Professional Documents

Culture Documents

FAQ Medical Rider

FAQ Medical Rider

Uploaded by

Mohd AimanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAQ Medical Rider

FAQ Medical Rider

Uploaded by

Mohd AimanCopyright:

Available Formats

Frequently Asked Questions (FAQ) FWD Medical Rider and FWD Medical Executive Rider

Part A – General Questions About The Rider & How To Get Started

1. What is FWD Medical Rider?

FWD Medical Rider is a regular contribution paying rider that provides Takaful protection for medical

coverage.

FWD Medical Rider maybe attachable to either FWD Invest First or FWD Future First.

2. What are the benefits provided and what is payable under this rider?

FWD Medical Rider provides medical coverage to the person(s) covered up to a maximum expiry age of

80 or expiry of base plan, whichever comes first.

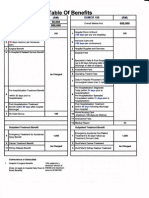

Please refer to the benefits below:

FWD Medical Rider Benefits (Hospitalisation Benefit, Outpatient Benefit & Other Benefits)

Hospitalisation Benefit

▪ Hospital Room & Board (maximum up to 365 days per year)

▪ Intensive Care Unit (maximum up to 90 days per year)

▪ Hospital Supplies & Services

▪ Surgical Fees (pre-surgery care up to 30 days and post-surgery care up to 30 days from surgery

date)

▪ Operating Theatre Fees

▪ Anaesthetist’s Fees

▪ Ambulance Fees

▪ In-Hospital Physician Visit (maximum up to 150 days per year, maximum 2 visits per day)

Outpatient Benefit

▪ Pre-Hospitalisation Diagnostic Tests (within 60 days before hospitalisation)

▪ Pre-Hospitalisation Specialist Consultation (within 60 days before hospitalisation)

▪ Post-Hospitalisation Treatment (within 90 days after hospitalisation)

▪ Day Surgery/Day Care Procedure

▪ Outpatient Cancer Treatment

▪ Outpatient Kidney Dialysis Treatment

▪ Outpatient Dengue Treatment

▪ Outpatient Physiotherapy Treatment (within 90 days after hospitalisation)

▪ Emergency Accidental Outpatient/Dental Treatment (within 24 hours and follow-up treatment

up to 30 days)

Other Benefits

▪ Organ Transplant (once per lifetime)

▪ Second Medical Opinion (limit per year)

▪ Daily Cash Allowance at Malaysia Government Hospital (maximum up to 150 days per year)

▪ Daily Cash Allowance at Malaysia Private Hospital (maximum up to 150 days year)

▪ Home Nursing Care (maximum up to 180 days per lifetime)

▪ Intraocular Lens

▪ Medical Report Fees

FWD Medical Executive Rider Benefits

▪ Additional Annual Limit due to Cancer, Heart Attack or Kidney Failure

▪ Maternity Complications

▪ In-Hospital Psychiatric Treatment (up to 30 days per year and 180 days per lifetime)

FWD Takaful Berhad (Company No. 731530-M) 1 of 10

▪ Hospital Companion’s Bed (1 bed for 1 person who accompanies, maximum up to 60 days per

year)

▪ Alternative Medical Practitioner

3. Is the product Shariah-compliant?

Yes. The product is approved by our Shariah committee. We adopt the following shariah principles:

▪ Tabarru’: A donation for the purpose of takaful where participants agree to assist each other

financially.

▪ Wakalah: The contract where the participant appoints the Takaful Operator to manage the

participants’ risk fund and agrees to pay the Takaful Operator on a pre-agreed basis for the

services provided.

▪ Ju'alah: It is the reward to the Takaful Operator for the good performance of the participants’

risk fund it will be managing. The Takaful Operator will be rewarded with a 50% share of the

surplus from the participants’ risk fund and the remaining 50% will be distributed to

participants.

▪ Qard: An interest-free loan that we grant to the participants’ risk fund if it is in deficit. The loan

is repayable from the future surplus arising in the participants’ risk fund.

4. Who is this rider suitable for?

This rider is suitable for those who are looking for medical protection and comprehensive cover in the

event of hospitalisation or surgery due to sickness or accidental injury. We will provide eligible

benefits listed in the Schedule of Benefits under this rider.

5. What plan option is available for me?

There are 4 plans available: Plan 1/Plan 2/Plan 3/Plan 4.

All plans are now available for individual/couple/family plan. The limit stated in the Schedule of Benefits

is per person covered.

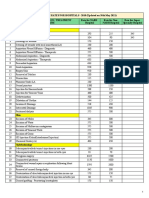

Please refer to the below table:

FWD Medical Rider Benefits

Plan Plan 1 Plan 2 Plan 3 Plan 4

Deductible (RM) 0/1,000/10,000/50,000

Initial Annual Limit (RM) 200,000 300,000 500,000 -

Lifetime Limit (RM) - - - -

Hospitalisation Benefit

Hospital Room & Board

(maximum up to 365 days per year) 200 300 500 As charged

(RM)

Intensive Care Unit

As charged

(maximum up to 90 days per year)

Hospital Supplies & Services As charged

Surgical Fees

(pre-surgery care up to 30 days and

As charged

post-surgery care up to 30 days from

surgery date)

Operating Theatre Fees As charged

Anaesthetist’s Fees As charged

Ambulance Fees As charged

In-Hospital Physician Visit As charged

FWD Takaful Berhad (Company No. 731530-M) 2 of 10

(maximum up to 150 days per year,

maximum 2 visits per day)

Outpatient Benefit

Pre-Hospitalisation Diagnostic Tests

As charged

(within 60 days before hospitalisation)

Pre-Hospitalisation Specialist

Consultation As charged

(within 60 days before hospitalisation)

Post-Hospitalisation Treatment (within

As charged

90 days after hospitalisation)

Day Surgery/Day Care Procedure As charged

Outpatient Cancer Treatment As charged

Outpatient Kidney Dialysis Treatment As charged

Outpatient Dengue Treatment As charged

Outpatient Physiotherapy Treatment

As charged

(within 90 days after hospitalisation)

Emergency Accidental

Outpatient/Dental Treatment (within 24

As charged

hours and follow-up treatment up to 30

days)

Other Benefits

Organ Transplant

As charged

(once per lifetime)

Second Medical Opinion

1,000

(limit per year) (RM)

Daily Cash Allowance at Government

Hospital

200

(maximum up to 150 days per year)

(RM)

Daily Cash Allowance at Private Hospital

50

(maximum up to 150 days year) (RM)

Home Nursing Care

As charged

(maximum up to 180 days per lifetime)

Intraocular Lens (RM) Up to 3,000 per eye, 6,000 per lifetime

Medical Report Fees (RM) 100 per disability

FWD Medical Executive Rider Benefits

Plan Plan 1 Plan 2 Plan 3 Plan 4

Deductible (RM) 0/1,000/10,000/50,000

Revised Initial Annual Limit (RM) 2,000,000 3,000,000 5,000,000 -

Lifetime Limit (RM) - - - -

Extended Benefits

Additional Annual Limit due to Cancer,

2,000,000 3,000,000 5,000,000 -

Heart Attack or Kidney Failure

Maternity Complications

4,000 6,000 8,000 10,000

(limit per year) (RM)

In-Hospital Psychiatric Treatment As charged

FWD Takaful Berhad (Company No. 731530-M) 3 of 10

(up to 30 days per year and 180 days per

lifetime)

Hospital Companion’s Bed (1 bed for 1

person who accompanies, maximum up As charged

to 60 days per year)

Alternative Medical Practitioner

1,000

(limit per year) (RM)

6. What is the coverage term of this rider?

The rider coverage term will be equal to the coverage term of the base certificate and subject to a

minimum of 5 years or up to the maximum expiry age for the rider.

7. Who is eligible to participate in this rider?

Age eligibility:

Person Covered Minimum entry age Maximum entry age

For Single Plan:

- Main person covered - 1 month old - 65 years old age next birthday

(subject to base plan’s maximum

entry age)

For couple/family plan:

- Main person covered - 1 month old - 65 years old age next birthday

- Parents/Spouse - 17 years old age (subject to base plan’s maximum

- Children next birthday entry age)

- 1 month old - 60 years old age next birthday

- 20 years old age next birthday

Note: Main person covered under the rider certificate is the same person as person covered under the

base certificate.

8. Can I participate in more than one plan?

Yes, you can.

9. When will my coverage begin?

You’ll be covered from the commencement date stated in your Medical rider Takaful schedule.

10. How much do I have to contribute for the rider?

The contribution amount depends on the below factors:

▪ Age at start of certificate.

▪ Gender of person covered.

▪ Plan selected.

▪ Smoker status.

▪ Lifestyle

▪ Health status, and

▪ Medical history

Part B – Questions About Benefits Under This Rider

1. Is there any cash value under this rider?

No, there is no cash value under this rider.

FWD Takaful Berhad (Company No. 731530-M) 4 of 10

2. Is there any maturity benefit under this rider?

No, there is no maturity benefit under this rider.

3. Under what circumstances will my rider cover end?

Your rider cover ends on the earliest of the following:

a) the person covered reaching the expiry age; or

b) the date we approve a written request to terminate this rider; or

c) on the date this rider ends; or

d) the date when the base certificate or this rider certificate lapses.

Part C - Contribution Payment

1. What is the contribution payment term of this rider?

The rider contribution payment term and rider certificate cover term are the same and subject to a

minimum term of 5 years. If the remaining certificate term of the base certificate is less than 5 years

at the rider purchase date, the rider certificate cannot be purchased.

2. How do I pay for my contribution?

You may pay your contributions by credit or debit card.

3. Can I change my payment mode?

Yes. You may change your payment mode on the next payment due date. The payment frequency will

be the same as the base plan.

4. Will there be any increase or decrease in contribution during the coverage term?

There will be an increase or decrease in the regular contribution if:

▪ there is a plan change (for example: change from Plan 1 to Plan 2)

▪ there is a deductible change (for example: change from 0 to 50,000)

▪ there is a plan type change (for example: change from individual plan to family plan)

▪ any of the person covered dies (for couple/family plan)

▪ Re-pricing

5. Is the contribution paid eligible for tax relief?

Yes. Please check with your tax adviser on your eligibility and note that this is subject to the final

decision by the Inland Revenue Board.

6. What is the implication of the unsuccessful payment of my monthly contribution?

The Takaful Certificate will lapse if we didn’t receive your contribution within 60 days from the

contribution due date.

Part D – Claims Procedures and Exclusions

1. How do I make claim for Non Panel Hospital?

We’ve a dedicated claims page on our website and we’ll walk you through each step for reimbursement

for Non Panel Hospital.

2. What are the documents required for filing claim for Non Panel Hospital?

Click here and we’ll help you find the documents you need.

FWD Takaful reserves the right to request for more evidence at the expense of the claimant.

3. What is the waiting period under this rider?

(a) Specified Illnesses: waiting period of 120 days from commencement date (or reinstatement date)

shall apply

FWD Takaful Berhad (Company No. 731530-M) 5 of 10

(b) Other medical conditions: waiting period of 30 days from commencement date (or

reinstatement date) shall apply.

Specified illnesses are the following disabilities and its related complications:

▪ Hypertension, diabetes melitus and cardiovascular disease;

▪ Growths of any kind including tumours, cysts, nodules or polyps;

▪ Stones in the urinary system and biliary system;

▪ Any disease of the ear, nose (including sinuses) or throat;

▪ Hernias, haemorrhoids, fistulae, hydrocele or varicocele;

▪ Any disease of the reproductive system including endometriosis

▪ Any disorders of the spine (including a slipped disc) or any knee conditions;

▪ Deviated nasal septum/nasal & paranasal sinus disorders

▪ Diseases of tonsils/adenoids

▪ Surgery of thyroid gland unless due to malignancy;

▪ All types of Hernia;

▪ Spermatocoel;

▪ Retinopathy/Retinal detachment;

▪ Peripheral vascular disease due to diabetes/diabetic foot;

▪ Renal failure due to diabetes;

▪ Osteoporosis/Pathological fracture;

▪ Cataract; or

▪ Joint replacements unless due to an accident.

4. Am I covered outside Malaysia?

Yes, the coverage offered under this rider is applicable worldwide. However, you must be a Malaysian

citizen residing in Malaysia and it’ll be subject to terms and conditions as stated in the certificate.

5. How long will it take for a claim reimbursement to be processed?

It takes up to 14 working days from the date when the complete/full documents are received to process

claim reimbursement.

6. How do I check the status of my claims?

The covered person/claimant may contact our Service Hotline at 1300 13 7988 or 603 2771

7771(International Calls) or email to contact.my@fwd.com

Our office hours are from 9.00 am – 6.00 pm on Monday to Friday, excluding weekends and public

holidays.

Note:

The above claims procedure is for reference only. For more details, please refer to the relevant policy

provisions. FWD Takaful reserves the right to amend these requirements or seek additional information

to support each claim.

7. What is the benefit exclusion applicable for this rider?

▪ This rider has certain exclusions, meaning situations where we won’t pay a benefit. We list

below the exclusions that apply to the benefits under your rider.

FWD Takaful Berhad (Company No. 731530-M) 6 of 10

▪ We may also apply specific exclusions to your rider. If any specific exclusions apply, we’ll record

the details in an endorsement.

List of Exclusion

Pre Existing condition

Any claim arises because the person covered wilfully participated in an unlawful act, or unlawful failure to

act.

War

Plastic or cosmetic surgery for beautification purposes;

Circumcision or any surgery on the foreskin;

Eye examination for visual impairments due to near-sightedness, farsightedness or astigmatism or radial

keratotomy;

Any form of dental care or Surgery unless necessitated by injury but excluding the replacement of natural

teeth, placement of denture and prosthetic services such as bridges and crowns or their replacement;

Private nursing care, non-Hospital nursing care, rest cures or sanitaria care;

Venereal disease and its sequelae;

HIV (Human Immunodeficiency Virus) related diseases, AIDS (Acquired Immune Deficiency Syndrome) or AIDS

related diseases;

Any communicable diseases required quarantine by law;

Any congenital disorders or hereditary diseases or deformities conditions

Pregnancy or pregnancy related conditions including childbirth, complications arising from pregnancy such as

miscarriage, abortion, pre-natal or post-natal care, contraceptive methods for birth controls, infertility

treatments and its complications;

Impotence, sterilization, erectile dysfunctions and its complications;

Investigation and treatment of sleep and snoring disorders;

Hyperhidrosis;

Hormone replacement therapy;

Mental or nervous disorders (including psychosis, neurosis and their physiological or psychosomatic

manifestations);

Hospital confinement or expenses incurred for sex changes;

Expenses incurred for donation of any body organ by the Covered Person and costs of acquisition of the organ

including all costs incurred by the donor during organ transplant and its complications except for kidney

transplant as stipulated under End Stage Kidney Failure benefit; t

Hospitalisation primarily for investigatory purposes, screening, diagnosis, X-ray examination, general physical

or medical examinations, not incidental to treatment or diagnosis of a Disability or any treatment which is

not Medically Necessary and any preventive treatments, preventive medicines, stem cell therapy, treatments

specifically for weight reduction or gain;

Any treatment or investigation which is not medically necessary, or convalescence, custodial or rest care;

Any Disability caused by self-destruction, intentional self-inflicted injuries and illness, while sane or insane;

Injuries or Hospitalisation as a result of drug abuse, or while under the influence of alcohol not prescribed by

a Registered Medical Practitioner;

Ionising radiation or contamination by radioactivity from any nuclear fuel or nuclear waste from process of

nuclear fission or from any nuclear weapon material;

Sickness or Injury arising from any dangerous or professional sporting activity or hobbies, such as but not

limited to hang-gliding, ballooning, parachuting, sky-diving, bungee jumping, hunting, mountaineering, water

skiing, underwater activities requiring breathing apparatus, or other similar activities;

Travel in an aircraft, aerial conveyance or device except as a fare-paying passenger in a commercial aircraft

licensed for passenger service on a scheduled flight over an established route.

Any Shariah Non-Compliance event

Part E - Certificate Servicing

1. Can I cancel my rider?

▪ Yes, you can cancel (terminate) your rider at any time. If you cancel your rider, your cover will end

from the date we cancel your rider certificate.

FWD Takaful Berhad (Company No. 731530-M) 7 of 10

▪ We’ll deduct from your contribution:

- an amount that covers the period you’ve been covered for; and

- an administrative fee;

and then refund you what is left. If your refund amount is less than or equal to RM 10 and we

don’t have your bank account details, we’ll donate the amount to a charity of our choosing. If it is

more than RM10 and we don’t have your bank account details, we’ll transfer the monies to

Register of Unclaimed Moneys. You’ll not be able to reinstate (restart) your rider after you cancel

it.

2. Can I change my credit or debit card details?

Yes, you may. Simply download and fill up the Change Request Form from our website and send it to

us at contact.my@fwd.com or place your request by logging into myPortal at

www.fwd.com.my/en/myportal/

3. Can I change my address or personal details?

Yes, you may. Simply download and fill up the Change Request Form from our website and send it to

us at contact.my@fwd.com or place your request by logging into myPortal at

www.fwd.com.my/en/myportal/

4. Can I reinstate my lapsed rider?

Yes. The reinstatement is allowed within 2 years from the lapse date. You’ll need to submit the

reinstatement request by completing the reinstatement application form and pay all outstanding

contributions plus the prorated contribution till the next contribution due date plus medical expenses

(if any).

However, the acceptance of your reinstatement request is subject to the health underwriting at the

time of your request.

▪ Reinstatements for rider certificates that have lapsed for more than 2 years will not be

allowed.

- Any reinstatement shall cover only those events that occur after the reinstatement date.

Part F - Other information

1. What are the documents I’ll receive after participating in FWD Medical Rider?

You’ll receive a certificate pack which includes the following:

▪ Cover Letter;

▪ Takaful Schedule;

▪ Takaful Certificate - that provides the terms and conditions of the contract for the Takaful

coverage;

▪ copy of customer fact finds

▪ copy of your completed Proposal Form;

▪ copy of the Product Illustration;

▪ copy of Product Disclosure Sheet

▪ copy of PDPA Notice

− If you’ve opted for softcopy documents, an email will be sent to you to register a myPortal account.

The softcopy certificate pack will be available on myPortal.

− If you’ve opted to receive hardcopy documents, we’ll send you the certificate pack for your reference

and safekeeping.

For standard cases, the certificate pack will be issued within one month from the date of receipt of

the application form, together with the complete documents / requirements and the appropriate

Takaful Contribution.

FWD Takaful Berhad (Company No. 731530-M) 8 of 10

2. Where can I get further information about family takaful?

Find out more information about family takaful plans by referring to the insurance info booklet on

‘Family Takaful’ at www.insuranceinfo.com.my

If you’ve any other questions, please contact us at:

Customer Care

FWD Takaful Berhad

Level 29, Menara Shell

211 Jalan Tun Sambanthan

Brickfields, 50470 Kuala Lumpur.

Malaysia Hotline : 1300 13 7988 (Monday – Fridays 9.00am – 6.00pm, Exclude Weekend and Public

Holidays)

International Calls: 603 2771 7771

Fax : 603 2710 7800

E-mail : contact.my@fwd.com

Website : www.fwd.com.my

MyPortal : www.fwd.com.my/en/myportal/

FWD Takaful Berhad (Company No. 731530-M) 9 of 10

You might also like

- Tokio Marine Life - IHealth Plus Brochure-2019Document44 pagesTokio Marine Life - IHealth Plus Brochure-2019kinosraj kumaranNo ratings yet

- MS Nursing Questions and AnswersDocument8 pagesMS Nursing Questions and Answerspihikan80% (5)

- PolicyDocument10 pagesPolicyKalyaniNo ratings yet

- AXA-HOPEMedic2 XtraBrochure (Agency) (Sep2018)Document60 pagesAXA-HOPEMedic2 XtraBrochure (Agency) (Sep2018)E-Qie BalNo ratings yet

- Zurich Max MedicDocument5 pagesZurich Max MedicPremkumar NadarajanNo ratings yet

- Aia Platinum Health BrochureDocument8 pagesAia Platinum Health BrochureRaymond AngNo ratings yet

- Max Medic Plan 1Document1 pageMax Medic Plan 1Premkumar NadarajanNo ratings yet

- AIA PlatinumDocument8 pagesAIA PlatinumHihiNo ratings yet

- EH SME Policy Jacket 2018R2 - FINAL - 19072018Document25 pagesEH SME Policy Jacket 2018R2 - FINAL - 19072018Hafiz IqbalNo ratings yet

- Smart Health PDS BI 20181221 (Revised)Document3 pagesSmart Health PDS BI 20181221 (Revised)Shanti GunaNo ratings yet

- Benefit Table For Ramani 2023-2Document2 pagesBenefit Table For Ramani 2023-2Mercy MtaeNo ratings yet

- J Care Medical Insurance BenefitsDocument8 pagesJ Care Medical Insurance BenefitssolomonNo ratings yet

- Max Medic Plan 2Document1 pageMax Medic Plan 2Premkumar NadarajanNo ratings yet

- Health InsuranceDocument9 pagesHealth Insuranceamjad.ghumrolive.comNo ratings yet

- 1 Health ProtectorDocument1 page1 Health ProtectorKhairul RafiziNo ratings yet

- Blue Royale 66 100 BrochureDocument2 pagesBlue Royale 66 100 BrochureAna Patricia SanchezNo ratings yet

- SamplePDS MHT ENDocument5 pagesSamplePDS MHT ENHifdzul Malik ZainalNo ratings yet

- SIM Benefir ScheduleDocument12 pagesSIM Benefir ScheduleHihiNo ratings yet

- HLA MediShield ENG - Updated AUG 18Document16 pagesHLA MediShield ENG - Updated AUG 18Chan SCNo ratings yet

- Prubsn Prudential HEDocument24 pagesPrubsn Prudential HEscrib madNo ratings yet

- Smartcare Optimum Plus BrochureDocument12 pagesSmartcare Optimum Plus BrochureMeng Seng EngNo ratings yet

- Income FlexCareDocument22 pagesIncome FlexCareDarren ChenNo ratings yet

- 20190329011144blue Royale Brochure Full - 2019-03 (March 12)Document12 pages20190329011144blue Royale Brochure Full - 2019-03 (March 12)Al Polen Jr SingcayNo ratings yet

- Brochure Health Foundation A4Document4 pagesBrochure Health Foundation A4BartoszNo ratings yet

- Blue Royale 0 65 BrochureDocument12 pagesBlue Royale 0 65 BrochureAna Patricia SanchezNo ratings yet

- CPG - Presentation 26.04.2018 - EnglishDocument46 pagesCPG - Presentation 26.04.2018 - EnglishChuộtĐẻTrứngNo ratings yet

- PRUValue Med PRUMillion Med Booster Leaflet - ENGDocument14 pagesPRUValue Med PRUMillion Med Booster Leaflet - ENGchau thiranNo ratings yet

- Sme Product Brochure PDFDocument37 pagesSme Product Brochure PDFNoor Azman YaacobNo ratings yet

- I-Medik RIDER Suite: Your One Stop Medical Protection SolutionDocument83 pagesI-Medik RIDER Suite: Your One Stop Medical Protection SolutionainafaqeeraNo ratings yet

- Great Health Direct: A Medical Plan To Protect You Against Life's UncertaintiesDocument9 pagesGreat Health Direct: A Medical Plan To Protect You Against Life's Uncertaintieslulalala8888No ratings yet

- Smart Medic ShieldDocument25 pagesSmart Medic ShieldSpring WaterNo ratings yet

- International Exclusive Individual Pds enDocument7 pagesInternational Exclusive Individual Pds enJeroy TanNo ratings yet

- Get Well in Comfort: Kembali Pulih Dalam KeselesaanDocument10 pagesGet Well in Comfort: Kembali Pulih Dalam KeselesaanonyakNo ratings yet

- Premier Medic PartnerDocument2 pagesPremier Medic PartnerHihiNo ratings yet

- MEDICLASSIC Gold One PagerDocument1 pageMEDICLASSIC Gold One Pagerjaluku jinNo ratings yet

- Fast Simple Affordable: Direct MedDocument5 pagesFast Simple Affordable: Direct MedHasdanNo ratings yet

- International Exclusive Brochure enDocument12 pagesInternational Exclusive Brochure enMeng Seng EngNo ratings yet

- Health Insurance: For Your Group & Their Family MembersDocument2 pagesHealth Insurance: For Your Group & Their Family MembersSudhir JadhavNo ratings yet

- Employee Presentation SilverDocument24 pagesEmployee Presentation Silverkishan310No ratings yet

- Img 0001Document1 pageImg 0001Hillary YTengNo ratings yet

- Takafulink Medical Plus FlyerDocument6 pagesTakafulink Medical Plus Flyerapi-628837449No ratings yet

- Compare SMX & SMSDocument2 pagesCompare SMX & SMSJ20 00cNo ratings yet

- Takaful MySME Partner Brochure ENG-5Document20 pagesTakaful MySME Partner Brochure ENG-5Mahmud HishamNo ratings yet

- Senior Med: Securing The Cost of Old AgeDocument12 pagesSenior Med: Securing The Cost of Old AgeHASIRULNIZAM BIN HASHIMNo ratings yet

- Select Brochure Full - 2022 10 (October 01)Document12 pagesSelect Brochure Full - 2022 10 (October 01)Erl D. MelitanteNo ratings yet

- Greenply-Benefit Manual - PPSXDocument28 pagesGreenply-Benefit Manual - PPSXArkadev ChakrabartiNo ratings yet

- Product Summary FOR Enhanced Hospital & Surgical Insurance AND Group Major Medical InsuranceDocument8 pagesProduct Summary FOR Enhanced Hospital & Surgical Insurance AND Group Major Medical InsuranceAxel KruseNo ratings yet

- Pacific Cross - 2020-10 (October 01)Document12 pagesPacific Cross - 2020-10 (October 01)Eeza OrtileNo ratings yet

- Final PSL Healthpolicy Wording PERSISTANT 2021-22Document38 pagesFinal PSL Healthpolicy Wording PERSISTANT 2021-22AsifNo ratings yet

- 20210326092901select Brochure Full - 01 April 2021Document12 pages20210326092901select Brochure Full - 01 April 2021iqbal_anggaraNo ratings yet

- Blue Royale Brochure Full - 2023-09 (September 22)Document12 pagesBlue Royale Brochure Full - 2023-09 (September 22)Invictus InsuranceNo ratings yet

- Product Fact Sheet Year 2024Document6 pagesProduct Fact Sheet Year 2024Shanis LinNo ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- DHA Basic Dependents Parents TOB1Document10 pagesDHA Basic Dependents Parents TOB1REGEENANo ratings yet

- Premier: A Medical Insurance Plan For Senior CitizensDocument8 pagesPremier: A Medical Insurance Plan For Senior CitizensStefNo ratings yet

- Smartmedic Million BrochureDocument11 pagesSmartmedic Million BrochureAlwin AlexanderNo ratings yet

- 01-Select Brochure Full - 2023-10Document16 pages01-Select Brochure Full - 2023-10Juliet CoNo ratings yet

- ANNEXURE IIIE (Medi-Assist PPT On Medical Insurance)Document20 pagesANNEXURE IIIE (Medi-Assist PPT On Medical Insurance)Shiv RamNo ratings yet

- Medical Integration Model as it Pertains to Musculoskeletal ConditionsFrom EverandMedical Integration Model as it Pertains to Musculoskeletal ConditionsNo ratings yet

- Guide For Contribution Payment Via Jompay: 3 Simple Steps On How To Use Jompay From Internet or Mobile BankingDocument8 pagesGuide For Contribution Payment Via Jompay: 3 Simple Steps On How To Use Jompay From Internet or Mobile BankingMohd AimanNo ratings yet

- Volatiles in Plant Biology: Applications of Volatile AnalysisDocument1 pageVolatiles in Plant Biology: Applications of Volatile AnalysisMohd AimanNo ratings yet

- UMP Supervision PolicyDocument6 pagesUMP Supervision PolicyMohd AimanNo ratings yet

- 50 Palabras Mas Comunes en Ingles Hablado y EscritoDocument7 pages50 Palabras Mas Comunes en Ingles Hablado y EscritoChristian SalinasNo ratings yet

- Muaturun KatalogaaaaaaaaaaaaaaaaaaaaaaaaDocument4 pagesMuaturun KatalogaaaaaaaaaaaaaaaaaaaaaaaaMohd AimanNo ratings yet

- WritingDocument19 pagesWritingMohd AimanNo ratings yet

- Primer Design ReportDocument1 pagePrimer Design ReportMohd AimanNo ratings yet

- This Protocol Describes The Production of Competent Yeast Cells For Lithium AcetateDocument7 pagesThis Protocol Describes The Production of Competent Yeast Cells For Lithium AcetateMohd AimanNo ratings yet

- Career Development Ramstad Hall Room 112 253-535-7459: WWW - Plu.edu/ CareerDocument1 pageCareer Development Ramstad Hall Room 112 253-535-7459: WWW - Plu.edu/ CareerMohd AimanNo ratings yet

- Tissue Culture YeastDocument5 pagesTissue Culture YeastMohd AimanNo ratings yet

- Re Comb Dna Competent CellDocument11 pagesRe Comb Dna Competent CellMohd AimanNo ratings yet

- Alamat IndustriDocument8 pagesAlamat IndustriMohd AimanNo ratings yet

- Random Amplified Polymorphic DNA (RAPD) and SSR Marker Efficacy For Maize Hybrid IdentificationDocument8 pagesRandom Amplified Polymorphic DNA (RAPD) and SSR Marker Efficacy For Maize Hybrid IdentificationMohd AimanNo ratings yet

- Prevention of Odontogenic Infection - Principles of Management - Dental Ebook & Lecture Notes PDF Download (Studynama - Com - India's Biggest Website For BDS Study Material Downloads)Document17 pagesPrevention of Odontogenic Infection - Principles of Management - Dental Ebook & Lecture Notes PDF Download (Studynama - Com - India's Biggest Website For BDS Study Material Downloads)Vinnie SinghNo ratings yet

- 2009-SUPPORT Tools For Evidence-Informed Policymaking in Health 18-Planning Monitoring and Evaluation of PoliciesDocument8 pages2009-SUPPORT Tools For Evidence-Informed Policymaking in Health 18-Planning Monitoring and Evaluation of PoliciesJULIO CESAR MATEUS SOLARTENo ratings yet

- National Headquarters Philippine National Police Health ServiceDocument7 pagesNational Headquarters Philippine National Police Health ServiceGIDEON, JR. INESNo ratings yet

- E9 KSCL tháng 4_ Đống ĐaDocument8 pagesE9 KSCL tháng 4_ Đống ĐaPhuong Anh TranNo ratings yet

- Surgical Nursing (III)Document32 pagesSurgical Nursing (III)Opio MosesNo ratings yet

- The Lucid Interval Associated With Epidural Bleeding: Evolving UnderstandingDocument7 pagesThe Lucid Interval Associated With Epidural Bleeding: Evolving Understandingyosiaputra100% (1)

- Scientific Events Distribution PDFDocument9 pagesScientific Events Distribution PDFCodrin FodorNo ratings yet

- Cesarean SectionDocument14 pagesCesarean Sectionمؤمن شطناويNo ratings yet

- The New India Assurance Co. LTD,: Senior Citizen Mediclaim PolicyDocument28 pagesThe New India Assurance Co. LTD,: Senior Citizen Mediclaim PolicyRaghavendra RajuNo ratings yet

- PreOperative CareDocument9 pagesPreOperative CareYana Pot100% (2)

- Nursing Science Journal (NSJ) : e-ISSN: 2722-5054Document5 pagesNursing Science Journal (NSJ) : e-ISSN: 2722-5054Iskandar PakayaNo ratings yet

- Nursing Care Plan On: Ca OvaryDocument13 pagesNursing Care Plan On: Ca Ovaryvaishali TayadeNo ratings yet

- Prevention of Hospital-Acquired Infections: A Practical Guide 2nd EditionDocument72 pagesPrevention of Hospital-Acquired Infections: A Practical Guide 2nd EditionHussein AhmedNo ratings yet

- Adult Psychiatry Intake Questionnaire - 20090522Document5 pagesAdult Psychiatry Intake Questionnaire - 20090522sirius_nstNo ratings yet

- List of Empanelled HCOs - Patna (May 2021)Document7 pagesList of Empanelled HCOs - Patna (May 2021)Mr unknownNo ratings yet

- Laparoscopy and Laparoscopic SurgeryDocument7 pagesLaparoscopy and Laparoscopic SurgeryLaura RojasNo ratings yet

- Firmin Technique For Microtia ReconstructionDocument7 pagesFirmin Technique For Microtia ReconstructionDimitris Rodriguez100% (1)

- Classification of HospitalDocument38 pagesClassification of Hospitaljennie jung100% (1)

- c2c0cd139fda07ba6be5a534a2c33894Document13 pagesc2c0cd139fda07ba6be5a534a2c33894Jenny GamesonNo ratings yet

- 1556188104-Workshop Overview On Stoma CareDocument31 pages1556188104-Workshop Overview On Stoma CareZuldi ErdiansyahNo ratings yet

- CGHS Mumbai 2010 Rates Updated On 30th May 2021Document49 pagesCGHS Mumbai 2010 Rates Updated On 30th May 2021zemse11715No ratings yet

- Aureus. It Can Be Either Acute or ChronicDocument7 pagesAureus. It Can Be Either Acute or ChronicfortunelobsterNo ratings yet

- TracheostomyDocument29 pagesTracheostomyFemi AustinNo ratings yet

- FosclistDocument3 pagesFosclistLori MendezNo ratings yet

- Comparison of 3D C-Arm Fluoroscopy and 3D Image-GuidedDocument8 pagesComparison of 3D C-Arm Fluoroscopy and 3D Image-Guidedgevowo3277No ratings yet

- Choledocal CystDocument11 pagesCholedocal CystBilly JonatanNo ratings yet

- Fin e 26 2019Document14 pagesFin e 26 2019vanjinathan_aNo ratings yet

- The Treatment of Nasal Fractures: A Changing ParadigmDocument7 pagesThe Treatment of Nasal Fractures: A Changing ParadigmWindy HapsariNo ratings yet

- Prepostetic Surgery PDFDocument13 pagesPrepostetic Surgery PDFna zifaNo ratings yet