo ratings yet

- CHAPTER I - Introduction-to-Public-FinanceDocument12 pagesCHAPTER I - Introduction-to-Public-FinanceMaricel GoNo ratings yet

- Meaning and Scope of Public FinanceDocument10 pagesMeaning and Scope of Public Financetanmaya_purohitNo ratings yet

- Course No. AIS 2305 - Theory and Practice of Taxation - Lect Materials - Tax Theory - Jan 2012Document22 pagesCourse No. AIS 2305 - Theory and Practice of Taxation - Lect Materials - Tax Theory - Jan 2012Shariful Islam JoyNo ratings yet

- Public Finance CH1 - PrintDocument6 pagesPublic Finance CH1 - PrintWegene Benti UmaNo ratings yet

- Chapter 1 - Public FinanceDocument7 pagesChapter 1 - Public FinancePeter DundeeNo ratings yet

- Chapter One Mening and Scope of Public FinanceDocument12 pagesChapter One Mening and Scope of Public FinanceHabibuna Mohammed100% (1)

- PFT HandOutDocument14 pagesPFT HandOutyechale tafereNo ratings yet

- UntitledDocument9 pagesUntitledAbebaw DebieNo ratings yet

- PF and Public RevenueDocument16 pagesPF and Public Revenuedeondalmeida17No ratings yet

- Introduction To Public FinanceDocument33 pagesIntroduction To Public FinanceIrene CheronoNo ratings yet

- TaxationDocument23 pagesTaxationsabit hussenNo ratings yet

- h1 Public EconomicsDocument9 pagesh1 Public EconomicsRajiv VyasNo ratings yet

- EconomicsDocument4 pagesEconomicsiNo ratings yet

- Public Finance (Sharbani)Document5 pagesPublic Finance (Sharbani)Sumitava PaulNo ratings yet

- Chap 1 TaxDocument10 pagesChap 1 TaxNatnael MengistuNo ratings yet

- 11 Advanced Taxation Aau MaterialDocument129 pages11 Advanced Taxation Aau MaterialErmi ManNo ratings yet

- Chapter 2Document25 pagesChapter 2Abas Mohamed SidowNo ratings yet

- Public FinanceDocument36 pagesPublic Financeelizabeth nyasakaNo ratings yet

- Introduction To Public FinanceDocument9 pagesIntroduction To Public FinanceJ lodhi50% (2)

- Best Public FinanceDocument12 pagesBest Public FinanceMinaw BelayNo ratings yet

- Public Finance Study GUIDE 2019/2020: Morning/Evening/WeekendDocument67 pagesPublic Finance Study GUIDE 2019/2020: Morning/Evening/Weekendhayenje rebeccaNo ratings yet

- Principles of Public Finance (Notes For Final Exams by Muhammad Ali)Document27 pagesPrinciples of Public Finance (Notes For Final Exams by Muhammad Ali)Muhammad AliNo ratings yet

- Public Finance and TaxationDocument22 pagesPublic Finance and TaxationDj I amNo ratings yet

- Teju's Public Finance Hand Out PDFDocument136 pagesTeju's Public Finance Hand Out PDFሳቢያን-nationNo ratings yet

- Public Finance & Taxations CH 1-4Document177 pagesPublic Finance & Taxations CH 1-4fentawmelaku1993100% (1)

- Govt Budget-NotesDocument4 pagesGovt Budget-NotespuxvapsNo ratings yet

- Basics of Public FinanceDocument6 pagesBasics of Public FinanceAtta Ur Rehman KhanNo ratings yet

- 5th Sem H CC-11 Public Finance Meaning Definition Amitava Sarkar 16-01-2021Document3 pages5th Sem H CC-11 Public Finance Meaning Definition Amitava Sarkar 16-01-2021Victoria777No ratings yet

- Public Finance II Year PDFDocument18 pagesPublic Finance II Year PDFerekNo ratings yet

- CH 2 PF in EthiopiaDocument23 pagesCH 2 PF in EthiopiaNatnael MengistuNo ratings yet

- Social Security, Protection: Electricity, Water Supply, Railways, Heavy Electrical Atomic EnergyDocument46 pagesSocial Security, Protection: Electricity, Water Supply, Railways, Heavy Electrical Atomic EnergyYoseph KassaNo ratings yet

- Public Finance vs. Private FinanceDocument9 pagesPublic Finance vs. Private FinanceYashNo ratings yet

- .Public Finance Notes - 1683175688000Document57 pages.Public Finance Notes - 1683175688000Simon silaNo ratings yet

- Session 4 Fiscal PolicyDocument13 pagesSession 4 Fiscal PolicyThouseef AhmedNo ratings yet

- Chapter One TaxationDocument10 pagesChapter One TaxationEmebet TesemaNo ratings yet

- Economics Final Project Draft by R Phani Krishna Class Xii Sec IDocument21 pagesEconomics Final Project Draft by R Phani Krishna Class Xii Sec Ir.phaniKrishna krishnaNo ratings yet

- Module 1 - No ActivitiesDocument6 pagesModule 1 - No ActivitiesLeah Jane DamegNo ratings yet

- Public Finance and TaxationDocument134 pagesPublic Finance and TaxationyebegashetNo ratings yet

- Lecture 2 Notes Types of EntrepreneursDocument8 pagesLecture 2 Notes Types of EntrepreneursAmrit KaurNo ratings yet

- Case Study 1Document30 pagesCase Study 1Amrit KaurNo ratings yet

- MonographDocument16 pagesMonographAmrit KaurNo ratings yet

- Edp Notes QuestionsDocument6 pagesEdp Notes QuestionsAmrit KaurNo ratings yet

- Unit 1Document92 pagesUnit 1Amrit KaurNo ratings yet

- Burden of Public DebtDocument4 pagesBurden of Public DebtAmrit KaurNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityAmrit KaurNo ratings yet

- Edp NotesDocument11 pagesEdp NotesAmrit KaurNo ratings yet

- Tax SystemDocument5 pagesTax SystemAmrit KaurNo ratings yet

- University School of Business: Class: Sixth Semester Subject: EDP Subject Code:CMD 359Document3 pagesUniversity School of Business: Class: Sixth Semester Subject: EDP Subject Code:CMD 359Amrit KaurNo ratings yet

- Case Study-Steve JobsDocument7 pagesCase Study-Steve JobsAmrit KaurNo ratings yet

- Topics of Advancement-EdpDocument1 pageTopics of Advancement-EdpAmrit KaurNo ratings yet

- Entrepreneurship Multiple Choice QuestionsDocument3 pagesEntrepreneurship Multiple Choice QuestionsAmrit Kaur100% (4)

- Lecture 4 NotesDocument8 pagesLecture 4 NotesAmrit KaurNo ratings yet

- CH-1.3 Monetary & Fiscal PolicyDocument21 pagesCH-1.3 Monetary & Fiscal PolicyAmrit KaurNo ratings yet

- Sources of Finance: Lease FinancingDocument4 pagesSources of Finance: Lease FinancingAmrit KaurNo ratings yet

- Life Skills Curriculum Semester 3: Understanding StressDocument7 pagesLife Skills Curriculum Semester 3: Understanding StressAmrit KaurNo ratings yet

- Institute-University School of Business Department-CommerceDocument14 pagesInstitute-University School of Business Department-CommerceAmrit KaurNo ratings yet

- Lecture 2 Notes: (A) Fixed Capital Requirements: in Order To Start Business, Funds Are Required To Purchase FixedDocument5 pagesLecture 2 Notes: (A) Fixed Capital Requirements: in Order To Start Business, Funds Are Required To Purchase FixedAmrit KaurNo ratings yet

- Financial Sector Reforms - Meaning and ObjectivesDocument9 pagesFinancial Sector Reforms - Meaning and ObjectivesAmrit Kaur100% (1)

- L'Oréal: SECTOR - Consumer StaplesDocument11 pagesL'Oréal: SECTOR - Consumer StaplesMaria AlexandraNo ratings yet

- Final ExamDocument18 pagesFinal ExamHarryNo ratings yet

- Business Policy in Economic SystemDocument30 pagesBusiness Policy in Economic SystemGiri Bargava100% (2)

- NeoGrowth Social Impact Report 2018Document47 pagesNeoGrowth Social Impact Report 2018Krishnanand GaurNo ratings yet

- Clearly Case StudyDocument6 pagesClearly Case StudyParag PardhiNo ratings yet

- Meed Fa Construction Crane-Survey-Dubai 022016 PDFDocument32 pagesMeed Fa Construction Crane-Survey-Dubai 022016 PDFSithick MohamedNo ratings yet

- Chase ManhattanDocument2 pagesChase ManhattanCristie0% (1)

- CY Tax Incentives For Expatriate 2021 NoexpDocument4 pagesCY Tax Incentives For Expatriate 2021 Noexpjose mangas murilloNo ratings yet

- Prof. Jon D. Inocentes, Cpa Lecture January 31, 2018Document8 pagesProf. Jon D. Inocentes, Cpa Lecture January 31, 2018Riza Mae Biad LumaadNo ratings yet

- DepreciationDocument4 pagesDepreciationMadhura KhapekarNo ratings yet

- Asha Insurance CompanyDocument38 pagesAsha Insurance CompanyKamrul Hasan ShaonNo ratings yet

- VP Marketing Business Operations in Portland OR Resume Kathy StrombergDocument3 pagesVP Marketing Business Operations in Portland OR Resume Kathy StrombergKathyStrombergNo ratings yet

- Neighbour Hood PlanningDocument9 pagesNeighbour Hood PlanningNupur MishraNo ratings yet

- Working Capital NikunjDocument82 pagesWorking Capital Nikunjpatoliyanikunj002No ratings yet

- Tally NotesDocument3 pagesTally NotesArchana DeyNo ratings yet

- Assessment of Performance and Critical Success Factors of Rural Road Construction in SouthDocument143 pagesAssessment of Performance and Critical Success Factors of Rural Road Construction in SouthloveahNo ratings yet

- Quality ControlDocument20 pagesQuality ControltasnufaNo ratings yet

- Prioritization and Time Management: Course OutlineDocument1 pagePrioritization and Time Management: Course OutlinesunitaNo ratings yet

- F 13 Financial Accounting CpaDocument9 pagesF 13 Financial Accounting CpaMarcellin MarcaNo ratings yet

- Paper XVI - Management Accounting SyllabusDocument2 pagesPaper XVI - Management Accounting Syllabusrajesh2ndNo ratings yet

- A New Lean Six Sigma Framework For Improving CompetitivenessDocument12 pagesA New Lean Six Sigma Framework For Improving CompetitivenessmaryamNo ratings yet

- Mzfilemanagerv 2 Dorigin 1Document30 pagesMzfilemanagerv 2 Dorigin 1Jorge EchanizNo ratings yet

- ABM MCQ Test Sept 2021Document7 pagesABM MCQ Test Sept 2021Shyam PatelNo ratings yet

- Bata India LTDDocument3 pagesBata India LTDViny GokhruNo ratings yet

- Cuenta Romero Generali InternationalDocument2 pagesCuenta Romero Generali InternationalMaria ClaraNo ratings yet