Professional Documents

Culture Documents

Canara Robeco Emerging Equities: For Private Circulation

Canara Robeco Emerging Equities: For Private Circulation

Uploaded by

Aadeesh JainCopyright:

Available Formats

You might also like

- FX Risk Hedging at EADSDocument14 pagesFX Risk Hedging at EADSAlexandra Ermakova100% (1)

- OceanLink Partners Q1 2019 LetterDocument14 pagesOceanLink Partners Q1 2019 LetterKan ZhouNo ratings yet

- National Hard Money Lender DirectoryDocument5 pagesNational Hard Money Lender Directoryolivexa100% (1)

- Frank Spence ValuationDocument2 pagesFrank Spence ValuationShivam AryaNo ratings yet

- Indus Way - 100069 PDFDocument2 pagesIndus Way - 100069 PDFAadeesh JainNo ratings yet

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- Invest in Mid Cap Fund - UTI Equity Mutual FundsDocument2 pagesInvest in Mid Cap Fund - UTI Equity Mutual FundsRinku MishraNo ratings yet

- India's No.1 Portfolio Management Services PortalDocument1 pageIndia's No.1 Portfolio Management Services Portalrahul patelNo ratings yet

- Product Snapshot: DSP 10Y G-Sec FundDocument2 pagesProduct Snapshot: DSP 10Y G-Sec FundManoj SharmaNo ratings yet

- 824e0 Leaflet Motilal Oswal Nifty Microcap 250 Index Fund One Pager RD Feb 2024Document2 pages824e0 Leaflet Motilal Oswal Nifty Microcap 250 Index Fund One Pager RD Feb 2024final bossuNo ratings yet

- Tatton Tracker Active Quarterly Report Oct-Dec 19Document6 pagesTatton Tracker Active Quarterly Report Oct-Dec 19Danny DawsonNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- SATop 40 SharesDocument2 pagesSATop 40 Sharesleratomsimanga04No ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- PMSGDSEP2022Document292 pagesPMSGDSEP2022Rohan ShahNo ratings yet

- Compare Fund - MutualfundindiaDocument2 pagesCompare Fund - MutualfundindiaSujesh SasiNo ratings yet

- DSP Mid Cap Fund Aug 2023Document7 pagesDSP Mid Cap Fund Aug 2023RajNo ratings yet

- October 2020 FactsheetDocument2 pagesOctober 2020 FactsheetMohit AgarwalNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- Marcellus Rising Giants PMS: JANUARY 2022Document21 pagesMarcellus Rising Giants PMS: JANUARY 2022Devraj DashNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- Nippon India Banking and Financial Services FundDocument1 pageNippon India Banking and Financial Services FundKunik SwaroopNo ratings yet

- Our Mission..... Your Growth: Team Code: JusticiaDocument28 pagesOur Mission..... Your Growth: Team Code: JusticiaParth KakadeNo ratings yet

- Model Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue CalculationDocument41 pagesModel Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue Calculationavinash singhNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- HR Team Day Out - May 2012 v3Document61 pagesHR Team Day Out - May 2012 v3sashaNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- Portfolios Factsheet: Fund Objective Fund DetailsDocument1 pagePortfolios Factsheet: Fund Objective Fund DetailsJ. BangjakNo ratings yet

- VPC - Accelerated Growth FundDocument1 pageVPC - Accelerated Growth FundKareemAdams9029No ratings yet

- Equitas Small Finance Bank Company UpdateDocument10 pagesEquitas Small Finance Bank Company Updatefinal bossuNo ratings yet

- Marcellus Rising-Giants-PMS Direct 10dec21Document21 pagesMarcellus Rising-Giants-PMS Direct 10dec21maina00000No ratings yet

- Karma - Capital - Domestic Factsheet-November - 2023 FinalDocument18 pagesKarma - Capital - Domestic Factsheet-November - 2023 FinalDeepan KapadiaNo ratings yet

- Uti Equity Fund: Why Multi Cap Funds?Document2 pagesUti Equity Fund: Why Multi Cap Funds?Suresh DhanasekarNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- For Those Who Play To Win.: Midcap Fund Midcap FundDocument4 pagesFor Those Who Play To Win.: Midcap Fund Midcap FundABCNo ratings yet

- Parag Parikh Flexi Cap FundDocument3 pagesParag Parikh Flexi Cap Fundtusharkhatri728No ratings yet

- RPCF May 2014 (English)Document1 pageRPCF May 2014 (English)Anonymous fS6Znc9No ratings yet

- Presentation 1Document9 pagesPresentation 1Zubair KhanNo ratings yet

- HTHB KLDocument7 pagesHTHB KLypNo ratings yet

- FM304 Franchise ModelDocument4 pagesFM304 Franchise ModelPinki AgarwalNo ratings yet

- DebtDocument9 pagesDebtapi-3705377No ratings yet

- Morning Star Report 20190726102823Document1 pageMorning Star Report 20190726102823YumyumNo ratings yet

- Icici Prudential Equity and Debt Fund Direct PlanDocument1 pageIcici Prudential Equity and Debt Fund Direct Planrohitgoyal_ddsNo ratings yet

- HDFC Life Presentation - H1 FY19 - F PDFDocument43 pagesHDFC Life Presentation - H1 FY19 - F PDFMaithili SUBRAMANIANNo ratings yet

- Fund Allocation Investment Objective: Pami Equity Index Fund, IncDocument1 pageFund Allocation Investment Objective: Pami Equity Index Fund, IncRamil MontealtoNo ratings yet

- Ambit Good & Clean Midcap Portfolio September 2020: Asset ManagementDocument20 pagesAmbit Good & Clean Midcap Portfolio September 2020: Asset ManagementVinay T MNo ratings yet

- OpenView 2019 SaaS Benchmarks Report PDFDocument64 pagesOpenView 2019 SaaS Benchmarks Report PDFyann2No ratings yet

- Quarterly Report - September 2021Document6 pagesQuarterly Report - September 2021Chaitanya JagarlapudiNo ratings yet

- MIEF-factsheet 230320 152602Document3 pagesMIEF-factsheet 230320 152602ryanbud96No ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- Move With The Markets: Motilal Oswal Nifty 200 Momentum 30 ETFDocument2 pagesMove With The Markets: Motilal Oswal Nifty 200 Momentum 30 ETFfirstname lastnameNo ratings yet

- R&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Document3 pagesR&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Jaspreet SinghNo ratings yet

- Earnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - NsDocument34 pagesEarnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - Nssunil.dasarath jadhavNo ratings yet

- Debt FundDocument8 pagesDebt Fundapi-3705377No ratings yet

- Sip Presentation - May 2020Document40 pagesSip Presentation - May 2020DBCGNo ratings yet

- Samriddhi Factsheet Dec2020Document1 pageSamriddhi Factsheet Dec2020DerickNo ratings yet

- 360 ONE Equity Opportunity Fund - Apr24Document2 pages360 ONE Equity Opportunity Fund - Apr24speedenquiryNo ratings yet

- Financial Modelling ReportDocument15 pagesFinancial Modelling ReportakshaynamsaniNo ratings yet

- Quarterly Update - June 2021Document5 pagesQuarterly Update - June 2021Chaitanya Jagarlapudi100% (1)

- Check List of Documents For NRIDocument1 pageCheck List of Documents For NRIAadeesh JainNo ratings yet

- Check List of Documents For Demat RIDocument1 pageCheck List of Documents For Demat RIAadeesh JainNo ratings yet

- Overnight Funds - May' 20Document2 pagesOvernight Funds - May' 20Aadeesh JainNo ratings yet

- AbhayDocument2 pagesAbhayAadeesh JainNo ratings yet

- UTI Income SchemeDocument10 pagesUTI Income SchemeAadeesh JainNo ratings yet

- HDFC Children Fund FormDocument6 pagesHDFC Children Fund FormAadeesh JainNo ratings yet

- Indus Way - Q4FY18 - Investor UpdateDocument21 pagesIndus Way - Q4FY18 - Investor UpdateAadeesh JainNo ratings yet

- Official Sample Paper For Phase 2 Exam: With Answers and Detailed SolutionsDocument21 pagesOfficial Sample Paper For Phase 2 Exam: With Answers and Detailed SolutionsAadeesh JainNo ratings yet

- 8 TH June 2018 Mutual Fund TrackerDocument221 pages8 TH June 2018 Mutual Fund TrackerAadeesh JainNo ratings yet

- Financial/ Securities Markets Notes: For Sebi Grade A & Rbi Grade BDocument10 pagesFinancial/ Securities Markets Notes: For Sebi Grade A & Rbi Grade BAadeesh JainNo ratings yet

- Edge360 FAQDocument6 pagesEdge360 FAQAadeesh JainNo ratings yet

- BSE Scheme Master For PhysicalDocument309 pagesBSE Scheme Master For PhysicalAadeesh JainNo ratings yet

- Credit Rating Agencies in India: All Banking and Government ExamsDocument6 pagesCredit Rating Agencies in India: All Banking and Government ExamsAadeesh JainNo ratings yet

- Alternate Sources OF Finance: FOR RBI Grade B ExamDocument9 pagesAlternate Sources OF Finance: FOR RBI Grade B ExamAadeesh JainNo ratings yet

- Banking Regulations Basel Norms1590249674403 PDFDocument10 pagesBanking Regulations Basel Norms1590249674403 PDFAadeesh JainNo ratings yet

- Application: Type of AccountDocument2 pagesApplication: Type of AccountL&R WingNo ratings yet

- 25.ecb & FdiDocument4 pages25.ecb & FdimercatuzNo ratings yet

- IBA, Main Campus: Regulations of Financial MarketsDocument50 pagesIBA, Main Campus: Regulations of Financial MarketsOmer CrestianiNo ratings yet

- Multi FactorDocument22 pagesMulti FactorAnanda Rea KasanaNo ratings yet

- The Net Present Value of Mudharabah And: Musharakah ModelsDocument22 pagesThe Net Present Value of Mudharabah And: Musharakah ModelsmohsinbilalNo ratings yet

- Advanced Accounting: Intercompany Profit Transactions - BondsDocument27 pagesAdvanced Accounting: Intercompany Profit Transactions - BondsDims DimsNo ratings yet

- HLA Cash Fund Jan 23 PDFDocument3 pagesHLA Cash Fund Jan 23 PDFIvy VooNo ratings yet

- Cash Management ReportDocument118 pagesCash Management Reportkamdica85% (20)

- Us Postal CardsDocument6 pagesUs Postal Cardsapi-242424864No ratings yet

- Formule Corporate FinanceDocument6 pagesFormule Corporate FinanceБота Омарова100% (1)

- Class 12 Macro Economics Chapter 5 - Revision NotesDocument4 pagesClass 12 Macro Economics Chapter 5 - Revision NotesROHIT SHANo ratings yet

- Tax Computation Part 1Document15 pagesTax Computation Part 1Neema EzekielNo ratings yet

- Samarth PDFDocument5 pagesSamarth PDFsamarth jariwalaNo ratings yet

- Financial RiskDocument8 pagesFinancial RiskAnusha ButtNo ratings yet

- 10 Ways To Deal With Car Salesmen Successfully... !!!Document4 pages10 Ways To Deal With Car Salesmen Successfully... !!!a rahNo ratings yet

- Chapter2 - Audit in ReceivablesDocument35 pagesChapter2 - Audit in ReceivablesVidia Ayu Kusuma100% (1)

- 01 Course Notes On InvestmentsDocument6 pages01 Course Notes On InvestmentsMaxin TanNo ratings yet

- Basel Norms For BankingDocument5 pagesBasel Norms For BankingAkshat PrakashNo ratings yet

- SystemGeneratedPayReceipt 1625429581Document2 pagesSystemGeneratedPayReceipt 1625429581Just A DudeNo ratings yet

- E BankingDocument10 pagesE BankingsureshsusiNo ratings yet

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- Financial Accounting and Reporting IDocument5 pagesFinancial Accounting and Reporting IKim Cristian Maaño50% (2)

- Account Statement From 1 Jul 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jul 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancepratibha guptaNo ratings yet

- 7110 s12 Ms 21Document7 pages7110 s12 Ms 21mstudy123456No ratings yet

- SAP Order To Cash Cycle Journal Entries With ScreenshotDocument3 pagesSAP Order To Cash Cycle Journal Entries With ScreenshotDevesh ChangoiwalaNo ratings yet

- Fresh Schedule 2021Document268 pagesFresh Schedule 2021bagas waraNo ratings yet

- Study On Call Money & Commercial Paper MarketDocument28 pagesStudy On Call Money & Commercial Paper MarketVarun Puri100% (2)

Canara Robeco Emerging Equities: For Private Circulation

Canara Robeco Emerging Equities: For Private Circulation

Uploaded by

Aadeesh JainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Canara Robeco Emerging Equities: For Private Circulation

Canara Robeco Emerging Equities: For Private Circulation

Uploaded by

Aadeesh JainCopyright:

Available Formats

Canara Robeco Emerging Equities For Private Circulation

Large & Mid Cap Fund - An open ended equity scheme investing in both large cap and mid cap stocks for Distributor’s only

Canara Robeco Emerging Equities being an open ended large & mid cap fund, follows a bottom-up approach to predominantly invest in a well

diversified portfolio of companies within large & mid cap universe. The fund endeavours to identify the stars of tomorrow within the segment.

Month-end AUM: Rs. 5596.46 crs Data as on 28th Feb’20

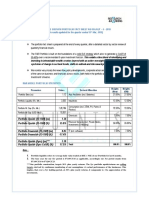

SIP Performance (Rs.10,000 invested every month)^

Canara Robeco Nifty Large Midcap 250

Particulars Total Amt invested (INR) Market Value (INR) S&P BSE Sensex TRI##

Emerging Equities TRI #

1 year 1,20,000 1,28,351 13.28% -0.59% -2.19%

3 years 3,60,000 3,95,422 6.21% 1.96% 6.67%

5 years 6,00,000 7,79,547 10.43% 7.06% 9.26%

7 years 8,40,000 15,45,522 17.13% 10.66% 10.15%

10 years 12,00,000 31,33,966 18.27% 11.50% 10.51%

Since Inception 18,00,000 75,66,420 17.35% N.A 11.14%

Inception Date : Canara Robeco Emerging Equity – Reg - Growth Plan is 11-Mar-05

Long Term Performance (CAGR)

Top 5 Sectors

Canara Robeco

NIFTY Large Outperformance/

Particulars Emerging Consumer Non Durables |

Midcap 250 TRI Underperformance

Equities 6.30%

1 years 12.80 5.13 7.67 Software | 6.30%

3 years 10.34 7.43 2.91 Finance | 9.35%

5 years 11.18 7.56 3.62 Pharmaceuticals | 9.40%

10 years 18.66 11.11 7.55

Banks | 22.90%

Since Inception 16.56 N.A. N.A.

0% 5% 10% 15% 20% 25%

Portfolio Quants Market Capitalization (%)

3.51%

Standard Deviation 15.79

Large Cap

5.18%

Portfolio Beta 0.95

Mid Cap

Portfolio Turnover Ratio 0.59 times 47.36%

43.95% Small Cap

R-Squared 0.89

Debt, Cash &

Sharpe Ratio 0.46 Others

Top Holdings Industry Classification % of Net Assets Portfolio Snapshot

HDFC Bank Ltd Banks 6.56% Total No. of Stocks 56

ICICI Bank Ltd Banks 5.75% Top Stock Holding (%) 6.56%

Axis Bank Ltd Banks 3.73% Top 10 Stocks Holding (%) 35.16%

Reliance Industries Ltd Petroleum Products 3.68% Top 3 Industries (%) 41.65%

Kotak Mahindra Bank Ltd Banks 2.92% Top 5 Industries (%) 54.25%

^Past performance may or may not be sustained in the future. SIP investment date is taken to be 1st of the month or subsequent day if 1st is a holiday and investment of

Rs.10,000 is taken and are in CAGR. The calculations are based on the Regular Plan-Growth Option NAVs. # Scheme Benchmark , ##Additional benchmark. $ Source: MFI Explorer, ICRA Online.

Different plans have a different expense structure. The past performance may or may not be sustained in the future. Returns are based on growth NAV of Regular plan and are calculated on

compounded annualized basis for a period of more than (or equal to) a year and absolute basis for a period less than a year. The current fund manager Mr. Miyush Gandhi is managing the

scheme since 5-April-2018 and Mr. Shridatta Bhandwaldar is managing the scheme since 01-October-19. For the performance of other funds managed by fund manager of Canara Robeco

Emerging Equities kindly visit: https://www.canararobeco.com/forms-downloads/forms-and-information-documents/information-document/factsheets

The information used towards formulating the outlook have been obtained from sources published by third parties. While such publications are believed to be reliable, however, neither the

AMC, its officers, the trustees, the Fund nor any of their affiliates or representatives assume any responsibility for the accuracy of such information and assume no financial liability whatsoever to

the user of this document. The information contained herein is only for the reading/understanding of the registered Advisors/Distributors and should not be circulated to investors /prospective

investors. The document is solely for the information and understanding of intended recipients only. Internal views, estimates, opinions expressed herein may or may not materialize. These

views, estimates, opinions alone are not sufficient and should not be used for the development or implementation of an investment strategy. Forward looking statements are based on internal

views and assumptions and subject to known and unknown risks and uncertainties which could materially impact or differ the actual results or performance from those expressed or implied

under those statements.

Mutual Fund investments are subject to market risks, read all Scheme related documents carefully.

You might also like

- FX Risk Hedging at EADSDocument14 pagesFX Risk Hedging at EADSAlexandra Ermakova100% (1)

- OceanLink Partners Q1 2019 LetterDocument14 pagesOceanLink Partners Q1 2019 LetterKan ZhouNo ratings yet

- National Hard Money Lender DirectoryDocument5 pagesNational Hard Money Lender Directoryolivexa100% (1)

- Frank Spence ValuationDocument2 pagesFrank Spence ValuationShivam AryaNo ratings yet

- Indus Way - 100069 PDFDocument2 pagesIndus Way - 100069 PDFAadeesh JainNo ratings yet

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- Invest in Mid Cap Fund - UTI Equity Mutual FundsDocument2 pagesInvest in Mid Cap Fund - UTI Equity Mutual FundsRinku MishraNo ratings yet

- India's No.1 Portfolio Management Services PortalDocument1 pageIndia's No.1 Portfolio Management Services Portalrahul patelNo ratings yet

- Product Snapshot: DSP 10Y G-Sec FundDocument2 pagesProduct Snapshot: DSP 10Y G-Sec FundManoj SharmaNo ratings yet

- 824e0 Leaflet Motilal Oswal Nifty Microcap 250 Index Fund One Pager RD Feb 2024Document2 pages824e0 Leaflet Motilal Oswal Nifty Microcap 250 Index Fund One Pager RD Feb 2024final bossuNo ratings yet

- Tatton Tracker Active Quarterly Report Oct-Dec 19Document6 pagesTatton Tracker Active Quarterly Report Oct-Dec 19Danny DawsonNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- SATop 40 SharesDocument2 pagesSATop 40 Sharesleratomsimanga04No ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- PMSGDSEP2022Document292 pagesPMSGDSEP2022Rohan ShahNo ratings yet

- Compare Fund - MutualfundindiaDocument2 pagesCompare Fund - MutualfundindiaSujesh SasiNo ratings yet

- DSP Mid Cap Fund Aug 2023Document7 pagesDSP Mid Cap Fund Aug 2023RajNo ratings yet

- October 2020 FactsheetDocument2 pagesOctober 2020 FactsheetMohit AgarwalNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- Marcellus Rising Giants PMS: JANUARY 2022Document21 pagesMarcellus Rising Giants PMS: JANUARY 2022Devraj DashNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- Nippon India Banking and Financial Services FundDocument1 pageNippon India Banking and Financial Services FundKunik SwaroopNo ratings yet

- Our Mission..... Your Growth: Team Code: JusticiaDocument28 pagesOur Mission..... Your Growth: Team Code: JusticiaParth KakadeNo ratings yet

- Model Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue CalculationDocument41 pagesModel Content: Input Capital Schedules Capital Expenditures & Depreciation Operational Expenses Revenue Calculationavinash singhNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- HR Team Day Out - May 2012 v3Document61 pagesHR Team Day Out - May 2012 v3sashaNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- Portfolios Factsheet: Fund Objective Fund DetailsDocument1 pagePortfolios Factsheet: Fund Objective Fund DetailsJ. BangjakNo ratings yet

- VPC - Accelerated Growth FundDocument1 pageVPC - Accelerated Growth FundKareemAdams9029No ratings yet

- Equitas Small Finance Bank Company UpdateDocument10 pagesEquitas Small Finance Bank Company Updatefinal bossuNo ratings yet

- Marcellus Rising-Giants-PMS Direct 10dec21Document21 pagesMarcellus Rising-Giants-PMS Direct 10dec21maina00000No ratings yet

- Karma - Capital - Domestic Factsheet-November - 2023 FinalDocument18 pagesKarma - Capital - Domestic Factsheet-November - 2023 FinalDeepan KapadiaNo ratings yet

- Uti Equity Fund: Why Multi Cap Funds?Document2 pagesUti Equity Fund: Why Multi Cap Funds?Suresh DhanasekarNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- For Those Who Play To Win.: Midcap Fund Midcap FundDocument4 pagesFor Those Who Play To Win.: Midcap Fund Midcap FundABCNo ratings yet

- Parag Parikh Flexi Cap FundDocument3 pagesParag Parikh Flexi Cap Fundtusharkhatri728No ratings yet

- RPCF May 2014 (English)Document1 pageRPCF May 2014 (English)Anonymous fS6Znc9No ratings yet

- Presentation 1Document9 pagesPresentation 1Zubair KhanNo ratings yet

- HTHB KLDocument7 pagesHTHB KLypNo ratings yet

- FM304 Franchise ModelDocument4 pagesFM304 Franchise ModelPinki AgarwalNo ratings yet

- DebtDocument9 pagesDebtapi-3705377No ratings yet

- Morning Star Report 20190726102823Document1 pageMorning Star Report 20190726102823YumyumNo ratings yet

- Icici Prudential Equity and Debt Fund Direct PlanDocument1 pageIcici Prudential Equity and Debt Fund Direct Planrohitgoyal_ddsNo ratings yet

- HDFC Life Presentation - H1 FY19 - F PDFDocument43 pagesHDFC Life Presentation - H1 FY19 - F PDFMaithili SUBRAMANIANNo ratings yet

- Fund Allocation Investment Objective: Pami Equity Index Fund, IncDocument1 pageFund Allocation Investment Objective: Pami Equity Index Fund, IncRamil MontealtoNo ratings yet

- Ambit Good & Clean Midcap Portfolio September 2020: Asset ManagementDocument20 pagesAmbit Good & Clean Midcap Portfolio September 2020: Asset ManagementVinay T MNo ratings yet

- OpenView 2019 SaaS Benchmarks Report PDFDocument64 pagesOpenView 2019 SaaS Benchmarks Report PDFyann2No ratings yet

- Quarterly Report - September 2021Document6 pagesQuarterly Report - September 2021Chaitanya JagarlapudiNo ratings yet

- MIEF-factsheet 230320 152602Document3 pagesMIEF-factsheet 230320 152602ryanbud96No ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- Move With The Markets: Motilal Oswal Nifty 200 Momentum 30 ETFDocument2 pagesMove With The Markets: Motilal Oswal Nifty 200 Momentum 30 ETFfirstname lastnameNo ratings yet

- R&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Document3 pagesR&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Jaspreet SinghNo ratings yet

- Earnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - NsDocument34 pagesEarnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - Nssunil.dasarath jadhavNo ratings yet

- Debt FundDocument8 pagesDebt Fundapi-3705377No ratings yet

- Sip Presentation - May 2020Document40 pagesSip Presentation - May 2020DBCGNo ratings yet

- Samriddhi Factsheet Dec2020Document1 pageSamriddhi Factsheet Dec2020DerickNo ratings yet

- 360 ONE Equity Opportunity Fund - Apr24Document2 pages360 ONE Equity Opportunity Fund - Apr24speedenquiryNo ratings yet

- Financial Modelling ReportDocument15 pagesFinancial Modelling ReportakshaynamsaniNo ratings yet

- Quarterly Update - June 2021Document5 pagesQuarterly Update - June 2021Chaitanya Jagarlapudi100% (1)

- Check List of Documents For NRIDocument1 pageCheck List of Documents For NRIAadeesh JainNo ratings yet

- Check List of Documents For Demat RIDocument1 pageCheck List of Documents For Demat RIAadeesh JainNo ratings yet

- Overnight Funds - May' 20Document2 pagesOvernight Funds - May' 20Aadeesh JainNo ratings yet

- AbhayDocument2 pagesAbhayAadeesh JainNo ratings yet

- UTI Income SchemeDocument10 pagesUTI Income SchemeAadeesh JainNo ratings yet

- HDFC Children Fund FormDocument6 pagesHDFC Children Fund FormAadeesh JainNo ratings yet

- Indus Way - Q4FY18 - Investor UpdateDocument21 pagesIndus Way - Q4FY18 - Investor UpdateAadeesh JainNo ratings yet

- Official Sample Paper For Phase 2 Exam: With Answers and Detailed SolutionsDocument21 pagesOfficial Sample Paper For Phase 2 Exam: With Answers and Detailed SolutionsAadeesh JainNo ratings yet

- 8 TH June 2018 Mutual Fund TrackerDocument221 pages8 TH June 2018 Mutual Fund TrackerAadeesh JainNo ratings yet

- Financial/ Securities Markets Notes: For Sebi Grade A & Rbi Grade BDocument10 pagesFinancial/ Securities Markets Notes: For Sebi Grade A & Rbi Grade BAadeesh JainNo ratings yet

- Edge360 FAQDocument6 pagesEdge360 FAQAadeesh JainNo ratings yet

- BSE Scheme Master For PhysicalDocument309 pagesBSE Scheme Master For PhysicalAadeesh JainNo ratings yet

- Credit Rating Agencies in India: All Banking and Government ExamsDocument6 pagesCredit Rating Agencies in India: All Banking and Government ExamsAadeesh JainNo ratings yet

- Alternate Sources OF Finance: FOR RBI Grade B ExamDocument9 pagesAlternate Sources OF Finance: FOR RBI Grade B ExamAadeesh JainNo ratings yet

- Banking Regulations Basel Norms1590249674403 PDFDocument10 pagesBanking Regulations Basel Norms1590249674403 PDFAadeesh JainNo ratings yet

- Application: Type of AccountDocument2 pagesApplication: Type of AccountL&R WingNo ratings yet

- 25.ecb & FdiDocument4 pages25.ecb & FdimercatuzNo ratings yet

- IBA, Main Campus: Regulations of Financial MarketsDocument50 pagesIBA, Main Campus: Regulations of Financial MarketsOmer CrestianiNo ratings yet

- Multi FactorDocument22 pagesMulti FactorAnanda Rea KasanaNo ratings yet

- The Net Present Value of Mudharabah And: Musharakah ModelsDocument22 pagesThe Net Present Value of Mudharabah And: Musharakah ModelsmohsinbilalNo ratings yet

- Advanced Accounting: Intercompany Profit Transactions - BondsDocument27 pagesAdvanced Accounting: Intercompany Profit Transactions - BondsDims DimsNo ratings yet

- HLA Cash Fund Jan 23 PDFDocument3 pagesHLA Cash Fund Jan 23 PDFIvy VooNo ratings yet

- Cash Management ReportDocument118 pagesCash Management Reportkamdica85% (20)

- Us Postal CardsDocument6 pagesUs Postal Cardsapi-242424864No ratings yet

- Formule Corporate FinanceDocument6 pagesFormule Corporate FinanceБота Омарова100% (1)

- Class 12 Macro Economics Chapter 5 - Revision NotesDocument4 pagesClass 12 Macro Economics Chapter 5 - Revision NotesROHIT SHANo ratings yet

- Tax Computation Part 1Document15 pagesTax Computation Part 1Neema EzekielNo ratings yet

- Samarth PDFDocument5 pagesSamarth PDFsamarth jariwalaNo ratings yet

- Financial RiskDocument8 pagesFinancial RiskAnusha ButtNo ratings yet

- 10 Ways To Deal With Car Salesmen Successfully... !!!Document4 pages10 Ways To Deal With Car Salesmen Successfully... !!!a rahNo ratings yet

- Chapter2 - Audit in ReceivablesDocument35 pagesChapter2 - Audit in ReceivablesVidia Ayu Kusuma100% (1)

- 01 Course Notes On InvestmentsDocument6 pages01 Course Notes On InvestmentsMaxin TanNo ratings yet

- Basel Norms For BankingDocument5 pagesBasel Norms For BankingAkshat PrakashNo ratings yet

- SystemGeneratedPayReceipt 1625429581Document2 pagesSystemGeneratedPayReceipt 1625429581Just A DudeNo ratings yet

- E BankingDocument10 pagesE BankingsureshsusiNo ratings yet

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- Financial Accounting and Reporting IDocument5 pagesFinancial Accounting and Reporting IKim Cristian Maaño50% (2)

- Account Statement From 1 Jul 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jul 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancepratibha guptaNo ratings yet

- 7110 s12 Ms 21Document7 pages7110 s12 Ms 21mstudy123456No ratings yet

- SAP Order To Cash Cycle Journal Entries With ScreenshotDocument3 pagesSAP Order To Cash Cycle Journal Entries With ScreenshotDevesh ChangoiwalaNo ratings yet

- Fresh Schedule 2021Document268 pagesFresh Schedule 2021bagas waraNo ratings yet

- Study On Call Money & Commercial Paper MarketDocument28 pagesStudy On Call Money & Commercial Paper MarketVarun Puri100% (2)