Professional Documents

Culture Documents

Pakistan Stock Exchange Limited

Pakistan Stock Exchange Limited

Uploaded by

erfanxp0 ratings0% found this document useful (0 votes)

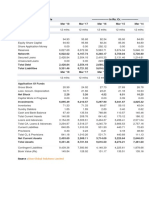

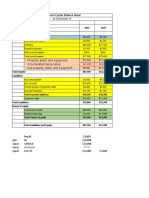

16 views1 pageThis document provides financial information for Pak Elektron Limited for the years 2014-2017. It shows that the company's paid-up capital increased from Rs. 3981.45 million in 2014 to Rs. 4976.82 million in 2017. The company's net sales increased from Rs. 15904.96 million in 2014 to Rs. 26166.31 million in 2017. Profits after tax grew from Rs. 1227.30 million in 2014 to Rs. 1393.17 million in 2017. Pak Elektron Limited manufactures and sells electrical capital goods and domestic appliances.

Original Description:

Original Title

PAEL

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides financial information for Pak Elektron Limited for the years 2014-2017. It shows that the company's paid-up capital increased from Rs. 3981.45 million in 2014 to Rs. 4976.82 million in 2017. The company's net sales increased from Rs. 15904.96 million in 2014 to Rs. 26166.31 million in 2017. Profits after tax grew from Rs. 1227.30 million in 2014 to Rs. 1393.17 million in 2017. Pak Elektron Limited manufactures and sells electrical capital goods and domestic appliances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

16 views1 pagePakistan Stock Exchange Limited

Pakistan Stock Exchange Limited

Uploaded by

erfanxpThis document provides financial information for Pak Elektron Limited for the years 2014-2017. It shows that the company's paid-up capital increased from Rs. 3981.45 million in 2014 to Rs. 4976.82 million in 2017. The company's net sales increased from Rs. 15904.96 million in 2014 to Rs. 26166.31 million in 2017. Profits after tax grew from Rs. 1227.30 million in 2014 to Rs. 1393.17 million in 2017. Pak Elektron Limited manufactures and sells electrical capital goods and domestic appliances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Pakistan Stock Exchange Limited

S.No.

Pak Elektron Limited

CHAIRMAN 2014 2015 2016 2017

M. NASEEM SAIGOL FINANCIAL POSITION (Rs. In Million)

Paid-Up Capital 3981.45 3981.45 4976.82 4976.82

CHIEF EXECUTIVE/MANAGING DIRECTOR Reserves & Surplus 5170.05 6552.28 11064.39 11033.03

M. MURAD SAIGOL Preference Shares 449.58 449.58 449.58 449.58

Sharholder's Equity 9601.08 10983.31 16490.79 16459.43

BOARD OF DEIRECTORS: Capital Reserves 1293.86 1293.86 4279.95 4279.95

Deferred Taxation / Liabilities 2048.94 1804.91 1598.16 1918.38

M. AZAM SAIGOL

Long Term Loans / Deposits 7269.28 6065.72 4557.69 4027.52

M. NASEEM SAIGOL Current Liabilities 7082.12 7636.66 7726.06 10308.59

ASADULLAH KHAWAJA Total Assets 30689.64 32974.30 35128.22 37049.05

SHEIKH MUHAMMAD SHAKEEL Fixed Assets (Gross) 20873.29 22632.44 24296.73 24957.20

SYED HAROON RASHID Accumulated Depreciation / 6122.14 6847.66 7664.00 8502.39

Amortization

MUHAMMAD ZEID YOUSAF SAIGOL 14751.15 15784.78 16632.73 16454.81

Fixed Assets (Net)

SYED MANZAR HASSAN Capital work in Progress 59.74 63.15 133.30 1266.43

M. MURAD SAIGOL Long Term Investment 63.99 9.01 26.44 8.95

USMAN SHAHID Current Assets 15621.95 16827.58 18069.39 18946.93

JAMAL BAQUAR OPERATING POSITION (Rs. In Million)

MS. AZRA SHOAIB Sales (Net) / Revenues 15904.96 20102.89 20506.26 26166.31

REGISTERED OFFICE: Cost of Sales 12707.60 16126.54 16765.48 22192.12

Gross Profit 3197.36 3976.35 3740.78 3974.19

17-Aziz Avenue, Canal Bank, Operating Expenses 752.11 822.11 888.16 1420.36

Gulberg - V, Operating Profit / (Loss) 2445.25 3154.24 2852.62 2553.83

Financial Charges 1161.06 1118.81 886.94 921.05

Lahore

Other Income 21.70 22.38 37.62 17.79

HEAD OFFICE: Prior Year Adjustment 0.00 0.00 0.00 0.00

Profit / (Loss) Before Taxation 1218.43 1903.39 1855.69 1511.96

17 - Aziz Avenue, Canal Bank, Taxation Current & Deff -8.87 229.66 -97.15 118.79

Gulberg - V, Prior Years 0.00 1.36 1.96 0.00

Lahore Total -8.87 231.02 -95.19 118.79

Profit / (Loss) After Taxation 1227.30 1672.37 1950.88 1393.17

AUDITORS: RATIOS

Rehman Sarfaraz Rahim Iqbal Rafiq Book Value 24.11 27.59 33.14 33.07

LOCATION OF FACTORY / PLANT Assets Turnover 0.52 0.61 0.58 0.71

14 KM, Ferozepur Road, Lahore. Current Ratio 2.21 2.20 2.34 1.84

Earning Per Share Pre Tax 3.06 4.78 3.73 3.04

Earning Per Share After Tax 3.08 4.20 3.92 2.80

YEAR ENDING: Payout Ratio After Tax 0.00 29.76 76.53 96.43

December Market Capitalization 11960.28 27268.95 31841.69 41845.10

AUTHORISED CAPITAL: DISTRIBUTION

6000 mil Cash Dividend % 0.00 12.50 30.00 27.00

Rs:

Stock Dividend % 0.00 0.00 0.00 0.00

PAID VALUE: Total % 0.00 12.50 30.00 27.00

Rs: 10 SHARE PRICE Rs.

SHARES TRADED: High 41.38 96.68 75.35 126.00

Low 18.70 40.30 52.61 42.15

1253.025 mil Average 30.04 68.49 63.98 84.08

No.of SHAREHOLDERS:

7530

CAPACITY UTILISATION:

Multi Products

COMPANY INFORMATION

The Company was incorporated in Pakistan on March

03, 1956 as a public limited company. The shares of

the Comapny are quoted on Pakistan Stock Exchange

Limited.

The principal activity of the company is manufacturing

and sale of electrical capital goods and domestic

appliances.

You might also like

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- Consolidated BS - Date of AcquisitionDocument2 pagesConsolidated BS - Date of AcquisitionKharen Valdez0% (1)

- Financial Analysis-Southwest AirlinesDocument16 pagesFinancial Analysis-Southwest AirlinesManish Kumar100% (8)

- MCBDocument1 pageMCBAbdul Habib MirNo ratings yet

- Bestway Cement Limited: Location of Factory / PlantDocument1 pageBestway Cement Limited: Location of Factory / PlantBurhan Ahmed MayoNo ratings yet

- Analysis ReportsDocument1 pageAnalysis ReportsMuiz SaddozaiNo ratings yet

- Pakistan Stock Exchange Limited: D. G. Khan Cement Company LimitedDocument1 pagePakistan Stock Exchange Limited: D. G. Khan Cement Company LimitederfanxpNo ratings yet

- Pakistan Stock Exchange LimitedDocument1 pagePakistan Stock Exchange LimitederfanxpNo ratings yet

- Analysis Report PsoDocument3 pagesAnalysis Report PsoMuhammad Waqas HafeezNo ratings yet

- Analysis ReportsDocument1 pageAnalysis Reportsfari khNo ratings yet

- Pakistan Stock Exchange Limited: The Searle Company LimitedDocument1 pagePakistan Stock Exchange Limited: The Searle Company LimitederfanxpNo ratings yet

- Atlas HondaDocument2 pagesAtlas HondasaranidoNo ratings yet

- Maple Leaf Cement Factory Limited: Formerly: Karachi Stock Exchange LimitedDocument1 pageMaple Leaf Cement Factory Limited: Formerly: Karachi Stock Exchange LimitedHussain AliNo ratings yet

- BNWMDocument1 pageBNWMHussain AliNo ratings yet

- Feroze1888 Mills Limited: Formerly: Karachi Stock Exchange LimitedDocument1 pageFeroze1888 Mills Limited: Formerly: Karachi Stock Exchange LimitedHussain AliNo ratings yet

- Location of Factory / PlantDocument1 pageLocation of Factory / PlantGhulam AhmadNo ratings yet

- Pakistan Stock Exchange Limited: Indus Motor Company LimitedDocument1 pagePakistan Stock Exchange Limited: Indus Motor Company Limitedmusab nawazNo ratings yet

- Pakistan Stock Exchange LimitedDocument1 pagePakistan Stock Exchange LimitedayazNo ratings yet

- Analysis Reports PDFDocument1 pageAnalysis Reports PDFFaizan AhmadNo ratings yet

- Pakistan CablesDocument2 pagesPakistan CablesSaad SiddiquiNo ratings yet

- CashFlow - StandaloneDocument3 pagesCashFlow - StandaloneSourav RajeevNo ratings yet

- Ronak L & Yash FADocument9 pagesRonak L & Yash FAronakNo ratings yet

- (XI) Bibliography and AppendixDocument5 pages(XI) Bibliography and AppendixSwami Yog BirendraNo ratings yet

- Accounts Case Study On Ratio AnalysisDocument6 pagesAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033No ratings yet

- Larsen & Toubro LTDocument21 pagesLarsen & Toubro LTakshay BhiseNo ratings yet

- Ch-3 Finance Department Trading & P&L AccountDocument4 pagesCh-3 Finance Department Trading & P&L AccountMit MehtaNo ratings yet

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNo ratings yet

- Annual-Report-FY-2019-20 QDocument76 pagesAnnual-Report-FY-2019-20 Qhesax93983No ratings yet

- Suzlon Energy Balance Sheet, P&L Statment, CashflowDocument10 pagesSuzlon Energy Balance Sheet, P&L Statment, CashflowBharat RajputNo ratings yet

- Bibliography: Edition) - Allahabad, India: Chaitanya Publishing HouseDocument5 pagesBibliography: Edition) - Allahabad, India: Chaitanya Publishing HouseSocialist GopalNo ratings yet

- Financial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak AggarwalDocument6 pagesFinancial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak Aggarwalsehrawat009mNo ratings yet

- Financials of Canara BankDocument14 pagesFinancials of Canara BankSattwik rathNo ratings yet

- 58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentDocument4 pages58 Annual Report 2009-2010 Performance Profile: Assets & Provision For Diminution in InvestmentKartheek DevathiNo ratings yet

- Illustration Acc FMDocument22 pagesIllustration Acc FMHEMACNo ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- Financial Management II ProjectDocument11 pagesFinancial Management II ProjectsimlimisraNo ratings yet

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenNo ratings yet

- Shree Cement Financial Model Projections BlankDocument10 pagesShree Cement Financial Model Projections Blankrakhi narulaNo ratings yet

- (All Non-Ratios in Millions)Document13 pages(All Non-Ratios in Millions)Aninda DuttaNo ratings yet

- VERTICAL LIABILITIES 1Document4 pagesVERTICAL LIABILITIES 1NL CastañaresNo ratings yet

- P & L A/C Sanghicement Amt. %: IncomeDocument5 pagesP & L A/C Sanghicement Amt. %: IncomeMansi VyasNo ratings yet

- BalaJi Amines LTDDocument7 pagesBalaJi Amines LTDchittorasNo ratings yet

- Lakshmi Machine Works: PrintDocument9 pagesLakshmi Machine Works: Printlaxmi joshiNo ratings yet

- Assingment SCM SEM4 - 1Document17 pagesAssingment SCM SEM4 - 1KARTHIYAENI VNo ratings yet

- Balance Sheet (In Crores) - MSN LABORATARIESDocument3 pagesBalance Sheet (In Crores) - MSN LABORATARIESnawazNo ratings yet

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- 17 - Manoj Batra - Hero Honda MotorsDocument13 pages17 - Manoj Batra - Hero Honda Motorsrajat_singlaNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDparika khannaNo ratings yet

- COMPANY/FINANCE/BALANCE SHEET AGG./175/Nestle IndiaDocument1 pageCOMPANY/FINANCE/BALANCE SHEET AGG./175/Nestle IndiabhuvaneshkmrsNo ratings yet

- UTV Software Communications LTDDocument4 pagesUTV Software Communications LTDNeesha PrabhuNo ratings yet

- Income Statement 2018-2019 %: Sources of FundsDocument8 pagesIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument4 pagesApollo Hospitals Enterprise Limitedpaigesh1No ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- Company Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Document14 pagesCompany Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Sujay SinghviNo ratings yet

- Income Latest: Financials (Standalone)Document3 pagesIncome Latest: Financials (Standalone)Vishwavijay ThakurNo ratings yet

- bajaj B.S.Document2 pagesbajaj B.S.arsoni1999No ratings yet

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- TSLA Balance Sheet: Collapse AllDocument6 pagesTSLA Balance Sheet: Collapse Allsaed cabdiNo ratings yet

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Document11 pages12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaNo ratings yet

- Gujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Document128 pagesGujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Riya ShahNo ratings yet

- Atest Quarterly/Halfyearly As On (Months) : %OI %OI %OIDocument4 pagesAtest Quarterly/Halfyearly As On (Months) : %OI %OI %OIManas AnandNo ratings yet

- Psocrt 1007Document54 pagesPsocrt 1007erfanxpNo ratings yet

- Pakistan Stock Exchange Limited: The Searle Company LimitedDocument1 pagePakistan Stock Exchange Limited: The Searle Company LimitederfanxpNo ratings yet

- Pakistan Stock Exchange Limited: D. G. Khan Cement Company LimitedDocument1 pagePakistan Stock Exchange Limited: D. G. Khan Cement Company LimitederfanxpNo ratings yet

- Pakistan Stock Exchange LimitedDocument1 pagePakistan Stock Exchange LimitederfanxpNo ratings yet

- POBox1553 Application-Form NEW 2018-Jan WWW - Jobsalert.pk PDFDocument1 pagePOBox1553 Application-Form NEW 2018-Jan WWW - Jobsalert.pk PDFerfanxpNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- CaseDocument3 pagesCaseAileean Irish100% (1)

- Performance Evaluation & Ratio Analysis: Meghna Cement Mills LTDDocument10 pagesPerformance Evaluation & Ratio Analysis: Meghna Cement Mills LTDSayed Abu SufyanNo ratings yet

- University of Rajasthan: B.B.A (II Sem.) 205 BBA-205 B.B.A. (Second Semester) Exam.,2013Document3 pagesUniversity of Rajasthan: B.B.A (II Sem.) 205 BBA-205 B.B.A. (Second Semester) Exam.,2013GuruKPO0% (1)

- NMIMS - SBM: Teaching Plan Financial Management Academic Year: 2016-17 Course Code Course Title Course Instructor/sDocument3 pagesNMIMS - SBM: Teaching Plan Financial Management Academic Year: 2016-17 Course Code Course Title Course Instructor/sAnkur MadaanNo ratings yet

- 11CBSE Chapter 1 Meaning and Objective of AccountingDocument8 pages11CBSE Chapter 1 Meaning and Objective of AccountingSanyam YadavNo ratings yet

- Class 12 Accounts Notes Chapter 9 Studyguide360Document19 pagesClass 12 Accounts Notes Chapter 9 Studyguide360Ali ssNo ratings yet

- Org Structure FactsheetDocument2 pagesOrg Structure FactsheetThuNo ratings yet

- CBSE Class 11 Accountancy Syllabus Updated For 20Document1 pageCBSE Class 11 Accountancy Syllabus Updated For 20AarushNo ratings yet

- Wonderful SME Sdn. Bhd. - Illustrative Financial Statements 2016Document124 pagesWonderful SME Sdn. Bhd. - Illustrative Financial Statements 2016Selva Bavani SelwaduraiNo ratings yet

- Accounting For Manufacturing Concern Lecture 1Document3 pagesAccounting For Manufacturing Concern Lecture 1marites yuNo ratings yet

- REVIEWER AACA (Midterm)Document15 pagesREVIEWER AACA (Midterm)cynthia karylle natividadNo ratings yet

- FRIA and PCADocument74 pagesFRIA and PCANiñanne Nicole Baring BalbuenaNo ratings yet

- Chapter # 4: Findings, Recommendation and SuggestionDocument5 pagesChapter # 4: Findings, Recommendation and Suggestionm0424mNo ratings yet

- Audit & Assurance BibleDocument90 pagesAudit & Assurance BibleLionelNo ratings yet

- What Is The Philippine Stock Exchange, Inc.?Document2 pagesWhat Is The Philippine Stock Exchange, Inc.?Genelle SorianoNo ratings yet

- Topic 3 Economic Study MethodsDocument52 pagesTopic 3 Economic Study MethodsJayson Dela Cruz OmictinNo ratings yet

- Ultratech JaypeeDocument8 pagesUltratech JaypeeDeepak Badlani0% (1)

- At03 06 Transaction CyclesDocument6 pagesAt03 06 Transaction CyclesaceNo ratings yet

- Formation of A Germany Startup CompanyDocument68 pagesFormation of A Germany Startup CompanyKarolina KukielkaNo ratings yet

- Chapter 11-Part 1 Share Transaction Soal 1Document2 pagesChapter 11-Part 1 Share Transaction Soal 1Nicko Arisandiy0% (1)

- 12a Isc 858 AccountsDocument18 pages12a Isc 858 AccountsA.c. GuptaNo ratings yet

- Analysis of Income Statement of Kohat Cement Company and DDocument31 pagesAnalysis of Income Statement of Kohat Cement Company and DMBA...KID100% (3)

- Jfounder of Tally: - Ss Goenka in 1986: 1. Personal AccountDocument40 pagesJfounder of Tally: - Ss Goenka in 1986: 1. Personal AccountSiddiqui AlmasNo ratings yet

- Audit of Cash and Cash Equivalents - Set ADocument7 pagesAudit of Cash and Cash Equivalents - Set AZyrah Mae SaezNo ratings yet

- OncaDocument6 pagesOncaVinylcoated ClipsNo ratings yet

- 2015 010701Document508 pages2015 010701Rsandee70100% (1)

- Cost Concept and Behavior RaibornDocument40 pagesCost Concept and Behavior RaibornRJ MonsaludNo ratings yet