Professional Documents

Culture Documents

Lecture5 Cash Flow and Effective Interest PDF

Lecture5 Cash Flow and Effective Interest PDF

Uploaded by

suraj bhandari0 ratings0% found this document useful (0 votes)

26 views16 pagesOriginal Title

Lecture5 Cash Flow and Effective Interest.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

26 views16 pagesLecture5 Cash Flow and Effective Interest PDF

Lecture5 Cash Flow and Effective Interest PDF

Uploaded by

suraj bhandariCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 16

Effective Interest and Cash

Flow

Dr. Shree Raj Shakya

Lecture 5, 2013

Lecture 5 - Dr.Shree Raj Shakya 1

Nominal Interest rate

• If a financial institutions uses a unit of time

other than a year, i.e. a quarter, a month,

half-year, then it quotes interest rate on

annual basis such as r% compounded

monthly, quarterly, or half-yearly.

• The interest rate or Annual Percentage

Rate (APR) is called the nominal interest

rate.

Lecture 5 - Dr.Shree Raj Shakya 2

Effective Interest rate

• The effective interest rate is the one rate

that truly represents the interest earned in

a year.

ia = (1+r/M)M -1

where,

ia = effective annual interest rate

M =the number of compounding period per year

r/M = the interest rate per compounding period

Lecture 5 - Dr.Shree Raj Shakya 3

Effective Interest rate per

payment period

• If the transaction occurs more than one

time a year then, effective interest rate per

payment period becomes.

i = (1+r/(CK))c -1

where,

i = effective interest rate per payment period

C = No. of compound period per payment period

K = No. of payment period per year

r/CK = the interest rate per compounding period

Lecture 5 - Dr.Shree Raj Shakya 4

Continuous compounding

interest rate

• As the number of compounding periods 'M'

becomes large, then r/M becomes too

small, hence as M approaches infinity, r/M

tends to '0', we comes to the situation of

continuous compounding.

ic = er/k -1

where,

ic = effective interest rate per payment period

r = nominal interest rate

K = No. of payment period per year

Lecture 5 - Dr.Shree Raj Shakya 5

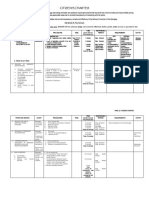

Examples 1

Suppose you make equal quarterly deposits

of Rs 1,000 into a fund that pays interest at a

rate of 12% compounded monthly.

Find the balance at the end of year '1'

Quarterly Amount deposited, A = Rs 1,000

Nominal interest rate, r = 12% per year

No. of compounding period per year, M = 12

No. of payment period per year, K = 4

Compounding period per payment period, C = M/K = 3

Effective interest rate per payment period, ia = (1+r/CK)C -1

No of payment period, N = K x 1 = 4

F = A x (F/A, ia, N) Lecture 5 - Dr.Shree Raj Shakya 6

Examples 1

Lecture 5 - Dr.Shree Raj Shakya 7

Examples 2

A series of equal quarterly receipts of Rs 500

extends over a period of 5 years. What is the

present value of this quarterly payment series at

8% interest compounded continuously?

Equal quarterly receipt, A = Rs 500

Nominal interest rate, r = 8%

No. of compounding period per year = continuous

No. of receipts per year, K = 4

Effective interest rate per quarter, Ic = er/k -1

No of quarterly receipt, N = 4 qtr/yr x 5yrs = 20

P = A(P/A, ic, N) Lecture 5 - Dr.Shree Raj Shakya 8

Examples 2

Lecture 5 - Dr.Shree Raj Shakya 9

Examples 3

Suppose you make Rs 1,000 monthly deposit to a

registered retirement savings plan that pays

interest at a rate of 10% compounded quarterly.

Compute the balance at the end of 10 years

Monthly Amount deposited, A = Rs 1,000

Nominal interest rate, r = 10%

No. of compounding period per year, M = 4

No. of payment period per year, K = 12

Compounding period per payment period, C = M/K = 1/3

Effective interest rate per payment period, ia = (1+r/CK)C -1

No of payment period, N = K x 10 = 120

F = A x (F/A, ia, N)

Lecture 5 - Dr.Shree Raj Shakya 10

Examples 3

Lecture 5 - Dr.Shree Raj Shakya 11

Cash Flow Example 1

If you win a lottery you have the choice of either

accepting

• Rs I million now or

• taking the 20 annual installments (Rs 100,000

each year, a total of Rs 20 million).

A local bank offers an annual interest rate of 10%

Which option would be more desirable?

Lecture 5 - Dr.Shree Raj Shakya 12

Cash Flow Example 2

To help you reach Rs 5,000 goal in 5 years from

now,

your father 'offers to give you Rs 500 now.

You plan to get a part-time job and make additional

deposits at the end of each year. ( The first deposit

is made at the end of first year.).

If all your money is deposited in a bank that pays

7% interest,

how large must your annual deposits be?

Lecture 5 - Dr.Shree Raj Shakya 13

Cash Flow Example 3

A small firm has borrowed Rs 100,000 to

purchase certain equipment.

The loan carries an interest rate of 15% and

is to be repaid in equal installments over the

next 5 years.

Compute the amount of this annual

installment.

Lecture 5 - Dr.Shree Raj Shakya 14

Cash Flow Example 4

Ram and Sita just opened two savings accounts at

a bank.

The accounts earn 10% annual interest.

Ram wants to deposit Rs 1000 in his account at the

end of first year and increase this amount by Rs

300 for each of the following 5 years.

Sita wants to deposit an equal amount each year

for next 6 years.

What should be the size of Sita's annual

deposit so that two accounts would have equal

balances at the end of 6 years?

Lecture 5 - Dr.Shree Raj Shakya 15

Cash Flow Example 5

A self-employed individual, Krishna, is opening a retirement

account at a bank.

His goal is to accumulate Rs 1,000,000 in the account by

the time he retires from work in 20 years.

A local bank is willing to open such a retirement account

that pays 8% interest compounded annually, throughout the

20 years.

Krishna expects his annual income will increase at a 6%

annual rate during his working career.

He wishes to start with a deposit at the end of year '1' of A,

and increase the deposit at a rate of 6% each year

thereafter.

What should be the size of his first deposit A?

The first deposit will occur at the end of year ‘1', and the

subsequent deposits will he made at the end of each year.

The last deposit will be made at the end of year'20'.

Lecture 5 - Dr.Shree Raj Shakya 16

You might also like

- The Financial Planning Workbook: A Comprehensive Guide to Building a Successful Financial Plan (2024 Edition)From EverandThe Financial Planning Workbook: A Comprehensive Guide to Building a Successful Financial Plan (2024 Edition)Rating: 4 out of 5 stars4/5 (9)

- (#3) Basic Concepts of Risk and Return, and The Time Value of MoneyDocument22 pages(#3) Basic Concepts of Risk and Return, and The Time Value of MoneyBianca Jane GaayonNo ratings yet

- SImple and Compound Interest Notes Lyst6475Document11 pagesSImple and Compound Interest Notes Lyst6475AMIT VERMANo ratings yet

- Training Manual For DFS Production For The Salt ProcessorsDocument115 pagesTraining Manual For DFS Production For The Salt ProcessorsSyed AhamedNo ratings yet

- Interest Practice ProblemsDocument24 pagesInterest Practice Problemsmaheswara448No ratings yet

- Lecture 4Document18 pagesLecture 4Maria LabutinNo ratings yet

- Module 3 Nominal and Effective IRDocument19 pagesModule 3 Nominal and Effective IRkikiNo ratings yet

- Citizens CharterDocument3 pagesCitizens CharterChona Dabu100% (1)

- 66 Job Interview Questions For Data ScientistsDocument10 pages66 Job Interview Questions For Data ScientistsRavi RanjanNo ratings yet

- Questions For Financial Functions in ExcelDocument20 pagesQuestions For Financial Functions in ExcelTarunSainiNo ratings yet

- 01 Time Value of Money-ModifiedDocument62 pages01 Time Value of Money-ModifiedSatyam PandeyNo ratings yet

- Time Value NotesDocument23 pagesTime Value NotesSunita BasakNo ratings yet

- Interest Practice ProblemsDocument26 pagesInterest Practice ProblemsSaadia Anwar Ali100% (1)

- Engineering EconomicsDocument50 pagesEngineering EconomicsDeepak Bangwal0% (1)

- EE - L2 To L6 - Time Value of Money Compount Interest FormulasDocument22 pagesEE - L2 To L6 - Time Value of Money Compount Interest FormulasRaviraj MaiyaNo ratings yet

- Discounted Cash Flow Valuation: Rights Reserved Mcgraw-Hill/IrwinDocument48 pagesDiscounted Cash Flow Valuation: Rights Reserved Mcgraw-Hill/IrwinEnna rajpootNo ratings yet

- Business Maths 1 Interest-1Document24 pagesBusiness Maths 1 Interest-1emmanuelifende1234No ratings yet

- Engineering Economics: Ali SalmanDocument10 pagesEngineering Economics: Ali SalmanZargham KhanNo ratings yet

- DBS 1 FM 2Document8 pagesDBS 1 FM 2Chu WenNo ratings yet

- Time ValueDocument6 pagesTime Valuechris david100% (1)

- Lecture 07Document10 pagesLecture 07Muhammad Shoaib Aslam KhichiNo ratings yet

- Activity Sheet In: Business FinanceDocument7 pagesActivity Sheet In: Business FinanceCatherine LarceNo ratings yet

- 5 Nominal and Effective Interest Rates RSDocument32 pages5 Nominal and Effective Interest Rates RSAkshat PradhanNo ratings yet

- Principles of Money-Time RelationshipsDocument13 pagesPrinciples of Money-Time RelationshipsMichael QuidorNo ratings yet

- Engineering Economics: Ali SalmanDocument11 pagesEngineering Economics: Ali SalmanUsama FarooqNo ratings yet

- Time Value of Money 1Document27 pagesTime Value of Money 1Namaku ImaNo ratings yet

- Practice QuestionsDocument3 pagesPractice QuestionsLeo RaheelNo ratings yet

- Chapter 4 Time Value of MoneyDocument64 pagesChapter 4 Time Value of Moneysubash shresthaNo ratings yet

- Simple InterestTricks Tips PDFDocument39 pagesSimple InterestTricks Tips PDFSHUBHAM Yadav100% (1)

- 14th Week RevisedDocument115 pages14th Week Revised조선관 Tony ChoNo ratings yet

- Time Value of MoneyDocument17 pagesTime Value of Moneyabdiel100% (3)

- Engineering Economics: Ali SalmanDocument11 pagesEngineering Economics: Ali SalmanAli Haider RizviNo ratings yet

- Ecnomic Notes 2Document4 pagesEcnomic Notes 2ehnzdhmNo ratings yet

- Overview of Time Value of MoneyDocument48 pagesOverview of Time Value of MoneyKathleen MarcialNo ratings yet

- Time Value of MoneyDocument18 pagesTime Value of MoneyPranshuNo ratings yet

- MST 111 ReviewerDocument10 pagesMST 111 ReviewerJohn MichaelNo ratings yet

- CH 4 Effective - InterestDocument23 pagesCH 4 Effective - InterestRashadafanehNo ratings yet

- Simple Interest (Average Return) Total Marks 15Document6 pagesSimple Interest (Average Return) Total Marks 15hassaan azharNo ratings yet

- Lec4-Nominal-Effective Rates-Plus AudioDocument30 pagesLec4-Nominal-Effective Rates-Plus AudioAhmad MedlejNo ratings yet

- Compound Interest (Week 9) - AguilarDocument7 pagesCompound Interest (Week 9) - AguilarCherry AguilarNo ratings yet

- Au Mod - 1Document8 pagesAu Mod - 1Keyur PopatNo ratings yet

- FPWM - Time Value of Money QuestionsDocument4 pagesFPWM - Time Value of Money QuestionsvuppalashrimanthNo ratings yet

- Concept Compound InterestDocument14 pagesConcept Compound InterestPartha MajumderNo ratings yet

- A. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyDocument12 pagesA. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyArcon Solite BarbanidaNo ratings yet

- Unit 3: AnnuitiesDocument15 pagesUnit 3: AnnuitiesRicky Thanmai100% (1)

- Chapter 4Document69 pagesChapter 4xffbdgngfNo ratings yet

- Attachment Summary Sheet Time Value of MoneyDocument9 pagesAttachment Summary Sheet Time Value of Moneydevesh chaudharyNo ratings yet

- Chapter 1c - Time Value of MoneyDocument16 pagesChapter 1c - Time Value of MoneyOdysseYNo ratings yet

- Chapter 9: Mathematics of FinanceDocument55 pagesChapter 9: Mathematics of FinanceQuang PHAMNo ratings yet

- Module 3 Nominal and Effective IRDocument19 pagesModule 3 Nominal and Effective IRTimbul SihotangNo ratings yet

- EE - L2 To L6 - Time Value of Money Compount Interest FormulasDocument30 pagesEE - L2 To L6 - Time Value of Money Compount Interest FormulasganeshNo ratings yet

- Interest Rates SummaryDocument28 pagesInterest Rates SummaryMichael ArevaloNo ratings yet

- Compound Interest: Simple Interest vs. Compound Interest Formula Sample ProblemsDocument46 pagesCompound Interest: Simple Interest vs. Compound Interest Formula Sample ProblemsRoselle Malabanan100% (1)

- Econ 313 Handout Time Value of MoneyDocument63 pagesEcon 313 Handout Time Value of MoneyKyle RagasNo ratings yet

- Module 3 Nominal and Effective IRDocument24 pagesModule 3 Nominal and Effective IRtori doriNo ratings yet

- JAIIB Accounting Module A NotesDocument205 pagesJAIIB Accounting Module A NotesAkanksha MNo ratings yet

- Topic 2 - APR & EAR ProblemsDocument2 pagesTopic 2 - APR & EAR Problemskar ping0% (1)

- EC07Document22 pagesEC07engrsaab51No ratings yet

- Time Value of MoneyDocument11 pagesTime Value of MoneyRajesh PatilNo ratings yet

- Simulated Exam - Questions - General MathematicsDocument2 pagesSimulated Exam - Questions - General MathematicsWesly Paul Salazar CortezNo ratings yet

- Financial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesFrom EverandFinancial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesNo ratings yet

- Criteria For Master Teacher: (With Additional Proposed Documents and The Specific Points As Support To Other Criteria)Document19 pagesCriteria For Master Teacher: (With Additional Proposed Documents and The Specific Points As Support To Other Criteria)Dennis ReyesNo ratings yet

- Government Led Joint Assessment in Conflict Affected Districts of Xarardheere & Ceel DheerDocument9 pagesGovernment Led Joint Assessment in Conflict Affected Districts of Xarardheere & Ceel DheerBarre Moulid ShuqulNo ratings yet

- Lec04.UDP LinhdtDocument16 pagesLec04.UDP LinhdtHọc Sinh Nghiêm TúcNo ratings yet

- Product Specifications Product Specifications: HWXX HWXX - 6516DS1 6516DS1 - VTM VTMDocument2 pagesProduct Specifications Product Specifications: HWXX HWXX - 6516DS1 6516DS1 - VTM VTMcesarbayonaNo ratings yet

- Bathroom Items Any RFQDocument8 pagesBathroom Items Any RFQarqsarqsNo ratings yet

- Temidayo Cybercrime ReportDocument13 pagesTemidayo Cybercrime ReportMAYOWA ADEBAYONo ratings yet

- Doe School PlanDocument16 pagesDoe School PlanHNNNo ratings yet

- Regional Trial Court: Motion To Quash Search WarrantDocument3 pagesRegional Trial Court: Motion To Quash Search WarrantPaulo VillarinNo ratings yet

- Furse Datasheet Bimetallic Connectors DGT 281021Document2 pagesFurse Datasheet Bimetallic Connectors DGT 281021KhaledNo ratings yet

- Soliven vs. FastformsDocument2 pagesSoliven vs. FastformsClaudine Allyson DungoNo ratings yet

- 4 Differently Able Persons ActDocument7 pages4 Differently Able Persons Actumer plays gameNo ratings yet

- Sheik Md. Maadul Hoque (ID 150201010035)Document49 pagesSheik Md. Maadul Hoque (ID 150201010035)Mizanur RahmanNo ratings yet

- Digital Electronics MCQDocument10 pagesDigital Electronics MCQDr.D.PradeepkannanNo ratings yet

- Criminal Law II - Quasi OffensesDocument2 pagesCriminal Law II - Quasi OffensesJanine Prelle DacanayNo ratings yet

- 3 Simpson Wickelgren (2007) Naked Exclusion Efficient Breach and Downstream Competition1Document10 pages3 Simpson Wickelgren (2007) Naked Exclusion Efficient Breach and Downstream Competition1211257No ratings yet

- Connorm Edid6507-Assign 2Document27 pagesConnorm Edid6507-Assign 2api-399872156No ratings yet

- Daftar Harga: Digital PrintingDocument4 pagesDaftar Harga: Digital PrintingHikmatus Shoimah Firdausi NuzulaNo ratings yet

- Institute of Cost and Management Accountants of Pakistan: Employment Application FormDocument2 pagesInstitute of Cost and Management Accountants of Pakistan: Employment Application FormRashidAliNo ratings yet

- VLANS and Other HardwareDocument20 pagesVLANS and Other HardwareVishal KushwahaNo ratings yet

- PDFDocument1 pagePDFMiguel Ángel Gálvez FernándezNo ratings yet

- Food Safety: Research PaperDocument6 pagesFood Safety: Research PaperJon Slavin100% (1)

- CursorDocument7 pagesCursorSachin KumarNo ratings yet

- FreemanWhite Hybrid Operating Room Design GuideDocument11 pagesFreemanWhite Hybrid Operating Room Design GuideFaisal KhanNo ratings yet

- Cut List Cheat SheetDocument1 pageCut List Cheat SheetmeredithNo ratings yet

- Sinumerik - 828D - Machine Commissioning - 2009 PDFDocument476 pagesSinumerik - 828D - Machine Commissioning - 2009 PDFpavlestepanic9932No ratings yet

- Conclusion and Future EnhancementDocument2 pagesConclusion and Future EnhancementHelloprojectNo ratings yet

- Data Communication and Networking Prelims ExamDocument7 pagesData Communication and Networking Prelims ExamSagarAnchalkarNo ratings yet