Professional Documents

Culture Documents

Value Reporting Form - CP 13 10

Value Reporting Form - CP 13 10

Uploaded by

Steve SolakCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Value Reporting Form - CP 13 10

Value Reporting Form - CP 13 10

Uploaded by

Steve SolakCopyright:

Available Formats

POLICY NUMBER: COMMERCIAL PROPERTY

CP 13 10 04 02

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

VALUE REPORTING FORM

This endorsement modifies insurance provided under the following:

BUILDING AND PERSONAL PROPERTY COVERAGE FORM

CONDOMINIUM COMMERCIAL UNIT-OWNERS COVERAGE FORM

STANDARD PROPERTY POLICY

One or more of the following symbols will be shown in the Declarations in place of a Coinsurance percentage: DR,

WR, MR, QR, PR. For an explanation of these symbols, refer to "Reporting Period" under Section D. – Definitions.

A. Additional Covered Property (a) File the first report with us within 60

1. Covered Property is extended to include per- days of the end of the first "reporting

period"; and

E

sonal property at the following types of loca-

tions for which a Limit of Insurance is shown in (b) File the second report with us within

the Declarations or on the Reported – Acquired 30 days of the end of the second "re-

– Incidental Locations Schedule: porting period", concurrent with sub-

L

a. "Reported locations"; mission of the first report; and

b. "Acquired locations"; and (c) File each subsequent report with us

within 30 days of the end of each

c. "Incidental locations".

P

subsequent "reporting period" and at

2. The following is added to Property Not Cov- expiration.

ered: (2) Reporting Period symbol QR (Quarterly)

Covered Property does not include property at is shown in the Declarations and the in-

M

fairs or exhibitions. ception date of the policy falls in March,

B. Reporting Provisions June, September or December, you

must:

For Covered Property to which this endorsement

applies: (a) File the first report with us within 60

A

days of the end of the first "reporting

1. Reports Of Values period"; and

a. You must file a report with us following each (b) File each subsequent report with us

"reporting period" and at expiration, in ac- within 30 days of the end of each

S

cordance with b. or c. below, showing the subsequent "reporting period" and at

values of Covered Property separately at expiration.

each location. Each report must show the

values that existed on the dates required by (3) Reporting Period symbol QR (Quarterly)

the "reporting period"; these dates are the is shown in the Declarations and the in-

report dates. ception date of the policy does not fall in

March, June, September or December,

b. If this policy is a renewal of a value report- you must file a report with us within 30

ing form policy we previously issued, you days of the end of each "reporting pe-

must file a report with us within 30 days of riod" and at expiration.

the end of each "reporting period" and at

expiration. (4) Reporting Period symbol PR (Policy

Year) is shown in the Declarations, you

c. If coverage was not previously issued by us must file a report with us within 30 days

on a value reporting form basis and: of the end of each "reporting period" and

(1) Reporting Period symbol DR (Daily), WR at expiration.

(Weekly) or MR (Monthly) is shown in d. For property at "incidental locations", your

the Declarations, you must: reports must show separately the entire val-

ues in each state.

CP 13 10 04 02 © ISO Properties, Inc., 2001 Page 1 of 4 o

e. You may not correct inaccurate reports after 4. Failure To Submit Reports

loss or damage. If at the time of loss or damage you have failed

2. Full Reporting to submit:

The Coinsurance Additional Condition is re- a. The first required report of values:

placed by the following: (1) We will not pay more than 75% of the

COINSURANCE amount we would otherwise have paid;

a. If your report of values for a location where and

loss or damage occurs, for the last "report- (2) We will only pay for loss or damage at

ing period" before loss or damage, shows locations shown in the Declarations.

less than the full value of the Covered b. Any required report of values after the first

Property at that location on the report dates, required report:

we will pay only a proportion of the loss. The

proportion of loss payable, prior to applica- (1) We will not pay more for loss or damage

tion of the deductible, will not be greater at any location than the values you last

than the proportion determined by: reported for that location; and

(1) The values you reported for the location (2) We will only pay for loss or damage at

where the loss or damage occurred, di- locations reported in your last report filed

vided by before the loss.

(2) The value of the Covered Property at 5. Treatment Of "Specific Insurance"

E

that location on the report dates. a. You must include the amount of all "specific

b. For locations you acquire after the last insurance" in your reports of value.

report of values, we will not pay a greater b. We will subtract the value of "specific insur-

proportion of loss, prior to the application of

L

ance" from your values when computing

the deductible, than the proportion deter- advance and final premium under this en-

mined by: dorsement.

(1) The values you reported for all locations, Example:

P

divided by If: The value of the property is $ 400,000

(2) The value of the Covered Property at all The amount of "specific

locations on the report dates. insurance" is $ 50,000

M

Example of Under Reporting: The Limit of Insurance under

If: The values reported are $ 90,000 this form is $ 300,000

The actual values on Your report of values should show:

the report dates were $ 120,000 Value of Property $ 400,000

A

The deductible is $ 250 Amount of "Specific

The amount of loss is $ 60,000 Insurance" $ 50,000

Step a: $90,000 ÷ $120,000 = .75 Difference $ 350,000

S

Step b: .75 x $60,000 = $45,000 We will compute final premium based on the val-

ues in excess of reported "specific insurance"

Step c: $45,000 – $250 = $44,750

during the policy year.

The most we will pay is $44,750. The remaining

c. Subject to all other applicable provisions of

$15,250 is not covered.

this policy, including the applicable Limit of

3. Reports In Excess Of Limit Of Insurance Insurance, the most we will pay is that por-

If the values you report exceed the Limit of In- tion of the loss that exceeds the sum of (1)

surance: and (2) below:

a. We will determine final premium based on (1) The amount due from "specific insur-

all the values you report, less "specific in- ance", whether you can collect on it or

surance"; not; plus

b. In the event of loss or damage, we will not (2) The amount of any deductible applying

pay more than the Limit of Insurance appli- to such "specific insurance".

cable to the Covered Property.

Page 2 of 4 © ISO Properties, Inc., 2001 CP 13 10 04 02 o

Examples Example #3

The following examples assume that the Reporting ("Specific insurance" subject to 100% coinsurance

Provisions applicable to this form have been complied requirement. Value of property at time of loss is

with. $370,000.)

If: the amount of the "specific insurance" is Amount of loss $360,000

$50,000; Deductibles

the Limit of Insurance under this form is "Specific Insurance" $ 5,000

$300,000;

This insurance $ 1,000

the Deductible applicable to the "specific

Amount due from

insurance" is $5,000; and

"Specific Insurance" $43,600*

the Deductible applicable to this insurance is

$1,000; $49,600 – $ 49,600

we will determine the most we will pay as follows: $310,400

Example #1 The most this insurance will pay is $300,000 (the Limit

of Insurance).

("Specific insurance" not subject to a coinsurance

requirement.) The most payable, combined, from the "specific insur-

Amount of loss $300,000 ance" and this insurance is $343,600 ($43,600 +

$300,000). The remainder of the loss, $16,400, is not

Deductibles covered.

E

"Specific Insurance" $ 5,000 *The amount due from "specific insurance" will

This insurance $ 1,000 vary based on such factors as the amount of loss,

Amount due from the value of property at time of loss, and the coin-

L

"Specific Insurance" $50,000* surance requirement, if any, applicable under the

policy providing "specific insurance".

$56,000 – $ 56,000

C. Premium Adjustment

The most this insurance will pay $244,000

P

For Covered Property to which this endorsement

The most payable, combined, from the "specific insur- applies:

ance" and this insurance is $294,000 ($50,000 +

$244,000). The remainder of the loss, $6,000, is not 1. The premium charged at the inception of each

policy year is an advance premium. We will

M

covered.

determine the final premium for this insurance

Example #2 after the policy year, or expiration, based on the

("Specific insurance" subject to 100% coinsurance average of your reports of value.

requirement. Value of property at time of loss is 2. Based on the difference between the advance

A

$350,000.) premium and the final premium, for each policy

Amount of loss $300,000 year, we will:

Deductibles a. Charge additional premium; or

"Specific Insurance" $ 5,000

S

b. Return excess premium.

This insurance $ 1,000 The due date for any additional premium is the

Amount due from date shown as the due date on the bill.

"Specific Insurance" $37,900* D. Definitions

$43,900 – $ 43,900 1. "Acquired Locations" means any locations in

The most this insurance will pay $256,100 the policy territory acquired after the inception

of the coverage under this endorsement.

The most payable, combined, from the "specific insur-

ance" and this insurance is $294,000 ($37,900 + 2. "Incidental Locations" means any locations

$256,100). The remainder of the loss, $6,000, is not not shown in the Declarations, other than "ac-

covered. quired locations" and "reported locations", with

values of $25,000 or less.

CP 13 10 04 02 © ISO Properties, Inc., 2001 Page 3 of 4 o

3. "Reported Locations" means any locations, d. QR (Quarterly), reports must show values

other than those shown in the Declarations, as of the last day of each month; but the

that have been reported to us at the inception "reporting period" ends on the last day of:

of the coverage under this endorsement. (1) March;

4. "Reporting Period" means the period of time (2) June;

for which new reports of value are due, as

shown by a symbol in the Declarations. If the (3) September; and

symbol is: (4) December.

a. DR (Daily), reports must show values as of e. PR (Policy Year), reports must show values

each day; but the "reporting period" ends on as of the last day of each month; but the

the last day of the month. "reporting period" ends on the policy anni-

b. WR (Weekly), reports must show values as versary date.

of the last day of each week; but the "re- 5. "Specific Insurance" means other insurance

porting period" ends on the last day of the that:

month. a. Covers the same Covered Property to which

c. MR (Monthly), reports must show values as this endorsement applies; and

of the last day of the month; and the "re- b. Is not subject to the same plan, terms,

porting period" ends on the last day of each conditions and provisions as this insurance,

month. including this endorsement.

E

L

P

M

A

S

Page 4 of 4 © ISO Properties, Inc., 2001 CP 13 10 04 02 o

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Ebook PDF The Economy Today 15th Edition PDFDocument41 pagesEbook PDF The Economy Today 15th Edition PDFseth.duckey867100% (41)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Extra Expense Coverage Form (CP 00 50)Document5 pagesExtra Expense Coverage Form (CP 00 50)Steve SolakNo ratings yet

- Crib Plans: Myoutdoorplans - CoDocument6 pagesCrib Plans: Myoutdoorplans - Cojing ledesmaNo ratings yet

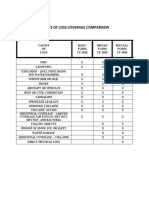

- Causes of Loss Form Comparison ChartDocument1 pageCauses of Loss Form Comparison ChartSteve SolakNo ratings yet

- Peak Season Limit of Insurance - CP 12 30Document1 pagePeak Season Limit of Insurance - CP 12 30Steve SolakNo ratings yet

- Outdoor Trees, Shrubs and Plants - CP 14 30Document1 pageOutdoor Trees, Shrubs and Plants - CP 14 30Steve SolakNo ratings yet

- Radio or Television Antenna - CP 14 50Document1 pageRadio or Television Antenna - CP 14 50Steve SolakNo ratings yet

- Fungus, Wet Rot, Dry Rot, & Bacteria - CP 04 31Document1 pageFungus, Wet Rot, Dry Rot, & Bacteria - CP 04 31Steve SolakNo ratings yet

- Shipper Load ConfirmationDocument2 pagesShipper Load ConfirmationSteve Holloway JrNo ratings yet

- Star 000 Exe Decsb KLCS CVS DWG 0104 - 0Document9 pagesStar 000 Exe Decsb KLCS CVS DWG 0104 - 0Muhammad NurimranNo ratings yet

- A Monopolist Faces A Market Demand Curve Given by QDocument1 pageA Monopolist Faces A Market Demand Curve Given by Qtrilocksp SinghNo ratings yet

- The Impact of Rapid Population Growth On Economic Development in Ethiopia - 045539Document51 pagesThe Impact of Rapid Population Growth On Economic Development in Ethiopia - 045539ABAYNEGETAHUN getahun100% (1)

- Economics 2019 v1.1: IA3 Sample Assessment InstrumentDocument13 pagesEconomics 2019 v1.1: IA3 Sample Assessment InstrumentAahz MandiusNo ratings yet

- Tax Invoice: AB Cartridge Private LimitedDocument1 pageTax Invoice: AB Cartridge Private LimitedSunil PatelNo ratings yet

- Lab Wiring 3Document10 pagesLab Wiring 3Nur Afiqah Mohamad NayanNo ratings yet

- Gclid Cijp2Cmgh6Kcfuf66Woduwxbiwsearch Results: Vishwakarma Institute of Information Technology (Viit)Document10 pagesGclid Cijp2Cmgh6Kcfuf66Woduwxbiwsearch Results: Vishwakarma Institute of Information Technology (Viit)Mahendra BelsarwarNo ratings yet

- Purchase Request 3850 - Invitation To QuoteDocument1 pagePurchase Request 3850 - Invitation To QuoteJoy Francia Mae RamosNo ratings yet

- Annex 1B Child Mapping-TAGAS EditedDocument10 pagesAnnex 1B Child Mapping-TAGAS Editedalma agnasNo ratings yet

- Why The Mega City Focus? Megacity Is The New World Disorder by Manuel CastellDocument3 pagesWhy The Mega City Focus? Megacity Is The New World Disorder by Manuel CastellishikaNo ratings yet

- Description: S&P Bse TeckDocument5 pagesDescription: S&P Bse TeckNeelkanth DaveNo ratings yet

- 40 Lakshya, Vol - III, Issue 40Document4 pages40 Lakshya, Vol - III, Issue 40Tarun beraNo ratings yet

- Course 13 Nig - Lifting Operations EnglishDocument44 pagesCourse 13 Nig - Lifting Operations EnglishDelta akathehuskyNo ratings yet

- Ami MushroomDocument3 pagesAmi MushroomSoulayman CRNo ratings yet

- Government of West Bengal: Registration Authority: TAMLUK RTO Form 23 Certificate of RegistrationDocument1 pageGovernment of West Bengal: Registration Authority: TAMLUK RTO Form 23 Certificate of Registrationzaid AhmedNo ratings yet

- Electricity Company Accounts: Solutions To Assignment ProblemsDocument3 pagesElectricity Company Accounts: Solutions To Assignment ProblemsHemmu sahuNo ratings yet

- Info@ks-Legal - In: Rating/Loan Eligibility Across The IndustryDocument4 pagesInfo@ks-Legal - In: Rating/Loan Eligibility Across The IndustryDavid ManiNo ratings yet

- Ms en 1992 1-1-2010 National Annex Sallehyassin@Yahoo - Com1Document29 pagesMs en 1992 1-1-2010 National Annex Sallehyassin@Yahoo - Com1Naziemi AhmadNo ratings yet

- Learning Curve ExercisesDocument6 pagesLearning Curve ExercisesRosele CabañelezNo ratings yet

- WIN SlidedocsDocument2 pagesWIN SlidedocsAdams BruinsNo ratings yet

- Evaluacion Final - Escenario 8 - PRIMER BLOQUE-TEORICO - PRACTICO - GLOBALIZACION Y COMPETITIVIDAD - (GRUPO B01)Document7 pagesEvaluacion Final - Escenario 8 - PRIMER BLOQUE-TEORICO - PRACTICO - GLOBALIZACION Y COMPETITIVIDAD - (GRUPO B01)liliana rinconNo ratings yet

- Amazon Briefcase BillDocument2 pagesAmazon Briefcase BillUtsav MallapurNo ratings yet

- Form of A Notice On Behalf of An Individual by An AdvocateDocument2 pagesForm of A Notice On Behalf of An Individual by An Advocatekinnari bhutaNo ratings yet

- Backward Stochastic Differential Equations in Financial MathematicsDocument34 pagesBackward Stochastic Differential Equations in Financial MathematicslerhlerhNo ratings yet

- Peta - 3RD - QTR - Economics Ethics Sy 21 22Document3 pagesPeta - 3RD - QTR - Economics Ethics Sy 21 22Kevin GuinsisanaNo ratings yet

- Case Role Play - TTPestControl-vFinal-candidateDocument2 pagesCase Role Play - TTPestControl-vFinal-candidateFaisalNo ratings yet

- A Comparative Analysis of Lic and Private CompanyDocument8 pagesA Comparative Analysis of Lic and Private CompanyHarshvardhan RathoreNo ratings yet