Professional Documents

Culture Documents

India - Healthcare: NCR Healthcare Visit: Tales From Delhi

India - Healthcare: NCR Healthcare Visit: Tales From Delhi

Uploaded by

akumar4uCopyright:

Available Formats

You might also like

- NABH Accredited AYUSH Hospitals As Downloaded On 09.08.2023Document19 pagesNABH Accredited AYUSH Hospitals As Downloaded On 09.08.2023yolomeNo ratings yet

- Credit and CollectionDocument129 pagesCredit and CollectionKim Ritua - Tabudlo40% (5)

- Delta Corp Annual Report FY 2021-22Document241 pagesDelta Corp Annual Report FY 2021-22akumar4uNo ratings yet

- Netra Case Study For EndtermDocument9 pagesNetra Case Study For EndtermGarima GeetikaNo ratings yet

- 9.403 Chapter 4: Efficient Securities MarketsDocument10 pages9.403 Chapter 4: Efficient Securities MarketsYanee ReeNo ratings yet

- Aster DMDocument51 pagesAster DMPradeep Kumar SahuNo ratings yet

- The Indian Medical Devices MarketDocument19 pagesThe Indian Medical Devices MarketSandeep Kumar100% (2)

- Narayana Hrudayalaya - 141215 PDFDocument7 pagesNarayana Hrudayalaya - 141215 PDFrawatbs2020No ratings yet

- Bharuch Hospital ProjectDocument89 pagesBharuch Hospital Projectzaheeruddin_mohdNo ratings yet

- About Narayana HrudayalayaDocument2 pagesAbout Narayana HrudayalayaChandra Sekhar100% (2)

- Hospital Critical Care Hospital Ranking Survey March 2021Document3 pagesHospital Critical Care Hospital Ranking Survey March 2021ravi ohlyanNo ratings yet

- Fortis Concall Q3 26 02 2009Document29 pagesFortis Concall Q3 26 02 2009prasherMBANo ratings yet

- Maternity NetworkDocument13 pagesMaternity NetworkArun Kumar SamalNo ratings yet

- AHEL Investor Presentation December 22 INRDocument51 pagesAHEL Investor Presentation December 22 INRLiu BillyNo ratings yet

- Corporate Fact Sheets: Security & Intellgence Solutions IncDocument6 pagesCorporate Fact Sheets: Security & Intellgence Solutions IncB J DasNo ratings yet

- Vipul MedCorp TPA PresentationDocument26 pagesVipul MedCorp TPA PresentationAkash YadavNo ratings yet

- Hosconnn Brochure-1Document12 pagesHosconnn Brochure-1India Heals-2020No ratings yet

- Marketing AnalysisDocument6 pagesMarketing AnalysisSwagato SarkarNo ratings yet

- Case Study On :'œmarketing Strategies of Henry Ford of Heart Surgery - Narayana Health Care Also Known As Narayana Hrudayalaya, Leading India in World For Health Care'Document7 pagesCase Study On :'œmarketing Strategies of Henry Ford of Heart Surgery - Narayana Health Care Also Known As Narayana Hrudayalaya, Leading India in World For Health Care'Editor IJTSRDNo ratings yet

- Merger of Radiant With Max Healthcare Dec18Document39 pagesMerger of Radiant With Max Healthcare Dec18Rohit RajNo ratings yet

- Hospital Interior Designing Services PDFDocument6 pagesHospital Interior Designing Services PDFreddi.demullu007No ratings yet

- Hospital Interior Designing Services PDFDocument6 pagesHospital Interior Designing Services PDFreddi.demullu007No ratings yet

- NATHEALTH Year End Progress Report 2023-1Document127 pagesNATHEALTH Year End Progress Report 2023-1Moumita Roy ChowdhuryNo ratings yet

- Hospital Interior Designing Services PDFDocument6 pagesHospital Interior Designing Services PDFreddi.demullu007No ratings yet

- Indian School of Business: January 31, 2019Document23 pagesIndian School of Business: January 31, 2019Sarvesh KashyapNo ratings yet

- Jeena Sikho Presentation May 2024Document40 pagesJeena Sikho Presentation May 2024Puneet367No ratings yet

- SIP Project Presentation Brand Promotion of Moolchand Medcity Through Value Added Service (VAS) Program and Medical Camp Nitin SharmaDocument17 pagesSIP Project Presentation Brand Promotion of Moolchand Medcity Through Value Added Service (VAS) Program and Medical Camp Nitin SharmaNitin SharmaNo ratings yet

- LIFENET Hospitals (India) : Developing New Services' Case StudyDocument16 pagesLIFENET Hospitals (India) : Developing New Services' Case StudyDesh Verma ASAP, LucknowNo ratings yet

- Expansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal GopiDocument13 pagesExpansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal Gopiakumar4uNo ratings yet

- Aalok Ghosh Lmo AssignmentDocument5 pagesAalok Ghosh Lmo AssignmentAalok GhoshNo ratings yet

- Kle GokakDocument1 pageKle GokakBhaskar SuryapethNo ratings yet

- Prakriya Hospitals Investor Brochure - 2019Document19 pagesPrakriya Hospitals Investor Brochure - 2019Abhishek S AatreyaNo ratings yet

- Emb FinalDocument18 pagesEmb FinalVikrantGuptaNo ratings yet

- Company Name Founded Yeinvestor (S) Latest FinanDocument3 pagesCompany Name Founded Yeinvestor (S) Latest FinanParehjuiNo ratings yet

- Assignment: Max IndiaDocument5 pagesAssignment: Max IndiaP.Umasankar SubudhiNo ratings yet

- NABH Accredited HospitalsDocument56 pagesNABH Accredited Hospitalsdchandra15No ratings yet

- Narayana Hrudalaya Heart HospitalDocument17 pagesNarayana Hrudalaya Heart HospitalWaibhav Krishna100% (1)

- CV Vikram Vikas NigamDocument4 pagesCV Vikram Vikas NigamVikram Vikas NigamNo ratings yet

- Meditech QuoteDocument5 pagesMeditech QuoteAnand_HvacNo ratings yet

- Hospital ListDocument7 pagesHospital ListSivaramakrishnan KNo ratings yet

- Sharing An Eastward Vision - Express HealthcareDocument5 pagesSharing An Eastward Vision - Express HealthcareVeena Parkhi KhasbardarNo ratings yet

- DABUR Working Capital Finance Auto Saved)Document66 pagesDABUR Working Capital Finance Auto Saved)Antima TyagiNo ratings yet

- List of HospitalsDocument170 pagesList of HospitalsDrShripad Taklikar33% (3)

- Jupiter IC 1nov23Document37 pagesJupiter IC 1nov23ofusandeepNo ratings yet

- NATHEALTH Annual Report - March 2024Document133 pagesNATHEALTH Annual Report - March 2024Moumita Roy ChowdhuryNo ratings yet

- Gujarat Health Care SystemDocument18 pagesGujarat Health Care Systemrohan agrawal4uNo ratings yet

- Production: Ramdev Acharya Balkrishna AyurvedaDocument7 pagesProduction: Ramdev Acharya Balkrishna Ayurvedaharjeet bhatia100% (1)

- Medical Devices Manufacturing in India:: A Sunrise SegmentDocument2 pagesMedical Devices Manufacturing in India:: A Sunrise SegmentDevasyaNo ratings yet

- Max Multispecialty HospitalDocument33 pagesMax Multispecialty HospitalShiv Shankar GuptaNo ratings yet

- Inventory Control Techniques in A Tertiary Care Hospital PDFDocument56 pagesInventory Control Techniques in A Tertiary Care Hospital PDFkrishnaNo ratings yet

- Vaatsalya HospitalsDocument18 pagesVaatsalya HospitalsFarjendra KumarNo ratings yet

- S.No. Roll No Rank Comm Course Institute State DNB R1 Course DNB R1 Institute R1 To R2Document188 pagesS.No. Roll No Rank Comm Course Institute State DNB R1 Course DNB R1 Institute R1 To R2Maneesh BalachandranNo ratings yet

- Apollo GleneaglesDocument15 pagesApollo Gleneaglessujal vermaNo ratings yet

- Top DNB Ortho Surgery Institutions byDocument14 pagesTop DNB Ortho Surgery Institutions byDr ThanosNo ratings yet

- 20.07.18 Healthcare Supply Chain Management SummitDocument10 pages20.07.18 Healthcare Supply Chain Management SummitKumarNo ratings yet

- Rasachikitsa Chandigarh 2023Document9 pagesRasachikitsa Chandigarh 2023Shree ayurvedic panchakarma Multi speciality centerNo ratings yet

- 5002710315Document239 pages5002710315Ravi BhadauriaNo ratings yet

- Aravind Eye Hospital - LCM AssignmentDocument7 pagesAravind Eye Hospital - LCM Assignmentkrishna sharmaNo ratings yet

- Patanjali Internet InfoDocument20 pagesPatanjali Internet InfoPrasad KadamNo ratings yet

- Monarch - Networth - Capital - Initiates - Coverage - On - Rainbow - Children's MedicareDocument14 pagesMonarch - Networth - Capital - Initiates - Coverage - On - Rainbow - Children's MedicareSriram RanganathanNo ratings yet

- Patanjali A Yur Ved Invades IndiaDocument20 pagesPatanjali A Yur Ved Invades IndiaManshu PoorviNo ratings yet

- Annual Report 2017 2018Document220 pagesAnnual Report 2017 2018akumar4uNo ratings yet

- Notice of 27th AgmDocument14 pagesNotice of 27th Agmakumar4uNo ratings yet

- Quarter December 2017 2018Document9 pagesQuarter December 2017 2018akumar4uNo ratings yet

- The Startup's Guide To Google CloudDocument18 pagesThe Startup's Guide To Google Cloudakumar4uNo ratings yet

- Zscaler Inc - Form 10-K (Sep-18-2019)Document164 pagesZscaler Inc - Form 10-K (Sep-18-2019)akumar4uNo ratings yet

- IBEF IT-and-BPM-January-2021Document34 pagesIBEF IT-and-BPM-January-2021akumar4u100% (1)

- Design Thinking EbookDocument850 pagesDesign Thinking Ebookakumar4uNo ratings yet

- Rummy Mobile Gaming ComparisonDocument2 pagesRummy Mobile Gaming Comparisonakumar4uNo ratings yet

- Zscaler Inc - Form 10-K (Sep-17-2020)Document186 pagesZscaler Inc - Form 10-K (Sep-17-2020)akumar4uNo ratings yet

- IBEF Healthcare-March-2021Document39 pagesIBEF Healthcare-March-2021akumar4uNo ratings yet

- Healthcare: Ind AS 116: Impact Analysis On Healthcare CompaniesDocument7 pagesHealthcare: Ind AS 116: Impact Analysis On Healthcare Companiesakumar4uNo ratings yet

- Expansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal GopiDocument13 pagesExpansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal Gopiakumar4uNo ratings yet

- KMC Speciality Hospitals India Limited BSE 524520 FinancialsDocument38 pagesKMC Speciality Hospitals India Limited BSE 524520 Financialsakumar4uNo ratings yet

- Fortis Healthcare Limited BSE 532843 FinancialsDocument44 pagesFortis Healthcare Limited BSE 532843 Financialsakumar4uNo ratings yet

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDocument39 pagesKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- Indian HospitalsDocument8 pagesIndian Hospitalsakumar4uNo ratings yet

- Healthcare: Resilient Growth in A Seasonally Weak QuarterDocument9 pagesHealthcare: Resilient Growth in A Seasonally Weak Quarterakumar4uNo ratings yet

- A Study of India's Healthcare Sector Including Union Budget 2020Document15 pagesA Study of India's Healthcare Sector Including Union Budget 2020akumar4uNo ratings yet

- Stock CertificateDocument4 pagesStock CertificatejustjadeNo ratings yet

- Mold-Tek Packaging: Spreading Its Wings!Document11 pagesMold-Tek Packaging: Spreading Its Wings!DCDC DCNo ratings yet

- Investment Banking Preparation Week 1Document12 pagesInvestment Banking Preparation Week 1Andrusha MakalewskiNo ratings yet

- Functions of IfciDocument4 pagesFunctions of IfciKŕiśhñą Śińgh100% (1)

- NTPC 2013-14Document261 pagesNTPC 2013-14w1593503No ratings yet

- Chapter-4: Fixed Income SecuritiesDocument52 pagesChapter-4: Fixed Income SecuritiesNati YalewNo ratings yet

- PRIYAM INTERNSHIP Jmarathon AdvisoryDocument72 pagesPRIYAM INTERNSHIP Jmarathon Advisorypriyam prasad padhyNo ratings yet

- Draft Investment ProposalDocument5 pagesDraft Investment ProposalSandeep Borse100% (1)

- Mrunal's Economy Win20CSP Updates Pillar#2B: ATMA NIRBHAR Page 27Document35 pagesMrunal's Economy Win20CSP Updates Pillar#2B: ATMA NIRBHAR Page 27Ali SmartNo ratings yet

- The Vault Guide To Deutsche BankDocument56 pagesThe Vault Guide To Deutsche BankAkansha SinghNo ratings yet

- Case Summary 1. Norman J. Hamilton v. Umedbhai PatelDocument2 pagesCase Summary 1. Norman J. Hamilton v. Umedbhai PatelKanika Jain100% (2)

- 11th Edition Eugene F. Brigham University of Florida Joel F. Houston University of FloridaDocument18 pages11th Edition Eugene F. Brigham University of Florida Joel F. Houston University of FloridaHoàng Anh NguyễnNo ratings yet

- Medhasvi Expertise PVT LTDDocument4 pagesMedhasvi Expertise PVT LTDಹರೀಶ ಆತ್ರೇಯNo ratings yet

- Informe de BullTick Sobre ArgentinaDocument4 pagesInforme de BullTick Sobre ArgentinaEl DestapeNo ratings yet

- Vita Coco IPO Form S-1 (2021)Document294 pagesVita Coco IPO Form S-1 (2021)Chris ChavezNo ratings yet

- 2022 NPC Circular No. 02 Amending NPC Circular 2020-01 Guidelines On Loan Related TransactionsDocument6 pages2022 NPC Circular No. 02 Amending NPC Circular 2020-01 Guidelines On Loan Related TransactionsWilliam SantosNo ratings yet

- CAL Top 100 Stockholders As of 06.30.17Document4 pagesCAL Top 100 Stockholders As of 06.30.17Edgar LayNo ratings yet

- Credit Rating AgenciesDocument24 pagesCredit Rating AgenciesManish JangidNo ratings yet

- Rosher v. Rosher Case AnalysisDocument11 pagesRosher v. Rosher Case AnalysisShubh Dixit67% (3)

- Ipo PDFDocument7 pagesIpo PDFGoutam ReddyNo ratings yet

- Accounting For Bonus Issue: By: Ca Parveen JindalDocument10 pagesAccounting For Bonus Issue: By: Ca Parveen Jindalphani chowdaryNo ratings yet

- Chapter 15 Raising CapitalDocument2 pagesChapter 15 Raising CapitalLorren YabutNo ratings yet

- Basics of InvestmentDocument19 pagesBasics of InvestmentJohn DawsonNo ratings yet

- Investor Presentation MARCH 2021Document42 pagesInvestor Presentation MARCH 2021dnikosdNo ratings yet

- FileDocument75 pagesFileAarti Ladda SarafNo ratings yet

- Chapter-1: 1.1 Indian Banking IndustryDocument76 pagesChapter-1: 1.1 Indian Banking IndustryAnkur ChopraNo ratings yet

- The Current and The Future Outlook of Pakistan's Power SectorDocument7 pagesThe Current and The Future Outlook of Pakistan's Power SectorSufyan SafiNo ratings yet

- Filing Revised Form LM-30: An Overview of Union Officer and Employee ReportingDocument41 pagesFiling Revised Form LM-30: An Overview of Union Officer and Employee ReportingUSA_DepartmentOfLaborNo ratings yet

India - Healthcare: NCR Healthcare Visit: Tales From Delhi

India - Healthcare: NCR Healthcare Visit: Tales From Delhi

Uploaded by

akumar4uOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India - Healthcare: NCR Healthcare Visit: Tales From Delhi

India - Healthcare: NCR Healthcare Visit: Tales From Delhi

Uploaded by

akumar4uCopyright:

Available Formats

India - Healthcare NCR Healthcare visit

29 January 2020

NCR Healthcare visit: tales from Delhi

DD MMM YYYY

We spent two days in Delhi-NCR (National Capital Region), Affordable care model can work, but receivables remain an

meeting with management of privately held hospitals and issue: We met with a hospital chain that operates several 100-bed

diagnostic players. Our target was to gauge demand and supply hospitals in semi-urban areas of North India. They have been treating

for Healthcare, which can, in turn, help us assess if hospital Ayushman Bharat patients profitably. While there is no issue of

occupancy and return ratios will improve in NCR in future. New receivables with the Ayushman Bharat scheme, significant receivables

large corporate hospitals are coming up in Gurgaon/Dwarka. are outstanding from sick PSUs. The affordable model does not work on

Emerging players have eaten into Delhi’s catchment by setting star doctor concept, so the cost is kept low.

up high-quality hospitals in Meerut, Mathura, Agra, Patna,

Chandigarh, Ludhiana and Jaipur. On the diagnostics front, there North India is fairly penetrated when it comes to pathology

are at least 25-30 new B2B players who have emerged in Delhi testing, 25-30 new B2B players in the last 5 years: During the

in the last 5 years. There is limited opportunity to penetrate visit, we were told by a diagnostic player that DLPL and SRL Diagnostics

untapped areas in North India and Dr. Lal and SRL have already have already established touch points across tier-3 and tier-4 towns in

set-up touch-points in tier-3, tier-4 towns. We also visited a North India and provide reasonably-efficient services. Therefore,

Mohalla clinic, a community health centre initiative by the penetration-led growth in pathology in North India seems to be done

government of Delhi. We believe the Central government would with. We also observed emergence of 25-30 pathology labs in NCR who

eventually need to replicate Mohalla clinic’s success elsewhere offer B2B services. We believe that competition is the prime reason for

in the country. DLPL’s somewhat limited ability to take price hikes in this market.

New hospital supply in North India does not seem to stop: At Mohalla clinics by Delhi government offer real value to Delhi

least 6 corporate hospital chains have expanded in North India during residents: Delhi government has established 451 operational clinics, of

the last decade. These include Medanta, Kailash, Asian, Ivy, Paras and which 35 are working double shifts. Each clinic has a staff of 4, including

the newly emerging Nayati Healthcare. Five of these chains (each has a doctor. Cost per patient to Government works out to be US$2. Mohalla

+1,000 beds) are spread across various towns of North India. These clinics have replaced single-doctor practice as the primary care

hospital chains have added 8,000 private super-specialty beds in North provider. They provide free medicines (trade generics) and offer free

India over the last decade. Plans have been announced to add 8,000 more testing. While Central government’s Ayushman Bharat Scheme

beds to this existing capacity. predominantly provides surgical care, a Mohalla clinic offers primary

care. We believe that the success of Mohalla clinics will impel the central

More capacity coming up in Gurgaon, which already has the government to replicate it along with the Ayushman Bharat Scheme.

highest bed capacity in the country: We counted 3,200 private

premium beds in Gurgaon, including a recently-opened Manipal hospital

in Dwarka and a Narayana Hospital in Gurgaon. This equates to 1

private premium bed for every 1,300 people. Nayati has started

constructing a 450-bed hospital in Gurgaon. This should be seen along

with the fact that several super-specialty hospitals have come up in tier-

2 towns, eating into NCR’s catchment.

Dr Abhishek Sharma | abhishek.sharma@iiflcap.com Rahul Jeewani | rahul.jeewani@iiflcap.com |

91 22 4646 4668 91 22 4646 4673

India - Healthcare

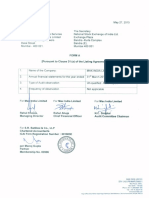

Figure 1: Emergence of North India corporate hospital chains: taking private healthcare Figure 3: Over 3,000 private premium operational beds in Gurgaon; one ‘premium’ bed

to the hinterland for every 1,200 persons

Hospital Started operations in Operational beds Hospital Started operations in Operational beds

Medanta (Gurgaon, Lucknow, Indore, Medanta 2009 900

2009 onwards 2,350

Ranchi) Artemis 2007 400

Kailash (Noida, Behror, Jewar, Khurja, Fortis (FMRI) 2012 275

1995 onwards 1,500

Dehradun) Narayana Superspecialty 2018 220

Asian (Faridabad, Moradabad, Patna, Paras 2006 300

2010 onwards 1,200

Noida)

Max Gurgaon 2007 100

Ivy (Mohali, Hoshiarpur, Amritsar, Khanna,

2008 onwards 1,100 W Pratiksha 2015 110

Nawashahr, Panchkula, Bathinda)

CK Birla Hospital for Women 2017 75

Paras (Gurugram, Patna, Darbhanga,

2006 onwards 1,000 Manipal Dwarka 2018 380

Panchkula, Ranchi, Udaipur)

Nayati Healthcare 2016 onwards 500 Nayati Healthcare TBC 450

QRG Faridabad 2016 450 Total beds 3,210

Apollo Lucknow 2019 330 Source: IIFL Research

Source: IIFL Research

Figure 2: More capacity coming up in North India

Announced projects Bed capacity

Amrita Institute of Medical Sciences , Faridabad 2,400

Medanta (NOIDA, Gorakhpur, Varanasi, Allahabad) 3,700

Nayati Healthcare (Gurugram, Varanasi, Amritsar) 1,700

Paras (Ranchi) 330

Source: IIFL Research

abh i sh ek . sh a r ma @i ifl cap . c om 2

India - Healthcare

Disclosure: Published in 2020, © IIFL Securities Limited (Formerly ‘India Infoline Limited’) 2020

India Infoline Group (hereinafter referred as IIFL) is engaged in diversified financial services business including equity broking, DP services, merchant banking, portfolio management services, distribution of Mutual Fund,

insurance products and other investment products and also loans and finance business. India Infoline Ltd (“hereinafter referred as IIL”) is a part of the IIFL and is a member of the National Stock Exchange of India Limited

(“NSE”) and the BSE Limited (“BSE”). IIL is also a Depository Participant registered with NSDL & CDSL, a SEBI registered merchant banker and a SEBI registered portfolio manager. IIL is a large broking house catering to

retail, HNI and institutional clients. It operates through its branches and authorised persons and sub-brokers spread across the country and the clients are provided online trading through internet and offline trading

through branches and Customer Care.

a) This research report (“Report”) is for the personal information of the authorized recipient(s) and is not for public distribution and should not be reproduced or redistributed to any other person or in any form without

IIL’s prior permission. The information provided in the Report is from publicly available data, which we believe, are reliable. While reasonable endeavors have been made to present reliable data in the Report so far as

it relates to current and historical information, but IIL does not guarantee the accuracy or completeness of the data in the Report. Accordingly, IIL or any of its connected persons including its directors or subsidiaries

or associates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained, views and opinions expressed in this

publication.

b) Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and

estimates contained in this report reflect a judgment of its original date of publication by IIFL and are subject to change without notice. The price, value of and income from any of the securities or financial

instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of

such securities or financial instruments.

c) The Report also includes analysis and views of our research team. The Report is purely for information purposes and does not construe to be investment recommendation/advice or an offer or solicitation of an offer to

buy/sell any securities. The opinions expressed in the Report are our current opinions as of the date of the Report and may be subject to change from time to time without notice. IIL or any persons connected with it

do not accept any liability arising from the use of this document.

d) Investors should not solely rely on the information contained in this Report and must make investment decisions based on their own investment objectives, judgment, risk profile and financial position. The recipients

of this Report may take professional advice before acting on this information.

e) IIL has other business segments / divisions with independent research teams separated by 'Chinese walls' catering to different sets of customers having varying objectives, risk profiles, investment horizon, etc and

therefore, may at times have, different and contrary views on stocks, sectors and markets.

f) This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication,

availability or use would be contrary to local law, regulation or which would subject IIL and its affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may

not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this Report may come are required to inform themselves of and to observe such restrictions.

g) As IIL along with its associates, are engaged in various financial services business and so might have financial, business or other interests in other entities including the subject company(ies) mentioned in this Report.

However, IIL encourages independence in preparation of research report and strives to minimize conflict in preparation of research report. IIL and its associates did not receive any compensation or other benefits

from the subject company(ies) mentioned in the Report or from a third party in connection with preparation of the Report. Accordingly, IIL and its associates do not have any material conflict of interest at the time of

publication of this Report.

h) As IIL and its associates are engaged in various financial services business, it might have:-

(a) received any compensation (except in connection with the preparation of this Report) from the subject company in the past twelve months; (b) managed or co-managed public offering of securities for the subject

company in the past twelve months; (c) received any compensation for investment banking or merchant banking or brokerage serv ices from the subject company in the past twelve months; (d) received any

compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months; (e) engaged in market making activity for the

subject company.

i) IIL and its associates collectively do not own (in their proprietary position) 1% or more of the equity securities of the subject company mentioned in the report as of the last day of the month preceding the publication

of the research report.

j) The Research Analyst engaged in preparation of this Report or his/her relative:-

(a) does not have any financial interests in the subject company (ies) mentioned in this report; (b) does not own 1% or more of the equity securities of the subject company mentioned in the report as of the last day

of the month preceding the publication of the research report; (c) does not have any other material conflict of interest at the time of publication of the research report.

k) The Research Analyst engaged in preparation of this Report:-

(a) has not received any compensation from the subject company in the past twelve months; (b) has not managed or co-managed public offering of securities for the subject company in the past twelve months; (c)

has not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months; (d) has not received any compensation for products or

services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months; (e) has not received any compensation or other benefits from the subject

company or third party in connection with the research report; (f) has not served as an officer, director or employee of the subject company; (g) is not engaged in market making activity for the subject company.

L) IIFLCAP accepts responsibility for the contents of this research report, subject to the terms set out below, to the extent that it is delivered to a U.S. person other than a major U.S. institutional investor. The analyst

whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry Regulatory Authority (“FINRA”) and may not be an associated person of IIFLCAP and,

therefore, may not be subject to applicable restrictions under FINRA Rules on communications with a subject company, public appearances and trading securities held by a research analyst account.

We submit that no material disciplinary action has been taken on IIL by any regulatory authority impacting Equity Research Analysis.

abh i sh ek . sh a r ma @i ifl cap . c om 3

India - Healthcare

A graph of daily closing prices of securities is available at http://www.nseindia.com/ChartApp/install/charts/mainpage.jsp, www.bseindia.com and http://economictimes.indiatimes.com/markets/stocks/stock-quotes.

(Choose a company from the list on the browser and select the “three years” period in the price chart).

Name, Qualification and Certification of Research Analyst: Dr Abhishek Sharma(PGDM), Rahul Jeewani(PGDM)

IIFL Securities Limited (Formerly ‘India Infoline Limited’), CIN No.: L99999MH1996PLC132983, Corporate Office – IIFL Centre, Kamala City, Senapati Bapat Marg, Lower Parel, Mumbai – 400013 Tel: (91-22)

4249 9000 .Fax: (91-22) 40609049, Regd. Office – IIFL House, Sun Infotech Park, Road No. 16V, Plot No. B-23, MIDC, Thane Industrial Area, Wagle Estate, Thane – 400604 Tel: (91-22) 25806650. Fax: (91-22)

25806654 E-mail: mail@indiainfoline.com Website: www.indiainfoline.com, Refer www.indiainfoline.com for detail of Associates.

Stock Broker SEBI Regn.: INZ000164132, PMS SEBI Regn. No. INP000002213, IA SEBI Regn. No. INA000000623, SEBI RA Regn.:- INH000000248

Key to our recommendation structure

BUY - Stock expected to give a return 10%+ more than average return on a debt instrument over a 1-year horizon.

SELL - Stock expected to give a return 10%+ below the average return on a debt instrument over a 1-year horizon.

Add - Stock expected to give a return 0-10% over the average return on a debt instrument over a 1-year horizon.

Reduce - Stock expected to give a return 0-10% below the average return on a debt instrument over a 1-year horizon.

Distribution of Ratings: Out of 227 stocks rated in the IIFL coverage universe, 101 have BUY ratings, 8 have SELL ratings, 85 have ADD ratings and 32 have REDUCE ratings

Price Target: Unless otherwise stated in the text of this report, target prices in this report are based on either a discounted cash flow valuation or comparison of valuation ratios with companies seen by the analyst as

comparable or a combination of the two methods. The result of this fundamental valuation is adjusted to reflect the analyst’s views on the likely course of investor sentiment. Whichever valuation method is used there is a

significant risk that the target price will not be achieved within the expected timeframe. Risk factors include unforeseen changes in competitive pressures or in the level of demand for the company’s products. Such demand

variations may result from changes in technology, in the overall level of economic activity or, in some cases, in fashion. Va luations may also be affected by changes in taxation, in exchange rates and, in certain industries,

in regulations. Investment in overseas markets and instruments such as ADRs can result in increased risk from factors such as exchange rates, exchange controls, taxation, and political and social conditions. This

discussion of valuation methods and risk factors is not comprehensive – further information is available upon request.

Apollo Hospitals: 3 year price and rating history Date Close price Target price Rating

(Rs) (Rs) (Rs)

Price TP/Reco changed date

2,000 18 Nov 2019 1397 1540 ADD

27 Jul 2018 939 1135 ADD

1,500

1,000

500

0

Mar-17

May-17

Nov-17

Mar-18

May-18

Jan-19

Mar-19

May-19

Jan-17

Jan-18

Jul-18

Nov-18

Nov-19

Jan-20

Jul-17

Sep-17

Sep-18

Jul-19

Sep-19

abh i sh ek . sh a r ma @i ifl cap . c om 4

India - Healthcare

Dr Lal Path Lab: 3 year price and rating history Date Close price Target price Rating

(Rs) (Rs) (Rs)

Price TP/Reco changed date

2,000 11 Jun 2019 1062 1100 ADD

20 Nov 2018 847 1000 BUY

1,500 27 Jul 2018 924 1000 ADD

08 Aug 2017 832 1000 BUY

1,000 15 May 2017 891 1100 BUY

500

0

Mar-17

May-17

Nov-17

Mar-18

May-18

Jan-19

Mar-19

May-19

Jan-17

Jan-18

Jul-18

Nov-18

Nov-19

Jan-20

Jul-17

Sep-17

Sep-18

Jul-19

Sep-19

HealthCare Global: 3 year price and rating history

(Rs) Price TP/Reco changed date Date Close price Target price Rating

(Rs) (Rs)

400

350 28 May 2019 199 180 REDUCE

300 26 Feb 2018 303 350 BUY

250

200

150

100

50

0

Mar-17

May-17

Nov-17

Mar-18

May-18

Jan-19

Mar-19

May-19

Jan-17

Jan-18

Jul-18

Nov-18

Nov-19

Jan-20

Jul-17

Sep-17

Sep-18

Jul-19

Sep-19

abh i sh ek . sh a r ma @i ifl cap . c om 5

You might also like

- NABH Accredited AYUSH Hospitals As Downloaded On 09.08.2023Document19 pagesNABH Accredited AYUSH Hospitals As Downloaded On 09.08.2023yolomeNo ratings yet

- Credit and CollectionDocument129 pagesCredit and CollectionKim Ritua - Tabudlo40% (5)

- Delta Corp Annual Report FY 2021-22Document241 pagesDelta Corp Annual Report FY 2021-22akumar4uNo ratings yet

- Netra Case Study For EndtermDocument9 pagesNetra Case Study For EndtermGarima GeetikaNo ratings yet

- 9.403 Chapter 4: Efficient Securities MarketsDocument10 pages9.403 Chapter 4: Efficient Securities MarketsYanee ReeNo ratings yet

- Aster DMDocument51 pagesAster DMPradeep Kumar SahuNo ratings yet

- The Indian Medical Devices MarketDocument19 pagesThe Indian Medical Devices MarketSandeep Kumar100% (2)

- Narayana Hrudayalaya - 141215 PDFDocument7 pagesNarayana Hrudayalaya - 141215 PDFrawatbs2020No ratings yet

- Bharuch Hospital ProjectDocument89 pagesBharuch Hospital Projectzaheeruddin_mohdNo ratings yet

- About Narayana HrudayalayaDocument2 pagesAbout Narayana HrudayalayaChandra Sekhar100% (2)

- Hospital Critical Care Hospital Ranking Survey March 2021Document3 pagesHospital Critical Care Hospital Ranking Survey March 2021ravi ohlyanNo ratings yet

- Fortis Concall Q3 26 02 2009Document29 pagesFortis Concall Q3 26 02 2009prasherMBANo ratings yet

- Maternity NetworkDocument13 pagesMaternity NetworkArun Kumar SamalNo ratings yet

- AHEL Investor Presentation December 22 INRDocument51 pagesAHEL Investor Presentation December 22 INRLiu BillyNo ratings yet

- Corporate Fact Sheets: Security & Intellgence Solutions IncDocument6 pagesCorporate Fact Sheets: Security & Intellgence Solutions IncB J DasNo ratings yet

- Vipul MedCorp TPA PresentationDocument26 pagesVipul MedCorp TPA PresentationAkash YadavNo ratings yet

- Hosconnn Brochure-1Document12 pagesHosconnn Brochure-1India Heals-2020No ratings yet

- Marketing AnalysisDocument6 pagesMarketing AnalysisSwagato SarkarNo ratings yet

- Case Study On :'œmarketing Strategies of Henry Ford of Heart Surgery - Narayana Health Care Also Known As Narayana Hrudayalaya, Leading India in World For Health Care'Document7 pagesCase Study On :'œmarketing Strategies of Henry Ford of Heart Surgery - Narayana Health Care Also Known As Narayana Hrudayalaya, Leading India in World For Health Care'Editor IJTSRDNo ratings yet

- Merger of Radiant With Max Healthcare Dec18Document39 pagesMerger of Radiant With Max Healthcare Dec18Rohit RajNo ratings yet

- Hospital Interior Designing Services PDFDocument6 pagesHospital Interior Designing Services PDFreddi.demullu007No ratings yet

- Hospital Interior Designing Services PDFDocument6 pagesHospital Interior Designing Services PDFreddi.demullu007No ratings yet

- NATHEALTH Year End Progress Report 2023-1Document127 pagesNATHEALTH Year End Progress Report 2023-1Moumita Roy ChowdhuryNo ratings yet

- Hospital Interior Designing Services PDFDocument6 pagesHospital Interior Designing Services PDFreddi.demullu007No ratings yet

- Indian School of Business: January 31, 2019Document23 pagesIndian School of Business: January 31, 2019Sarvesh KashyapNo ratings yet

- Jeena Sikho Presentation May 2024Document40 pagesJeena Sikho Presentation May 2024Puneet367No ratings yet

- SIP Project Presentation Brand Promotion of Moolchand Medcity Through Value Added Service (VAS) Program and Medical Camp Nitin SharmaDocument17 pagesSIP Project Presentation Brand Promotion of Moolchand Medcity Through Value Added Service (VAS) Program and Medical Camp Nitin SharmaNitin SharmaNo ratings yet

- LIFENET Hospitals (India) : Developing New Services' Case StudyDocument16 pagesLIFENET Hospitals (India) : Developing New Services' Case StudyDesh Verma ASAP, LucknowNo ratings yet

- Expansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal GopiDocument13 pagesExpansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal Gopiakumar4uNo ratings yet

- Aalok Ghosh Lmo AssignmentDocument5 pagesAalok Ghosh Lmo AssignmentAalok GhoshNo ratings yet

- Kle GokakDocument1 pageKle GokakBhaskar SuryapethNo ratings yet

- Prakriya Hospitals Investor Brochure - 2019Document19 pagesPrakriya Hospitals Investor Brochure - 2019Abhishek S AatreyaNo ratings yet

- Emb FinalDocument18 pagesEmb FinalVikrantGuptaNo ratings yet

- Company Name Founded Yeinvestor (S) Latest FinanDocument3 pagesCompany Name Founded Yeinvestor (S) Latest FinanParehjuiNo ratings yet

- Assignment: Max IndiaDocument5 pagesAssignment: Max IndiaP.Umasankar SubudhiNo ratings yet

- NABH Accredited HospitalsDocument56 pagesNABH Accredited Hospitalsdchandra15No ratings yet

- Narayana Hrudalaya Heart HospitalDocument17 pagesNarayana Hrudalaya Heart HospitalWaibhav Krishna100% (1)

- CV Vikram Vikas NigamDocument4 pagesCV Vikram Vikas NigamVikram Vikas NigamNo ratings yet

- Meditech QuoteDocument5 pagesMeditech QuoteAnand_HvacNo ratings yet

- Hospital ListDocument7 pagesHospital ListSivaramakrishnan KNo ratings yet

- Sharing An Eastward Vision - Express HealthcareDocument5 pagesSharing An Eastward Vision - Express HealthcareVeena Parkhi KhasbardarNo ratings yet

- DABUR Working Capital Finance Auto Saved)Document66 pagesDABUR Working Capital Finance Auto Saved)Antima TyagiNo ratings yet

- List of HospitalsDocument170 pagesList of HospitalsDrShripad Taklikar33% (3)

- Jupiter IC 1nov23Document37 pagesJupiter IC 1nov23ofusandeepNo ratings yet

- NATHEALTH Annual Report - March 2024Document133 pagesNATHEALTH Annual Report - March 2024Moumita Roy ChowdhuryNo ratings yet

- Gujarat Health Care SystemDocument18 pagesGujarat Health Care Systemrohan agrawal4uNo ratings yet

- Production: Ramdev Acharya Balkrishna AyurvedaDocument7 pagesProduction: Ramdev Acharya Balkrishna Ayurvedaharjeet bhatia100% (1)

- Medical Devices Manufacturing in India:: A Sunrise SegmentDocument2 pagesMedical Devices Manufacturing in India:: A Sunrise SegmentDevasyaNo ratings yet

- Max Multispecialty HospitalDocument33 pagesMax Multispecialty HospitalShiv Shankar GuptaNo ratings yet

- Inventory Control Techniques in A Tertiary Care Hospital PDFDocument56 pagesInventory Control Techniques in A Tertiary Care Hospital PDFkrishnaNo ratings yet

- Vaatsalya HospitalsDocument18 pagesVaatsalya HospitalsFarjendra KumarNo ratings yet

- S.No. Roll No Rank Comm Course Institute State DNB R1 Course DNB R1 Institute R1 To R2Document188 pagesS.No. Roll No Rank Comm Course Institute State DNB R1 Course DNB R1 Institute R1 To R2Maneesh BalachandranNo ratings yet

- Apollo GleneaglesDocument15 pagesApollo Gleneaglessujal vermaNo ratings yet

- Top DNB Ortho Surgery Institutions byDocument14 pagesTop DNB Ortho Surgery Institutions byDr ThanosNo ratings yet

- 20.07.18 Healthcare Supply Chain Management SummitDocument10 pages20.07.18 Healthcare Supply Chain Management SummitKumarNo ratings yet

- Rasachikitsa Chandigarh 2023Document9 pagesRasachikitsa Chandigarh 2023Shree ayurvedic panchakarma Multi speciality centerNo ratings yet

- 5002710315Document239 pages5002710315Ravi BhadauriaNo ratings yet

- Aravind Eye Hospital - LCM AssignmentDocument7 pagesAravind Eye Hospital - LCM Assignmentkrishna sharmaNo ratings yet

- Patanjali Internet InfoDocument20 pagesPatanjali Internet InfoPrasad KadamNo ratings yet

- Monarch - Networth - Capital - Initiates - Coverage - On - Rainbow - Children's MedicareDocument14 pagesMonarch - Networth - Capital - Initiates - Coverage - On - Rainbow - Children's MedicareSriram RanganathanNo ratings yet

- Patanjali A Yur Ved Invades IndiaDocument20 pagesPatanjali A Yur Ved Invades IndiaManshu PoorviNo ratings yet

- Annual Report 2017 2018Document220 pagesAnnual Report 2017 2018akumar4uNo ratings yet

- Notice of 27th AgmDocument14 pagesNotice of 27th Agmakumar4uNo ratings yet

- Quarter December 2017 2018Document9 pagesQuarter December 2017 2018akumar4uNo ratings yet

- The Startup's Guide To Google CloudDocument18 pagesThe Startup's Guide To Google Cloudakumar4uNo ratings yet

- Zscaler Inc - Form 10-K (Sep-18-2019)Document164 pagesZscaler Inc - Form 10-K (Sep-18-2019)akumar4uNo ratings yet

- IBEF IT-and-BPM-January-2021Document34 pagesIBEF IT-and-BPM-January-2021akumar4u100% (1)

- Design Thinking EbookDocument850 pagesDesign Thinking Ebookakumar4uNo ratings yet

- Rummy Mobile Gaming ComparisonDocument2 pagesRummy Mobile Gaming Comparisonakumar4uNo ratings yet

- Zscaler Inc - Form 10-K (Sep-17-2020)Document186 pagesZscaler Inc - Form 10-K (Sep-17-2020)akumar4uNo ratings yet

- IBEF Healthcare-March-2021Document39 pagesIBEF Healthcare-March-2021akumar4uNo ratings yet

- Healthcare: Ind AS 116: Impact Analysis On Healthcare CompaniesDocument7 pagesHealthcare: Ind AS 116: Impact Analysis On Healthcare Companiesakumar4uNo ratings yet

- Expansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal GopiDocument13 pagesExpansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal Gopiakumar4uNo ratings yet

- KMC Speciality Hospitals India Limited BSE 524520 FinancialsDocument38 pagesKMC Speciality Hospitals India Limited BSE 524520 Financialsakumar4uNo ratings yet

- Fortis Healthcare Limited BSE 532843 FinancialsDocument44 pagesFortis Healthcare Limited BSE 532843 Financialsakumar4uNo ratings yet

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDocument39 pagesKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- Indian HospitalsDocument8 pagesIndian Hospitalsakumar4uNo ratings yet

- Healthcare: Resilient Growth in A Seasonally Weak QuarterDocument9 pagesHealthcare: Resilient Growth in A Seasonally Weak Quarterakumar4uNo ratings yet

- A Study of India's Healthcare Sector Including Union Budget 2020Document15 pagesA Study of India's Healthcare Sector Including Union Budget 2020akumar4uNo ratings yet

- Stock CertificateDocument4 pagesStock CertificatejustjadeNo ratings yet

- Mold-Tek Packaging: Spreading Its Wings!Document11 pagesMold-Tek Packaging: Spreading Its Wings!DCDC DCNo ratings yet

- Investment Banking Preparation Week 1Document12 pagesInvestment Banking Preparation Week 1Andrusha MakalewskiNo ratings yet

- Functions of IfciDocument4 pagesFunctions of IfciKŕiśhñą Śińgh100% (1)

- NTPC 2013-14Document261 pagesNTPC 2013-14w1593503No ratings yet

- Chapter-4: Fixed Income SecuritiesDocument52 pagesChapter-4: Fixed Income SecuritiesNati YalewNo ratings yet

- PRIYAM INTERNSHIP Jmarathon AdvisoryDocument72 pagesPRIYAM INTERNSHIP Jmarathon Advisorypriyam prasad padhyNo ratings yet

- Draft Investment ProposalDocument5 pagesDraft Investment ProposalSandeep Borse100% (1)

- Mrunal's Economy Win20CSP Updates Pillar#2B: ATMA NIRBHAR Page 27Document35 pagesMrunal's Economy Win20CSP Updates Pillar#2B: ATMA NIRBHAR Page 27Ali SmartNo ratings yet

- The Vault Guide To Deutsche BankDocument56 pagesThe Vault Guide To Deutsche BankAkansha SinghNo ratings yet

- Case Summary 1. Norman J. Hamilton v. Umedbhai PatelDocument2 pagesCase Summary 1. Norman J. Hamilton v. Umedbhai PatelKanika Jain100% (2)

- 11th Edition Eugene F. Brigham University of Florida Joel F. Houston University of FloridaDocument18 pages11th Edition Eugene F. Brigham University of Florida Joel F. Houston University of FloridaHoàng Anh NguyễnNo ratings yet

- Medhasvi Expertise PVT LTDDocument4 pagesMedhasvi Expertise PVT LTDಹರೀಶ ಆತ್ರೇಯNo ratings yet

- Informe de BullTick Sobre ArgentinaDocument4 pagesInforme de BullTick Sobre ArgentinaEl DestapeNo ratings yet

- Vita Coco IPO Form S-1 (2021)Document294 pagesVita Coco IPO Form S-1 (2021)Chris ChavezNo ratings yet

- 2022 NPC Circular No. 02 Amending NPC Circular 2020-01 Guidelines On Loan Related TransactionsDocument6 pages2022 NPC Circular No. 02 Amending NPC Circular 2020-01 Guidelines On Loan Related TransactionsWilliam SantosNo ratings yet

- CAL Top 100 Stockholders As of 06.30.17Document4 pagesCAL Top 100 Stockholders As of 06.30.17Edgar LayNo ratings yet

- Credit Rating AgenciesDocument24 pagesCredit Rating AgenciesManish JangidNo ratings yet

- Rosher v. Rosher Case AnalysisDocument11 pagesRosher v. Rosher Case AnalysisShubh Dixit67% (3)

- Ipo PDFDocument7 pagesIpo PDFGoutam ReddyNo ratings yet

- Accounting For Bonus Issue: By: Ca Parveen JindalDocument10 pagesAccounting For Bonus Issue: By: Ca Parveen Jindalphani chowdaryNo ratings yet

- Chapter 15 Raising CapitalDocument2 pagesChapter 15 Raising CapitalLorren YabutNo ratings yet

- Basics of InvestmentDocument19 pagesBasics of InvestmentJohn DawsonNo ratings yet

- Investor Presentation MARCH 2021Document42 pagesInvestor Presentation MARCH 2021dnikosdNo ratings yet

- FileDocument75 pagesFileAarti Ladda SarafNo ratings yet

- Chapter-1: 1.1 Indian Banking IndustryDocument76 pagesChapter-1: 1.1 Indian Banking IndustryAnkur ChopraNo ratings yet

- The Current and The Future Outlook of Pakistan's Power SectorDocument7 pagesThe Current and The Future Outlook of Pakistan's Power SectorSufyan SafiNo ratings yet

- Filing Revised Form LM-30: An Overview of Union Officer and Employee ReportingDocument41 pagesFiling Revised Form LM-30: An Overview of Union Officer and Employee ReportingUSA_DepartmentOfLaborNo ratings yet