Professional Documents

Culture Documents

Interest Rate 1yr Bond: C 5%, R 10%

Interest Rate 1yr Bond: C 5%, R 10%

Uploaded by

nikhil KulkarniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interest Rate 1yr Bond: C 5%, R 10%

Interest Rate 1yr Bond: C 5%, R 10%

Uploaded by

nikhil KulkarniCopyright:

Available Formats

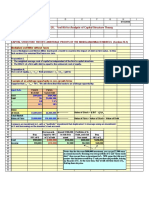

Interest

rate 0.05

1yr bond: c = 5%,

R= 10%

Survival Default Discount

Hazard rate Time probability probabilty rate Coupon+Face

0.02 0 1.00 1.00

0.02 6 0.98 0.02 0.98 5

0.02 12 0.96 0.02 0.95 105

0.02 18 0.94 0.02 0.93

0.02 24 0.92 0.02 0.91

0.02 30 0.90 0.02 0.88

0.02 36 0.89 0.02 0.86

0.02 42 0.87 0.02 0.84

0.02 48 0.85 0.02 0.82

0.02 54 0.83 0.02 0.80

0.02 60 0.82 0.02 0.78

2yr bond: c = 2%,

R= 25%

Discounte Discounte

d d

Expected Expected

Recovery value Coupon+Face Recovery value

d(0,t)*(q(t)*c + (1-q(t))*R) d(0,t)*(q(t)*c + (1-q(t))*R)

10 4.98 2 25 2.40

10 96.17 2 25 2.29

2 25 2.19

102 25 85.66

Price 101.15 Price 92.55

3yr bond: 4yr bond:

c = 5%, R= c = 5%,

50% R=10%

Discounte

d

Coupon+F Expected Coupon+F

ace Recovery value ace Recovery

t)*c + (1-q(t))*R) d(0,t)*(q(t)*c + (1-q(t))*R)

5 50 5.76 5 10

5 50 5.50 5 10

5 50 5.26 5 10

5 50 5.03 5 10

5 50 4.81 5 10

105 50 80.98 5 10

5 10

105 10

Price 107.35 Price

5yr bond:

c=10%,

R=20%

Discounte Discounte

d d

Expected Coupon+F Expected

value ace Recovery value

d(0,t)*(q(t)*c + (1-q(t))*R) d(0,t)*(q(t)*c + (1-q(t))*R)

4.98 10 20 9.95

4.76 10 20 9.51

4.55 10 20 9.10

4.35 10 20 8.70

4.16 10 20 8.32

3.98 10 20 7.95

3.80 10 20 7.60

73.46 10 20 7.27

10 20 6.95

110 20 70.47

104.02 Price 145.82

Interest r 0.05

1yr bond: c = 5%,

R= 10%

Hazard rate Time Survival probabiDefault probabiDiscount rate Coupon+Face

0.02 0 1.00 1.00

0.02 6 0.98 0.02 0.98 5

0.02 12 0.96 0.02 0.95 105

0.02 18 0.94 0.02 0.93

0.02 24 0.92 0.02 0.91

0.02 30 0.90 0.02 0.88

0.02 36 0.89 0.02 0.86

0.02 42 0.87 0.02 0.84

0.02 48 0.85 0.02 0.82

0.02 54 0.83 0.02 0.80

0.02 60 0.82 0.02 0.78

2yr bond: c = 8%,

R= 25%

Recovery Discounted Expected value Coupon+Face Recovery Discounted Expected value

d(0,t)*(q(t)*c + (1-q(t))*R) d(0,t)*(q(t)*c + (1-q(t))*R)

10 4.98 2 25 2.40

10 96.14 2 25 2.30

2 25 2.18

102 25 85.72

Model Price 101.12 Model Price 92.60

True Price 101.20 True Price 92.58

Error 0.01 Error 0.00

Sum Error 0.02

3yr bond: 4yr bond:

c = 5%, R= c = 5%,

50% R=10%

d Expected value Coupon+FaRecovery Discounted Expected value Coupon+Fa

t)*c + (1-q(t))*R) d(0,t)*(p(t)*c + (1-p(t))*R)

5 50 5.76 5

5 50 5.51 5

5 50 5.24 5

5 50 5.01 5

5 50 4.81 5

105 50 81.06 5

5

105

Model Price 107.39

True Price 107.35

Error 0.00

5yr bond:

c=10%,

R=20%

Recovery Discounted Expected value Coupon+FaRecovery Discounted Expected value

d(0,t)*(q(t)*c + (1-q(t))*R) d(0,t)*(q(t)*c + (1-q(t))*R)

10 4.98 10 20 9.95

10 4.76 10 20 9.51

10 4.54 10 20 9.09

10 4.35 10 20 8.69

10 4.16 10 20 8.32

10 3.98 10 20 7.96

10 3.80 10 20 7.61

10 73.51 10 20 7.27

10 20 6.95

110 20 70.59

Model Price 104.08 Model Price 145.95

True Price 104.09 True Price 145.86

Error 0.00 Error 0.01

d Expected value

t)*c + (1-q(t))*R)

Spread 218.89

Principal 1,000,000

Recovery 0.45

Interest 0.01

Expected

Survival value of PV of

Hazard probability Fixed premium premium Default Prob.

Month Discount rate (%) payment (ExD) (NxFxB) (%)

0 1.00 0.010 100.0

3 1.00 0.010 99.0 54.7 54.17 5,404 1.0

6 1.00 0.010 98.0 54.7 53.63 5,336 1.0

9 0.99 0.010 97.0 54.7 53.09 5,269 1.0

12 0.99 0.010 96.0 54.7 52.55 5,203 1.0

15 0.99 0.010 95.1 54.7 52.04 5,139 0.9

18 0.99 0.010 94.2 54.7 51.53 5,077 0.9

21 0.98 0.010 93.3 54.7 51.03 5,015 0.9

24 0.98 0.010 92.4 54.7 50.54 4,954 0.9

Premium Leg 41,603.28

Protection Leg 41,603.28

Value 0.00

PV of

PV of Expected expected

Accrued accrued Protection protection

interest interest payment payment

(E/2xG) (NxIxB) (1-R)H (NxKxB)

0.28 27.48 0.0055 5,524.85

0.27 27.14 0.0055 5,455.57

0.27 26.80 0.0054 5,387.16

0.27 26.46 0.0054 5,319.61

0.26 25.23 0.0051 5,071.00

0.25 24.92 0.0051 5,009.18

0.25 24.62 0.0050 4,948.11

0.25 24.32 0.0050 4,887.79

You might also like

- CF Tutorial 2Document15 pagesCF Tutorial 21 KohNo ratings yet

- SAC Micro Pullback Strategy v2Document3 pagesSAC Micro Pullback Strategy v2Syed Atif MushtaqNo ratings yet

- On August 1 Year 3 Carleton LTD Ordered Machinery From PDFDocument1 pageOn August 1 Year 3 Carleton LTD Ordered Machinery From PDFDoreenNo ratings yet

- How To Calculate Present Values: Discounted Cash Flow Analysis (Time Value of Money)Document16 pagesHow To Calculate Present Values: Discounted Cash Flow Analysis (Time Value of Money)cypriancourageNo ratings yet

- Bonds and Cds v2Document14 pagesBonds and Cds v2Viacheslav BaykovNo ratings yet

- 6 of 7 - Assignment - PracticeDocument3 pages6 of 7 - Assignment - Practicetian jinNo ratings yet

- Ejercicio RetadorDocument10 pagesEjercicio RetadoringenieromantencionNo ratings yet

- Exam2012 2013 AnsDocument6 pagesExam2012 2013 Ansxinruifan523No ratings yet

- FM09-CH 09Document12 pagesFM09-CH 09Mukul KadyanNo ratings yet

- FM Practice Sheet Booklet SOLUTIONS - Nov 2022Document135 pagesFM Practice Sheet Booklet SOLUTIONS - Nov 2022Dhruvi VachhaniNo ratings yet

- Data Kesetimbangan Etanol-Air (Fraksi Massa) T (°C) X YDocument40 pagesData Kesetimbangan Etanol-Air (Fraksi Massa) T (°C) X YM Ragil ZandisyahNo ratings yet

- Chapter 4 Tutorial QuestionDocument5 pagesChapter 4 Tutorial QuestionAtyylliaaNo ratings yet

- Pricing Corporate Bonds: For Possible Losses From Default (Liquidity Is Also A Factor)Document33 pagesPricing Corporate Bonds: For Possible Losses From Default (Liquidity Is Also A Factor)Harry EdwinNo ratings yet

- Chapter 1Document16 pagesChapter 1Jorge Luis IzaguirreNo ratings yet

- 05Document22 pages05DeenaNo ratings yet

- Draft For T-1Document33 pagesDraft For T-1Gabby GalvezNo ratings yet

- CIV 4013-Assignment 2010Document8 pagesCIV 4013-Assignment 2010Virtual RealityNo ratings yet

- Ch19 21Document3 pagesCh19 21Shivansh ChawlaNo ratings yet

- Shelf-Life FDA OvaisDocument8 pagesShelf-Life FDA OvaisOvais08100% (2)

- Abhilash N - FIMDocument6 pagesAbhilash N - FIMAbhilash NNo ratings yet

- Bond AasingmentDocument12 pagesBond Aasingmentakansha topaniNo ratings yet

- 12-11-2022 - Jee SR ELITE (CIPL, IPL IC & ISB) - Jee - 221112 - 181622Document12 pages12-11-2022 - Jee SR ELITE (CIPL, IPL IC & ISB) - Jee - 221112 - 181622kaveendra ChilukamarriNo ratings yet

- R D N (N: Spearman RankDocument4 pagesR D N (N: Spearman RankTALINGDAN, AGNER CHRISTIAN FULGENCIONo ratings yet

- Answer Key 1: Tri Vi Dang Columbia University Corporate Finance Fall 2012Document4 pagesAnswer Key 1: Tri Vi Dang Columbia University Corporate Finance Fall 2012sykim657No ratings yet

- Chapter 4 Solution CH 4 Corporate Finance Brealey Myers AllenDocument9 pagesChapter 4 Solution CH 4 Corporate Finance Brealey Myers AllenPooja GoelNo ratings yet

- BiostatDocument7 pagesBiostatyoan yulista hartivaNo ratings yet

- W22 NEMA Premium Efficiency 30 HP 6P 324-6T 3Ph 575 V 60 HZ IC411Document9 pagesW22 NEMA Premium Efficiency 30 HP 6P 324-6T 3Ph 575 V 60 HZ IC411lucasbzpNo ratings yet

- BA 2802 - Principles of Finance Solutions To Problems For Recitation #5Document7 pagesBA 2802 - Principles of Finance Solutions To Problems For Recitation #5Eda Nur EvginNo ratings yet

- A. Suatu Obligasi 5 Tahun Memberikan Coupon USD 80 Per Tahun Harga Pasar USD 900, Face Value: USD 1000, Hitung Yield To MaturityDocument6 pagesA. Suatu Obligasi 5 Tahun Memberikan Coupon USD 80 Per Tahun Harga Pasar USD 900, Face Value: USD 1000, Hitung Yield To MaturityHermanNo ratings yet

- Assignment - 1: Department of CSEDocument13 pagesAssignment - 1: Department of CSEBabui JantusNo ratings yet

- Store Miller's Cost Albert's CostDocument8 pagesStore Miller's Cost Albert's CostkaranNo ratings yet

- NO Pekerjaan Optimistic Duration A Most Lifefly Duration M Pessimistic Duration BDocument4 pagesNO Pekerjaan Optimistic Duration A Most Lifefly Duration M Pessimistic Duration BAnonymous aAWNZHsDZNo ratings yet

- CBM Trending 210316Document6 pagesCBM Trending 210316Lukmi AgustiansyahNo ratings yet

- 36-401 Modern Regression HW #5 Solutions: Air - FlowDocument7 pages36-401 Modern Regression HW #5 Solutions: Air - FlowSNo ratings yet

- Final Spring07 Solutions SampleDocument15 pagesFinal Spring07 Solutions SampleAnass BNo ratings yet

- Resoluciones LabsDocument12 pagesResoluciones LabsTavito PerezNo ratings yet

- Transient Analysis of Synchronous Generator: Step 1Document18 pagesTransient Analysis of Synchronous Generator: Step 1rmthilinaNo ratings yet

- Quality GaDocument5 pagesQuality GatsakysngobezaNo ratings yet

- Valuing Common Stocks: Chapter 7 Tool Kit For Stock ValuationDocument20 pagesValuing Common Stocks: Chapter 7 Tool Kit For Stock ValuationElias DEBSNo ratings yet

- Andre Setiawan - 2203001 - Tugas TSP MRPDocument6 pagesAndre Setiawan - 2203001 - Tugas TSP MRPsyaifaeza.jbgNo ratings yet

- Evaluasi Sumur GG-02: South SumatraDocument25 pagesEvaluasi Sumur GG-02: South SumatraYosua Pandapotan SihotangNo ratings yet

- Gravel Pack Design For Water WellDocument1 pageGravel Pack Design For Water WellRohullah MayarNo ratings yet

- Solution To Convexity QuestionDocument2 pagesSolution To Convexity QuestionnatashaNo ratings yet

- Equivalent Concrete Strength - Advance-B1-COLUMNDocument7 pagesEquivalent Concrete Strength - Advance-B1-COLUMNWahid wrbelNo ratings yet

- FV 1000 1 2 3 C 10% Fvofcf E.Y. 10% PV OF CF 90.909090909 82.6446281 826.446281 T 3 Price FV C E.Y. T Price FV C E.Y. T PriceDocument10 pagesFV 1000 1 2 3 C 10% Fvofcf E.Y. 10% PV OF CF 90.909090909 82.6446281 826.446281 T 3 Price FV C E.Y. T Price FV C E.Y. T PriceMayank GuptaNo ratings yet

- Chapter 26. Tool Kit For Analysis of Capital Structure TheoryDocument11 pagesChapter 26. Tool Kit For Analysis of Capital Structure TheoryJITIN ARORANo ratings yet

- AGB 321 Agribusiness Managerial Economics - Assignment Oct 2023Document6 pagesAGB 321 Agribusiness Managerial Economics - Assignment Oct 2023covertessaysNo ratings yet

- Percentage Class NotesDocument6 pagesPercentage Class NotesSid MalhotraNo ratings yet

- Clip 85Document1 pageClip 85Victor WuNo ratings yet

- X1, Mass Fraction: Waktu, Menit M1, %co X, Mass Fractionl, M Waktu, Menit M2, %co X, Mass Fractionl, MDocument6 pagesX1, Mass Fraction: Waktu, Menit M1, %co X, Mass Fractionl, M Waktu, Menit M2, %co X, Mass Fractionl, MSteven KennedyNo ratings yet

- Chapter 9. Tool Kit For The Cost of CapitalDocument14 pagesChapter 9. Tool Kit For The Cost of CapitalasimqaiserNo ratings yet

- IPF Assignment 4Document12 pagesIPF Assignment 4Nitesh MehlaNo ratings yet

- Problem Set Ii Finanzas CorporativasDocument19 pagesProblem Set Ii Finanzas CorporativasDamian MamaniNo ratings yet

- Zero-Coupon Bond Bonos de Descuento Puro: Ley Del Precio ÚnicoDocument11 pagesZero-Coupon Bond Bonos de Descuento Puro: Ley Del Precio ÚnicoSebastian MejiaNo ratings yet

- Zgjidhje Ushtrime InvaDocument6 pagesZgjidhje Ushtrime InvainvaNo ratings yet

- AFMCoeden Question Excel FileDocument11 pagesAFMCoeden Question Excel FileJophal ShajuNo ratings yet

- Print Destilasi FixxxDocument5 pagesPrint Destilasi FixxxTeguh SubektiNo ratings yet

- Jun 2003 - AnsDocument15 pagesJun 2003 - AnsHubbak KhanNo ratings yet

- Book 1Document6 pagesBook 1jayantiNo ratings yet

- Sales Vs TV Apearances: Regression StatisticsDocument26 pagesSales Vs TV Apearances: Regression StatisticsElisabete PadilhaNo ratings yet

- Final Exam MFIN Updated 25april2023Document11 pagesFinal Exam MFIN Updated 25april2023hanwen zhangNo ratings yet

- MCX Annual Report FY2015Document236 pagesMCX Annual Report FY2015Da BaulNo ratings yet

- Financial Management Unit 3Document10 pagesFinancial Management Unit 3Ram KrishnaNo ratings yet

- MPU 3353 Personal Financial Planning in Malaysia: Investment Basics: The Management of RiskDocument35 pagesMPU 3353 Personal Financial Planning in Malaysia: Investment Basics: The Management of RiskherueuxNo ratings yet

- Quiz 2Document10 pagesQuiz 2Dawna Lee BerryNo ratings yet

- Sbi Mutual FundsDocument78 pagesSbi Mutual FundsGunveen AbrolNo ratings yet

- Voltas: Sub: Annual Report 2018-19Document2 pagesVoltas: Sub: Annual Report 2018-19ravi shankarNo ratings yet

- CH 3 Discussion and Practice QuestionsDocument11 pagesCH 3 Discussion and Practice Questionsshimoni.mistry.180670107043No ratings yet

- Advanced Performance Management: Useful Formulas and EquationsDocument3 pagesAdvanced Performance Management: Useful Formulas and Equationstaxathon thaneNo ratings yet

- General and Technical Interview QuestionsDocument28 pagesGeneral and Technical Interview QuestionsAlka JosephNo ratings yet

- Accounts Project: Maruti-Suzuki DepreciationDocument8 pagesAccounts Project: Maruti-Suzuki Depreciationprasalr100% (3)

- Question #1: Inventory ItemDocument7 pagesQuestion #1: Inventory ItemAngelo TipaneroNo ratings yet

- Methodology List of Outdated Credit Rating 26jan2024Document65 pagesMethodology List of Outdated Credit Rating 26jan2024Swapnil SinghNo ratings yet

- Asset Management PrepDocument6 pagesAsset Management PrepCharlotte HoNo ratings yet

- Accounts of Clubs and Societies NotesDocument8 pagesAccounts of Clubs and Societies NotesChai Cheng YuNo ratings yet

- Mergers AcquisitionDocument11 pagesMergers AcquisitionAamir NabiNo ratings yet

- Session 13 - IBF - Fall 2017 - Cost of CapitalDocument36 pagesSession 13 - IBF - Fall 2017 - Cost of CapitalPalwashey SaadNo ratings yet

- Quiz Advance AccountingDocument5 pagesQuiz Advance AccountingGeryNo ratings yet

- PTTCDN D02 Team-05 Hoa-Sen-GroupDocument61 pagesPTTCDN D02 Team-05 Hoa-Sen-GroupHợp NguyễnNo ratings yet

- 9 - Bonds and Their ValuationDocument1 page9 - Bonds and Their Valuationjasminn_2No ratings yet

- Chart of AccountDocument7 pagesChart of Accountacahalim1103No ratings yet

- Disloyalty of A DirectorDocument2 pagesDisloyalty of A DirectorDailyn Jaectin0% (1)

- Answer Key - Importing and ExportingDocument4 pagesAnswer Key - Importing and Exportingmaria ronoraNo ratings yet

- Dekmar Trades CourseDocument15 pagesDekmar Trades CourseKyle MNo ratings yet

- Microsoft PowerPoint Presentation NouDocument6 pagesMicrosoft PowerPoint Presentation NouTatiana BuruianaNo ratings yet

- CLDP - Moot Court Case - Sharp CleanersDocument6 pagesCLDP - Moot Court Case - Sharp CleanersBhavik M. VakilNo ratings yet

- Hedge Funds StrategiesDocument13 pagesHedge Funds StrategiesJoel FernandesNo ratings yet

- Soal Latihan Minggu 4Document9 pagesSoal Latihan Minggu 4Alifia AprizilaNo ratings yet

- Introduction To Cash Flow Statement Acc Project Term 2Document7 pagesIntroduction To Cash Flow Statement Acc Project Term 2ANCHAL YADAVNo ratings yet