Professional Documents

Culture Documents

RBI Format ROI PC

RBI Format ROI PC

Uploaded by

Sandesh ManeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RBI Format ROI PC

RBI Format ROI PC

Uploaded by

Sandesh ManeCopyright:

Available Formats

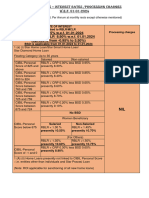

RETAIL LOANS – INTEREST RATES /PROCESSING CHARGES

(All loans at floating ROI, Per Annum at monthly rests except otherwise mentioned)

RATE OF INTEREST

All linked to RBLR/MCLR PROCESSING CHARGES

RBLR 6.85 % w.e.f. 01.06.2020

& BOI MCLR 7.60 % w.e.f. 01.07.2020 (All charges are

Exclusive of GST)

1 (a) Star Home Loan/Star Smart Home Loan/ Star Home Loan/Star Smart

Star Diamond Home Loan Home Loan/Star Pravasi

Home Loan :

Floating Category-Up to 30 years For Individuals –

For all loans amounts:-

0.25 % of loan amount

Salaried Self Employed

Min. Rs. 1500/- Max. Rs.

CIBIL-Personal RBLR + 0.00% = 6.85%

Score of 760 and (no further concession for women beneficiary) 20000/-

above

CIBIL-Personal RBLR + 0.15% = 7.00% RBLR + 0.25% = 7.10%

For Partnership firms and

Score between (for women beneficiary) (for women beneficiary) Corporates:

725 to 759

RBLR + 0.20% = 7.05% RBLR + 0.30%=7.15%

Processing charges to be double

(for others) (for others) that of applicable to individuals.

CIBIL-Personal RBLR + 0.25% = 7.10% RBLR + 0.85% = 7.70% i.e. @ 0.50% of the loan amount

Score between (for women beneficiary) (for women beneficiary) Min. Rs.3000/- and Max.

675 and 724 Rs.40000/-

RBLR + 0.30% = 7.15% RBLR +0.90% = 7.75%

(for others) (for others) For Rural areas:-

Processing charges 75% of that

CIBIL-Personal RBLR +0.15% = 7.00% RBLR + 0.25% = 7.10% applicable to individuals in

Score of -1 and 0 (for women beneficiary) (for women beneficiary) respect of loan availed by

RBLR +0.20% = 7.05% RBLR +0.30% = 7.15%

(for others) (for others)

borrowers from rural branches.

Min. rs.1500/- & Max.

rs.20000/-

@additional 0.10% CRP will be charged for customers who

intend to switchover from Base Rate/MCLR to RBLR. Star Diamond Home Loan :

One time processing charge of

*PLEASE NOTE RATE OF INTEREST FOR STAR HOME Rs.50000/- or maximum as per

LOAN/STAR SMART HOME LOAN & STAR DIAMOND HOME Star Home Loan Scheme,

LOAN WILL BE BASED ON CIBIL SCORE. whichever is higher

CRE-RH-Home Loans will attract 0.50% additional rate of interest

1 (b) Home Loans presently not linked to CIBIL i.e. entities

other than individuals & And Star Pravasi Loan:-

REPO Linked As per respective Home Loan

For women beneficiary RBLR + 0.05% = 6.90% schemes

(Star Pravasi)

For others (Star RBLR + 0.10% = 6.95%

Pravasi, Corporates,

etc.)

@additional 0.10% CRP will be charged for customers who

intend to switchover from Base Rate/MCLR to RBLR.

1. (C) Home Loans presently not linked to CIBIL Personal As per respective Home Loan

Score: Pradhan Mantri Awas Yojana (PMAY): - schemes

(Note: ROI applicable for sanctioning of all new PMAY loans)

REPO Linked

Irrespective of loan amount RBLR i.e. 6.85%

@additional 0.10% CRP will be charged for customers who

intend to switchover from Base Rate/MCLR to RBLR.

2. Star Top Up Loan

As per respective Home Loan

Rate of Interest applicable in respective Home Loan account plus schemes

premium of 0.50% subject to minimum RBLR

3 Star Personal Loan Scheme

a. Fully Secured RBLR + 4.50% = 11.35%

b. Clean/Unsecured RBLR + 5.50% = 12.35% One time 2.00% of loan

c. For senior Citizens aged 60 RBLR + 3.50% = 10.35% amount

years and above & for loans up to Min. Rs.1,000/-

Rs. 50000.00 Max. Rs.10,000/-

d. Financing Secured under tie-up RBLR + 4.50% = 11.35%

arrangements Senior Citizen (60 years &

above) No Processing Charges

4 Star Pensioner Loan Scheme

Pensioners:

One time 2.00% of loan amount

Fully Secured/clean/unsecured as RBLR + 2.50% = 9.35% Min. Rs. 500/- Max.Rs.2,000/-

per Star Pensioner Loan Scheme No Processing Charges for

senior citizens (60 years &

above)

5. (a) Star Vehicle Loan for individuals

4 Wheelers / 2 Wheelers including Super Bikes: New For New Four 0.25% of limit, minimum

& 2nd Hand Vehicle – Wheeler Loan Rs.1000/- and

Max.Rs.5,000

For New Two 1% of loan amount

wheeler/2nd minimum Rs.500/-

Salaried Self Employed hand vehicles and Max.Rs.10,000

CIBIL-Personal RBLR + 0.50% = RBLR + 0.60% = (both 2/4

Score of 760 and 7.35% 7.45% wheeler)

above No processing charges for Senior Citizen,

CIBIL-Personal RBLR + 0.75% = RBLR + 0.85% = Retired Employees of the Bank and

Score between 725 7.60% 7.70% Pensioners drawing Pension from the

and 759 Bank.

CIBIL-Personal RBLR +0.80% = RBLR + 0.90% = For Rural areas:

Score between 675 7.65% 7.75% Processing charges will be 75% of that

and 724 applicable to individual borrowers provided

CIBIL-Personal RBLR + 0.90% = RBLR + 1.10% = loan is availed by borrowers from rural

Score of -1 & 0 7.75% 7.95% areas/ from rural branches.

Min. rs.1500/- & Max. rs.20000/-

@additional 0.10% CRP will be charged for

customers who intend to switchover from Base

Rate/MCLR to RBLR.

**PLEASE NOTE RATE OF INTEREST WILL BE

BASED ON CIBIL SCORE FOR INDIVIDUALS AND

SELF EMPLOYED

(b) Star Vehicle Loan In case of entities other than

individuals

In case of Partnership firms and

REPO Linked Corporate borrowers, processing

RBLR + 0.75% = 7.60% charges will be double that applicable

@additional 0.10% CRP will be charged for to individuals.

customers who intend to switchover from Base

Rate/MCLR to RBLR.

6. i. Star Educational Loans : Educational Loan as per IBA scheme

Up to Rs. 7.5 Lakhs covered under RBLR + 1.70% = 8.55%%No processing charges.

CGFSEL a) No Processing charges – for study in

Above Rs. 7.50 Lakhs RBLR + 2.50% = 9.35%% India.

Concessions*: b) For study abroad: Processing charges

a) for Girl Students: 0.50 % Rs.5,000/-

b) All students pursuing professional courses (Like (Processing charge excluding GST will be

Engineering /Medical /Management etc.) are eligible refunded once actual loan is availed.

for 0.50 % interest concession. Applicant/s are suitably advised about this

Maximum concession under (a) & (b) is 1 % p.a. condition at the time of submission of

subject to, minimum RBLR application and consent letter will be

obtained from the applicant/s to avoid

dispute at later stage).

Student applicant may be required to pay

HIGHER AMOUNTS ABOVE Rs.20.00 LACS ARE ALSO fee/charges, if any, levied by third party

SANCTIONED ON CASE TO CASE BASIS. service providers who operate common

portal for lodging loan applications set up.

ii. Star Vidya Loan

For studies in India in Premier Institutes Max. Rs. 30.00 lacs One time charges for any Deviations from the

Scheme norms including approval of courses outside

scheme

Institutes as per List A RBLR Up to Rs.4.00 lacs Rs. 500/-*

Institutes as per List B RBLR Over Rs.4.00 lacs up to Rs.1,500/-*

Rs.7.50 lacs

Institutes as per List C RBLR Over Rs.7.50 lacs up to Rs.3,000/-*

Rs.20.00 lacs

*Per Deviation

iii. Pradhan Mantri Kaushal Rin Yojana NIL

RBLR + 1.50 = 8.35%

1 % interest concession may be provided for loanees, if the interest is serviced during the study

period when repayment holiday is specified for interest/repayment under the scheme. No concession

will be available after commencement of repayment.

7. Star Loan Against Property

For Loan (Repayable by installments)

Loan/Reducible OD RBLR + 2.00% = 8.85% One time @ 1% of sanctioned loan amount

OD-Non Reducible RBLR + 2.50% = 9.35% Min. Rs.5000/- and Max. Rs.50000/-.

For Mortgage OD (Reducible)

0.50% of the Sanctioned limit

min.Rs.5,000/- and Max. Rs.30000/- for 1st

year at the time of original sanction.

0.25% of the Reviewed limit min.Rs.2,500/-

& Max. Rs.15000/- for subsequent years.

For Mortgage OD (Not reducible )

0.50% of the Sanctioned/Reviewed limit

min.Rs.5,000/- and Max. Rs.30000/- on

annual basis.

For Rural areas:

Processing charges will be 75% of those

normal applicable charges in respect of

loans availed by borrowers from rural

areas from rural branches.

Mortgage fees:-

Limit upto Rs.10.00 Rs.5000/- + GST

lacs

Limit exceeding Rs.10000/ + GST

Rs.10.00 lacs &

upto 1oo lakhs

Loans over Rs.100 Rs.20000/ + GST

lakhs upto Rs.500

lakhs

8. BOI STAR DOCTOR PLUS (RETAIL) SCHEME

Personal Loans

1. Fully Secured RBLR + 2.00% = 8.85% 50% concession in charges as

2. Clean/Unsecured RBLR + 3.00% = 9.85% applicable to

Vehicle Loan:4 Wheelers only Members of public for Personal Loan and

Doctor Plus (New vehicle & RBLR + 0.40% = 7.25% Vehicle loan

Second hand)

9. Star Holiday Loan One time 2.00% of loan amount

Min. Rs.1,000/-

1. Fully Secured RBLR + 4.50% = 11.35% Max. Rs.10,000/-

2. Clean/Unsecured RBLR + 5.50% = 12.35% Senior Citizen (60 years & above) No

Processing Charges

10. Star IPO

1% of limit sanctioned min. Rs.1000/- and

Up to 60 days RBLR + 3.25% = 10.10% max. Rs.5000/- per account to be

recovered at the time of sanction of limit

Over 60 days RBLR + 4.50% = 11.35% and at annual review.

11. Earnest Money Deposit Scheme

Short Term (below 12 RBLR = 6.85%

One time Rs.500 per application

months)

Long Term (12 RBLR + 5.00% % = 11.85%

months and above)

LOANS NOT LINKED TO RBLR AS PER RBI GUIDELINES AND CONTINUE TO BE IN MCLR REGIME:

I) STAR MITRA PERSONAL LOAN SCHEME:

Fixed rate : 1 Year MCLR + 1.00% (CRP)+ 0.30 (BSS) Waived

II) STAR REVERSE MORTGAGE LOAN SCHEME Loan Amount Processing Charges

Upto Rs.5 lacs Rs.1250 + GST

1 Year MCLR + 2.30% (CRP) + 0.30% (BSS): Fixed for Upto Rs.10 lacs Rs.2500 + GST

initial period of 5 years subject to reset clause at the end Upto Rs.20 lacs Rs.5000 + GST

Upto Rs.25 lacs Rs.6250 + GST

of every 5 years period. Valuation report fees and Advocates fees to be

borne by the borrower.

Annual Service Charge @ 0.25% on the loan

amount outstanding/recoverable at the time of

annual review.

A. Access to own credit report – charges per report max. Rs.50/-

B. CERSAI registration Fees: As per Annexure.

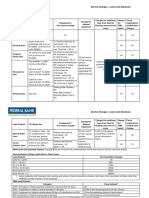

Annexure-I

Fee Chargeable as specified in the Table under rule 7

All the charges are excluding GST

Serial Nature of transaction to be Rule Form Amount of fee payable

No Register .

1. Particulars of creation or Sub-rule (2) Form Rs.100 for creation and for any

modification of security interest by of rule 4. I subsequent modification of security

way of mortgage by deposit of title interest for a loan above Rs.5 lakh.

deeds. For a loan upto Rs.5 lakh, the fee would

be Rs.50 for both creation and

modification of security interest.

2. Particulars of creation or Sub-rule (2A) Form NIL

modification of security interest by of rule 4. I

way of mortgage of immovable

property other than by deposit of title

deeds

3. Particulars of creation or Sub-rule (2B) Form Rs.100 for creation and for any

modification of security interest in of rule 4. I subsequent modification of security

hypothecation of plant and interest for a loan above Rs.5 lakh.

machinery, stocks, debt including For a loan upto Rs.5 lakh, the fee would

book debt or receivables, whether be Rs.50 for both creation and

existing or future. modification of security interest.

4. Particulars of creation or Sub-rule (2C) Form Rs.100 for creation and for any

modification of security interest in of rule 4. I subsequent modification of security

intangible assets, being know-how, interest for a loan above Rs.5 lakh.

patent, copyright, trade mark,

licence, franchise or any other For a loan upto Rs.5 lakh, the fee would

business or commercial right of be Rs.50 for both creation and

similar nature modification of security interest.

5. Particulars of creation or Sub-rule (2D) Form Rs.100 for creation and for any

modification of security interest in of rule 4. I subsequent modification of security

any under construction residential or interest for a loan above Rs.5 lakh.

commercial building or a part thereof For a loan upto Rs.5 lakh, the fee would

by an agreement or instrument other be Rs.50 for both creation and

than by mortgage. modification of security interest.

6. Particulars of satisfaction of charge Sub-rule (2), Form NIL

for security interest filed under sub- (2A), (2B), II

rule (2) and (2A) to (2D) of rule 4 (2C), (2D) of

rule 4.

7. Particulars of securitization or - Form Rs.500/-

reconstruction of financial assets III

8. Particulars of satisfaction of - Form Rs.50/-

securitization or reconstruction IV

transactions

9. Any application for information - - Rs.10/-

recorded/maintained in the Register

by any person

10. Any application for condonation of Sub-rule (2) - Not exceeding 10 times of the basic fee,

delay up to 30 days of rule 5. as applicable

ADDITIONAL FEE APPLICABLE FOR DELAY IN FILING OF RECORDS WEF 22.1.2016

Sr. No. Number of days of delay Additional fee to Illustration

in filing of chargeable charged

transaction

1 From 31 to 40 days Twice the amount of If the applicable fee is Rs.100/- then additional

applicable fee fee applicable will be Rs.200/-

2 From 41 days to 50 days Five times the amount of If the applicable fee is Rs.100/- then additional

applicable fee fee applicable will be Rs.500/-

3 From 51 days to 60 days Ten times the amount of If the applicable fee is Rs.100/- then additional

applicable fee fee applicable will be Rs.1000/-

All the above charges are excluding GST

Provided that where particulars of transaction of creation or modification of more than one

security interest are filed by a person, the fee payable by such person shall be the one that is the

highest among the fee prescribed for security interest for which particulars of creation or

modification are filed by such persons.

You might also like

- Riner ComplaintDocument47 pagesRiner ComplaintTony Winton100% (1)

- CB Lecture 4Document17 pagesCB Lecture 4Tshepang MatebesiNo ratings yet

- Banco Filipino Savings and Mortgage Bank v. Monetary Board, G.R. No. 70054Document2 pagesBanco Filipino Savings and Mortgage Bank v. Monetary Board, G.R. No. 70054xxxaaxxxNo ratings yet

- RBI Format ROI PCDocument8 pagesRBI Format ROI PCom vermaNo ratings yet

- RBI Format ROI PDocument8 pagesRBI Format ROI PSrikanth ReddyNo ratings yet

- RBI Format ROI PC PDFDocument9 pagesRBI Format ROI PC PDFmohana sundaram pNo ratings yet

- RBI - ROI FormatDocument9 pagesRBI - ROI Formatranajoy biswasNo ratings yet

- Rate of InterestDocument9 pagesRate of InterestUdaydeep SinghNo ratings yet

- Rbi Format Roi PCDocument10 pagesRbi Format Roi PCsriramNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatDevender RajuNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatSandeep SandyNo ratings yet

- Rbi Format Roi PCDocument11 pagesRbi Format Roi PCSumeet TripathiNo ratings yet

- BOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)Document5 pagesBOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)AvunNo ratings yet

- RBI ROI FormatDocument8 pagesRBI ROI Formatsrinivas.rmbaNo ratings yet

- RetailServiceCharges Adv EnglishDocument4 pagesRetailServiceCharges Adv EnglishYogesh PangareNo ratings yet

- PNB Loan Interest Rate 04 - 08 - 2021Document9 pagesPNB Loan Interest Rate 04 - 08 - 2021Somasundaram MuthiahNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- It Has Now Been Decided To Increase Rate of Interest On Home Loans by 0.05% Across All Slabs W.E.FDocument2 pagesIt Has Now Been Decided To Increase Rate of Interest On Home Loans by 0.05% Across All Slabs W.E.FRohitKujurNo ratings yet

- Msme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Document4 pagesMsme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Santosh KumarNo ratings yet

- Advances Related Service Charges W.E.F. 01.04.2019 A PDFDocument11 pagesAdvances Related Service Charges W.E.F. 01.04.2019 A PDFSudhakar BataNo ratings yet

- Green Veh OnepagerDocument2 pagesGreen Veh OnepagerRohith RaoNo ratings yet

- Loan Guideline and DetailDocument1 pageLoan Guideline and DetailIbu SiddiqNo ratings yet

- Charges 20131130Document3 pagesCharges 20131130SssNo ratings yet

- IOB9540Foot Service Charges 01.07.2017 PDFDocument39 pagesIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccNo ratings yet

- Fees and Charges W.E.F. 13th Dec, 2021Document4 pagesFees and Charges W.E.F. 13th Dec, 2021Chandrashekar ReddyNo ratings yet

- Service Charges Final - 03.06.2017for Circular IssuingDocument39 pagesService Charges Final - 03.06.2017for Circular IssuingshivaNo ratings yet

- Housing Loan DetailsDocument9 pagesHousing Loan DetailsPandurangbaligaNo ratings yet

- RetailServiceCharges Adv EnglishDocument4 pagesRetailServiceCharges Adv EnglishMohit KumarNo ratings yet

- Updated Roi 15.05.2024 To 30.06.2024Document1 pageUpdated Roi 15.05.2024 To 30.06.2024Divya MaheshNo ratings yet

- Revision of Service Charges Wef 01042023Document53 pagesRevision of Service Charges Wef 01042023kkrandy01No ratings yet

- PNB Suvidha Scheme (Deposits) : Categorization of Retail Lending SchemesDocument3 pagesPNB Suvidha Scheme (Deposits) : Categorization of Retail Lending Schemesnishi namitaNo ratings yet

- Fees and Charges W.E.F. 17th Mar, 2021Document3 pagesFees and Charges W.E.F. 17th Mar, 2021MANOJ PANSENo ratings yet

- Commercial Banking AssignmentDocument9 pagesCommercial Banking AssignmentDinesh KumarNo ratings yet

- P Seg Int Rate As On 15.06.2022Document2 pagesP Seg Int Rate As On 15.06.2022Devanathan HbkNo ratings yet

- RLLR SchemeDocument1 pageRLLR SchemeBhushan Singh BadgujjarNo ratings yet

- Soc 2018 (Finall)Document15 pagesSoc 2018 (Finall)Engr Hafiz Qasim AliNo ratings yet

- Charges Home NewDocument3 pagesCharges Home Newkirubaharan2022No ratings yet

- Schedule of Bank Charges Bank Al HabibDocument11 pagesSchedule of Bank Charges Bank Al HabibLala JanNo ratings yet

- RETAIL - Interest For Retail Loans - MCLR - Service Charges - From Web On 25082018Document12 pagesRETAIL - Interest For Retail Loans - MCLR - Service Charges - From Web On 25082018Harish YadavNo ratings yet

- Is On Retail LoansDocument5 pagesIs On Retail LoansDipti NagarNo ratings yet

- Service Charges - Loans and Advances 14 NovDocument21 pagesService Charges - Loans and Advances 14 Novsamuelbihari2012No ratings yet

- ServicechargesCADDocument8 pagesServicechargesCADdixeshNo ratings yet

- 03.01.2024 Consolidated Ser. ChargesDocument63 pages03.01.2024 Consolidated Ser. ChargesNadeem KhanNo ratings yet

- Educative Series Gold LoanDocument2 pagesEducative Series Gold LoanRohith RaoNo ratings yet

- Schedule of Service Charges and Fees: Name of The Bank Allahabad BankDocument5 pagesSchedule of Service Charges and Fees: Name of The Bank Allahabad BankmodijiNo ratings yet

- Bank Loan OffersDocument11 pagesBank Loan OffersAnandNo ratings yet

- Credit Guarantee Fund Scheme For Micro and Small Enterprises (Cgmse)Document2 pagesCredit Guarantee Fund Scheme For Micro and Small Enterprises (Cgmse)Santhosh santhuNo ratings yet

- P Seg Interest Rate From 15.12.2022Document2 pagesP Seg Interest Rate From 15.12.2022amitNo ratings yet

- Mclr-W.e.f. 15.03.2019Document1 pageMclr-W.e.f. 15.03.2019Mir Javed QuadriNo ratings yet

- Chartered Accountant Meet Ao Nagpur Welcomes YouDocument15 pagesChartered Accountant Meet Ao Nagpur Welcomes YouEmmy RoyNo ratings yet

- Banking OadsdDocument85 pagesBanking Oadsdkalis vijayNo ratings yet

- BOI MSME Loan ProductsDocument95 pagesBOI MSME Loan ProductsganpatigajanandganeshNo ratings yet

- Educative Series LAPDocument2 pagesEducative Series LAPRohith RaoNo ratings yet

- Interest Rate Chart: 3 Months MCLR (%) One Year MCLR (%)Document1 pageInterest Rate Chart: 3 Months MCLR (%) One Year MCLR (%)akrmbaNo ratings yet

- LOANRATEOFINTERESTDocument10 pagesLOANRATEOFINTERESTgaurav singhNo ratings yet

- PlanDocument2 pagesPlanshital agaleNo ratings yet

- Annexure 2Document77 pagesAnnexure 2Maheshkumar AmulaNo ratings yet

- The Jammu & Kashmir Bank LTD: AccountDocument5 pagesThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçNo ratings yet

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Document24 pagesDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdNo ratings yet

- Canara Bank ChargesDocument8 pagesCanara Bank Chargesaca_trader100% (1)

- Personal Loan: Why Avail A Personal Loan From HDFC Bank?Document6 pagesPersonal Loan: Why Avail A Personal Loan From HDFC Bank?Ramana GNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Leveraged Loan ReadingDocument51 pagesLeveraged Loan ReadingStarletNo ratings yet

- Private Lending For: Higher ProfitsDocument27 pagesPrivate Lending For: Higher ProfitsmimicfireNo ratings yet

- Presentation of Commercial Bank Operations On The Chapter "Deposit MobilizationDocument46 pagesPresentation of Commercial Bank Operations On The Chapter "Deposit MobilizationSaurav PantaNo ratings yet

- Seatwork - Day 20 - Leases AnswersDocument9 pagesSeatwork - Day 20 - Leases AnswersRj ArenasNo ratings yet

- Module 2 Credit - CollectionDocument14 pagesModule 2 Credit - CollectionAicarl JimenezNo ratings yet

- Internship Report On Soneri Bank LimitedDocument77 pagesInternship Report On Soneri Bank Limitedناظم راجپوت بھٹیNo ratings yet

- Introducing : Microsoft Dynamics 365Document32 pagesIntroducing : Microsoft Dynamics 365arunchennai1No ratings yet

- Hybrid FinancingDocument34 pagesHybrid Financingshayan.53260No ratings yet

- Skrip Isb547Document3 pagesSkrip Isb547HANA' HASSAN HALMINo ratings yet

- Can We Claim HRA and Home LoanDocument5 pagesCan We Claim HRA and Home LoanBipin PatilNo ratings yet

- Chapter 2 Banking OperationsDocument24 pagesChapter 2 Banking OperationsVishvesh ShahNo ratings yet

- Nell Doctrine - Yi-Leisure-Philippines-IncDocument19 pagesNell Doctrine - Yi-Leisure-Philippines-IncTata Digal RabeNo ratings yet

- SMO Script PDFDocument5 pagesSMO Script PDF『SHREYAS NAIDU』No ratings yet

- 19 Best Real Estate Prospecting Letter TemplatesDocument26 pages19 Best Real Estate Prospecting Letter TemplatesKatia LeiteNo ratings yet

- CH 05Document18 pagesCH 05muazNo ratings yet

- Pram An Are Tail BankingDocument10 pagesPram An Are Tail BankingDr.I.SelvamaniNo ratings yet

- How The Economic Machine WorksDocument8 pagesHow The Economic Machine WorksMiki CristinaNo ratings yet

- Structuring Aircraft Financing Transactions w0016292Document9 pagesStructuring Aircraft Financing Transactions w0016292forcetenNo ratings yet

- Banking and Finance: A. Reading SectionDocument10 pagesBanking and Finance: A. Reading SectionLaili Zahrotul Maulinda LindaNo ratings yet

- CFA Chapter Six PROBLEMS With SolutionsDocument3 pagesCFA Chapter Six PROBLEMS With SolutionsFagbola Oluwatobi OmolajaNo ratings yet

- CRED TRANS Federal Builders, Inc. Vs Foundation Specialist, Inc.Document2 pagesCRED TRANS Federal Builders, Inc. Vs Foundation Specialist, Inc.Jimenez LorenzNo ratings yet

- Busi431 - Formative Assessment 1Document4 pagesBusi431 - Formative Assessment 1hamzaNo ratings yet

- Factors Affecting Repayment Performance in Microfinance ProgramsDocument6 pagesFactors Affecting Repayment Performance in Microfinance ProgramsChan AyeNo ratings yet

- A. First Metro Investment CorporationDocument2 pagesA. First Metro Investment CorporationJeth Vigilla NangcaNo ratings yet

- 1932Document21 pages1932api-578672468No ratings yet

- QWR For 1 BorrowerDocument6 pagesQWR For 1 BorrowerRick Albritton100% (1)

- Sanction LetterDocument3 pagesSanction LetterOnis EnergyNo ratings yet