Professional Documents

Culture Documents

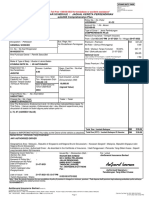

FIN 410 (Asia Insurance LTD)

FIN 410 (Asia Insurance LTD)

Uploaded by

Tamim RahmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN 410 (Asia Insurance LTD)

FIN 410 (Asia Insurance LTD)

Uploaded by

Tamim RahmanCopyright:

Available Formats

Brief Overview of the Company

1. Date of Incorporation: April 30, 2000

2. Commencement of business: April 30, 2000

3. Authorized Capital: Tk. 300 million

4. Paid up Capital: Tk. 60 million

5. Number of Branches: 12

Company Profile

The company was incorporated on 30th April 2000 under the company Act 1994 as a public

company Limited by shares for carrying out all kinds of general insurance activities and was

granted certificate for commencement of Business on 30th April 2000 for general insurance

business. Financial performance of the Company has been consistently positive, delivering both

underwriting and investment income and by giving attractive returns to its shareholders from

inception. The Authorized capital is Tk. 300 million consisting of 3,000,000 ordinary shares of

Tk. 100 each. The sponsors/subscribers have already contributed to the paid up capital of Tk.

60.00 million as required by the Chief Controller of Insurance. In fulfillment of the conditions of

license by the Chief Controller of Insurance, the company now proposes to raise the paid up

capital to Tk. 150.00 million by issuing 900,000 ordinary shares of Tk. 100.00 each by way of

initial public offering (IPO).

Since its establishment in 2000 as one of the leading general insurance companies in the private

sector, the Company has within a short span of time established itself as one of the most reputed

and trustworthy insurance companies in the country. Selective underwriting and prompt

settlement of claims have contributed towards building up a very respectable image of the

Company within the business community. The Company has 12 branches throughout the

country.

The future prospect of Asia Insurance Limited is not only to increase business volume but also to

upgrade the ranking and service quality of the Company. Asia Insurance emphasize on internal

and external training in different subject area for the human resource development of the

Company.

Asia Insurance Limited’s Vision

To be one of the leading Insurance Company in the country.

Providing integrated insurance service in the non-life sector.

Having special track record of prompt customer service and speedy claim settlement.

Asia Insurance Limited’s Mission

To enhance profitability through customer’s satisfaction.

To create shareholders value.

To continue commitment to excellence.

Asia Insurance Limited’s Objectives

Meet customers demand with utmost effort.

To ensure maximum protection of shareholders’ investment.

To provide secured employment environment.

To develop corporate culture and promote good governance.

To maintain transparency in disclosures.

Business operation:

The company is carrying out following types of insurance/reinsurance:

Fire insurance.

Marine insurance.

Motor insurance.

Engineering insurance.

Money Insurance.

Industrial Category.

Medical Category.

Business Category.

General Category.

Fire Insurance:

Fire and Allied Perils Insurance

Industrial All Risks Insurance

Machinery Breakdown and Business Interruption Insurance

Property All Risk Insurance

Power Plant Operational Package Insurance

Comprehensive Machinery Insurance (CMI)

Marine insurance:

Marine Cargo Insurance

Marine Hull Insurance

Goods in Transit Insurance

Motor insurance:

Private Vehicle Insurance

Commercial Vehicle Insurance

Motor Cycle Insurance

Motor Transit Insurance

Engineering insurance:

Contractors’ All Risks Insurance (CAR)

Erection All Risks Insurance (EAR)

Boiler & Pressure Vessel Insurance (BPV)

Machinery Breakdown Insurance (MBD)

Deterioration of stock Insurance (DOS)

Contractors’ Plant & Machinery Insurance (CPM)

Electrical Equipment Insurance (EEI)

Money Insurance

Cash in Transit Insurance

Cash in Safe Insurance

Cash on Counter Insurance

Cash in ATM Risk Insurance

Bank Lockers Insurance

Fidelity Guarantee Insurance

Bankers’ Blanket Bond Insurance

Industrial Category:

Burglary & House Breaking Insurance

Workmen’s Compensation Insurance

Peoples Personal Accident Insurance

Public Liability Insurance

Product Liability Insurance

Employers’ Liability Insurance

Medical Category

Overseas Medi-Claim (B&H) Insurance

Business Category

Professional Indemnity Insurance

Hotel Owners’ All Risk Insurance

General Category

Personal Accident Insurance

All Risks Insurance

You might also like

- UCP 600 With ExplanationDocument82 pagesUCP 600 With ExplanationMAHFUZ ISLAM100% (8)

- Blastmax 250 EngDocument116 pagesBlastmax 250 Engf_uribe2511100% (1)

- JHQ3750 Ins PDFDocument34 pagesJHQ3750 Ins PDFAlice ZakariaNo ratings yet

- Commission Agreement Guide and TemplateDocument7 pagesCommission Agreement Guide and TemplateMorales SimatupangNo ratings yet

- Group Assignment: Submitted ToDocument6 pagesGroup Assignment: Submitted ToTahir WarraichNo ratings yet

- Yahya 1Document34 pagesYahya 1husnain_bajwa007No ratings yet

- InsuranceDocument16 pagesInsuranceoib creditNo ratings yet

- Over View of Rupali Insurance Company LimitedDocument24 pagesOver View of Rupali Insurance Company LimitedSumona Akther RichaNo ratings yet

- Efu General Insurance LTDDocument7 pagesEfu General Insurance LTDMalik Ahmad LasaniNo ratings yet

- Financial Performance of Asia Ins. Co. LTDDocument23 pagesFinancial Performance of Asia Ins. Co. LTDmuttakihossain07No ratings yet

- T I o M S: Olani Nstitute F Anagement TudiesDocument37 pagesT I o M S: Olani Nstitute F Anagement Tudiesmaitrithakar12054No ratings yet

- Assignment On The Overview of South Asia Insurance Company LTD DocxDocument8 pagesAssignment On The Overview of South Asia Insurance Company LTD Docxriduan niamNo ratings yet

- Over View of Rupali Insurance Company LimitedDocument24 pagesOver View of Rupali Insurance Company LimitedSumona Akther RichaNo ratings yet

- Internship Report of Adamjee InsuranceDocument20 pagesInternship Report of Adamjee InsuranceMohsin Rahim100% (4)

- Who We AreDocument7 pagesWho We AreObsetan HurisaNo ratings yet

- Group Assignment 1Document15 pagesGroup Assignment 1Chin Yee LooNo ratings yet

- New India Assurance CoDocument59 pagesNew India Assurance CoAnandi KonarNo ratings yet

- Insurance Co. in PakDocument14 pagesInsurance Co. in Pakhani856No ratings yet

- ReportDocument40 pagesReportHarshitha MahdikNo ratings yet

- Introduction Letter1Document5 pagesIntroduction Letter1Neha MewadaNo ratings yet

- General InsruanceDocument53 pagesGeneral InsruanceDeep LathNo ratings yet

- Name: Sadia Roll No: 220524Document18 pagesName: Sadia Roll No: 220524Naeem AminNo ratings yet

- Proposal - Humano EnergyDocument14 pagesProposal - Humano EnergymsewornooNo ratings yet

- Broking Project Malaysia (Recovered)Document34 pagesBroking Project Malaysia (Recovered)goldhazyyNo ratings yet

- Rabbi InsuranceDocument6 pagesRabbi InsuranceYasin ArAthNo ratings yet

- Alfalah Insurance CompanyDocument41 pagesAlfalah Insurance CompanyZunaira Furqan100% (2)

- Internship ReportDocument28 pagesInternship ReportAhmad NawazNo ratings yet

- AdamjeeDocument35 pagesAdamjeeFazeela Rana50% (2)

- Final Project Fire InsuranceDocument22 pagesFinal Project Fire InsuranceSayed JafarNo ratings yet

- SR - No. Particulars Page No.: Krupanidhi Institute of Management Education 2009Document56 pagesSR - No. Particulars Page No.: Krupanidhi Institute of Management Education 2009Shubhi KhandujaNo ratings yet

- Marine Insurance: Presented By: Chhaya Roll No.: 32Document22 pagesMarine Insurance: Presented By: Chhaya Roll No.: 32Chhaya, 32No ratings yet

- Insurance Project On ULIP-K JAINDocument66 pagesInsurance Project On ULIP-K JAINkhushboo_jain100% (1)

- Insurance Companies: in Trinidad & TobagoDocument22 pagesInsurance Companies: in Trinidad & TobagokjneroNo ratings yet

- A Report On Credit RatingDocument29 pagesA Report On Credit RatingShuvo HasanNo ratings yet

- Bajaj Allianz General Insurance Company LimitedDocument39 pagesBajaj Allianz General Insurance Company LimitedcanarypsNo ratings yet

- Ratio Analysis of The Insurance CompanyDocument16 pagesRatio Analysis of The Insurance CompanyAsma YasinNo ratings yet

- The Study On Various Insurance Products of OrientalDocument25 pagesThe Study On Various Insurance Products of OrientalMohd NizamNo ratings yet

- Bangladesh General Insurance Company LTDDocument4 pagesBangladesh General Insurance Company LTDS. M. Hasibur RahmanNo ratings yet

- Mera EditedDocument77 pagesMera EditedMohini Nitin MariaNo ratings yet

- IMCOST 2012-2013: Ihr LogoDocument35 pagesIMCOST 2012-2013: Ihr LogoShankar DhondwadNo ratings yet

- Asha Insurance CompanyDocument38 pagesAsha Insurance CompanyKamrul Hasan ShaonNo ratings yet

- Micro Insurance Project ReportDocument45 pagesMicro Insurance Project Reportkamdica71% (7)

- Swot Analysis On Reliance InsuranceDocument37 pagesSwot Analysis On Reliance InsuranceDhananjay SharmaNo ratings yet

- Bwrr2043: Chapter 1 Introduction To The Insurance Company OperationsDocument36 pagesBwrr2043: Chapter 1 Introduction To The Insurance Company OperationsRafiq WafiyNo ratings yet

- Final Project Fire InsuranceDocument22 pagesFinal Project Fire InsuranceDeep Lath50% (2)

- MR Sanjay 2Document66 pagesMR Sanjay 2Swopneswar DashNo ratings yet

- Summer Training Project Report: Master of Business Administration (Mba)Document69 pagesSummer Training Project Report: Master of Business Administration (Mba)Sidhant kumarNo ratings yet

- A Report OnDocument13 pagesA Report OnPrashant MagarNo ratings yet

- Mitangi Final BookDocument80 pagesMitangi Final Bookmitangi100% (1)

- Company ProfileDocument44 pagesCompany ProfileBheeshm SinghNo ratings yet

- Green Delta Insurance Company LimitedDocument30 pagesGreen Delta Insurance Company LimitedIffat Ara AhmedNo ratings yet

- Insurance Meaning, Insurance Act 1938Document23 pagesInsurance Meaning, Insurance Act 1938KARISHMAAT100% (1)

- Ecgc (Export Credit Guarantee Corporation)Document64 pagesEcgc (Export Credit Guarantee Corporation)pratikshapatil5975% (8)

- Internship Report Adamjee Insurance CoDocument95 pagesInternship Report Adamjee Insurance CoUneeza AliNo ratings yet

- Money and Banking NewwDocument7 pagesMoney and Banking NewwbakhtawarshahNo ratings yet

- Verview of The City General Insurance Company Limited: TH RD THDocument9 pagesVerview of The City General Insurance Company Limited: TH RD THnowsharNo ratings yet

- Ranjit's United India Fire & General Insurance Companies LTDDocument42 pagesRanjit's United India Fire & General Insurance Companies LTDKristin SmithNo ratings yet

- Complete Project Met Life IndiaDocument98 pagesComplete Project Met Life IndiaRaghu RamNo ratings yet

- Insurance in IndiaDocument88 pagesInsurance in IndiaRam_Revankar_5970100% (1)

- Insurance, Regulations and Loss Prevention : Basic Rules for the Industry Insurance: Business strategy books, #5From EverandInsurance, Regulations and Loss Prevention : Basic Rules for the Industry Insurance: Business strategy books, #5No ratings yet

- Commercial Trucking Insurance for Veteran Truckers: How to Save Money, Time, and a Lot of HeadachesFrom EverandCommercial Trucking Insurance for Veteran Truckers: How to Save Money, Time, and a Lot of HeadachesNo ratings yet

- FIN 408 MT 01 Fall 2020Document2 pagesFIN 408 MT 01 Fall 2020Tamim RahmanNo ratings yet

- FIN435 FinalDocument25 pagesFIN435 FinalTamim RahmanNo ratings yet

- FIN 408 Final Exam Fall 2020Document2 pagesFIN 408 Final Exam Fall 2020Tamim RahmanNo ratings yet

- Gengo Spanish S1 #23 Let's Go in Latin America: Lesson NotesDocument6 pagesGengo Spanish S1 #23 Let's Go in Latin America: Lesson NotesTamim RahmanNo ratings yet

- Gengo Spanish S1 #19 Latin American Downtime Is in Order!: Lesson NotesDocument6 pagesGengo Spanish S1 #19 Latin American Downtime Is in Order!: Lesson NotesTamim RahmanNo ratings yet

- Gengo Spanish S1 #20 No Pictures Here in Latin America: Lesson NotesDocument6 pagesGengo Spanish S1 #20 No Pictures Here in Latin America: Lesson NotesTamim RahmanNo ratings yet

- 020 G - S1L20 - 111411 - Spod101 - RecordingscriptDocument8 pages020 G - S1L20 - 111411 - Spod101 - RecordingscriptTamim RahmanNo ratings yet

- Gengo Spanish S1 #18 How You Doin' in Latin America?: Lesson NotesDocument6 pagesGengo Spanish S1 #18 How You Doin' in Latin America?: Lesson NotesTamim RahmanNo ratings yet

- Gengo Spanish S1 #17 Where Are You in Latin America?: Lesson NotesDocument7 pagesGengo Spanish S1 #17 Where Are You in Latin America?: Lesson NotesTamim RahmanNo ratings yet

- Gengo Spanish S1 #13 Good To See You in Latin America!: Lesson NotesDocument6 pagesGengo Spanish S1 #13 Good To See You in Latin America!: Lesson NotesTamim RahmanNo ratings yet

- Gengo Spanish S1 #12 Do You Have Any Spanish Recommendations?Document7 pagesGengo Spanish S1 #12 Do You Have Any Spanish Recommendations?Tamim RahmanNo ratings yet

- Gengo Spanish S1 #15 A Delicious Dinner in Latin America: Lesson NotesDocument7 pagesGengo Spanish S1 #15 A Delicious Dinner in Latin America: Lesson NotesTamim RahmanNo ratings yet

- 016 G - S1L16 - 101711 - Spod101 - RecordingscriptDocument8 pages016 G - S1L16 - 101711 - Spod101 - RecordingscriptTamim RahmanNo ratings yet

- Gengo Spanish S1 #3 Spanish In-Flight Entertainment: Lesson NotesDocument7 pagesGengo Spanish S1 #3 Spanish In-Flight Entertainment: Lesson NotesTamim RahmanNo ratings yet

- Gengo Spanish S1 #11 Don't Let The Rain Ruin Your Latin American DayDocument7 pagesGengo Spanish S1 #11 Don't Let The Rain Ruin Your Latin American DayTamim RahmanNo ratings yet

- Gengo Spanish S1 #7 Pardon Me, What Was That Spanish Word?: Lesson NotesDocument7 pagesGengo Spanish S1 #7 Pardon Me, What Was That Spanish Word?: Lesson NotesTamim RahmanNo ratings yet

- Gengo Spanish S1 #9 Snacking On Tamales in Latin America: Lesson NotesDocument7 pagesGengo Spanish S1 #9 Snacking On Tamales in Latin America: Lesson NotesTamim RahmanNo ratings yet

- Gengo Spanish S1 #4 Do Celebrities Exist in The Spanish-Speaking World?Document6 pagesGengo Spanish S1 #4 Do Celebrities Exist in The Spanish-Speaking World?Tamim RahmanNo ratings yet

- Gengo Spanish S1 #8 Getting Formal at The Latin American Ticket WindowDocument6 pagesGengo Spanish S1 #8 Getting Formal at The Latin American Ticket WindowTamim RahmanNo ratings yet

- Gengo Spanish S1 #6 Making New Spanish-Speaking Friends: Lesson NotesDocument6 pagesGengo Spanish S1 #6 Making New Spanish-Speaking Friends: Lesson NotesTamim RahmanNo ratings yet

- 002 G - S1L2 - 071111 - Spod101 - RecordingscriptDocument8 pages002 G - S1L2 - 071111 - Spod101 - RecordingscriptTamim RahmanNo ratings yet

- 003 G - S1L3 - 071811 - Spod101 - RecordingscriptDocument9 pages003 G - S1L3 - 071811 - Spod101 - RecordingscriptTamim RahmanNo ratings yet

- 005 G - S1L5 - 080111 - Spod101 - RecordingscriptDocument8 pages005 G - S1L5 - 080111 - Spod101 - RecordingscriptTamim RahmanNo ratings yet

- Gengo Spanish S1 #2 Charmed in Latin America: Lesson NotesDocument6 pagesGengo Spanish S1 #2 Charmed in Latin America: Lesson NotesTamim RahmanNo ratings yet

- John A. Jones v. General Motors Corporation v. Pamela Lynn Brown, Third Party, 856 F.2d 22, 3rd Cir. (1988)Document6 pagesJohn A. Jones v. General Motors Corporation v. Pamela Lynn Brown, Third Party, 856 F.2d 22, 3rd Cir. (1988)Scribd Government DocsNo ratings yet

- Notice: Investment Company Act of 1940: GE Life and Annuity Assurance Co., Et Al.Document5 pagesNotice: Investment Company Act of 1940: GE Life and Annuity Assurance Co., Et Al.Justia.comNo ratings yet

- Motor Claim FormDocument4 pagesMotor Claim FormAnsh SharmaNo ratings yet

- Civ1l Servants Act-1973+Document62 pagesCiv1l Servants Act-1973+rehmanNo ratings yet

- Mecon Limited: RANCHI - 834002Document63 pagesMecon Limited: RANCHI - 834002Abhinay SunmoonNo ratings yet

- Del Rosario Vs The Equitable Insurance and Casualty CoDocument3 pagesDel Rosario Vs The Equitable Insurance and Casualty CoChelle BelenzoNo ratings yet

- IPCC Taxation Guideline Answer Nov 2015 ExamDocument16 pagesIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaNo ratings yet

- Ycoa Accdet Docu UsDocument72 pagesYcoa Accdet Docu UsSrinivas N GowdaNo ratings yet

- Marine Cargo Proposal Form - Inland Transit: Igi - Marine Underwriting DepartmentDocument2 pagesMarine Cargo Proposal Form - Inland Transit: Igi - Marine Underwriting DepartmentFaheemNo ratings yet

- Burton Snowboard SimDocument16 pagesBurton Snowboard SimJooriNo ratings yet

- Province of Antique Unadjusted Trial Balance As of August 2017 All FundsDocument4 pagesProvince of Antique Unadjusted Trial Balance As of August 2017 All FundsDom Minix del RosarioNo ratings yet

- Edli Admin Charges Waived Wef 1 Apr 2017 Goi Notification 15 Mar 2017Document1 pageEdli Admin Charges Waived Wef 1 Apr 2017 Goi Notification 15 Mar 2017AVISHA CONSULTANCYNo ratings yet

- Commercial Banking in The US Industry ReportDocument40 pagesCommercial Banking in The US Industry ReportPpham100% (1)

- Asuransi Ch. 10Document23 pagesAsuransi Ch. 10Tessa Kusuma DewiNo ratings yet

- No Fault Principle in The Public Liability Insurance Act 1991 Legislative History Implementation and Present Day Relevance of Compensation StructureDocument17 pagesNo Fault Principle in The Public Liability Insurance Act 1991 Legislative History Implementation and Present Day Relevance of Compensation StructureAkib HussainNo ratings yet

- Objectives:: Define The Information Needed:-This First Step States That What Is The InformationDocument44 pagesObjectives:: Define The Information Needed:-This First Step States That What Is The InformationKrishna Prasad GaddeNo ratings yet

- DSP Account ComparisonDocument4 pagesDSP Account ComparisonAJAYNo ratings yet

- Rob Dog TunDocument1 pageRob Dog TunChandra SegarNo ratings yet

- Pcab PDFDocument11 pagesPcab PDFArlyn JarabeNo ratings yet

- Time Value of Money: Gitman and Hennessey, Chapter 5Document43 pagesTime Value of Money: Gitman and Hennessey, Chapter 5Faye Del Gallego EnrileNo ratings yet

- Store ManagementDocument85 pagesStore ManagementDinesh Mudaliar100% (3)

- BP Trans Ocean Rig AgreementDocument412 pagesBP Trans Ocean Rig Agreementtom_fowler7438No ratings yet

- Pfizer ProxyDocument1 pagePfizer ProxyChinnu SalimathNo ratings yet

- HDFC ERGO - Bharat Griha Raksha: 16 July, 2023Document4 pagesHDFC ERGO - Bharat Griha Raksha: 16 July, 2023kuntalbhNo ratings yet

- Export Credit and Guarantee CorporationDocument8 pagesExport Credit and Guarantee CorporationIndrajitNo ratings yet

- Agency ReviewerDocument71 pagesAgency ReviewerMarvi BlaiseNo ratings yet