Professional Documents

Culture Documents

Ngineering: R S I L - (S L)

Ngineering: R S I L - (S L)

Uploaded by

Hasan ShahriarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ngineering: R S I L - (S L)

Ngineering: R S I L - (S L)

Uploaded by

Hasan ShahriarCopyright:

Available Formats

ncr ENGINEERING

National Credit Ratings Limited

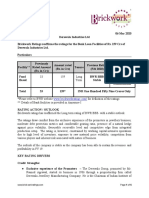

RATINGS (MARCH 2011) ENTITY RATING

STEELTECH INDUSTRIES LTD. (SIL)

Long Term Short Term Date of Rating Declaration

A (Single A) ST-3 01/03/2011

BANK LOAN RATINGS

Outstanding

Limit

Nature of Facility (TK. In Rating

(TK. In Million)

Million)

Non Funded Facilities

210.00 ---- BLR A+

(L/C, BG)

Funded Facility ( TR, Bial,

335.70 315.40 BLR A+

HPSM))

* Outstanding loan facilities as on January 31, 2011

RATING RATIONALE

The above rating reflects SIL’s satisfactory track record, satisfactory capacity

utilization, experienced management team, efficient production process, good

profit margin and standard leverage ratio. The ratings are however influenced by

modest financial profile characterized by low coverage ratio, long working capital

cycle, moderate liquidity ratio and the volatile nature of the industry.

FINANCIAL DATA

TK (mln) ASSESSMENT

The business performance of Steeltech Industries Ltd has improved significantly

June-10 Jun-09

in FY 2010, as the actual production has increased after the new production lines

Total Assets 512.76 321.68 came in full operation. The gross revenue and EBITDA has increased substantially

Equity 179.12 106.28 during FY 2010. In spite of a sales growth of 139.64% in FY2010 relative to the

Net Turnover 436.18 339.38 previous year, the gross margin remained steady at 18.20% because of the

Net Income 22.15 4.13 rising cost of imported raw materials. The company reported net income of TK

EBITDA 79.48 31.24 31.32 Million in FY2010 against net turnover of TK 436.18 Million.

ROE % 21.24 13.67 The company primarily depends on short term borrowings to manage the working

Interest Coverage capital requirements and maintain the inventory level. The Cash Cycle improves a

2.82 2.85 little in FY2010 relative to the previous year though it is still longer.

(X)

Net Debt/ (Net SIL’s interest coverage ratio has improved slightly in FY2010 than the previous

61.02 61.07

Debt + Equity) % fiscal year but its debt service coverage ratio has decreased in FY2010 compared

to FY2009 because of more increase in short term borrowings than adjusted

quick assets. Despite increase in current assets the adjusted quick ratio has

ANALYSTS deteriorated in FY2010 relative to FY2009 due to increase in short term liability.

SIL maintains a standard 60:40 debt -equity ratio. Any material increase in

Mohammad Saifur Abedin Ome leveraging would impact the financial profile of the company, which would have

+0088-02-9359878 negative rating implication.

ome@ncrbd.com

PROFILE

Md. Hasan Shahriar Chowdhury

+0088-02-9359878 SIL, incorporated as a private Limited Company in February 2003 and

shahriar@ncrbd.com commencing commercial operations in November 2003, is mainly involved in

manufacturing and marketing stainless steel pipes. Other than manufacturing

stainless steel pipes, SIL also produces copper bars, pipes and tubes and various

rubber products for various industries. The allied concerns of SIL include 1) Kai

Bangladesh Aluminum Ltd. 2) Altech Aluminum Industries Ltd. 3) Multipanels Ltd.

4) Tissuetech Industries Ltd. 5) Papertech industries Ltd. 7) paragon Ceramics

Industries Ltd. The company’s is owned and managed by a 11 members BoD.

The management is headed by the Managing Director; Mr. Abbasi Adam Ali who

is also one of the sponsor Directors of the company.

DISCLAIMER

NCR has used due care in preparation of this document. Our information has been obtained from sources we consider to be reliable but its accuracy or completeness is not

guaranteed. NCR shall owe no liability whatsoever to any loss or damage caused by or resulting from any error in such information. None of the information in this

document may be copied or otherwise reproduced, stored or disseminated in whole or in part in any form or by any means whatsoever by any person without NCR’s written

consent. Our reports and ratings constitute opinions, not recommendations to buy or to sell.

Tel: + 88-02-9359878 Fax: +88-02-9332769 Website: www.ncrbd.com

In preparing this report NCR has used the Bank Loan Rating Methodology which is available at our website: www.ncrbd.com

You might also like

- Unit 10 - Operational Risk Ed14Document200 pagesUnit 10 - Operational Risk Ed14Muhammad Shoaib AkramNo ratings yet

- Chapter 7 ParcorDocument10 pagesChapter 7 Parcornikki syNo ratings yet

- Basic MF Development Model v1.1Document4 pagesBasic MF Development Model v1.1AlexNo ratings yet

- March 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystDocument35 pagesMarch 2008 CAIA Level II Sample Questions: Chartered Alternative Investment AnalystAnubhav Srivastava100% (1)

- Saakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedDocument4 pagesSaakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedRanib SainjuNo ratings yet

- Suprajit Engineering LimitedDocument6 pagesSuprajit Engineering LimitedHarinath ReddyNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- July 8, 2021Document12 pagesJuly 8, 2021786rohitsandujaNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Abul Khair Steel Products Surveillance Rating Report 2012 ReDocument4 pagesAbul Khair Steel Products Surveillance Rating Report 2012 Remadhusri002No ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Coptech Wire IndustryDocument4 pagesCoptech Wire IndustryKarthi KarthiNo ratings yet

- Iron Triangle Limited - R - 23102020Document8 pagesIron Triangle Limited - R - 23102020hesham zakiNo ratings yet

- West Coast Paper Mills LTDDocument6 pagesWest Coast Paper Mills LTDRavi KNo ratings yet

- Entertainment-City-Jan 2019 BRICKWORKDocument6 pagesEntertainment-City-Jan 2019 BRICKWORKPuneet367No ratings yet

- Prateek Wires (P) LTD - R - 08102020Document6 pagesPrateek Wires (P) LTD - R - 08102020DarshanNo ratings yet

- JBM Ogihara Automotive India LimitedDocument8 pagesJBM Ogihara Automotive India Limitedankityad129No ratings yet

- Assessment of Working Capital RequirementsDocument13 pagesAssessment of Working Capital Requirementsamit_kachhwaha100% (2)

- Hyundai Steel India - R - 08062018Document7 pagesHyundai Steel India - R - 08062018Andrew BruceNo ratings yet

- LGB Forge Limited: Summary of Rating ActionDocument7 pagesLGB Forge Limited: Summary of Rating ActionPuneet367No ratings yet

- TM International Logistics Limited: Summary of Rated InstrumentsDocument7 pagesTM International Logistics Limited: Summary of Rated InstrumentsSunny SkNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- 40 - Copy of 42 - Cma Format For BankDocument20 pages40 - Copy of 42 - Cma Format For Bankcvrao04100% (4)

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- Jeevaka Industries PVT R 06042020Document7 pagesJeevaka Industries PVT R 06042020saikiran reddyNo ratings yet

- Alkali Metals Limited - R - 26112020Document7 pagesAlkali Metals Limited - R - 26112020Yogi173No ratings yet

- Ashok Leyland-R-29042019Document7 pagesAshok Leyland-R-29042019RealNo ratings yet

- Ace Designers Limited: Summary of Rated InstrumentsDocument7 pagesAce Designers Limited: Summary of Rated InstrumentskachadaNo ratings yet

- Noble Tech Industries Private LimitedDocument3 pagesNoble Tech Industries Private Limitedkarthikeyan A INo ratings yet

- Larsen & Toubro Limited - R - 26062020 PDFDocument12 pagesLarsen & Toubro Limited - R - 26062020 PDFdeepesh dhanrajaniNo ratings yet

- PR JyotiCNC 26apr23Document7 pagesPR JyotiCNC 26apr23Virag ShahNo ratings yet

- CRISIL Research Ipo Grading Rat KNR ConstructionDocument4 pagesCRISIL Research Ipo Grading Rat KNR ConstructionharshaddekhaneNo ratings yet

- KEC International LimitedDocument9 pagesKEC International Limiteddevsingh.bhadauriyaNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- KEI Industries LimitedDocument8 pagesKEI Industries Limitedpraveen kumarNo ratings yet

- Ajax Fiori-R-07092017Document7 pagesAjax Fiori-R-07092017parimal.rodeNo ratings yet

- Morningstar - At&T, Inc. - Credit Update - 03.11.2011Document16 pagesMorningstar - At&T, Inc. - Credit Update - 03.11.2011emerging11No ratings yet

- Apex Spinning & Knitting Mills Rating Report Surveillance 2015 PDFDocument5 pagesApex Spinning & Knitting Mills Rating Report Surveillance 2015 PDFben crabbNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Derewala Industries 6mar2020Document6 pagesDerewala Industries 6mar2020Mukul SoniNo ratings yet

- Aishwarya Institute of Management & ItDocument20 pagesAishwarya Institute of Management & ItArvind Singh RathoreNo ratings yet

- Terrier Security Services (India) Private LimitedDocument7 pagesTerrier Security Services (India) Private Limitedgcgary87No ratings yet

- D&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsDocument6 pagesD&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsMahee MahemaaNo ratings yet

- Kumar Arch Tech - R-06082020Document7 pagesKumar Arch Tech - R-06082020Denish GalaNo ratings yet

- Indotech Transformers LimitedDocument6 pagesIndotech Transformers LimitedMonika GNo ratings yet

- Assessment of Working Capital RequirementsDocument13 pagesAssessment of Working Capital RequirementsAkash RanabhatNo ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- Fa May June - 2012Document4 pagesFa May June - 2012xodic49847No ratings yet

- Nyse Cas 2011Document118 pagesNyse Cas 2011gaja babaNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- 2010 August MS KhuranaDocument4 pages2010 August MS Khuranaprasad.patilNo ratings yet

- Amman TRY Sponge and Power Private LimitedDocument4 pagesAmman TRY Sponge and Power Private LimitedKathiresan Mathavi's SonNo ratings yet

- Gokak Textiles Limited: Ratings Reaffirmed Long-Term Rating Withdrawn Summary of Rating ActionDocument6 pagesGokak Textiles Limited: Ratings Reaffirmed Long-Term Rating Withdrawn Summary of Rating Actionabhi MestriNo ratings yet

- PR Faridabad Steel 24jan23Document6 pagesPR Faridabad Steel 24jan23partoshsingh746No ratings yet

- Risk and ReturnDocument6 pagesRisk and ReturnKaushlesh KumarNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Bharat Electronics Limited: Summary of Rating ActionDocument7 pagesBharat Electronics Limited: Summary of Rating ActionrohanNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Nonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryFrom EverandNonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- BujaiDocument2 pagesBujaiMhyr Pielago CambaNo ratings yet

- Practice Questions On Capital Structure 16042021 044448pm 10112022 084456pmDocument12 pagesPractice Questions On Capital Structure 16042021 044448pm 10112022 084456pmHadia ZafarNo ratings yet

- Bollinger Band (Part 2)Document5 pagesBollinger Band (Part 2)Miguel Luz RosaNo ratings yet

- Practice Solution 1Document8 pagesPractice Solution 1Luigi NocitaNo ratings yet

- Investment Awareness Program Ver. 4Document40 pagesInvestment Awareness Program Ver. 4Arvind MittalNo ratings yet

- BBA-1 SyllabusDocument3 pagesBBA-1 Syllabusdinakar070No ratings yet

- Solutions To Problems: LG 2 BasicDocument18 pagesSolutions To Problems: LG 2 BasicHerdiyanaNurcahyantiNo ratings yet

- Position Trading Maximizing Probability of Winning TradesDocument91 pagesPosition Trading Maximizing Probability of Winning Tradescarlo bakaakoNo ratings yet

- SFM Text BookDocument299 pagesSFM Text BookGopika CA100% (1)

- Theories of Dividend PolicyDocument13 pagesTheories of Dividend PolicyNavneet NandaNo ratings yet

- BRD - 20221104073537 - BRD Quarterly Report September 30 2022Document90 pagesBRD - 20221104073537 - BRD Quarterly Report September 30 2022teoxysNo ratings yet

- Equity Crowdfunding (Asean) PDFDocument107 pagesEquity Crowdfunding (Asean) PDFAnson LiangNo ratings yet

- NEP Long - Jonathan ChangDocument11 pagesNEP Long - Jonathan ChangJonathanChangNo ratings yet

- Accountancy MARKING SCHEME Class-XII Set-IDocument9 pagesAccountancy MARKING SCHEME Class-XII Set-Iaamiralishiasbackup1No ratings yet

- Bank Management PDFDocument3 pagesBank Management PDFchahatNo ratings yet

- Coal India LimitedDocument35 pagesCoal India LimitedBobby ChristiantoNo ratings yet

- AMC - Taranis - CH0575781247 - PO - Terms - Final - NEWDocument19 pagesAMC - Taranis - CH0575781247 - PO - Terms - Final - NEWBuchotNo ratings yet

- Financial Management: For The Purpose of CA TestDocument4 pagesFinancial Management: For The Purpose of CA TestANJALI GHANSHANINo ratings yet

- Chapter 6 9eDocument49 pagesChapter 6 9eRahil VermaNo ratings yet

- Annual Report of FAYSAL Bank Limited 2009Document129 pagesAnnual Report of FAYSAL Bank Limited 2009zabeehNo ratings yet

- Viktor & Rolf - Market Research by Jessica - Corrigan - IssuuDocument1 pageViktor & Rolf - Market Research by Jessica - Corrigan - IssuuVelvet SmithNo ratings yet

- CapitaWorld Presentation PDFDocument16 pagesCapitaWorld Presentation PDFYatra ShuklaNo ratings yet

- Chapter 13Document45 pagesChapter 13Léo AudibertNo ratings yet

- AR Plusbhd 2002Document66 pagesAR Plusbhd 2002s46856qsxnNo ratings yet

- Your Money or Your Life - Vicki Robin and Joe DominguezDocument102 pagesYour Money or Your Life - Vicki Robin and Joe Dominguezhipnoza.ezoterica.ro100% (1)

- Comparative Study Between Equity and Mutual Fund InvestmentDocument60 pagesComparative Study Between Equity and Mutual Fund InvestmentKrupanshi MevchaNo ratings yet