Professional Documents

Culture Documents

r140128c PDF

r140128c PDF

Uploaded by

munawar abbas0 ratings0% found this document useful (0 votes)

27 views3 pagesThe document summarizes the state of Pakistan's banking sector and efforts to promote financial inclusion. It notes that while the banking sector has seen strong growth and profitability, it has yet to fully tap market opportunities or maximize return on equity. Large segments of the population remain unbanked or underserved. The State Bank of Pakistan has undertaken various initiatives to promote financial inclusion through branchless banking, mobile wallets, and partnerships with international organizations. The goal is to transform Pakistan's financial system into one with efficient market-based services available to more people, including the poor, women, and youth.

Original Description:

Original Title

r140128c (1).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the state of Pakistan's banking sector and efforts to promote financial inclusion. It notes that while the banking sector has seen strong growth and profitability, it has yet to fully tap market opportunities or maximize return on equity. Large segments of the population remain unbanked or underserved. The State Bank of Pakistan has undertaken various initiatives to promote financial inclusion through branchless banking, mobile wallets, and partnerships with international organizations. The goal is to transform Pakistan's financial system into one with efficient market-based services available to more people, including the poor, women, and youth.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

27 views3 pagesr140128c PDF

r140128c PDF

Uploaded by

munawar abbasThe document summarizes the state of Pakistan's banking sector and efforts to promote financial inclusion. It notes that while the banking sector has seen strong growth and profitability, it has yet to fully tap market opportunities or maximize return on equity. Large segments of the population remain unbanked or underserved. The State Bank of Pakistan has undertaken various initiatives to promote financial inclusion through branchless banking, mobile wallets, and partnerships with international organizations. The goal is to transform Pakistan's financial system into one with efficient market-based services available to more people, including the poor, women, and youth.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Yaseen Anwar: Brief overview of Pakistan’s banking sector and innovative

banking practices

Speech by Mr Yaseen Anwar, Governor of the State Bank of Pakistan, at Bahria University

Convocation, Karachi, 22 December 2014.

* * *

Vice Chancellor, Bahria University, Prof….…..

Distinguished Faculty members, Dear students, Ladies and Gentleman, I would like to thank

Bahria University for inviting me to this Convocation.

First of all, let me congratulate all position holders and students who have earned their distinctions

and university degrees through sheer willpower, hard work and dedication. Your education has

provided you with the resources to lead and change. You should be determined to create your

own individual voice upholding the values of creativity championed by this institution, while

acknowledging your link with the community.

The importance of education cannot be overemphasized. Education is fundamental to any

society’s progress for it prepares generations to equip themselves with the knowledge and skills to

meet the challenges of the ever changing world. When education blends with youthful energy, it

organizes people economically, socially and politically, which helps the society to step-up on the

ladder of civilization. Education is the catalyst of national development; it is what distinguishes

nations form one another.

Pakistan has immense human potential. More than half of our population is below the age of 25;

sadly the education systems aren’t appropriately managed and sufficient enough to exploit this

potential. This is where institutions such as Bahria University and the rest of private sector can

play their role to ameliorate current educational level. To increase the pace of economic

development, our policies must be focused towards advancement of education. For a stronger,

respected and flourishing Pakistan, we must in our capacity address the issues related to

education.

Taking benefit of this opportunity, I would like to share my thoughts on the state of banking sector

and the need for adopting innovative banking practices from around the world to deliver better

customer value and financial inclusion in Pakistan.

In recent years, growth and turnaround in Pakistan’s banking sector has been remarkable and

unprecedented. Classified as Pakistan’s and region’s best performing sector, the banking

industry’s assets have risen to over US $97 billion with profitability of Rs 187 billion (pre-tax) in

FY12 which is exceptional and at an all-time high. Similarly, during FY 2012 deposits have grown

at a fast clip of 17 percent which is the highest in the last five years. The Capital Adequacy Ratio

(CAR) of the banking sector, which was already well above the regulatory requirements; increased

further to 15.4 percent in FY12. The solvency of the banking sector has improved due to robust

profitability, fresh equity injections and decreasing Risk Weighted Assets (RWA) owing to risk-

averse behavior.

However, the important question that we all must ask ourselves is that has the banking sector

exhausted market opportunities and maximized return on equity? Here I would like to quote some

statistics to flash the untapped opportunities for retail banking in Pakistan:

• First, banks are yet to tap in the banking opportunities with the vast unbanked masses as

the credit to private sector is only around 18 of the GDP which is too low. According to the

Access to Finance Study (A2FS) only 12 percent of the population has access to formal

financial services. Whereas of the remaining 88 percent, only 32 percent are informally

served and 56 percent are completely excluded.

BIS central bankers’ speeches 1

• Second, the existing branch network of the banking system is insufficient to serve the

millions of unbanked masses. The total number of bank branches in Pakistan is very low

at around 10,600 which place Pakistan among the countries with the highest per bank

population of around 15,000 persons per branch.

• Third, private credit to GDP ratio is abysmally low at 18.4 percent compared with other

countries at the same level of development.

• Fourth, the sectoral distribution of credit is highly skewed and very low compared to the

needs of the producing sectors of our economy.

• Finally, the banking sector has nearly neglected the financing needs of the Mico Small

and Medium Enterprises (MSME) as 80% of the credit is availed by only 25,000

borrowers.

A recent World Bank study confirms a positive relationship between financial inclusion, faster

economic growth and poverty alleviation. Given these challenges, SBP aims to address financial

exclusion through variety of interventions, it aims to enhance delivery of financial services through

technology based branchless banking, mobile wallets etc. Let me share my thoughts on financial

inclusion, our efforts, and its current landscape.

Financial inclusion is core component of financial sector development strategy. It envisages

transforming the financial market into an equitable system with efficient market based financial

services to the otherwise excluded poor and marginalized population including women and young

people.

Pakistan microfinance regulation had been ranked number 1 in the world by the economist

intelligence unit of the economist magazine 2010 and 2011.

Pakistan has become one of the fastest growing markets for branchless banking in the World.

These developments include increased competition, technological innovation, new business

models, transformation in customers’ needs and behaviors, and regulatory proportionality.

International development agencies and media have now been highlighting Pakistan for its market

and institutional environment for branchless banking. Moreover, according to a recent CGAP

publication, “Pakistan serves as an example of how public and private institutions together can

move a country towards a digital financially inclusive system.” In fact the branchless banking is

going to dominate the retail banking landscape in the long-term.

Branchless Banking has also proved to be an effective instrument in channelizing the Government

to Persons (G2P) payments in trying times like serving Internally Displaced Persons (IDPs), flood

affectees during the last two years, and beneficiaries of the Benazir Income Support Programme.

In the coming days, this channel is expected to continue playing an important role towards the

promotion of financial inclusion and the management of Government to Person (G2P) Programs

like Salaries Disbursements, Pensions, BISP, Watan Cards, Pakistan Cards and tax collections

services, etc. The existing Branchless Banking deployments can cater to the needs of over

10 million potential beneficiaries of G2P payments in Pakistan.

SBP has partnered with DFID to launch a financial inclusion program. A number of initiatives have

been taken to promote access to finance in the MSMEs, agriculture and housing which creates

enabling environment by addressing regulatory barrier market failures and industry bottlenecks

and ensuring consumer protection.

Lack of financial literacy is a major constraint in advancing financial inclusion SBP launched the

first ever nationwide financial literacy program last year, the pilot phase of the program has been

concluded successfully by targeting about 50000 beneficiaries in various provinces regions and

districts with emphasis on low income strata.

2 BIS central bankers’ speeches

SBP has deepened global partnership with World Bank, Asian development bank and other

international and bilateral development agencies to make financial services accessible to the

unbanked population.

We will see the impacts of these initiatives in near future, which should create more opportunities

for the marginalized segment of the society, so they can play their part in the development of this

country.

At this point in time, you’re curious minds will have a lot of questions, some of them will be

answered by your mentors, some will be left unanswered, and for them you have to use your

imagination and knowledge. Some of you have already chosen a path for yourself and some of

you are yet to decide, questions like what field will be more appealing. In which organization you

will learn more? Should you apply in fast growing private sector or should you join public sector?

Should you apply for a job or pursue higher studies? Whatever you do, do it with utmost dedication

I am sure optimism, creative thinking and challenging conventional wisdom will help you achieve

your goals and lead you towards a more prosperous future.

Let me once again congratulate the graduates who have received their degrees today. I wish you

well in your future pursuits.

BIS central bankers’ speeches 3

You might also like

- Review Test Submission: Practice Quiz 1 - Module 1: Quizzes and TestsDocument97 pagesReview Test Submission: Practice Quiz 1 - Module 1: Quizzes and TestsPalak MehtaNo ratings yet

- Exercise 2 SolDocument3 pagesExercise 2 SolAlbiLikaNo ratings yet

- SECURITIZATION Role of The Trustee in Asset-BackedSecuritiesDocument12 pagesSECURITIZATION Role of The Trustee in Asset-BackedSecuritiesDinSFLANo ratings yet

- Challenges - and - Opportunities - To - Microfin 8Document5 pagesChallenges - and - Opportunities - To - Microfin 8Ammi DonNo ratings yet

- CSR As A Tool For Poverty Elevation in PakistanDocument3 pagesCSR As A Tool For Poverty Elevation in PakistanNote EightNo ratings yet

- Research Paper On Microfinance in India PDFDocument8 pagesResearch Paper On Microfinance in India PDFegya6qzc100% (1)

- The Future of Microfinance in IndiaDocument3 pagesThe Future of Microfinance in IndiaSurbhi AgarwalNo ratings yet

- Feasibility Study of Student LoanDocument38 pagesFeasibility Study of Student LoanAlauddin Ahmed Jahan100% (1)

- Thesis Microfinance IndiaDocument5 pagesThesis Microfinance IndiaHelpWithPaperWritingAlbuquerque100% (2)

- Financial InclusionDocument3 pagesFinancial Inclusionapi-3701467No ratings yet

- Modal TextDocument6 pagesModal TextdungptpNo ratings yet

- SK CH: Accelerating Financial InclusionDocument3 pagesSK CH: Accelerating Financial InclusionVinuthna PatibandlaNo ratings yet

- Research Paper Suhail Khakil 2010Document13 pagesResearch Paper Suhail Khakil 2010Khaki AudilNo ratings yet

- Indian Banking Sector Towards The Next OrbitDocument17 pagesIndian Banking Sector Towards The Next OrbitKalyan Raman VadlamaniNo ratings yet

- Regional Forum On "Emerging Opportunities and Challenges of Financial Inclusion in Asia-Pacific Region"Document5 pagesRegional Forum On "Emerging Opportunities and Challenges of Financial Inclusion in Asia-Pacific Region"digitalNo ratings yet

- The Future of Microfinance in IndiaDocument6 pagesThe Future of Microfinance in Indiaanushri2No ratings yet

- Health Benefits of Financial Inclusion A Literature ReviewDocument7 pagesHealth Benefits of Financial Inclusion A Literature Reviewl1wot1j1fon3No ratings yet

- Micro Finance and Small Enterprises Development: Client Perspective Study of Baluchistan, PakistanDocument14 pagesMicro Finance and Small Enterprises Development: Client Perspective Study of Baluchistan, PakistanYousaf KhanNo ratings yet

- Topic of The Week For Discussion: 12 To 18 March: Topic: Microfinance Sector in IndiaDocument2 pagesTopic of The Week For Discussion: 12 To 18 March: Topic: Microfinance Sector in Indiarockstar104No ratings yet

- Financial Inclusion in India Research Paper PDFDocument8 pagesFinancial Inclusion in India Research Paper PDFaflbtjglu100% (1)

- A Research Paper On RBI Branch Licensing Policy: "Branching" The Gap Between FinancialDocument13 pagesA Research Paper On RBI Branch Licensing Policy: "Branching" The Gap Between Financialgayatrimohanty05No ratings yet

- Aman-Mrinal Financial Management AssignmentDocument24 pagesAman-Mrinal Financial Management AssignmentAman KumarNo ratings yet

- Yaseen Anwar Speech Role of FIMs in EconomyDocument4 pagesYaseen Anwar Speech Role of FIMs in EconomyAijaz Mustafa HashmiNo ratings yet

- Microfinance: in Partial Fulfillment of The Requirements For The Degree ofDocument11 pagesMicrofinance: in Partial Fulfillment of The Requirements For The Degree ofpromilagoyalNo ratings yet

- Lucky - Financial InclusionDocument128 pagesLucky - Financial InclusionDinesh Nayak100% (1)

- Financial Inclusion - A Road India Needs To TravelDocument8 pagesFinancial Inclusion - A Road India Needs To Traveliysverya9256No ratings yet

- Dissertation Report On Microfinance in IndiaDocument6 pagesDissertation Report On Microfinance in IndiaPaySomeoneToDoMyPaperCorpusChristi100% (1)

- Financial Inclusion & Financial Literacy: SBI InitiativesDocument5 pagesFinancial Inclusion & Financial Literacy: SBI Initiativesprashaant4uNo ratings yet

- Vol 6, No 23 (2015)Document8 pagesVol 6, No 23 (2015)RezwanMNo ratings yet

- Mfi Obj.1Document13 pagesMfi Obj.1Anjum MehtabNo ratings yet

- Finance ProjectDocument6 pagesFinance ProjectPradeep Mib2022No ratings yet

- 7.P Syamala DeviDocument4 pages7.P Syamala DeviSachin SahooNo ratings yet

- Financial Inclusion in India: A Theoritical Assesment: ManagementDocument6 pagesFinancial Inclusion in India: A Theoritical Assesment: ManagementVidhi BansalNo ratings yet

- Fic Cir 14102011Document12 pagesFic Cir 14102011bindulijuNo ratings yet

- About Financial InclusionDocument5 pagesAbout Financial InclusionAhsan AliNo ratings yet

- Research Paper Financial InclusionDocument6 pagesResearch Paper Financial Inclusionlsfxofrif100% (1)

- Research Paper On Microfinance Institutions in IndiaDocument8 pagesResearch Paper On Microfinance Institutions in Indiafvfee39dNo ratings yet

- Newxx PDFDocument159 pagesNewxx PDFnehaprakash028No ratings yet

- Why Has Microfinance Been A Policy Success? Bangladesh and BeyondDocument17 pagesWhy Has Microfinance Been A Policy Success? Bangladesh and BeyondTanjeemNo ratings yet

- "Microfinance in India An Indepth Study": Project Proposal TitledDocument7 pages"Microfinance in India An Indepth Study": Project Proposal TitledAnkush AgrawalNo ratings yet

- Feature ArticleDocument4 pagesFeature Articlechan DesignsNo ratings yet

- Financial Inclusion: Corporate Finance ProjectDocument16 pagesFinancial Inclusion: Corporate Finance ProjectPallavi AgrawallaNo ratings yet

- K C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesDocument9 pagesK C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesAnamika Rai PandeyNo ratings yet

- MicrofinanceDocument58 pagesMicrofinanceSamuel Davis100% (1)

- FIBAC Report 2018 - tcm9 200791 PDFDocument84 pagesFIBAC Report 2018 - tcm9 200791 PDFShankar ShridharNo ratings yet

- Project On Micro FinanceDocument68 pagesProject On Micro FinanceKapil RaoNo ratings yet

- Banking Information Concept Banking Sector in UgandaDocument3 pagesBanking Information Concept Banking Sector in UgandaDakshesh PatelNo ratings yet

- Dissertation On Smes FinancingDocument5 pagesDissertation On Smes FinancingBuyPsychologyPapersTulsa100% (1)

- Thesis On Rural Banking in IndiaDocument7 pagesThesis On Rural Banking in IndiaBuyALiteratureReviewPaperHuntsville100% (2)

- Fs - Financial InclusionDocument7 pagesFs - Financial InclusionWasim SNo ratings yet

- Financial Inclusion - RBI - S InitiativesDocument12 pagesFinancial Inclusion - RBI - S Initiativessahil_saini298No ratings yet

- 100 % Financial Inclusion: A Challenging Task Ahead: Dr. Reena AgrawalDocument16 pages100 % Financial Inclusion: A Challenging Task Ahead: Dr. Reena AgrawalAashi Sharma100% (1)

- Microfinance in India - Growth and Present StatusDocument16 pagesMicrofinance in India - Growth and Present StatusIJOPAAR JOURNALNo ratings yet

- Thesis On Microfinance in IndiaDocument5 pagesThesis On Microfinance in IndiaOnlinePaperWritersUK100% (2)

- PRT 2Document54 pagesPRT 2muhammad.salman100No ratings yet

- The Truth of Micro Finance in PakistanDocument9 pagesThe Truth of Micro Finance in PakistanMuhammad Muneer AnsariNo ratings yet

- Financing of SSIs in Developing CountriesDocument5 pagesFinancing of SSIs in Developing CountriesMd Ajmal malikNo ratings yet

- ArticleDocument3 pagesArticleDebasish RoutNo ratings yet

- Financial Inclusion BrochureDocument24 pagesFinancial Inclusion BrochureAngie Henderson Moncada100% (1)

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Myanmar Financial Institutions LawDocument70 pagesMyanmar Financial Institutions LawNelson100% (1)

- ILPA Due Diligence Questionnaire ToolDocument27 pagesILPA Due Diligence Questionnaire ToolEthan BatraskiNo ratings yet

- Question Paper Co Operative Accounting of CampusDocument5 pagesQuestion Paper Co Operative Accounting of CampusJagadeesha Mohan71% (7)

- (PDF) Digested Cases - Compress PDFDocument102 pages(PDF) Digested Cases - Compress PDFJOJI ROBEDILLONo ratings yet

- Exhibit C Case 1. 12-Cv-03184-RJ 1-3Document12 pagesExhibit C Case 1. 12-Cv-03184-RJ 1-3JaniceWolkGrenadierNo ratings yet

- Loan Amort CalculatorDocument11 pagesLoan Amort CalculatorGeromil HernandezNo ratings yet

- Chap 12 - Cost of Capital - EditedDocument17 pagesChap 12 - Cost of Capital - EditedRusselle Therese Daitol100% (1)

- Discuss The Impact of Capitalizing Operating Leases On Value RelevanceDocument3 pagesDiscuss The Impact of Capitalizing Operating Leases On Value RelevanceKaiWenNgNo ratings yet

- Last Pay Certificate PDFDocument2 pagesLast Pay Certificate PDFMani kumar MaddelaNo ratings yet

- 1 Exercises On Swaps: 5:3% 5:4% Libor +0:6%Document6 pages1 Exercises On Swaps: 5:3% 5:4% Libor +0:6%Rimpy SondhNo ratings yet

- Femele 2Document9 pagesFemele 2nadiaNo ratings yet

- Chapter 3 (10th Edition) 2013Document37 pagesChapter 3 (10th Edition) 2013Nguyen Dac ThichNo ratings yet

- 2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFDocument1 page2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFVasanth Kumar AllaNo ratings yet

- WFT Ch17 SolutionsDocument32 pagesWFT Ch17 Solutionshappybebe69No ratings yet

- RB Patel Financial Report Analysis 2015 - 2019Document25 pagesRB Patel Financial Report Analysis 2015 - 2019Tea MatakibauNo ratings yet

- Comprehensive Problem Project ManagementDocument3 pagesComprehensive Problem Project ManagementAmir ParwarishNo ratings yet

- Princ-Ch24-02 Measuring Cost OflivingDocument29 pagesPrinc-Ch24-02 Measuring Cost OflivingnianiaNo ratings yet

- I M Pandey Financial Management Chapter 28Document3 pagesI M Pandey Financial Management Chapter 28Rushabh VoraNo ratings yet

- Terms Conditions Citi Speed Cash and Citi Balance Conversion Sodexo Promo2 PDFDocument2 pagesTerms Conditions Citi Speed Cash and Citi Balance Conversion Sodexo Promo2 PDFhoneylyncastro948yahoo.comNo ratings yet

- Vat BookDocument119 pagesVat BookgoldenslvrNo ratings yet

- Limitation Act, 1963 With Respect To IBC LawsDocument12 pagesLimitation Act, 1963 With Respect To IBC LawsVbs ReddyNo ratings yet

- ACT Invoice May PDFDocument2 pagesACT Invoice May PDFnagesh_kashyapNo ratings yet

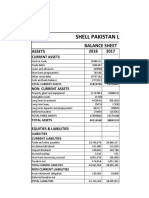

- Shell Pakistan LTD: Assets 2018 2017Document11 pagesShell Pakistan LTD: Assets 2018 2017mohammad bilalNo ratings yet

- ObliCon - 1275 To 1282Document4 pagesObliCon - 1275 To 1282LeaGabrielleAbbyFariolaNo ratings yet

- Nestle Financial AnalysisDocument35 pagesNestle Financial AnalysisAisha Chohan100% (1)

- Farmers ClubDocument25 pagesFarmers Clubbhumika16490No ratings yet

- Account StatementDocument10 pagesAccount StatementPuBg FreakNo ratings yet