Professional Documents

Culture Documents

Knowledge-Based Financial Statement Fraud Detection System - Based On An Ontology and A Decision Tree

Knowledge-Based Financial Statement Fraud Detection System - Based On An Ontology and A Decision Tree

Uploaded by

DENIS LIZETH ROJAS MARTINOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Knowledge-Based Financial Statement Fraud Detection System - Based On An Ontology and A Decision Tree

Knowledge-Based Financial Statement Fraud Detection System - Based On An Ontology and A Decision Tree

Uploaded by

DENIS LIZETH ROJAS MARTINCopyright:

Available Formats

KNOWLEDGE-BASED FINANCIAL STATEMENT

FRAUD DETECTION SYSTEM:

BASED ON AN ONTOLOGY AND A DECISION TREE

XIAO-BO TANG*, GUANG-CHAO LIU**, JING

YANG***, WEI WEI****

X.-B. TANG, G.-CH. LIU, J. YANG, W.

WEI. KNOWLEDGE-BASED FINANCIAL

STATEMENT FRAUD DETECTION

SYSTEM

Intelligent financial

Introduction

Financial statement fraud happens

statement fraud

when corporations intentionally detection

prepare financial statements that

TIntelligent financial statement fraud

include misstated or misrepresented

detection aims at discovering the patterns of

material to mislead stock market

financial statement fraud to provide early

investors and regulators (Rezaee warning to regulators and support investors’

2005).. decision-making processes by using artificial

intelligence

According to Hajek

and Henriques (2017), the common types of methods.

financial statement fraud include omissions

in financial records, falsification or

manipulation of revenue, income, assets,

Ontology

expenses An ontology is “a formal, explicit

and other financial variables, and specification of a shared

misrepresentation of management

conceptualization” (Gruber 1993).

discussions and analysis.

Specifically, ontology

Financial statement fraud seriously affects

investors and formally describes concepts in a

regulators. It causes huge losses in the domain and those concepts’

economy and the attributes (Noy et al. 2000). By

stock market and destroys the general abstracting the concepts and

public’s confidence terminology of a specific domain,

in the business environment. the ontology

forms the shared concepts of a

domain and constructs.

-ANDREA NAVARRETE

-DENIS ROJAS

-HEIDY RANGEL

-SARAY ROYETH

-TATIANA RUBIO

You might also like

- Ola Cab BillDocument3 pagesOla Cab Billjesh22482564% (22)

- BOA Merchant ID List As of 09/01/2020: Client Line: 3459-5116-1883 American Express Discover Visa/MastercardDocument1 pageBOA Merchant ID List As of 09/01/2020: Client Line: 3459-5116-1883 American Express Discover Visa/MastercardChristina Trigo100% (3)

- Wareflex - Investing MemoDocument2 pagesWareflex - Investing MemoThuý NgaNo ratings yet

- Complaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDocument25 pagesComplaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDinSFLA85% (13)

- Fraud in Accounting, Organizations, SocietyDocument17 pagesFraud in Accounting, Organizations, SocietyYougie PoerbaNo ratings yet

- Forensic Accounting Research of Mr. Gian Carlo N. CatahumDocument51 pagesForensic Accounting Research of Mr. Gian Carlo N. CatahumJasmin Ng100% (1)

- 2011 DSS Detecting Evolutionary Financial Statement Fraud PDFDocument7 pages2011 DSS Detecting Evolutionary Financial Statement Fraud PDFwibowati sektiyaniNo ratings yet

- Study On Behavioral Finance, Behavioral Biases, and Investment DecisionsDocument14 pagesStudy On Behavioral Finance, Behavioral Biases, and Investment DecisionsTJPRC PublicationsNo ratings yet

- Behavorial FinanceDocument27 pagesBehavorial FinanceAli RizviNo ratings yet

- Financial LiteracyDocument15 pagesFinancial Literacyhinabatool777_651379No ratings yet

- Forensic Accounting Theory Ozili (2020)Document16 pagesForensic Accounting Theory Ozili (2020)Sri HastutiNo ratings yet

- FULL-158-160 Ekstraksi Kulit Buah Naga (Dragon Fruit) Sebagai Zat Pewarna Alami Pada Kain BatikDocument7 pagesFULL-158-160 Ekstraksi Kulit Buah Naga (Dragon Fruit) Sebagai Zat Pewarna Alami Pada Kain BatikDina ChamidahNo ratings yet

- 91968-Design Principles For Robust Fraud Detection - The Case of Stoc Kmarket Manipulation PDFDocument24 pages91968-Design Principles For Robust Fraud Detection - The Case of Stoc Kmarket Manipulation PDFIoanna ChNo ratings yet

- Behavioural FinanceDocument12 pagesBehavioural FinanceDivya Chauhan100% (2)

- Forensic Accounting and Financial Fraud: A. O. Enofe, O. R. Agbonkpolor, O. J. EdebiriDocument8 pagesForensic Accounting and Financial Fraud: A. O. Enofe, O. R. Agbonkpolor, O. J. EdebiriGeorge Valentine Nelson D RozarioNo ratings yet

- Bikas 2013Document7 pagesBikas 2013Tabi WilliamNo ratings yet

- Heuristic and Biases Related To Financia PDFDocument20 pagesHeuristic and Biases Related To Financia PDFQamarulArifinNo ratings yet

- Fundamentals of BFWMDocument42 pagesFundamentals of BFWMVinayak SinhaNo ratings yet

- 1.IJAFMRAUG20181 With Cover Page v2Document15 pages1.IJAFMRAUG20181 With Cover Page v2Rabaa DooriiNo ratings yet

- Chapter - Iii Theoretical Framework of Financial Literacy and Financial Well-BeingDocument28 pagesChapter - Iii Theoretical Framework of Financial Literacy and Financial Well-Beingpooja shandilyaNo ratings yet

- 4792 16477 1 PBDocument7 pages4792 16477 1 PBAnonymous IzaCtaSvYlNo ratings yet

- Chapter 2 - 5Document56 pagesChapter 2 - 5rotimibukunmienochNo ratings yet

- Detection Fraud of Financial Statement With Fraud Triangle: November 2013Document19 pagesDetection Fraud of Financial Statement With Fraud Triangle: November 2013Syakir Che SarujiNo ratings yet

- Shabirisha (2015) - HeuristicsDocument20 pagesShabirisha (2015) - HeuristicsKhushi HemnaniNo ratings yet

- Research Paper 2Document30 pagesResearch Paper 2mutharahul08No ratings yet

- Cielik 2018Document13 pagesCielik 2018salman samirNo ratings yet

- Fund Service PDFDocument143 pagesFund Service PDFsamyadeep4444_443676No ratings yet

- AOSPreprintDocument17 pagesAOSPreprintIrma HarrietNo ratings yet

- GVcef CunhaDocument25 pagesGVcef Cunhaabdullahzahoor987No ratings yet

- Page 1 of 41: UNIT 1: Traditional Finance To Behavioral FinanceDocument41 pagesPage 1 of 41: UNIT 1: Traditional Finance To Behavioral FinanceAditya Raj ShrivastavaNo ratings yet

- Qualitative FinanceDocument6 pagesQualitative FinanceRajendra LamsalNo ratings yet

- An Overview of Corporate Fraud and Its Prevention ApproachDocument18 pagesAn Overview of Corporate Fraud and Its Prevention ApproachAgung Giantino ManfaNo ratings yet

- Behavioral Finance-Group 14Document6 pagesBehavioral Finance-Group 14Priyanka PawarNo ratings yet

- Finance WopDocument17 pagesFinance WopNITYA JHANWARNo ratings yet

- 1 SMDocument24 pages1 SMTahir DestaNo ratings yet

- Behavioral Corporate Finance A Brief ReviewDocument7 pagesBehavioral Corporate Finance A Brief ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 06.chapter 2Document15 pages06.chapter 2Saad KapadiaNo ratings yet

- Sciencedirect: Financial Liberalization, Credit Constraints and Collateral: The Case of Manufacturing Industry in TunisiaDocument19 pagesSciencedirect: Financial Liberalization, Credit Constraints and Collateral: The Case of Manufacturing Industry in TunisiafouadNo ratings yet

- Adam SzyszkaDocument16 pagesAdam SzyszkaBatool HuzaifahNo ratings yet

- Behavioral Finance: Quo Vadis?Document15 pagesBehavioral Finance: Quo Vadis?Igor MartinsNo ratings yet

- Forensic Term PaperDocument11 pagesForensic Term PaperPaul OlaleNo ratings yet

- Case 2 For OE PDFDocument15 pagesCase 2 For OE PDFAISHEEK BHATTACHARYANo ratings yet

- 18 MBA402 BBFDocument68 pages18 MBA402 BBFFelipe ConcepcionNo ratings yet

- International Institution For Special Education Lucknow: CaseletDocument9 pagesInternational Institution For Special Education Lucknow: Caseletsaurabh dixitNo ratings yet

- A Study of Auditors' Responsibility For Fraud Detection in MalaysiaDocument8 pagesA Study of Auditors' Responsibility For Fraud Detection in MalaysiaUmmu ZubairNo ratings yet

- A Comprehensive Review of Literature On Creative Accounting: Supriya Khaneja Vidhi BhargavaDocument16 pagesA Comprehensive Review of Literature On Creative Accounting: Supriya Khaneja Vidhi BhargavaShriya RamanNo ratings yet

- Chapter - Ii Conceptual Framework On Behavioural FinanceDocument26 pagesChapter - Ii Conceptual Framework On Behavioural FinanceSukanya RNo ratings yet

- The Role of Psychological Factors in The Decision-Making of Investors in IndiaDocument5 pagesThe Role of Psychological Factors in The Decision-Making of Investors in IndiaIJAR JOURNALNo ratings yet

- Do The Fraud Triangle Components Motivate Fraud in IndonesiaDocument10 pagesDo The Fraud Triangle Components Motivate Fraud in IndonesiaAgung Giantino ManfaNo ratings yet

- Detection of Financial Statement Fraud and Feature Selection Using Data Mining TechniquesDocument10 pagesDetection of Financial Statement Fraud and Feature Selection Using Data Mining TechniqueskamaruddinNo ratings yet

- Theories and Determinants of Voluntary Disclosure: WWW - Sciedu.ca/afr Accounting and Finance Research Vol. 3, No. 1 2014Document9 pagesTheories and Determinants of Voluntary Disclosure: WWW - Sciedu.ca/afr Accounting and Finance Research Vol. 3, No. 1 2014Ysabella AnguloNo ratings yet

- Best ArticleDocument5 pagesBest ArticleRabaa DooriiNo ratings yet

- MSC Accounting Seminar Paper On Forensic AuditDocument26 pagesMSC Accounting Seminar Paper On Forensic AuditKobayashi2014100% (1)

- BehavioralFinance 8 5 14 SSRN DDocument69 pagesBehavioralFinance 8 5 14 SSRN DKarima ELALLAMNo ratings yet

- Financial Institutions and MarketsDocument283 pagesFinancial Institutions and MarketsGood Anony7No ratings yet

- Forensic Accounting and Fraud - A Review of Literature and Policy ImplicationsDocument7 pagesForensic Accounting and Fraud - A Review of Literature and Policy ImplicationsDINGDINGWALANo ratings yet

- Financial Statement Fraud - Lesson From US N EuroDocument13 pagesFinancial Statement Fraud - Lesson From US N EuroEko Bayu Dian PNo ratings yet

- Porta EconomicConsequencesLegal 2008Document49 pagesPorta EconomicConsequencesLegal 2008Anshita SinghNo ratings yet

- Pnabp191 PDFDocument39 pagesPnabp191 PDFAhmed Abdullah MacalinNo ratings yet

- Dawood SabDocument13 pagesDawood SabAhmad Faraz VirkNo ratings yet

- UAS MO. (202210280211001) (Khoiron Khulud) 1Document10 pagesUAS MO. (202210280211001) (Khoiron Khulud) 1Y-Celiboy OrochimaruNo ratings yet

- Do Individual Risk Attitudes, Experience, and Organizational Culture Influence The Conservatism of Indonesian Auditors?Document14 pagesDo Individual Risk Attitudes, Experience, and Organizational Culture Influence The Conservatism of Indonesian Auditors?Andy SuarnaNo ratings yet

- Altman Z Score 1995Document20 pagesAltman Z Score 1995Almaliyana BasyaibanNo ratings yet

- The New Science of Asset Allocation: Risk Management in a Multi-Asset WorldFrom EverandThe New Science of Asset Allocation: Risk Management in a Multi-Asset WorldNo ratings yet

- Company Profile of ShreeSatya GroupDocument4 pagesCompany Profile of ShreeSatya GroupRohan HajelaNo ratings yet

- Challenges That Women Entrepreneurs and Startup Are Facing in AddisDocument61 pagesChallenges That Women Entrepreneurs and Startup Are Facing in AddisKalkidan Admasu AyalewNo ratings yet

- What Is Really Different About Emerging Market Multinationals?Document7 pagesWhat Is Really Different About Emerging Market Multinationals?karishmakakarishmaNo ratings yet

- Income Tax RefundDocument3 pagesIncome Tax RefundAKHiiLESH BhamaNo ratings yet

- Kridha Logistics Pvt. Ltd. - Company ProfileDocument9 pagesKridha Logistics Pvt. Ltd. - Company ProfilePrateek AgarwalNo ratings yet

- 0113 - Busduct 630a - Offer Price - EmcoDocument1 page0113 - Busduct 630a - Offer Price - EmcoManish KumarNo ratings yet

- Winter 2017 Engineering Management: Jyothis AcademyDocument75 pagesWinter 2017 Engineering Management: Jyothis AcademyMithlesh SharmaNo ratings yet

- Facility Location and Layout - Numerical TechniquesDocument6 pagesFacility Location and Layout - Numerical TechniquesBanferbie NongrumNo ratings yet

- TINA Bank StatementDocument2 pagesTINA Bank Statementmohamed elmakhzniNo ratings yet

- Yavantu DocusDocument3 pagesYavantu DocusEnock MuntuNo ratings yet

- This Study Resource Was: Case: San Miguel in The New MillenniumDocument2 pagesThis Study Resource Was: Case: San Miguel in The New MillenniumBaby BabeNo ratings yet

- I N T R o D U C T I o N T o C D o SDocument20 pagesI N T R o D U C T I o N T o C D o SSavvy KhannaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSarb GillNo ratings yet

- Instructions For Foreclosure BondDocument5 pagesInstructions For Foreclosure BondOneNation100% (2)

- Wayanad Department of General and Higher e Centre Pulpally Town PulpallypoDocument24 pagesWayanad Department of General and Higher e Centre Pulpally Town PulpallypoDelta PayNo ratings yet

- Computation of Shankar Sharma V2Document2 pagesComputation of Shankar Sharma V2akhil kwatraNo ratings yet

- Financial Risk - Monitoring Sovereign, Currency and Banking Sector RiskDocument9 pagesFinancial Risk - Monitoring Sovereign, Currency and Banking Sector RiskjimmiilongNo ratings yet

- October 2019 Global Financial Development DatabaseDocument861 pagesOctober 2019 Global Financial Development DatabasestellaNo ratings yet

- ViewDocument18 pagesViewAmritanshu TiwariNo ratings yet

- Lecture 1Document22 pagesLecture 1Md. Atiqul Hoque NiloyNo ratings yet

- Cross Docking PPT AVENGERSDocument13 pagesCross Docking PPT AVENGERSRei RacazaNo ratings yet

- Market Integration: Edward B. Agravante, MM, Mba, JD Laguna State Polytechnic UniversityDocument19 pagesMarket Integration: Edward B. Agravante, MM, Mba, JD Laguna State Polytechnic UniversityJoksmer MajorNo ratings yet

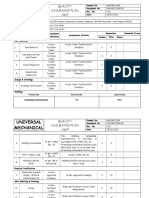

- QAP For Pneumatic Test BathDocument3 pagesQAP For Pneumatic Test BathRaish AlamNo ratings yet

- Nature of TechnopreneurshipDocument4 pagesNature of Technopreneurshiprichard nuevaNo ratings yet

- D 1 CbaaDocument66 pagesD 1 CbaaMohd Imran IdrisiNo ratings yet

- Power-of-Attorney of A Person Who Stay Abroad-304Document2 pagesPower-of-Attorney of A Person Who Stay Abroad-304Assassin AgentNo ratings yet