Professional Documents

Culture Documents

Product Name: Heartbeat - Product UIN: MAXHLIP20065V051920

Product Name: Heartbeat - Product UIN: MAXHLIP20065V051920

Uploaded by

RekhaCopyright:

Available Formats

You might also like

- PremiumRept MDS - RameshDocument2 pagesPremiumRept MDS - Rameshnavengg521No ratings yet

- Premium Receipt - 008927742 - 131423Document2 pagesPremium Receipt - 008927742 - 131423Vignesh MahadevanNo ratings yet

- 80D.pdf-Piyush - Copy 3Document1 page80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNo ratings yet

- Libra ReceiptDocument1 pageLibra ReceiptAaryan TandelNo ratings yet

- Prakash B Medical Insurance 22-23Document1 pagePrakash B Medical Insurance 22-23Prakash BattalaNo ratings yet

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- (Formerly Known As Max Bupa Health Insurance Co. LTD.) : Product Name: Reassure - Product Uin: Maxhlip21060V012021Document47 pages(Formerly Known As Max Bupa Health Insurance Co. LTD.) : Product Name: Reassure - Product Uin: Maxhlip21060V012021apprenant amitNo ratings yet

- Religare PDFDocument5 pagesReligare PDFsomnathNo ratings yet

- Medical Insurance Certificate Max BupaDocument1 pageMedical Insurance Certificate Max BupaBinod DashNo ratings yet

- 13 18 0038121 00 PDFDocument7 pages13 18 0038121 00 PDFRaoul JhaNo ratings yet

- 2825100207112402000Document4 pages2825100207112402000bipin012No ratings yet

- Epidemiology of Mental IllnessDocument30 pagesEpidemiology of Mental IllnessAtoillah IsvandiaryNo ratings yet

- Product Name: Max Bupa Health Recharge, Product UIN: MAXHLIP18129V011718Document51 pagesProduct Name: Max Bupa Health Recharge, Product UIN: MAXHLIP18129V011718906rahulNo ratings yet

- FPPack PDFDocument34 pagesFPPack PDFmeet1996No ratings yet

- PolicySoftCopy 473620702Document50 pagesPolicySoftCopy 473620702Amit MalikNo ratings yet

- Formerly Known As Max Bupa Health Insurance Co. Ltd.Document43 pagesFormerly Known As Max Bupa Health Insurance Co. Ltd.Ruth ParrNo ratings yet

- PolicyDocument55 pagesPolicyBaneNo ratings yet

- Reliance Individual Mediclaim Policy ScheduleDocument1 pageReliance Individual Mediclaim Policy ScheduleParthiban K100% (1)

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- ALisha Medical SelfDocument1 pageALisha Medical SelfaaravaNo ratings yet

- Self Health InsuranceDocument1 pageSelf Health InsurancedevendraNo ratings yet

- PolicySoftCopy 201910201120390513 5dabf5af537a7b2e32033e06 PDFDocument35 pagesPolicySoftCopy 201910201120390513 5dabf5af537a7b2e32033e06 PDFNaveen KrishnaNo ratings yet

- Max Health InsuranceDocument1 pageMax Health InsuranceanuNo ratings yet

- Star Health Policy DocDocument6 pagesStar Health Policy DocDev PandayNo ratings yet

- Certificate of Insurance HDFC ERGO Group ProtectDocument5 pagesCertificate of Insurance HDFC ERGO Group Protectzahid aliNo ratings yet

- Subject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000Document2 pagesSubject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000shekarNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document4 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)Ameya SudameNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood Ahmad100% (1)

- PolicyDocument56 pagesPolicyPoonam RathourNo ratings yet

- FDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115Document4 pagesFDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115arjunNo ratings yet

- Pooja Policy Self 80 DDocument2 pagesPooja Policy Self 80 Dcagopalofficebackup100% (1)

- CareHealth Policy 2020-21 Nihit FamilyDocument5 pagesCareHealth Policy 2020-21 Nihit FamilyJacob PruittNo ratings yet

- BA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanDocument2 pagesBA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanSudesh ChauhanNo ratings yet

- HDFC Tli - Converted - by - AbcdpdfDocument1 pageHDFC Tli - Converted - by - Abcdpdfharshim guptaNo ratings yet

- Corona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleDocument17 pagesCorona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleGlobal College of Engineering TechnologyNo ratings yet

- ICICI COI IncomeProtect 445605Document5 pagesICICI COI IncomeProtect 445605sree koundinyaNo ratings yet

- HDFC ERGO General Insurance Company Limited: Date: 04/02/2019Document4 pagesHDFC ERGO General Insurance Company Limited: Date: 04/02/2019rohit choudharyNo ratings yet

- 30515407628522max Bupa Premium Reeipt Parents PDFDocument1 page30515407628522max Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- FHP H0225594Document2 pagesFHP H0225594Raghavendra KamathNo ratings yet

- Insurance Parents Top UpDocument45 pagesInsurance Parents Top UpAbhinav SinhaNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyNikky KapoorNo ratings yet

- 02122020Document5 pages02122020Kumar FanishwarNo ratings yet

- 80 D Religare Health Insurace Premium Receipt Rs.21347Document7 pages80 D Religare Health Insurace Premium Receipt Rs.21347Shree Sai Enterprise100% (1)

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument3 pagesHDFC ERGO General Insurance Company LimitedAnish ShahNo ratings yet

- Policy DocDocument6 pagesPolicy DocSoma Shekar ANo ratings yet

- P 131124 01 2023 008806 Policy DocDocument4 pagesP 131124 01 2023 008806 Policy DockasturihospitalsecunderabadNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- Premium Receipt PDFDocument1 pagePremium Receipt PDFAjit Kumar TiwariNo ratings yet

- Rajendra Prasad ShrivastavaDocument2 pagesRajendra Prasad ShrivastavaSourabh ShrivastavaNo ratings yet

- LIC Premium Paid Statement Swapnil Nage 1Document1 pageLIC Premium Paid Statement Swapnil Nage 1Swapnil NageNo ratings yet

- Max Bupa Premium Reeipt ParentDocument1 pageMax Bupa Premium Reeipt ParentsanojcenaNo ratings yet

- Parents Insurance PremiumDocument1 pageParents Insurance Premiumprajeesh.vijayanNo ratings yet

- Sam Park DocumentDocument4 pagesSam Park DocumentShahadNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Veeravenkata Mallikarjuna Rao KarriDocument1 pageVeeravenkata Mallikarjuna Rao KarriArjunNo ratings yet

- Medical Insurance Star Health SelfDocument1 pageMedical Insurance Star Health SelfMadhumitha LNo ratings yet

- Relig AreDocument5 pagesRelig AresomnathNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- Infection Control Management Plan: PurposeDocument6 pagesInfection Control Management Plan: PurposeRekhaNo ratings yet

- Step 7 How - To - Conduct - A - Mock - Tracer PDFDocument10 pagesStep 7 How - To - Conduct - A - Mock - Tracer PDFRekhaNo ratings yet

- Joint Commission PDFDocument52 pagesJoint Commission PDFRekha100% (1)

- Joint Commission PDFDocument52 pagesJoint Commission PDFRekha100% (1)

- Brochure - FICCI Healthcare Excellence Awards 2020Document10 pagesBrochure - FICCI Healthcare Excellence Awards 2020RekhaNo ratings yet

- Quality and Patient SafetyDocument19 pagesQuality and Patient SafetyRekhaNo ratings yet

- Dr. Kiki - Pengantar Trauma UpdateDocument20 pagesDr. Kiki - Pengantar Trauma UpdateRsud Malinau Ppk Blud100% (1)

- HemodialysisDocument19 pagesHemodialysisDonita Meña LaroyaNo ratings yet

- ACEP Ketamine Guideline 2011Document13 pagesACEP Ketamine Guideline 2011Daniel Crook100% (1)

- Mechler - 2022 - Evidence-Based Pharmacological Treatment Options For ADHD in Children and AdolescentsDocument11 pagesMechler - 2022 - Evidence-Based Pharmacological Treatment Options For ADHD in Children and AdolescentsRene LutherNo ratings yet

- Mandalas and Wellness WheelsDocument22 pagesMandalas and Wellness WheelsnuskoNo ratings yet

- TranscriptDocument4 pagesTranscriptGuru PrasadNo ratings yet

- TK HD SLED Indikasi Dan PenatalaksanaannyaDocument22 pagesTK HD SLED Indikasi Dan PenatalaksanaannyaMuhammad Ahmad bin makruf syammaku100% (1)

- Surat Buat VisaDocument12 pagesSurat Buat VisaNurul FitrianaNo ratings yet

- Test Bank For Clinical Immunology and Serology A Laboratory Perspective 3rd Edition StevensDocument11 pagesTest Bank For Clinical Immunology and Serology A Laboratory Perspective 3rd Edition StevensWilbur Penny100% (39)

- Methanolic Leaf Extraction of Cogon (POACEAE: Imperata Cylindrica) AS A Potential Alternative Therapeutics For Breast CancerDocument8 pagesMethanolic Leaf Extraction of Cogon (POACEAE: Imperata Cylindrica) AS A Potential Alternative Therapeutics For Breast CancerRechelle CabagingNo ratings yet

- DR Carl Pfeiffer - Schizophrenias Ours To Conquer-Riordan-Clinic-Books (Orthomolecular Medicine)Document383 pagesDR Carl Pfeiffer - Schizophrenias Ours To Conquer-Riordan-Clinic-Books (Orthomolecular Medicine)Anonymous Jap77xvqPKNo ratings yet

- DIC Case StudyDocument7 pagesDIC Case StudyRobertNo ratings yet

- WIlson DiseaseDocument11 pagesWIlson DiseaseOrdnas UcimNo ratings yet

- 1-Oral Diagnosis Involves:: D-All of The AboveDocument12 pages1-Oral Diagnosis Involves:: D-All of The AboveQalaq 02No ratings yet

- Forensic Dentistry Case Book 6:: A Self-Inflicted Bite Mark A Case ReportDocument2 pagesForensic Dentistry Case Book 6:: A Self-Inflicted Bite Mark A Case ReportRizky Mega ChandraNo ratings yet

- Pocket Pediatric Hematologi OnkologiDocument5 pagesPocket Pediatric Hematologi OnkologiAdrian KhomanNo ratings yet

- Indications and Contraindications For Couples TherapyDocument10 pagesIndications and Contraindications For Couples TherapyVartika jainNo ratings yet

- GALZOTE PaperCase1-SurgeryDocument4 pagesGALZOTE PaperCase1-SurgeryRock GalzoteNo ratings yet

- Limiting Dynamic Driving Pressure in Patients.2Document11 pagesLimiting Dynamic Driving Pressure in Patients.2AleCosentinoNo ratings yet

- Case 40 2015 A 40-Year-Old Homeless Woman With Headache Hypertension and PsychosisDocument8 pagesCase 40 2015 A 40-Year-Old Homeless Woman With Headache Hypertension and Psychosisapi-344719326No ratings yet

- Routes of Drug AdministrationDocument23 pagesRoutes of Drug Administrationrosalyn sugayNo ratings yet

- Chap 118Document5 pagesChap 118theodoruskevinNo ratings yet

- LetrozoleDocument10 pagesLetrozoleThunnisa SivNo ratings yet

- Neenamol CM ResumeDocument1 pageNeenamol CM ResumeNeenamolNo ratings yet

- 1 PBDocument7 pages1 PBAnnisa magfiraNo ratings yet

- Pediatric Vestibular Disorders PDFDocument10 pagesPediatric Vestibular Disorders PDFNati GallardoNo ratings yet

- Antidepressant and Antipsychotic Side-Effects and Personalised Prescribing, A Systematic Review and Digital Tool Development. Lancet 2023Document17 pagesAntidepressant and Antipsychotic Side-Effects and Personalised Prescribing, A Systematic Review and Digital Tool Development. Lancet 2023tomil.hoNo ratings yet

- Noncardiogenic Pulmonary EdemaDocument9 pagesNoncardiogenic Pulmonary EdemaMuhamad Ibnu HasanNo ratings yet

- Dsa FLXM Pi en 00Document7 pagesDsa FLXM Pi en 00yantuNo ratings yet

Product Name: Heartbeat - Product UIN: MAXHLIP20065V051920

Product Name: Heartbeat - Product UIN: MAXHLIP20065V051920

Uploaded by

RekhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Product Name: Heartbeat - Product UIN: MAXHLIP20065V051920

Product Name: Heartbeat - Product UIN: MAXHLIP20065V051920

Uploaded by

RekhaCopyright:

Available Formats

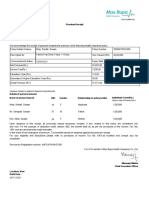

Date: 16/03/2020

Policy Number: 30086876202008

Customer ID: 0000103473

MR. SHUGOTA CHAKRABARTI

FLAT NO 201 SHREEDEVI RESIDENCY,

MUNINANJAPPA L/O T C PALYA MAIN ROAD,

RAMMURTHY NAGAR,

BENGALURU,

KARNATAKA - 560016

Mobile: 9901100800

Subject : Max Bupa Health Insurance Policy No. 30086876202008

Dear MR. SHUGOTA CHAKRABARTI,

Thank you for renewing your Max Bupa health insurance policy. At Max Bupa, we put your health first and are committed to provide you access to the

very best of healthcare, backed by the highest standards of service.

Please find enclosed your Max Bupa Policy Kit which will help you understand your policy in detail and give you more information on

how to access our services easily. Your policy kit includes the following:

• Insurance Certificate: Confirming your specific policy details like date of commencement, persons covered and specific conditions related to

your plan.

• Premium Receipt: Receipt issued for the premium paid by you.

Do visit us at www.maxbupa.com to view and download our updated list of network hospitals in your city, list of expenses generally excluded, claim

forms and for other useful information. You can register with us online using your policy number, date of birth & email id and access your policy

details. In case of any further assistance, call us at our customer helpline no. 1860-500-8888 or email us at customercare@maxbupa.com.

We request you to read your policy terms and conditions carefully so that you are fully aware of your policy benefits. For benefits related to section

80D, please consult your tax advisor.

Assuring you of our best services and wishing you and your loved ones good health always.

Yours Sincerely,

Ashish Mehrotra

Managing Director and Chief Executive Officer

Important - Please read this document and keep in a safe place.

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

Policyholder Servicing Turnaround Times as prescribed by Insurance Regulatory and

Development Authority of India (IRDAI)

POLICY SERVICING Turnaround time*

(Calendar Days)

Post Policy issue service requests – from the date of receipt of service 10 Days

request

Proposal refund in case of cancellation – from the date of decision of 15 Days

the proposal

CLAIM SERVICING Turnaround time*

(Calendar Days)

From the date of receipt of last necessary document (no investigation) 30 Days

From the date of receipt of last necessary document (with investigation) 45 Days

GRIEVANCE HANDLING Turnaround time*

(Calendar Days)

Acknowledge a grievance – from the date of receipt of grievance 3 Days

Resolve a grievance– from the date of receipt of grievance 14 Days

*Turnaround time will start from the date of receipt of complete documents at Max Bupa Health Insurance Company Ltd.

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

Policy Schedule

Policyholder Name: MR. SHUGOTA CHAKRABARTI Policy Number 30086876202008

Policyholder Address: Policy Commencement Date and Time From 21/03/2020 00:00 A.M.

FLAT NO 201 SHREEDEVI RESIDENCY, Policy Expiry Date and Time To 20/03/2021 23:59 P.M.

MUNINANJAPPA L/O T C PALYA MAIN ROAD, Plan opted Silver

RAMMURTHY NAGAR, Policy Type Family Floater

BENGALURU, Zone Coverage opted Zone 1: All India coverage

KARNATAKA - 560016 Policy Period 1 Year

Renewal / Payment Due Date 20/03/2021

Details of Electronic Insurance Account (eIA)

eIA Number None

Insurance Repository Name None

Cover Details

Name of the Insured Base Sum Insured (in Rs) Loyalty Additions accrued Sum Insured (Base Sum Personal Accident (PA) /

Person(s) (in Rs.) Insured + Loyalty Critical Illness (CI) opted

Additions + Refill

amount^) (in Rs.)

Mr. Shugota Chakrabarti 3,00,000 1,50,000 7,50,000 Not opted

Ms. Parishi Chakrabarti Not opted

Mrs. Rekha Chakrabarti Not opted

^Re-fill amount up to Base Sum Insured. Please refer to clause 3.12 of the Policy terms and conditions.

Premium Details

Net Premium / Integrated Central Goods and State/UT Goods and Gross Premium (Rs.) Gross Premium (Rs.)

Taxable Value Goods and Service Tax (9.00 %) Service Tax (9.00 %) (in words)

(Rs.) Service Tax

(18.00 %)

21,353.00 0.00 1,921.77 1,921.77 25,197.00 Twenty-Five Thousand

One Hundred

Ninety-Seven Only

Nominee Details

Nominee Name Relationship with the Policyholder

Rekha Chakrabarti Spouse

Intermediary Details

Intermediary Name Intermediary Code Intermediary Contact No.

NA NA NA

Claim Administrator Servicing Branch Details

Max Bupa Health Insurance Company Limited Max Bupa Health Insurance Company Ltd, First Floor,Vaishnavi Silicon Terrace, 30/1, Hosur

Main Road Adugodi,Opp Prestige Bangalore(Karnataka)-560095

Signature Not Verified

Vikas Gujral

2020.03.17 02:13

Encryption

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

Optional Benefit/ Feature Details

Particulars Details

Personal Accident Cover Not Opted

Critical Illness Cover Not Opted

Hospital Cash Not Opted

Co-payment opted(additional) Not Opted

Enhanced Geographical Scope Not Applicable

e-consultation opted Not opted

Premium waiver opted Not Opted

Annual Aggregate Deductible opted (in Rs.) Not Opted

Product Benefit Table1

Inpatient Care Covered up to Sum Insured

Eligible Room Category / Room Rent Shared Room or 1% of the Base Sum Insured per day

Pre-hospitalization Medical Expenses (60 Days) Covered up to Sum Insured

Post-hospitalization Medical Expenses (90 Days) Covered up to Sum Insured

Day Care Treatment Covered up to Sum Insured

Domiciliary Hospitalization Covered up to Sum Insured

Alternative treatment Covered up to Sum Insured

Living Organ Donor Transplant Covered up to Sum Insured

Emergency Ambulance Network Hospital: Covered up to Sum Insured

Non-network Hospital: Covered up to Rs. 2,000 per event

Maternity Benefit Covered up to Rs.30,000

New Born Baby Covered up to Sum Insured

Health Check-up Once in two years, tests as per annexure-IV - Applicable only if the insured in Policy

is renewed with us without a break or if the Policy continues to be in force for the

2nd Policy year in the 2 year Policy Period (if applicable)

Re-fill Benefit Covered up to Base Sum Insured

Pharmacy and Diagnostic Services Available through our empanelled service provider

Loyalty Additions Increase of 10% of expiring Base Sum Insured in a Policy Year; maximum up to

50% of Base Sum Insured

HIV / AIDS Covered up to Rs 50,000

Emergency Assistance Services Covered up to Sum Insured

Mental disorder treatment Covered up to Sum Insured (sub-limit of Rs 50,000 applicable on few conditions)

Second Medical Opinion Not Applicable

Child Care Benefits Not Applicable

Specified Illness Cover Not Applicable

OPD Treatment and Diagnostic Services Not Applicable

Emergency Medical Evacuation Not Applicable

Emergency Hospitalization Not Applicable

1

The details of the benefits will change depending upon the plan opted. All the benefits are on per Policy Year basis, if otherwise not mentioned.

Insured Person Details

Name of the Age Insured Gender Relationship Insured Additional Pre Existing Personal Waiting

Insured Person DOB with Sum Insured Condition* Period#

(s) Max Bupa

(Since)

Mr. Shugota 44 04/10/1975 Male Self 21/03/2012 0 None None

Chakrabarti

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

Ms. Parishi 12 17/08/2007 Female Daughter 21/03/2012 0 None None

Chakrabarti

Mrs. Rekha 39 25/12/1980 Female Spouse 21/03/2012 0 None None

Chakrabarti

(* -Pre existing Disease as disclosed by You / Insured Person or discovered by us during medical underwriting)

(# -Please refer clause 6.4 of the Policy terms &conditions)

Policy issuing office: Delhi, Consolidated Stamp Duty deposited as per the order of Government of National Capital Territory of Delhi.

GSTI No.: 29AAFCM7916H1Z4 SAC Code / Type of Service : 997133 / General Insurance Services

Max Bupa State Code: 29 Customer State Code / Customer GSTI No.: 29 /NA

Location: New Delhi Chief Operating Officer

Date: 16/03/2020 For and on behalf of Max Bupa Health Insurance Company Limited

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

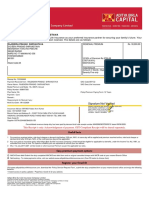

Premium Receipt

Dear MR. SHUGOTA CHAKRABARTI

FLAT NO 201 SHREEDEVI RESIDENCY

MUNINANJAPPA L/O T C PALYA MAIN ROAD

RAMMURTHY NAGAR

BENGALURU

KARNATAKA - 560016

We acknowledge the receipt of payment towards the premium of the following health insurance policy:

Policyholder's Name Mr. Shugota Chakrabarti Policy Number 30086876202008

Plan Opted for Heartbeat - Silver Plan Type Family Floater Base Sum Insured (Rs.) 3,00,000

Policy Commencement Date # 21/03/2020 Policy Expiry Date 20/03/2021

Premium Calculation:

(A) Premium (Rs.) – Base product 21,353.00

(B) Premium (Rs.) – Personal Accident cover 0.00

(C) Premium (Rs.) – Critical Illness cover 0.00

(D) Premium (Rs.) – Premium waiver 0.00

(E) Premium (Rs.) – Hospital Cash 0.00

(F) Premium (Rs.) – Enhanced Geographical Scope for International coverage 0.00

(G) Premium (Rs.) – e-consultation 0.00

Loading (Rs.) 0.00

Net Premium / Taxable value (Rs.) 21,353.00

Integrated Goods and Service Tax (18.00 %) 0.00

Central Goods and Service Tax (9.00 %) 1,921.77

State/UT Goods and Service Tax (9.00 %) 1,921.77

Gross Premium (Rs.) 25,197.00

#

Issuance of policy is subject to clearance of premium paid

Details of Persons Insured

Name of person Insured Age Gender Relationship

Mr. Shugota Chakrabarti 44 Male Self

Ms. Parishi Chakrabarti 12 Female Daughter

Mrs. Rekha Chakrabarti 39 Female Spouse

You may get tax benefits on up to Rs. 25,197.00. For the purpose of deduction under section 80D,the benefit shall be as per the provisions of

the Income Tax Act,1961 and any amendments made thereafter. For your eligibility and deductions, please refer to provisions of Income Tax

Act 1961 as modified and consult your tax consultant. In the event of non-realization of premium, tax benefits cannot be obtained against this

premium receipt.

Upon issuance of this receipt, all previously issued temporary receipts, if any, related to this policy are considered null and void.

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

GSTI No.: 29AAFCM7916H1Z4 SAC Code / Type of Service : 997133 / General Insurance Services

Max Bupa State Code: 29 Customer State Code / Customer GSTI No.: 29 /NA

Policy issuing office: Delhi, Consolidated Stamp Duty deposited as per the order of Government of National Capital Territory of Delhi.

Location: New Delhi Chief Operating Officer

Date: 16/03/2020 For and on behalf of Max Bupa Health Insurance Company Limited

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

Customer Information Sheet

Sl. No. Policy Clause

Title Description

Number

1 Product Name Heartbeat

2 What am I Base Coverage:

covered for • Hospital admission longer than 24 hrs 3.1

• Related medical expenses up to Sum Insured incurred up to 60 days prior to hospitalization 3.2

• Related medical expenses incurred up to Sum Insured within 90 days from date of discharge 3.3

• All procedures requiring less than 24 hours hospitalization, list of day care procedures per 3.4

Annexure III of Policy Document

• Domiciliary hospitalization covered up to Sum Insured 3.5

• Alternative treatment covered up to Sum Insured 3.6

• Living organ donor transplant covered up to Sum Insured 3.7

• Emergency Ambulance covered up to Rs. 2,000 per hospitalization (for hospitalization in non- 3.8

network hospitals) and up to Sum Insured (for hospitalization in network hospitals)

• Maternity benefit covers Reasonable Medical Expenses for delivery of a child & medically 3.9

necessary termination of pregnancy, where female Insured Person of age 18 years or above is

covered under Family First Policy; Or both Insured Person and his / her legally married spouse

are covered under Family Floater Policy, after a period of 24 months of continuous coverage

since the inception of the first Policy, with maternity as a benefit, with Us.

Medical Expenses for Pre and Post Hospitalization under Maternity Benefit will not be

available.

• New born baby will be covered as an insured person from birth till the end of policy year in 3.10

which the baby is born, subject to Maternity Benefits should be payable. Vaccination expenses

of the new born baby for the first Year, subject to addition of the new born baby in the policy

at renewal of the policy are also covered under this benefit.

• Health Check-up is covered post completion of 1st policy year as per plan and Sum Insured 3.11

chosen by You

• Refill benefit is covered up to 100% of Base Sum Insured in case the Sum Insured gets 3.12

exhausted during Policy Year

• Pharmacy and diagnostic services 3.13

• Loyalty additions through increase in Sum Insured by 10% of expiring Base Sum Insured in a 3.14

Policy Year, maximum up to 100% (50% in case of silver plan) of Base Sum Insured, irrespective

of claims status

• Expenses incurred by the Insured Person for Hospitalization (including Day Care Treatment) 3.15

due to condition caused by or associated with HIV / AIDS are covered up to a maximum of Rs.

50,000

• Emergency Assistance service are covered within India up to Sum Insured 3.16

• Mental disorders treatment covered up to Sum Insured (sub-limit applicable on few conditions 3.17

/ disorders)

Additional coverage applicable only for Platinum Plan:

• Coverage for Second Medical Opinion can be availed for planned surgery and specified illnesses 3.18

• Child Care benefits for specified vaccination expenses for Insured children until they have 3.19

completed 12 years are covered. Expenses for nutrition and growth consulting provided for

the child during a visit for such vaccination is also covered.

• Specified Illness Cover is covered if an Insured Person suffers a Specified Illness during the 3.20

Policy Period and while the Policy is in force. We will cover Reasonable and Customary

expenses for In-patient treatment and Hospital Accommodation as long as:

-- The symptoms of the Specified Illness first occur or manifest itself during the Policy Period

and after completion of 90 day from the inception of 1st Policy with us.

-- The Specified Illness is diagnosed by a Medical practitioner within India during the Policy

Period and after completion of 90 day from the inception of 1st Policy with us.

-- Medical treatment for the Specified Illness is taken outside India, but only within those

regions specified in the Schedule of Insurance Certificate.

V1, July 2019

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

-- The Specified Illnesses covered are as follows:

Cancer, Myocardial Infarction (Heart Attack), Coronary Artery Bypass Graft (CABG), Major

Organ Transplant, Stroke, Surgery of Aorta, Coronary Angioplasty, Primary Pulmonary

Arterial Hypertension & Brain Surgery.

• OPD Treatment and Diagnostic Services expenses are covered for medically necessary 3.21

consultation as an outpatient with a Medical Practitioner to assess the Insured Person’s

condition.

• Emergency Medical Evacuation: We will cover Emergency Medical Evacuation, outside India, 3.22

but within only those regions specified in the Policy Schedule.

• Emergency Hospitalization: We will cover Emergency Hospitalization if required immediately 3.23

after the emergency medical evacuation outside India, but within only those regions specified

in the Policy Schedule.

Optional Coverage:

• Personal Accident coverage against accidental death, permanent total and permanent partial 4.1

disability

• Critical Illness coverage for 20 major illnesses which includes cancer, first heart attack, open 4.2

chest CABG, etc.

• e-Consultation for unlimited tele / online medical consultations 4.3

• One time premium waiver benefit if the Policyholder (who should also be an Insured Person) 4.4

dies or is diagnosed with any of the specified illness as mentioned in Policy Document

• Hospital Cash benefit is paid as per the plan chosen for a maximum for 30 days per insured 4.5

person per policy year, provided that the Insured Person should have been Hospitalized for a

minimum period of 48 hours and In-patient Care Hospitalization should have been paid by Us.

• Enhanced Geographical Scope for Specified Illness, Emergency Medical Evacuation (outside 4.6

India) and Emergency Hospitalization (outside India) for extending cover to USA & Canada

(applicable under Platinum plan only)

3 What are the • Admission solely for the purpose of Physiotherapy, evaluation, investigations, diagnosis or 7.14

major observation services

exclusions in • Artificial life maintenance 7.3

the • Treatment for any condition / illness which requires hormone replacement therapy 7.13

policy • Circumcision unless necessary for the treatment of a disease or necessitated by an Accident 7.4

• Any form of AYUSH Treatment, except inpatient treatment taken under Ayurveda, Unani, 7.5

Siddha and Homeopathy

• Treatment for any Injury or Illness resulting directly or indirectly from nuclear, radiological 7.6

emissions, war or war like situations (whether war is declared or not), rebellion (act of armed

resistance to an established government or leader), acts of terrorism

• Screening, counseling or treatment related to external Congenital Anomaly 7.7

• Hospital accommodation when it is used solely or primarily for any services provided for the 7.8

purpose of Convalescence, Rehabilitation and Respite Care

• Cosmetic or Plastic Surgery 7.9

• Eyesight & Optical Services 7.11

• Experimental or Unproven Treatment 7.12

(Note: the above is a partial listing of the policy exclusions. Please refer to the policy clauses for

the full listing)

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

4 Waiting • Initial waiting Period: 30 days for all illness (not applicable on renewal or for accidents) 6.2

period • Specific Waiting periods: For all Insured Persons who are above 45 years of age as on the date 6.3

of inception of the first Policy with us , 24 months for medical conditions and / or Surgical

Procedures as specified in policy clause number 6.3, unless the condition is directly caused

due to Cancer or by an Accident (covered from day 1)

• Pre-existing diseases: Covered after 24 months (48 months in case of silver plan) of continuous 6.1

coverage

The aforementioned Waiting Periods shall not apply to Health Check-up, Pharmacy and Diagnostic

Services, Personal Accident Cover, Critical Illness Cover, e-Consultation and Premium Waiver

• For critical illness cover, 90 days initial waiting period along with Pre-existing Disease waiting 4.2

period of 48 months and Survival Period exclusion of 30 days will apply for all conditions

• Mental disorder treatment will have a waiting period of 36 months since inception of the 3.17

policy and subject to continuous renewal.

• Cases related to HIV/AIDS will be subject to a waiting period of 48 months from the inception 3.15

of the policy with us.

• Specified Illness cover will have an initial waiting period of 90 days from the date of inception 3.20

of cover with us.

5 Payment basis • Cashless treatment or Reimbursement of covered expenses up to specified limits 8.2

• Fixed amount on the occurrence of a covered event under Personal Accident Cover, Critical 4.1, 4.2

Illness Cover and Hospital Cash & 4.5

6 Loss Sharing In case of a claim, this policy will cover up to the amount / limits mentioned below:

• Sub-limits*

-- Room rent sub limit applicable as per plan chosen by you

-- Ambulance cover for Rs.2,000 per hospitalization (for non network hospital) and up to

Sum Insured (for network hospitals)

-- Maternity sub limit applicable as per plan and Sum Insured chosen by you

-- Health Check up limits per insured person as per plan and sum insured chosen by you

-- Treatment for any condition caused or associated with HIV/AIDS will have a sublimit of

Rs. 50,000 per policy year

-- Mental disorders treatment - sub-limit as per the plan chosen by you is applicable on

specific mental conditions / disorders on a cumulative basis as specified in section 3.17 of

policy terms and conditions Treatment

-- OPD treatment is covered up to a sub limit as per plan chosen by You

• Co-Payment

-- If You select Zone 2 (cities other than Mumbai (including Navi Mumbai & Thane), Delhi 10.14

NCR, Kolkata & Gujarat State), then a zone-wise co-payment of 20% will apply for

treatment in Mumbai (including Navi Mumbai & Thane), Delhi NCR, Kolkata & Gujarat

State. (Not applicable to platinum plan)

-- Additional optional co-payment of 10% or 20% can be chosen by You. 5.1

• Annual Aggregate Deductible (not available for new business)

-- Options of Rs 1 Lac, 2 Lac and 3 Lac can be availed along with premium Discount. Available 5.2

only for Silver plan for Family Floater and Individual variants.

*Kindly refer to the Product Benefit Table in Policy Document to understand the sub limits

applicable as per the plan and sum insured chosen by you.

7 Renewal • Your policy is ordinarily renewable for life provided the due premium is paid on time 10.4

Conditions • The Renewal premium is payable on or before the due date and in any circumstances before

the expiry of Grace Period of 30 days

• Renewal premium will alter based on individual Age. The reference of Age for calculating the

premium for Family Floater Policies shall be the Age of the eldest Insured Person

• Renewal premium will not alter based on individual claim experience. Renewal premium rates

may be changed provided that such changes are approved by IRDAI and in accordance with

the IRDAI’s rules and regulations as applicable from time to time

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

8 Renewal • Loyalty Additions with increase of 10% of expiring Base Sum Insured in a Policy Year; maximum 3.14

Benefits up to 100% (50% in case of silver plan) of Base Sum Insured

• Health Checkup: If the Policy is Renewed with Us without a break or if the Policy continues to 3.11

be in force for the 2nd Policy Year in the 2 year Policy Period (if applicable), then the Insured

Person may avail a health check-up as per the plan eligibility.

• OPD Treatment and Diagnostic Services (For Platinum Policyholders only): If the Policy is 3.21 (e)

renewed without any break and there is a unutilized amount in a Policy Year, 80% of this

amount can be carried forward to the immediately succeeding Policy Year provided the total

amount (including the unutilized amount available under this benefit) shall at no time exceed

2.5 times the amount of the entitlement under the plan

9 Cancellation This policy would be cancelled, and no claim or refund would be due to you if: 10.2

• you have not correctly disclosed details about current and past health status OR

• you have otherwise encouraged or participated in any fraudulent claim under the policy.

10 Claims For Cashless Service: 8.0

• Hospital Network details can be obtained from www.maxbupa.com

• We must be contacted to pre-authorize Cashless Facility for planned treatment at least 72

hours prior to the proposed treatment.

• If the Insured Person has been Hospitalized in an Emergency, We must be contacted to pre-

authorize Cashless Facility within 48 hours of the Insured Person’s Hospitalization or before

discharge from the Hospital, whichever is earlier.

For Reimbursement of Claim:

• We shall be provided with the necessary information and documentation in respect of all

claims at Your/Insured Person’s expense within 30 days of the Insured Event giving rise to

a claim or within 30 days from the date of occurrence of an Insured Event or completion of

Survival Period (in case of Critical Illness Cover).

11 Policy • In case of any query or complaint/grievance, You/the Insured Person may approach Our office 10.17

Servicing/ at the following address:

Grievances/ Customer Services Department

Complaints Max Bupa Health Insurance Company Limited

B-1/I-2, Mohan Cooperative Industrial Estate

Mathura Road, New Delhi-110044

Customer Helpline No: 1860-500-8888

Fax No.: 011-30902010

Email ID: customercare@maxbupa.com

Senior citizens may write to us at: seniorcitizensupport@maxbupa.com

• IRDAI/(IGMS/Call Centre): Email ID: complaints@irdai.gov.in

• Ombudsman (Refer Annexure 1 of policy document for List of Insurance Ombudsmen)

12 Insured’s • Free Look - If you do not agree to the terms and conditions of the Policy, you may cancel the 10.1

Rights Policy, stating your reasons within 15 days (30 days if the Policy has been sold through distance

marketing) of receipt of the Policy document provided no claims have been made under any

benefits. The free look provision is not applicable at the time of Renewal of the Policy.

• Implied renewability - Your policy is ordinarily renewable for life provided the due premium 10.4

is paid on time

• Migration and Portability - You can port your policy at the time of renewal according to the 9.0

IRDAI guidelines. You can contact Customer Service Department (phone no. and email ID

provided above) for migration and portability.

• Increase in Sum Insured during the Policy term - You may opt for enhancement of Sum Insured 10.4.g

at the time of Renewal, subject to underwriting. You can contact Customer Service Department

(phone no. and email ID provided above) for increasing the Sum Insured.

• Turn Around Time (TAT) for issue of Pre-Auth – 4 hours

• Turn Around Time (TAT) for settlement of Reimbursement - We shall settle or repudiate a claim 8.4.b

within 30 days of the receipt of the last necessary information and documentation

13 Insured’s • Please disclose all pre-existing disease/s or condition/s before buying a policy. Non-disclosure 10.9

Obligations may result in claim not being paid.

• Disclosure of material information at the time of Renewal such as change in occupation, ad- 10.4.d

dress etc.

Legal Disclaimer Note:

The information must be read in conjunction with the product brochure and policy document. In case of any conflict between the CIS and the

policy document, the terms and conditions mentioned in the policy document shall prevail.

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

Heartbeat

Policy Terms & Conditions

1. Preamble reduce the Sum Insured for the Policy Year in which the Insured

This ‘Heartbeat’ policy is a contract of insurance between You and Event in relation to which the claim is made has been occurred,

Us which is subject to payment of full premium in advance and the unless otherwise specified in the respective section. Thereafter

terms, conditions and exclusions of this Policy. This Policy has been only the balance Sum Insured after payment of claim amounts

issued on the basis of the Disclosure to Information Norm, including admitted shall be available for future claims arising in that Policy

the information provided by You in the Proposal Form and / or the Year.

Information Summary Sheet.

3.1 Inpatient Care

Please inform Us immediately of any change in the address or any What is covered:

other changes affecting You or any Insured Person which would impact We will indemnify the Medical Expenses incurred for one or more of

the benefits, terms and conditions under this Policy. the following due to the Insured Person’s Hospitalization during the

Policy Period following an Illness or Injury:

In addition, please note the list of exclusions is set out in Section 7 of a. Room Rent: Room boarding and nursing charges during

this Policy. Hospitalization as charged by the Hospital where the Insured

Person availed medical treatment;

2. Definitions & Interpretation b. Medical Practitioners’ fees, excluding any charges or fees for

For the purposes of interpretation and understanding of this Policy, Standby Services;

We have defined, in Section 11, some of the important words used in c. Investigative tests or diagnostic procedures directly related to the

the Policy which will have the special meaning accorded to these terms Insured Event which led to the current Hospitalization;

for the purposes of this Policy. For the remaining language and words d. Medicines, drugs as prescribed by the treating Medical

used, the usual meaning as described in standard English language Practitioner related to the Insured Event that led to the current

dictionaries shall apply. The words and expressions defined in the Hospitalization;

Insurance Act 1938, IRDA Act 1999, regulations notified by the IRDAI e. Intravenous fluids, blood transfusion, injection administration

and circulars and guidelines issued by the IRDAI, together with their charges and /or allowable consumables;

amendment shall carry the meanings given therein. f. Operation theatre charges;

g. The cost of prosthetics and other devices or equipment, if

Note: Where the context permits, the singular will be deemed to implanted internally during Surgery;

include the plural, one gender shall be deemed to include the other h. Intensive Care Unit Charges.

genders and references to any statute shall be deemed to refer to any

replacement or amendment of that statute. Conditions - The above coverage is subject to fulfillment of following

conditions:

3. Benefits available under the Policy a. The Hospitalization is for Medically Necessary Treatment and

The benefits available under this Policy are described below. advised in writing by a Medical Practitioner.

a. The Policy covers Reasonable and Customary Charges incurred b. If the Insured Person is admitted in a Hospital room where the

towards medical treatment taken by the Insured Person during room category opted or Room Rent incurred is higher than the

the Policy Period for an Illness, Injury or condition as described in eligibility as specified in the Policy Schedule, then We shall be

the sections below and contracted or sustained during the Policy liable to pay only a pro-rated portion of the total Associated

Period. The benefits listed in the sections below will be payable Medical Expenses (including surcharge or taxes thereon) as per

subject to the terms, conditions and exclusions of this Policy and the following formula:

the availability of the Sum Insured and any sub-limits for the (Eligible Room Rent limit / Room Rent actually incurred) * total

benefit as maybe specified in the Policy Schedule. Associated Medical Expenses

b. All the benefits (including optional benefits) which are available

under the Policy along with the respective limits / amounts Associated Medical Expenses shall include Room Rent, nursing

applicable based on the Sum Insured have been summarized in charges for Hospitalization as an Inpatient excluding private

the Product Benefit Table in Annexure II. nursing charges, Medical Practitioners’ fees excluding any charges

c. All claims under the Policy must be made in accordance with the or fees for Standby Services, investigation and diagnostics

process defined under Section 8 (Claim Process & Requirements). procedures directly related to the current admission, operation

d. All claims paid under any benefit except for those admitted theatre charges, ICU Charges.

under Section 3.11 (Health Check-up), Section 3.13 (Pharmacy c. We will pay the visiting fees or consultation charges for any

and diagnostic services), Section 3.16 (Emergency Assistance Medical Practitioner visiting the Insured Person only if:

Services except Medical Evacuation), Section 3.18 (Second i. The Medical Practitioner’s treatment or advice has been

Medical Opinion), Section 4.1 (Personal Accident Cover), Section specifically sought by the Hospital; and

4.2 (Critical Illness Cover), Section 4.3 (e-Consultation), Section ii. The visiting fees or consultation charges are included in the

4.4 (Premium Waiver) and Section 4.5 (Hospital Cash) shall Hospital’s bill

V1, July 2019

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

3.2 Pre-hospitalization Medical Expenses e. Any claim admitted under this Section 3.3 shall reduce the

What is covered: Sum Insured for the Policy Year in which In-patient Care or Day

We will indemnify on Reimbursement basis only, the Insured Person’s Care Treatment or Domiciliary Hospitalization or Alternative

Pre-hospitalization Medical Expenses incurred in respect of an Illness Treatments claim has been incurred.

or Injury.

Sub-limit:

Conditions - The above coverage is subject to fulfilment of following a. We will pay Post-hospitalization Medical Expenses only for up to 90

conditions: days immediately following the Insured Person’s discharge from

a. We have accepted a claim under Section 3.1 (Inpatient Care) Hospital or Day Care Treatment or Domiciliary Hospitalization or

or Section 3.4 (Day Care Treatment) or Section 3.5 (Domiciliary Alternative Treatments.

Hospitalization) or Section 3.6 (Alternative Treatments).

b. Pre-hospitalization Medical Expenses are incurred for the same 3.4 Day Care Treatment

condition for which We have accepted the Inpatient Care or Day What is covered:

Care Treatment or Domiciliary Hospitalization or Alternative We will indemnify the Medical Expenses incurred on the Insured

Treatments claim. Person’s Day Care Treatment during the Policy Period following an

c. The expenses are incurred after the inception of the First Policy Illness or Injury. List of Day Care Treatments which are covered under

with Us. If any portion of these expenses is incurred before the the Policy are provided in Annexure III.

inception of the First Policy with Us, then We shall be liable only

for those expenses incurred after the commencement date of the Conditions - The above coverage is subject to fulfilment of following

First Policy, irrespective of the initial waiting period. conditions:

d. Pre-hospitalization Medical Expenses incurred on physiotherapy a. The Day Care Treatment is advised in writing by a Medical

will also be payable provided that such physiotherapy is prescribed Practitioner as Medically Necessary Treatment.

in writing by the treating Medical Practitioner as Medically b. Only those Day Care Treatments are covered that are mentioned

Necessary Treatment and is directly related to the same condition under list of Day Care Treatments under Annexure III.

that led to Hospitalization. c. If We have accepted a claim under this benefit, We will also

e. Any claim admitted under this Section 3.2 shall reduce the indemnify the Insured Person’s Pre-hospitalization Medical

Sum Insured for the Policy Year in which In-patient Care or Day Expenses and Post-hospitalization Medical Expenses in

Care Treatment or Domiciliary Hospitalization or Alternative accordance with Sections 3.2 and 3.3 above.

Treatments claim has been incurred.

What is not covered:

Sub-limit: OPD Treatment and Diagnostic Services costs are not covered under

a. We will pay above mentioned Pre-hospitalization Medical this benefit.

Expenses only for period up to 60 days immediately preceding

the Insured Person’s admission for Inpatient Care or Day 3.5 Domiciliary Hospitalization

Care Treatment or Domiciliary Hospitalization or Alternative What is Covered:

Treatments. We will indemnify on Reimbursement basis only, the Medical Expenses

incurred for the Insured Person’s Domiciliary Hospitalization during

3.3 Post-hospitalization Medical Expenses the Policy Period following an Illness or Injury.

What is covered:

We will indemnify on Reimbursement basis only, the Insured Person’s Conditions - The above coverage is subject to fulfilment of following

Post-hospitalization Medical Expenses incurred following an Illness or conditions:

Injury. a. The Domiciliary Hospitalization continues for at least 3

consecutive days in which case We will make payment under this

Conditions - The above coverage is subject to fulfilment of following benefit in respect of Medical Expenses incurred from the first day

conditions: of Domiciliary Hospitalization;

a. We have accepted a claim under Section 3.1 (Inpatient Care) b. The treating Medical Practitioner confirms in writing that the

or Section 3.4 (Day Care Treatment) or Section 3.5 (Domiciliary Insured Person’s condition was such that the Insured Person could

Hospitalization) or Section 3.6 (Alternative Treatments). not be transferred to a Hospital OR the Insured Person satisfies Us

b. Post-hospitalization Medical Expenses are incurred for the same that a Hospital bed was unavailable.

condition for which We have accepted the Inpatient Care or Day c. If We have accepted a claim under this benefit, We will also

Care Treatment or Domiciliary Hospitalization or Alternative indemnify the Insured Person’s Pre-hospitalization Medical

Treatments claim. Expenses and Post-hospitalization Medical Expenses in

c. The expenses incurred shall be as advised in writing by the accordance with Sections 3.2 and 3.3 above.

treating Medical Practitioner.

d. Post-hospitalization Medical Expenses incurred on physiotherapy 3.6 Alternative Treatments

will also be payable provided that such physiotherapy is prescribed What is covered:

in writing by the treating Medical Practitioner as Medically We will indemnify the Medical Expenses incurred on the Insured

Necessary Treatment and is directly related to the same condition Person’s Hospitalization for Inpatient Care during the Policy Period on

that led to Hospitalization. treatment taken under Ayurveda, Unani, Siddha and Homeopathy.

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

Conditions - The above coverage is subject to fulfilment of following Person by road Ambulance to a Hospital for treatment in an Emergency

conditions: following an Illness or Injury.

a. The treatment should be taken in: Conditions - The above coverage is subject to fulfilment of following

i. A Government Hospital or in any institute recognized by conditions:

government and/or accredited by Quality Council of India/ a. The medical condition of the Insured Person requires immediate

National Accreditation Board on Health. ambulance services from the place where the Insured Person is

ii. Teaching Hospitals of AYUSH colleges recognized by Central injured or is ill to a Hospital where appropriate medical treatment

Council of Indian Medicine (CCIM) and Central Council of can be obtained or;

Homeopathy (CCH) b. The medical condition of the Insured Person requires immediate

iii. AYUSH Hospitals having registration with a Government ambulance services from the existing Hospital to another Hospital

authority under appropriate Act in the State / UT and with advanced facilities as advised by the treating Medical

complies with the following minimum criteria: Practitioner for management of the current Hospitalization.

1) Has at least fifteen in-patient beds; c. This benefit is available for only one transfer per Hospitalization.

2) Has minimum five qualified and registered AYUSH d. The ambulance service shall be offered by a healthcare or

doctors; ambulance Service Provider.

3) Has qualified staff under its employment round the clock; e. We have accepted a claim under Section 3.1 (Inpatient Care)

4) Has dedicated AYUSH therapy sections; above.

5) Maintains daily records of patients and makes these f. We will cover expenses up to the amount specified in Your Policy

accessible to the insurance company’s authorized Schedule.

personnel.

b. Pre-hospitalization Medical Expenses incurred for up to 60 days What is not covered:

immediately preceding the Insured Person’s admission and Post- The Insured Person’s transfer to any Hospital or diagnostic centre for

hospitalization Medical Expenses incurred for up to 90 days evaluation purposes only.

immediately following the Insured Person’s discharge will also be

indemnified under this benefit in accordance with Sections 3.2 3.9 Maternity Benefit

and 3.3 above, provided that these Medical Expenses relate only What is covered:

to Alternative Treatments and not Allopathy. We will indemnify the Maternity Expenses incurred during the Policy

c. Section 7.5 of the Permanent Exclusions (other than for Yoga) Period.

shall not apply to the extent this benefit is applicable.

Conditions - The above coverage is subject to fulfilment of following

3.7 Living Organ Donor Transplant conditions:

What is covered: a. This benefit is available only if:

We will indemnify the Medical Expenses incurred for a living organ i. The female Insured Person of Age 18 years or above is covered

donor’s treatment as an Inpatient for the harvesting of the organ under a Family First Policy; or

donated. ii. Both the Insured Person and his / her legally married spouse

are covered under a Family Floater Policy.

Conditions - The above coverage is subject to fulfilment of following b. This Benefit cannot be availed under an Individual Policy.

conditions: c. The female Insured Person in respect of whom a claim for

a. The donation conforms to the Transplantation of Human Organs Maternity Benefits is made must have been covered as an Insured

Act 1994 and any amendments thereafter and the organ is for the Person for a period of 24 months of continuous coverage since

use of the Insured Person. the inception of the First Policy, with maternity as a benefit, with

b. The organ transplant is certified in writing by a Medical Practitioner Us.

as Medically Necessary Treatment for the Insured Person. d. For the purposes of this benefit, We shall consider any eligibility

c. We have accepted the recipient Insured Person’s claim under period for maternity benefits served by the Insured Person under

Section 3.1 (Inpatient Care). any previous policy with Us.

e. The Maternity Expenses incurred are Reasonable and Customary

What is not covered: Charges.

a. Stem cell donation whether or not it is Medically Necessary f. The Maternity Benefit may be claimed under the Policy in respect

Treatment except for Bone Marrow Transplant. of eligible Insured Person(s) only twice during the lifetime of the

b. Pre-hospitalization Medical Expenses or Post-hospitalization Policy including any Renewal thereafter for the delivery of a child

Medical Expenses of the organ donor. or Medically Necessary and lawful termination of pregnancy up

c. Screening or any other Medical Expenses related to the organ to maximum 2 pregnancies or terminations.

donor, which are not incurred during the duration of Insured g. Any treatment related to the complication of pregnancy or

Person’s Hospitalization for organ transplant. termination will be treated within the maternity sub limits.

d. Transplant of any organ/tissue where the transplant is Unproven/ h. On Renewal or incase of internal Portability, if an enhanced sub-

Experimental Treatment or investigational in nature. limit is applicable under this benefit, 24 months of continuous

e. Expenses related to organ transportation or preservation. coverage (as per Section 3.9.c) would apply afresh to the extent

f. Any other medical treatment or complication in respect of the of the increased benefit amount.

donor, which is directly or indirectly consequence to harvesting. i. Clause 7.18 & 7.24 under Permanent Exclusions is superseded to

the extent covered under this Benefit.

3.8 Emergency Ambulance

What is not covered:

What is covered

a. Expenses incurred in respect of the harvesting and storage of

We will indemnify the costs incurred, on transportation of the Insured

stem cells for any purposes whatsoever;

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

b. Medical Expenses for ectopic pregnancy will be covered under the 3.11 Health Check-up

Section 3.1 (Inpatient Care) and shall not fall under the Maternity What is covered:

Benefit. The Insured Person may avail a health check-up, only for Diagnostic

c. Sections 3.2 (Pre-hospitalization Medical Expenses) and Section Tests, up to a sub-limit as per the Plan applicable to the Insured Person

3.3 (Post- hospitalization Medical Expenses) are not payable as specified in the Product Benefits Table.

under this benefit.

d. Any expenses to manage complications arising from or relating to Note – In case of silver plan, a pre-defined set of tests can be availed by

pregnancy or termination of pregnancy within 24 months from the Insured Person. A list of eligible tests is attached in Annexure – IV.

the inception of the First Policy with Us.

e. Pre-natal and post-natal Medical Expenses. Conditions - The above coverage is subject to fulfilment of following

conditions:

3.10 New Born Baby a. Health check-up will be available on Cashless Facility basis only

What is covered: and will be arranged at Our empanelled Service Providers.

We will cover the Medical Expenses incurred towards the medical

treatment of the Insured Person’s New Born Baby from the date What is not covered:

of delivery until the expiry of the Policy Year, subject to continuous

Any unutilized test or amount cannot be carried forward to the next

coverage of 24 months of that Insured Person since the inception of

Policy Year.

the First Policy which offers Maternity Benefit with Us, without the

requirement of payment of any additional premium

3.12 Re-fill Benefit

Conditions - The above coverage is subject to fulfilment of following What is covered:

conditions: If the Base Sum Insured and increased Sum Insured under Loyalty

a. All the terms and conditions mentioned in Section 3.9 (Maternity Additions (Section 3.14) (if any) has been partially or completely

Benefit) shall apply to this benefit as well. exhausted due to claims paid or accepted as payable for any Illness /

b. The New Born Baby should be added as an endorsement within Injury during the Policy Year under Section 3.1 or Section 3.4 or Section

90 days from date of delivery 3.5 or Section 3.6 or Section 3.7, then We will provide an additional re-

c. We will indemnify the Reasonable and Customary Charges for fill amount of maximum up to 100% of the Base Sum Insured.

Medical Expenses incurred for the below vaccination of the New

Born Baby till the New Born Baby completes one year from his/ Conditions - The above coverage is subject to fulfilment of following

her birth. conditions:

a. The re-fill amount shall be utilized only for subsequent claims

Time Vaccination to be done (Age) Frequency under Section 3.1 (In-patient Care) or Section 3.4 (Day Care

interval Treatment) or Section 3.5 (Domiciliary Hospitalization) or Section

3.6 (Alternative Treatments) or Section 3.7 (Living Organ Donor

0-3 BCG (From birth to 1 week) 1 Transplant) arising in that Policy Year for any or all Insured

months OPV (1 week) + IPV1 (6 weeks,10 weeks) 3 Person(s).

DPT (6 & 10 weeks) 2 b. We will provide a re-fill amount only once in a Policy Year.

c. For Family Floater Policies, the re-fill amount will be available on a

Hepatitis-B (0 & 6 weeks) 2

floater basis to all Insured Persons in that Policy Year.

Haemophilus influenzae type B (Hib) (6 & 2

10 Weeks) What is not covered:

Rota (6 & 10 Weeks) 2 a. If the re-fill amount is not utilized in whole or in part in a Policy

3-6 OPV (6 months) + IPV (14 weeks) 2 Year, it cannot be carried forward to any extent in any subsequent

months Policy Year.

DPT (14 weeks) 1

b. This benefit is not available under Family First Policy.

Hepatitis-B (6 months) 1

Haemophilus influenzae type B (Hib) (14 1 3.13 Pharmacy and Diagnostic Services

weeks) What is covered:

Rota (14 weeks) 1 You may purchase medicines or avail diagnostic services from Our

9 MMR ( 9 months) 1 Service Provider through Our website or mobile application.

months OPV (9 months) 1 Conditions - The above coverage is subject to fulfilment of following

12 months Typhoid (12 months) 1 conditions:

Hepatitis A (12 months) 1 a. The cost for the purchase of the medicines or for availing

diagnostic services shall be borne by You.

d. If the Policy expires before the New Born Baby has completed one b. Further it is made clear that purchase of medicines from Our

year, then Medical Expenses for balance vaccination shall not be Service Provider is Your absolute discretion and choice.

covered and will be covered only if the Policy is Renewed with the

New Born Baby as an Insured Person and not otherwise. 3.14 Loyalty Additions

e. On the expiry of the Policy Year We will cover the baby as an What is covered:

Insured Person under the Policy on request of the Proposer, a. For an Individual Policy or Family Floater Policy, if the Policy is

subject to Our underwriting policy and payment of the applicable Renewed with Us without a break or if the Policy continues to

additional premium. be in force for the 2nd Policy Year in the 2 year Policy Period

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

respectively (if applicable), We will provide Loyalty Additions reduction in the accumulated Cumulative Bonus shall be limited to

in the form of Cumulative Bonus by increasing the Sum Insured 50% of the accumulated Cumulative Bonus. Post reduction in the

applicable under the Policy by 10% of the Base Sum Insured of Base Sum Insured and the accumulated Cumulative Bonus, if the

the immediately preceding Policy Year subject to a maximum of accumulated Cumulative Bonus is equal to or more than 100% of

a percentage as specified in the Policy Schedule. There will be the revised Base Sum Insured, then there will be no further increase

no change in the sub-limits applicable to various benefits due to in the accumulated Cumulative Bonus upon Renewal of such Policy.

increase in Sum Insured under this benefit. h. In case the Base Sum Insured under the Policy is increased at the

b. For a Family First Policy, if the Policy is Renewed with Us without time of Renewal, the applicable accumulated Cumulative Bonus

a break or if the Policy continues to be in force for the 2nd Policy shall also be increased in proportion to the Base Sum Insured. The

Year in the 2 year Policy Period respectively (if applicable), We maximum increase in the accumulated Cumulative Bonus shall be

will provide Loyalty Additions in the form of Cumulative Bonus by limited to 50% of the accumulated Cumulative Bonus. Post increase

increasing the Sum Insured applicable under the Policy by 10% of in the Base Sum Insured and the accumulated Cumulative Bonus, if

the Base Sum Insured of the immediately preceding Policy Year the accumulated Cumulative Bonus is equal to or more than 100%

of each individual Insured Person only subject to a maximum of a of the revised Base Sum Insured, then there will be no further

percentage as specified in the Policy Schedule. The increase shall increase in the accumulated Cumulative Bonus upon Renewal of

not apply to the Floater Sum Insured stated in the Policy Schedule such Policy.

as applicable under the Policy. There will be no change in the sub- i. This benefit is not applicable for Health Check-up, Pharmacy &

limits applicable to any benefit due to increase in Sum Insured diagnostic services, Emergency assistance services, Second Medical

under this benefit. Opinion, Child care benefits and any of the optional benefits (if

opted for). Enhancement of Sum Insured due to Loyalty Additions

Conditions - The above coverage is subject to fulfilment of following benefit cannot be utilized for the aforementioned benefits.

conditions:

a. If the Insured Person in the expiring Policy is covered under an 3.15 HIV / AIDS

Individual Policy and has an accumulated Cumulative Bonus in What is covered:

the expiring Policy under this benefit, and such expiring Policy is We will indemnify the expenses incurred by the Insured Person for

Renewed with Us on a Family Floater Policy, then We will provide Hospitalization (including Day Care Treatment) due to condition

the credit for the accumulated Cumulative Bonus to the Family caused by or associated with HIV / AIDS up to the limit as specified in

Floater Policy. Your Policy Schedule.

b. If the Insured Person in the expiring Policy is covered under an

Individual Policy and has an accumulated Cumulative Bonus in Conditions - The above coverage is subject to fulfilment of following

the expiring Policy under this benefit, and such expiring Policy is conditions:

Renewed with Us on a Family First Policy, then the accumulated a. The Hospitalization or Day Care Treatment is Medically Necessary

Cumulative Bonus to be carried forward for credit in the Renewing and the Illness is the outcome of HIV / AIDS. This needs to be

Policy would be the accumulated Cumulative Bonus for that Insured prescribed in writing by a registered Medical Practitioner.

Person only. b. The coverage under this benefit is provided for opportunistic

c. If the Insured Persons in the expiring Policy are covered under a infections which are caused due to low immunity status in HIV

Family First Policy and have an accumulated Cumulative Bonus for / AIDS resulting in acute infections which may be bacterial, viral,

each Insured Person in the expiring Policy under this benefit, and fungal or parasitic.

such expiring Policy is Renewed with Us on a Family Floater Policy c. The patient should be a declared HIV positive.

with same or higher Base Sum Insured, then the accumulated d. This benefit is provided subject to a Waiting Period of 48 months

Cumulative Bonus to be carried forward for credit in the Renewing from inception of the cover with Us, with HIV / AIDS covered as a

Policy would be the least of the accumulated Cumulative Bonus benefit, for the respective Insured Person.

amongst all the Insured Persons. e. Pre-hospitalization Medical Expenses incurred for up to 60 days,

d. If the Insured Persons in the expiring Policy are covered under a if falling within the Policy Period, immediately preceding the

Family First Policy and have an accumulated Cumulative Bonus for Insured Person’s admission and Post-hospitalization Medical

each Insured Person in the expiring Policy under this benefit, and Expenses incurred for up to 90 days, if falling within the Policy

such expiring Policy is Renewed with Us on an Individual Policy with Period, immediately following the Insured Person’s discharge

same or higher Base Sum Insured, then the accumulated Cumulative will also be indemnified under this benefit as per Section 3.2 &

Bonus to be carried forward for credit in the Renewing Policy would Section 3.3 respectively.

be the accumulated Cumulative Bonus for that Insured Person.

e. If the Insured Persons in the expiring Policy are covered on a Family What is not covered:

a. Chronic health conditions including ischemic heart disease,

Floater Policy and such Insured Persons Renew their expiring Policy

chronic liver disease, chronic kidney disease, cerebro-vascular

with Us by splitting the Floater Sum Insured stated in the Policy

disease/ stroke, bronchial asthma and neoplasms which are not

Schedule in to two or more floater / individual / Family First Policy,

directly related to the patient’s immunity status would not be

then We will provide the credit of the accumulated Cumulative

covered under this benefit.

Bonus to the split Policy reduced proportionately. b. Lifestyle diseases like diabetes, hypertension, heart diseases and

f. If the Insured Persons covered on a Family Floater Policy are reduced dyslipidemia which are not related to HIV / AIDS would not be

at the time of Renewal, the applicable accumulated Cumulative covered under this benefit.

Bonus shall also be reduced proportionately.

g. In case the Base Sum Insured under the Policy is reduced at the time Sub-limit:

of Renewal, the applicable accumulated Cumulative Bonus shall also a. This benefit is covered up to a limit of Rs. 50,000.

be reduced in proportion to the Base Sum Insured. The maximum b. Pre-hospitalization and Post-hospitalization Medical Expenses

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

are also covered within the overall benefit sub-limit as specified hundred and fifty) kilometers or more away from the residential

above in point (a). address as mentioned in the Policy Schedule, and the travel is for

less than 90(ninety) days period.

3.16 Emergency Assistance Services

What is covered: What is not covered:

This Policy provides a host of value added Emergency Medical a. No claims for Reimbursement of expenses incurred for services

Assistance and Emergency personal services as described below, on arranged by Insured/Insured Person(s) will be entertained as the

Cashless Facility basis. coverage under this section 3.16 are on Cashless Facility basis

only.

a. Medical referral: Insured Person(s) will have tele-access to b. Emergency assistance service will not be provided in the following

an operations center of Our Service Provider, who with their instances:

multilingual staff on duty 24(twenty-four) hours a day, 365(three i. Travel undertaken specifically for securing medical treatment

hundred and sixty-five) days a year will provide reference of ii. Services sought outside India.

doctors in the vicinity where the Insured Person is located for iii. If Emergency is a result of injuries resulting from participation

medical consultations. This medical consultation is only facilitated in acts of war or insurrection

by Us / Our Service Provider and is independent judgment of iv. Commission of unlawful act(s).

medical consultant. We do not assume any liability and shall not v. Attempt at suicide /self-inflicted injuries.

be deemed to assume any liability towards any loss or damage vi. Incidents involving the use of drugs, unless prescribed by a

arising out of or in relation to any opinion, advice, prescription, physician

actual or alleged errors, omissions and representations made by vii. Transfer of the insured person from one medical facility to

the professional giving medical consultant. another medical facility of similar capabilities and providing a

b. Emergency medical evacuation: When an adequate medical similar level of care

facility is not available proximate to the Insured Person, as

determined by the Insured Person’s attending physician and c. We / Our Service Provider will not evacuate or repatriate an

agreed by Us / Our Service Provider, We/Our Service Provider insured person in the following instances:

will arrange and pay for ambulance services under appropriate i. Without medical authorization from attending physician

medical supervision, by an appropriate mode of transport as ii. With mild lesions, simple injuries such as sprains, simple

decided by Us / Our Service Provider’s consulting physician fractures, or mild sickness or similar such conditions which

and patient’s attending physician to the nearest medical facility can be treated by local doctors and do not prevent Insured

capable of providing the required care. Person(s) from continuing your trip or returning home

c. Medical repatriation: We / Our Service Provider will arrange and as determined by Us / Our Service Provider’s consulting

pay for transportation under medical supervision to the Insured physician and the Insured Person’s attending physician

Person’s residence or to a medical or rehabilitation facility near the iii. If the Insured Person is pregnant and beyond the end of

Insured Person’s residence (as mentioned in the Policy Schedule) the 28th week and with respect to the child born from the

when the Insured Person’s attending physician determines that pregnancy, We / Our Service Provider shall not evacuate or

transportation is medically necessary and is agreed by Us / Our repatriate the Insured Person and the child who was born

Service Provider, at such time as the Insured Person is medically while the Insured Person was traveling beyond the 28th week

cleared for travel by Us / Our Service Provider’s consulting iv. With mental or nervous disorders unless hospitalized

physician and Insured Person’s attending physician.

d. Compassionate visit: When an Insured Person will be hospitalized d. Specific exclusions:

for more than seven (7) consecutive days and has travelled i. Trips exceeding 90(ninety) days from declared residence.

without a companion or doesn’t have a companion by his / her

side, We / Our Service Provider will arrange and pay for travel of While assistance services are available all over India, transportation

a family member or personal friend to visit such Insured Person response time is directly related to the location / jurisdiction where an

by providing an appropriate means of transportation via economy event occurs. We / Our Service Provider is not responsible for failing

carrier transportation as determined by Us / Our Service Provider. to provide services or for delays in the delivery of services caused

The family member or the personal friend is responsible to meet by reasons beyond Our reasonable control, including without any

all travel document requirements, as may be applicable. limitation, strike, road traffic, the weather conditions, availability and

e. Care and/or transportation of minor children: One-way economy accessibility of airports, flight conditions, availability of hyperbaric

common carrier transportation, with attendants if required, will chambers, pandemics and endemics, communications systems, absence

be provided to the place of residence of minor child(ren) when of proper travel documents or where rendering of service is limited or

they are left unattended as a result of medical emergency or prohibited by local law, edict or regulation. Our / Our Service Provider’s

death of an Insured person. performance of any obligation here in this section 3.16 shall be waived

f. Return of mortal remains: In the event of death of Insured Person, / excused if such failure to perform is caused by an event, contingency,

We/Our Service Provider will arrange and pay for the return of or circumstance beyond its reasonable control that prevents, hinders

mortal remains to an authorized funeral home proximate to the or makes impractical the performance of services. Legal actions arising

Insured Person’s legal residence. hereunder shall be barred unless written notice thereof is received by

Us / Our Service Provider within one (1) year from the date of event

Conditions - Any coverage under this section 3.16 is subject to fulfilment giving rise to such legal action. All consulting physicians and Our Service

of following conditions: Provider are independent contractors and not under the control of the

a. The services are provided when Insured Person(s) is/are traveling Company. We / Our Service Provider are not responsible or liable for any

within India to a place which is at a minimum distance of 150(one service rendered herein through professionals to You.

Product Name: Heartbeat | Product UIN: MAXHLIP20065V051920

3.17 Mental Disorders Treatment family residential place where a person with mental illness resides

What is covered: with his relatives or friend.

We will indemnify the expenses incurred by the Insured Person for d. The Insured Person in respect of whom a claim for any expenses