Professional Documents

Culture Documents

Equity Elss 29 Aug 2020 1936

Equity Elss 29 Aug 2020 1936

Uploaded by

Ankit Goel0 ratings0% found this document useful (0 votes)

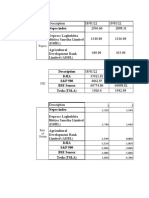

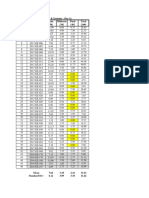

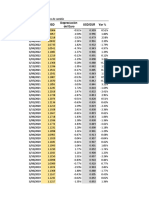

50 views3 pagesThe document provides information on 37 equity ELSS (Equity Linked Savings Scheme) funds including their name, rating, category, launch date, expense ratio, 1 year return, 1 year rank, net assets. ELSS funds are equity mutual funds that provide tax benefits under section 80C of the Income Tax Act. The funds are rated on a scale of 1 to 5, with 1 being the highest rated.

Original Description:

Original Title

equity-elss-29-Aug-2020--1936

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information on 37 equity ELSS (Equity Linked Savings Scheme) funds including their name, rating, category, launch date, expense ratio, 1 year return, 1 year rank, net assets. ELSS funds are equity mutual funds that provide tax benefits under section 80C of the Income Tax Act. The funds are rated on a scale of 1 to 5, with 1 being the highest rated.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

50 views3 pagesEquity Elss 29 Aug 2020 1936

Equity Elss 29 Aug 2020 1936

Uploaded by

Ankit GoelThe document provides information on 37 equity ELSS (Equity Linked Savings Scheme) funds including their name, rating, category, launch date, expense ratio, 1 year return, 1 year rank, net assets. ELSS funds are equity mutual funds that provide tax benefits under section 80C of the Income Tax Act. The funds are rated on a scale of 1 to 5, with 1 being the highest rated.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 3

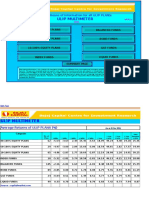

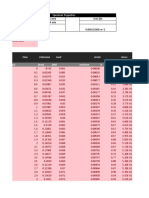

Value Research

Generate on: 29-Aug-2020 19:36

Equity: ELSS

Fund Name Rating Analyst's Choice ? Category

Aditya Birla Sun Life Tax 4 Coming Soon EQ-ELSS

Axis Long Term Equity Fu 5 Coming Soon EQ-ELSS

Baroda ELSS 96 Fund - Di 1 Coming Soon EQ-ELSS

BNP Paribas Long Term Eq 3 Coming Soon EQ-ELSS

BOI AXA Tax Advantage F 5 Coming Soon EQ-ELSS

Canara Robeco Equity Tax 5 Coming Soon EQ-ELSS

DSP Tax Saver Fund - Dir 4 Coming Soon EQ-ELSS

Edelweiss Long Term Equi 3 Coming Soon EQ-ELSS

Essel Long Term Advanta 3 Coming Soon EQ-ELSS

Franklin India Taxshield 2 Coming Soon EQ-ELSS

HDFC Taxsaver Fund - Dir 1 Coming Soon EQ-ELSS

HSBC Tax Saver Equity Fu 3 Coming Soon EQ-ELSS

ICICI Prudential Long Ter 3 Coming Soon EQ-ELSS

IDBI Equity Advantage Fu 3 Coming Soon EQ-ELSS

IDFC Tax Advantage (ELSS 2 Coming Soon EQ-ELSS

Indiabulls Tax Savings Fu-- Coming Soon EQ-ELSS

Invesco India Tax Plan - 4 Coming Soon EQ-ELSS

ITI Long Term Equity Fund-- Coming Soon EQ-ELSS

JM Tax Gain Fund - Direc 4 Coming Soon EQ-ELSS

Kotak Tax Saver - Direct 3 Coming Soon EQ-ELSS

LIC MF Tax Plan - Direct 3 Coming Soon EQ-ELSS

L&T Tax Advantage Fund 3 Coming Soon EQ-ELSS

Mahindra Manulife ELSS K 2 Coming Soon EQ-ELSS

Mirae Asset Tax Saver Fu 5 Coming Soon EQ-ELSS

Motilal Oswal Long Term 4 Coming Soon EQ-ELSS

Nippon India Tax Saver ( 1 Coming Soon EQ-ELSS

Parag Parikh Tax Saver F -- Coming Soon EQ-ELSS

PGIM India Long Term Equ 3 Coming Soon EQ-ELSS

Principal Tax Savings Fun 3 Coming Soon EQ-ELSS

Quant Tax Plan - Direct 4 Coming Soon EQ-ELSS

Quantum Tax Saving Fund 2 Coming Soon EQ-ELSS

SBI Long Term Equity Fun 2 Coming Soon EQ-ELSS

Shriram Long Term Equity-- Coming Soon EQ-ELSS

Sundaram Diversified Equ 2 Coming Soon EQ-ELSS

Tata India Tax Savings Fu 4 Coming Soon EQ-ELSS

Taurus Tax Shield Fund - 4 Coming Soon EQ-ELSS

Union Long Term Equity F 2 Coming Soon EQ-ELSS

UTI Long Term Equity Fun 3 Coming Soon EQ-ELSS

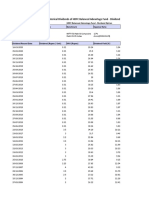

Launch Expense Ratio (%) 1 Yr Ret (%) 1 Yr Rank

2013-01-01 0.92 14.34 6/37

2013-01-01 0.90 9.48 14/37

2013-01-01 1.93 7.78 22/37

2013-01-01 1.19 12.39 10/37

2013-01-01 1.51 26.03 2/37

2013-01-02 1.23 17.37 4/37

2013-01-01 0.94 8.92 18/37

2013-01-21 0.68 7.23 24/37

2015-12-30 0.38 5.10 29/37

2013-01-01 1.04 1.11 35/37

2013-01-01 1.37 1.97 33/37

2013-01-01 1.26 5.71 28/37

2013-01-01 1.22 7.91 21/37

2013-09-10 1.20 4.99 30/37

2013-01-01 1.03 10.09 13/37

2017-12-28 0.50 5.78 27/37

2013-01-01 1.15 11.76 11/37

2019-10-18 0.38 -- --

2013-01-01 0.80 7.30 23/37

2013-01-01 0.99 8.96 17/37

2013-01-02 1.29 3.28 32/37

2013-01-01 1.43 6.80 25/37

2016-10-18 0.68 9.14 16/37

2015-12-28 0.39 15.22 5/37

2015-01-21 0.77 4.35 31/37

2013-01-01 1.24 -0.40 36/37

2019-07-24 1.14 21.01 3/37

2015-12-11 1.37 8.15 20/37

2013-01-02 2.05 9.29 15/37

2013-01-01 0.57 34.05 1/37

2008-12-23 1.29 -1.56 37/37

2013-01-01 1.31 11.60 12/37

2019-01-25 0.60 14.12 8/37

2013-01-01 1.79 1.83 34/37

2013-01-01 0.74 6.25 26/37

2013-01-01 0.93 8.74 19/37

2013-01-01 1.94 13.46 9/37

2013-01-01 1.43 14.17 7/37

Net Assets (Cr)

10,383

21,051

161.00

447.00

284.00

1,089

6,083

119.00

54.00

3,453

6,517

136.00

6,271

469.00

2,065

80.00

1,075

35.00

37.00

1,203

255.00

2,981

297.00

3,858

1,540

8,610

55.00

318.00

390.00

12.00

69.00

7,239

27.00

2,177

1,997

63.00

263.00

1,297

You might also like

- Nedbank Group - Leadership and Adaptive Space For Digital InnovationDocument8 pagesNedbank Group - Leadership and Adaptive Space For Digital Innovationmoveee2No ratings yet

- LinkedIn Bessemer Venture Partners PDFDocument7 pagesLinkedIn Bessemer Venture Partners PDFAnkit Goel100% (1)

- Design & Verification of Low Power SocsDocument54 pagesDesign & Verification of Low Power SocsAnkit GoelNo ratings yet

- Value Research Equity: Large & Midcap Fund Name Rating Analysts' View CategoryDocument3 pagesValue Research Equity: Large & Midcap Fund Name Rating Analysts' View CategoryVIJAY KOUSHAL ATYAMNo ratings yet

- Nippon India Mutual Fund 14 May 2020 1231Document3 pagesNippon India Mutual Fund 14 May 2020 1231Anish AnishNo ratings yet

- Fund Selector 20 May 2020 1741Document3 pagesFund Selector 20 May 2020 1741Mayank GandhiNo ratings yet

- Ulip MultimeterDocument17 pagesUlip MultimeterRaghu RaoNo ratings yet

- Axis Bank EMI CHARTDocument7 pagesAxis Bank EMI CHARTKumara SwamyNo ratings yet

- Amtek Ratios 1Document18 pagesAmtek Ratios 1Dr Sakshi SharmaNo ratings yet

- Investment Performance Nov 30 2022 On 01062023Document3 pagesInvestment Performance Nov 30 2022 On 01062023Jaya GunehaNo ratings yet

- All PRS FundsDocument1 pageAll PRS FundsKay LimNo ratings yet

- 14-03-2018 DMFUN Daily MF Report 14.03Document11 pages14-03-2018 DMFUN Daily MF Report 14.03Shriyank BhargavaNo ratings yet

- Bond Valuaion of InddicesDocument13 pagesBond Valuaion of InddicesRehan AnsariNo ratings yet

- Tabel Pipa GalvanizDocument12 pagesTabel Pipa GalvanizapriadyNo ratings yet

- Fundcard: Invesco India Contra FundDocument4 pagesFundcard: Invesco India Contra FundChittaNo ratings yet

- Edelweiss Fund Tracker - 31 May 2010Document309 pagesEdelweiss Fund Tracker - 31 May 2010rpk1974No ratings yet

- Date New Entry In3 Months: YES YES YES YES YES YES YES YES YESDocument6 pagesDate New Entry In3 Months: YES YES YES YES YES YES YES YES YEShamsNo ratings yet

- Mutual Funds Historical Dividends of HDFC Balanced Advantage Fund - Dividend OptionDocument4 pagesMutual Funds Historical Dividends of HDFC Balanced Advantage Fund - Dividend OptionsahilNo ratings yet

- StationsReport 202072419535Document390 pagesStationsReport 202072419535angiNo ratings yet

- HomeworkDocument27 pagesHomeworkHồ Ngọc HàNo ratings yet

- Readings - Q0212606 - 01-May-2020 03-43-41-000 PM PDFDocument3 pagesReadings - Q0212606 - 01-May-2020 03-43-41-000 PM PDFvirendramehraNo ratings yet

- Eco!) @ A5Document8 pagesEco!) @ A5Vedansh shahNo ratings yet

- Axis Long Term Equity FundDocument4 pagesAxis Long Term Equity FundChittaNo ratings yet

- Homework 55Document78 pagesHomework 55Alferid ShifaNo ratings yet

- Activity GDP Performace - Sheet1Document1 pageActivity GDP Performace - Sheet1CONTESSNICHOLE ORTEGANo ratings yet

- Equity Value Oriented 29 Aug 2020 1936Document3 pagesEquity Value Oriented 29 Aug 2020 1936Ankit GoelNo ratings yet

- Poker P&L 2007 v7 Example VersionDocument55 pagesPoker P&L 2007 v7 Example Versionapi-3714149No ratings yet

- Chapter Four 2 7Document12 pagesChapter Four 2 7Olasunmade Rukayat olamideNo ratings yet

- Cricket RulesDocument2 pagesCricket Rulesmansoor azherNo ratings yet

- StationsReport 202139204911Document129 pagesStationsReport 202139204911AndresNo ratings yet

- OT Assignment Subham 2Document19 pagesOT Assignment Subham 2S SubhamNo ratings yet

- IBF PROJECT Perfect OneDocument96 pagesIBF PROJECT Perfect OneNaveed AbbasNo ratings yet

- NUST Business School: Course Title: Fundamentals of Econometrics Assignment#1Document12 pagesNUST Business School: Course Title: Fundamentals of Econometrics Assignment#1Isbah INo ratings yet

- Debt Low DurationDocument1 pageDebt Low DurationKondorpa BorchetiaNo ratings yet

- Mobile 50,000: Rate of DepDocument5 pagesMobile 50,000: Rate of DepCma Suresh KoppisettiNo ratings yet

- Index 12jul2021Document76 pagesIndex 12jul2021hamsNo ratings yet

- Fecto Sugar: 2009 2008 Liquidity RatioDocument10 pagesFecto Sugar: 2009 2008 Liquidity RatioMushal JamilNo ratings yet

- Advancing SideDocument16 pagesAdvancing Sidemuhamad choirulNo ratings yet

- Datetime Tunal Pm10 Co So2 Vel Viento Dir Viento Temp - 4M Precipitaci NoDocument2 pagesDatetime Tunal Pm10 Co So2 Vel Viento Dir Viento Temp - 4M Precipitaci Nocristian jose lopez gallegoNo ratings yet

- CIL December2022 Conv Above 03022023Document5 pagesCIL December2022 Conv Above 03022023Hafiz IqbalNo ratings yet

- MTP 18 43 Corrigendum 1713520083Document1 pageMTP 18 43 Corrigendum 1713520083ilizawadhwaniNo ratings yet

- 1 Year Beta Calculated Using Weekly DataDocument9 pages1 Year Beta Calculated Using Weekly Datatopeq100% (1)

- Fiqha Haqqi (15105304001)Document19 pagesFiqha Haqqi (15105304001)adilla ikhsaniiNo ratings yet

- Current RatioDocument6 pagesCurrent RatioSakshi NagotkarNo ratings yet

- Assignment 1 Description 2Document26 pagesAssignment 1 Description 2HUANG WENCHENNo ratings yet

- EE 220: Signals & Systems - (Sec-A) EE 220: Signals & Systems - (Sec-B) # Roll-Number Quiz (30) Midterm (30) Final (40) TotalDocument4 pagesEE 220: Signals & Systems - (Sec-A) EE 220: Signals & Systems - (Sec-B) # Roll-Number Quiz (30) Midterm (30) Final (40) TotalRao Haris Rafique KhanNo ratings yet

- Sesión 01Document5 pagesSesión 01MARIA NAYELI TORVISCO AGUILARNo ratings yet

- SARIMADocument8 pagesSARIMAdiego.labastidaNo ratings yet

- Periodo Fecha Saldo Capital Interes Cuota Desg Mult ITF TotalDocument1 pagePeriodo Fecha Saldo Capital Interes Cuota Desg Mult ITF TotalClaudia E. Mamani LuqueNo ratings yet

- Amanat Transport LTD - LS01-IOP - Payment Deferral: 2018 Totals 13,838.70 1,545.05 1,545.05 12,293.65Document2 pagesAmanat Transport LTD - LS01-IOP - Payment Deferral: 2018 Totals 13,838.70 1,545.05 1,545.05 12,293.65Amanat BhullarNo ratings yet

- Descuento AFP ONP Aporte Comision Prima #De Trabajad OR Asig. Familiar Sueldo Bruto Total AFP Otros Descuent OS Total Descuent ODocument3 pagesDescuento AFP ONP Aporte Comision Prima #De Trabajad OR Asig. Familiar Sueldo Bruto Total AFP Otros Descuent OS Total Descuent OGeiner Vega EusebioNo ratings yet

- Portfolio ConstructionDocument15 pagesPortfolio Constructionapi-3765908No ratings yet

- AG PipeScheduleDocument1 pageAG PipeScheduleHamzaNoumanNo ratings yet

- Inver 2Document51 pagesInver 2Ougoust DrakeNo ratings yet

- Currency and Exchanges Manual For Authorised DealersDocument294 pagesCurrency and Exchanges Manual For Authorised DealersFranco DurantNo ratings yet

- Harga ER Varian Harga ER Varian Harga ER VarianDocument2 pagesHarga ER Varian Harga ER Varian Harga ER VarianStevanus Dwi wijanarkoNo ratings yet

- Ma Pipe Dimensions and WeightsDocument1 pageMa Pipe Dimensions and WeightsKirkNo ratings yet

- Plan IlhaDocument3 pagesPlan IlhaHerbert VasconcelosNo ratings yet

- FM JewelleryDocument24 pagesFM JewelleryAyush BapnaNo ratings yet

- Weights & Measures: Threaded Rod and Full Thread StudsDocument2 pagesWeights & Measures: Threaded Rod and Full Thread StudsHassan HelmyNo ratings yet

- Weights Rod PDFDocument2 pagesWeights Rod PDFHassan HelmyNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Axis Top Picks Jun 2022Document90 pagesAxis Top Picks Jun 2022Ankit GoelNo ratings yet

- Yelp Bessemer Venture PartnersDocument8 pagesYelp Bessemer Venture PartnersAnkit GoelNo ratings yet

- Equity Multi Cap 29 Aug 2020 1935Document6 pagesEquity Multi Cap 29 Aug 2020 1935Ankit GoelNo ratings yet

- Equity Value Oriented 29 Aug 2020 1936Document3 pagesEquity Value Oriented 29 Aug 2020 1936Ankit GoelNo ratings yet

- Aggressive Growth Funds 29 Aug 2020 1922Document6 pagesAggressive Growth Funds 29 Aug 2020 1922Ankit GoelNo ratings yet

- India Nikkei Markit MFG PMI - 6 Oct 2017Document2 pagesIndia Nikkei Markit MFG PMI - 6 Oct 2017Ankit GoelNo ratings yet

- Wealth Builder Funds 29 Aug 2020 1916Document30 pagesWealth Builder Funds 29 Aug 2020 1916Ankit GoelNo ratings yet

- Group 30 Case 2 A) We Recommend Following Business To The People MentionedDocument3 pagesGroup 30 Case 2 A) We Recommend Following Business To The People MentionedAnkit GoelNo ratings yet

- Can You Overwrite The Constrained Values. How. Some Other Questions 1.C/C++, OOPS Concepts. 2. Aptitude Questions. 4. Verilog, SVDocument1 pageCan You Overwrite The Constrained Values. How. Some Other Questions 1.C/C++, OOPS Concepts. 2. Aptitude Questions. 4. Verilog, SVAnkit GoelNo ratings yet

- India GDP, CHG Y-Y - 7 Dec 2017Document2 pagesIndia GDP, CHG Y-Y - 7 Dec 2017Ankit GoelNo ratings yet

- SVTB Files File Name PathDocument2 pagesSVTB Files File Name PathAnkit GoelNo ratings yet

- What Is Setup Time and Hold Time? If There Is Clock SkewDocument3 pagesWhat Is Setup Time and Hold Time? If There Is Clock SkewAnkit GoelNo ratings yet

- Env TX - Agent RX - Agent: TB - TopDocument1 pageEnv TX - Agent RX - Agent: TB - TopAnkit GoelNo ratings yet

- Programme No.10 AIM-To Design A D - Flip Flop CODE - Following Is The VHDL Code For Simulation of D Flip FlopDocument8 pagesProgramme No.10 AIM-To Design A D - Flip Flop CODE - Following Is The VHDL Code For Simulation of D Flip FlopAnkit GoelNo ratings yet

- Dcs-Ii Lab File: - Anupam Sobti 17/EC/09Document19 pagesDcs-Ii Lab File: - Anupam Sobti 17/EC/09Ankit GoelNo ratings yet

- Ddr3-Emac40-Queue-Manager Test Bench: - C2sisDocument20 pagesDdr3-Emac40-Queue-Manager Test Bench: - C2sisAnkit Goel100% (1)

- PPTDocument19 pagesPPTAnkit GoelNo ratings yet

- Wk4 Seminar Abc & Overhead Absorption Methods Q Workshop Problems Example 1Document6 pagesWk4 Seminar Abc & Overhead Absorption Methods Q Workshop Problems Example 1FungaiNo ratings yet

- 9a Quiz Post Kaizen ActivitiesDocument1 page9a Quiz Post Kaizen ActivitiesJose OrtegaNo ratings yet

- Questionnaire QEEnHSMS PDFDocument7 pagesQuestionnaire QEEnHSMS PDFFadzilah MohamadNo ratings yet

- SBM Dimension1 LEADERSHIPDocument32 pagesSBM Dimension1 LEADERSHIPFe ApolonioNo ratings yet

- COSTDocument15 pagesCOSTalia fauniNo ratings yet

- Curriculum Vitae: Aamir SuhailDocument3 pagesCurriculum Vitae: Aamir SuhailMrSumitkrgautamNo ratings yet

- The Mutual Fund That Ate Wall Street-Based On An Index Few People Know About - WSJDocument7 pagesThe Mutual Fund That Ate Wall Street-Based On An Index Few People Know About - WSJHarmanjitNo ratings yet

- Abdul Wahid (HSE Engineer) ..-3Document4 pagesAbdul Wahid (HSE Engineer) ..-3Hassan Rauf RaoNo ratings yet

- Mid Term Exam: Project ManagementDocument9 pagesMid Term Exam: Project ManagementMuneeb AliNo ratings yet

- KnowMore Test TasksDocument6 pagesKnowMore Test TasksMonnu montoNo ratings yet

- FInal Script.Document7 pagesFInal Script.PRINCE SINGH RAJPUT Student, Jaipuria IndoreNo ratings yet

- PMDG 737 Paint Kit HowToDocument8 pagesPMDG 737 Paint Kit HowToIvan MedinaNo ratings yet

- Frederic CaseDocument6 pagesFrederic Caseshehzad AhmedNo ratings yet

- (Intro Entrepreneurship) (G) Business Plan Group 7Document64 pages(Intro Entrepreneurship) (G) Business Plan Group 7Farrah SharaniNo ratings yet

- Ipino Parbonetti 2017Document32 pagesIpino Parbonetti 2017Jenn AtidaNo ratings yet

- Assignment On Corporate EntrepreneurshipDocument6 pagesAssignment On Corporate EntrepreneurshipKumneger GeremewNo ratings yet

- Grammar Goals 5 Pupils BookDocument94 pagesGrammar Goals 5 Pupils BookDanny Ureña AriasNo ratings yet

- Auditing Principles and Practice I Chapter 6Document28 pagesAuditing Principles and Practice I Chapter 6demsashu21No ratings yet

- IPE - ToR-incorporated With WB CommentDocument5 pagesIPE - ToR-incorporated With WB CommentEmil LeauNo ratings yet

- Value Stream MappingDocument101 pagesValue Stream MappingTanbir KuhelNo ratings yet

- Mercantil Bank Study Case - Enterprise Architecture EnterpriseDocument19 pagesMercantil Bank Study Case - Enterprise Architecture EnterpriseKlaudius Waditra PradnyaNo ratings yet

- 1 - Copywriting Sample Instructions - v2 - BilingualDocument6 pages1 - Copywriting Sample Instructions - v2 - Bilingualmarcus204No ratings yet

- Management Accounting Practices of The Philippines Small and Medium-Sized EnterprisesDocument21 pagesManagement Accounting Practices of The Philippines Small and Medium-Sized Enterprisespamela dequillamorteNo ratings yet

- SOSTAC Model of MarketingDocument17 pagesSOSTAC Model of Marketingsinghrachanabaghel60% (5)

- Sap Guide Deleting Purchase OrdersDocument3 pagesSap Guide Deleting Purchase OrdersomarelzainNo ratings yet

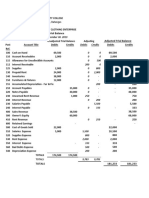

- ACT202 - BFK - 2018 (Here) (Neem Soap)Document20 pagesACT202 - BFK - 2018 (Here) (Neem Soap)Zidan ZaifNo ratings yet

- Fajar Dwi Budianto 22216548 Analysis of Healt Level Pt. Bank Danamon Indonesia, TBK Using The Rgec Method For The 2015-2019 PeriodDocument2 pagesFajar Dwi Budianto 22216548 Analysis of Healt Level Pt. Bank Danamon Indonesia, TBK Using The Rgec Method For The 2015-2019 PeriodluistervNo ratings yet

- AE 25 Module 1 Lesson 1Document99 pagesAE 25 Module 1 Lesson 1Queeny Mae Cantre ReutaNo ratings yet

- Valves - Essential WorkhorsesDocument2 pagesValves - Essential WorkhorsesBramJanssen76No ratings yet