Professional Documents

Culture Documents

Problem On Cash Budget

Problem On Cash Budget

Uploaded by

Rusheel Chava0 ratings0% found this document useful (0 votes)

38 views1 pageThe document provides information about Macline Limited's monthly wages, materials purchased, overheads, and sales over a 9 month period. It also provides additional details needed to prepare a 3 month cash budget for June, July, and August, including payment terms, expenses, loan repayment, and new equipment purchase. Preparing a cash budget is important for the company to plan for cash needs and identify potential shortfalls so corrective action can be taken to ensure bills are paid on time.

Original Description:

Original Title

Problem on cash budget

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information about Macline Limited's monthly wages, materials purchased, overheads, and sales over a 9 month period. It also provides additional details needed to prepare a 3 month cash budget for June, July, and August, including payment terms, expenses, loan repayment, and new equipment purchase. Preparing a cash budget is important for the company to plan for cash needs and identify potential shortfalls so corrective action can be taken to ensure bills are paid on time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

38 views1 pageProblem On Cash Budget

Problem On Cash Budget

Uploaded by

Rusheel ChavaThe document provides information about Macline Limited's monthly wages, materials purchased, overheads, and sales over a 9 month period. It also provides additional details needed to prepare a 3 month cash budget for June, July, and August, including payment terms, expenses, loan repayment, and new equipment purchase. Preparing a cash budget is important for the company to plan for cash needs and identify potential shortfalls so corrective action can be taken to ensure bills are paid on time.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Problem: Cash budget

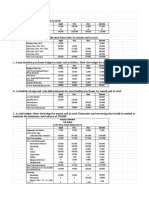

The following information relates to Macline Limited:

Month Wages incurred Materials Purchased Overheads Sales

February 6,000 20,000 10,000 30,000

March 8,000 30,000 12,000 40,000

April 10,000 25,000 16,000 60,000

May 9,000 35,000 14,000 50,000

June 12,000 30,000 18,000 70,000

July 10,000 25,000 16,000 60,000

August 9,000 25,000 18,000 50,000

September 9,000 30,000 14,000 50,000

i) It is expected that the cash balance on 31 st May will be Rs. 22,000.

ii) The wages may be assumed to be paid within the month they are incurred.

iii) It is company policy to pay creditors for materials three months after receipt.

iv) Debtors are expected to pay two months after delivery.

v) Included in the overhead figures is Rs. 2,000 per month which represents depreciation on

two cars and one delivery van.

vi) There is a one-month delay in paying the overhead expenses.

vii) 10% of the monthly sales are for cash and 90% are sold on credit.

viii) A commission of 5% is paid to agents on all the sales on credit but it is not paid until the

month following the sales to which it relates, this expense is not included in the overhead

figures shown.

ix) It is intended to repay a loan of Rs. 25,000 on 30 th June.

x) Delivery is expected in July of a new machine costing Rs. 45,000 of which Rs. 15,000 will be

paid on delivery and Rs. 15,000 in each of the following months.

xi) Assume that overdraft facilities are available if required.

You are required to prepare a cash budget for each of the three months of June, July and

August.

Also explain why the preparation of cash budget is important for the company.

You might also like

- Quiz 3.1 BudgetingDocument6 pagesQuiz 3.1 BudgetingMaxine ConstantinoNo ratings yet

- Master Budgeting (Sample Problems With Answers)Document11 pagesMaster Budgeting (Sample Problems With Answers)Jonalyn TaboNo ratings yet

- c5 Solutions BudgetingDocument13 pagesc5 Solutions BudgetingChinnam Lalitha100% (1)

- ACCT1003 - Worksheet - 8 - Summer 2016Document5 pagesACCT1003 - Worksheet - 8 - Summer 2016sandrae brownNo ratings yet

- Months: Sales Purchases Wages ExpensesDocument2 pagesMonths: Sales Purchases Wages Expensespranay6390% (1)

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Document7 pagesBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarNo ratings yet

- Budgeting - ExamplesDocument2 pagesBudgeting - Examplessunil.ctNo ratings yet

- Cash Management: ProblemsDocument4 pagesCash Management: ProblemsPoojitha ReddyNo ratings yet

- Cash BudgetingDocument3 pagesCash Budgetingsunil.ctNo ratings yet

- Example Question Financial ManagementDocument3 pagesExample Question Financial ManagementNadhirah NadriNo ratings yet

- Budgetary ControlDocument5 pagesBudgetary ControlJasdeep Singh DeepuNo ratings yet

- Forecasting Short Term Operating Sample ProblemsDocument8 pagesForecasting Short Term Operating Sample ProblemsJanaisa BugayongNo ratings yet

- Question On Budget A LevelDocument3 pagesQuestion On Budget A LevelMUSTHARI KHANNo ratings yet

- Cash Budget Sums Mcom Sem 4Document14 pagesCash Budget Sums Mcom Sem 4Prachi BhosaleNo ratings yet

- Assignment QuestionsDocument3 pagesAssignment QuestionsmaheeshNo ratings yet

- Cashbu 1Document4 pagesCashbu 1ANAND SRINIVASANNo ratings yet

- Cash BudgetingDocument5 pagesCash BudgetingAnissa GeddesNo ratings yet

- Master BudgetDocument36 pagesMaster BudgetRafols AnnabelleNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Budgeting Tute 01Document2 pagesBudgeting Tute 01Maithri Vidana KariyakaranageNo ratings yet

- Cash Budget Test 3Document2 pagesCash Budget Test 3Prince TshepoNo ratings yet

- Cash Budget FormatDocument5 pagesCash Budget FormatAmit DeyNo ratings yet

- M5 Management of Cash Pract. ProbDocument5 pagesM5 Management of Cash Pract. ProbAmruta PeriNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256No ratings yet

- Budgeting - 1Document3 pagesBudgeting - 1Muhammad MansoorNo ratings yet

- Budgeting Cash BudgetDocument5 pagesBudgeting Cash BudgetMAZLIZA AZUANA ABDULLAHNo ratings yet

- Session 7 Practice Questions - Profit Planning: Multiple ChoiceDocument4 pagesSession 7 Practice Questions - Profit Planning: Multiple ChoiceLee Freckles Haengbok0% (1)

- Total Factory Overheads For Each Type of Product (Variable)Document2 pagesTotal Factory Overheads For Each Type of Product (Variable)Mayank JainNo ratings yet

- Cash ManagementDocument8 pagesCash Managementf4farhansiddiqui17No ratings yet

- BUDGETINGDocument7 pagesBUDGETINGuma selvarajNo ratings yet

- Cash Budget TutorialDocument2 pagesCash Budget TutorialThando Majola-MasondoNo ratings yet

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaNo ratings yet

- Cash Management QuestionsDocument5 pagesCash Management QuestionsManasi Jamsandekar100% (1)

- Exercise 3 BudgetingDocument4 pagesExercise 3 BudgetingGabrielleNo ratings yet

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- Case Analysis (1 30)Document3 pagesCase Analysis (1 30)manishadaaNo ratings yet

- Cash Management NumericalsDocument5 pagesCash Management NumericalsAnjali Jain100% (1)

- ADFM Cash BudgetDocument5 pagesADFM Cash BudgetNidheena K SNo ratings yet

- Chapter # 7 Exercise & ProblemsDocument4 pagesChapter # 7 Exercise & ProblemsZia Uddin0% (1)

- Financial PlanningDocument6 pagesFinancial Planningakimasa raizeNo ratings yet

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Two The 20%. The: Vinze and of As TinDocument4 pagesTwo The 20%. The: Vinze and of As TinPRAYAGRAJ MITRA MANDAL GROUPNo ratings yet

- DiscussionDocument2 pagesDiscussionHaniNo ratings yet

- Profit. Planning and ControlDocument16 pagesProfit. Planning and ControlNischal LawojuNo ratings yet

- Quiz 3.1 BudgetingDocument6 pagesQuiz 3.1 BudgetingMaxine ConstantinoNo ratings yet

- 17 - Ni Putu Cherline Berliana - Problem 11.1 & 11.8Document6 pages17 - Ni Putu Cherline Berliana - Problem 11.1 & 11.8putu cherline21No ratings yet

- Topic 6 - Cash BudgetDocument3 pagesTopic 6 - Cash Budgetmichelle beyonceNo ratings yet

- Exercise 2.1Document9 pagesExercise 2.1Nurul ShazalinaNo ratings yet

- Additional Information:: From The Following Information Prepare A Cash Budget For The Months of June and JulyDocument2 pagesAdditional Information:: From The Following Information Prepare A Cash Budget For The Months of June and JulyNsscollege RajakumariNo ratings yet

- Assignment 3 MA 09062021 063143pmDocument1 pageAssignment 3 MA 09062021 063143pmAli AhmadNo ratings yet

- Final PPC Section BDocument13 pagesFinal PPC Section BMadhav RajbanshiNo ratings yet

- Accounting Test Bank 3Document5 pagesAccounting Test Bank 3likesNo ratings yet

- 08 TP - Evangelista Angela - 501PDocument9 pages08 TP - Evangelista Angela - 501PBetchang AquinoNo ratings yet

- Final Exam - Sent StudentsDocument6 pagesFinal Exam - Sent StudentsYến Hoàng HảiNo ratings yet

- ACFrOgAMXLJQ31ib6NhLGI0LJ g6GJ517KX03aMrtqxVEqeGBZVYeNyhJHHN9 NBC Vi fXXpyOSGJRyPbtkRLA5DID6 - WJh7xyy7T4 - lcWF9qvk7GWZbEblGKEapUTdWZQyBqXGaUpCDjeEy - FVDocument6 pagesACFrOgAMXLJQ31ib6NhLGI0LJ g6GJ517KX03aMrtqxVEqeGBZVYeNyhJHHN9 NBC Vi fXXpyOSGJRyPbtkRLA5DID6 - WJh7xyy7T4 - lcWF9qvk7GWZbEblGKEapUTdWZQyBqXGaUpCDjeEy - FVmy VinayNo ratings yet

- BudgetingDocument3 pagesBudgetingRitika NagpalNo ratings yet

- ForecastingDocument2 pagesForecastingprashantNo ratings yet

- Double EntryDocument8 pagesDouble EntryRose Angel SaremoNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- JSW Steel Annual Report 2016-17Document782 pagesJSW Steel Annual Report 2016-17Rusheel ChavaNo ratings yet

- Transfer Pricing Example: The High Value Computer (HVC) Key AssumptionsDocument8 pagesTransfer Pricing Example: The High Value Computer (HVC) Key AssumptionsRusheel ChavaNo ratings yet

- Problem On Flexible BudgtDocument1 pageProblem On Flexible BudgtRusheel ChavaNo ratings yet

- JSW Steel Ar Full Report 2018-19 12-35Document528 pagesJSW Steel Ar Full Report 2018-19 12-35Rusheel ChavaNo ratings yet

- JSW Steel Ar Full Report 2018-19 12-35Document886 pagesJSW Steel Ar Full Report 2018-19 12-35Rusheel ChavaNo ratings yet

- JSW Steel Annual Report 2015-16 Full PDFDocument257 pagesJSW Steel Annual Report 2015-16 Full PDFRusheel ChavaNo ratings yet

- Pitchbook AnalysisDocument4 pagesPitchbook AnalysisRusheel ChavaNo ratings yet

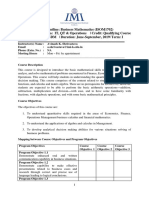

- Course Outline - Business MathematicsDocument4 pagesCourse Outline - Business MathematicsRusheel ChavaNo ratings yet

- Integration & Its Application: Session 7Document22 pagesIntegration & Its Application: Session 7Rusheel ChavaNo ratings yet

- I Assets As at 31.03.2019 As at 31.03.2018: Total Non-Current AssetsDocument10 pagesI Assets As at 31.03.2019 As at 31.03.2018: Total Non-Current AssetsRusheel ChavaNo ratings yet

- Marketing Management 1Document4 pagesMarketing Management 1Rusheel ChavaNo ratings yet

- FrfreavesfvDocument44 pagesFrfreavesfvRusheel ChavaNo ratings yet

- Course Outline - Managerial EconomicsDocument5 pagesCourse Outline - Managerial EconomicsRusheel ChavaNo ratings yet

- Bloombeg Launchpad English Manual YuErHa PDFDocument32 pagesBloombeg Launchpad English Manual YuErHa PDFRusheel ChavaNo ratings yet

- Admission Offer Letter PDFDocument2 pagesAdmission Offer Letter PDFRusheel Chava100% (1)

- Straight Line & Its Applications: Dr. Avinash K ShrivastavaDocument52 pagesStraight Line & Its Applications: Dr. Avinash K ShrivastavaRusheel ChavaNo ratings yet

- Set Theory: Basic, Essential, and Important Properties of SetsDocument48 pagesSet Theory: Basic, Essential, and Important Properties of SetsRusheel ChavaNo ratings yet