Professional Documents

Culture Documents

23 PF

23 PF

Uploaded by

Sunil PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

23 PF

23 PF

Uploaded by

Sunil PatelCopyright:

Available Formats

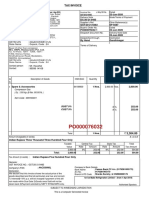

Tax Invoice (ORIGINAL FOR RECIPIENT)

Rubik Infotech Pvt Ltd Invoice No. Dated

206, 2nd Floor PRIMATE

Opp Gormoh Restaurant

RIPL/20-21/0326 1-Sep-2020

Off Judges Bunglows, Delivery Note Mode/Terms of Payment

Bodakdev, Ahmedabad

Phone : 079-26872516/17 7 Days from bill date

GSTIN/UIN: 24AAFCR4189P1ZP

State Name : Gujarat, Code : 24 Supplier's Ref. Other Reference(s)

CIN: U52334GJ2011PTC065769

E-Mail : account@rubikinfotech.com

Buyer's Order No. Dated

Buyer

M/s HRPL RESTAURANTS PRIVATE LIMITED PO000076243-2 26-Jun-2020

Despatch Document No. Delivery Note Date

12,13 Floor, 1201-1204,1301-1302,

Elenza Vertax, Sindhu Bhavan Road, Bodakdev

Ahmedabad - 380059 Despatched through Destination

GSTIN/UIN : 24AAHCR3681C1ZJ E-License Ahmedabad

State Name : Gujarat, Code : 24 Terms of Delivery

Sl Description of HSN/SAC Quantity Rate per Amount

No. Services

1 MICROSOFT OFFICE 365 Cloud-1 9973 110 pcs 98.00 pcs 10,780.00

Microsoft 365 business basic

subscription

2 MICROSOFT OFFICE 365 Cloud-1 9973 52 pcs 521.00 pcs 27,092.00

Microsoft 365 business

Standard subscription

.

Form:1-09-2020 to 30-09-2020

37,872.00

CGST@9% 9 % 3,408.48

SGST@9% 9 % 3,408.48

R/o 0.04

We hereby confirm that TDS Has been deducted under Section 194J,

under section 197A of Income Tax Act,1961.The TDS to be deducted

against the material supplied under this invoice has been deposited

under PAN AABCC4077F by The holder of the PAN Mentioned and

No be deducted on this Invoices per notification No.21/2012

dated-13/06/2012Of the Ministry of Finance

Total 162 pcs ₹ 44,689.00

Amount Chargeable (in words) E. & O.E

Indian Rupees Forty Four Thousand Six Hundred Eighty Nine Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

9973 37,872.00 9% 3,408.48 9% 3,408.48 6,816.96

Total 37,872.00 3,408.48 3,408.48 6,816.96

Tax Amount (in words) : Indian Rupees Six Thousand Eight Hundred Sixteen and Ninety Six paise

Only

Company's PAN : AAFCR4189P

Declaration

1) Our Resposibility ceases on delivery of the goods to Company's Bank Details

customer. 2) Goods once sold will not be taken back. Bank Name : HDFC Bank-002418

3) Payment should be made strictly as per terms A/c No. : 07832560002418

mentioned. 4) Subject to Ahmedabad Jurisdication. Branch & IFS Code : Bodakdev & HDFC0000783

Digitally signed by for Rubik Infotech Pvt Ltd

5) Interest @ 24% PA will be charged from the date of

Invoice for delayed payment.6)any change required in JITESH JITESH CHAUHAN

the bill should be intimated within 7 days of the date of

billing.

CHAUHAN Date: 2020.09.01

17:35:26 +05'30' Authorised Signatory

SUBJECT TO AHMEDABAD JURISDICTION

This is a Computer Generated Invoice

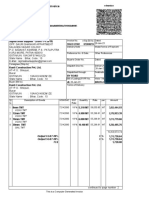

Tax Invoice (EXTRA COPY)

Rubik Infotech Pvt Ltd Invoice No. Dated

206, 2nd Floor PRIMATE

Opp Gormoh Restaurant

RIPL/20-21/0326 1-Sep-2020

Off Judges Bunglows, Delivery Note Mode/Terms of Payment

Bodakdev, Ahmedabad

Phone : 079-26872516/17 7 Days from bill date

GSTIN/UIN: 24AAFCR4189P1ZP

State Name : Gujarat, Code : 24 Supplier's Ref. Other Reference(s)

CIN: U52334GJ2011PTC065769

E-Mail : account@rubikinfotech.com

Buyer's Order No. Dated

Buyer

M/s HRPL RESTAURANTS PRIVATE LIMITED PO000076243-2 26-Jun-2020

Despatch Document No. Delivery Note Date

12,13 Floor, 1201-1204,1301-1302,

Elenza Vertax, Sindhu Bhavan Road, Bodakdev

Ahmedabad - 380059 Despatched through Destination

GSTIN/UIN : 24AAHCR3681C1ZJ E-License Ahmedabad

State Name : Gujarat, Code : 24 Terms of Delivery

Sl Description of HSN/SAC Quantity Rate per Amount

No. Services

1 MICROSOFT OFFICE 365 Cloud-1 9973 110 pcs 98.00 pcs 10,780.00

Microsoft 365 business basic

subscription

2 MICROSOFT OFFICE 365 Cloud-1 9973 52 pcs 521.00 pcs 27,092.00

Microsoft 365 business

Standard subscription

.

Form:1-09-2020 to 30-09-2020

37,872.00

CGST@9% 9 % 3,408.48

SGST@9% 9 % 3,408.48

R/o 0.04

We hereby confirm that TDS Has been deducted under Section 194J,

under section 197A of Income Tax Act,1961.The TDS to be deducted

against the material supplied under this invoice has been deposited

under PAN AABCC4077F by The holder of the PAN Mentioned and

No be deducted on this Invoices per notification No.21/2012

dated-13/06/2012Of the Ministry of Finance

Total 162 pcs ₹ 44,689.00

Amount Chargeable (in words) E. & O.E

Indian Rupees Forty Four Thousand Six Hundred Eighty Nine Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

9973 37,872.00 9% 3,408.48 9% 3,408.48 6,816.96

Total 37,872.00 3,408.48 3,408.48 6,816.96

Tax Amount (in words) : Indian Rupees Six Thousand Eight Hundred Sixteen and Ninety Six paise

Only

Company's PAN : AAFCR4189P

Declaration

1) Our Resposibility ceases on delivery of the goods to Company's Bank Details

customer. 2) Goods once sold will not be taken back. Bank Name : HDFC Bank-002418

3) Payment should be made strictly as per terms A/c No. : 07832560002418

mentioned. 4) Subject to Ahmedabad Jurisdication. Branch & IFS Code : Bodakdev & HDFC0000783

Digitally signed by for Rubik Infotech Pvt Ltd

5) Interest @ 24% PA will be charged from the date of

Invoice for delayed payment.6)any change required in JITESH JITESH CHAUHAN

the bill should be intimated within 7 days of the date of

billing.

CHAUHAN Date: 2020.09.01

17:35:49 +05'30' Authorised Signatory

SUBJECT TO AHMEDABAD JURISDICTION

This is a Computer Generated Invoice

You might also like

- Case Write Up 1Document4 pagesCase Write Up 1E learningNo ratings yet

- TAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedDocument16 pagesTAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedSophia Perez100% (1)

- Tax Invoice: Roltech InfotechDocument1 pageTax Invoice: Roltech InfotechSunil PatelNo ratings yet

- Now or Never Nova Scotia - Final Report With Research & Engagement DocumentationDocument258 pagesNow or Never Nova Scotia - Final Report With Research & Engagement Documentationone_Nova_Scotia100% (1)

- SHRI GIRAJ JI BILL 09.07.2024Document1 pageSHRI GIRAJ JI BILL 09.07.2024Ashish BansalNo ratings yet

- Tax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountDocument2 pagesTax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountSunil PatelNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- BricsmeterDocument1 pageBricsmeterProcess Vadodara 1No ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- SHRI RAM BIL 09.07.2024Document1 pageSHRI RAM BIL 09.07.2024Ashish BansalNo ratings yet

- Ms Color N Style PVT LTD Lf-22!23!342Document3 pagesMs Color N Style PVT LTD Lf-22!23!342krishnaNo ratings yet

- 09 - 03221437101182 SECR BilaspurDocument2 pages09 - 03221437101182 SECR BilaspurAbhishek DahiyaNo ratings yet

- Tax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Document1 pageTax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Sunil PatelNo ratings yet

- Tax Invoice Cum ChallanDocument6 pagesTax Invoice Cum ChallanSunil PatelNo ratings yet

- D-524 BiomeriuxDocument4 pagesD-524 BiomeriuxVinay KatochNo ratings yet

- Bta s2Document2 pagesBta s2msNo ratings yet

- Sss Kunti 502Document2 pagesSss Kunti 502msNo ratings yet

- STS1036Document2 pagesSTS1036Shilpa AmitNo ratings yet

- Secured Package PDFDocument2 pagesSecured Package PDFAman DagaNo ratings yet

- Shope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851Document1 pageShope No. Sarve No. 20/3, Gatha Mandir Road Dehu Road, Pune GSTIN/UIN: 27AACFY4277H1ZT State Name: Maharashtra, Code: 27 Contact: +91 9518338851cnanda89No ratings yet

- Nakodar Jan 2023Document1 pageNakodar Jan 2023Randhir ChaubeyNo ratings yet

- Rdso-Stores-Po-Tribo Meter-03012024Document2 pagesRdso-Stores-Po-Tribo Meter-03012024Karthikeyan RajamanickamNo ratings yet

- 21 - 30221463102456 NCR JhansiDocument2 pages21 - 30221463102456 NCR JhansiAbhishek DahiyaNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherDIPL MUMBAINo ratings yet

- Invoice - 282 EnHDocument4 pagesInvoice - 282 EnHPriyank PawarNo ratings yet

- 056Document1 page056Dipak KotkarNo ratings yet

- Tax Invoice: Agarwal Impex 21-22/758 3588 9-Feb-2022Document2 pagesTax Invoice: Agarwal Impex 21-22/758 3588 9-Feb-2022bhola.vilesh7No ratings yet

- Galcons India - PI No. 08-003Document1 pageGalcons India - PI No. 08-003Gunaseelan RvNo ratings yet

- SP Steel - InvoiceDocument2 pagesSP Steel - Invoiceaniketshaw228No ratings yet

- Bta s1Document1 pageBta s1msNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender Decision - and No Vetting Is Needed Being A Tender Committee CaseDocument4 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender Decision - and No Vetting Is Needed Being A Tender Committee CasedycmmgncrNo ratings yet

- Bharat Sanchar 1074Document4 pagesBharat Sanchar 1074SandeepKumarNo ratings yet

- 319 IiplDocument3 pages319 IiplAmitabh PatraNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAvijitSinharoyNo ratings yet

- Negbuy 02 09 2022Document1 pageNegbuy 02 09 2022Aditya SinghNo ratings yet

- 1504 SVCDocument3 pages1504 SVCAmitabh PatraNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPriyanka DevghareNo ratings yet

- Bom 487Document1 pageBom 487Roop HariaNo ratings yet

- Listing DetailsDocument2 pagesListing DetailsArun DevNo ratings yet

- SEPC Power Thoothkudi Loadcell_76_25May24 (1)Document1 pageSEPC Power Thoothkudi Loadcell_76_25May24 (1)PARGUNAN BHARATHINo ratings yet

- Tax Invoice: IRNDocument1 pageTax Invoice: IRNCA Shrikant VaranasiNo ratings yet

- GM SyntexDocument2 pagesGM Syntexvbbhagat1988No ratings yet

- 1499 SVCDocument3 pages1499 SVCAmitabh PatraNo ratings yet

- Airtel 974Document1 pageAirtel 974OL RentNo ratings yet

- 3ccounting VoucherDocument3 pages3ccounting VoucherSuhas TopkarNo ratings yet

- 42 Delpro AccessoriesDocument2 pages42 Delpro AccessoriesDurga prasadNo ratings yet

- Po SRV 4513Document1 pagePo SRV 4513Ankit KumarNo ratings yet

- HMB Ispat Pi 81022Document1 pageHMB Ispat Pi 81022Suman PramanikNo ratings yet

- Icf PoDocument3 pagesIcf PoManojNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- 349 AdcplDocument3 pages349 AdcplAmitabh PatraNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceVinayak DhotreNo ratings yet

- Bts 44445Document1 pageBts 44445msNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27 Place of Supply: MaharashtraDocument2 pagesTax Invoice: State Name: Maharashtra, Code: 27 Place of Supply: MaharashtraAslamShikalgarNo ratings yet

- 03221416102121-Ladder R.H. For LHB Fac CoachesDocument2 pages03221416102121-Ladder R.H. For LHB Fac CoachesGAGAN SHARMANo ratings yet

- Inv - 485Document2 pagesInv - 485arnabmukherjee.1212005No ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument3 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionAnkur MishraNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnjani KumariNo ratings yet

- BT Pre3Document1 pageBT Pre3msNo ratings yet

- GST Invoice: Shubham Engineering Works - (2019-20)Document3 pagesGST Invoice: Shubham Engineering Works - (2019-20)vinodNo ratings yet

- 2cx150 SQ - MM Cross Linked Polyethylene & XLPE InsulatedDocument2 pages2cx150 SQ - MM Cross Linked Polyethylene & XLPE InsulatedSSE TRD JabalpurNo ratings yet

- PO5200490820Document8 pagesPO5200490820gawademadhavi30No ratings yet

- B No17 PDFDocument1 pageB No17 PDFFSPL HSENo ratings yet

- RFQ - EbpxDocument4 pagesRFQ - EbpxSunil PatelNo ratings yet

- Po000078223 PDFDocument2 pagesPo000078223 PDFSunil PatelNo ratings yet

- Tax Invoice 20056204: Urbanpiper Technology Private LimitedDocument1 pageTax Invoice 20056204: Urbanpiper Technology Private LimitedSunil PatelNo ratings yet

- PO000079908Document1 pagePO000079908Sunil PatelNo ratings yet

- Tax Invoice Cum ChallanDocument6 pagesTax Invoice Cum ChallanSunil PatelNo ratings yet

- Tax Invoice: AB Cartridge Private LimitedDocument1 pageTax Invoice: AB Cartridge Private LimitedSunil PatelNo ratings yet

- Fakhr Wood Handicarfts: 7 PO0000 Paid 8223Document2 pagesFakhr Wood Handicarfts: 7 PO0000 Paid 8223Sunil PatelNo ratings yet

- Tax Invoice: Urbanpiper Technology Private LimitedDocument1 pageTax Invoice: Urbanpiper Technology Private LimitedSunil PatelNo ratings yet

- (In Case of Multiple Location Please Fill Separate Vendor Form For Each LocationDocument2 pages(In Case of Multiple Location Please Fill Separate Vendor Form For Each LocationSunil PatelNo ratings yet

- HRPL CENTER KITCHEN NON BRANDED HEAVY MATERIALDocument1 pageHRPL CENTER KITCHEN NON BRANDED HEAVY MATERIALSunil PatelNo ratings yet

- Expense CKDocument2 pagesExpense CKSunil PatelNo ratings yet

- Tax Invoice: Name BrandDocument3 pagesTax Invoice: Name BrandSunil PatelNo ratings yet

- Plumbing Work SR - No. Item Description (Plumbing) Qty. Unit Jigar Bhai Supply Rate (RS.) Installation Rate (RS.)Document6 pagesPlumbing Work SR - No. Item Description (Plumbing) Qty. Unit Jigar Bhai Supply Rate (RS.) Installation Rate (RS.)Sunil PatelNo ratings yet

- Sr. No. Outlet Company NumberDocument2 pagesSr. No. Outlet Company NumberSunil PatelNo ratings yet

- HRPL 2144.SK.2019-20Document1 pageHRPL 2144.SK.2019-20Sunil PatelNo ratings yet

- KentDocument1 pageKentSunil PatelNo ratings yet

- Sales OrderDocument1 pageSales OrderSunil PatelNo ratings yet

- Ashish: 28,29/shivam Estate, NR - Ujala Circle, S.G.Highway, Sarkhej, Ahmedabad-382210Document2 pagesAshish: 28,29/shivam Estate, NR - Ujala Circle, S.G.Highway, Sarkhej, Ahmedabad-382210Sunil PatelNo ratings yet

- Offer Letter Sunil KumarDocument3 pagesOffer Letter Sunil KumarSunil PatelNo ratings yet

- Saharsh Solutions Nr. Soni Ni Chali, C204, Sumel Business Park 7, RAKHIAL, AHMEDABAD, Ahmedabad, Gujarat, 380023Document2 pagesSaharsh Solutions Nr. Soni Ni Chali, C204, Sumel Business Park 7, RAKHIAL, AHMEDABAD, Ahmedabad, Gujarat, 380023Sunil PatelNo ratings yet

- Spare Expenses DetailsDocument74 pagesSpare Expenses DetailsSunil PatelNo ratings yet

- Kraft Paper: Supplier Referance Mill GSM Excise Vat/ CST Freight Payment Grace DaysDocument13 pagesKraft Paper: Supplier Referance Mill GSM Excise Vat/ CST Freight Payment Grace DaysSunil Patel100% (1)

- CONTACTDocument11 pagesCONTACTSunil PatelNo ratings yet

- Naman Corporation: QuatationDocument2 pagesNaman Corporation: QuatationSunil PatelNo ratings yet

- Machine Supplier Contact Person Mobile RemarksDocument3 pagesMachine Supplier Contact Person Mobile RemarksSunil PatelNo ratings yet

- TCW Module 3 Pre FinalDocument21 pagesTCW Module 3 Pre FinalMark Jade BurlatNo ratings yet

- Mi Report FinalDocument74 pagesMi Report FinalArittraKar100% (1)

- Course Detail 7th Sem Mkm. BBADocument8 pagesCourse Detail 7th Sem Mkm. BBAHari AdhikariNo ratings yet

- Marketing Strategy of FMCG Product: A Case Study of Hindustan Unilever LimitedDocument3 pagesMarketing Strategy of FMCG Product: A Case Study of Hindustan Unilever LimitedSundaramNo ratings yet

- T8-R44-P2-Hull-RMFI-Ch24-v3 - Study NotesDocument22 pagesT8-R44-P2-Hull-RMFI-Ch24-v3 - Study Notesshantanu bhargavaNo ratings yet

- Momentex LLC: Executive SummaryDocument25 pagesMomentex LLC: Executive SummaryEdoardo SmookedNo ratings yet

- 2238 8777 1 PBDocument9 pages2238 8777 1 PBMuhammad MulyawanNo ratings yet

- Introduction of Mutual FundsDocument5 pagesIntroduction of Mutual FundsSh IVa Ku MAr100% (1)

- 0605 2018 - MP PDFDocument1 page0605 2018 - MP PDFAnonymous DohqBW7g0% (1)

- Sourcing Strategies of Fahion Retailers PDFDocument10 pagesSourcing Strategies of Fahion Retailers PDFVinay VashisthNo ratings yet

- Consumer Staples (Food & Beverage) : Henry Fund ResearchDocument7 pagesConsumer Staples (Food & Beverage) : Henry Fund Researchashrafherzalla100% (1)

- Project Justification: Increase OEEDocument21 pagesProject Justification: Increase OEEKaran Singh RaiNo ratings yet

- Intended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsDocument10 pagesIntended Learning Outcomes: Principles of Customs Administration LESSON 1: Profile of The Bureau of CustomsAbdurahman shuaibNo ratings yet

- Review Questions - OVWL 2023Document8 pagesReview Questions - OVWL 2023zitkonkuteNo ratings yet

- Dlp-Epp 6 - Week 1 - Day 4 - 3rd QuarterDocument1 pageDlp-Epp 6 - Week 1 - Day 4 - 3rd QuarterSHARON MAY CRUZNo ratings yet

- TCS JV With MitsubishiDocument4 pagesTCS JV With MitsubishiPiyush SrivastavaNo ratings yet

- Bearish Engulfing PatternDocument3 pagesBearish Engulfing PatternkosurugNo ratings yet

- Auditing Problems - 001Document2 pagesAuditing Problems - 001Geoff MacarateNo ratings yet

- EMAILDocument1 pageEMAILSmdryfruits IranianNo ratings yet

- Sample 1 Bakery Business PlanDocument18 pagesSample 1 Bakery Business PlanJohn Leric Dela MercedNo ratings yet

- CH 18Document9 pagesCH 18MBASTUDENTPUPNo ratings yet

- D2.2 SWOT AnalysisDocument16 pagesD2.2 SWOT AnalysisPALACIOS HERRERA JORGE LUISNo ratings yet

- Chapter 1 - DDocument26 pagesChapter 1 - DSujani MaarasingheNo ratings yet

- Chapter 3 Marginal Analisys For Optimal DecisionsDocument20 pagesChapter 3 Marginal Analisys For Optimal DecisionsNadeen ZNo ratings yet

- Ultimate Guide To Auto Trader MetricsDocument8 pagesUltimate Guide To Auto Trader Metricsjaromaj811No ratings yet

- EntrepreneurshipDocument22 pagesEntrepreneurshipHercel Louise HernandezNo ratings yet

- Kolehiyo NG Lungsod NG LipaDocument72 pagesKolehiyo NG Lungsod NG LipaMJ ArandaNo ratings yet