Professional Documents

Culture Documents

Appendix B: Sample Auditing and Attestation Testlet Released by AICPA

Appendix B: Sample Auditing and Attestation Testlet Released by AICPA

Uploaded by

Marjorie Ampong0 ratings0% found this document useful (0 votes)

34 views50 pages1. An auditor would consider modifying a standard review report if management refuses to capitalize material leases. The auditor should modify the report to disclose this departure from GAAP.

2. Analytical procedures assist auditors in identifying conditions that may indicate substantial doubt about an entity's ability to continue as a going concern, except for projecting a deviation rate by comparing sample results to population characteristics.

3. The highest risk of asset misappropriation occurs when there are a large number of transactions processed in a short period of time, as this allows less time for detection.

Original Description:

Original Title

Appendix B.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. An auditor would consider modifying a standard review report if management refuses to capitalize material leases. The auditor should modify the report to disclose this departure from GAAP.

2. Analytical procedures assist auditors in identifying conditions that may indicate substantial doubt about an entity's ability to continue as a going concern, except for projecting a deviation rate by comparing sample results to population characteristics.

3. The highest risk of asset misappropriation occurs when there are a large number of transactions processed in a short period of time, as this allows less time for detection.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

34 views50 pagesAppendix B: Sample Auditing and Attestation Testlet Released by AICPA

Appendix B: Sample Auditing and Attestation Testlet Released by AICPA

Uploaded by

Marjorie Ampong1. An auditor would consider modifying a standard review report if management refuses to capitalize material leases. The auditor should modify the report to disclose this departure from GAAP.

2. Analytical procedures assist auditors in identifying conditions that may indicate substantial doubt about an entity's ability to continue as a going concern, except for projecting a deviation rate by comparing sample results to population characteristics.

3. The highest risk of asset misappropriation occurs when there are a large number of transactions processed in a short period of time, as this allows less time for detection.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 50

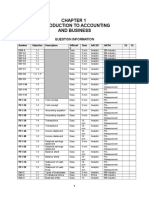

Appendix B: Sample Auditing and Attestation c. Authorization of credit memos by personnel 6.

During an engagement to review the financial

Testlet Released by AICPA who receive cash may permit the statements of a nonissuer (nonpublic) entity, an

misappropriation of cash. accountant becomes aware that several leases

1. According to the profession’s ethical d. The failure to prepare shipping documents that should be capitalized are not capitalized.

standards, an auditor would be considered may cause an overstatement of inventory The accountant considers these leases to be

independent in which of the following balances. material to the financial statements. The

instances? 4. In planning an audit, the auditor’s knowledge accountant decides to modify the standard

a. The auditor is the officially appointed stock about the design of relevant controls should be review report because management will not

transfer agent of a client. used to capitalize the leases. Under these

b. The auditor’s checking account that is fully a. Identify the types of potential misstatements circumstances, the accountant should

insured by a federal agency is held at a client that could occur. 1. An accountant who accepts

financial institution. an engagement to compile a financial projection 2. Which of the following audit procedures

c. The client owes the auditor fees for more most likely would make the client aware that most likely would assist an auditor in identifying

than two years prior to the issuance of the audit the conditions and events that may indicate there

report. a. Projection may not be included in a could be substantial doubt about an entity’s

d. The client is the only tenant in a commercial document with audited historical financial ability to continue as a going concern?

building owned by the auditor. statements. a. Confirmation of accounts receivable from

2. Which of the following characteristics most b. Accountant’s responsibility to update the principal customers.

likely would heighten an auditor’s concern projection for future events and circumstances b. Reconciliation of interest expense with debt

about the risk of material misstatements in an is limited to one year. outstanding.

entity’s financial statements? c. Projection omits all hypothetical assumptions c. Confirmation of bank balances.

a. The entity’s industry is experiencing declining and presents the most likely future financial d. Review of compliance with terms of debt

customer demand. position. agreements.

b. Employees who handle cash receipts are not d. Engagement does not include an evaluation 3. Which of the following would not be

bonded. of the support for the assumptions underlying considered an analytical procedure?

c. Bank reconciliations usually include in-transit the projection. a. Converting dollar amounts of income

deposits. 5. Which of the following information statement account balances to percentages of

d. Equipment is often sold at a loss before being discovered during an audit most likely would net sales for comparison with industry

fully depreciated. raise a question concerning possible illegal acts? averages.

3. Which of the following fraudulent activities a. Related-party transactions, although properly b. Developing the current year’s expected net

most likely could be perpetrated due to the lack disclosed, were pervasive during the year. sales based on the sales trend of similar entities

of effective internal controls in the revenue b. The entity prepared several large checks within the same industry.

cycle? payable to cash during the year. c. Projecting a deviation rate by comparing the

a. Fictitious transactions may be recorded that c. Material internal control weaknesses results of a statistical sample with the actual

cause an understatement of revenues and an previously reported to management were not population characteristics.

overstatement of receivables. corrected. d. Estimating the current year’s expected

b. Claims received from customers for goods d. The entity was a campaign contributor to expenses based on the prior year’s expenses

returned may be intentionally recorded in other several local political candidates during the and the current year’s budget.

customers’ accounts. year. 4. A group engagement partner (principal

auditor) decides not to refer to the audit of a

component (other) auditor who audited a c. Obtaining an understanding of internal 11. Which of the following is the best way to

subsidiary of the consolidated financial control to assess control risk. compensate for the lack of adequate

statements. After making inquiries about the d. Having previous experience in the client’s segregation of duties in a small organization?

component auditor’s professional reputation industry. a. Disclosing lack of segregation of duties to the

and independence, the group engagement 7. Obtaining an understanding of an internal external auditors during the annual review.

partner most likely would control involves evaluating the design of the b. Replacing personnel every three or four

a. Document in the engagement letter that the control and determining whether the control years.

principal auditor assumes no responsibility for has been c. Requiring accountants to pass a yearly

the other CPA’s work. a. Authorized. background check.

b. Obtain written permission from the other b. Implemented. d. Allowing for greater management oversight

CPA to omit the reference in the principal c. Tested. of incompatible activities.

auditor’s report. d. Monitored. 12. Which of the following situations most likely

c. Consider the significance of the component 8. Which of the following procedures most represents the highest risk of a misstatement

and design audit procedures accordingly. likely would be performed in a review arising from misappropriations of assets?

d. Add an emphasis-of-matter paragraph to the engagement of a nonissuer’s financial a. A large number of bearer bonds on hand.

auditor’s report indicating that the subsidiary’s statements in accordance with Statements on b. A large number of inventory items with low

financial statements are not material to the Standards for Accounting and Review Services? sales prices.

consolidated financial statements. a. Making inquiries of management. c. A large number of transactions processed in a

5. In auditing related-party transactions, an b. Observing a year-end inventory count. short period of time.

auditor ordinarily places primary emphasis on c. Assessing the internal control system. d. A large number of fixed assets with easily

a. The probability that related-party d. Examining subsequent cash receipts. identifiable serial numbers.

transactions will recur. 9. An auditor should consider which of the 13. Which of the following procedures would an

b. Confirming the existence of the related following when evaluating the ability of a auditor most likely perform in the planning

parties. company to continue as a going concern? stage of an audit?

c. Verifying the valuation of the related-party a. Audit fees. a. Make a preliminary judgment about

transactions. b. Future assurance services. materiality.

d. The adequacy of the disclosure of the c. Management’s plans for disposal of assets. b. Confirm a sample of the entity’s accounts

related-party transactions. d. A lawsuit for which judgment is not payable with known creditors.

6. The inability to complete which of the anticipated for 18 months. c. Obtain written representations from

following activities most likely would prevent an 10. In which of the following should an auditor’s management that there are no unrecorded

accountant from accepting and completing an report refer to the lack of consistency when transactions.

engagement for a review of financial there is a change in accounting principle that is d. Communicate management’s initial selection

statements performed in accordance with significant? of accounting policies to the audit committee.

Statements on Standards for Accounting and a. The scope paragraph. 14. An auditor is not required to confirm

Review Services? b. The opinion paragraph. accounts receivable if the overall balance of the

a. Performing tests of details of major account c. An emphasis-of-matter paragraph following accounts is

balances. the opinion paragraph. a. Older than the prior year.

b. Performing inquiries and analytical d. An emphasis-of-matter paragraph before the b. Immaterial.

procedures. opinion paragraph. c. Smaller than expected.

d. Subject to valuation estimates.

15. Under which of the following circumstances a. Four years. a. The firm that proposes the lowest fee for the

should an auditor consider confirming the terms b. Five years. work required.

of a large complex sale? c. Six years. b. Independent for purposes of examining

a. When the assessed level of control risk over d. Seven years. financial information required to be filed

the sale is low. 20. A government internal audit function is annually with the DOL.

b. When the assessed level of detection risk presumed to be free from organizational c. Included on the list of firms approved by the

over the sale is high. independence impairments for reporting DOL.

c. When the combined assessed level of internally when the head of the organization d. Independent of the utility company and not

inherent and control risk over the sale is a. Is not accountable to those charged with relying on its services.

moderate. governance. 24. An accountant was asked by a potential

d. When the combined assessed level of b. Performs auditing procedures that are client to perform a compilation of its financial

inherent and control risk over the sale is high. consistent with generally accepted accounting statements. The accountant is not familiar with

16. Of which of the following matters is a principles. the industry in which the client operates. In this

management representation letter required to c. Is a line-manager of the unit under audit. situation, which of the following actions is the

contain specific representations? d. Is removed from political pressures to accountant most likely to take?

a. Length of a material contract with a new conduct audits objectively, without fear of a. Request that management engage an

customer. political reprisal. independent industry expert to consult with the

b. Information concerning fraud by the CFO. 21. Each of the following is a type of a known accountant.

c. Reason for a significant increase in revenue misstatement, except b. Accept the engagement and obtain an

over the prior year. a. An inaccuracy in processing data. adequate level of knowledge about the

d. The competency and objectivity of the b. The misapplication of accounting principles. industry.

internal audit department. c. Differences between management and the c. Decline the engagement.

17. In which of the following paragraphs auditor’s judgment regarding estimates. d. Postpone accepting the engagement until the

(section) of an auditor’s report on a nonpublic d. A difference between the classification of a accountant has obtained an adequate level of

company does an auditor communicate the reported financial statement element and the knowledge about the industry.

nature of the audit procedures performed? classification according to generally accepted 25. To compile financial statements of a

a. Introductory paragraph. accounting principles. nonissuer in accordance with Statements of

b. Opinion paragraph. 22. An accountant can perform, with Standards for Accounting and Review Services,

c. Auditor’s Responsibilities paragraph. preapproval of the audit committee of the an accountant should

d. Emphasis-of-matter paragraph. board of directors, which of the following non a. Identify material misstatements in the

18. The understanding with the client regarding audit services during the audit of an issuer? financial statements.

a financial statement audit generally includes a. Bookkeeping services. b. Review bank statement reconciliations.

which of the following matters? b. Human resource services. c. Make inquiries of significant customers,

a. The expected opinion to be issued. c. Tax planning services. vendors, and creditors.

b. The responsibilities of the auditor. d. Internal audit outsourcing services. d. Obtain a general understanding of the client’s

c. The contingency fee structure. 23. The controller of a small utility company has business transactions.

d. The preliminary judgment about materiality. interviewed audit firms proposing to perform 26. A CPA firm would best provide itself

19. Under Sarbanes-Oxley Act of 2002, exactly the annual audit of their employee benefit plan. reasonable assurance of meeting its

how many consecutive years may an audit According to the guidelines of the Department responsibility to offer professional services that

partner lead an audit for an issuer? of Labor (DOL), the selected auditor must be conform to professional standards by

a. Establishing an understanding with each Under these circumstances, Brown most likely b. Restrict the use of the report to those

client concerning individual responsibilities in a would specified users within the entity.

signed engagement letter. a. Add an emphasis-of-matter paragraph to the c. Be limited to data derived from the entity’s

b. Assessing the risk that errors and fraud may standard auditor’s report that justifies the audited financial statements.

cause the financial statements to contain reason for the omission. d. Indicate that the data are subject to

material misstatements. b. Refuse to accept the engagement as prospective results that may not be achieved.

c. Developing specific audit objectives to proposed because of the client-imposed scope 33. For which of the following audit tests would

support management’s assertions that are limitation. an auditor most likely use attribute sampling?

embodied in the financial statements. c. Explain to Zag that the omission requires a a. Inspecting purchase orders for proper

d. Maintaining a comprehensive system of qualification of the auditor’s opinion. approval by supervisors.

quality control that is suitably designed in d. Prepare the statement of cash flows as an b. Making an independent estimate of recorded

relation to its organizational structure. accommodation to Zag and express an payroll expense.

27. An auditor who is unable to form an opinion unmodified opinion. c. Determining that all payables are recorded at

on a new client’s opening inventory balances 30. Under the ethical standards of the year-end.

may issue an unmodified (unqualified) opinion profession, which of the following is a d. Selecting accounts receivable for

on the current year’s . “permitted loan” regardless of the date it was confirmation of account balances.

a. Income statement only. obtained? 34. According to the Code of Professional

b. Statement of cash flows only. a. Home mortgage loan. Conduct of the AICPA, for which type of service

c. Balance sheet only. b. Student loan. may a CPA receive a contingent fee?

d. Statement of shareholders’ equity only. c. Secured automobile loan. a. Performing an audit of a financial statement.

28. Which of the following procedures would a d. Personal loan. b. Performing a review of a financial statement.

CPA most likely perform during the risk 31. In confirming a client’s accounts receivable c. Performing an examination of prospective

assessment phase of a financial statement in prior years, an auditor discovered many financial information.

audit? differences between recorded account balances d. Seeking a private letter ruling.

a. Make inquiries of the client’s lawyer and confirmation replies. These differences 35. Which of the following controls should

concerning pending litigation. were resolved and were not misstatements. In prevent an invoice for the purchase of

b. Perform cutoff tests of cash receipts and defining the sampling unit for the current year’s merchandise from being paid twice?

disbursements. audit, the auditor most likely would choose a. The check signer accounts for the numerical

c. Compare financial information with a. Customers with credit balances. sequence of receiving reports used in support

nonfinancial operating data. b. Small account balances. of each payment.

d. Recalculate the prior year’s accruals and c. Individual overdue balances. b. An individual independent of cash operations

deferrals. d. Individual invoices. prepares a bank reconciliation.

29. Zag Co. issues financial statements that 32. An auditor is engaged to report on selected c. The check signer reviews and cancels the

present financial position and results of financial data that are included in a client- voucher packets.

operations but Zag omits the related statement prepared document containing audited financial d. Two check signers are required for all checks

of cash flows. Zag would like to engage Brown, statements. Under these circumstances, the over a specified amount.

CPA, to audit its financial statements without report on the selected data should 36. A client has capitalizable leases but refuses

the statement of cash flows although Brown’s a. State that the presentation is a to capitalize them in the financial statements.

access to all of the information underlying the comprehensive basis of accounting other than Which of the following reporting options does

basic financial statements will not be limited. GAAP.

an auditor have if the amounts pervasively 39. Which of the following management d. The cost of substantive procedures will

distort the financial statements? assertions is an auditor most likely testing if the exceed the cost of testing the relevant controls.

a. Qualified opinion. audit objective states that all inventory on hand 43. Which of the following courses of action is

b. Unmodified (unqualified) opinion. is reflected in the ending inventory balance? the most appropriate if an auditor concludes

c. Disclaimer opinion. a. The entity has rights to the inventory. that there is a high risk of material

d. Adverse opinion. b. Inventory is properly valued. misstatement?

37. Which of the following items should be c. Inventory is properly presented in the a. Use smaller, rather than larger, sample sizes.

included in prospective financial statements financial statements. b. Perform substantive tests as of an interim

issued in an attestation engagement performed d. Inventory is complete. date.

in accordance with Statements on Standards for 40. Which of the following activities is an c. Select more effective substantive tests.

Attestation Engagements? accountant not responsible for in review d. Increase of tests of controls.

a. All significant assertions used to prepare the engagements performed in accordance with 44. Which of the following procedures would be

financial statements. Statements on Standards for Accounting and generally performed when evaluating the

b. All significant assumptions used to prepare Review Services? accounts receivable balance in an engagement

the financial statements. a. Performing basic analytical procedures. to review financial statements in accordance

c. Pro forma financial statements for the past b. Remaining independent. with Statements on Standards for Accounting

two years. c. Developing an understanding of internal and Review Services?

d. Historical financial statements for the past control. a. Perform a reasonableness test of the balance

three years. d. Providing any form of assurance. by computing days’ sales in receivables.

38. A company employs three accounts payable 41. Which of the following items should be b. Vouch a sample of subsequent cash receipts

clerks and one treasurer. Their responsibilities included in an auditor’s report for financial from customers.

are as follows: statements prepared in conformity with a c. Confirm individually significant receivable

Employee Responsibility Clerk 1 Reviews special-purpose financial reporting framework? balances with customers.

vendor invoices for proper signature approval. a. A sentence stating that the auditor is d. Review subsequent bank statements for

Clerk 2 Enters vendor invoices into the responsible for the financial statements. evidence of cash deposits.

accounting system and verifies payment terms. b. A title that includes the word “independent.” 45. In which of the following circumstances

Clerk 3 Posts entered vendor invoices to the c. The signature of the company controller. would a covered member’s independence be

accounts payable ledger for payment and mails d. A paragraph stating that the audit was impaired with respect to a nonissuer client?

checks. Treasurer Reviews the vendor invoices conducted in accordance with the special- a. The member is designated to serve as

and signs each check. Which of the following purpose financial reporting framework. guardian of a friend’s children if the need arises,

would indicate a weakness in the company’s 42. Which of the following statements best and the friend’s estate, which would be held in

internal control? describes why an auditor would use only trust for the children, holds significant stock

a. Clerk 1 opens all of the incoming mail. substantive procedures to evaluate specific ownership in a client entity.

b. Clerk 2 reconciles the accounts payable relevant assertion and risks? b. The member’s spouse qualifies because of

ledger with the general ledger monthly. a. The relevant internal control components are geographical residence to belong to a client’s

c. Clerk 3 mails the checks and remittances after not well documented. credit union, and all transactions with the credit

they have been signed. b. The internal auditor already has tested the union are conducted under normal operating

d. The treasurer uses a stamp for signing relevant controls and found them effective. practices.

checks. c. Testing the operating effectiveness of the

relevant controls would not be efficient.

c. The member owns municipal utility bonds b. Consider the additional audit effort and cost c. Determine whether controls have been

issued by a client, and the bonds are not required to complete the audit. circumvented by collusion.

material to the member’s wealth. c. Evaluate the possibility that financial d. Document the assessed level of control risk.

d. The member belongs to a client golf club that statement information affected by the

requires members to acquire a share of the limitation on work to be performed may be A. Auditor’s Consideration of Internal Control

club’s debt securities. incorrect or incomplete. When a Computer Is Present

46. According to the AICPA Statements on d. Consider the reason given for the client’s 1. An advantage of using systems flowcharts to

Standards for Attestation Engagements, a public 49. Hart, CPA, is engaged to review the year-2 document information about internal control

accounting firm should establish quality control financial statements of Kell Co., a nonissuer. instead of using internal control questionnaires

policies to provide assurance about which of Previously, Hart audited Kell’s year-1 financial is that systems flowcharts

the following matters related to agreed-upon statements and expressed a qualified opinion a. Identify internal control weaknesses more

procedures engagements? due to a scope limitation. Hart decides to prominently.

a. Use of the report is not restricted. include a separate paragraph in the year-2 b. Provide a visual depiction of clients’ activities.

b. The public accounting firm takes review report because comparative financial c. Indicate whether control procedures are

responsibility for the sufficiency of procedures. statements are being presented for year 2 and operating effectively.

c. The practitioner is independent from the year 1. This separate paragraph should indicate d. Reduce the need to observe clients’

client and other specified parties. the employees performing routine tasks.

d. The practitioner sets the criteria to be used in a. Substantive reasons for the prior year’s 2. A flowchart is most frequently used by an

the determination of findings. qualified opinion. auditor in connection with the

47. A cooling-off period of how many years is b. Reason for changing the level of service from a. Preparation of generalized computer audit

required before a member of an issuer’s audit an audit to a review. programs.

engagement team may begin working for the c. Consistency of application of accounting b. Review of the client’s internal control.

registrant in a key position? principles between year 2 and year 1. c. Use of statistical sampling in performing an

a. One year. d. Restriction on the distribution of the report audit.

b. Two years. for internal use only. d. Performance of analytical procedures of

c. Three years. 50. Which of the following statements is account balances.

d. Four years. generally correct about the sample size in 3. Matthews Corp. has changed from a system

48. A CPA is engaged to audit the financial statistical sampling when testing internal of recording time worked on clock cards to a

statements of a nonissuer. After the audit controls? computerized payroll system in which

begins, the client’s management questions the a. As the population size doubles, the sample employee’s record time in and out with

extent of procedures and objects to the size should increase by about 67%. magnetic cards. The computer system

confirmation of certain contracts. The client b. The sample size is inversely proportional to automatically updates all payroll records.

asks the accountant to change the scope of the the expected error rate. Because of this change

engagement from an audit to a review. Under c. There is no relationship between the a. A generalized computer audit program must

these circumstances, the accountant should do tolerable error rate and the sample size. be used.

each of the following, except d. The population size has little or no effect on b. Part of the audit trail is altered.

a. Issue an accountant’s review report with a the sample size. c. The potential for payroll-related fraud is

separate paragraph discussing the change in b. Assess the operational efficiency of internal diminished.

engagement scope. control. d. Transactions must be processed in batches.

4. Which of the following is correct concerning that processes most of its financial data only in 12. Which of the following types of evidence

batch processing of transactions? electronic form, such as a paperless system? would an auditor most likely examine to

a. Transactions are processed in the order they a. Continuous monitoring and analysis of determine whether internal control is operating

occur, regardless of type. transaction processing with an embedded audit as designed?

b. It has largely been replaced by online real- module. a. Gross margin information regarding the

time processing in all but legacy systems. b. Increased reliance on internal control client’s industry.

c. It is more likely to result in an easy-to-follow activities that emphasize the segregation of b. Confirmations of receivables verifying

audit trail than is online transaction processing. duties. account balances.

d. It is used only in non-database applications. c. Verification of encrypted digital certificates c. Client records documenting the use of

5. An auditor would be most likely to assess used to monitor the authorization of computer programs.

control risk at the maximum level in an transactions. d. Anticipated results documented in budgets or

electronic environment with automated d. Extensive testing of firewall boundaries that forecasts.

system-generated information when restrict the recording of outside network traffic. 13. An auditor anticipates assessing control risk

a. Sales orders are initiated using 9. Which of the following is not a major reason at a low level in a computerized environment.

predetermined, automated decision rules. for maintaining an audit trail for a computer Under these circumstances, on which of the

b. Payables are based on many transactions and system? following activities would the auditor initially

large in dollar amount. a. Deterrent to fraud. focus?

c. Fixed asset transactions are few in number, b. Monitoring purposes. a. Programmed control activities.

but large in dollar amount. c. Analytical procedures. b. Application control activities.

d. Accounts receivable records are based on d. Query answering. c. Output control activities.

many transactions and are large in dollar 10. Computer systems are typically supported d. General control activities.

amount. by a variety of utility software packages that are 14. After the preliminary phase of the review of

6. In a highly automated information processing important to an auditor because they a client’s computer controls, an auditor may

system tests of control a. May enable unauthorized changes to data decide not to perform tests of controls related

a. Must be performed in all circumstances. files if not properly controlled. to the controls within the computer portion of

b. May be required in some circumstances. b. Are very versatile programs that can be used the client’s internal control. Which of the

c. Are never required. on hardware of many man which of the following would not be a valid reason for

d. Are required in first year audits. following is not a major manufacturers. choosing to omit such tests?

7. Which of the following is least likely to be c. May be significant components of a client’s a. The controls duplicate operative controls

considered by an auditor considering application programs. existing elsewhere in the structure.

engagement of an information technology (IT) d. Are written specifically to enable auditors to b. There appear to be major weaknesses that

specialist on an audit? extract and sort data. would preclude reliance on the stated

a. Complexity of client’s systems and IT 11. computer-asset concerned with which of procedure.

controls. the following controls in a distributed data c. The time and dollar costs of testing exceed

b. Requirements to assess going concern status. processing system? the time and dollar savings in substantive

c. Client’s use of emerging technologies. a. Hardware controls. testing if the tests of controls show the controls

d. Extent of entity’s participation in electronic b. Systems documentation controls. to be operative.

commerce. c. Access controls. d. The controls appear adequate.

8. Which of the following strategies would a d. Disaster recovery controls.

CPA most likely consider in auditing an entity

15. Auditing by testing the input and output of a a. Test data. 22. Which of the following is not among the

computer system instead of the computer b. Review of program logic. errors that an auditor might include in the test

program itself will c. Integrated test facility. data when auditing a client’s computer system?

a. Not detect program errors which do not d. Parallel simulation. a. Numeric characters in alphanumeric fields.

show up in the output sampled. B. Computerized Audit Tools b. Authorized code.

b. Detect all program errors, regardless of the 19. To obtain evidence that online access c. Differences in description of units of measure.

nature of the output. controls are properly functioning, an auditor d. Illogical entries in fields whose logic is tested

c. Provide the auditor with the same type of most likely would by programmed consistency checks.

evidence as tests of application controls. a. Create checkpoints at periodic intervals after 23. Which of the following computer-assisted

d. Not provide the auditor with confidence in live data processing to test for unauthorized use auditing techniques allows fictitious and real

the results of the auditing procedures. of the system. transactions to be processed together without

16. Which of the following client information b. Examine the transaction log to discover client operating personnel being aware of the

technology (IT) systems generally can be whether any transactions were lost or entered testing process?

audited without examining or directly testing twice due to a system malfunction. a. Integrated test facility.

the IT computer programs of the system? c. Enter invalid identification numbers or b. Input controls matrix.

a. A system that performs relatively passwords to ascertain whether the system c. Parallel simulation.

uncomplicated processes and produces detailed rejects them. d. Data entry monitor.

output. d. Vouch a random sample of processed 24. Which of the following methods of testing

b. A system that affects a number of essential transactions to assure proper authorization. application controls utilizes a generalized audit

master files and produces a limited output. 20. An auditor most likely would introduce test software package prepared by the auditors?

c. A system that updates a few essential master data into a computerized payroll system to test a. Parallel simulation.

files and produces no printed output other than controls related to the b. Integrated testing facility approach.

final balances. a. Existence of unclaimed payroll checks held by c. Test data approach.

d. A system that performs relatively supervisors. d. Exception report tests.

complicated processing and produces very little b. Early cashing of payroll checks by employees. 25. in creating lead schedules for an audit

detailed output. c. Discovery of invalid employee I.D. numbers. engagement, a CPA often uses automated work

17. An auditor who wishes to capture an d. Proper approval of overtime by supervisors. paper software. What client information is

entity’s data as transactions are processed and 21. When an auditor tests a computerized needed to begin this process?

continuously test the entity’s computerized accounting system, which of the following is a. Interim financial information such as third

information system most likely would use which true of the test data approach? quarter sales, net income, and inventory and

of the following techniques? a. Several transactions of each type must be receivables balances.

a. Snapshot application. tested. b. Specialized journal information such as the

b. Embedded audit module. b. Test data are processed by the client’s invoice and purchase order numbers of the last

c. Integrated data check. computer programs under the auditor’s control. few sales and purchases of the year.

d. Test data generator. c. Test data must consist of all possible valid c. General ledger information such as account

18. Which of the following computer-assisted and invalid conditions. numbers, prior year account balances, and

auditing techniques processes client input data d. The program tested is different from the current year unadjusted information.

on a controlled program under the auditor’s program used throughout the year by the client. d. Adjusting entry information such as deferrals

control to test controls in the computer and accruals, and reclassification journal

system? entries.

26. Using microcomputers in auditing may a. Compiler programs. 1. An advantage of using statistical over

affect the methods used to review the work of b. Supervisory programs. nonstatistical sampling methods in tests of

staff assistants because c. Utility programs. controls is that the statistical methods

a. The generally accepted auditing standards d. User programs. a. Can more easily convert the sample into a

may differ. 30. Smith Corporation has numerous dual-purpose test useful for substantive testing.

b. Documenting the supervisory review may customers. A customer file is kept on disk b. Eliminate the need to use judgment in

require assistance of consulting services storage. Each customer file contains name, determining appropriate sample sizes.

personnel. address, credit limit, and account balance. The c. Afford greater assurance than a nonstatistical

c. Supervisory personnel may not have an auditor wishes to test this file to determine sample of equal size.

understanding of the capabilities and limitations whether credit limits are being exceeded. The d. Provide an objective basis for quantitatively

of microcomputers. best procedure for the auditor to follow would evaluating sample risk.

d. Working paper documentation may not be to 2. An advantage of statistical sampling over

contain readily observable details of a. Develop test data that would cause some nonstatistical sampling is that statistical

calculations. account balances to exceed the credit limit and sampling helps an auditor to

27. An auditor would least likely use computer determine if the system properly detects such a. Eliminate the risk of nonsampling errors.

software to situations. b. Reduce the level of audit risk and materiality

a. Access client data files. b. Develop a program to compare credit limits to a relatively low amount.

b. Prepare spreadsheets. with account balances and print out the details c. Measure the sufficiency of the evidential

c. Assess computer control risk. of any account with a balance exceeding its matter obtained.

d. Construct parallel simulations. credit limit. d. Minimize the failure to detect errors and

28. A primary advantage of using generalized c. Request a printout of all account balances so fraud.

audit software packages to audit the financial they can be manually checked against the credit A.3. Uncertainty and Audit Sampling

statements of a client that uses a computer limits. 3. The likelihood of assessing control risk too

system is that the auditor may d. Request a printout of a sample of account high is the risk that the sample selected to test

a. Access information stored on computer files balances so they can be individually checked controls

while having a limited understanding of the against the credit limits. a. Does not support the auditor’s planned

client’s hardware and software features. 31. An auditor most likely would test for the assessed level of control risk when the true

b. Consider increasing the use of substantive presence of unauthorized computer program operating effectiveness of the control structure

tests of transactions in place of analytical changes by running a justifies such an assessment.

procedures. a. Program with test data. b. Contains misstatements that could be

c. Substantiate the accuracy of data through b. Check digit verification program. material to the financial statements when

self-checking digits and hash totals. c. Source code comparison program. aggregated with misstatements in other

d. Reduce the level of required tests of controls d. Program that computes control totals. account balances or transactions classes.

to a relatively small amount. 32. An entity has the following invoices in a c. Contains proportionately fewer monetary

29. Auditors often make use of computer request and assess whether the request is errors or deviations from prescribed controls

programs that perform routine processing reasonable. than exist in the balance or class as a whole.

functions such as sorting and merging. These A.2. General Approaches to Audit Sampling—

programs are made available by electronic data Nonstatistical and Statistical

processing companies and others and are

specifically referred to as

d. Does not support the tolerable error for a. The larger of the samples that would

some or all of management’s assertions. otherwise have been designed for the two

4. The risk of incorrect acceptance and the separate purposes.

likelihood of assessing control risk too low b. The smaller of the samples that would

relate to the otherwise have been designed for the two

a. Allowable risk of tolerable misstatement. separate purposes.

b. Preliminary estimates of materiality levels. c. The combined total of the samples that

c. Efficiency of the audit. would otherwise have been designed for the

d. Effectiveness of the audit. two separate purposes.

5. Which of the following best illustrates the d. More than the larger of the samples that

concept of sampling risk? 7. In which of the situations would the auditor would otherwise have been designated for the

a. A randomly chosen sample may not be have properly concluded that control risk is at two separate purposes, but less than the

representative of the population as a whole on or below the planned assessed level? combined total of the samples that would

the characteristic of interest. a. I. otherwise have been designed for the two

b. An auditor may select audit procedures that b. II. separate purposes.

are not appropriate to achieve the specific c. III. A.5. Types of Statistical Sampling Plans

objective. d. IV. 11. The expected population deviation rate of

c. An auditor may fail to recognize errors in the 8. As a result of tests of controls, the auditor client billing errors is 3%. The auditor has

documents examined for the chosen sample. assesses control risk too high and thereby established a tolerable rate of 5%. In the review

d. The documents related to the chosen sample increases substantive testing. This is illustrated of client invoices the auditor should use

may not be available for inspection. by situation a. Stratified sampling.

6. In assessing sampling risk, the risk of a. I. b. Variable sampling.

incorrect rejection and the risk of assessing b. II. c. Discovery sampling.

control risk too high relate to the c. III. d. Attribute sampling.

a. Efficiency of the audit. d. IV. 12. Which of the following sampling methods

b. Effectiveness of the audit. 9. While performing a test of details during an would be used to estimate a numerical

c. Selection of the sample. audit, an auditor determined that the sample measurement of a population, such as a dollar

d. Audit quality controls. results supported the conclusion that the value?

Items 7 and 8 are based on the following recorded account balance was materially a. Attribute sampling.

information: misstated. It was, in fact, not materially b. Stop-or-go sampling.

The diagram below depicts the auditor’s misstated. This situation illustrates the risk of c. Variables sampling.

estimated deviation rate compared with the a. Assessing control risk too high. d. Random-number sampling.

tolerable rate, and also depicts the true b. Assessing control risk too low. 13. For which of the following audit tests would

population deviation rate compared with the c. Incorrect rejection. an auditor most likely use attribute sampling?

tolerable rate. d. Incorrect acceptance. a. Making an independent estimate of the

A.4. Types of Audit Tests in Which Sampling amount of a LIFO inventory.

May Be Used b. Examining invoices in support of the

10. The size of a sample designed for dual valuation of fixed asset additions.

purpose testing should be c. Selecting accounts receivable for

confirmation of account balances.

d. Inspecting employee time cards for proper a. Must be systematically replaced in the c. No Yes

approval by supervisors. population after sampling. d. Yes No

14. An underlying feature of random-based b. May systematically occur more than once in 22. Which of the following statements is correct

selection of items is that each the sample. concerning statistical sampling in tests of

a. Stratum of the accounting population be c. Must be recorded in a systematic pattern controls?

given equal representation in the sample. before the sample can be drawn. a. Deviations from control procedures at a given

b. Item in the accounting population be d. May occur in a systematic pattern, thus rate usually result in misstatements at a higher

randomly ordered. destroying the sample randomness. rate.

c. Item in the accounting population should 19. What is the primary objective of using b. As the population size doubles, the sample

have an opportunity to be selected. stratification as a sampling method in auditing? size should also double.

d. Item must be systematically selected using a. To increase the confidence level at which a c. The qualitative aspects of deviations are not

replacement. decision will be reached from the results of the considered by the auditor.

15. Which of the following statistical selection sample selected. d. There is an inverse relationship between the

techniques is least desirable for use by an b. To determine the occurrence rate for a given sample size and the tolerable rate.

auditor? characteristic in the population being studied. 23. In determining the sample size for a test of

a. Systematic selection. c. To decrease the effect of variance in the total controls, an auditor should consider the likely

b. Stratified selection. population. rate of deviations, the allowable risk of

c. Block selection. d. To determine the precision range of the assessing control risk too low, and the

d. Sequential selection. sample selected. a. Tolerable deviation rate.

16. Which of the following statistical sampling B.1. Tests of Controls—Sampling Risk b. Risk of incorrect acceptance.

plans does not use a fixed sample size for tests 20. As a result of tests of controls, an auditor c. Nature and cause of deviations.

of controls? assessed control risk too low and decreased d. Population size.

a. Dollar-unit sampling. substantive testing. This assessment occurred 24. Which of the following combinations results

b. Sequential sampling. because the true deviation rate in the in a decrease in sample size in a sample for

c. PPS sampling. population was attributes?

d. Variables sampling. a. Less than the risk of assessing control risk too

17. If certain forms are not consecutively low, based on the auditor’s sample.

numbered b. Less than the deviation rate in the auditor’s

a. Selection of a random sample probably is not sample.

possible. c. More than the risk of assessing control risk

b. Systematic sampling may be appropriate. too low, based on the auditor’s sample.

c. Stratified sampling should be used. d. More than the deviation rate in the auditor’s

d. Random number tables cannot be used. sample. 25. An auditor is testing internal control

18. When performing a test of a control with 21. Which of the following factors is(are) procedures that are evidenced on an entity’s

respect to control over cash receipts, an auditor considered in determining the sample size for a vouchers by matching random numbers with

may use a systematic sampling technique with a test of controls? voucher numbers. If a random number matches

start at any randomly selected item. The biggest Expected deviation rate Tolerable deviation the number of avoided voucher, that voucher

disadvantage of this type of sampling is that the rate ordinarily should be replaced by another

items in the population a. Yes Yes voucher in the random sample if the voucher

b. No No a. Constitutes a deviation.

b. Has been properly voided. 28. The objective of the tolerable rate in d. Either I or II.

c. Cannot be located. sampling for tests of controls of internal control 32. An auditor should consider the tolerable

d. Represents an immaterial dollar amount. is to rate of deviation when determining the number

26. An auditor plans to examine a sample of a. Determine the probability of the auditor’s of check requests to select for a test to obtain

twenty purchase orders for proper approvals as conclusion based upon reliance factors. assurance that all check requests have been

prescribed by the client’s control procedures. b. Determine that financial statements taken as properly authorized. The auditor should also

One of the purchase orders in the chosen a whole are not materially in error. consider

sample of twenty cannot be found, and the c. Estimate the reliability of substantive tests. The average dollar value of the check requests

auditor is unable to use alternative procedures d. Estimate the range of procedural deviations the allowable risk of assessing control risk too

to test whether that purchase order was in the population. low a. Yes Yes b. Yes No c. No Yes d. No No

properly approved. The auditor should 29. The tolerable rate of deviations for a test of

a. Choose another purchase order to replace a control is generally B.2. Statistical (Attributes) Sampling for Tests

the missing purchase order in the sample. a. Lower than the expected rate of errors in the of Controls

b. Consider this test of control invalid and related accounting records. 33. Which of the following statements is correct

proceed with substantive tests since internal b. Higher than the expected rate of errors in the concerning statistical sampling in tests of

control cannot be relied upon. related accounting records. controls?

c. Treat the missing purchase order as a c. Identical to the expected rate of errors in a. As the population size increases, the sample

deviation for the purpose of evaluating the related accounting records. size should increase proportionately.

sample. d. Unrelated to the expected rate of errors in b. Deviations from specific internal control

d. Select a completely new set of twenty the related accounting records. procedures at a given rate ordinarily result in

purchase orders. 30. If the auditor is concerned that a population misstatements at a lower rate.

27. When assessing the tolerable rate, the may contain exceptions, the determination of a c. There is an inverse relationship between the

auditor should consider that, while deviations sample size sufficient to include at least one expected population deviation rate and the

from control procedures increase the risk of such exception is a characteristic of sample size.

material misstatements, such deviations do not a. Discovery sampling. d. In determining tolerable rate, an auditor

necessarily result in errors. This explains why b. Variables sampling. considers detection risk and the sample size.

a. A recorded disbursement that does not show c. Random sampling. 34. What is an auditor’s evaluation of a

evidence of required approval may nevertheless d. Dollar-unit sampling. statistical sample for attributes when a test of

be a transaction that is properly authorized and 31. In determining the number of documents to fifty documents results in three deviations if

recorded. select for a test to obtain assurance that all tolerable rate is 7%, the expected population

b. Deviations would result in errors in the sales have been properly authorized, an auditor deviation rate is 5%, and the allowance for

accounting records only if the deviations and should consider the tolerable rate of deviation sampling risk is 2%?

the errors occurred on different transactions. from the control activity. The auditor should a. Modify the planned assessed level of control

c. Deviations from pertinent control procedures also consider the risk because the tolerable rate plus the

at a given rate ordinarily would be expected to I. Likely rate of deviations. allowance for sampling risk exceeds the

result in errors at a higher rate. II. Allowable risk of assessing control risk too expected population deviation rate.

d. A recorded disbursement that is properly high. b. Accept the sample results as support for the

authorized may nevertheless be a transaction a. I only. planned assessed level of control risk because

that contains a material error. b. II only. the sample deviation rate plus the allowance for

c. Both I and II. sampling risk exceeds the tolerable rate.

c. Accept the sample results as support for the 37. Which of the following statements is correct disbursements if the auditor is aware of several

planned assessed level of control risk because concerning statistical sampling in tests of unusually large cash disbursements?

the tolerable rate less the allowance for controls? a. Set the tolerable rate of deviation at a lower

sampling risk equals the expected population a. The population size has little or no effect on level than originally planned.

deviation rate. determining sample size except for very small b. Stratify the cash disbursements population so

d. Modify the planned assessed level of control populations. that the unusually large disbursements are

risk because the sample deviation rate plus the b. The expected population deviation rate has selected.

allowance for sampling risk exceeds the little or no effect on determining sample size c. Increase the sample size to reduce the effect

tolerable rate. except for very small populations. of the unusually large disbursements.

Items 35 and 36 are based on the following: c. As the population size doubles, the sample d. Continue to draw new samples until all the

An auditor desired to test credit approval on size also should double. unusually large disbursements appear in the

10,000 sales invoices processed during the year. d. For a given tolerable rate, a larger sample sample.

The auditor designed a statistical sample that size should be selected as the expected 41. Which of the following sample planning

would provide 1% risk of assessing control risk population deviation rate decreases. factors would influence the sample size for a

too low (99% confidence) that not more than B.3. Nonstatistical Sampling for Tests of substantive test of details for a specific

7% of the sales invoices lacked approval. The Controls account?

auditor estimated from previous experience 38. When an auditor has chosen a random Expected amount of misstatements Measure

that about 2 1/2% of the sales invoices lacked sample and is using nonstatistical attributes of tolerable misstatement a. No No b. Yes Yes

approval. A sample of 200 invoices was sampling, that auditor c. No Yes d. Yes No 42. When planning a sample

examined and 7 of them were lacking approval. a. Need not consider the risk of assessing for a substantive test of details, an auditor

The auditor then determined the achieved control risk too low. should consider tolerable misstatement for the

upper precision limit to be 8%. b. Has committed a nonsampling error. sample. This consideration should

35. In the evaluation of this sample, the auditor c. Will have to use discovery sampling to a. Be related to the auditor’s business risk.

decided to increase the level of the preliminary evaluate the results. b. Not be adjusted for qualitative factors.

assessment of control risk because the d. Should compare the deviation rate of the c. Be related to preliminary judgments about

a. Tolerable rate (7%) was less than the sample to the tolerable deviation rate. materiality levels.

achieved upper precision limit (8%). C.1. Tests of Details—Sampling Risk d. Not be changed during the audit process.

b. Expected deviation rate (7%) was more than 39. How would increases in tolerable 43. A number of factors influences the sample

the percentage of errors in the sample (3 1/2%). misstatement and assessed level of control risk size for a substantive test of details of an

c. Achieved upper precision limit (8%) was more affect the sample size in a substantive test of account balance. All other factors being equal,

than the percentage of errors in the sample (3 details? which of the following would lead to a larger

1/2%). Increase in tolerable misstatement Increase in sample size?

d. Expected deviation rate (2 1/2%) was less assessed level of control risk a. Increase sample a. Greater reliance on internal control.

than the tolerable rate (7%). size Increase sample size b. Increase sample size b. Greater reliance on analytical procedures.

36. The allowance for sampling risk was Decrease sample size c. Decrease sample size c. Smaller expected frequency of errors.

a. 5 1/2% Increase sample size d. Decrease sample size d. Smaller measure of tolerable misstatement.

b. 4 1/2% Decrease sample size 40. Which of the following 44. In estimation sampling for variables, which

c. 3 1/2% courses of action would an auditor most likely of the following must be known in order to

d. 1% follow in planning a sample of cash estimate the appropriate sample size required

to meet the auditor’s needs in a given b. Overstated units have a lower probability of a. $1,000

situation? sample selection than units that are b. $2,000

a. The qualitative aspects of errors. understated. c. $4,000

b. The total dollar amount of the population. c. The auditor controls the risk of incorrect d. $5,000

c. The acceptable level of risk. acceptance by specifying that risk level for the C.3. Classical Variables Sampling

d. The estimated rate of misstatements in the sampling plan. 49. An auditor is determining the sample size

population. d. The sampling interval is calculated by dividing for an inventory observation using mean-per-

45. An auditor established a $60,000 tolerable the number of physical units in the population unit estimation, which is a variables sampling

misstatement for an asset with an account by the sample size. plan. To calculate the required sample size, the

balance of $1,000,000. The auditor selected a 47. Hill has decided to use probability- auditor usually determines the

sample of every twentieth item from the proportional-to-size (PPS) sampling, sometimes Variability in the dollar amounts of inventory

population that represented the asset account called dollar-unit sampling, in the audit of a items Risk of incorrect acceptance a. Yes Yes b.

balance and discovered overstatements of client’s accounts receivable balances. Hill plans Yes No c. No Yes d. No No 50. In statistical

$3,700 and understatements of $200. Under to use the following PPS sampling table: sampling methods used in substantive testing,

these circumstances, the auditor most likely an auditor most likely would stratify a

would conclude that population into meaningful groups if

a. There is an unacceptably high risk that the a. Probability-proportional-to-size (PPS)

actual misstatements in the population exceed sampling is used.

the tolerable misstatement because the total b. The population has highly variable recorded

projected misstatement is more than the amounts.

tolerable misstatement. c. The auditor’s estimated tolerable

b. There is an unacceptably high risk that the misstatement is extremely small.

Additional information Tolerable

tolerable misstatement exceeds the sum of d. The standard deviation of recorded amounts

misstatements (net of effect of expected

actual overstatements and understatements. is relatively small.

misstatements) $ 24,000 Risk of incorrect

c. The asset account is fairly stated because the 51. The use of the ratio estimation sampling

acceptance 20% Number of misstatements 1

total projected misstatement is less than the technique is most effective when

Recorded amount of accounts receivable

tolerable misstatement. a. The calculated audit amounts are

$240,000 Number of accounts 360 what sample

d. The asset account is fairly stated because the approximately proportional to the client’s book

size should Hill use?

tolerable misstatement exceeds the net of amounts.

a. 120

projected actual overstatements and b. A relatively small number of differences exist

b. 108

understatements. in the population.

c. 60

C.2. Probability-Proportional-to-Size (PPS) c. Estimating populations whose records consist

d. 30

Sampling of quantities, but not book values.

48. In a probability-proportional-to-size sample

46. Which of the following statements is correct d. Large overstatement differences and large

with a sampling interval of $5,000, an auditor

concerning probability-proportional-to-size understatement differences exist in the

discovered that a selected account receivable

(PPS) sampling, also known as dollar unit population.

with a recorded amount of $10,000 had an

sampling? 52. In the application of statistical techniques to

audit amount of $8,000. If this were the only

a. The sampling distribution should the estimation of dollar amounts, a preliminary

error discovered by the auditor, the projected

approximate the normal distribution. sample is usually taken primarily for the

error of this sample would be purpose of estimating the population

a. Variability. c. Stop or go. b. The auditor rarely needs the assistance of a

b. Mode. d. Ratio estimation. computer program to design an efficient

c. Range. 56. The major reason that the difference and sample.

d. Median. ratio estimation methods would be expected to c. Inclusion of zero and negative balances

53. Using statistical sampling to assist in produce audit efficiency is that the generally does not require special design

verifying the year-end accounts payable a. Number of members of the populations of considerations.

balance, an auditor has accumulated the differences or ratios is smaller than the number d. Any amount that is individually significant is

following data: of members of the population of book values. automatically identified and selected.

b. Beta risk may be completely ignored.

c. Calculations required in using difference or H.3.c. Audits conducted in accordance with the

ratio estimation are less arduous and fewer Single Audit Act

than those required when using direct 163. In auditing compliance with requirements

Using the ratio estimation technique, the estimation. governing major federal financial assistance

auditor’s estimate of year-end accounts payable d. Variability of the populations of differences programs under the Single Audit Act, the

balance would be or ratios is less than that of the populations of auditor’s consideration of materiality differs

a. $6,150,000 book values or audited values. from materiality under generally accepted

b. $6,000,000 57. Which of the following statements is correct auditing standards. Under the Single Audit Act,

c. $5,125,000 concerning the auditor’s use of statistical materiality is

d. $5,050,000 sampling? a. Calculated in relation to the financial

54. Use of the ratio estimation sampling a. An auditor needs to estimate the dollar statements taken as a whole.

technique to estimated dollar amounts is amount of the standard deviation of the b. Determined separately for each major federal

inappropriate when population to use classical variables sampling. financial assistance program.

a. The total book value is known and b. An assumption of PPS sampling is that the c. Decided in conjunction with the auditor’s risk

corresponds to the sum of all the individual underlying accounting population is normally assessment.

book values. distributed. d. Ignored, because all account balances,

b. A book value for each sample item is c. A classical variables sample needs to be regardless of size, are fully tested.

unknown. designed with special considerations to include 164. Kent is auditing an entity’s compliance

c. There are some observed differences negative balances in the sample. with requirements governing a major federal

between audited values and book values. d. The selection of zero balances usually does financial assistance program in accordance with

d. The audited values are nearly proportional to not require special sample design the Single Audit Act. Kent detected

the book values. considerations when using PPS sampling. noncompliance with requirements that have a

55. An auditor is performing substantive tests of C.4. Comparison of PPS Sampling to Classical material effect on that program. Kent’s report

pricing and extensions of perpetual inventory Variables Sampling on compliance should express a(n)

balances consisting of a large number of items. 58. Which of the following most likely would be a. Unmodified opinion with a separate

Past experience indicates numerous pricing and an advantage in using classical variables emphasis-of-matter paragraph.

extension errors. Which of the following sampling rather than probability-proportional- b. Qualified opinion or an adverse opinion.

statistical sampling approaches is most to-size (PPS) sampling? c. Adverse opinion or a disclaimer of opinion.

appropriate? a. An estimate of the standard deviation of the d. Limited assurance on the items tested.

a. Unstratified mean-per-unit. population’s recorded amounts is not required. 165. When performing an audit of a city that is

b. Probability-proportional-to-size. subject to the requirements of the Uniform

Single Audit Act of 1984, an auditor should (nonpublic company) is to provide what type of b. When an auditor is aware that a client has

adhere to assurance? distributed a restricted-use report to

a. Governmental Accounting Standards Board a. Absolute assurance. inappropriate third parties, the auditor should

General Standards. b. Limited assurance. immediately inform the client to cease and

b. Governmental Finance Officers Association c. No assurance. desist.

Governmental Accounting, d. Reasonable assurance. c. An auditor controls distribution through

Auditing, and Financial Reporting Principles. 2. The existence of audit risk is recognized by insisting that the client not duplicate the

c. General Accounting Office Government the statement in the auditor’s standard report restricted-use report for any purposes.

Auditing Standards. that the auditor d. An auditor is not responsible for controlling

d. Securities and Exchange Commission a. Obtains reasonable assurance about whether the distribution of such reports.

Regulation S-X. the financial statements are free of material 5. March, CPA, is engaged by Monday Corp., a

166. A CPA has performed an examination of misstatement. client, to audit the financial statements of Wall

the general-purpose financial statements of Big b. Assesses the accounting principles used and Corp., a company that is not March’s client.

City. The examination scope included the also evaluates the overall financial statement Monday expects to present Wall’s audited

additional requirements of the Single Audit Act. presentation. financial statements with March’s auditor’s

When reporting on Big City’s internal c. Realizes some matters, either individually or report to 1st Federal Bank to obtain financing in

accounting and administrative controls used in in the aggregate, are important while other- Monday’s attempt to purchase Wall. In these

administering a federal financial assistance matters are not important. circumstances, March’s auditor’s report would

program, the CPA should d. Is responsible for expressing an opinion on usually be addressed to

a. Communicate those weaknesses that are the financial statements, which are the a. Monday Corp., the client that engaged

material in relation to the general-purpose responsibility of management. March.

financial statements. 3. When an accountant performs more than b. Wall Corp., the entity audited by March.

b. Express an opinion on the systems used to one level of service (for example, a compilation c. 1st Federal Bank.

administer major federal financial assistance and a review, or a compilation and an audit) d. Both Monday Corp. and 1st Federal Bank.

programs and express negative assurance on concerning the financial statements of a A.2. Nonpublic Companies (Nonissuers)

the systems used to administer nonmajor nonissuer (nonpublic) entity, the accountant 6. Which of the following statements is a basic

federal financial assistance programs. generally should issue the report that is element of the auditor’s standard report?

c. Communicate those weaknesses that are appropriate for a. The disclosures provide reasonable assurance

material in relation to the federal financial a. The lowest level of service rendered. that the financial statements are free of

assistance program. b. The highest level of service rendered. material misstatement.

d. Express negative assurance on the systems c. A compilation engagement. b. The auditor evaluated the overall internal

used to administer major federal financial d. A review engagement. control.

assistance programs and express no opinion on 4. Which of the following statements is correct c. An audit includes assessing significant

the systems used to administer nonmajor concerning an auditor’s responsibility for estimates made by management.

federal financial assistance programs. controlling the distribution by the client of a d. The financial statements are consistent with

restricted-use report? those of the prior period.

A.1. Audit Reports: Standard Unmodified a. An auditor must make clear to the client that 7. In May 20X9, an auditor reissues the auditor’s

Reports—Background it is illegal to distribute such a report beyond to report on the 20X7 financial statements at a

1. The objective of an accountant’s compilation specified parties. continuing client’s request. The 20X7 financial

of the financial statements of a nonissuer statements are not restated and the auditor

does not revise the wording of the report. The auditor’s report on comparative financial the event, Wilson’s report ordinarily should be

auditor should statements? dated

a. Dual date the reissued report. Examination of evidence on a test basis a. March 6, 20X9.

b. Use the release date of the reissued report. Consistent application of accounting principles b. April 10, 20X9.

c. Use the original report date on the reissued a. Explicitly Explicitly b. Implicitly Implicitly c. c. April 24, 20X9.

report. Implicitly Explicitly d. Explicitly Implicitly 12. An d. Using dual dating.

d. Use the current period auditor’s report date auditor concludes that extreme doubt exists 15. An auditor issued an audit report that was

on the reissued report. about the integrity of management and the dual dated for a subsequent event occurring

8. For a nonpublic company, which section representations obtained from management after the completion of fieldwork but before

(paragraph) of the audit report includes a relating to the fairness of the financial issuance of the auditor’s report. The auditor’s

statement that the auditor believes that the statements and the completeness of the record responsibility for events occurring subsequent

audit evidence obtained is sufficient? of transactions. If the auditor retains the client, to the completion of fieldwork was

a. Introductory. which audit report is most likely to be a. Extended to subsequent events occurring

b. Opinion. appropriate? through the date of issuance of the report.

c. Auditor’s responsibility. a. Unmodified with emphasis-of-matter b. Extended to include all events occurring since

d. Management’s responsibility. paragraph. the completion of fieldwork.

9. For a nonpublic company audit report, a b. Standard unmodified. c. Limited to the specific event referenced.

statement that the auditor has audited the c. Disclaimer. d. Limited to include only events occurring up to

financial statements followed by the titles of d. Adverse the date of the last subsequent event

the financial statements is included in the 13. Which of the following best describes the referenced.

a. Management’s responsibility section of the reference to the expression “taken as a whole” A.3. Public Companies (Issuers)

audit report. in the fourth generally accepted auditing 16. A financial statement audit report issued for

b. The opening paragraph of the auditor’s standard of reporting? the audit of an issuer (public) company

standard report. a. It applies equally to a complete set of concludes that the financial statements follow

c. The auditor’s responsibility section of the financial statements and to each individual a. Generally accepted accounting principles.

audit report. financial statement. b. Public Company Accounting Oversight Board

d. The opinion paragraph of the auditor’s b. It applies only to a complete set of financial standards.

standard report. statements. c. Generally accepted auditing standards.

10. Which of the following phrases should be c. It applies equally to each item in each d. International accounting standards.

included in the opinion paragraph when an financial statement. 17. Which of the following is not correct

auditor expresses a qualified opinion? d. It applies equally to each material item in concerning information included in an audit

When read in conjunction with Note X With each financial statement. report of financial statements issued under the

the foregoing explanation 14. Wilson, CPA, completed gathering sufficient requirements of the Public Company

a. Yes No appropriate audit evidence for the audit of Accounting Oversight Board?

b. No Yes Abco’s December 31, 20X8 financial statements a. The report should include the title “Report of

c. Yes Yes on March 6, 20X9. A subsequent event Independent Registered Public Accounting

d. No No requiring adjustment to the 20X8 financial Firm.”

11. How does an auditor make the following statements occurred on April 10, 20X9 and b. The report should refer to the standards of

representations when issuing the standard came to Wilson’s attention on April 24, 20X9. If the PCAOB.

the adjustment is made without disclosure of

c. The report should include a paragraph d. A different emphasis-of-matter paragraph a. The auditor is asked to report on the balance

referring to the auditor’s report on compliance describing Tech’s plans for financial recovery sheet, but not on the other basic financial