Professional Documents

Culture Documents

Unit 7: Hedge Accounting: Accounting and Reporting of Financial Instruments

Unit 7: Hedge Accounting: Accounting and Reporting of Financial Instruments

Uploaded by

devanshi jainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 7: Hedge Accounting: Accounting and Reporting of Financial Instruments

Unit 7: Hedge Accounting: Accounting and Reporting of Financial Instruments

Uploaded by

devanshi jainCopyright:

Available Formats

ACCOUNTING AND REPORTING OF FINANCIAL INSTRUMENTS 12.

UNIT 7:

HEDGE ACCOUNTING

7.1INTRODUCTION

The objective of hedge accounting is to represent, in the financial statements, the effect of an

entity's risk management activities that use financial instruments to manage exposures

arising from particular risks that could affect profit or loss (or other comprehensive income, in the

case of investments in equity instruments for which an entity has elected to present changes in

fair value in other comprehensive income).

An entity may choose to designate a hedging relationship between a hedging instrument and a

hedged item, ie, hedge accounting is an option provided qualifying criteria are met. In such case,

accounting for gain/ loss arising on the hedging relationship, ie, including hedging instrument and

hedged item shall be accounted in a specific manner as detailed further in the unit in order to

avoid measurement and recognition inconsistencies which may arise otherwise if the hedging

instrument and hedged item were accounted separately.

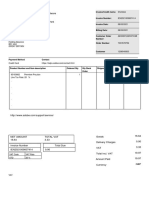

A step wise analysis has been presented using the following diagrammatic presentation –

Identify the hedged item [ie, exposed to one or more risks]

Step 1

Identify the hedging instrument [ie, a derivative or non-derivative to off-set risks in cash flow/ fair value

Step 2

Evaluate if hedging relationship meets the requisite criteria for hedge accounting

Step 3

If hedge is effective, establish type of hedge –

Fair value hedge

Step 4

Cash flow hedge

Hedge of net investment in foreign operation

Account for the hedging relationship basis guidance in Ind AS 109

Step 6

© The Institute of Chartered Accountants of India

A hedge relationship can be evaluated for a single hedged item or group of items and the hedging

instrument can also be a single instrument or multiple instruments hedging specific risk associated with

the hedged item.

7.2IDENTIFYING THE HEDGED ITEM AND DESIGNATION OF HEDGED ITEMS

A hedged item can be a recognised asset or liability, an unrecognised firm commitment,

a forecast transaction or a net investment in a foreign operation. The hedged item can

be:

(a) a single item; or

(b) a group of items.

A hedged item can also be a component of such an item or group of items.

The hedged item must be reliably measurable.

If a hedged item is a forecast transaction (or a component thereof), that transaction must be

highly probable.

An entity may designate an item in its entirety or a component of an item as the hedged

item in a hedging relationship.

An entire item comprises all changes in cash flows or fair value of an item.

A component comprises less than the entire fair value change or cash flow variability of

an item. In that case, an entity may designate only the following types of components

(including combinations) as hedged items:

(a) only changes in the cash flows or fair value of an item attributable to a specific risk

or risks (risk component), provided that, based on an assessment within the

context of the particular market structure, the risk component is separately

identifiable and reliably measurable. Risk components include a designation of

only changes in the cash flows or the fair value of a hedged item above or below

a specified price or other variable (a one-sided risk).

(b) one or more selected contractual cash flows.

(c) components of a nominal amount, ie a specified part of the amount of an item

7.3QUALIFYING INSTRUMENTS FOR HEDGE ACCOUNTING AND DESIGNATI

Derivative measured at fair value through profit or loss (except for written opti

Hedging instrument

Non-Derivative financial asset or financial liability measured at fair value through pro

Exceptions to designating non-derivative financial asset or non-derivative financial

liability as hedging instrument:

A financial liability designated as at fair value through profit or loss for which the amount

of its change in fair value that is attributable to changes in the credit risk of that liability

is presented in other comprehensive income.

For a hedge of foreign currency risk, the foreign currency risk component of a non-

derivative financial asset or a non-derivative financial liability may be designated as a

hedging instrument provided that it is not an investment in an equity instrument for which

an entity has elected to present changes in fair value in other comprehensive income.

For hedge accounting purposes, only contracts with a party external to the reporting entity

(ie external to the group or individual entity that is being reported on) can be designated as

hedging instruments.

A qualifying instrument must be designated in its entirety as a hedging instrument.

The only exceptions permitted are:

(a) separating the intrinsic value and time value of an option contract and designating as

the hedging instrument only the change in intrinsic value of an option and not the change

in its time value;

(b) separating the forward element and the spot element of a forward contract and

designating as the hedging instrument only the change in the value of the spot element

of a forward contract and not the forward element; and

(c) a proportion of the entire hedging instrument, such as 50 per cent of the nominal

amount, may be designated as the hedging instrument in a hedging relationship.

However, a hedging instrument may not be designated for a part of its change in fair

value that results from only a portion of the time period during which the hedging

instrument remains outstanding.

Written options are not hedging instruments: A derivative instrument that combines a

written option and a purchased option (for example, an interest rate collar) does not qualify

as a hedging instrument if it is, in effect, a net written option at the date of designation.

The decision tree to determining if an instrument can be designated as a hedging instrument

is as follows:

Whether the hedging instrument is a

derivative or non-derivative?

Non-derivative financial

Derivative asset or non-derivative

financial liability

Whether a net written

option? (a) Non-derivative FL

No

whose FV changes

attributable to credit risk

are recognized in OCI?

Yes or

(b) Investment in equity

instrument designated

Cannot be a hedging as FVOCI?

instrument Can be a hedging

instrument

Yes

7.4QUALIFYING CRITERIA FOR HEDGE ACCOUNTING

A hedging relationship qualifies for hedge accounting only if all of the following criteria are met:

(a) Hedging relationship consists only of eligible hedging instruments and eligible hedged

items.

(b) At the inception of the hedging relationship, there is formal designation and

documentation of the hedging relationship and the entity's risk management objective

and strategy for undertaking the hedge. That documentation shall include identification of the

hedging instrument, the hedged item, the nature of the risk being hedged and how the entity

will assess whether the hedging relationship meets the hedge effectiveness requirements

(including its analysis of the sources of hedge ineffectiveness and how it determines the

hedge ratio)

(c) Hedging relationship meets all of the following hedge effectiveness requirements:

i. there is an economic relationship between the hedged item and the hedging

instrument;

ii. the effect of credit risk does not dominate the value changes that result from that

economic relationship; and

iii. the hedge ratio of the hedging relationship is the same as that resulting from the

quantity of the hedged item that the entity actually hedges and the quantity of the

hedging instrument that the entity actually uses to hedge that quantity of hedged item.

However, that designation shall not reflect an imbalance between the weightings of the

hedged item and the hedging instrument that would create hedge ineffectiveness

(irrespective of whether recognised or not) that could result in an accounting outcome

that would be inconsistent with the purpose of hedge accounting.

7.5ACCOUNTING RELATIONSHIPS

FOR QUALIFYING HEDGING

An entity applies hedge accounting to hedging relationships that meet the qualifying criteria.

Types of hedging relationships:

Fair value hedge

Three types of hedging relationships

Cash flow hedge

Hedge of net investment in foreign operation

Fair value hedge

A fair value hedge is a hedge of the exposure to changes in fair value of a recognised asset

or liability or an unrecognised firm commitment, or a component of any such item, that is

attributable to a particular risk and could affect profit or loss.

Where a fair value hedge meets the qualifying criteria, fair value hedge shall be accounted

as follows:

Fair value hedge

Is the hedged item an equity

Hedging gain/ loss on hedged item

instrument designated as FVOCI Gain/ loss* recognized in OCI

Yes

Gain/ loss recognized in P&L

Adjusted in carrying amount of hedged item

No

*Gain/ loss comprises both hedging instrument and hedged item

If the hedged item is a financial asset (or a component thereof) that is measured at fair

value through other comprehensive income (FVOCI) other than equity instrument

designated as FVOCI in accordance with Ind AS 109, the hedging gain or loss on the

hedged item shall be recognised in profit or loss.

When a hedged item is an unrecognised firm commitment (or a component thereof), the

cumulative change in the fair value of the hedged item subsequent to its designation is

recognised as an asset or a liability with a corresponding gain or loss recognised in

profit or loss.

Cash flow hedge

A cash flow hedge is a hedge of the exposure to variability in cash flows that is attributable

to a particular risk associated with all, or a component of, a recognised asset or liability (such

as all or some future interest payments on variable debt), or a highly probable forecast

transaction, and could affect profit or loss.

Where a cash flow hedge meets the qualifying criteria, it shall be accounted as follows:

(a) the separate component of equity associated with the hedged item (cash flow hedge

reserve) is adjusted to the lower of the following (in absolute amounts):

i. the cumulative gain or loss on the hedging instrument from inception of the hedge;

and

ii. the cumulative change in fair value (present value) of the hedged item (ie the

present value of the cumulative change in the hedged expected future cash flows)

from inception of the hedge.

(b) the portion of the gain or loss on the hedging instrument that is determined to be an

effective hedge (ie the portion that is offset by the change in the cash flow hedge reserve

calculated in accordance with (a)) shall be recognised in other comprehensive income.

(c) any remaining gain or loss on the hedging instrument (or any gain or loss required to

balance the change in the cash flow hedge reserve calculated in accordance with (a)) is

hedge ineffectiveness that shall be recognised in profit or loss

(d) the amount that has been accumulated in the cash flow hedge reserve in accordance

with (a) shall be accounted for as follows:

i. If a hedged forecast transaction subsequently results in the recognition of a non-

financial asset or non-financial liability, or a hedged forecast transaction for a non-

financial asset or a non-financial liability becomes a firm commitment for which fair

value hedge accounting is applied, the entity shall remove that amount from the cash

flow hedge reserve and include it directly in the initial cost or other carrying amount of

the asset or the liability. This is not a reclassification adjustment as defined in IAS 1 and

hence it does not affect other comprehensive income.

ii. For cash flow hedges other than those covered by (i), that amount shall be

reclassified from the cash flow hedge reserve to profit or loss as a reclassification

adjustment in the same period or periods during which the hedged expected future

cash flows affect profit or loss (for example, in the periods that interest income or

interest expense is recognised or when a forecast sale occurs).

iii. However, if that amount is a loss and an entity expects that all or a portion of that

loss will not be recovered in one or more future periods, it shall immediately

reclassify the amount that is not expected to be recovered into profit or loss as a

reclassification adjustment.

Hedge of net investment in foreign operation

Hedge of a net investment in foreign operation, including a hedge of a monetary item that is

accounted for as part of the net investment, shall be accounted for similarly to cash flow hedges:

Hedge of net investment in foreign operation

Portion of gain/loss on hedging instrument that is determined to be effective hedge

Ineffective p

Gain/ loss recognized in OCI (Foreign currency translation reserve) Gain/ loss recog

The cumulative gain or loss on the hedging instrument relating to the effective portion of the hedge that

has been accumulated in the foreign currency translation reserve shall be reclassified from equity to

profit or loss as a reclassification adjustment on the disposal or partial disposal of the foreign operation.

You might also like

- DPS Custodial Terms and Conditions Dec2022 v29Document7 pagesDPS Custodial Terms and Conditions Dec2022 v29Roxana Ignat100% (1)

- Tata Starbucks Joint Venture - FinalDocument23 pagesTata Starbucks Joint Venture - FinalAnand Singh33% (3)

- Real CKA Exam Questions 2021Document11 pagesReal CKA Exam Questions 2021CKA DumpsIT.com0% (3)

- IFRS 9 Financial Instruments Quiz.Document4 pagesIFRS 9 Financial Instruments Quiz.حسين عبدالرحمنNo ratings yet

- SAP Collateral Management System (CMS): Configuration Guide & User ManualFrom EverandSAP Collateral Management System (CMS): Configuration Guide & User ManualRating: 4 out of 5 stars4/5 (1)

- Hedge AccountingDocument8 pagesHedge AccountingSathisha KrishnappaNo ratings yet

- Sem 10B HedgeAccounting - Part I (NTUL)Document19 pagesSem 10B HedgeAccounting - Part I (NTUL)Gordon Ong JinjieNo ratings yet

- Snapshot - IFRS 9 - Financial Instruments - Hedge AccountingDocument1 pageSnapshot - IFRS 9 - Financial Instruments - Hedge AccountingottieNo ratings yet

- AC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Document41 pagesAC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Shawn TayNo ratings yet

- 19331sm Finalnew cp6Document24 pages19331sm Finalnew cp6Naveen HRNo ratings yet

- Chapter 6 Accounting and Reporting of Financial InstrumentsDocument24 pagesChapter 6 Accounting and Reporting of Financial InstrumentsMahendra Kumar B RNo ratings yet

- IA Downloaded From GoogleDocument5 pagesIA Downloaded From Googlearnold espiniliNo ratings yet

- Gr.1 Report Hedging Foreign CurrencyDocument54 pagesGr.1 Report Hedging Foreign CurrencyJeanette FormenteraNo ratings yet

- Derivatives As Hedging Instrument in Managing Foreign Currency ExposuresDocument52 pagesDerivatives As Hedging Instrument in Managing Foreign Currency ExposuresCasper John Nanas MuñozNo ratings yet

- Optimal Designation of Hedging Relationships Under FASB Statement 133Document13 pagesOptimal Designation of Hedging Relationships Under FASB Statement 133postscriptNo ratings yet

- Title - Debt InvestmentsDocument4 pagesTitle - Debt InvestmentsJulian AlbaNo ratings yet

- Lesson 2-Hedging Foreign Currency Exchange Rate RiskDocument3 pagesLesson 2-Hedging Foreign Currency Exchange Rate RiskMila Casandra CastañedaNo ratings yet

- IAS 39 EnglishDocument3 pagesIAS 39 EnglishsrilusianaNo ratings yet

- Chapter 21 Financial Instruments (Students)Document49 pagesChapter 21 Financial Instruments (Students)Kelvin Chu JYNo ratings yet

- Hedge AccountingDocument5 pagesHedge Accountingchowchow123No ratings yet

- References: Paragraph 11ADocument14 pagesReferences: Paragraph 11AMariella AntonioNo ratings yet

- FAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerDocument12 pagesFAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerMae100% (2)

- Module 4 - Financial Instruments (Assets)Document9 pagesModule 4 - Financial Instruments (Assets)Luisito CorreaNo ratings yet

- Final SummaryDocument6 pagesFinal SummaryAkanksha singhNo ratings yet

- IFRS 9 Financial Instruments QuizletDocument2 pagesIFRS 9 Financial Instruments QuizletSherillyn BardoquilloNo ratings yet

- Accounting and Reporting of Financial Instruments: Basic ConceptsDocument15 pagesAccounting and Reporting of Financial Instruments: Basic Conceptsshouvik palNo ratings yet

- 1647114301financial Instrument - Part 1 (Classification Measurement)Document18 pages1647114301financial Instrument - Part 1 (Classification Measurement)mg21138No ratings yet

- IFRS 9 Part IV Hedging November 2015Document28 pagesIFRS 9 Part IV Hedging November 2015Nicolaus CopernicusNo ratings yet

- Ias 39Document6 pagesIas 39Syahral AhmadNo ratings yet

- Financial Instruments - IFRS 9Document3 pagesFinancial Instruments - IFRS 9aubrey lomaadNo ratings yet

- Ind AS - 21 Provisions, Contingent Liabilities and Contingent Assets Objective ApplicabilityDocument4 pagesInd AS - 21 Provisions, Contingent Liabilities and Contingent Assets Objective ApplicabilityManaswi TripathiNo ratings yet

- 08 Financial InstrumentsDocument28 pages08 Financial InstrumentsHaris IshaqNo ratings yet

- W5 Module 8 Financial Instrument FrameworkDocument9 pagesW5 Module 8 Financial Instrument FrameworkElmeerajh JudavarNo ratings yet

- NOTES On PFRS 9 Financial InstrumentsDocument11 pagesNOTES On PFRS 9 Financial Instrumentsjsus22100% (1)

- Financial Accounting 2Document17 pagesFinancial Accounting 2Devvrat TyagiNo ratings yet

- Ifrs 9Document42 pagesIfrs 9tariqNo ratings yet

- Hedge Accounting and DerivativesDocument7 pagesHedge Accounting and DerivativesDioNo ratings yet

- Financial InstrumentsDocument7 pagesFinancial InstrumentsTrifan_DumitruNo ratings yet

- Financial Instruments (2021)Document17 pagesFinancial Instruments (2021)Tawanda Tatenda Herbert100% (1)

- Fas133 FASB Derivatives Hedge Accounting RulesDocument22 pagesFas133 FASB Derivatives Hedge Accounting Rulesswinki3100% (1)

- Pfrs 7 Financial Instruments DisclosuresDocument3 pagesPfrs 7 Financial Instruments DisclosuresR.A.No ratings yet

- Accounting For Embedded DerivativesDocument22 pagesAccounting For Embedded Derivativeslwilliams144No ratings yet

- Deegan5e SM Ch15Document19 pagesDeegan5e SM Ch15Rachel TannerNo ratings yet

- AC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsDocument78 pagesAC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsmerryNo ratings yet

- URR Guidance NoteDocument15 pagesURR Guidance NoteIvana TodorovNo ratings yet

- Hedge AccountingDocument6 pagesHedge AccountingWei MaoNo ratings yet

- Group 4 - IFRS 7 & 9 Assignment GRPDocument8 pagesGroup 4 - IFRS 7 & 9 Assignment GRPB CHIBWANANo ratings yet

- Cfas 2ND Term Finals PDFDocument16 pagesCfas 2ND Term Finals PDFPam LlanetaNo ratings yet

- Share Based TransactionDocument3 pagesShare Based TransactionShiza ArifNo ratings yet

- Pert 1 2 - Derivative-Complete-NewDocument89 pagesPert 1 2 - Derivative-Complete-NewChevalier ChevalierNo ratings yet

- Fundamentals of Advanced Accounting 6Th Edition Hoyle Solutions Manual Full Chapter PDFDocument67 pagesFundamentals of Advanced Accounting 6Th Edition Hoyle Solutions Manual Full Chapter PDFDaisyHillyowek100% (12)

- FAC3702 Learning Unit 6 Financial InstrumentsDocument4 pagesFAC3702 Learning Unit 6 Financial InstrumentsObert MarongedzaNo ratings yet

- Fundamentals of Advanced Accounting 6th Edition Hoyle Solutions ManualDocument38 pagesFundamentals of Advanced Accounting 6th Edition Hoyle Solutions Manualjeanbarnettxv9v100% (13)

- 18 Ifrs 9Document4 pages18 Ifrs 9Irtiza AbbasNo ratings yet

- Ifrs 9 - Financial Instruments Ias 38 and Ifrs 7Document43 pagesIfrs 9 - Financial Instruments Ias 38 and Ifrs 7JaaNo ratings yet

- Int. Acc 3 AssignDocument3 pagesInt. Acc 3 AssignElea MorataNo ratings yet

- Aik CH 5Document10 pagesAik CH 5rizky unsNo ratings yet

- Unit 3: Financial Instruments: Equity and Financial LiabilitiesDocument33 pagesUnit 3: Financial Instruments: Equity and Financial LiabilitiesJagrit OberoiNo ratings yet

- Pfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsDocument6 pagesPfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsSHARON SAMSONNo ratings yet

- Financial Instrument NotesDocument3 pagesFinancial Instrument NotesKrishna AdhikariNo ratings yet

- CH 05Document33 pagesCH 05Khoirunnisa DwiastutiNo ratings yet

- Format of Minutes of First Board Meeting - Corporate LawsDocument11 pagesFormat of Minutes of First Board Meeting - Corporate Lawsdevanshi jainNo ratings yet

- Ashok G. Rajani CASEDocument5 pagesAshok G. Rajani CASEdevanshi jainNo ratings yet

- UNION OF INDIA & OTHERS V. Bharat ForgeDocument78 pagesUNION OF INDIA & OTHERS V. Bharat Forgedevanshi jainNo ratings yet

- Bhaiya PDFDocument1 pageBhaiya PDFdevanshi jainNo ratings yet

- Kotak Mahindra Bank Limited CaseDocument32 pagesKotak Mahindra Bank Limited Casedevanshi jainNo ratings yet

- Asset Reconstruction Company (India) Limited Versus Tulip Star Hotels Limited & Ors.Document31 pagesAsset Reconstruction Company (India) Limited Versus Tulip Star Hotels Limited & Ors.devanshi jainNo ratings yet

- An "Internal" Critique of Justice Scalia's Theory of Statutory InterpretationDocument57 pagesAn "Internal" Critique of Justice Scalia's Theory of Statutory Interpretationdevanshi jainNo ratings yet

- Beni Prasad V Hardai BibiDocument46 pagesBeni Prasad V Hardai Bibidevanshi jainNo ratings yet

- STATE TAX OFFICER CaseDocument31 pagesSTATE TAX OFFICER Casedevanshi jainNo ratings yet

- In The Supreme Court of India: Equiv Alent Citation: 2012AC R2173Document20 pagesIn The Supreme Court of India: Equiv Alent Citation: 2012AC R2173devanshi jainNo ratings yet

- This Content Downloaded From 157.47.136.49 On Mon, 26 Apr 2021 04:46:28 UTCDocument9 pagesThis Content Downloaded From 157.47.136.49 On Mon, 26 Apr 2021 04:46:28 UTCdevanshi jainNo ratings yet

- BK PavitraDocument65 pagesBK Pavitradevanshi jainNo ratings yet

- This Content Downloaded From 157.38.66.64 On Fri, 23 Apr 2021 10:25:42 UTCDocument19 pagesThis Content Downloaded From 157.38.66.64 On Fri, 23 Apr 2021 10:25:42 UTCdevanshi jainNo ratings yet

- Versus: Efore MT AgarathnaDocument13 pagesVersus: Efore MT Agarathnadevanshi jainNo ratings yet

- Equiv Alent Citation: 2001iiiad (Delhi) 829, 2001C Rilj2404, 90 (2001) Dlt548Document19 pagesEquiv Alent Citation: 2001iiiad (Delhi) 829, 2001C Rilj2404, 90 (2001) Dlt548devanshi jainNo ratings yet

- Nupur Talwar Vs CBI Delhi and Ors 06012012 SCs120009COM181902Document7 pagesNupur Talwar Vs CBI Delhi and Ors 06012012 SCs120009COM181902devanshi jainNo ratings yet

- Bajrang Lal Sharma SCCDocument15 pagesBajrang Lal Sharma SCCdevanshi jainNo ratings yet

- 2012 SCC Online Guj 5453: (2013) 176 Comp Cas 217: (2013) 112 Cla 234Document12 pages2012 SCC Online Guj 5453: (2013) 176 Comp Cas 217: (2013) 112 Cla 234devanshi jainNo ratings yet

- Maria Monica Susairaj V State of MaharashtraDocument16 pagesMaria Monica Susairaj V State of Maharashtradevanshi jainNo ratings yet

- Amendment by Finance Act 2019Document1 pageAmendment by Finance Act 2019devanshi jainNo ratings yet

- Bilal Nazki and A.A. Kumbhakoni, JJ.: Equiv Alent Citation: 2009C Rilj2075Document16 pagesBilal Nazki and A.A. Kumbhakoni, JJ.: Equiv Alent Citation: 2009C Rilj2075devanshi jainNo ratings yet

- Manu Sharma V State (Document For Sections)Document10 pagesManu Sharma V State (Document For Sections)devanshi jainNo ratings yet

- Custom Chapter 3Document8 pagesCustom Chapter 3devanshi jainNo ratings yet

- Positive Aspects of AdvertisingDocument3 pagesPositive Aspects of Advertisingdevanshi jainNo ratings yet

- Custom Chapter 5Document38 pagesCustom Chapter 5devanshi jainNo ratings yet

- Recommendation LetterDocument1 pageRecommendation Letterdevanshi jainNo ratings yet

- Legal Notice 1Document2 pagesLegal Notice 1devanshi jainNo ratings yet

- What Is A Revenue Expenditure?Document3 pagesWhat Is A Revenue Expenditure?mickaylia greenNo ratings yet

- Group Assignment MGT (AC1101A) LatestDocument6 pagesGroup Assignment MGT (AC1101A) LatestSyaza Aisyah0% (1)

- Model Canvas ScarfDocument3 pagesModel Canvas Scarfanamariana1056% (9)

- Rico 29319100 Corporate Strategy Case IndofoodDocument4 pagesRico 29319100 Corporate Strategy Case IndofoodMifta ZanariaNo ratings yet

- Chapter II - International Trade and Foreign Direct InvestmentDocument13 pagesChapter II - International Trade and Foreign Direct InvestmenttheaNo ratings yet

- Instructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaDocument29 pagesInstructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaAISLINENo ratings yet

- Po 220323 - Anugrah Argon Medica 1, PT, GS MampangDocument2 pagesPo 220323 - Anugrah Argon Medica 1, PT, GS MampangDimas AlfatihNo ratings yet

- 2021 - 09 - 06 RBCE - CE-I-CT Change of Base Year of Consumer Price Index of Industrial Workers (Labour Index)Document3 pages2021 - 09 - 06 RBCE - CE-I-CT Change of Base Year of Consumer Price Index of Industrial Workers (Labour Index)amitkap00rNo ratings yet

- Dominican Businesses Plaza LamaDocument3 pagesDominican Businesses Plaza LamaelisandraNo ratings yet

- Power BI Resume 02Document2 pagesPower BI Resume 02haribabu madaNo ratings yet

- GJCPP5643 H: Income Tax Department Govt. of IndiaDocument1 pageGJCPP5643 H: Income Tax Department Govt. of Indiaswathi100% (1)

- Y2023. Holiday - Work - Schedule - Holy Week. 23.03.23 Tin - For Printing Purpose - 1679967133Document2 pagesY2023. Holiday - Work - Schedule - Holy Week. 23.03.23 Tin - For Printing Purpose - 1679967133Tintin EspulgarNo ratings yet

- ASK TONY: Our 17k Horror After My Cousin Died Without Leaving A Will and L&G Refused To Believe We Are RelatedDocument19 pagesASK TONY: Our 17k Horror After My Cousin Died Without Leaving A Will and L&G Refused To Believe We Are RelatedjuckNo ratings yet

- Customer Care (South) - Electricity Bill Collection CentresDocument14 pagesCustomer Care (South) - Electricity Bill Collection CentresRahul JaiswarNo ratings yet

- Applied Economics Theory of Consumer Behavior APDocument11 pagesApplied Economics Theory of Consumer Behavior APLulu BritanniaNo ratings yet

- 3 8 2021 Ae00007406537cgbDocument2 pages3 8 2021 Ae00007406537cgbAshley GreenNo ratings yet

- Fundamentals of Futures and Options Markets Hull 7th Edition Test BankDocument35 pagesFundamentals of Futures and Options Markets Hull 7th Edition Test Bankhoy.guzzler67fzc100% (49)

- 3.13 Pirovano v. Dela Rama Steamship Co., 96 P 335Document19 pages3.13 Pirovano v. Dela Rama Steamship Co., 96 P 335Sam ConcepcionNo ratings yet

- Korzan IC NoteDocument4 pagesKorzan IC NoteMo El-KasarNo ratings yet

- Activity 4Document8 pagesActivity 4khelxoNo ratings yet

- Companyprofil E: Erfanconstructionsolut IonDocument14 pagesCompanyprofil E: Erfanconstructionsolut IonNurin AleesyaNo ratings yet

- Causes and Effects of Delays in Construction of Medium Scale Drinking Water Supply Projects in Sri LankaDocument10 pagesCauses and Effects of Delays in Construction of Medium Scale Drinking Water Supply Projects in Sri LankaHanaNo ratings yet

- SSC CGL 2023 Permissible Benchmark DisabilitiesDocument11 pagesSSC CGL 2023 Permissible Benchmark Disabilitiesmalliksujan59No ratings yet

- My Business PlanDocument3 pagesMy Business PlanJocelyn PoliñoNo ratings yet

- "Kuraloane Fab Tech Private Limited" at BangaloreDocument23 pages"Kuraloane Fab Tech Private Limited" at BangaloreCHANDAN CHANDUNo ratings yet

- Marketing Management Assgiments AnswerDocument40 pagesMarketing Management Assgiments AnswerAlazer Tesfaye Ersasu TesfayeNo ratings yet

- Lavén (2022) Introduction To Strategy and Organization - DocumentationDocument59 pagesLavén (2022) Introduction To Strategy and Organization - DocumentationfizasohaibNo ratings yet