Professional Documents

Culture Documents

BSA 2B Roco, Xyriene Von Briel M

BSA 2B Roco, Xyriene Von Briel M

Uploaded by

Xyriene Roco0 ratings0% found this document useful (0 votes)

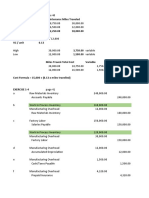

49 views8 pagesThe document appears to be the income statement of a company for a period. It shows sales of $2,087,700 and cost of goods sold of $1,542,000, resulting in gross profit of $539,700. Operating expenses were $239,700, leaving income before tax of $300,000. After deducting income tax of $90,000, the net profit was $210,000.

Original Description:

Original Title

BSA 2B Roco, Xyriene Von Briel M..xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document appears to be the income statement of a company for a period. It shows sales of $2,087,700 and cost of goods sold of $1,542,000, resulting in gross profit of $539,700. Operating expenses were $239,700, leaving income before tax of $300,000. After deducting income tax of $90,000, the net profit was $210,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

49 views8 pagesBSA 2B Roco, Xyriene Von Briel M

BSA 2B Roco, Xyriene Von Briel M

Uploaded by

Xyriene RocoThe document appears to be the income statement of a company for a period. It shows sales of $2,087,700 and cost of goods sold of $1,542,000, resulting in gross profit of $539,700. Operating expenses were $239,700, leaving income before tax of $300,000. After deducting income tax of $90,000, the net profit was $210,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 8

a Raw Materials 248000 Raw Materials

Accounts Payable 248000 248000

b Work-In-Process 186000 248000

Raw Materials 186000 62000

c Payroll 134000 Work-In-Process

Wages Payable 134000 186000

134000

Work-In-Process 134000

Payroll 134000 320000

35000(6000 units)

d Factory Overhead 3600

Cash 3600 Factory Overhead

3600

e Factory Overhead 16200 16200

Utilities Payable 16200 15800

6400

f Factory Overhead 15800

Acc umulated Depreciation 15800 42000

g Factory Overhead 6400 Finihed Goods (3000 units)

Cash 6400

Finished Goods 285000

Work-In-Process 285000

Accounts Receiveable 648000

Sales 648000

Cost of Goods Sold

Raw Materials Direct Materials Used

186000 Raw Materials, Beginnn 0

Add: Purchases 248000

186000 Net Purchases 248000

Add: Transportation In 0

Net Cost of Purchases 248000

Work-In-Process Raw materials avail for use 248000

285000 Less: Raw Materials, ending 62000

Direct Materials 186000

Direct Labor 134000

285000 Factory Overhead 42000

Manufacturing Cost 362000

Add: Work in Process, Beginning 0

Factory Overhead Good Placed in Process

Less: Work in Process End

Cost of Good Manufactured

How many units were sold in December?

( Sales) $648000 / (Cost per unit) $24

27000 units sold

nihed Goods (3000 units) How many units were completed in December?

27000 units sold + 3000 ending finished goods

30000 units

What was the per-unit cost of goods manufactured in December?

$327000 / 30000

$10.9 per unit

362000

35000

$327000

The Work in Process Inventory account of Phelan Company increased $23,000 during November 2013. Costs incurred durin

Direct Material 24000

Direct Labor 126000

Factory Overhead 42000

Manufacturing Cost 192000

Add: Work IN Process, 0

Cost of Goods Placed i 192000

Less: Work in Process 23000

Cost of Goods Manufa 169000

2013. Costs incurred during November included $24,000 of direct material, $126,000 of direct labor and $42,000 for overhead. What is

000 for overhead. What is the Cost of goods manufactured during November?

Raw Materials Beg 242500 Direct Materials Used

WIP beg 185500 Raw Materials Beg

Finished Goods beg 204600 Add: Purchases

Sales 2081700 Raw materials avail for use

Gross Profit 35% CGS Less: Raw materials end

Raw Material Purchases 1132500 Direct Materials Used

Operating Expenses 239700 Direct Labor

Income Tax 30% Prime Costs

Factory Overhead

Manufacturing Costs

Sales = Cost of Goods Sold + Gross Profit Add: Wip beg

Sales = Cost of Goods Sold + Cost of Goods Sold (35%) Goods placed in process

Sales = Cost of Goods Sold (135%) Less: WIP end

2081700 = Cost of Goods Sold (135%) Cost of goods manufacture

2081700/ 135% = Cost of Goods Sold Add: Finished goods beg

Cost of Goods Sold = 1542000 Cost of goods available for

Less: Finished goods end

Cost of Goods Sold

Sales 2081700

242500 Less: Cost of Goods Sold 1542000

1132500 Gross Profit 539700

1375000 Less: Expenses 239700

275000 Income before tax 300000

1100000 Less: Income Tax 90000

500000 Profit/Loss 210000

1600000

400000

2000000

185500

2185500

385500

1800000

204600

2004600

462600

1542000

You might also like

- Annex N-2 - Project Proposal (Group)Document3 pagesAnnex N-2 - Project Proposal (Group)Kh4rt 1995No ratings yet

- Nike Media PlanDocument21 pagesNike Media Planapi-562312644100% (1)

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- Problem Set 1 PDFDocument3 pagesProblem Set 1 PDFrenjith0% (2)

- CPLTDDocument11 pagesCPLTDCA Kiran KoshtiNo ratings yet

- Francis 7040IBA A3 JohnDocument10 pagesFrancis 7040IBA A3 JohnBoniface KigoNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- Tutor's Answer (W2)Document6 pagesTutor's Answer (W2)chikaNo ratings yet

- COGS F2F Practise Questions With SolutionsDocument5 pagesCOGS F2F Practise Questions With Solutionsak8ballpool111No ratings yet

- Hasan Yaseen 9990Document3 pagesHasan Yaseen 9990Haris KhanNo ratings yet

- Cost of Goods Sold Questions (Matz & Usry)Document9 pagesCost of Goods Sold Questions (Matz & Usry)Fahad NadeemNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- MA-II Assignment I - Cost SheetDocument3 pagesMA-II Assignment I - Cost Sheetshriya2413100% (1)

- Assignment 1Document2 pagesAssignment 1mkmanish1No ratings yet

- Cost of Goods Sold Questions (Matz & Usry)Document7 pagesCost of Goods Sold Questions (Matz & Usry)SAIRA SOOMRONo ratings yet

- Cost Bookkeeping AnswersDocument9 pagesCost Bookkeeping AnswersMuhammad Hassan Uddin100% (1)

- Manufacturing Account Income Statement 20200827Document1 pageManufacturing Account Income Statement 20200827Haewon KookNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Submitted by Nisar Ahmed Registration# 44150: Visic Corporation Cost of Goods Manufactured StatementDocument4 pagesSubmitted by Nisar Ahmed Registration# 44150: Visic Corporation Cost of Goods Manufactured StatementHaris KhanNo ratings yet

- Cost Accounting Chapter 5Document11 pagesCost Accounting Chapter 5ali chahilNo ratings yet

- Problem 9.10 SolutionDocument4 pagesProblem 9.10 SolutionPrincess Dhazerene M. ReyesNo ratings yet

- 1.3 เฉลย File 1.1 Ch 1 2-2022Document14 pages1.3 เฉลย File 1.1 Ch 1 2-2022Chokthawee RattanawetwongNo ratings yet

- Cost Accounting TutorialDocument49 pagesCost Accounting TutorialpreciousegualanNo ratings yet

- Cost Bookkeeping With AnswersDocument9 pagesCost Bookkeeping With AnswersHafsa HayatNo ratings yet

- Cost Sheet ProblemsDocument5 pagesCost Sheet ProblemsshamilaNo ratings yet

- Required: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeDocument3 pagesRequired: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeKean Brean GallosNo ratings yet

- CostingDocument46 pagesCostingRaghav KhakholiaNo ratings yet

- Chapter 2 Ca AnswersDocument9 pagesChapter 2 Ca Answersfaaltu accountNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingXen XeonNo ratings yet

- Manufacturing OperationsDocument14 pagesManufacturing OperationsGet BurnNo ratings yet

- Cost of Good Manufactured and Sold StatementDocument8 pagesCost of Good Manufactured and Sold StatementAyesha JavedNo ratings yet

- Lecture 3 Job Order CostingDocument20 pagesLecture 3 Job Order CostingTheresa RoqueNo ratings yet

- Cost ManufacturingDocument10 pagesCost ManufacturingCarlNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- ACCY112 Tut1 WIN 2022Document20 pagesACCY112 Tut1 WIN 2022Laiba RazaNo ratings yet

- Practice 1: Text Book: Managerial Accounting - Garrison and NoreenDocument4 pagesPractice 1: Text Book: Managerial Accounting - Garrison and NoreenMoin khanNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Financial Cost Sheet Unit 2Document6 pagesFinancial Cost Sheet Unit 2Julls ApouakoneNo ratings yet

- Cost Sheet: RequiredDocument1 pageCost Sheet: RequiredmuhsinNo ratings yet

- MA MathDocument16 pagesMA MathAvijit SahaNo ratings yet

- Problem 1-20: 1 JGG Manufacturing Company Manufacturing CostDocument9 pagesProblem 1-20: 1 JGG Manufacturing Company Manufacturing CostMackenzie Heart Obien0% (1)

- ShahDocument7 pagesShahShah NaqNo ratings yet

- Excel Practise Questions and SolutionsDocument18 pagesExcel Practise Questions and SolutionsFahad NadeemNo ratings yet

- Bài tập kế toán quản trị chương 4Document12 pagesBài tập kế toán quản trị chương 4Liêm PhanNo ratings yet

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- Manufacturing Account Worked Example Question 17Document6 pagesManufacturing Account Worked Example Question 17Roshan RamkhalawonNo ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Cost Sheet - CWDocument16 pagesCost Sheet - CWkushgarg627No ratings yet

- Marginal and AbsorptionDocument11 pagesMarginal and AbsorptionMURREE YTNo ratings yet

- Probs AnswerDocument4 pagesProbs AnswerLABASBAS, Alexidaniel I.No ratings yet

- Chapter 04Document4 pagesChapter 04Nouman BaigNo ratings yet

- Costsheet (Subham)Document3 pagesCostsheet (Subham)amijit93No ratings yet

- CGS - Cost of Goods StatementDocument4 pagesCGS - Cost of Goods StatementVix100% (1)

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- CS Uthkarsh PaiDocument9 pagesCS Uthkarsh Paiankita sahuNo ratings yet

- Acc Assignment Sem 2Document23 pagesAcc Assignment Sem 2Luqman HaqimNo ratings yet

- Manufacturing AccountsDocument12 pagesManufacturing AccountsAdrian RamsundarNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Accounts For Manufacturing BusinessDocument17 pagesAccounts For Manufacturing BusinessSteven RaintungNo ratings yet

- Chapter 6 Exercise Activity With AnswersDocument25 pagesChapter 6 Exercise Activity With Answers乙คckคrψ YTNo ratings yet

- Cost 1Document11 pagesCost 1Krish AgarwalNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Exercises On Accounting CycleDocument7 pagesExercises On Accounting CycleXyriene RocoNo ratings yet

- InformativeessayDocument1 pageInformativeessayXyriene RocoNo ratings yet

- Characteristics of Contract of PartnershipDocument2 pagesCharacteristics of Contract of PartnershipXyriene Roco100% (1)

- FV PV (FVF: Xyriene Von Briel M. Roco Bsa 2BDocument3 pagesFV PV (FVF: Xyriene Von Briel M. Roco Bsa 2BXyriene RocoNo ratings yet

- Stock Statement (73) - May-22Document7 pagesStock Statement (73) - May-22PRAMOD NAIRNo ratings yet

- Stifel ComplaintDocument47 pagesStifel ComplaintZerohedgeNo ratings yet

- CRM ProjectDocument125 pagesCRM ProjectRakshit ShahNo ratings yet

- Management Information Systems: Chapter 2 Global E-Business: How Businesses Use Information SystemsDocument19 pagesManagement Information Systems: Chapter 2 Global E-Business: How Businesses Use Information SystemsMurad AgazadeNo ratings yet

- Ps9004 Complete For PharmaceuticalDocument128 pagesPs9004 Complete For PharmaceuticalValmik SoniNo ratings yet

- Corporate StrategyDocument16 pagesCorporate StrategyswethaNo ratings yet

- Foreign Exchange MarketDocument24 pagesForeign Exchange MarketAnamika SonawaneNo ratings yet

- Old Public AdministrationDocument1 pageOld Public Administrationtikangkang100% (3)

- Cro PDFDocument19 pagesCro PDFK WangNo ratings yet

- AFM-Module 4 Part-B Ratio Analysis ProblemsDocument5 pagesAFM-Module 4 Part-B Ratio Analysis ProblemskanikaNo ratings yet

- Kaj Ahmad: Looking For Operations and Support Services EmploymentDocument3 pagesKaj Ahmad: Looking For Operations and Support Services Employmentahmad kajNo ratings yet

- TransGas CompanyDocument9 pagesTransGas CompanyNnamdi AzikeNo ratings yet

- Net Working Capital and CCCDocument9 pagesNet Working Capital and CCCJomar TeofiloNo ratings yet

- Domingo, Julianna Am R. Humss 12-CDocument1 pageDomingo, Julianna Am R. Humss 12-CJULIANNA AM DOMINGONo ratings yet

- 9.2 IAS36 - Impairment of Assets 1Document41 pages9.2 IAS36 - Impairment of Assets 1Given RefilweNo ratings yet

- BSAD489 - Ethics & Values in Business (K) - Assignment 1Document4 pagesBSAD489 - Ethics & Values in Business (K) - Assignment 1Desmond WilliamsNo ratings yet

- Project Report Product & Pricing Strategy: Submission Date: June 2, 2012Document34 pagesProject Report Product & Pricing Strategy: Submission Date: June 2, 2012Qasim ZiaNo ratings yet

- 101 HWK 5 KeyDocument2 pages101 HWK 5 KeyEldana BukumbayevaNo ratings yet

- Red Wine ProjectDocument31 pagesRed Wine ProjectKo Aung Pyae PhyoNo ratings yet

- Canton Corporation Is A Privately Owned Firm That Engages inDocument1 pageCanton Corporation Is A Privately Owned Firm That Engages inTaimur TechnologistNo ratings yet

- Assignment - Management AccountingDocument3 pagesAssignment - Management Accountingn.mahomodNo ratings yet

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross Incomericamae saladagaNo ratings yet

- Circle Advertising Internship ReportDocument35 pagesCircle Advertising Internship ReportTaimoor Ul HassanNo ratings yet

- Unit 2 - Forwards and FuturesDocument29 pagesUnit 2 - Forwards and FuturesNikita DakiNo ratings yet

- Erp Packages PDFDocument2 pagesErp Packages PDFAlexNo ratings yet