Professional Documents

Culture Documents

Valuation Matrix 4 Sept PDF

Valuation Matrix 4 Sept PDF

Uploaded by

Michio TeraokaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Matrix 4 Sept PDF

Valuation Matrix 4 Sept PDF

Uploaded by

Michio TeraokaCopyright:

Available Formats

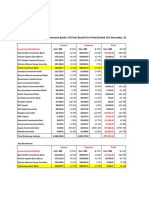

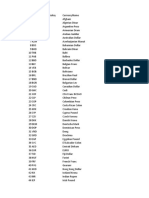

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE PCF EBITDA Growth Net Gearing

As of 4 September 2020 Code Rating (Mn) (Rp) Target (Rp Bn) 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021

Mandiri Universe 3,883,594.6 184,365.9 258,533.2 -27.0% 40.2% 21.1 15.0 13.6 11.8 2.1 2.0 3.2% 2.4% 10.1% 13.6% 15.6 15.4 -9.9% 14.7% 25.4% 22.6%

Banking 1,493,362.1 63,008.6 101,581.2 -34.4% 61.2% 23.7 14.7 N.A. N.A. 2.2 2.0 2.9% 1.4% 9.1% 14.1% N.A. N.A. N.A. N.A. N.A. N.A.

BCA BBCA Neutral 24,655 31,900 26,500 786,494.8 22,167.0 29,780.8 -22.4% 34.3% 35.5 26.4 N.A. N.A. 4.5 4.0 1.8% 1.2% 12.6% 15.9% N.A. N.A. N.A. N.A. N.A. N.A.

BNI BBNI Buy 18,649 5,225 5,900 97,439.2 7,073.2 15,323.1 -54.0% 116.6% 13.8 6.4 N.A. N.A. 0.9 0.8 3.9% 1.8% 6.2% 13.3% N.A. N.A. N.A. N.A. N.A. N.A.

BRI BBRI Buy 123,299 3,550 3,000 437,709.7 20,228.8 35,698.8 -41.1% 76.5% 21.6 12.3 N.A. N.A. 2.3 2.0 4.7% 1.4% 10.2% 17.3% N.A. N.A. N.A. N.A. N.A. N.A.

BTN BBTN Buy 10,590 1,555 1,350 16,467.5 1,235.9 1,554.0 490.6% 25.7% 13.3 10.6 N.A. N.A. 0.9 0.9 3.4% 1.8% 6.0% 8.6% N.A. N.A. N.A. N.A. N.A. N.A.

Danamon BDMN Buy 9,585 2,530 4,000 24,249.0 2,703.0 4,751.6 -33.6% 75.8% 9.0 5.1 N.A. N.A. 0.5 0.5 5.9% 3.9% 6.0% 10.0% N.A. N.A. N.A. N.A. N.A. N.A.

Bank BJB BJBR Buy 9,839 1,040 860 10,232.3 1,260.1 1,438.1 -19.2% 14.1% 8.1 7.1 N.A. N.A. 0.9 0.9 9.0% 9.1% 11.0% 12.8% N.A. N.A. N.A. N.A. N.A. N.A.

Bank Jatim BJTM Buy 14,918 585 590 8,776.4 1,145.5 1,434.0 -16.8% 25.2% 7.7 6.1 N.A. N.A. 0.9 0.9 8.2% 8.3% 12.2% 14.4% N.A. N.A. N.A. N.A. N.A. N.A.

CIMB Niaga BNGA Buy 25,132 815 840 20,482.3 2,340.1 4,211.1 -35.8% 80.0% 8.8 4.9 N.A. N.A. 0.5 0.5 7.1% 4.6% 5.6% 10.1% N.A. N.A. N.A. N.A. N.A. N.A.

BNLI BNLI Sell 28,016 1,325 430 37,156.6 908.9 1,494.2 -39.4% 64.4% 40.9 24.9 N.A. N.A. 1.5 1.4 0.0% 0.0% 3.8% 6.0% N.A. N.A. N.A. N.A. N.A. N.A.

Panin PNBN Buy 24,088 800 1,100 19,270.1 1,976.2 3,507.7 -40.4% 77.5% 9.8 5.5 N.A. N.A. 0.5 0.4 0.0% 0.0% 4.8% 8.3% N.A. N.A. N.A. N.A. N.A. N.A.

BTPS BTPS Buy 7,704 3,750 3,200 28,888.9 1,188.9 1,547.0 -15.1% 30.1% 24.3 18.7 N.A. N.A. 4.6 3.8 1.0% 0.8% 20.3% 22.2% N.A. N.A. N.A. N.A. N.A. N.A.

BFI Finance BFIN Buy 15,967 414 475 6,195.3 780.7 840.9 9.7% 7.7% 7.9 7.4 N.A. N.A. 0.9 0.8 2.9% 3.8% 12.2% 12.0% N.A. N.A. N.A. N.A. N.A. N.A.

Construction & materials 166,313.5 5,441.0 9,052.7 -56.7% 66.4% 30.6 18.4 14.1 10.6 1.3 1.2 2.0% 1.2% 4.1% 6.7% 34.8 10.5 -17.2% 33.9% 141.5% 142.8%

Indocement INTP Buy 3,681 11,650 14,500 42,886.3 1,672.7 2,003.1 -8.9% 19.8% 25.6 21.4 11.4 9.9 1.8 1.7 1.5% 1.4% 7.1% 8.1% 17.9 12.4 -7.0% 9.9% -34.5% -39.5%

Semen Indonesia SMGR Buy 5,932 10,350 11,020 61,391.2 2,520.2 2,824.6 5.4% 12.1% 24.4 21.7 9.8 9.2 1.8 1.7 2.0% 1.6% 7.6% 8.1% 16.1 10.5 1.6% 3.1% 69.0% 56.5%

Adhi Karya ADHI Buy 3,561 600 810 2,136.5 105.1 360.5 -84.2% 243.0% 20.3 5.9 8.5 6.5 0.4 0.3 6.2% 1.0% 1.7% 6.1% 5.0 5.0 -21.7% 32.7% 132.6% 144.3%

Pembangunan Perumahan PTPP Buy 6,200 950 1,370 5,889.9 218.9 753.8 -76.5% 244.3% 26.9 7.8 9.1 6.0 0.5 0.5 4.7% 1.1% 1.8% 6.1% 11.6 8.5 -33.1% 55.9% 44.1% 41.3%

Wijaya Karya WIKA Buy 8,960 1,220 1,680 10,931.4 561.1 1,158.6 -75.4% 106.5% 19.5 9.4 8.0 6.2 0.7 0.7 1.0% 2.1% 3.9% 7.7% 7.6 10.1 -21.7% 38.7% 39.0% 45.9%

Waskita Karya WSKT Buy 13,574 625 1,010 8,363.1 (578.8) (837.9) N/M -44.8% -14.4 -10.0 28.1 20.6 0.7 0.8 -1.4% -2.0% -4.0% -7.6% 1.8 5.8 -27.8% 36.8% 545.2% 719.5%

Wijaya Karya Beton WTON Buy 8,715 256 500 2,231.2 284.8 437.8 -44.4% 53.7% 7.8 5.1 3.7 2.6 0.6 0.6 6.9% 3.8% 8.3% 11.6% 2.2 2.2 -20.6% 29.0% 20.3% 10.8%

Waskita Beton WSBP Buy 26,361 164 242 4,323.2 390.7 530.2 -51.5% 35.7% 11.1 8.2 7.2 6.2 0.6 0.5 9.3% 4.5% 4.9% 6.6% 1.2 6.7 -31.3% 17.9% 45.6% 46.2%

Jasa Marga JSMR Buy 7,258 3,880 5,900 28,160.5 266.1 1,821.7 -87.9% 584.6% 105.8 15.5 23.0 12.2 1.5 1.4 1.6% 0.2% 1.4% 9.4% -2.1 22.8 -26.6% 101.0% 385.2% 408.4%

Consumer staples 960,213.5 41,249.7 51,515.3 -14.9% 24.9% 23.3 18.6 15.0 12.3 5.0 4.5 3.6% 3.1% 21.9% 25.5% 18.4 17.8 -15.8% 21.1% -3.0% -6.8%

Indofood CBP ICBP Buy 11,662 10,300 12,050 120,117.7 5,977.0 6,319.2 18.6% 5.7% 20.1 19.0 11.8 11.5 4.2 3.7 2.1% 2.5% 22.1% 20.8% 16.2 15.0 16.9% 1.2% -32.2% -35.8%

Indofood INDF Buy 8,781 7,600 9,950 66,727.7 5,919.1 6,306.6 20.6% 6.5% 11.3 10.6 6.9 6.5 1.6 1.5 3.7% 4.4% 15.0% 14.7% 9.5 8.8 3.3% 5.6% 11.5% 7.5%

Mayora MYOR Buy 22,359 2,490 2,600 55,673.9 2,413.2 2,190.5 21.4% -9.2% 23.1 25.4 15.7 14.5 4.9 4.4 1.3% 1.6% 23.0% 18.3% 42.3 13.1 0.5% 4.6% 33.2% 13.1%

Unilever UNVR Buy 38,150 8,400 9,700 320,460.0 7,419.9 8,138.5 0.3% 9.7% 43.2 39.4 30.3 27.8 64.1 59.5 2.3% 2.3% 144.3% 156.7% 40.9 33.1 -2.8% 8.7% 68.4% 42.8%

Gudang Garam GGRM Buy 1,924 47,475 63,450 91,346.1 7,421.7 10,320.8 -31.8% 39.1% 12.3 8.9 8.0 6.3 1.7 1.6 5.5% 5.5% 14.2% 18.4% 7.1 14.1 -26.3% 31.7% 19.1% 24.0%

HM. Sampoerna HMSP Buy 116,318 1,640 2,400 190,761.6 8,342.4 13,384.0 -39.2% 60.4% 22.9 14.3 17.6 10.5 6.3 5.3 7.1% 4.3% 25.2% 40.4% 19.3 14.1 -44.4% 64.5% -42.9% -54.9%

Kalbe Farma KLBF Buy 46,875 1,590 1,900 74,531.4 2,731.1 2,842.4 9.0% 4.1% 27.3 26.2 18.6 17.6 4.3 3.9 1.8% 1.9% 16.4% 15.7% 19.8 25.4 2.5% 5.3% -21.6% -21.9%

Sido Muncul SIDO Buy 15,000 1,400 1,600 21,000.0 884.8 949.9 9.5% 7.4% 23.7 22.1 17.7 16.4 6.5 6.3 3.5% 4.0% 28.2% 29.0% 24.0 21.8 2.8% 7.4% -29.1% -29.1%

Multi Bintang MLBI Buy 2,107 9,300 13,250 19,595.1 140.5 1,063.4 -88.3% 656.9% 139.5 18.4 34.1 11.8 51.3 15.0 4.6% 0.7% 18.4% 126.1% 14.2 31.5 -70.1% 180.2% 45.4% -22.0%

Healthcare 50,947.6 1,041.8 1,270.7 3.5% 22.0% 48.9 40.1 16.8 14.2 3.8 3.6 0.1% 0.2% 8.0% 9.2% 26.4 23.7 9.2% 16.5% -12.0% -16.9%

Mitra Keluarga MIKA Buy 14,551 2,390 2,600 34,776.3 693.1 815.4 -5.1% 17.6% 50.2 42.6 33.7 28.0 7.4 6.7 0.0% 0.0% 15.4% 16.5% 45.1 42.6 -3.4% 19.4% -29.7% -32.0%

Siloam Hospital SILO Buy 1,625 4,280 7,150 6,955.0 44.4 100.1 107.0% 125.6% 156.7 69.5 5.6 4.4 1.1 1.1 0.0% 0.0% 0.7% 1.6% 11.5 10.2 16.6% 13.9% -16.0% -25.9%

Hermina HEAL Buy 2,973 3,100 5,200 9,216.3 304.3 355.2 19.4% 16.7% 30.3 25.9 11.3 9.9 4.0 3.6 0.8% 0.9% 14.1% 14.6% 16.8 14.2 17.3% 16.2% 36.4% 37.5%

Consumer discretionary 294,649.6 18,149.4 25,247.9 -39.8% 39.1% 16.2 11.7 9.2 8.3 1.5 1.4 4.3% 3.0% 9.3% 12.3% 4.9 11.5 -18.3% 11.4% 19.8% 17.7%

Ace Hardware Indonesia ACES Neutral 17,150 1,600 1,500 27,440.0 710.8 1,055.3 -31.0% 48.5% 38.6 26.0 29.7 21.1 5.6 4.9 1.9% 1.3% 14.7% 20.0% 22.4 48.7 -31.7% 40.4% -39.6% -38.1%

Matahari Department Store LPPF Buy 2,918 1,280 1,800 3,734.9 50.4 496.7 -96.3% 884.6% 74.0 7.5 6.1 2.4 2.1 1.6 0.0% 0.4% 2.8% 24.4% 53.5 4.5 -78.5% 116.9% -58.8% -70.2%

MAP Aktif MAPA Buy 2,850 2,180 3,850 6,213.9 54.4 606.1 -92.1% 1013.2% 114.1 10.3 15.5 5.2 2.0 1.7 0.0% 0.3% 1.8% 18.0% 10.8 30.3 -71.2% 193.3% -35.8% -33.0%

Mitra Adiperkasa MAPI Buy 16,600 685 1,000 11,371.0 (1,704.4) 543.3 N/M N/M -6.7 20.9 -111.7 7.1 2.7 2.4 1.8% 0.0% -32.8% 12.1% -12.7 14.3 N/M N/M 39.5% 52.1%

Ramayana RALS Buy 7,096 635 700 4,506.0 (131.9) 142.9 N/M N/M -34.2 31.5 -55.8 11.9 1.3 1.2 8.5% -1.9% -3.5% 3.9% -36.1 12.5 N/M N/M -45.9% -54.3%

Erajaya Swasembada ERAA Buy 3,190 1,685 1,500 5,375.2 140.3 355.3 -52.5% 153.2% 38.3 15.1 15.4 10.0 1.1 1.0 0.5% 1.3% 2.9% 7.0% -120.8 9.4 -25.5% 52.7% 52.2% 47.6%

Astra International ASII Buy 40,484 5,050 5,000 204,441.9 14,709.9 17,215.6 -32.2% 17.0% 13.9 11.9 8.9 9.0 1.3 1.2 4.8% 3.2% 9.8% 10.9% 3.7 11.9 -9.3% -0.5% 25.5% 24.5%

Surya Citra Media SCMA Buy 14,622 1,200 1,800 17,673.2 1,565.6 1,693.2 35.7% 8.1% 11.3 10.4 7.9 7.5 3.0 2.7 6.2% 6.7% 28.6% 27.4% 11.0 9.6 29.8% 2.8% -13.6% -16.3%

Media Nusantara Citra MNCN Buy 13,047 845 2,200 10,481.2 2,427.2 2,593.1 24.1% 6.8% 4.3 4.0 3.3 2.8 0.8 0.7 3.5% 3.7% 19.7% 18.0% 4.4 3.9 16.9% 3.6% 16.7% 2.5%

MNC Studios MSIN Buy 5,202 290 650 1,508.6 267.2 315.5 16.3% 18.1% 5.6 4.8 3.3 3.1 1.0 0.9 8.9% 10.5% 18.5% 19.8% 4.2 7.1 15.9% 13.8% -5.7% 1.9%

Sarimelati Kencana PZZA Buy 3,022 630 850 1,903.8 59.7 230.8 -70.1% 286.4% 31.9 8.2 7.3 4.0 1.5 1.3 5.3% 1.6% 4.5% 16.5% 16.4 4.4 -37.0% 81.9% 6.1% 6.8%

Commodities 270,327.9 19,805.2 24,725.4 -18.5% 24.8% 13.6 10.9 5.0 4.2 1.1 1.1 2.9% 3.3% 8.7% 10.3% 6.0 6.3 -13.0% 10.8% -2.7% -10.3%

United Tractors UNTR Buy 3,730 23,100 31,700 86,166.1 7,172.4 10,603.3 -36.6% 47.8% 12.0 8.1 4.8 3.5 1.4 1.2 2.5% 3.7% 11.8% 15.8% 8.0 6.1 -25.1% 26.7% -10.3% -17.8%

Adaro (USD) ADRO Neutral 31,986 1,205 1,350 38,543.1 372.2 353.0 -7.9% -5.2% 7.2 7.7 3.0 2.9 0.7 0.7 4.8% 4.5% 9.7% 8.7% 3.7 3.6 -6.9% -4.1% 4.2% -4.7%

Harum Energy (USD) HRUM Neutral 2,661 1,595 1,300 4,093.8 17.4 13.6 -5.9% -21.7% 16.4 21.2 2.4 2.4 0.9 0.9 3.3% 2.6% 5.5% 4.2% 7.9 11.7 -2.4% -13.7% -93.3% -96.3%

Indika Energy (USD) INDY Neutral 5,210 1,025 910 5,340.4 1.6 6.4 N/M 286.9% 226.5 59.0 1.8 1.4 0.4 0.4 0.1% 0.4% 0.2% 0.7% 1.0 1.4 -14.4% 2.4% 27.6% 9.0%

Indo Tambangraya Megah (USD) ITMG Neutral 1,108 8,500 10,450 9,320.7 100.2 101.0 -20.8% 0.9% 6.5 6.5 2.0 1.9 0.7 0.7 13.1% 13.1% 11.4% 11.4% 2.4 4.1 -16.1% 0.9% -29.8% -32.5%

Bukit Asam PTBA Neutral 11,523 2,100 2,350 24,197.3 3,481.8 3,496.3 -18.3% 0.4% 6.9 6.9 4.3 4.2 1.3 1.2 10.8% 10.8% 18.8% 18.3% 5.2 6.7 -12.6% 1.5% -21.7% -21.2%

Antam ANTM Buy 24,031 825 700 19,825.4 (21.8) 196.7 N/M N/M -910.5 100.8 16.2 14.9 0.9 0.9 0.0% 0.3% -0.1% 0.9% 32.9 14.9 -29.1% 8.0% 16.3% 14.1%

Vale Indonesia (USD) INCO Buy 9,936 3,910 3,500 38,851.1 87.8 132.7 53.0% 51.1% 30.9 20.7 9.1 7.5 1.3 1.3 0.0% 0.0% 4.4% 6.3% 10.3 13.6 13.8% 17.0% -21.6% -25.6%

Timah TINS Neutral 7,448 820 670 6,107.2 (419.9) 246.4 31.3% N/M -14.5 24.8 41.2 10.1 1.2 1.1 -2.4% 1.4% -8.1% 4.6% 2.2 5.2 -53.0% 289.3% 149.7% 134.5%

Merdeka Copper Gold (USD) MDKA Buy 21,360 1,730 2,200 37,882.8 91.8 111.5 26.4% 21.5% 28.9 24.0 10.9 9.3 4.5 3.8 0.0% 0.0% 17.0% 17.4% 23.1 13.6 12.3% 10.4% 22.5% -13.7%

Property & Industrial Estate 89,398.9 7,211.0 9,743.6 -4.7% 35.1% 12.4 9.2 8.8 8.1 0.7 0.6 2.3% 1.9% 5.7% 7.2% -257.7 12.9 4.8% 8.7% 31.5% 29.4%

Alam Sutera Realty ASRI Sell 19,649 121 80 2,377.6 150.1 938.1 -85.2% 524.8% 15.8 2.5 6.6 5.1 0.2 0.2 1.7% 1.7% 1.4% 8.5% 4.0 2.2 -19.6% 19.4% 66.7% 57.5%

Bumi Serpong Damai BSDE Buy 21,171 750 1,160 15,878.5 1,398.9 2,049.5 -54.4% 46.5% 11.4 7.7 9.7 9.0 0.5 0.5 0.0% 0.6% 4.6% 6.3% -16.0 -15.4 -9.0% 10.7% 23.9% 24.3%

Ciputra Development CTRA Buy 18,560 740 1,120 13,734.6 831.7 1,094.2 -28.2% 31.5% 16.5 12.6 10.6 9.1 0.9 0.8 1.0% 1.0% 5.3% 6.6% 81.9 19.9 -17.2% 17.1% 33.6% 31.6%

Jaya Real Property JRPT Buy 13,750 434 670 5,967.5 997.4 1,064.6 -1.9% 6.7% 6.0 5.6 5.3 4.7 0.8 0.7 4.4% 0.1% 13.4% 12.7% 235.9 5.4 1.0% 6.2% -6.3% -9.2%

Pakuwon Jati PWON Buy 48,160 406 670 19,552.8 1,791.2 2,394.9 -34.1% 33.7% 10.9 8.2 7.4 5.9 1.2 1.1 1.5% 1.5% 11.4% 13.7% 7.8 6.0 -20.5% 22.7% -0.5% -5.9%

Summarecon Agung SMRA Buy 14,427 635 960 9,161.0 419.8 603.6 -18.5% 43.8% 21.8 15.2 10.3 9.2 1.2 1.1 0.8% 0.8% 5.6% 7.6% 20.0 8.0 -1.7% 9.4% 96.6% 85.2%

Lippo Karawaci LPKR Neutral 70,592 144 200 10,165.2 73.9 391.2 N/M 429.7% 137.6 26.0 10.7 10.8 0.4 0.3 0.7% 0.7% 0.3% 1.4% -2.2 -34.2 334.6% 2.5% 46.4% 49.0%

Puradelta Lestari DMAS Buy 48,198 230 390 11,085.6 1,441.4 1,085.7 81.9% -24.7% 7.7 10.2 7.2 9.8 1.6 1.5 10.4% 8.8% 20.8% 15.2% 10.5 12.3 91.2% -25.5% -9.7% -6.6%

Bekasi Fajar BEST Neutral 9,647 153 130 1,476.0 106.6 121.8 -72.0% 14.2% 13.8 12.1 6.7 9.7 0.3 0.3 2.3% 0.6% 2.4% 2.6% 2.8 12.5 -25.6% -26.1% 26.0% 29.1%

Telco 405,791.7 23,702.1 25,929.5 -5.2% 9.4% 17.1 15.6 5.7 5.4 2.6 2.5 4.4% 4.8% 15.5% 16.3% 5.5 5.0 7.4% 7.1% 108.3% 106.6%

EXCEL EXCL Buy 10,688 2,300 3,600 24,582.3 1,065.0 817.7 49.5% -23.2% 23.1 30.1 4.6 4.3 1.2 1.2 0.9% 1.3% 5.4% 4.0% 3.9 3.4 24.1% 7.3% 163.1% 163.0%

REDS- Research Equity Database System Page 1 of 2

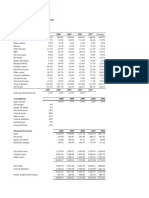

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE PCF EBITDA Growth Net Gearing

As of 4 September 2020 Code Rating (Mn) (Rp) Target (Rp Bn) 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021

Telkom TLKM Buy 99,062 2,860 3,900 283,317.9 19,402.8 21,026.2 4.0% 8.4% 14.6 13.5 5.3 5.0 2.7 2.6 5.5% 5.9% 19.1% 19.9% 5.3 4.8 5.2% 5.6% 57.8% 56.8%

Indosat ISAT Buy 5,434 2,310 3,200 12,552.4 (1,046.3) (647.6) N/M 38.1% -12.0 -19.4 4.3 3.8 1.1 1.1 0.0% 0.0% -8.6% -5.7% 2.0 1.6 4.4% 16.2% 254.2% 281.1%

Link Net LINK Buy 3,043 2,220 3,300 6,299.0 735.6 743.7 -17.8% 1.1% 8.6 8.5 3.7 3.7 1.3 1.2 7.0% 5.9% 15.5% 14.8% 3.8 3.7 -9.2% 6.0% 22.2% 29.0%

Tower Bersama TBIG Buy 22,657 1,275 1,400 27,579.6 1,068.4 1,264.1 30.4% 18.3% 25.8 21.8 11.8 11.0 5.0 4.5 2.2% 2.2% 20.4% 21.8% 14.7 14.5 8.7% 8.5% 445.6% 414.4%

Sarana Menara TOWR Buy 51,015 1,025 1,300 51,460.5 2,476.5 2,725.4 0.1 0.1 20.8 18.9 11.5 10.7 5.1 4.5 0.0 2.3% 26.5% 25.3% 11.8 12.1 14.6% 6.4% 207.3% 176.1%

Chemical 1,502.7 135.7 163.2 29.5% 20.3% 11.1 9.2 5.6 5.0 0.5 0.4 0.0% 0.0% 4.2% 4.8% 4.2 3.9 4.4% 6.3% 69.9% 60.4%

Aneka Gas AGII Buy 3,067 490 700 1,502.7 135.7 163.2 29.5% 20.3% 11.1 9.2 5.6 5.0 0.5 0.4 0.0% 0.0% 4.2% 4.8% 4.2 3.9 4.4% 6.3% 69.9% 60.4%

Airlines 2,258.7 539.7 836.7 30.0% 55.0% 4.2 2.7 4.0 2.4 0.4 0.4 0.0% 0.0% 9.8% 13.9% 3.7 1.1 29.4% 20.4% 65.0% 32.3%

GMF AeroAsia (USD) GMFI Neutral 28,234 80 275 2,258.7 37.8 59.0 26.1% 56.3% 4.2 2.7 4.0 2.4 0.4 0.4 0.0% 0.0% 10.1% 13.9% 3.8 1.1 25.5% 21.4% 65.0% 32.3%

Transportation 2,502.1 (175.2) 251.0 -155.7% N/M -14.3 10.0 10.8 4.4 0.5 0.5 -1.8% 2.5% -3.3% 4.8% 4.8 3.5 -70.1% N/M 5.4% 21.2%

Blue Bird BIRD Buy 2,502 1,000 1,700 2,502.1 (175.2) 251.0 N/M N/M -14.3 10.0 10.8 4.4 0.5 0.5 -1.8% 2.5% -3.3% 4.8% 4.8 3.5 -70.1% 217.9% 5.4% 21.2%

Poultry 115,054.9 2,746.2 5,082.7 -50.5% 85.1% 41.9 22.6 17.6 12.2 3.3 3.0 1.8% 1.0% 8.0% 13.8% 113.6 9.6 -31.4% 36.8% 42.2% 21.1%

Charoen Pokphand Indonesia CPIN Buy 16 6,100 5,500 100,027.8 2,057.7 3,377.9 -43.4% 64.2% 48.6 29.6 25.0 17.9 4.6 4.2 1.5% 0.9% 9.7% 14.8% 83.0 14.7 -31.9% 33.6% 18.3% -2.6%

Japfa Comfeed JPFA Buy 12 1,165 1,100 13,661.5 645.8 1,565.6 -63.4% 142.4% 21.2 8.7 8.5 5.4 1.2 1.1 3.8% 1.4% 5.9% 13.4% -23.8 2.9 -32.6% 43.9% 82.8% 58.3%

Malindo Feedmill MAIN Buy 2 610 675 1,365.6 42.7 139.2 -72.0% 225.6% 31.9 9.8 5.8 4.6 0.6 0.6 1.0% 3.3% 2.0% 6.4% 3.6 2.7 -18.7% 24.1% 73.8% 69.5%

Oil and Gas 31,271.5 1,510.8 3,133.4 61.2% 107.4% 20.7 10.0 7.0 5.6 0.8 0.8 1.9% 4.0% 4.0% 8.2% 4.0 4.5 -39.3% 22.3% 53.6% 47.4%

Perusahaan Gas Negara (USD) PGAS Buy 24,242 1,290 1,700 31,271.5 105.7 221.0 56.4% 109.1% 20.7 10.0 7.0 5.6 0.8 0.8 1.9% 4.0% 4.1% 8.2% 4.2 4.5 -41.2% 23.3% 53.6% 47.4%

Note : - *) means Company Data is using Bloomberg Data

- (USD) means Account under USD (USD Cents for Per Share Data)

- N/M means Not Meaningful

- N.A. means Not Applicable

REDS- Research Equity Database System Page 2 of 2

You might also like

- Total Cash Receipt From Issuance of BondsDocument11 pagesTotal Cash Receipt From Issuance of Bondskrisha milloNo ratings yet

- Matriks Valuasi Saham 21 Juli 2020Document2 pagesMatriks Valuasi Saham 21 Juli 2020jnn sNo ratings yet

- Matriks Valuasi Saham 18 May 2020Document2 pagesMatriks Valuasi Saham 18 May 2020hendarwinNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Kadek ArdianaNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2WidiasNastitiNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 6Document6 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 6Kadek ArdianaNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2srijokoNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Matriks Valuasi Saham Sharia 18 May 2020Document1 pageMatriks Valuasi Saham Sharia 18 May 2020hendarwinNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Document2 pagesEquity Valuation: REDS-Research Equity Database System Page 1 of 2Ariansyah NobelNo ratings yet

- Perkembangan Ekspor Dan Impor Indonesia September 2018Document2 pagesPerkembangan Ekspor Dan Impor Indonesia September 2018januar baharuliNo ratings yet

- Matriks Valuasi Saham Syariah 23112020Document2 pagesMatriks Valuasi Saham Syariah 23112020Naikerretaapi Sempit'aNo ratings yet

- Matriks Valuasi Saham Sharia 11 May 2020Document4 pagesMatriks Valuasi Saham Sharia 11 May 2020hendarwinNo ratings yet

- Matrix Valuasi Saham Syariah 1 Mar 21Document1 pageMatrix Valuasi Saham Syariah 1 Mar 21haji atinNo ratings yet

- Kenyan Brokerage & Investment Banking Financial Results 2009Document83 pagesKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNo ratings yet

- Harga Wajar DBIDocument40 pagesHarga Wajar DBISeptiawanNo ratings yet

- Top 17 Stocks BuyDocument13 pagesTop 17 Stocks BuySushilNo ratings yet

- Portfolio SnapshotDocument63 pagesPortfolio Snapshotgurudev21No ratings yet

- Analisa Agen No RepeatDocument1 pageAnalisa Agen No Repeatirfan edisonNo ratings yet

- Figure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional PlayersDocument1 pageFigure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional PlayersEno CasmiNo ratings yet

- BRI Danareksa Equity Snapshot 29 Jan 2024 FY23 BBNI, AVIA, CLEODocument7 pagesBRI Danareksa Equity Snapshot 29 Jan 2024 FY23 BBNI, AVIA, CLEOfinancialshooterNo ratings yet

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaNo ratings yet

- FIB Research - NSE Financial StatsDocument16 pagesFIB Research - NSE Financial StatslexmuiruriNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- IAPM AssignmentsDocument29 pagesIAPM AssignmentsMUKESH KUMARNo ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- Doddy Bicara InvestasiDocument34 pagesDoddy Bicara InvestasiAmri RijalNo ratings yet

- Portflio 2Document51 pagesPortflio 2gurudev21No ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- Business Valuation - ROTIDocument21 pagesBusiness Valuation - ROTITEDY TEDYNo ratings yet

- Discounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No FormulasDocument2 pagesDiscounted Cash Flow (DCF) Valuation: This Model Is For Illustrative Purposes Only and Contains No Formulasrito2005No ratings yet

- 唯品会估值模型Document21 pages唯品会估值模型Yiang QinNo ratings yet

- JSW Energy Valuation 2022Document40 pagesJSW Energy Valuation 2022ShresthNo ratings yet

- Submission v2Document32 pagesSubmission v2MUKESH KUMARNo ratings yet

- Reino Unido - AlexisDocument8 pagesReino Unido - AlexisAalexiis Ignacio TorresNo ratings yet

- HanssonDocument11 pagesHanssonJust Some EditsNo ratings yet

- Update Harga: Real-Time: QualityDocument44 pagesUpdate Harga: Real-Time: QualityNul AsashiNo ratings yet

- 2019 Q4 Financial Statement ENDocument17 pages2019 Q4 Financial Statement ENPinkky GithaNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- Update Harga: Real-Time: QualityDocument40 pagesUpdate Harga: Real-Time: Qualitymatumbaman 212No ratings yet

- TS - MSCI Indonesia Nov-21 Rebalancing PreviewDocument6 pagesTS - MSCI Indonesia Nov-21 Rebalancing PreviewAdri KhosasihNo ratings yet

- Nifty50 Q2 FY18 Quarterly EstimatesDocument8 pagesNifty50 Q2 FY18 Quarterly Estimatessrinivas NNo ratings yet

- Coal Heat RateDocument38 pagesCoal Heat Rateanon_116184023No ratings yet

- India Retail ForecastDocument2 pagesIndia Retail Forecastapi-3751572No ratings yet

- Danamon No More: DBS GroupDocument6 pagesDanamon No More: DBS GroupphuawlNo ratings yet

- Ev 0 ZQV5 WW VK 50 I 28 W YGYIA0 Ntoz BMHJRCHD 0 Vyo 9Document1 pageEv 0 ZQV5 WW VK 50 I 28 W YGYIA0 Ntoz BMHJRCHD 0 Vyo 9Jason SengNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- July 2010 Labor Demographics 09.02Document2 pagesJuly 2010 Labor Demographics 09.02JonHealeyNo ratings yet

- Ambuja Cements: NeutralDocument8 pagesAmbuja Cements: Neutral张迪No ratings yet

- CPG Financial Model and Valuation v2Document10 pagesCPG Financial Model and Valuation v2Mohammed YASEENNo ratings yet

- Risk and Return Relationship StudentDocument2 pagesRisk and Return Relationship StudentTor NadoNo ratings yet

- Chapter 26: Financial Planning & StrategyDocument3 pagesChapter 26: Financial Planning & StrategyMukul KadyanNo ratings yet

- Roches ExcelDocument4 pagesRoches ExcelJaydeep SheteNo ratings yet

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDocument3 pagesCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaNo ratings yet

- XLS EngDocument4 pagesXLS EngShubhangi JainNo ratings yet

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- VCF June Improving Margin at Retail - Public VersionDocument23 pagesVCF June Improving Margin at Retail - Public VersionLightship PartnersNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Energy Star Kids PrintDocument16 pagesEnergy Star Kids Printbala gamerNo ratings yet

- Id 21072020 PDFDocument10 pagesId 21072020 PDFbala gamerNo ratings yet

- Id 22072020 PDFDocument11 pagesId 22072020 PDFbala gamerNo ratings yet

- Wijaya Karya (Persero) TBK WIKA: Last Close Fair Value Market CapDocument4 pagesWijaya Karya (Persero) TBK WIKA: Last Close Fair Value Market Capbala gamerNo ratings yet

- Id 22062020 PDFDocument12 pagesId 22062020 PDFbala gamerNo ratings yet

- Id 23062020 PDFDocument11 pagesId 23062020 PDFbala gamerNo ratings yet

- Metals 09 00974 PDFDocument16 pagesMetals 09 00974 PDFbala gamerNo ratings yet

- TPADocument7 pagesTPAbala gamerNo ratings yet

- Inventory of Departmental Key Performance Indicators (Kpis) : Quadrant No. Key Performance Indicator Kpi Definition FormulaDocument55 pagesInventory of Departmental Key Performance Indicators (Kpis) : Quadrant No. Key Performance Indicator Kpi Definition Formulabala gamerNo ratings yet

- Full Scale Study of Plume Rise at Large Coal Fired Electric Generating StationsDocument9 pagesFull Scale Study of Plume Rise at Large Coal Fired Electric Generating Stationsbala gamerNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Economics 2019 v1.1: IA2 High-Level Annotated Sample ResponseDocument15 pagesEconomics 2019 v1.1: IA2 High-Level Annotated Sample ResponseAahz MandiusNo ratings yet

- Chapter 5Document17 pagesChapter 5Soh HerryNo ratings yet

- GLIBLCH1ShearmanSterling 2Document17 pagesGLIBLCH1ShearmanSterling 2Nattapong POkpaNo ratings yet

- Pagos Efectuados A LaboratoriosDocument14 pagesPagos Efectuados A LaboratoriosCronista.comNo ratings yet

- The VWMA Is The Ultimate Breakout ToolDocument5 pagesThe VWMA Is The Ultimate Breakout ToolHarish VoletiNo ratings yet

- Construction Form Daily Work Activity Report: Onsite Servicing Repair Minor ShutdownDocument2 pagesConstruction Form Daily Work Activity Report: Onsite Servicing Repair Minor ShutdownElmer BalaresNo ratings yet

- Finance 4 BSP and Monetary Policy AnswersDocument10 pagesFinance 4 BSP and Monetary Policy Answersjojie dadorNo ratings yet

- 0F4Project Resource Planning SheetpdfDocument3 pages0F4Project Resource Planning Sheetpdfdev kuuNo ratings yet

- Manuscript CH1-5Document70 pagesManuscript CH1-5Gia Nina de GuzmanNo ratings yet

- Ross 12e PPT Ch19ADocument12 pagesRoss 12e PPT Ch19ANhung HồngNo ratings yet

- Special Power of AttorneyDocument1 pageSpecial Power of AttorneyAllen Sandra navaretteNo ratings yet

- Bid FormDocument1 pageBid FormAileen EstanislaoNo ratings yet

- Garrett RankingDocument14 pagesGarrett RankingCorey Wells88% (25)

- Diamond Agrovet InvoiceDocument1 pageDiamond Agrovet Invoicesourav agarwalNo ratings yet

- COVID 19: The Impact of Government Policy Responses On Economic Activity and Stock Market Performance in MalaysiaDocument11 pagesCOVID 19: The Impact of Government Policy Responses On Economic Activity and Stock Market Performance in Malaysiachairul jossienugrasyamNo ratings yet

- Indian Economy On The Eve of IndependenceDocument12 pagesIndian Economy On The Eve of IndependenceShuchismita KashyapNo ratings yet

- Title of Article:-The Roles and Responsibilities of Management Accountants in The Era of GlobalizationDocument6 pagesTitle of Article:-The Roles and Responsibilities of Management Accountants in The Era of Globalizationhaileye gezmuNo ratings yet

- English Learning Guide Competency 1 Unit 6: Financial Education Workshop 1 Centro de Servicios Financieros-CSFDocument11 pagesEnglish Learning Guide Competency 1 Unit 6: Financial Education Workshop 1 Centro de Servicios Financieros-CSFTatiana BolivarNo ratings yet

- NOTICE OF SD, SF-181, UCC 1, SECURITY AGREEMENT, AFV, & DISCHARGE TO JUDGE PAMELA WASHINGTONDocument123 pagesNOTICE OF SD, SF-181, UCC 1, SECURITY AGREEMENT, AFV, & DISCHARGE TO JUDGE PAMELA WASHINGTONMARK MENO©™No ratings yet

- Unit 4 Rural - Urban Continuum: StructureDocument14 pagesUnit 4 Rural - Urban Continuum: Structurevivek vishwakarmaNo ratings yet

- Margaret Thatcher 19252013Document2 pagesMargaret Thatcher 19252013selvamuthukumarNo ratings yet

- Chapter 2 End of Chapter QuestionsDocument16 pagesChapter 2 End of Chapter QuestionsRajwat SinghNo ratings yet

- Adventure Works SalesDocument392 pagesAdventure Works SalesJohn F. RNo ratings yet

- الخطة الدراسيةDocument17 pagesالخطة الدراسيةsara abbasNo ratings yet

- Volatility Strategies ExplainedDocument19 pagesVolatility Strategies Explainedsandyk82No ratings yet

- Iata PDFDocument9 pagesIata PDFRaul Hernan Villacorta GarciaNo ratings yet

- Batch 2Document3 pagesBatch 2Heryani Alinn IINo ratings yet

- invoiceDocument1 pageinvoiceroshankumarae2015No ratings yet