Professional Documents

Culture Documents

Form PDF

Form PDF

Uploaded by

Chinmoyee SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form PDF

Form PDF

Uploaded by

Chinmoyee SharmaCopyright:

Available Formats

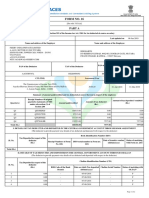

-----------------------------------------------------------------------------------------------------------------------------------

|OIL ID : 203392 | Company : OIL INDIA LIMITED | PL Bal : 4.50 | Std Basic: 60,000.00 |

|CHINMOYEE SHARMA | Location : Duliajan | CL Bal : 9.00000 | Std SplIncPay: 0.00 |

|SENIOR OFFICER | SBU: Duliajan Fields | VPF % : 0.00 | Work Schedule: FOWK |

|Grade : Level 1 / Grade B | Emp group : Active | PAN No : GYNPS3398C | |

|Dept : PRODUCTION SERVICES'S OFF | Pay area : Field Executives | Er PenCtri: 5,933.00 | |

|Section: CENTRAL ASSET | Pay period: 01.04.2020-30.04.2020| ErOISBS Cnt: | |

-----------------------------------------------------------------------------------------------------------------------------------

|Bank Name SBIN0006309 Account No. 20375908084 Net Pay = 77,947.00 |

-----------------------------------------------------------------------------------------------------------------------------------

-------------------------------------------------------------------------------------- -------------------------------------------

| Earnings | Deductions | |Form 16 Summary |

-------------------------------------------------------------------------------------- -------------------------------------------

|Basic | 60,000.00 |Ee PF contribution | 8,546.00 | |Gross Salary | 1,178,641.00 |

|Dearness Allowance | 11,220.00 |Prof Tax - split period | 208.00 | |Balance | 1,178,641.00 |

|North East Allowance | 6,000.00 |Income Tax | 10,364.00 | |Std Deduction | 50,000.00 |

|*Cafeteria Payment | 21,000.00 |Social Sec. Sche Rec. | 1,155.00 | |Empmnt tax (Prof Tax) | 2,496.00 |

| | | | | |Aggrg Deduction | 52,496.00 |

| | | | | |Incm under Hd Salary | 1,126,145.00 |

| | | | | |Gross Tot Income | 1,126,145.00 |

| | | | | |Agg of Chapter VI | 102,552.00 |

| | | | | |Total Income | 1,023,593.00 |

| | | | | |Tax on total Income | 119,577.90 |

| | | | | |Tax payable and surcharg | 124,362.00 |

| | | | | |Income Tax | 10,364.00 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

-----------------------------------------------------------------------------------------------------------------------------------

|Total | 98,220.00 |Total | 20,273.00 | | | |

-----------------------------------------------------------------------------------------------------------------------------------

|

-----------------------------------------------------------------------------------------------------------------------------------

|Loan Details | Perks & Other Income | Sec 10 Exemption | Perks/ Exemptions/Rebates-Summary |

-----------------------------------------------------------------------------------------------------------------------------------

| | | |Annual Perk 1.00 |

| | | |Agg of Chapter VI 102552.00 |

| | | | |

| | | | |

| | | | |

| | | | |

-----------------------------------------------------------------------------------------------------------------------------------

| ANY EXCESS OR LESS PAYMENT WILL BE ADJUSTED IN SUBSEQUENT PAYROLL/PAYSLIP. |

-----------------------------------------------------------------------------------------------------------------------------------

You might also like

- 02c - Requisition For Default JudgmentDocument4 pages02c - Requisition For Default Judgmentapi-250295486No ratings yet

- PDF 192659360280722Document1 pagePDF 192659360280722MILTON MOHANTYNo ratings yet

- Contract Management-PPT - Case StudyDocument13 pagesContract Management-PPT - Case StudySajeer M100% (1)

- Oct'21Document1 pageOct'21phanindra gaddeNo ratings yet

- The CompanyDocument1 pageThe Companyकपिल चौहानNo ratings yet

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- This Is A Computer Generated Statement NOT Requiring Any SignatureDocument1 pageThis Is A Computer Generated Statement NOT Requiring Any Signatureraj dNo ratings yet

- Existential Narcissism ThompsonDocument169 pagesExistential Narcissism ThompsonJosh ArmisteadNo ratings yet

- FormDocument1 pageFormhemant vatsaNo ratings yet

- 8ebda9db-ca4e-4b59-a33c-d19736a0183bDocument1 page8ebda9db-ca4e-4b59-a33c-d19736a0183bVenkata RajaNo ratings yet

- 0039 BB 7441651750277Document1 page0039 BB 7441651750277subhaniNo ratings yet

- July 1 Neha Agarwal 07 07 2Document1 pageJuly 1 Neha Agarwal 07 07 2Kolkata Jyote MotorsNo ratings yet

- PaySlip PDFDocument1 pagePaySlip PDFVamshi GoudNo ratings yet

- 001I7D7441643896296Document1 page001I7D7441643896296Shamantha ManiNo ratings yet

- Payslip - 2023 06 28Document1 pagePayslip - 2023 06 28ttamilpNo ratings yet

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocument3 pagesThis Is My Money. I Earned It by Doing My Best For Our CustomersAbzi SyedNo ratings yet

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocument2 pagesThis Is My Money. I Earned It by Doing My Best For Our CustomersSomeshNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Aug Salary SlipDocument1 pageAug Salary SlipDeepak AcsNo ratings yet

- October2023 Sal - SlipDocument2 pagesOctober2023 Sal - SlipdevNo ratings yet

- Payslip Prakhar PRA745634 1635359400000Document1 pagePayslip Prakhar PRA745634 163535940000024hours service centerNo ratings yet

- Payslip 5 2021Document1 pagePayslip 5 2021Mehraj PashaNo ratings yet

- November Pay SlipDocument2 pagesNovember Pay SlipanakinpowersNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- Payslip 11 2022Document1 pagePayslip 11 2022Md SharidNo ratings yet

- November Pay SlipDocument2 pagesNovember Pay SlipHanish Meena100% (1)

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- D114003jul2020 PDFDocument1 pageD114003jul2020 PDFRajarshiRoyNo ratings yet

- Mar 2024Document2 pagesMar 2024Tuneer SahaNo ratings yet

- Archana - Kankam ResumeDocument3 pagesArchana - Kankam ResumeArchanaNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023arun poojariNo ratings yet

- ITR FormDocument9 pagesITR FormAbdul WajidNo ratings yet

- Payslip - 2019 08 31 - ID 40025704Document1 pagePayslip - 2019 08 31 - ID 40025704R KNo ratings yet

- AcknowledgmentDocument1 pageAcknowledgmentSatyam MaramNo ratings yet

- RAVISH KUMAR SINGH's Pay Slip of March-2023Document1 pageRAVISH KUMAR SINGH's Pay Slip of March-2023ravish singhNo ratings yet

- Tharun J - Ford 15.3Document6 pagesTharun J - Ford 15.3Tharun Ricky0% (1)

- PaySlip 6 2023...Document1 pagePaySlip 6 2023...Rahul VarmanNo ratings yet

- UnknownDocument1 pageUnknownAnji BaduguNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountindhar666No ratings yet

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- A S Soft Technologies Private Limited: Pay Slip For The Month of August 2018Document1 pageA S Soft Technologies Private Limited: Pay Slip For The Month of August 2018csreddyatsapbiNo ratings yet

- A S Soft Technologies Private Limited: Pay Slip For The Month of July 2018Document1 pageA S Soft Technologies Private Limited: Pay Slip For The Month of July 2018srini reddyNo ratings yet

- Salary Slip FormatDocument9 pagesSalary Slip FormatAndi Gabriel Albu100% (1)

- Payslip For BeginnerDocument1 pagePayslip For BeginnerKhan SahbNo ratings yet

- Cprs Payslip1.jspDocument1 pageCprs Payslip1.jspRakesh KumarNo ratings yet

- ZHR RVPN 111500Document69 pagesZHR RVPN 111500vinodk33506No ratings yet

- Abhishek - Form 16Document2 pagesAbhishek - Form 16hrrecruiter.vhtbsNo ratings yet

- Salary SlipDocument1 pageSalary Slipkiran pawarNo ratings yet

- Itr 2022-23Document1 pageItr 2022-23digitalworldnangalNo ratings yet

- Pay Slip - Dec-22Document1 pagePay Slip - Dec-22mohitNo ratings yet

- 1 1000 Form16Document5 pages1 1000 Form16Rakshit SharmaNo ratings yet

- December 2022 CapgeminiDocument1 pageDecember 2022 CapgeminimanojkallemuchikkalNo ratings yet

- Salary Slip March 2024Document1 pageSalary Slip March 2024mandeepsingh157157157No ratings yet

- JunDocument1 pageJunkallinath nrNo ratings yet

- Payslip 11860967 AugDocument1 pagePayslip 11860967 Augshreya arunNo ratings yet

- Parle Agro PVT Ltd-46Document1 pageParle Agro PVT Ltd-46QASWA ENGINEERING PVT LTDNo ratings yet

- Manish Dwivedi Nov-18Document1 pageManish Dwivedi Nov-18Anonymous 3P7aeUIW2No ratings yet

- PayslipDocument2 pagesPaysliprajdeep singhNo ratings yet

- PayslipDocument2 pagesPayslipanandalogyNo ratings yet

- Technical Literature - BHF Packer PDFDocument31 pagesTechnical Literature - BHF Packer PDFChinmoyee SharmaNo ratings yet

- Catalogue: Packer SystemDocument56 pagesCatalogue: Packer SystemChinmoyee Sharma100% (1)

- 2020.04.25 Information About Contract LaboursDocument4 pages2020.04.25 Information About Contract LaboursChinmoyee SharmaNo ratings yet

- Job Program - CTU N2 Activation - CBA-16Document32 pagesJob Program - CTU N2 Activation - CBA-16Chinmoyee SharmaNo ratings yet

- Tornar® Drilling Scraper: Clean and Solids-Free WellboreDocument1 pageTornar® Drilling Scraper: Clean and Solids-Free WellboreChinmoyee SharmaNo ratings yet

- History File - CTU2 - 03-March-2020Document21 pagesHistory File - CTU2 - 03-March-2020Chinmoyee SharmaNo ratings yet

- Rock Mec Assignement No 3 by Prof UK SinghDocument2 pagesRock Mec Assignement No 3 by Prof UK SinghChinmoyee SharmaNo ratings yet

- Casting Material WCB PDFDocument9 pagesCasting Material WCB PDFChinmoyee SharmaNo ratings yet

- Propagation of A Vertical Hydraulic Fracture: R. P. Nordgren - Shell Development CO. Houston, TexDocument9 pagesPropagation of A Vertical Hydraulic Fracture: R. P. Nordgren - Shell Development CO. Houston, TexChinmoyee SharmaNo ratings yet

- Site Specific SOP of Tengakhat OCSDocument21 pagesSite Specific SOP of Tengakhat OCSChinmoyee SharmaNo ratings yet

- Santosh K Gupta - Numerical Methods For Engineers-New Age International Publishers (2005)Document349 pagesSantosh K Gupta - Numerical Methods For Engineers-New Age International Publishers (2005)Chinmoyee SharmaNo ratings yet

- Board of DirectorDocument2 pagesBoard of DirectorCpreiiNo ratings yet

- LLB 1 Sem Constitution Law of India LD 118 Feb 2021 PDFDocument1 pageLLB 1 Sem Constitution Law of India LD 118 Feb 2021 PDFAditya MishraNo ratings yet

- Public Law 94-192Document7 pagesPublic Law 94-192Shafienashu Lao ShiNo ratings yet

- Metrobank v. National Wages and Productivity Commission (2007)Document2 pagesMetrobank v. National Wages and Productivity Commission (2007)Erika C. Dizon100% (1)

- Legislative Assembly, Decree On The: Death Penalty, 1792Document3 pagesLegislative Assembly, Decree On The: Death Penalty, 1792ALAMRANo ratings yet

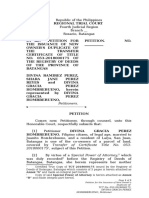

- Final Revised Petition Issuance of New OCT Divinagracia Hombrebueno 5Document5 pagesFinal Revised Petition Issuance of New OCT Divinagracia Hombrebueno 5Amelyn Albitos-Ylagan MoteNo ratings yet

- Criminal Law Book 1 Articles 11 - 20 - Philippine Law ReviewersDocument72 pagesCriminal Law Book 1 Articles 11 - 20 - Philippine Law ReviewersJan Nikka EstefaniNo ratings yet

- Admiralty and Maritime Law Guide PDFDocument2 pagesAdmiralty and Maritime Law Guide PDFcipinaNo ratings yet

- Family Law - 2Document4 pagesFamily Law - 2Muskan KhatriNo ratings yet

- Rule 64 Full Text CasesDocument37 pagesRule 64 Full Text CasesAna NiharaNo ratings yet

- Power PointDocument84 pagesPower PointAva LopezNo ratings yet

- No 14 AcceptanceDocument3 pagesNo 14 Acceptanceproukaiya7754No ratings yet

- Entity-Level Controls Fraud QuestionnaireDocument8 pagesEntity-Level Controls Fraud QuestionnaireKirby C. LoberizaNo ratings yet

- COI - Unit 3Document2 pagesCOI - Unit 3Lol FunnyNo ratings yet

- Issue of Encashment Certificate (EC)Document2 pagesIssue of Encashment Certificate (EC)Avnish KumarNo ratings yet

- Petitioners vs. vs. Respondents: First DivisionDocument7 pagesPetitioners vs. vs. Respondents: First DivisionJoannah SalamatNo ratings yet

- Digest CivproDocument69 pagesDigest CivproRay PiñocoNo ratings yet

- DOJ Opinion No. 63 S. 2006 - DigestDocument1 pageDOJ Opinion No. 63 S. 2006 - DigestQueenieNo ratings yet

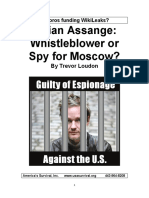

- Trevor Loudon AssangeDocument36 pagesTrevor Loudon AssangeAlena KlNo ratings yet

- Assignment Week 6 Politics For CotDocument1 pageAssignment Week 6 Politics For CotGia GalesNo ratings yet

- Primer: For Boi Registered CompaniesDocument13 pagesPrimer: For Boi Registered CompaniesSarah Jean TaliNo ratings yet

- Computer Network SLADocument10 pagesComputer Network SLApeterocallaghanNo ratings yet

- Bar Bench RelationsDocument3 pagesBar Bench Relationsswarnimpaudelv2.0No ratings yet

- Pha First Virtual Regional Conference - Letter To MembersDocument1 pagePha First Virtual Regional Conference - Letter To MembersArnel Lajo FulgencioNo ratings yet

- UGC Notification On Sexual HarassmentDocument8 pagesUGC Notification On Sexual HarassmentPrayas DansanaNo ratings yet

- In The High Court of Sindh at KarachiDocument24 pagesIn The High Court of Sindh at KarachiAsad IshaqNo ratings yet

- GR 115233 People V GutualDocument9 pagesGR 115233 People V GutualiamReadyPlayerOneNo ratings yet