Professional Documents

Culture Documents

Activity 3 - Sum-Of-Years Method

Activity 3 - Sum-Of-Years Method

Uploaded by

GUILLERMO MARULANDA0 ratings0% found this document useful (0 votes)

13 views3 pagesThis document provides information to calculate depreciation of an equipment asset using the sum-of-years digits method. It lists the cost of the asset as $14,000, the residual value as $3,000, and useful life as 7 years. It then shows the depreciation amount, accumulated depreciation, and book value for each year over the 7 year useful life.

Original Description:

Original Title

Activity 3 - Sum-of-years method

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information to calculate depreciation of an equipment asset using the sum-of-years digits method. It lists the cost of the asset as $14,000, the residual value as $3,000, and useful life as 7 years. It then shows the depreciation amount, accumulated depreciation, and book value for each year over the 7 year useful life.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views3 pagesActivity 3 - Sum-Of-Years Method

Activity 3 - Sum-Of-Years Method

Uploaded by

GUILLERMO MARULANDAThis document provides information to calculate depreciation of an equipment asset using the sum-of-years digits method. It lists the cost of the asset as $14,000, the residual value as $3,000, and useful life as 7 years. It then shows the depreciation amount, accumulated depreciation, and book value for each year over the 7 year useful life.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

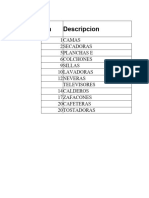

Fixed asset Equipment

Cost of acquisition $ 14,000 Numberator

Residual value $ 3,000 Denominator

Useful life (years) 7

DEPRECIATION TABLE BY TH

YEAR COST OF ASSET SDA FRACTION

0 $ 14,000

1 0.25

2 0.21

3 0.18

4 0.14

5 0.11

6 0.07

7 0.04

Year 1 Year 2 Year 3

7 6 5

28

DEPRECIATION TABLE BY THE SUM-OF-YEARS METHOD

DEPRECIABLE COST DEPRECIATION AMOUNT ACCUMULATED DEPRECIATION

$ 11,000.00 $ 2,750.00 $ 2,750.00

$ 11,000.00 $ 2,357.14 $ 5,107.14

$ 11,000.00 $ 1,964.29 $ 7,071.43

$ 11,000.00 $ 1,571.43 $ 8,642.86

$ 11,000.00 $ 1,178.57 $ 9,821.43

$ 11,000.00 $ 785.71 $ 10,607.14

$ 11,000.00 $ 392.86 $ 11,000.00

Year 4 Year 5 Year 6 Year 7

4 3 2 1

28

BOOK VALUE OF ASSETS

$ 14,000.00

$ 11,250.00

$ 8,892.86

$ 6,928.57

$ 5,357.14

$ 4,178.57

$ 3,392.86

$ 3,000.00

You might also like

- Análisis de La Información Financiera Actividad 3. Práctica en Inglés - 10%Document3 pagesAnálisis de La Información Financiera Actividad 3. Práctica en Inglés - 10%GUILLERMO MARULANDANo ratings yet

- MF Juros CompostosDocument4 pagesMF Juros CompostosWagnerNo ratings yet

- ACT3 Miranda Díaz Kevin David TADDCPDocument4 pagesACT3 Miranda Díaz Kevin David TADDCPMiranda Díaz Kevin DavidNo ratings yet

- Present ValueDocument8 pagesPresent ValuemasumaNo ratings yet

- Bond Price Value of A BondDocument3 pagesBond Price Value of A BondPham Quoc BaoNo ratings yet

- DEPRESIASIDocument7 pagesDEPRESIASISaffira Annisa BeningNo ratings yet

- InstructionsDocument4 pagesInstructionsmohitgaba19No ratings yet

- Ryan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Document3 pagesRyan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Giorgi MeskhishviliNo ratings yet

- Ocean Carriers FinalDocument3 pagesOcean Carriers FinalGiorgi MeskhishviliNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5Ahlam KassemNo ratings yet

- Stock Dads Compound Interest CalculatorDocument4 pagesStock Dads Compound Interest CalculatorMNo ratings yet

- Loan Payment Calculator Amortiztion ScheduleDocument2 pagesLoan Payment Calculator Amortiztion Scheduley shNo ratings yet

- College Savings CalculatorDocument1 pageCollege Savings CalculatorsrinaldyNo ratings yet

- Plazo (Meses, Semanas, Días) Saldo InsolutoDocument2 pagesPlazo (Meses, Semanas, Días) Saldo InsolutoFanny Osorio TapiasNo ratings yet

- 001-Functions Financial Amortization SchedulesDocument114 pages001-Functions Financial Amortization SchedulesAbhishek srivastavaNo ratings yet

- Tabla - Amortización - Sistema - Francés y AlemánDocument8 pagesTabla - Amortización - Sistema - Francés y AlemánLizbeth LaraNo ratings yet

- Amount Period of Loan Before ReschedulingDocument7 pagesAmount Period of Loan Before ReschedulingShancy SahooNo ratings yet

- Prestamo OdsDocument2 pagesPrestamo OdsJairo AndrésNo ratings yet

- Projection CalcDocument14 pagesProjection CalcSekhar ReddyNo ratings yet

- 2019-2020 Compensation PlanDocument17 pages2019-2020 Compensation PlanrustyNo ratings yet

- Institución Valor Cuota CAE Tasa de Interés MensualDocument32 pagesInstitución Valor Cuota CAE Tasa de Interés MensualJorge Andres Tapia AlburquenqueNo ratings yet

- Coursera NPVDocument1 pageCoursera NPVAli AkbarNo ratings yet

- Finanzas ESQUEMADocument6 pagesFinanzas ESQUEMARichard Taipe ChacaltanaNo ratings yet

- Interest vs. Principal: Rate Period Interest Principal Periods Present Value $ 350,000.00 Future Value TypeDocument1 pageInterest vs. Principal: Rate Period Interest Principal Periods Present Value $ 350,000.00 Future Value TypeArmand BoumdaNo ratings yet

- DepreciationDocument3 pagesDepreciationDreamer_ShopnoNo ratings yet

- Applied Math Practice For Financial Advisors - Exercises (Solutions)Document62 pagesApplied Math Practice For Financial Advisors - Exercises (Solutions)Ali kamakuraNo ratings yet

- Tablas de Amortización de CréditosDocument8 pagesTablas de Amortización de CréditosVASQUEZ MESA DANIEL MAURICIONo ratings yet

- Depreciation Excel FileDocument18 pagesDepreciation Excel Fileapi-454991083No ratings yet

- Profit Tracker v3.1Document18 pagesProfit Tracker v3.1alishaNo ratings yet

- Penghitungan Pertemuan #9Document2 pagesPenghitungan Pertemuan #9yamatoNo ratings yet

- Deber 1Document5 pagesDeber 1Carlos Javier Vergara GuanangaNo ratings yet

- Case Questions Excel SheetDocument8 pagesCase Questions Excel SheetMustafa MahmoodNo ratings yet

- Taller 3Document22 pagesTaller 3CRISTIAN CAMILO MORALES SOLISNo ratings yet

- Laboratorio 2Document5 pagesLaboratorio 2GIANCARLO APAZA MAMANINo ratings yet

- Annuity ComparisonDocument6 pagesAnnuity ComparisonMichael SherrinNo ratings yet

- Cash FlowDocument1 pageCash FlowVua GhoreNo ratings yet

- Principal and InterestDocument2 pagesPrincipal and InterestArmand BoumdaNo ratings yet

- Workshop 6 DropboxDocument7 pagesWorkshop 6 DropboxCourtney WoodNo ratings yet

- Gestão de BancaDocument10 pagesGestão de BancageraldolsfNo ratings yet

- Tutorial Solution DepreciationDocument2 pagesTutorial Solution DepreciationbillNo ratings yet

- FB Side by Side Pricing Guide 20-21Document1 pageFB Side by Side Pricing Guide 20-21Annor AmapolleyNo ratings yet

- Lab 1 CalcDocument4 pagesLab 1 CalcIgnazio GivensNo ratings yet

- Lab 1 CalcDocument4 pagesLab 1 CalcIgnazio GivensNo ratings yet

- Sales Team Hiring Plan v1.0: Assumptions Growth Targets AE Quota & Ramp-UpDocument18 pagesSales Team Hiring Plan v1.0: Assumptions Growth Targets AE Quota & Ramp-UpmarioNo ratings yet

- Factura Distribuidora MireyaDocument4 pagesFactura Distribuidora MireyaAnabel AdamesNo ratings yet

- Stanley College OSHC-Sheet - 100418Document3 pagesStanley College OSHC-Sheet - 100418Victor EleeasNo ratings yet

- Tasa Preferencial y CompradeudaDocument39 pagesTasa Preferencial y CompradeudaFernando JimenezNo ratings yet

- Mortgage Amortization ScheduleDocument8 pagesMortgage Amortization ScheduleJohnny CcyNo ratings yet

- FM Assignment 1 - 1.0Document12 pagesFM Assignment 1 - 1.0Satyam1771No ratings yet

- Shonae Carrington Project 6Document8 pagesShonae Carrington Project 6api-325533351No ratings yet

- Ejercicios 6-7Document5 pagesEjercicios 6-7Ana GarcíaNo ratings yet

- Cost Benefit AnalysisDocument4 pagesCost Benefit AnalysisswapnilNo ratings yet

- Fee MatrixDocument1 pageFee MatrixadrobbinsNo ratings yet

- Taller Calificable VPN-TIRDocument11 pagesTaller Calificable VPN-TIRMario MarinNo ratings yet

- New Automobile Depreciation: Years ValueDocument22 pagesNew Automobile Depreciation: Years Valueroyalb100% (4)

- MAMATEODocument20 pagesMAMATEOJeffry BuendiaNo ratings yet

- Homework Chapter 8Document2 pagesHomework Chapter 8simonasalNo ratings yet

- Latihan AnuitasDocument3 pagesLatihan AnuitasMndaNo ratings yet

- 1.VPL - Exercício 1.: Taxa - 10% An o Custo VPLDocument5 pages1.VPL - Exercício 1.: Taxa - 10% An o Custo VPLJill FordNo ratings yet

- Math Practice Simplified: Money & Measurement (Book K): Applying Skills to Problems Dealing with Money and MeasurementFrom EverandMath Practice Simplified: Money & Measurement (Book K): Applying Skills to Problems Dealing with Money and MeasurementNo ratings yet