Professional Documents

Culture Documents

Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 160

Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 160

Uploaded by

Washim Alam50COriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 160

Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 160

Uploaded by

Washim Alam50CCopyright:

Available Formats

https://telegram.me/pdf4exams https://telegram.

me/testseries4exams

So, UPA/Congress’s Budget-2012 required Sunder Construction (the Startup Company)

to pay 30% Tax + Penalty on the investment they received from Angel investor Sadhu

Yadav. This is dubbed as ‘Angel Tax’.

Norms were further tightened by Modi-regime, but then controversy that it will

discourage the growth of startup companies so norms relaxed- ‘Angel Tax will not

apply if Startup’s turnover is less than ₹ “x” crores or if startup was registered for

upto “y” years & other technical ball by ball commentary that is NOTIMP4UPSC.’

(Full) Budget-2019: IF Start-ups and their investors provide the required declarations

and information, then IT dept will settle the matter, and will do no further scrutiny.

24.4.2 _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ (DTAA) & Round Tripping

दोहरा कराधान प रहार समझौता

➢ It is a tax treaty signed between two or more countries.

➢ Objective? A taxpayer resides in one country and earns income in another, then he

need not pay (direct) tax twice in two countries for the same income.

➢ e.g. India Mauritius DTAA (1982): If a Mauritius person / company buy shares in India

and sells them at profit, then he need not pay Capital Gains Tax (CGT) in India. Only

the Mauritius government can ask CGT from him. And vice-versa.

➢ Loophole? India has ~10-20% CGT whereas Mauritius has ~0-3% CGT (depending on

nature of asset, how long the buyer kept asset before selling etc). So many Indian

Politicians, Businessmen and Bollywood actors would transfer the money using Hawala

to their shell companies in Mauritius, and then make those Mauritius shell companies

to invest back in Indian assets & avoid paying Indian CGT. This process is called Round

Tripping (राउड- पग) i.e. money that leaves the country through various channels and

makes its way back into the country as foreign investment.

➢ Similar loophole in India Singapore DTAA.

➢ 2016: Modi government amended the treaties = even Mauritius and Singapore

investments in India will be subjected to Indian taxes**.

24.4.3 _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ (POEM: पीओईएम)

➢ Bollywood Producer “A” forms a shell company in Cayman Islands (because it has a

very low rate of corporation tax). He gives this company international movie

distribution rights for his Indian movie @₹ 10 only. Then, Cayman Island company

makes ₹ 50 crore profits, but he’d not pay any taxes in India saying it’s a foreign

company making profits from foreign territories, so Income Tax Department of India

has no jurisdiction!

➢ But, here the Place of Effective Management is India, from where the Bollywood

producer was really taking the decisions of this shell company.

➢ So, Budget-2015 introduced the concept of POEM. Such overseas / foreign company

will be subjected to India’s 40% Corporation tax + cess + surcharge.

24.4.4 _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ (BEPS: बीईपीएस)

➢ Multinational Company (MNC) “M” opens fast food outlets in India & makes ₹ 50 crores

profit. By default, it should be subjected to 40% Corporation tax in India.

➢ But then MNC shows its Indian outlets had taken loan / raw material / patented

technology from MNC’s shell firm in Bahamas (where Corporation tax is 0-2%). So, after

Mrunal’s Economy Pillar#2B: Budget → Revenue Part : Page 160

https://telegram.me/pdf4exams https://telegram.me/testseries4exams

deducting these operating costs, it has zero profit, so in India, it will pay only 18.5%

Minimum Alternative Tax (MAT), instead of 40% Corporation tax.

➢ Thus, when MNCs shift profit from its source country to a tax-haven to avoid / reduce

paying taxes, its known as “BEPS”.

➢ 2019-July: India ratified the OECD’s multilateral convention to prevent base erosion

and profit shifting.

24.4.5 Transfer Pricing (ह तातरण मू ि)

➢ Transfer pricing happens whenever two subsidiary companies that are part of the same

multinational group, trade with each other.

➢ Suppose Coca Cola’s (Indian Subsidiary company) buys Sosyo Company’s shares or soda

formula at ₹ 10 crores, and then sells it to Coca Cola’s (Cayman Islands subsidiary

company) at ₹ 10 rupees. Then ₹ 10 is the transfer price.

➢ Coca Cola (Cayman Islands) further sells Sosyo’s shares / Soda-Formula to other

companies at very high price. Yet, Indian tax authorities will not get any Capital Gains

Tax (CGT) even though Coca-Cola (USA holding company) may be making profit

(Capital Gains) of billion$ from this ‘Indian Asset’ (Sosyo).

➢ 2001: Transfer pricing related provisions added in the Income Tax Act. But they were

quite strict leading to ‘tax terrorism’ by IT officials who’d slap notices on every

transaction, resulting into ‘No ease’ of doing business for MNCs.

24.4.6 Authority for Advance Rulings (AAR)

➢ After above episode, Pepsi (India) would like to know in advance whether its transfer

price of ₹ “y” or its imported / exported item worth ₹ “z” is agreeable to tax

authorities or not? lest it suffers from notices, raids and litigations afterwards.

➢ For this purpose, Authority for Advance Rulings (and their Appellate bodies) have been

set up under the Income Tax Act, Customs Act and even GST Act (Recall Amul Camel

Milk).

➢ Advance Pricing Agreement (APA: अ म मू य नधारण समझौता)= If in previous example,

Coca Coal approached AAR and an agreement was signed between taxpayer and a tax

authority that “Transfer price of ₹ y is agreeable to both of us, and will not attract

any notices / raids / litigations afterwards.”

24.4.7 _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _(GAAR)

Till now we learned how Indians and foreigners avoid tax payment in India through

loopholes like DTAA, POEM, BEPS, Transfer Pricing etc.

➢ So, UPA/Congress Govt setup economist Parthasarathi Shome panel who suggested

General Anti Avoidance Rules (GAAR: कर प रिजन रोधी यापक नयम) → they were

incorporated in Income Tax Act in 2012.

➢ GAAR empowers Income Tax officials to send notices to both Indians and foreigners for

suspected Tax Avoidance. (For Tax evasion, we’ve separate laws- PMLA, UFIA, BTPA)

➢ But critics alleged GAAR will result in tax terrorism, harassment, no ease of doing biz.

So successive Budgets kept delaying the GAAR- implementation. Finally done on

1/4/2017.

Mrunal’s Economy Pillar#2B: Budget → Revenue Part : Page 161

https://telegram.me/pdf4exams https://telegram.me/testseries4exams

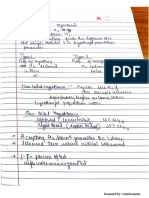

24.4.8 Reforms to reduce Tax Terrorism / Harassment

- We learned about the reforms to fight “Tax evasion” → ban on cash transaction of ₹ 2

lakh / >, Operation Clean Money etc. So on one hand, Income Tax Department has to

become strict / coercive to fight against Tax evasion.

- At the same time, IT dept. also needs to become more friendly towards honest

taxpayers, while reducing the scope of tax avoidance. Here notable measures are →

Organised by CBDT & CBIC for idea exchange between policy

makers and senior tax officers.

Rajaswa Gyan Sangam

2016: Modi gave them RAPID Mantra: R for Revenue, A for

2016 & 2017

Accountability, P for Probity, I for Information and D for

Digitization.

This bill aimed to replace the Income Tax Act, 1961 with simpler

Direct Tax Code 2010

provisions. But, lapsed with 15th LokSabha dissolution in 2014.

Easwar Panel on To simplify the provisions of IT Act, 1961, to remove ambiguities

Direct Taxes 2015 that cause unnecessary litigations & hardships to Taxpayers.

Setup by CBDT to draft New Direct Tax Legislation (Law) to

Arbind Modi Taskforce

replace IT Act 1961. Later Arbind modi retired & replaced by

2017

Akhilesh Ranjan. Its report is awaited.

2017: CBDT’s mobile app that helps you calculate and pay Income

____ ____

Tax, claim TDS refunds etc.

24.4.9 (Full) Budget-2019: Ease of paying taxes & reducing tax-terrorism

We’ll extract your financial data from Banks, Stock exchanges, Mutual Funds, EPFO,

Employers’ TDS submissions etc. and provide you with a Pre-filled tax returns containing

your salary income, capital gains from share/bond, bank interests, etc. This will help in

two ways:

1) personal income tax payers’ time and energy saved

2) accuracy of reporting income and paying taxes

Personal interaction between the assessee and Income Tax official = more chances of

harassment / bribery. So, we’ll launch two reforms:

1) Faceless assessment in electronic mode in some cases. E.g. assessee received a notice

about discrepancy in his report income vs TDS submitted by his banker, then at initial

stage assessee need not visit IT-office, simply give clarification in the web-portal.

2) Cases will be allotted in random computerized lottery basis to IT officials without

disclosing the name, designation or location of the Officer.

24.5 TAXATION → GLOBAL TREATIES, AGREEMENTS & INDEXES

24.5.1 Tax Information Exchange Agreement (TIEA: कर सच

ू ना ि नमय समझौता)

➢ India has signed such agreements with multiple countries. It enables mutual sharing of

information to detect tax avoidance and tax evasion. Example,

➢ 2019-May: India has notified a tax information exchange agreement (TIEA) with the

Marshall Islands whose Capital is _ _ _ _ _ _ _ _ ; it’s the first country in the world to

Mrunal’s Economy Pillar#2B: Budget → Revenue Part : Page 162

You might also like

- Mini Practice Set 4 QuickBooks Guide PDFDocument4 pagesMini Practice Set 4 QuickBooks Guide PDFJoseph SalidoNo ratings yet

- Project Report On TaxationDocument51 pagesProject Report On Taxationanuragmishra211277% (39)

- Greeks in AmericaDocument151 pagesGreeks in AmericaΜπάμπης ΦαγκρήςNo ratings yet

- Alchemy - Lesson 4 ProcessesDocument13 pagesAlchemy - Lesson 4 ProcessesbartolomeukumaNo ratings yet

- Structure of English-LET REVIEWERDocument25 pagesStructure of English-LET REVIEWERJhona Grace EstropeNo ratings yet

- Hrishad - Income TaxDocument9 pagesHrishad - Income Taxkhayyum0% (1)

- 21.6 D D T (DDT: लाभाश वतरण कर) : Mrunal's Economy Pillar#2A: Budget → Revenue Part → Tax-Receipts → Page 119Document3 pages21.6 D D T (DDT: लाभाश वतरण कर) : Mrunal's Economy Pillar#2A: Budget → Revenue Part → Tax-Receipts → Page 119Washim Alam50CNo ratings yet

- Direct Taxation: CA M. Ram Pavan KumarDocument60 pagesDirect Taxation: CA M. Ram Pavan KumarSravyaNo ratings yet

- India: Budget 2015-16 - For The Corporates: Corporate Tax RateDocument4 pagesIndia: Budget 2015-16 - For The Corporates: Corporate Tax RateraghuNo ratings yet

- Tax Evasion & Penalties - Understanding Tax Evasion and Penalties in IndiaDocument5 pagesTax Evasion & Penalties - Understanding Tax Evasion and Penalties in IndiaDiptanshu NandaNo ratings yet

- International Taxation in India - Recent Developments & Outlook (Part - Ii)Document6 pagesInternational Taxation in India - Recent Developments & Outlook (Part - Ii)ManishJainNo ratings yet

- Double TaxationDocument8 pagesDouble TaxationArun KumarNo ratings yet

- TAX Definition - : Tax Is A Compulsory Contribution Imposed by The Government On ItsDocument22 pagesTAX Definition - : Tax Is A Compulsory Contribution Imposed by The Government On ItsSayanm MittalNo ratings yet

- TaxationDocument7 pagesTaxationstk2796No ratings yet

- Indian Direct Tax Code 2009 - An Overview: Corporate TaxationDocument7 pagesIndian Direct Tax Code 2009 - An Overview: Corporate TaxationVishal PatwariNo ratings yet

- Cascading Effect of TaxesDocument5 pagesCascading Effect of TaxesPraveen NairNo ratings yet

- Thesis On Taxation in IndiaDocument5 pagesThesis On Taxation in Indiatit0feveh1h3100% (2)

- Patna University IMPORTANT THEORY QUESTION TAXATION 2023Document49 pagesPatna University IMPORTANT THEORY QUESTION TAXATION 2023satishksatish777No ratings yet

- Finance Bill 2012 - Major Issues and ChallengesDocument8 pagesFinance Bill 2012 - Major Issues and ChallengesNehaNo ratings yet

- Finance IGNOU PDFDocument197 pagesFinance IGNOU PDFAakash BanjareNo ratings yet

- Flash NewsDocument3 pagesFlash Newslingesh1892No ratings yet

- "Comparative Study of DTC (Direct Tax Code) Effective From 1april 2012." 1. IntroductionDocument11 pages"Comparative Study of DTC (Direct Tax Code) Effective From 1april 2012." 1. IntroductionAnurag GuptaNo ratings yet

- Act 311 Term PaperDocument7 pagesAct 311 Term PaperKazi Shariat UllahNo ratings yet

- IFM U5Document19 pagesIFM U5Deva BeharaNo ratings yet

- Direct Tax CodeDocument7 pagesDirect Tax CodeSudheer KrishnanNo ratings yet

- BBA Income TaxDocument195 pagesBBA Income TaxUjjwal KandhaweNo ratings yet

- Kenya Finance Bill 2020Document36 pagesKenya Finance Bill 2020Life NoanneNo ratings yet

- Income TaxDocument195 pagesIncome TaxAleti NithishNo ratings yet

- TaxationDocument7 pagesTaxationAkshatNo ratings yet

- DTP Full NotesDocument114 pagesDTP Full NotesCHAITHRANo ratings yet

- India Tax Structure 2011Document10 pagesIndia Tax Structure 2011wiesenerNo ratings yet

- Taxation ProjectDocument83 pagesTaxation ProjectManish JaiswalNo ratings yet

- Corporate TaxDocument30 pagesCorporate TaxVijay KumarNo ratings yet

- Vaishnavi ProjectDocument72 pagesVaishnavi ProjectAkshada DhapareNo ratings yet

- Individual Txation FY 2019 20 With Demo of Return FilingDocument73 pagesIndividual Txation FY 2019 20 With Demo of Return FilingGanesh PNo ratings yet

- Irect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Document3 pagesIrect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Washim Alam50CNo ratings yet

- Deduction of Tax at Source (TDS)Document19 pagesDeduction of Tax at Source (TDS)Adhithyan MNo ratings yet

- Tax System in IndiaDocument18 pagesTax System in IndiaDEV HUGENNo ratings yet

- Direct Tax CodeDocument8 pagesDirect Tax CodeImran HassanNo ratings yet

- TDS DocumentDocument34 pagesTDS DocumentSaleem JavedNo ratings yet

- Project Report On TaxationDocument51 pagesProject Report On TaxationsnehalNo ratings yet

- Taxation Law Project ON Effect of Specialized Taxation Slabs Under Start-Up IndiaDocument9 pagesTaxation Law Project ON Effect of Specialized Taxation Slabs Under Start-Up IndiaShaji SebastianNo ratings yet

- Direct Tax CodeDocument23 pagesDirect Tax CodeImran HassanNo ratings yet

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Taxation in IndiaDocument9 pagesTaxation in IndiaSiva BalanNo ratings yet

- Report On Developing SMEs 2Document12 pagesReport On Developing SMEs 2wizardwatch88No ratings yet

- Income Tax Consultants in HyderabadDocument51 pagesIncome Tax Consultants in Hyderabadav consaltansNo ratings yet

- Chapter:-1: About Karvy Data Management Services LimitedDocument40 pagesChapter:-1: About Karvy Data Management Services LimitedJyoti Pathak FnEqfAISerNo ratings yet

- Custom Duty in IndiaDocument29 pagesCustom Duty in IndiaKaranvir GuptaNo ratings yet

- Actual Intrenship ReportDocument83 pagesActual Intrenship ReportKshitija BalwadkarNo ratings yet

- Tax InformationDocument14 pagesTax InformationSravan Kumar KoorapatiNo ratings yet

- ProjectDocument10 pagesProjectAyush JainNo ratings yet

- Foreign Investment Inflows (Amount in Billion US $) : Source: Reserve Bank of India Data WarehouseDocument10 pagesForeign Investment Inflows (Amount in Billion US $) : Source: Reserve Bank of India Data WarehouseYatish JainNo ratings yet

- Fairfiled Insititute of Management and TechnologyDocument10 pagesFairfiled Insititute of Management and Technologynaman guptaNo ratings yet

- Finance Bill 2012-13Document21 pagesFinance Bill 2012-13shahbhavya2811No ratings yet

- Income Tax Planning in IndiaDocument61 pagesIncome Tax Planning in IndiaPRIYANKA LANDGENo ratings yet

- Tax ReformDocument5 pagesTax Reformakky.vns2004No ratings yet

- The New Direct Tax Code (DTC)Document18 pagesThe New Direct Tax Code (DTC)aggarwalajay2No ratings yet

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- Govt Revenue Source Tax and Non TaxDocument11 pagesGovt Revenue Source Tax and Non TaxSumra KhanNo ratings yet

- Indian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountDocument23 pagesIndian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountshankarinsideNo ratings yet

- Economics GAAR, GST.Document5 pagesEconomics GAAR, GST.Ankit AgrawalNo ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Read 4Document1 pageRead 4Washim Alam50CNo ratings yet

- Read 6Document2 pagesRead 6Washim Alam50CNo ratings yet

- .) - ) ' - Ab Cde ) B F G HB - Ib Jik L) Mdik - Inb MF B Dlmfo) B - Im L - PLQDocument4 pages.) - ) ' - Ab Cde ) B F G HB - Ib Jik L) Mdik - Inb MF B Dlmfo) B - Im L - PLQWashim Alam50CNo ratings yet

- Read 2Document2 pagesRead 2Washim Alam50CNo ratings yet

- Report 1Document3 pagesReport 1Washim Alam50CNo ratings yet

- Read 3Document2 pagesRead 3Washim Alam50CNo ratings yet

- Read 5Document2 pagesRead 5Washim Alam50CNo ratings yet

- G.S. Paper Ii - : Social JusticeDocument3 pagesG.S. Paper Ii - : Social JusticeWashim Alam50CNo ratings yet

- WWW - Visionias.in: 6 ©vision IASDocument2 pagesWWW - Visionias.in: 6 ©vision IASWashim Alam50CNo ratings yet

- Report 2Document3 pagesReport 2Washim Alam50CNo ratings yet

- WWW - Visionias.in: 3 ©vision IASDocument2 pagesWWW - Visionias.in: 3 ©vision IASWashim Alam50CNo ratings yet

- Report 3Document4 pagesReport 3Washim Alam50CNo ratings yet

- Report 5Document4 pagesReport 5Washim Alam50CNo ratings yet

- Report 6Document5 pagesReport 6Washim Alam50CNo ratings yet

- 30.4 B C A I G: Figure 1: Oil Barrel Prices in U$D. Source: ES2018-19, Vol2Ch6Document3 pages30.4 B C A I G: Figure 1: Oil Barrel Prices in U$D. Source: ES2018-19, Vol2Ch6Washim Alam50CNo ratings yet

- 45.4 P C: L / S: Mrunal's Economy Pillar#4: Sectors of Economy Page 307Document3 pages45.4 P C: L / S: Mrunal's Economy Pillar#4: Sectors of Economy Page 307Washim Alam50CNo ratings yet

- 48.6 P #4: I: Cpi, Wpi, Iip &: Mrunal's Economy Pillar#4: Sectors of Economy Page 332Document2 pages48.6 P #4: I: Cpi, Wpi, Iip &: Mrunal's Economy Pillar#4: Sectors of Economy Page 332Washim Alam50CNo ratings yet

- 45.8 E P PM-EAC?: Mrunal's Economy Pillar#4: Sectors of Economy Page 310Document3 pages45.8 E P PM-EAC?: Mrunal's Economy Pillar#4: Sectors of Economy Page 310Washim Alam50CNo ratings yet

- 45.5 P C N A: S: Position Planning Commission NITI AayogDocument3 pages45.5 P C N A: S: Position Planning Commission NITI AayogWashim Alam50CNo ratings yet

- Mrunal's Economy Pillar#4: Sectors of Economy Page 302Document3 pagesMrunal's Economy Pillar#4: Sectors of Economy Page 302Washim Alam50CNo ratings yet

- Economic System आ थक णाल →: Mrunal's Economy Pillar#4: Sectors of Economy → Page 305Document2 pagesEconomic System आ थक णाल →: Mrunal's Economy Pillar#4: Sectors of Economy → Page 305Washim Alam50CNo ratings yet

- Table 1: Tax Morale Is Affected by Two Types of Fairness: Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 166Document3 pagesTable 1: Tax Morale Is Affected by Two Types of Fairness: Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 166Washim Alam50CNo ratings yet

- Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 136Document3 pagesMrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 136Washim Alam50CNo ratings yet

- Paper 19 PDFDocument3 pagesPaper 19 PDFWashim Alam50CNo ratings yet

- 24 T B M & A I: Axation Lack Oney Llied SsuesDocument3 pages24 T B M & A I: Axation Lack Oney Llied SsuesWashim Alam50CNo ratings yet

- Haiwell-Guidance For Transforming LanguageDocument5 pagesHaiwell-Guidance For Transforming LanguageMosfet AutomationNo ratings yet

- L601 Pyjamas Assembly InstructionDocument16 pagesL601 Pyjamas Assembly InstructionDolly StevenNo ratings yet

- 5-8 Snapshot 1st Mininger, Rose, DayDocument5 pages5-8 Snapshot 1st Mininger, Rose, DayAdrian MickensNo ratings yet

- Interim Report EDUMENTORDocument17 pagesInterim Report EDUMENTORRajat Gaulkar100% (1)

- Jaipuria Institute of Management 1. Course Information MKT402 Marketing Planning and Control 3Document17 pagesJaipuria Institute of Management 1. Course Information MKT402 Marketing Planning and Control 3Sanjeev Kumar Suman Student, Jaipuria LucknowNo ratings yet

- Medina College Graduate School Department Comprehensive Examination Master of Arts in Nursing N 131 - The Administration ProcessDocument3 pagesMedina College Graduate School Department Comprehensive Examination Master of Arts in Nursing N 131 - The Administration ProcessRose Rebollos MaligroNo ratings yet

- Q3 - W2 - Grade9 - CSS - Carry Out VariationDocument10 pagesQ3 - W2 - Grade9 - CSS - Carry Out VariationREYNALDO R. DE LA CRUZ JR.No ratings yet

- (Form GNQ 16) Evaporative Condenser Pre Commissioning ChecklistDocument2 pages(Form GNQ 16) Evaporative Condenser Pre Commissioning Checklisteugene mejidanaNo ratings yet

- A. Company, Product Profile and Financial PlanDocument5 pagesA. Company, Product Profile and Financial PlanJubilyn LiborNo ratings yet

- Design BriefDocument216 pagesDesign BriefGia Vinh Bui TranNo ratings yet

- G.R. No. L-69344 April 26, 1991 Pg. 191Document3 pagesG.R. No. L-69344 April 26, 1991 Pg. 191Allysa Lei Delos ReyesNo ratings yet

- 1 EF1A - HDT - Money - To - Bitcoins - CSP20B1B PDFDocument15 pages1 EF1A - HDT - Money - To - Bitcoins - CSP20B1B PDFMohit KumarNo ratings yet

- Impact of COVID 19 in Islamic FinanceDocument76 pagesImpact of COVID 19 in Islamic FinanceTaraFKhaira100% (2)

- Tutorial 3 Answer EconomicsDocument9 pagesTutorial 3 Answer EconomicsDanial IswandiNo ratings yet

- Basic Cooking Principles For Creating A Social Innovation LabDocument5 pagesBasic Cooking Principles For Creating A Social Innovation LabclarityfacilitationNo ratings yet

- History of Labor LawDocument7 pagesHistory of Labor LawKalela HamimNo ratings yet

- Barangay Form 5 & 6Document4 pagesBarangay Form 5 & 6nilo bia100% (1)

- Choosing Flower EssenceDocument48 pagesChoosing Flower Essencebharikrishnan17701100% (8)

- ABC Taxa WebDocument13 pagesABC Taxa WebAnonymous RrT4w73RXPNo ratings yet

- Primary Sources of ShariahDocument15 pagesPrimary Sources of ShariahAeina FaiiziNo ratings yet

- Fill in The Blank Stories-Elf and Dragon: Basic Story StarterDocument1 pageFill in The Blank Stories-Elf and Dragon: Basic Story StarterCoach ReivanNo ratings yet

- Quick Setup Guide V1.2.1Document29 pagesQuick Setup Guide V1.2.1Jordan100% (1)

- Company Law by Dr. Avtar SinghDocument1 pageCompany Law by Dr. Avtar SinghSubir Chakrabarty0% (2)

- 83 - SUDO - Root Programme Unter User Laufen: SpecificationsDocument3 pages83 - SUDO - Root Programme Unter User Laufen: SpecificationssaeeddeepNo ratings yet

- Case Study of Core and Pluge PreparationDocument9 pagesCase Study of Core and Pluge PreparationSpeculeNo ratings yet