Professional Documents

Culture Documents

Itr-V: Indian Income Tax Return Verification Form

Itr-V: Indian Income Tax Return Verification Form

Uploaded by

Madhan Kumar BobbalaCopyright:

Available Formats

You might also like

- Vasilov BulgarianDocument6 pagesVasilov BulgarianAlexander G. VasilovskyNo ratings yet

- GRE Argument Essays (1-50)Document40 pagesGRE Argument Essays (1-50)Manish Gurjar85% (13)

- Pre Trial Order Civil CaseDocument3 pagesPre Trial Order Civil Casejennylynne73% (11)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Pharm Shelf Big Boss Review Aka Pharmacology Shelf Study GuideDocument13 pagesPharm Shelf Big Boss Review Aka Pharmacology Shelf Study Guideemceelee100% (2)

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMahendra PatilNo ratings yet

- 2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2Document1 page2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2sunny.likescatNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormviveknaikNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormviveknaikNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- 2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvDocument1 page2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvRohan KapurNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormDevesh Singh SenwalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormShyamala SubramanianNo ratings yet

- 2020 12 30 13 13 43 919 - 1609314223919 - XXXPP0183X - ItrvDocument1 page2020 12 30 13 13 43 919 - 1609314223919 - XXXPP0183X - Itrvtushar guptaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormInderdeepNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVivek BajajNo ratings yet

- 2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - ItrvDocument1 page2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - Itrvjohnyadav.ryNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formdibyan dasNo ratings yet

- 2020 07 15 21 11 18 480 - 1594827678480 - XXXPJ9614X - ItrvDocument1 page2020 07 15 21 11 18 480 - 1594827678480 - XXXPJ9614X - Itrvishasalex03No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNOOBS TEAMNo ratings yet

- 2020 12 01 19 35 05 933 - 1606831505933 - XXXPD0058X - ItrvDocument1 page2020 12 01 19 35 05 933 - 1606831505933 - XXXPD0058X - ItrvOnline tally guideNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr VDocument1 pageItr VsuneetbansalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formravi rajaNo ratings yet

- 2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFDocument1 page2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFtavenderpal singhNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNikhil SinghNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbhavya gowdaNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementrushikeshlohe01No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormBaby MazumdarNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMurari AgarwalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formjyothi venkat sainathNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formjyothi venkat sainathNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormRaghu TNo ratings yet

- 2021 01 16 13 47 21 871 - 1610785041871 - XXXPC3129X - ItrvDocument1 page2021 01 16 13 47 21 871 - 1610785041871 - XXXPC3129X - ItrvDibyo ChatterjeeNo ratings yet

- Nagji Badhabhai Rabari Itrv Ay 2020-21Document1 pageNagji Badhabhai Rabari Itrv Ay 2020-21B N MishraNo ratings yet

- 2021 01 08 20 23 43 556 - 1610117623556 - XXXPV9294X - ItrvDocument1 page2021 01 08 20 23 43 556 - 1610117623556 - XXXPV9294X - Itrvanusha.veldandiNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormArun VeeraniNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formvarghese philip kottaramNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormRohit SharmaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVikash SoniNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVikash SoniNo ratings yet

- Aszpl1595q ItrvDocument1 pageAszpl1595q ItrvNitish JulkaNo ratings yet

- PDF 269385040200221Document1 pagePDF 269385040200221ananya dasNo ratings yet

- Itr-V Bizpr9935f 2020-21 200956830110121Document1 pageItr-V Bizpr9935f 2020-21 200956830110121Rashi SrivastavaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument2 pagesItr-V: Indian Income Tax Return Verification FormMemories2022No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNavis AntonyNo ratings yet

- 2021 05 30 15 03 03 762 - 1622367183762 - XXXPG3713X - ItrvDocument1 page2021 05 30 15 03 03 762 - 1622367183762 - XXXPG3713X - ItrvvarughesevgeorgeNo ratings yet

- KiranDocument3 pagesKiransuneetbansalNo ratings yet

- PDF 201380090050524Document1 pagePDF 201380090050524nirlepenterprises411No ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearkeval limbasiyaNo ratings yet

- Itr-V Elkpd1794p 2024-25 188420870250424Document1 pageItr-V Elkpd1794p 2024-25 188420870250424taxindia610No ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearmohdmoin0493No ratings yet

- PDF 579203040271223Document1 pagePDF 579203040271223Manivannan VNo ratings yet

- Sunita RanaDocument1 pageSunita RanaVIKASH KUMARNo ratings yet

- Itr-V Aygpk1992d 2023-24 206400380070623Document1 pageItr-V Aygpk1992d 2023-24 206400380070623muraliswayambuNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnalharamislamicfoundationNo ratings yet

- PDF 676646680170622Document1 pagePDF 676646680170622CE30 Sanket BadadeNo ratings yet

- Itrv EnglishDocument1 pageItrv Englishniko belicNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearaccount patnaNo ratings yet

- Financial Analysis - Planning NotesDocument49 pagesFinancial Analysis - Planning NotesMadhan Kumar BobbalaNo ratings yet

- Dsa Invoice - Points To Remember: Don'tsDocument3 pagesDsa Invoice - Points To Remember: Don'tsMadhan Kumar BobbalaNo ratings yet

- Tax Invoice PrintingDocument2 pagesTax Invoice PrintingMadhan Kumar BobbalaNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Cpa Reading ListDocument6 pagesCpa Reading ListIddy MohamedNo ratings yet

- Memorials 2Document26 pagesMemorials 2NittiyaNo ratings yet

- The 5 Step Blueprint PDFDocument39 pagesThe 5 Step Blueprint PDFNikkie DetaroNo ratings yet

- Introduction To Malaysian EnglishDocument4 pagesIntroduction To Malaysian EnglishNEYLA SHAKIRA FADILLAHNo ratings yet

- Sebastian vs. BajarDocument12 pagesSebastian vs. BajarAnisah AquilaNo ratings yet

- SimMechanics Getting Started 2014bDocument40 pagesSimMechanics Getting Started 2014bengrasheedNo ratings yet

- RRLDocument2 pagesRRLAndrea MagtutoNo ratings yet

- Hornbill & SnapshotDocument13 pagesHornbill & SnapshotMahin AhmedNo ratings yet

- Elementary Logic Gates PDFDocument14 pagesElementary Logic Gates PDFGokaran ShuklaNo ratings yet

- 2012 JJC CH H1 P1 PrelimDocument12 pages2012 JJC CH H1 P1 PrelimLim Zer YeeNo ratings yet

- The Three Fs and Five Cs - Mondelēz's New Marketing ApproachDocument8 pagesThe Three Fs and Five Cs - Mondelēz's New Marketing ApproachSuzana NikolovskaNo ratings yet

- Liaqat Ali's SpeechDocument7 pagesLiaqat Ali's Speechdanyalanwarkhan37No ratings yet

- Schmitt & Kremmel (2016) Interpreting Vocabulary Test Scores What Do Various Item Formats Tell Us About Learners' Ability To Employ WordsDocument17 pagesSchmitt & Kremmel (2016) Interpreting Vocabulary Test Scores What Do Various Item Formats Tell Us About Learners' Ability To Employ WordsEdward FungNo ratings yet

- Cps CpsDocument20 pagesCps Cpsapi-545617234No ratings yet

- What's Next?: Career & College Readiness Lesson PlanDocument12 pagesWhat's Next?: Career & College Readiness Lesson PlanAsh BakerNo ratings yet

- School: Grade: Teacher: Learning Areas: Date: MARCH 2, 2021 Quarter: Checked BYDocument3 pagesSchool: Grade: Teacher: Learning Areas: Date: MARCH 2, 2021 Quarter: Checked BYFrit ZieNo ratings yet

- TSL 612 - Grammar Exercises 1-7Document20 pagesTSL 612 - Grammar Exercises 1-7Cosas de LaRubiaNo ratings yet

- Communication and Negotiation in The OrganizationDocument21 pagesCommunication and Negotiation in The OrganizationJho Harry ForcadasNo ratings yet

- Technological Institute of The Philippines Quezon City Civil Engineering Department Ce407Earthquake Engineering Prelim ExaminationDocument7 pagesTechnological Institute of The Philippines Quezon City Civil Engineering Department Ce407Earthquake Engineering Prelim ExaminationGerardoNo ratings yet

- Lahm Vs MayorDocument14 pagesLahm Vs MayorEmma Ruby Aguilar-ApradoNo ratings yet

- Model Predictive ControlDocument26 pagesModel Predictive Controlrodrigo_trentiniNo ratings yet

- Analysis of Makamisa by Jose RizalDocument11 pagesAnalysis of Makamisa by Jose RizalEna Albor Bautista100% (4)

- The Importance of Asset Allocation - IbbotsonDocument4 pagesThe Importance of Asset Allocation - IbbotsonRyan GohNo ratings yet

- Audience AnalysisDocument6 pagesAudience AnalysisAira MoresNo ratings yet

- Intl CRL Law-Syllabus-2023Document6 pagesIntl CRL Law-Syllabus-2023B Shivangi 1077No ratings yet

- Its RR 01 - 01Document106 pagesIts RR 01 - 01odcardozoNo ratings yet

Itr-V: Indian Income Tax Return Verification Form

Itr-V: Indian Income Tax Return Verification Form

Uploaded by

Madhan Kumar BobbalaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr-V: Indian Income Tax Return Verification Form

Itr-V: Indian Income Tax Return Verification Form

Uploaded by

Madhan Kumar BobbalaCopyright:

Available Formats

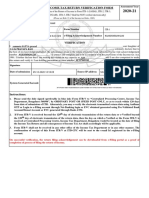

FORM INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, 2020-21

ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically]

(Please see Rule 12 of the Income-tax Rules, 1962)

Name VENKATA RAO MADIGANA

PAN CRUPM6498K Form Number ITR-4

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 365246520240620

VERIFICATION

I, _________________________________________________________________________________________son/

VENKATA RAO MADIGANA daughter of

___________________________________________________________________________________,

DEVUDU MADIGANA solemnly declare that to

the best of my knowledge and belief, the information given in the return which has been submitted by me vide acknowledgement

number __________________________

365246520240620 is correct and complete and is in accordance with the provisions of the Income-tax Act,

1961. I further declare that I am making this return in my capacity as____________________

Self and I am also competent to make

this return and verify it. I am holding permanent account number ________________.

CRUPM6498K .

Signature

Date of submission 24-06-2020 10:46:28 Source IP address 49.204.13.135

System Generated barcode

CRUPM6498K0436524652024062019BD9F9C3CFED401E30FF3A5F3D06053EAF464AB

Instructions:

1. Please send the duly signed (preferably in blue ink) Form ITR-V to “Centralized Processing Centre, Income Tax

Department, Bengaluru 560500”, by ORDINARY POST OR SPEED POST ONLY, so as to reach within 120 days

from date of submission of ITR. Alternately, you may e-verify the electronic transmitted return data using Aadhaar

OTP or Login to e-Filing account through Net-Banking login or EVC obtained generated using Pre-Validated Bank

Account/Demat Account or EVC generated through Bank ATM.

2. If Form ITR-V is received beyond the 120th day of electronic transmission of the return data or e-Verified beyond

the 120th day of electronic transmission of the return data, then the day on which e-Verified or the Form ITR-V is

received at Centralized Processing Centre, Income Tax Department, Bengaluru would be treated as the date of filing

the Income Tax Return and all consequences of Income Tax Act shall accordingly will be applicable.

3. Form ITR-V shall not be received in any other office of the Income Tax Department or in any other manner. The

confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail Id registered in the e-Filing

account.

On successful verification, the return filing acknowledgement can be downloaded from e-Filing portal as a proof of

completion of process of filing the return of Income.

You might also like

- Vasilov BulgarianDocument6 pagesVasilov BulgarianAlexander G. VasilovskyNo ratings yet

- GRE Argument Essays (1-50)Document40 pagesGRE Argument Essays (1-50)Manish Gurjar85% (13)

- Pre Trial Order Civil CaseDocument3 pagesPre Trial Order Civil Casejennylynne73% (11)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Pharm Shelf Big Boss Review Aka Pharmacology Shelf Study GuideDocument13 pagesPharm Shelf Big Boss Review Aka Pharmacology Shelf Study Guideemceelee100% (2)

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMahendra PatilNo ratings yet

- 2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2Document1 page2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2sunny.likescatNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormviveknaikNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormviveknaikNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- 2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvDocument1 page2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvRohan KapurNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormDevesh Singh SenwalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormShyamala SubramanianNo ratings yet

- 2020 12 30 13 13 43 919 - 1609314223919 - XXXPP0183X - ItrvDocument1 page2020 12 30 13 13 43 919 - 1609314223919 - XXXPP0183X - Itrvtushar guptaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormInderdeepNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVivek BajajNo ratings yet

- 2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - ItrvDocument1 page2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - Itrvjohnyadav.ryNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formdibyan dasNo ratings yet

- 2020 07 15 21 11 18 480 - 1594827678480 - XXXPJ9614X - ItrvDocument1 page2020 07 15 21 11 18 480 - 1594827678480 - XXXPJ9614X - Itrvishasalex03No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNOOBS TEAMNo ratings yet

- 2020 12 01 19 35 05 933 - 1606831505933 - XXXPD0058X - ItrvDocument1 page2020 12 01 19 35 05 933 - 1606831505933 - XXXPD0058X - ItrvOnline tally guideNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr VDocument1 pageItr VsuneetbansalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formravi rajaNo ratings yet

- 2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFDocument1 page2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFtavenderpal singhNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNikhil SinghNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbhavya gowdaNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementrushikeshlohe01No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormBaby MazumdarNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMurari AgarwalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formjyothi venkat sainathNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formjyothi venkat sainathNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormRaghu TNo ratings yet

- 2021 01 16 13 47 21 871 - 1610785041871 - XXXPC3129X - ItrvDocument1 page2021 01 16 13 47 21 871 - 1610785041871 - XXXPC3129X - ItrvDibyo ChatterjeeNo ratings yet

- Nagji Badhabhai Rabari Itrv Ay 2020-21Document1 pageNagji Badhabhai Rabari Itrv Ay 2020-21B N MishraNo ratings yet

- 2021 01 08 20 23 43 556 - 1610117623556 - XXXPV9294X - ItrvDocument1 page2021 01 08 20 23 43 556 - 1610117623556 - XXXPV9294X - Itrvanusha.veldandiNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormArun VeeraniNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formvarghese philip kottaramNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormRohit SharmaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVikash SoniNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVikash SoniNo ratings yet

- Aszpl1595q ItrvDocument1 pageAszpl1595q ItrvNitish JulkaNo ratings yet

- PDF 269385040200221Document1 pagePDF 269385040200221ananya dasNo ratings yet

- Itr-V Bizpr9935f 2020-21 200956830110121Document1 pageItr-V Bizpr9935f 2020-21 200956830110121Rashi SrivastavaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument2 pagesItr-V: Indian Income Tax Return Verification FormMemories2022No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNavis AntonyNo ratings yet

- 2021 05 30 15 03 03 762 - 1622367183762 - XXXPG3713X - ItrvDocument1 page2021 05 30 15 03 03 762 - 1622367183762 - XXXPG3713X - ItrvvarughesevgeorgeNo ratings yet

- KiranDocument3 pagesKiransuneetbansalNo ratings yet

- PDF 201380090050524Document1 pagePDF 201380090050524nirlepenterprises411No ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearkeval limbasiyaNo ratings yet

- Itr-V Elkpd1794p 2024-25 188420870250424Document1 pageItr-V Elkpd1794p 2024-25 188420870250424taxindia610No ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearmohdmoin0493No ratings yet

- PDF 579203040271223Document1 pagePDF 579203040271223Manivannan VNo ratings yet

- Sunita RanaDocument1 pageSunita RanaVIKASH KUMARNo ratings yet

- Itr-V Aygpk1992d 2023-24 206400380070623Document1 pageItr-V Aygpk1992d 2023-24 206400380070623muraliswayambuNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnalharamislamicfoundationNo ratings yet

- PDF 676646680170622Document1 pagePDF 676646680170622CE30 Sanket BadadeNo ratings yet

- Itrv EnglishDocument1 pageItrv Englishniko belicNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearaccount patnaNo ratings yet

- Financial Analysis - Planning NotesDocument49 pagesFinancial Analysis - Planning NotesMadhan Kumar BobbalaNo ratings yet

- Dsa Invoice - Points To Remember: Don'tsDocument3 pagesDsa Invoice - Points To Remember: Don'tsMadhan Kumar BobbalaNo ratings yet

- Tax Invoice PrintingDocument2 pagesTax Invoice PrintingMadhan Kumar BobbalaNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Cpa Reading ListDocument6 pagesCpa Reading ListIddy MohamedNo ratings yet

- Memorials 2Document26 pagesMemorials 2NittiyaNo ratings yet

- The 5 Step Blueprint PDFDocument39 pagesThe 5 Step Blueprint PDFNikkie DetaroNo ratings yet

- Introduction To Malaysian EnglishDocument4 pagesIntroduction To Malaysian EnglishNEYLA SHAKIRA FADILLAHNo ratings yet

- Sebastian vs. BajarDocument12 pagesSebastian vs. BajarAnisah AquilaNo ratings yet

- SimMechanics Getting Started 2014bDocument40 pagesSimMechanics Getting Started 2014bengrasheedNo ratings yet

- RRLDocument2 pagesRRLAndrea MagtutoNo ratings yet

- Hornbill & SnapshotDocument13 pagesHornbill & SnapshotMahin AhmedNo ratings yet

- Elementary Logic Gates PDFDocument14 pagesElementary Logic Gates PDFGokaran ShuklaNo ratings yet

- 2012 JJC CH H1 P1 PrelimDocument12 pages2012 JJC CH H1 P1 PrelimLim Zer YeeNo ratings yet

- The Three Fs and Five Cs - Mondelēz's New Marketing ApproachDocument8 pagesThe Three Fs and Five Cs - Mondelēz's New Marketing ApproachSuzana NikolovskaNo ratings yet

- Liaqat Ali's SpeechDocument7 pagesLiaqat Ali's Speechdanyalanwarkhan37No ratings yet

- Schmitt & Kremmel (2016) Interpreting Vocabulary Test Scores What Do Various Item Formats Tell Us About Learners' Ability To Employ WordsDocument17 pagesSchmitt & Kremmel (2016) Interpreting Vocabulary Test Scores What Do Various Item Formats Tell Us About Learners' Ability To Employ WordsEdward FungNo ratings yet

- Cps CpsDocument20 pagesCps Cpsapi-545617234No ratings yet

- What's Next?: Career & College Readiness Lesson PlanDocument12 pagesWhat's Next?: Career & College Readiness Lesson PlanAsh BakerNo ratings yet

- School: Grade: Teacher: Learning Areas: Date: MARCH 2, 2021 Quarter: Checked BYDocument3 pagesSchool: Grade: Teacher: Learning Areas: Date: MARCH 2, 2021 Quarter: Checked BYFrit ZieNo ratings yet

- TSL 612 - Grammar Exercises 1-7Document20 pagesTSL 612 - Grammar Exercises 1-7Cosas de LaRubiaNo ratings yet

- Communication and Negotiation in The OrganizationDocument21 pagesCommunication and Negotiation in The OrganizationJho Harry ForcadasNo ratings yet

- Technological Institute of The Philippines Quezon City Civil Engineering Department Ce407Earthquake Engineering Prelim ExaminationDocument7 pagesTechnological Institute of The Philippines Quezon City Civil Engineering Department Ce407Earthquake Engineering Prelim ExaminationGerardoNo ratings yet

- Lahm Vs MayorDocument14 pagesLahm Vs MayorEmma Ruby Aguilar-ApradoNo ratings yet

- Model Predictive ControlDocument26 pagesModel Predictive Controlrodrigo_trentiniNo ratings yet

- Analysis of Makamisa by Jose RizalDocument11 pagesAnalysis of Makamisa by Jose RizalEna Albor Bautista100% (4)

- The Importance of Asset Allocation - IbbotsonDocument4 pagesThe Importance of Asset Allocation - IbbotsonRyan GohNo ratings yet

- Audience AnalysisDocument6 pagesAudience AnalysisAira MoresNo ratings yet

- Intl CRL Law-Syllabus-2023Document6 pagesIntl CRL Law-Syllabus-2023B Shivangi 1077No ratings yet

- Its RR 01 - 01Document106 pagesIts RR 01 - 01odcardozoNo ratings yet