Professional Documents

Culture Documents

Rate of Depreciation in Case of WDV (1-nth Root of Residual Value) /cost (Cost-Sv) /life

Rate of Depreciation in Case of WDV (1-nth Root of Residual Value) /cost (Cost-Sv) /life

Uploaded by

AnishaSapraCopyright:

Available Formats

You might also like

- Chapter 06 Test BankDocument47 pagesChapter 06 Test BankBrandon LeeNo ratings yet

- COSTING of CASTINGDocument34 pagesCOSTING of CASTINGSiddharth Gupta100% (1)

- Market and Zonal Values - Trece MartiresDocument8 pagesMarket and Zonal Values - Trece MartiresAngelo LopezNo ratings yet

- Payslip Balp407938201933002 PDFDocument1 pagePayslip Balp407938201933002 PDFnik omek100% (1)

- Solved Jesse Owns A Duplex Used As Residential Rental Property TheDocument1 pageSolved Jesse Owns A Duplex Used As Residential Rental Property TheAnbu jaromiaNo ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedDocument6 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedJITHIN KRISHNAN MNo ratings yet

- Calpine SolutionDocument5 pagesCalpine SolutionDarshan GosaliaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- DR Reddy LabsDocument6 pagesDR Reddy LabsAdarsh ChavelNo ratings yet

- Kogas Ar 2020Document11 pagesKogas Ar 2020Vinaya NaralasettyNo ratings yet

- Change in Maintenance Cost (Rs. Lakhs)Document4 pagesChange in Maintenance Cost (Rs. Lakhs)gopi11789No ratings yet

- Statement Showing Cost & Profitability of Power Generated - Cogeneration PlantDocument19 pagesStatement Showing Cost & Profitability of Power Generated - Cogeneration PlantJAY PARIKHNo ratings yet

- Aditya: ForgeDocument17 pagesAditya: ForgeanupNo ratings yet

- Assignment 2Document2 pagesAssignment 2Amna AbdallahNo ratings yet

- Press Release Results q3 2022-23Document5 pagesPress Release Results q3 2022-23ak4442679No ratings yet

- Bajaj AnalysisDocument64 pagesBajaj AnalysisKetki PuranikNo ratings yet

- Ind Assignment ScenarioDocument6 pagesInd Assignment Scenariogaurav.jain.25nNo ratings yet

- Adani PortDocument6 pagesAdani PortAdarsh ChavelNo ratings yet

- Annexure I-17-1-18Document2 pagesAnnexure I-17-1-18latikakarmakar4231198065No ratings yet

- Chapter 1Document18 pagesChapter 1Kenny WongNo ratings yet

- C10 25.07.2017 Price Details Ingots, Billets & Wirerod No Change in Price of Ingots & Wire RodsDocument15 pagesC10 25.07.2017 Price Details Ingots, Billets & Wirerod No Change in Price of Ingots & Wire RodsSanjayNo ratings yet

- Calpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01Document68 pagesCalpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01KshitishNo ratings yet

- 30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowDocument13 pages30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowPMPNo ratings yet

- Price Adjustment Statement1Document13 pagesPrice Adjustment Statement1Abhinav BhardwajNo ratings yet

- L C Ti: Gujarat Minera Development Orpora On LimitedDocument10 pagesL C Ti: Gujarat Minera Development Orpora On Limitedayushshukla97690No ratings yet

- Financial ModelDocument10 pagesFinancial ModelAbdul RehmanNo ratings yet

- WEEKLY REPORT vs ACTUAL MGFI RND week 52Document1 pageWEEKLY REPORT vs ACTUAL MGFI RND week 52Danang Dwi CNo ratings yet

- CelastroFinanceModel-4.1Document17 pagesCelastroFinanceModel-4.1Seemant SengarNo ratings yet

- 27 November 2022Document1 page27 November 2022guntoro situmorangNo ratings yet

- Chapter 4 CB Problems - IDocument11 pagesChapter 4 CB Problems - IRoy YadavNo ratings yet

- Workbook 6 Capital Budgeting/Making Capital Investment Decisions/ Estimation of Project Cash FlowsDocument9 pagesWorkbook 6 Capital Budgeting/Making Capital Investment Decisions/ Estimation of Project Cash FlowsFaizaNo ratings yet

- A&f - Group Assignment - Assignment 2Document8 pagesA&f - Group Assignment - Assignment 2lavaniaNo ratings yet

- Jhanvi Shah 2012 CF PresentationDocument12 pagesJhanvi Shah 2012 CF PresentationJhanvi ShahNo ratings yet

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Public NoticeDocument5 pagesPublic NoticeBaldhariNo ratings yet

- Financial Model Template PowerDocument10 pagesFinancial Model Template Powerdarkkaizer23No ratings yet

- Chapter 4 CB Problems - FDocument11 pagesChapter 4 CB Problems - FAkshat SinghNo ratings yet

- BHEL - Rock Solid - RBS - Jan2011Document8 pagesBHEL - Rock Solid - RBS - Jan2011Jitender KumarNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- 2020 09 21 PH S SCC PDFDocument7 pages2020 09 21 PH S SCC PDFElcano MirandaNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Aqua SAFA PrintDocument8 pagesAqua SAFA PrintJipfco FafanNo ratings yet

- Britannia 1Document40 pagesBritannia 1Dipesh GuptaNo ratings yet

- C09 08.07.2017 Price Details Ingots, Billets & Wirerod No Change in Price of Ingots & Wire RodsDocument15 pagesC09 08.07.2017 Price Details Ingots, Billets & Wirerod No Change in Price of Ingots & Wire RodsSanjayNo ratings yet

- Chandra Gira 071-072 ProjectedDocument8 pagesChandra Gira 071-072 ProjectedBright Tone Music InstituteNo ratings yet

- Publication Noitce - EnglishDocument5 pagesPublication Noitce - EnglishSHIVAM KUMARNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- A. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Document11 pagesA. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Hoàng QuânNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Assignment 3 Feb MBA 1Document17 pagesAssignment 3 Feb MBA 1shahzad aliNo ratings yet

- Maharashtra EB Sale No Yes Mar No: Wind Power Project - Financial StatementDocument5 pagesMaharashtra EB Sale No Yes Mar No: Wind Power Project - Financial Statementaby_000No ratings yet

- Pm-Section D - BudgetingDocument43 pagesPm-Section D - BudgetingAlbee Koh Jia YeeNo ratings yet

- 23 November 2022Document1 page23 November 2022guntoro situmorangNo ratings yet

- Excel Setup and Imp FunctionsDocument28 pagesExcel Setup and Imp Functionskjvc0408No ratings yet

- Jeevan BikashDocument2 pagesJeevan Bikashclear menNo ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Document5 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Namrata ShahNo ratings yet

- Inari Financial Result Q1 FY2024Document17 pagesInari Financial Result Q1 FY2024GZHNo ratings yet

- Muskan Nagar - FM AssignmentDocument33 pagesMuskan Nagar - FM AssignmentMuskan NagarNo ratings yet

- The Calculations VR 4.0Document39 pagesThe Calculations VR 4.0bbookkss2024No ratings yet

- FMA Assignment Sem1 2019HB58032Document7 pagesFMA Assignment Sem1 2019HB58032rageshNo ratings yet

- Cash Flow KEC 765kV DC WARANGAL-WARORA TL Projecte For Stringing WorkDocument4 pagesCash Flow KEC 765kV DC WARANGAL-WARORA TL Projecte For Stringing WorkAkd DeshmukhNo ratings yet

- Schedule - I Calculation of Sales RevenueDocument20 pagesSchedule - I Calculation of Sales RevenueRohitNo ratings yet

- IAS 8 Class Example 1 - Suggested SolutionDocument3 pagesIAS 8 Class Example 1 - Suggested SolutionGiven RefilweNo ratings yet

- Operators and Expressions in Python Real PythonDocument22 pagesOperators and Expressions in Python Real PythonAnishaSapraNo ratings yet

- Mft5seim12 Python and RDocument7 pagesMft5seim12 Python and RAnishaSapraNo ratings yet

- Basic Data Types in Python Real PythonDocument15 pagesBasic Data Types in Python Real PythonAnishaSapraNo ratings yet

- Lecture 2 - R & Python: Nirma University, MBA FT, July-Sep, 2020Document16 pagesLecture 2 - R & Python: Nirma University, MBA FT, July-Sep, 2020AnishaSapraNo ratings yet

- FSA 19-21 Group Assignment Expectations Phase-IDocument2 pagesFSA 19-21 Group Assignment Expectations Phase-IAnishaSapraNo ratings yet

- Dep Mini Case Mohini Sharma Bengal Aluminium and Other ProblemsDocument3 pagesDep Mini Case Mohini Sharma Bengal Aluminium and Other ProblemsAnishaSapraNo ratings yet

- Reporting of Long-Lived Assets/PPE/Fixed AssetsDocument6 pagesReporting of Long-Lived Assets/PPE/Fixed AssetsAnishaSapraNo ratings yet

- 41 Income Tax Caculator For Salaried Person For Fy 2010 11Document10 pages41 Income Tax Caculator For Salaried Person For Fy 2010 11Udayan KarnatakNo ratings yet

- Advance TaxDocument2 pagesAdvance TaxVachanamrutha R.VNo ratings yet

- Challan 32Document1 pageChallan 32Aditya Kumar KaushikNo ratings yet

- Maritime Industry Advisory 2017-22 2017-22 - Availment of VAT ExemptionDocument3 pagesMaritime Industry Advisory 2017-22 2017-22 - Availment of VAT ExemptionPortCallsNo ratings yet

- Revised Offer Letter - ResolveTechDocument2 pagesRevised Offer Letter - ResolveTechsayali kadNo ratings yet

- GP Fund Calculation Formula Sheet For GP Fund StatementDocument4 pagesGP Fund Calculation Formula Sheet For GP Fund StatementLucky KhanNo ratings yet

- List of Corporation and EmployeeDocument9 pagesList of Corporation and Employeekath rynNo ratings yet

- 2306 Jan 2018 ENCS v4Document2 pages2306 Jan 2018 ENCS v4Mary Ann Pacariem100% (4)

- Taxation - PB - 19thDocument9 pagesTaxation - PB - 19thKenneth Bryan Tegerero TegioNo ratings yet

- Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDocument59 pagesIntermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldSumon iqbalNo ratings yet

- CHAPTER 3 - Transfer and Business TaxDocument6 pagesCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- False 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinDocument2 pagesFalse 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinLazy LeathNo ratings yet

- Tax Efficient RetirementDocument12 pagesTax Efficient RetirementPalak SharmaNo ratings yet

- Total Payable: NOV 22 - 08 11344 0950200U - 000000000 30 NOV 22 - 6Document1 pageTotal Payable: NOV 22 - 08 11344 0950200U - 000000000 30 NOV 22 - 6shahzadtecNo ratings yet

- Iesco Online BillDocument2 pagesIesco Online Billyousafkhansafi.95No ratings yet

- Leon Joaquin R. Valdez BSA2-1 Income Taxation (TRAIN Law Reflection)Document2 pagesLeon Joaquin R. Valdez BSA2-1 Income Taxation (TRAIN Law Reflection)LEON JOAQUIN VALDEZNo ratings yet

- AFAR Part 1 Page 1-20Document2 pagesAFAR Part 1 Page 1-20Tracy Ann AcedilloNo ratings yet

- COMPENSATION INCOME EXERCISES AnnualDocument1 pageCOMPENSATION INCOME EXERCISES AnnualJoyce Marie SablayanNo ratings yet

- September 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)Document8 pagesSeptember 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)anitaNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 21-2018 Issued On April 5, 2018Document1 pageREVENUE MEMORANDUM CIRCULAR NO. 21-2018 Issued On April 5, 2018Hansel Jake B. PampiloNo ratings yet

- 1 Useful Calender For Every Accountant 2010Document13 pages1 Useful Calender For Every Accountant 2010bharat100% (1)

- Presumptive Taxation: - Under Income Tax Act, 1961Document21 pagesPresumptive Taxation: - Under Income Tax Act, 1961Saksham JoshiNo ratings yet

- ProTools Subscription Invoice - March 2020Document1 pageProTools Subscription Invoice - March 2020thathy78No ratings yet

- Assignment 7.1 Millania 25-10-21Document2 pagesAssignment 7.1 Millania 25-10-21Shifa MuslimahNo ratings yet

- Gen Bir Annex B2Document2 pagesGen Bir Annex B2ArgielJedTabalBorras100% (2)

- Reflections On 6 Years of Public PolicyDocument5 pagesReflections On 6 Years of Public PolicyrmdantonNo ratings yet

Rate of Depreciation in Case of WDV (1-nth Root of Residual Value) /cost (Cost-Sv) /life

Rate of Depreciation in Case of WDV (1-nth Root of Residual Value) /cost (Cost-Sv) /life

Uploaded by

AnishaSapraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rate of Depreciation in Case of WDV (1-nth Root of Residual Value) /cost (Cost-Sv) /life

Rate of Depreciation in Case of WDV (1-nth Root of Residual Value) /cost (Cost-Sv) /life

Uploaded by

AnishaSapraCopyright:

Available Formats

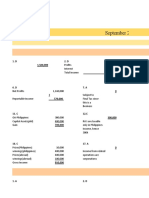

Bengal A

Cost 300

Scrap Value 15

Life (yrs) 10

WDV Rate 0.2588656

Rate of Depreciation in case of WDV (1-nth root of residual value)/cost

Straight line Yearly Depreciation 28.5

(cost- sv)/life

(A) Schedule of Dept. as per WDV Method

Year Cost Yearly Dep. Acc. Dep. WDV(BV)

2006-07 300 77.6596653 77.659665 222.34033

2007-08 300 57.5562532 135.2159 164.78408

2008-09 300 42.656922 177.87284 122.12716

(B) Schedule of Dep. As per SL Method

Year Cost Yearly Dep. Acc. Dep. WDV(BV)

2006-07 300 28.5 28.5 271.5

2007-08 300 28.5 57 243

2008-09 300 28.5 85.5 214.5

Amount of dep reduces due to change in method, amount of profit increases

Cost 700000

Life 25 End of 3rd year

RV 100000 Cost 700000

Mthod SL Acc. Dep. 72000

Yearly Dep SLM 24000 WDV(BV) 628000

Revised Yrly Dep., if the life estimates are revised

Cost 628000

Life 30

RV 100000

Revised Yrly Dep. 17600

Net effect of revising 6400

(Future profits will inc by)

Effect of change in Method of Dep on Net Income

(A) If change in method is treated as policy change= Retrospective effect

will have changes in 2 levels:

1. Change in current years profit (diff. in yearly dep. Amount) 14.156922035

(This will not have explicit effect on Fin. Stmt.)

2. Effect on previous years profit 78.215918504

(explicitly seen in PL above the line as addition to profit)

NET EFFECT OF CHANGE IN METHOD OF DEP 92.372840539

Bengal

Year Aluminum Adjusted Adjusted

ended

March Profit

31 Sales after

Tax NP RATIO Growth in sales PAT NP RATIO

2006 1215 129 0.1062

2007 1324 138 0.1042 0.09

2008 1589 163 0.1026 0.2

2009 2066 257 0.1244 0.3 192.33901 0.0931

(net profit ratio has actually b

from 10.2 to 9.31)

(B) If change in method is treated as estimate change= Prospective effect

Cost (at the beg. Of 2008-09) 164.784081496

Life 8 Have used asset for 2 years

RV 15 will remain same

Revised Dep as per SLM(applicable 2008-09 18.723010187

mates are revised

t profit ratio has actually been worsened

m 10.2 to 9.31)

et for 2 years

You might also like

- Chapter 06 Test BankDocument47 pagesChapter 06 Test BankBrandon LeeNo ratings yet

- COSTING of CASTINGDocument34 pagesCOSTING of CASTINGSiddharth Gupta100% (1)

- Market and Zonal Values - Trece MartiresDocument8 pagesMarket and Zonal Values - Trece MartiresAngelo LopezNo ratings yet

- Payslip Balp407938201933002 PDFDocument1 pagePayslip Balp407938201933002 PDFnik omek100% (1)

- Solved Jesse Owns A Duplex Used As Residential Rental Property TheDocument1 pageSolved Jesse Owns A Duplex Used As Residential Rental Property TheAnbu jaromiaNo ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedDocument6 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedJITHIN KRISHNAN MNo ratings yet

- Calpine SolutionDocument5 pagesCalpine SolutionDarshan GosaliaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- DR Reddy LabsDocument6 pagesDR Reddy LabsAdarsh ChavelNo ratings yet

- Kogas Ar 2020Document11 pagesKogas Ar 2020Vinaya NaralasettyNo ratings yet

- Change in Maintenance Cost (Rs. Lakhs)Document4 pagesChange in Maintenance Cost (Rs. Lakhs)gopi11789No ratings yet

- Statement Showing Cost & Profitability of Power Generated - Cogeneration PlantDocument19 pagesStatement Showing Cost & Profitability of Power Generated - Cogeneration PlantJAY PARIKHNo ratings yet

- Aditya: ForgeDocument17 pagesAditya: ForgeanupNo ratings yet

- Assignment 2Document2 pagesAssignment 2Amna AbdallahNo ratings yet

- Press Release Results q3 2022-23Document5 pagesPress Release Results q3 2022-23ak4442679No ratings yet

- Bajaj AnalysisDocument64 pagesBajaj AnalysisKetki PuranikNo ratings yet

- Ind Assignment ScenarioDocument6 pagesInd Assignment Scenariogaurav.jain.25nNo ratings yet

- Adani PortDocument6 pagesAdani PortAdarsh ChavelNo ratings yet

- Annexure I-17-1-18Document2 pagesAnnexure I-17-1-18latikakarmakar4231198065No ratings yet

- Chapter 1Document18 pagesChapter 1Kenny WongNo ratings yet

- C10 25.07.2017 Price Details Ingots, Billets & Wirerod No Change in Price of Ingots & Wire RodsDocument15 pagesC10 25.07.2017 Price Details Ingots, Billets & Wirerod No Change in Price of Ingots & Wire RodsSanjayNo ratings yet

- Calpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01Document68 pagesCalpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01KshitishNo ratings yet

- 30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowDocument13 pages30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowPMPNo ratings yet

- Price Adjustment Statement1Document13 pagesPrice Adjustment Statement1Abhinav BhardwajNo ratings yet

- L C Ti: Gujarat Minera Development Orpora On LimitedDocument10 pagesL C Ti: Gujarat Minera Development Orpora On Limitedayushshukla97690No ratings yet

- Financial ModelDocument10 pagesFinancial ModelAbdul RehmanNo ratings yet

- WEEKLY REPORT vs ACTUAL MGFI RND week 52Document1 pageWEEKLY REPORT vs ACTUAL MGFI RND week 52Danang Dwi CNo ratings yet

- CelastroFinanceModel-4.1Document17 pagesCelastroFinanceModel-4.1Seemant SengarNo ratings yet

- 27 November 2022Document1 page27 November 2022guntoro situmorangNo ratings yet

- Chapter 4 CB Problems - IDocument11 pagesChapter 4 CB Problems - IRoy YadavNo ratings yet

- Workbook 6 Capital Budgeting/Making Capital Investment Decisions/ Estimation of Project Cash FlowsDocument9 pagesWorkbook 6 Capital Budgeting/Making Capital Investment Decisions/ Estimation of Project Cash FlowsFaizaNo ratings yet

- A&f - Group Assignment - Assignment 2Document8 pagesA&f - Group Assignment - Assignment 2lavaniaNo ratings yet

- Jhanvi Shah 2012 CF PresentationDocument12 pagesJhanvi Shah 2012 CF PresentationJhanvi ShahNo ratings yet

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Public NoticeDocument5 pagesPublic NoticeBaldhariNo ratings yet

- Financial Model Template PowerDocument10 pagesFinancial Model Template Powerdarkkaizer23No ratings yet

- Chapter 4 CB Problems - FDocument11 pagesChapter 4 CB Problems - FAkshat SinghNo ratings yet

- BHEL - Rock Solid - RBS - Jan2011Document8 pagesBHEL - Rock Solid - RBS - Jan2011Jitender KumarNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- 2020 09 21 PH S SCC PDFDocument7 pages2020 09 21 PH S SCC PDFElcano MirandaNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Aqua SAFA PrintDocument8 pagesAqua SAFA PrintJipfco FafanNo ratings yet

- Britannia 1Document40 pagesBritannia 1Dipesh GuptaNo ratings yet

- C09 08.07.2017 Price Details Ingots, Billets & Wirerod No Change in Price of Ingots & Wire RodsDocument15 pagesC09 08.07.2017 Price Details Ingots, Billets & Wirerod No Change in Price of Ingots & Wire RodsSanjayNo ratings yet

- Chandra Gira 071-072 ProjectedDocument8 pagesChandra Gira 071-072 ProjectedBright Tone Music InstituteNo ratings yet

- Publication Noitce - EnglishDocument5 pagesPublication Noitce - EnglishSHIVAM KUMARNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- A. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Document11 pagesA. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Hoàng QuânNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Assignment 3 Feb MBA 1Document17 pagesAssignment 3 Feb MBA 1shahzad aliNo ratings yet

- Maharashtra EB Sale No Yes Mar No: Wind Power Project - Financial StatementDocument5 pagesMaharashtra EB Sale No Yes Mar No: Wind Power Project - Financial Statementaby_000No ratings yet

- Pm-Section D - BudgetingDocument43 pagesPm-Section D - BudgetingAlbee Koh Jia YeeNo ratings yet

- 23 November 2022Document1 page23 November 2022guntoro situmorangNo ratings yet

- Excel Setup and Imp FunctionsDocument28 pagesExcel Setup and Imp Functionskjvc0408No ratings yet

- Jeevan BikashDocument2 pagesJeevan Bikashclear menNo ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Document5 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Namrata ShahNo ratings yet

- Inari Financial Result Q1 FY2024Document17 pagesInari Financial Result Q1 FY2024GZHNo ratings yet

- Muskan Nagar - FM AssignmentDocument33 pagesMuskan Nagar - FM AssignmentMuskan NagarNo ratings yet

- The Calculations VR 4.0Document39 pagesThe Calculations VR 4.0bbookkss2024No ratings yet

- FMA Assignment Sem1 2019HB58032Document7 pagesFMA Assignment Sem1 2019HB58032rageshNo ratings yet

- Cash Flow KEC 765kV DC WARANGAL-WARORA TL Projecte For Stringing WorkDocument4 pagesCash Flow KEC 765kV DC WARANGAL-WARORA TL Projecte For Stringing WorkAkd DeshmukhNo ratings yet

- Schedule - I Calculation of Sales RevenueDocument20 pagesSchedule - I Calculation of Sales RevenueRohitNo ratings yet

- IAS 8 Class Example 1 - Suggested SolutionDocument3 pagesIAS 8 Class Example 1 - Suggested SolutionGiven RefilweNo ratings yet

- Operators and Expressions in Python Real PythonDocument22 pagesOperators and Expressions in Python Real PythonAnishaSapraNo ratings yet

- Mft5seim12 Python and RDocument7 pagesMft5seim12 Python and RAnishaSapraNo ratings yet

- Basic Data Types in Python Real PythonDocument15 pagesBasic Data Types in Python Real PythonAnishaSapraNo ratings yet

- Lecture 2 - R & Python: Nirma University, MBA FT, July-Sep, 2020Document16 pagesLecture 2 - R & Python: Nirma University, MBA FT, July-Sep, 2020AnishaSapraNo ratings yet

- FSA 19-21 Group Assignment Expectations Phase-IDocument2 pagesFSA 19-21 Group Assignment Expectations Phase-IAnishaSapraNo ratings yet

- Dep Mini Case Mohini Sharma Bengal Aluminium and Other ProblemsDocument3 pagesDep Mini Case Mohini Sharma Bengal Aluminium and Other ProblemsAnishaSapraNo ratings yet

- Reporting of Long-Lived Assets/PPE/Fixed AssetsDocument6 pagesReporting of Long-Lived Assets/PPE/Fixed AssetsAnishaSapraNo ratings yet

- 41 Income Tax Caculator For Salaried Person For Fy 2010 11Document10 pages41 Income Tax Caculator For Salaried Person For Fy 2010 11Udayan KarnatakNo ratings yet

- Advance TaxDocument2 pagesAdvance TaxVachanamrutha R.VNo ratings yet

- Challan 32Document1 pageChallan 32Aditya Kumar KaushikNo ratings yet

- Maritime Industry Advisory 2017-22 2017-22 - Availment of VAT ExemptionDocument3 pagesMaritime Industry Advisory 2017-22 2017-22 - Availment of VAT ExemptionPortCallsNo ratings yet

- Revised Offer Letter - ResolveTechDocument2 pagesRevised Offer Letter - ResolveTechsayali kadNo ratings yet

- GP Fund Calculation Formula Sheet For GP Fund StatementDocument4 pagesGP Fund Calculation Formula Sheet For GP Fund StatementLucky KhanNo ratings yet

- List of Corporation and EmployeeDocument9 pagesList of Corporation and Employeekath rynNo ratings yet

- 2306 Jan 2018 ENCS v4Document2 pages2306 Jan 2018 ENCS v4Mary Ann Pacariem100% (4)

- Taxation - PB - 19thDocument9 pagesTaxation - PB - 19thKenneth Bryan Tegerero TegioNo ratings yet

- Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDocument59 pagesIntermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldSumon iqbalNo ratings yet

- CHAPTER 3 - Transfer and Business TaxDocument6 pagesCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- False 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinDocument2 pagesFalse 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinLazy LeathNo ratings yet

- Tax Efficient RetirementDocument12 pagesTax Efficient RetirementPalak SharmaNo ratings yet

- Total Payable: NOV 22 - 08 11344 0950200U - 000000000 30 NOV 22 - 6Document1 pageTotal Payable: NOV 22 - 08 11344 0950200U - 000000000 30 NOV 22 - 6shahzadtecNo ratings yet

- Iesco Online BillDocument2 pagesIesco Online Billyousafkhansafi.95No ratings yet

- Leon Joaquin R. Valdez BSA2-1 Income Taxation (TRAIN Law Reflection)Document2 pagesLeon Joaquin R. Valdez BSA2-1 Income Taxation (TRAIN Law Reflection)LEON JOAQUIN VALDEZNo ratings yet

- AFAR Part 1 Page 1-20Document2 pagesAFAR Part 1 Page 1-20Tracy Ann AcedilloNo ratings yet

- COMPENSATION INCOME EXERCISES AnnualDocument1 pageCOMPENSATION INCOME EXERCISES AnnualJoyce Marie SablayanNo ratings yet

- September 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)Document8 pagesSeptember 22 - Chapter 9-Regular Income Tax: Inclusion From Gross Income (Assignment)anitaNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 21-2018 Issued On April 5, 2018Document1 pageREVENUE MEMORANDUM CIRCULAR NO. 21-2018 Issued On April 5, 2018Hansel Jake B. PampiloNo ratings yet

- 1 Useful Calender For Every Accountant 2010Document13 pages1 Useful Calender For Every Accountant 2010bharat100% (1)

- Presumptive Taxation: - Under Income Tax Act, 1961Document21 pagesPresumptive Taxation: - Under Income Tax Act, 1961Saksham JoshiNo ratings yet

- ProTools Subscription Invoice - March 2020Document1 pageProTools Subscription Invoice - March 2020thathy78No ratings yet

- Assignment 7.1 Millania 25-10-21Document2 pagesAssignment 7.1 Millania 25-10-21Shifa MuslimahNo ratings yet

- Gen Bir Annex B2Document2 pagesGen Bir Annex B2ArgielJedTabalBorras100% (2)

- Reflections On 6 Years of Public PolicyDocument5 pagesReflections On 6 Years of Public PolicyrmdantonNo ratings yet