Professional Documents

Culture Documents

Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent Payroll

Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent Payroll

Uploaded by

Shiva098Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent Payroll

Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent Payroll

Uploaded by

Shiva098Copyright:

Available Formats

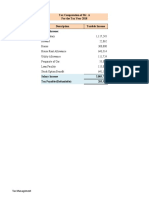

Income Tax Calculation Worksheet

ELLUCIAN HIGHER EDUCATION SYSTEMS INDIA PRIVATE LIMITED Ascent Payroll

PAN : AAQCS6720G/ TAN : BLRS40538B F.Y. : 2019-20 / A.Y. : 2020-21

Employee: 172620000 Shivakumar B.V. Calculation Month: March-2020

Date of Joining: 14/06/2010 PAN: ADOPV6089K Tax Category: MEN

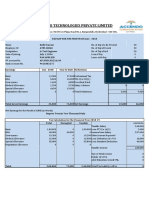

1. Gross Salary Actual(Rs.) Projection(Rs.) Total(Rs.)

Basic 1,058,400 0 1,058,400

House Rent Allowance 423,360 0 423,360

Conveyance Allowance 19,200 0 19,200

Medical Reim 15,000 0 15,000

Special Allowance 975,816 0 975,816

Sodexo 26,400 0 26,400

Leave Encash 11,760 0 11,760

ANNUAL HEALTH CHECKUP 2,107 0 2,107

Telephone and Internet Re 24,000 0 24,000

Thrive reimbursement 24,000 0 24,000

Totals: 2,580,043 0 2,580,043

HRA Exemption Calculation

Period Basic Rent Paid HRA Recd Rent Paid Less 40/50% Salary Least of

Non Metro Metro (A) 10% Salary (B) (C) (A,B,C)

Apr-2019 88,200 18,500 0 35,280 9,680 35,280 9,680

May-2019 88,200 18,500 0 35,280 9,680 35,280 9,680

Jun-2019 88,200 18,500 0 35,280 9,680 35,280 9,680

Jul-2019 88,200 19,500 0 35,280 10,680 35,280 10,680

Aug-2019 88,200 19,500 0 35,280 10,680 35,280 10,680

Sep-2019 88,200 19,500 0 35,280 10,680 35,280 10,680

Oct-2019 88,200 19,500 0 35,280 10,680 35,280 10,680

Nov-2019 88,200 19,500 0 35,280 10,680 35,280 10,680

Dec-2019 88,200 19,500 0 35,280 10,680 35,280 10,680

Totals: 793,800 172,500 317,520 93,120 317,520 93,120

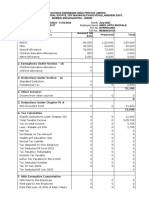

WORKSHEET :

1. Gross Salary 2,580,043

2. Less: Allowances Exempt Under Section 10

House Rent Allowance 93,120

Sodexo (Put 1100 or 2200 pm) 26,400

3. Balance (1-2) 2,460,523

4. Deductions:

Standard Deduction 50,000

Tax On Employment 2,400

5. Aggregate of 4 52,400

6. Income chargeable under the head 'Salaries' (3-5) 2,408,123

7. Add: Any other income reported by the employee

8. Gross total income (6+7) 2,408,123

9. Deductions under Chapter VI-A Qualifying Deductible

Gross Amount

(A) Section 80C, 80CCC and 80CCD Amount Amount

(a) Section 80 C

a. Provident Fund 127,008 127,008

b. Life Insurance Premium 35,172 22,992

c. Public Provident Fund 24,000 0

d. Sukanya Samruddhi Yojana 20,000 0

Total of Section 80C, 80CCC and 80CCD 206,180 150,000 150,000

(b) National Pension Scheme (1B) 50,000 50,000 50,000

10. Aggregate of deductible amount under Chapter VIA 200,000

11. Total Income (8-10) 2,208,130

12. Tax on total income 474,939

13. Less: rebate u/s 87A 0

*

Printed On 01/04/2020 10:17:38 Calculation based on Actual Declaration Page 1 of 2

14. Tax payable and surcharge thereon 474,939 + 0 474,939

15. Add: Education CESS 4.00% on (14) 18,998

16. Less: Rebate Under Section 89 0

17. Total Tax Liability (14+15-16) 493,937

18. Less Tax deducted at source till February-2020 448,079

19. Tax payable/refundable (17-18) 45,858

20. Tax payable/refundable this month 45,858

# Investment under 80CCD is allocated to 80CCD(1B) first and balance amount limited to 10% of basic is allocated to 80CCD.

Income tax calculated as follows:

From To Tax Percent % Tax

0 250,000 0 0

250,000 500,000 5 12,500

500,000 1,000,000 20 100,000

1,000,000 2,208,130 30 362,439

474,939

Total Tax on income 2,208,130 (excluding surcharge, CESS and Rebate) *

Printed On 01/04/2020 10:17:38 Calculation based on Actual Declaration Page 2 of 2

You might also like

- TCS Feb Payslip PDFDocument2 pagesTCS Feb Payslip PDFNikhilreddy SingireddyNo ratings yet

- Pearl River Valley Flood Control District 2022 BudgetDocument1 pagePearl River Valley Flood Control District 2022 BudgetAnthony WarrenNo ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Axis Bank LTD Payslip For The Month of August - 2019Document3 pagesAxis Bank LTD Payslip For The Month of August - 2019Venkateswarlu KamaniNo ratings yet

- Taxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Document15 pagesTaxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Harold Dan AcebedoNo ratings yet

- SAP US Payroll Tax ClassDocument45 pagesSAP US Payroll Tax Classmastersaphr100% (3)

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Income Tax Calculation Worksheet: Danfoss Power Solutions India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Danfoss Power Solutions India Private Limited Ascent Payrollbabasahebjawale 5207No ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776No ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- TM PQsDocument10 pagesTM PQsAnooshayNo ratings yet

- Salary Nov 2020Document2 pagesSalary Nov 2020Tarun RawatNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- Confidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerDocument1 pageConfidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerAbdul Nayeem100% (1)

- Mar 2023Document1 pageMar 2023gaurav sharmaNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- 1% Stock Movement StrategyDocument1 page1% Stock Movement Strategyashish10mca9394No ratings yet

- I JT Statement For F.Y 2022-23Document7 pagesI JT Statement For F.Y 2022-23Sasidhar KatariNo ratings yet

- StoqnamadruateDocument4 pagesStoqnamadruateDela cruz, Hainrich (Hain)No ratings yet

- Sample WorksheetDocument4 pagesSample WorksheetSam Rae LimNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- Lembar Jawab Laporan KeuanganDocument10 pagesLembar Jawab Laporan Keuanganricoananta10No ratings yet

- Port Huron's Preliminary 2017-18 BudgetDocument13 pagesPort Huron's Preliminary 2017-18 BudgetMichael EckertNo ratings yet

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Car Lease ComparisonDocument16 pagesCar Lease Comparisonrahul kumarNo ratings yet

- Bafacr4X Non-Financial Liabilities: Problem 4.1Document7 pagesBafacr4X Non-Financial Liabilities: Problem 4.1Aga Mathew MayugaNo ratings yet

- Main Tables (Lower Version)Document2 pagesMain Tables (Lower Version)vishalbharatshah2776No ratings yet

- Payslip June Upgrad (Talentedge)Document1 pagePayslip June Upgrad (Talentedge)kartik.chahal.ug21No ratings yet

- Answer To RQ 3 - Week 6 PDFDocument1 pageAnswer To RQ 3 - Week 6 PDFcalebNo ratings yet

- Tax Calculator 2018-19 (Farrukh Iqbal Khan)Document2 pagesTax Calculator 2018-19 (Farrukh Iqbal Khan)FarrukhNo ratings yet

- Incometax Calculation Worksheet (Old Regime) : Nippon Koei India Private Limited Ascent PayrollDocument2 pagesIncometax Calculation Worksheet (Old Regime) : Nippon Koei India Private Limited Ascent Payrollraz sharmaNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilNo ratings yet

- ACCO 30033 Exercise 5 GOVACCDocument2 pagesACCO 30033 Exercise 5 GOVACCMika MolinaNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- 1967 - 202223 - REVISED - Revised 1 - Statement of IncomeDocument2 pages1967 - 202223 - REVISED - Revised 1 - Statement of IncomeSmita desaiNo ratings yet

- Computation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Document5 pagesComputation of Total Income (Revised) Income From House Property (Chapter IV C) 319200Yogesh SainiNo ratings yet

- ATPL10060 - Kolli Sravani - JUNE - 2018 PDFDocument1 pageATPL10060 - Kolli Sravani - JUNE - 2018 PDFsravani kolliNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- Aug PDFDocument1 pageAug PDFRNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- Ilovepdf - MRPDocument3 pagesIlovepdf - MRPPramod ramprsad PàtidarNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- PERSIJADocument10 pagesPERSIJAricoananta10No ratings yet

- Abdul Qadeer Accounts 2020-08-0-9-20Document6 pagesAbdul Qadeer Accounts 2020-08-0-9-20Abbas WazeerNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Assignment 1Document6 pagesAssignment 1Nichole TumulakNo ratings yet

- SD ProjectsDocument3 pagesSD Projectskhaleel leoNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- Profits and Gains of Business or ProfessionDocument3 pagesProfits and Gains of Business or ProfessionKumar GajulaNo ratings yet

- MDRRMODocument4 pagesMDRRMOSum WhosinNo ratings yet

- Short Term Credit Line ExampleDocument1 pageShort Term Credit Line ExampleNhư Hoài ThươngNo ratings yet

- Emp Annual Statement-2Document1 pageEmp Annual Statement-2shivamrajsingh12042001No ratings yet

- Case 1: Market PriceDocument6 pagesCase 1: Market PriceNoor ul HudaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Tender 26012023Document1 pageTender 26012023hasan jamiNo ratings yet

- RMC No. 68-2019 - DigestDocument3 pagesRMC No. 68-2019 - DigestAMNo ratings yet

- GSIS v. GMCDocument5 pagesGSIS v. GMCSean Galvez100% (1)

- Case Study - Pakland Cement LMTD by Raza Kamal and Ehtesham AliDocument12 pagesCase Study - Pakland Cement LMTD by Raza Kamal and Ehtesham Alidox4printNo ratings yet

- Trans Acci OnesDocument6 pagesTrans Acci OnesNorys VivasNo ratings yet

- Article Review Done by Endeshaw YibeltalDocument4 pagesArticle Review Done by Endeshaw Yibeltalendeshaw yibetal100% (2)

- Kingdom Annual Audited Results Dec 2009Document11 pagesKingdom Annual Audited Results Dec 2009Kristi DuranNo ratings yet

- 7 IBTaDocument37 pages7 IBTaDiana RioNo ratings yet

- Simcity 4Document10 pagesSimcity 4Ryo HikariNo ratings yet

- EY-Kazakhstan Oil and Gas Tax Guide 2014Document24 pagesEY-Kazakhstan Oil and Gas Tax Guide 2014shankar_embaNo ratings yet

- Corporate Tax Planning MCQ PDFDocument4 pagesCorporate Tax Planning MCQ PDFPruthiraj SahooNo ratings yet

- Billing Address: Tax InvoiceDocument1 pageBilling Address: Tax InvoiceManojkumar DNo ratings yet

- SolarEIS - IIT - PercentDocument52 pagesSolarEIS - IIT - PercentArya PanuntunNo ratings yet

- Business Partner in S4 HANADocument64 pagesBusiness Partner in S4 HANARakesh Gupta100% (2)

- Gatchalian v. CollectorDocument6 pagesGatchalian v. CollectorSosthenes Arnold MierNo ratings yet

- Factors Affecting Pricing DecisionsDocument22 pagesFactors Affecting Pricing Decisionsdejen mengstieNo ratings yet

- BASC College CodeDocument75 pagesBASC College CodeEdna Mae CruzNo ratings yet

- Un1360 02 Un1365 02 Operation ManualDocument82 pagesUn1360 02 Un1365 02 Operation ManualEnter_69100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: 01-A, 1ST/F, 183/2,19/2, ANZDocument1 pageTax Invoice/Bill of Supply/Cash Memo: 01-A, 1ST/F, 183/2,19/2, ANZsachin shindeNo ratings yet

- FormulaireDocument2 pagesFormulaireweldsaidiNo ratings yet

- Major Assignment #3Document17 pagesMajor Assignment #3Elijah GeniesseNo ratings yet

- CH 12 SM AssigDocument6 pagesCH 12 SM AssigJefferson SarmientoNo ratings yet

- SSRDocument1,945 pagesSSRSNo ratings yet

- Natural Vegetation of EthiopiaDocument19 pagesNatural Vegetation of EthiopiaFakki Jabeessaa100% (3)

- L1f17bsme0025 2 PDFDocument1 pageL1f17bsme0025 2 PDFbilal buttNo ratings yet

- Taxation Laws and Practice in BangladeshDocument26 pagesTaxation Laws and Practice in BangladeshZafour80% (10)

- Tax1 Syllabus SY 2021-2022Document31 pagesTax1 Syllabus SY 2021-2022Shanon Cristy GacaNo ratings yet

- Other Percentage Taxes Focus Notes (Group 1)Document7 pagesOther Percentage Taxes Focus Notes (Group 1)LeonilaEnriquez100% (1)

- Pan CardDocument1 pagePan CardPradeep SagarNo ratings yet