Professional Documents

Culture Documents

Business Math

Business Math

Uploaded by

Niña Magsael (KrazyMhee)Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Math

Business Math

Uploaded by

Niña Magsael (KrazyMhee)Copyright:

Available Formats

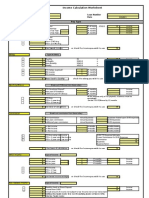

Period Equivalent Period

12 months

52 weeks

1 year 24 *Half-Months*

(for semi-monthly payment)

26 *Two-weeks* periods

(for bi-weekly payment)

Description Notation Computation

S annual

Monthly Salary S monthly 12

S annual S monthly

or

Semi-Monthly Salary S semi-monthly 24 2

Weekly Salary S weekly S annual

52

Bi-Weekly Salary S bi-weekly S annual

or 2 x S

26

weekly

Gross and Net earnings

Gross income

- Is the computed pay before the ddeduction of income tax and other deductibles (e.g.,

contributions for insurance or social insurance)

- refers to income that is computed prior to any deductions such as social security

contributions, health insurance contributions, and withholding taxes

Net Income

- Commonly known as “take-home pay”

- The amount received by the employee after all taxes have been withheld and all

contributions have been deducted from the gross earnings

Gross Earnings for Salaried Workers

The gross earnings for salaried worker are often quoted on an annual basis. This annual figure is the

amount the employee earns per year. Salaries may be quoted on a different basis depending on the time

period. Usually, companies paid their salaried workers on a weekly basis, on a bi-weekly basis, on a

monthly basis, on a semi-monthly basis, or on a bi-monthly basis. Here we note that bi-weekly and bi-

monthly mean every two weeks and every two months, respectively. Likewise, semi-monthly means

every half-month. The common conversion between weekly, monthly, and annual figure is carried out

using the following table

Table 1. Conversion factors for time periods on salary

Period Equivalent Period

12 months

52 weeks

1 year 24 *Half-Months*

(for semi-monthly payment)

26 *Two-weeks* periods

(for bi-weekly payment)

Therefore, given an annual salary figure (which we denote by S annual), we can obtain the

equivalent monthly, weekly, semi-monthly, bi-weekly salary by considering the following conversion

table.

Table 2. Summary of Conversion Of Time Basis for Salaries

Description Notation Computation

S annual

Monthly Salary S monthly 12

S annual S monthly

or

Semi-Monthly Salary S semi-monthly 24 2

Weekly Salary S weekly S annual

52

Bi-Weekly Salary S bi-weekly S annual

or 2 x S

26

weekly

Example

A nationwide survey has determined that the average monthly salary of a high school teacher is

₱ 25, 600.00. On average, how much does a high school teacher earn in one year? In one week? Every

two weeks?

Solution

The given amount is salary quoted on a monthly basis. In order to convert the salary to an

annual or a yearly figure, we multiply it by 12, since there are twelve months in a year:

Annual salary = ₱ 25, 600.00 x 12 = ₱ 307, 200. 00

Based on our conversion table above, the weekly salary is obtained by dividing the annual figure

by 52,

Weekly salary = ₱ 307, 200. 00 / 52 = ₱ 5, 907. 69

Finally, the salary obtained every two weeks is calculated by multiplying the weekly salary by 2,

Bi-weekly salary = ₱ 5, 907. 69 x 2 = ₱ 11, 815. 38

The same result is also obtained by dividing the annual salary by 26.

Gross Earnings for Wage-Earners

Wage earners are compensated based on an hourly rate.

A wage earner’s daily gross pay is decomposed into two components—the regular pay and the

overtime pay.

Regular pay is the number of hours worked by the employee (less than or equal to eight hours)

multiplied by the applicable hourly rate. This amount is also referred to as the basic daily wage.

If W represents the total daily wage of an employee, h is the number of hours put in by the

employee that day, and r is the employee’s applicable hourly rate, then his daily regular wage is

computed as

W=hxr

Where 0 ≤ h ≤ 8. If h exceeds eight hours, then a special rate is applied to the number of hours

in excess of eight hours. This rate is called the overtime rate.

You might also like

- Bedspace ContractDocument3 pagesBedspace ContractWAlly Perez74% (23)

- Income Calculation WorksheetDocument1 pageIncome Calculation Worksheetrush2serveNo ratings yet

- Olens Rule 11 Service LetterDocument10 pagesOlens Rule 11 Service LetterInformationIsPower50% (2)

- Motion To Post BondDocument20 pagesMotion To Post BondJ Doe100% (1)

- Salary CalculationDocument3 pagesSalary CalculationNatNo ratings yet

- Annualized Risk and ReturnDocument1 pageAnnualized Risk and ReturnManjot KaurNo ratings yet

- Lecture 12 On 22 Mar On PV of AnnuitiesDocument26 pagesLecture 12 On 22 Mar On PV of AnnuitiesEthan ChristiansNo ratings yet

- exhibit_101Document9 pagesexhibit_101richal.sharma11No ratings yet

- Math ReviewerFinalsDocument17 pagesMath ReviewerFinalssamgyupNo ratings yet

- Budget Planner PDFDocument1 pageBudget Planner PDFAden BanksNo ratings yet

- Income Calculation Worksheet 3xDocument9 pagesIncome Calculation Worksheet 3xrnj1230No ratings yet

- Compound Interest CalculatorDocument12 pagesCompound Interest Calculatornathansri93No ratings yet

- EOF Lecture Notes - Bond Math - Sep 22Document27 pagesEOF Lecture Notes - Bond Math - Sep 22碧莹成No ratings yet

- Pound InterestDocument15 pagesPound InterestISTORYANo ratings yet

- FY09 Salary Computation Guidelines 3-24-08Document1 pageFY09 Salary Computation Guidelines 3-24-08shobhasharma82No ratings yet

- Resume Task IiiDocument3 pagesResume Task IiiAdinapraja DienNo ratings yet

- ORDINARY ANNUITY - Future and Present ValueDocument33 pagesORDINARY ANNUITY - Future and Present ValueSALIM SHARIFUNo ratings yet

- Lesson 2 Wk10 4th Fundamental Operations of Mathematics As Applied in Salaries and Wages StudentDocument11 pagesLesson 2 Wk10 4th Fundamental Operations of Mathematics As Applied in Salaries and Wages StudentFrancine Arielle Bernales100% (1)

- Gen Math Q2 - Week 4 - General AnnuityDocument22 pagesGen Math Q2 - Week 4 - General AnnuityFrancisco, Ashley Dominique V.No ratings yet

- Own A HomeDocument2 pagesOwn A HomehelpmewinNo ratings yet

- Compounding More Than Once A YearDocument14 pagesCompounding More Than Once A YearAllaine BenitezNo ratings yet

- Compound Interest More Than ONCEDocument24 pagesCompound Interest More Than ONCEJennifer MagangoNo ratings yet

- Chapter 6 AnnuityDocument62 pagesChapter 6 Annuity2022885126No ratings yet

- Chapter 2 (Part B - Compound Interest)Document9 pagesChapter 2 (Part B - Compound Interest)Agnes AyangNo ratings yet

- BFW1001 Foundations of Finance: Analytical ToolsDocument13 pagesBFW1001 Foundations of Finance: Analytical ToolsQuoc Viet DuongNo ratings yet

- Lesson 15 Salary and IncomeDocument22 pagesLesson 15 Salary and IncomeKlinth GalsimNo ratings yet

- BA 2802 - Principles of Finance Solutions To Problems For Recitation #2Document10 pagesBA 2802 - Principles of Finance Solutions To Problems For Recitation #2Eda Nur EvginNo ratings yet

- Present Value Compounded More Than Once A YearDocument14 pagesPresent Value Compounded More Than Once A YearAllaine BenitezNo ratings yet

- Performance Task: in General MathematicsDocument19 pagesPerformance Task: in General MathematicsMaximilian KolbeNo ratings yet

- Annuities and Sinking FundsDocument99 pagesAnnuities and Sinking Funds张荟萍No ratings yet

- Different Financial Ratios:: Income Statement and Cash Flows Statement Provides Information AboutDocument6 pagesDifferent Financial Ratios:: Income Statement and Cash Flows Statement Provides Information AboutChunchu AnilNo ratings yet

- Cvitanic CH 2 Fin1Document21 pagesCvitanic CH 2 Fin1Camila Florencio JaraNo ratings yet

- ACT 404 (3rd Presentation)Document33 pagesACT 404 (3rd Presentation)SEIDU ISSAHAKUNo ratings yet

- Annuity NotesDocument8 pagesAnnuity NotesXohaib LeghariNo ratings yet

- 07 Compound-Interest-CalculatorDocument10 pages07 Compound-Interest-CalculatorrealtorsinfaridabadNo ratings yet

- Lecture 7Document7 pagesLecture 7bbasmiuNo ratings yet

- 10A Chapter 2 Interest and Depreciation PDFDocument32 pages10A Chapter 2 Interest and Depreciation PDFAbhishekMaranNo ratings yet

- Cash Flow PDFDocument1 pageCash Flow PDFjoytoriolsantiagoNo ratings yet

- Annual Budget SetupDocument1 pageAnnual Budget SetupMar VrNo ratings yet

- Reducing Balance LoansDocument71 pagesReducing Balance LoansofishifaNo ratings yet

- C5 TVMDocument45 pagesC5 TVMVi LeNo ratings yet

- GENMATH - Simple and General AnnuitiesDocument2 pagesGENMATH - Simple and General AnnuitiesBern Balingit-Arnaiz100% (5)

- Chapter 3 AnnuityDocument20 pagesChapter 3 AnnuityPrincess Mae AgbonesNo ratings yet

- PPT5-Mathematics of FinanceDocument22 pagesPPT5-Mathematics of FinanceRano Acun100% (2)

- FINANCE LAST PUSH-1Document35 pagesFINANCE LAST PUSH-1lulamangwenya67No ratings yet

- COMPOUND INTEREST & PRESENT VALUE by FINANCIAL OTABILDocument9 pagesCOMPOUND INTEREST & PRESENT VALUE by FINANCIAL OTABILPrincillaNo ratings yet

- Compounding More Than Once A YearDocument7 pagesCompounding More Than Once A Yearprincessnylighte13No ratings yet

- Time Value of Money FMDocument28 pagesTime Value of Money FMMonkey DLuffyyyNo ratings yet

- Compounding InterestDocument11 pagesCompounding Interestagus joharudinNo ratings yet

- Simple AnnuityDocument22 pagesSimple AnnuityAshley AniganNo ratings yet

- NC 9 CHPT 8 Earning Money - UnlockedDocument30 pagesNC 9 CHPT 8 Earning Money - UnlockedAlyssa L100% (1)

- Interest and DepreciationDocument34 pagesInterest and DepreciationBismuthNo ratings yet

- Module 7. Annuities: 1. Simple AnnuityDocument19 pagesModule 7. Annuities: 1. Simple AnnuityMori OugaiNo ratings yet

- Annuity - Introduction Ordinary AnnuityDocument24 pagesAnnuity - Introduction Ordinary AnnuityThomasaquinos msigala JrNo ratings yet

- ANNUITYDocument21 pagesANNUITYsuzhanearriba50No ratings yet

- Recurring Deposit Monthly Income OptionDocument1 pageRecurring Deposit Monthly Income OptionkorivisarojiniNo ratings yet

- FPSB India - Retirement Module Sample Paper - Simplified Solution Using Calculator - March 2013Document9 pagesFPSB India - Retirement Module Sample Paper - Simplified Solution Using Calculator - March 2013Krupa VoraNo ratings yet

- Effective and Nominal Interest Rates: (A) What Annual Interest Rate Did You Earn If Interest Is Compounded Yearly?Document6 pagesEffective and Nominal Interest Rates: (A) What Annual Interest Rate Did You Earn If Interest Is Compounded Yearly?Owene Miles AguinaldoNo ratings yet

- TOSEND BusMath Q2 Mod10 W3 Gross-And-Net-EarningsDocument18 pagesTOSEND BusMath Q2 Mod10 W3 Gross-And-Net-EarningsAidalyn RagonjanNo ratings yet

- OrdinaryAnnuity Part 1Document20 pagesOrdinaryAnnuity Part 1Kim TNo ratings yet

- Introduction To Salaries Wages Income and BenefitsDocument14 pagesIntroduction To Salaries Wages Income and BenefitsYAHIKOヤヒコYUICHIゆいちNo ratings yet

- Lesson 6Document10 pagesLesson 6Jean LeysonNo ratings yet

- Liberation Steamship Co., Inc. vs. CIRDocument6 pagesLiberation Steamship Co., Inc. vs. CIRLornaNatividadNo ratings yet

- How To Read Chargesheets - RLP (Roksin Law Papers)Document7 pagesHow To Read Chargesheets - RLP (Roksin Law Papers)Robinsh K SinghNo ratings yet

- Axj Anti-Bullies: Probable Complaint Against S.T.O.L.E.N. of Canada?Document2 pagesAxj Anti-Bullies: Probable Complaint Against S.T.O.L.E.N. of Canada?Ed VallejoNo ratings yet

- Helma PDocument3 pagesHelma PslumbaNo ratings yet

- Workers and Restaurants Are Priorities (WRAP) Act INTRODocument5 pagesWorkers and Restaurants Are Priorities (WRAP) Act INTROCM Kenyan McDuffieNo ratings yet

- International Commercial ArbitrationDocument37 pagesInternational Commercial ArbitrationSanwar BajadNo ratings yet

- Saudi Arabian Airlines vs. RebesencioDocument54 pagesSaudi Arabian Airlines vs. RebesencioisaaabelrfNo ratings yet

- Request Letter For DSC Approval - 2024Document1 pageRequest Letter For DSC Approval - 2024khuledhanaji1No ratings yet

- Partha Moulik-Offer LetterDocument3 pagesPartha Moulik-Offer LetterparthaNo ratings yet

- JurisprudenceDocument120 pagesJurisprudenceArunaMLNo ratings yet

- Rockette v. Kingston - Document No. 3Document3 pagesRockette v. Kingston - Document No. 3Justia.comNo ratings yet

- Jess 406Document18 pagesJess 406K GOVINDIENNo ratings yet

- Affidavit of Probable Cause: ArresteeDocument3 pagesAffidavit of Probable Cause: ArresteeMcKenzie StaufferNo ratings yet

- Order in Respect of Kesar Petro Products LimitedDocument8 pagesOrder in Respect of Kesar Petro Products LimitedShyam SunderNo ratings yet

- Serg Products Vs PCI LeasingDocument3 pagesSerg Products Vs PCI LeasingErika Angela Galceran100% (2)

- 26 Henson vs. Intermediate Appellate CourtDocument2 pages26 Henson vs. Intermediate Appellate CourtJemNo ratings yet

- 201333660Document56 pages201333660The Myanmar TimesNo ratings yet

- Contract For Website DesignDocument4 pagesContract For Website DesignarshinnefNo ratings yet

- Ward Committee 2011Document4 pagesWard Committee 2011Sunder RajagopalanNo ratings yet

- Bryte v. American Household, 4th Cir. (2005)Document16 pagesBryte v. American Household, 4th Cir. (2005)Scribd Government DocsNo ratings yet

- Foreclosure Case Wins Misc 48 PagesDocument46 pagesForeclosure Case Wins Misc 48 Pagestraderash1020100% (4)

- People vs. de Jesus, 63 Phil. 760Document3 pagesPeople vs. de Jesus, 63 Phil. 760JERepaldoNo ratings yet

- Bcas Char & Ant Ver Form 2023 004Document3 pagesBcas Char & Ant Ver Form 2023 004Taqvi haidarNo ratings yet

- Dc2019-10-0013-Annex-K1 (Template Amendment For Change of Project Location)Document5 pagesDc2019-10-0013-Annex-K1 (Template Amendment For Change of Project Location)Anthony ChoiNo ratings yet

- Bildner Vs IlusorioDocument2 pagesBildner Vs IlusorioNichole Patricia PedriñaNo ratings yet

- League of NationDocument6 pagesLeague of NationDonaldduck Sam100% (2)

- Pacana Vs Pascual LopezDocument2 pagesPacana Vs Pascual LopezJani MisterioNo ratings yet