Professional Documents

Culture Documents

Corporate Tax Planning MCQ PDF

Corporate Tax Planning MCQ PDF

Uploaded by

Pruthiraj SahooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Tax Planning MCQ PDF

Corporate Tax Planning MCQ PDF

Uploaded by

Pruthiraj SahooCopyright:

Available Formats

www.downloadmela.

com

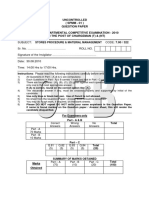

(53) SARDAR PATEL UNIVERSITY

No of Pages: 4+2

"M:. Coni: '(CBCS) (Semester- Ill)

. Monday, 02"d December 2013

2.30PM to 5.30PM

COURSE TITLE: CORPORATE TAX PLANNING CODE NO. : PB03ECOM01

Maximum Marks: 60

Exam No. 1r-- J

L------~····--·-

Candidate's Name :

-----~--~------~-~-- ..................... ····~-----.. ·-··•-......... '.

Candidate's Signature:·-----~·--~------··

Supervisor's Signature

r·----···-..-----------..,---------..,·-·-.. 1

' --~ J

QUESTION NO. 1 OBJECTIVE (MCQ) (12)

QUESTION P APEI{-CUM-ANSWER SHEET MARKS OBTAINED

GENERAL INSTRUCTIONS

I. The question no. I is objective type multiple choice questions.

2. The first half an hour is allotted to the objective questions.

3. Answers of the questions are to be given in the Answer Sheet attached se arately.

4. Eac~estion has four alternative responses, marked as W G) .C 0 ou have to darken

the , . 'the oval with black or blue pen only. For example:

correct answer.

W C n where 'B' is the

5. Fifteen (15) multiple-cboice questions of one mark each is asked, out of which the candidate

would be required to answer any twelve (12).

6. Please darken the ovals completely.

7. More than one response is not permitted.

www.downloadmela.com - World's number one free educational download portal

www.downloadmela.com

Q. 1 Select the most appropriate answer for each of the following cases:

1 .................. is legal as well as ethical.

(A) Tax Planning

(B) Tax Avoidance

(C) Tax Evasion

(D) Tax Management

2 ................. Means the "art of dodging tax without breaking the law".

(A) Tax Planning '

(B) Tax Avoidance

(C) Tax Evasion

(D) Tax Management

3 If Mr. SP, an individual deposits Rs.l,OO,OOO in Public Provident Fund Account, so as

, to reduce his tax liability, this can be·called as an act of ............... .

(A) Tax Planning

(B) Tax Avoidance

(C) Tax Evasion

(D) Tax Management

4 Which of the following will not be considered 'Dividend' u/s 2(22) of Income Tax

Act, 1961?

(A) Distribution entailing release of company's assets

(B) Issuing Right Shares to shareholders

(C) Distribution on liquidation of company

(D) Distribution on .~;eduction of share capital

5 What is the rate of Dividend Distribution Tax for Domestic Companies'?

(A) 10%

(B) 16.2225%

. (C) 7 Y2%

(D) 5%

6 Issue of bonus shares to Equity shareholders was taxable in the hands of ............ ..

Before June 18 \ 1997.

(A) Company issuing such bonus shares

(B) Equity shareholders

(C) Both Company issuing such bonus shares and Preference shareholders

(D) None of the above

7 While amalgamation there must be a provision in the of both the

Companies to amalgamate with any other company.

· (A) Memorandum of Association of Both the companies

(B) Articles of Association of amalgamating Company

(C) Both Memorandum of Association and Articles of Association of Association

of both the companies

(D)None of Above

www.downloadmela.com - World's number one free educational download portal

www.downloadmela.com

8 At the end of lease period ________

(A) Lessee becomes the owner of assets

(B) Lessee disposes of assets '

(C) Lessor take back the assets

~·-~(D~)~A=ll~o~f~ab~o~v~e.-~~·-------------------------------------~

9 Optimum Capital structure means ......... .

(A)High Cost of Capital and low firm value

(B)Low Cost of Capital and High firm value

(C) High Cost of Capital and High firm value

(D)Low Cost of Capital and low firm value

10 In case of demerger of the undertaking, being transferred by the

demerged company, immediately before the demerger, becomes the property of the

resulting company by virtue of the demerger. .

(A) More than 3/41h property

(B) More that 60% of the property

(C) all the property

. (D)More that 50% of the property

11 An employee cannot claim benefit of exemption on ...... .

(A) death-cum-retirement gratuity

(B) Uncommitted pension

(C) Retrenchment compassion .

(D) Contribution to provident fund

12 In a scheme of amalgamation u/s 2(1B), all the proportion of company should

be vested in company.

(A) Amalgamated, amalgamating

(B) Amalgamating, amalgamated

(C) Merged, Demerged

(D) Acquired, Acquisition

13 If condition u/s 72A of income tax act are not satisfied, the amalgamating company

can not claim benefit of. ........ .

(A) Unabsorbed depreciation

(B) Accumulated losses

(C) Both

(D)Norie of above

14 Non-disclosure of income from 'Benami Transactions' is an act of ............... .

(A) Tax Planning

(B) Tax Avoidance

(C) Tax Evasion

(D) Tax Management

15 KP Ltd wants to Merge with DP Ltd. What are the legal procedure to be followed for

the said purpose, Kindly arrange it as per law

1. High Court's Approval

2. Intimation to Stock Exchange

3. Obtaining Government Approval

4, Provision in the object clause

(A)1,2,3,4 (B) 2,3,1,4 (C) 4,3,2,1 (D)3,2,4,1

www.downloadmela.com - World's number one free educational download portal

www.downloadmela.com

ANSWER-SHEET

Options

Que. No.

A B c D

1. w .w (£) (Q)

2. w (i) (£) (Q)

3. w (i) (£) (Q)

4. w G) (£) (Q)

5. w (i) (£) (Q)

6. w G) (£) (Q)

7. w (i) 0 (Q)

8. w (i) (£) (Q)

9. w (i) 0 (Q)

10. w (i) 0 (Q)

' 11. w (i) 0 (Q)

12. w (i) 0 (Q)

13. w G) (f)· (Q)

14. w (i) 0 ·(Q)

15. (i) w 0 CQ)

www.downloadmela.com - World's number one free educational download portal

You might also like

- 2CEXAM Mock Question Licensing Examination Paper 7Document10 pages2CEXAM Mock Question Licensing Examination Paper 7Tsz Ngong Ko100% (1)

- Certified Officer Course PDFDocument8 pagesCertified Officer Course PDFAbhishek Kaushik33% (3)

- Ifrs 17: Patrik Oliver PantiaDocument20 pagesIfrs 17: Patrik Oliver PantiaPatrik Oliver Pantia100% (1)

- Advance Account II MCQ FinalbsisjshDocument33 pagesAdvance Account II MCQ FinalbsisjshPranit Pandit100% (1)

- Capital Budgeting Techniques: Multiple Choice QuestionsDocument10 pagesCapital Budgeting Techniques: Multiple Choice QuestionsRod100% (1)

- Corporate Tax Planning MCQDocument4 pagesCorporate Tax Planning MCQPruthiraj SahooNo ratings yet

- COMMERCEDocument15 pagesCOMMERCEJayprakash ThakurNo ratings yet

- Hsslive-march-2023-qn-FY 449 (Accounts With AFS)Document16 pagesHsslive-march-2023-qn-FY 449 (Accounts With AFS)nadidawaunionthekkekadNo ratings yet

- B.B.A. Degree Examination, December 2023 Online Programme Examinations Third Year - Fifth Semester Rural Banking (CBCS - 2020 Onwards)Document8 pagesB.B.A. Degree Examination, December 2023 Online Programme Examinations Third Year - Fifth Semester Rural Banking (CBCS - 2020 Onwards)jva_worldNo ratings yet

- Ballb 6 Sem Company Law p2 Winter 2018Document2 pagesBallb 6 Sem Company Law p2 Winter 2018Shashank BhoseNo ratings yet

- Hsslive-xi-june-2022-qn-FY 49 (Accounts With AFS) PDFDocument16 pagesHsslive-xi-june-2022-qn-FY 49 (Accounts With AFS) PDFDanish JohnNo ratings yet

- PPSC Junior Auditor Question Papers 1Document5 pagesPPSC Junior Auditor Question Papers 1preet103411No ratings yet

- F010402TDocument16 pagesF010402TKriti PatelNo ratings yet

- Mcom 1 Sem Bannking N Insurance Services S 2019Document9 pagesMcom 1 Sem Bannking N Insurance Services S 2019Krishna TiwariNo ratings yet

- Formatted Accounting Finance For Bankers AFB 3Document5 pagesFormatted Accounting Finance For Bankers AFB 3SijuNo ratings yet

- 1 Accountancy Class XII Commerce 0Document149 pages1 Accountancy Class XII Commerce 0Raj PeruaNo ratings yet

- JA-QP-Both ShiftsDocument22 pagesJA-QP-Both ShiftsOnline workshopNo ratings yet

- CA Final Afm Qa MTP 1 May 2024Document19 pagesCA Final Afm Qa MTP 1 May 2024Bijay AgrawalNo ratings yet

- CA Final AFM Q MTP 1 May 2024 Castudynotes ComDocument9 pagesCA Final AFM Q MTP 1 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- Receivable Management - Financial Management MCQ - Learn CramDocument46 pagesReceivable Management - Financial Management MCQ - Learn CramstrikertalkshereNo ratings yet

- Accountancy, Class XI Com, UT-1 (Periodic)Document4 pagesAccountancy, Class XI Com, UT-1 (Periodic)manoj bhattNo ratings yet

- Accounting An Introduction NZ 2nd Edition Atrill Test BankDocument36 pagesAccounting An Introduction NZ 2nd Edition Atrill Test Bankupdive.beknavemyzyu100% (37)

- BFN Alpha 2014 2015Document58 pagesBFN Alpha 2014 2015CHIDINMA ONUORAHNo ratings yet

- Xi Chemistry Past Paper Karachi Board: Page 1 of 68Document68 pagesXi Chemistry Past Paper Karachi Board: Page 1 of 68salman100% (1)

- Document From Maqsood AhmadDocument22 pagesDocument From Maqsood AhmadAnnas AhmadNo ratings yet

- St. Lawrence Convent, Sr. Sec, School Class XI (2021-2022) Business Studies UT-2 Timing 9:00am - 9:45am Maximum Marks 20 General InstructionsDocument5 pagesSt. Lawrence Convent, Sr. Sec, School Class XI (2021-2022) Business Studies UT-2 Timing 9:00am - 9:45am Maximum Marks 20 General Instructionsshahnawaz alamNo ratings yet

- CPT Question Paper December 2016 With Answer Key PDFDocument28 pagesCPT Question Paper December 2016 With Answer Key PDFSarthak LakhaniNo ratings yet

- Accounting For Decision Makers - Final Exam Oct 2022Document12 pagesAccounting For Decision Makers - Final Exam Oct 2022Ahmed EhabNo ratings yet

- Ballb 6 Sem Company Law p2 7471 Summer 2019Document3 pagesBallb 6 Sem Company Law p2 7471 Summer 2019Shashank BhoseNo ratings yet

- Uncontrolled (SPMM - 01) Question Paper Limited Departmental Competitive Examination - 2010 For The Post of Chargeman (T) & (NT)Document8 pagesUncontrolled (SPMM - 01) Question Paper Limited Departmental Competitive Examination - 2010 For The Post of Chargeman (T) & (NT)Amit Kumar100% (1)

- Wa0003.Document173 pagesWa0003.labiot324No ratings yet

- Accounting For Share Capital: Vachhanis' Professional Academy-RatlamDocument18 pagesAccounting For Share Capital: Vachhanis' Professional Academy-RatlamSarthak JoshiNo ratings yet

- Accounting Practice MCQ Set 1Document3 pagesAccounting Practice MCQ Set 1TabishNo ratings yet

- Sample Paper Class 11TH CommerceDocument5 pagesSample Paper Class 11TH CommerceSamarth KhatorNo ratings yet

- 66-C-1 - Set 1 - Main PaperDocument47 pages66-C-1 - Set 1 - Main Papersasta jiNo ratings yet

- AnswerDocument2 pagesAnswerNirmal K PradhanNo ratings yet

- HVFDocument46 pagesHVFsarosathishcNo ratings yet

- POB Jan P1 2023Document9 pagesPOB Jan P1 2023Celice LewisNo ratings yet

- Multiple Choice Questions: Arts, Commerce and Science College, Bodwad. Question Bank Subject: - Corporate AccountingDocument12 pagesMultiple Choice Questions: Arts, Commerce and Science College, Bodwad. Question Bank Subject: - Corporate AccountingAshutosh shahNo ratings yet

- C 420 (Set A) .AccountantDocument32 pagesC 420 (Set A) .AccountantJivender KumarNo ratings yet

- BFM Mod D-2Document7 pagesBFM Mod D-2Raghvendra SinghNo ratings yet

- Superintendent 687 C 544 Set ADocument32 pagesSuperintendent 687 C 544 Set ATanushree ChatterjeeNo ratings yet

- 0610 Commerce Paper IIDocument11 pages0610 Commerce Paper IIpriya_psalmsNo ratings yet

- Model Test Paper Accounts Officer PostsDocument45 pagesModel Test Paper Accounts Officer PostsdevarajbcomNo ratings yet

- Sample Exam December 2019Document10 pagesSample Exam December 2019miguelNo ratings yet

- MCQ Fa (Unit 3)Document10 pagesMCQ Fa (Unit 3)Udit SinghalNo ratings yet

- Dwnload Full Financial Accounting Canadian Canadian 5th Edition Libby Test Bank PDFDocument35 pagesDwnload Full Financial Accounting Canadian Canadian 5th Edition Libby Test Bank PDFxatiaaumblask100% (16)

- Personal Financial PlanningDocument4 pagesPersonal Financial PlanningSnehal MohodNo ratings yet

- MS 11 BSTDocument14 pagesMS 11 BSTdharmitdhruvNo ratings yet

- Sample Questions For Class 11: PatternDocument6 pagesSample Questions For Class 11: PatternNeha SarafNo ratings yet

- Sample Questions For Class 11: PatternDocument6 pagesSample Questions For Class 11: PatternNeha SarafNo ratings yet

- Jaiib Sample QuestionsDocument4 pagesJaiib Sample Questionskubpyg100% (1)

- MFT Samp Questions BusinessDocument7 pagesMFT Samp Questions BusinessKiều Thảo AnhNo ratings yet

- Foundation EconomicsDocument17 pagesFoundation EconomicsSunil MewadakalalNo ratings yet

- Hours) : - (L) : (Part-lI)Document11 pagesHours) : - (L) : (Part-lI)Sadhik LaluwaleNo ratings yet

- Econ 2 Deg Exam 2016 - 2017 - FINAL PDFDocument11 pagesEcon 2 Deg Exam 2016 - 2017 - FINAL PDFAriel WangNo ratings yet

- Exit Exam Tutorial ClassDocument58 pagesExit Exam Tutorial Classkedirmahammed8No ratings yet

- Economics MCQs Practice Test 1Document6 pagesEconomics MCQs Practice Test 1Majid AbNo ratings yet

- Accounting An Introduction NZ 2nd Edition Atrill Test BankDocument18 pagesAccounting An Introduction NZ 2nd Edition Atrill Test BankAdrianHayescgide100% (13)

- Any Requests For Time Off Should Be 126. Last Year, Tadaka Computer SolutionsDocument3 pagesAny Requests For Time Off Should Be 126. Last Year, Tadaka Computer SolutionsNguyen TrongNo ratings yet

- Accountancy Model Paper-2-1Document9 pagesAccountancy Model Paper-2-1Hashim SethNo ratings yet

- Bse, Nse, Ise, Otcei, NSDLDocument17 pagesBse, Nse, Ise, Otcei, NSDLoureducation.in100% (4)

- Rbi Circular On Standardization of Irs ContractsDocument1 pageRbi Circular On Standardization of Irs ContractsKirubakaran KaliaperumalNo ratings yet

- Capital Structure Limit To Usage of DebtDocument28 pagesCapital Structure Limit To Usage of DebtAlisha SharmaNo ratings yet

- Cgu ProblemsDocument2 pagesCgu ProblemsAlizeyyNo ratings yet

- Investment Management Module 1Document21 pagesInvestment Management Module 1rijochacko87No ratings yet

- Dividend Policy: Principles & ApplicationsDocument46 pagesDividend Policy: Principles & Applicationscuteserese roseNo ratings yet

- Mallin4e ch04Document8 pagesMallin4e ch04Minh Thư Phạm HuỳnhNo ratings yet

- Introduction To Accounting: (Meaning and Objectives of Accounting and Accounting Information)Document3 pagesIntroduction To Accounting: (Meaning and Objectives of Accounting and Accounting Information)Pushp RanjanNo ratings yet

- SEED - ZW Notice of AGMDocument1 pageSEED - ZW Notice of AGMWebSter NyandoroNo ratings yet

- Title V Bylaws: Section 46. Adoption of By-Laws. - Every Section 45. Adoption of Bylaws. - ForDocument20 pagesTitle V Bylaws: Section 46. Adoption of By-Laws. - Every Section 45. Adoption of Bylaws. - ForRon Ico RamosNo ratings yet

- Chapter 1Document4 pagesChapter 1Mikaela LacabaNo ratings yet

- Analisis Kinerja Keuangan Dan Tingkat Risiko Gagal Bayar Utang PT PLN (Persero)Document18 pagesAnalisis Kinerja Keuangan Dan Tingkat Risiko Gagal Bayar Utang PT PLN (Persero)rezaNo ratings yet

- Indian Accounting Standard 5Document12 pagesIndian Accounting Standard 5Rattan Preet SinghNo ratings yet

- How Does The Stock Exchange Work?: © This Worksheet Is FromDocument3 pagesHow Does The Stock Exchange Work?: © This Worksheet Is Fromdante jesus barrios vilcahuamanNo ratings yet

- CA Foundation Accounting Suggested Answers Nov 2019Document17 pagesCA Foundation Accounting Suggested Answers Nov 2019Sambhav JainNo ratings yet

- Icai Module QuestionsDocument26 pagesIcai Module QuestionsrachitNo ratings yet

- EXAM - IA2 ReviewerDocument17 pagesEXAM - IA2 ReviewerMohammad Raffe GuroNo ratings yet

- Jm-Financial-Ltd ProspectusDocument39 pagesJm-Financial-Ltd Prospectusvishakha chaudharyNo ratings yet

- Economics Final Exam SolutionsDocument4 pagesEconomics Final Exam SolutionsPower GirlsNo ratings yet

- HDFC Balanced Advantage Fund - Apr 22 - 1 PDFDocument2 pagesHDFC Balanced Advantage Fund - Apr 22 - 1 PDFAkash BNo ratings yet

- SAS#8-FIN081 Long Quiz 1Document5 pagesSAS#8-FIN081 Long Quiz 1Eunice Lyafe PanilagNo ratings yet

- Mini-Case 1 AnswerDocument2 pagesMini-Case 1 AnswerKazak KhardaeNo ratings yet

- Relationship Maintenace FormDocument1 pageRelationship Maintenace FormArnel Albarando33% (3)

- Chapter 6 Topicwise Question BankDocument20 pagesChapter 6 Topicwise Question BankVINUS DHANKHARNo ratings yet

- Vue Cinema FSDocument168 pagesVue Cinema FSYeshwanth LeoNo ratings yet

- Ch02-Vinamilk Finacial Report 2015Document63 pagesCh02-Vinamilk Finacial Report 2015Pham Phu Cuong B2108182No ratings yet

- CIEL MF Study Material 1Document50 pagesCIEL MF Study Material 1LalitNo ratings yet