Professional Documents

Culture Documents

Paper 19 PDF

Paper 19 PDF

Uploaded by

Washim Alam50CCopyright:

Available Formats

You might also like

- PPR 100 Pipes and Fittings Updated Price List 07 March 2023Document1 pagePPR 100 Pipes and Fittings Updated Price List 07 March 2023Sj interiorNo ratings yet

- Lab 3-2 PHM Reliable Catering Weekly Payroll ReportDocument1 pageLab 3-2 PHM Reliable Catering Weekly Payroll ReportAitor AguadoNo ratings yet

- 22 Wealth MultipliersDocument19 pages22 Wealth MultipliersShantrece MarshallNo ratings yet

- Project For Taxation LawDocument11 pagesProject For Taxation Lawtanmaya guptaNo ratings yet

- Impact of Black-MoneyDocument26 pagesImpact of Black-MoneyDevikaSharma100% (2)

- VAT On Merchandise Purchased and SoldDocument5 pagesVAT On Merchandise Purchased and SoldBernadette Solis100% (1)

- So Why Were Rs 500 and Rs 1000 Bank Notes Demonetized?: Currency Legal Tender National CurrencyDocument19 pagesSo Why Were Rs 500 and Rs 1000 Bank Notes Demonetized?: Currency Legal Tender National CurrencyAbhay SharmaNo ratings yet

- Case Study 1Document6 pagesCase Study 1mashila arasanNo ratings yet

- DemonetisationDocument44 pagesDemonetisationPriya SonuNo ratings yet

- Bes172 p4 Blackmoney 2 Demonetization Soil RateDocument40 pagesBes172 p4 Blackmoney 2 Demonetization Soil Rateroy lexterNo ratings yet

- Demonetisation:: Why Was Demonetization DoneDocument3 pagesDemonetisation:: Why Was Demonetization DoneRadhika JaiswalNo ratings yet

- Case Study On Economic Event-Demonetization: Sanjana Menon B 2017155Document7 pagesCase Study On Economic Event-Demonetization: Sanjana Menon B 2017155Sanjana MenonNo ratings yet

- PEM ReportDocument6 pagesPEM Reportxx69dd69xxNo ratings yet

- Master of Business Administration: Third Semester MF0012Document21 pagesMaster of Business Administration: Third Semester MF0012Rajesh PhulwaniNo ratings yet

- DemonetisationDocument20 pagesDemonetisationMukti BarolaNo ratings yet

- Demonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaDocument15 pagesDemonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaShalvi RanjanNo ratings yet

- Economics Projec1Document9 pagesEconomics Projec1Kalyani SreekumarNo ratings yet

- Demonetization FILEDocument13 pagesDemonetization FILEDamanjot KaurNo ratings yet

- Demonetisation in India: A Study of Its' Impact On Various Key SectorsDocument8 pagesDemonetisation in India: A Study of Its' Impact On Various Key SectorsHimanshuNo ratings yet

- Notes On Ruppe and DigitalisationDocument23 pagesNotes On Ruppe and DigitalisationsanjayNo ratings yet

- Sample Research Paper PDFDocument27 pagesSample Research Paper PDFSANYA JAINNo ratings yet

- 8EF2 - HDT - Budget3 - EF3 - BoP - PartA @ PDFDocument45 pages8EF2 - HDT - Budget3 - EF3 - BoP - PartA @ PDFMohanNo ratings yet

- Simranjeet Kaur 3051Document11 pagesSimranjeet Kaur 3051Mani JattNo ratings yet

- Isha SinghDocument10 pagesIsha Singhskguddu2003No ratings yet

- Demonetisation EconomicsDocument17 pagesDemonetisation Economics125117059No ratings yet

- Demonitisation (Report)Document41 pagesDemonitisation (Report)onlinebaijnathNo ratings yet

- DemonetisationDocument6 pagesDemonetisationRENUKA THOTENo ratings yet

- Canvass: Capturing News With An Analytical EdgeDocument6 pagesCanvass: Capturing News With An Analytical EdgeRanjith RoshanNo ratings yet

- Demon Et IzationDocument16 pagesDemon Et Izationashlesha tripathiNo ratings yet

- Black Market and The Indian EconomyDocument6 pagesBlack Market and The Indian EconomyMehak LIfez TrailingNo ratings yet

- Sept 2020 QuizDocument63 pagesSept 2020 QuizFirozAlamAhmedNo ratings yet

- Demonetization ProjectDocument8 pagesDemonetization ProjectFloydCorreaNo ratings yet

- 8 EF2 - HDT - Budget3 - EF3 - BoP - PartA PDFDocument45 pages8 EF2 - HDT - Budget3 - EF3 - BoP - PartA PDFShivrajNo ratings yet

- Topic No-01 How To Increase Foreign Remittance Inflow To BangladeshDocument2 pagesTopic No-01 How To Increase Foreign Remittance Inflow To BangladeshSakib IqbalNo ratings yet

- Demonetisation Explained and NotificationsDocument31 pagesDemonetisation Explained and Notificationsaanchal singhNo ratings yet

- Effects of Demonetization On Banks - Law Times JournalDocument4 pagesEffects of Demonetization On Banks - Law Times JournalKhanak ChauhanNo ratings yet

- DEMONYDocument2 pagesDEMONYSRIKRISHNANo ratings yet

- Black Money SandeshDocument43 pagesBlack Money SandeshRohan PhapaleNo ratings yet

- DemonetizationDocument60 pagesDemonetizationHenna LitinNo ratings yet

- ConclusionDocument12 pagesConclusionPrithvish ShettyNo ratings yet

- Aditya Eco Sem 2 Assign 2 FinalDocument7 pagesAditya Eco Sem 2 Assign 2 Finaludit rajNo ratings yet

- Impact of DemonetizationDocument7 pagesImpact of DemonetizationPartha Sarathi BarmanNo ratings yet

- Issues & Challenges - Impact of Demonetizaion On Indian EconomyDocument4 pagesIssues & Challenges - Impact of Demonetizaion On Indian EconomyPS FITNESSNo ratings yet

- Demonetization: Success & Failures: Presented By:-Harshvardhan Bartwal (Prof. R.C. Dangwal) DeanDocument17 pagesDemonetization: Success & Failures: Presented By:-Harshvardhan Bartwal (Prof. R.C. Dangwal) DeanDheeraj rawatNo ratings yet

- Project On Contemporary Economical Issue: "Demonetisation"Document12 pagesProject On Contemporary Economical Issue: "Demonetisation"SammyNo ratings yet

- DemonetisationDocument2 pagesDemonetisationAaditi VNo ratings yet

- Project TitleDocument9 pagesProject Titlemondalsomen75No ratings yet

- Paper 3Document6 pagesPaper 3Washim Alam50CNo ratings yet

- Tute 2 2021 IFIMDocument3 pagesTute 2 2021 IFIMptrip2323No ratings yet

- Eco Term PaperDocument16 pagesEco Term PaperRoshaniNo ratings yet

- Set 3Document144 pagesSet 3Arham TanvirNo ratings yet

- Text DemonetisationDocument5 pagesText Demonetisation20-CMB-01 Mudasir ShabirNo ratings yet

- Black Money in IndiaDocument18 pagesBlack Money in IndiaSamarth DNo ratings yet

- Demonstration Instrument: A Blow and Outcome On The Indian PopulaceDocument4 pagesDemonstration Instrument: A Blow and Outcome On The Indian PopulaceAnonymous lPvvgiQjRNo ratings yet

- Unit 4 DBDocument12 pagesUnit 4 DBDeepika. BabuNo ratings yet

- Sir Fareed Lec 6 Economy.Document22 pagesSir Fareed Lec 6 Economy.Fozia NazarNo ratings yet

- 01demonetization in IndiaDocument17 pages01demonetization in IndiaDheeraj rawatNo ratings yet

- Impact of Demonetization On Indian Economy: Anjali Ahuja Sakshi AnandDocument3 pagesImpact of Demonetization On Indian Economy: Anjali Ahuja Sakshi AnandHEMANTH KUMARNo ratings yet

- DemonetisationDocument18 pagesDemonetisationDarshita PajvaniNo ratings yet

- Demonitisation and GSTDocument3 pagesDemonitisation and GSTnakulshali1No ratings yet

- How to Uplift the Uae Economy Without Oil RevenueFrom EverandHow to Uplift the Uae Economy Without Oil RevenueNo ratings yet

- A Comprehensive Assessment of Tax Capacity in Southeast AsiaFrom EverandA Comprehensive Assessment of Tax Capacity in Southeast AsiaNo ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- .) - ) ' - Ab Cde ) B F G HB - Ib Jik L) Mdik - Inb MF B Dlmfo) B - Im L - PLQDocument4 pages.) - ) ' - Ab Cde ) B F G HB - Ib Jik L) Mdik - Inb MF B Dlmfo) B - Im L - PLQWashim Alam50CNo ratings yet

- Read 6Document2 pagesRead 6Washim Alam50CNo ratings yet

- Read 2Document2 pagesRead 2Washim Alam50CNo ratings yet

- Read 5Document2 pagesRead 5Washim Alam50CNo ratings yet

- Read 4Document1 pageRead 4Washim Alam50CNo ratings yet

- Read 3Document2 pagesRead 3Washim Alam50CNo ratings yet

- WWW - Visionias.in: 3 ©vision IASDocument2 pagesWWW - Visionias.in: 3 ©vision IASWashim Alam50CNo ratings yet

- 45.8 E P PM-EAC?: Mrunal's Economy Pillar#4: Sectors of Economy Page 310Document3 pages45.8 E P PM-EAC?: Mrunal's Economy Pillar#4: Sectors of Economy Page 310Washim Alam50CNo ratings yet

- G.S. Paper Ii - : Social JusticeDocument3 pagesG.S. Paper Ii - : Social JusticeWashim Alam50CNo ratings yet

- Report 6Document5 pagesReport 6Washim Alam50CNo ratings yet

- Report 3Document4 pagesReport 3Washim Alam50CNo ratings yet

- WWW - Visionias.in: 6 ©vision IASDocument2 pagesWWW - Visionias.in: 6 ©vision IASWashim Alam50CNo ratings yet

- Report 1Document3 pagesReport 1Washim Alam50CNo ratings yet

- 45.4 P C: L / S: Mrunal's Economy Pillar#4: Sectors of Economy Page 307Document3 pages45.4 P C: L / S: Mrunal's Economy Pillar#4: Sectors of Economy Page 307Washim Alam50CNo ratings yet

- Report 2Document3 pagesReport 2Washim Alam50CNo ratings yet

- Report 5Document4 pagesReport 5Washim Alam50CNo ratings yet

- 48.6 P #4: I: Cpi, Wpi, Iip &: Mrunal's Economy Pillar#4: Sectors of Economy Page 332Document2 pages48.6 P #4: I: Cpi, Wpi, Iip &: Mrunal's Economy Pillar#4: Sectors of Economy Page 332Washim Alam50CNo ratings yet

- 45.5 P C N A: S: Position Planning Commission NITI AayogDocument3 pages45.5 P C N A: S: Position Planning Commission NITI AayogWashim Alam50CNo ratings yet

- Economic System आ थक णाल →: Mrunal's Economy Pillar#4: Sectors of Economy → Page 305Document2 pagesEconomic System आ थक णाल →: Mrunal's Economy Pillar#4: Sectors of Economy → Page 305Washim Alam50CNo ratings yet

- Mrunal's Economy Pillar#4: Sectors of Economy Page 302Document3 pagesMrunal's Economy Pillar#4: Sectors of Economy Page 302Washim Alam50CNo ratings yet

- Table 1: Tax Morale Is Affected by Two Types of Fairness: Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 166Document3 pagesTable 1: Tax Morale Is Affected by Two Types of Fairness: Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 166Washim Alam50CNo ratings yet

- 30.4 B C A I G: Figure 1: Oil Barrel Prices in U$D. Source: ES2018-19, Vol2Ch6Document3 pages30.4 B C A I G: Figure 1: Oil Barrel Prices in U$D. Source: ES2018-19, Vol2Ch6Washim Alam50CNo ratings yet

- Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 136Document3 pagesMrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 136Washim Alam50CNo ratings yet

- 24 T B M & A I: Axation Lack Oney Llied SsuesDocument3 pages24 T B M & A I: Axation Lack Oney Llied SsuesWashim Alam50CNo ratings yet

- Release, Waiver and Quitclaim: Know All Men by These PresentsDocument1 pageRelease, Waiver and Quitclaim: Know All Men by These PresentsPj CuarterosNo ratings yet

- ASSESSMENT OF INTERNAL REVENUE TAXES 2024 InitialDocument31 pagesASSESSMENT OF INTERNAL REVENUE TAXES 2024 InitialRey Jay BICARNo ratings yet

- Taxes Corporations Trusts: Michael Wenzel (2002)Document3 pagesTaxes Corporations Trusts: Michael Wenzel (2002)nabilNo ratings yet

- EXE. Chapter 4 (Part 1)Document1 pageEXE. Chapter 4 (Part 1)Hằng HằngNo ratings yet

- Order FL0231309238: Mode of Payment: NONCODDocument1 pageOrder FL0231309238: Mode of Payment: NONCODSAIKAT PAULNo ratings yet

- Phil Gold Processing & Refining Corp: RF Monthly-Lgm 3Document1 pagePhil Gold Processing & Refining Corp: RF Monthly-Lgm 3bonemarkcosNo ratings yet

- China Banking Corporation Vs Commissioner of Internal RevenueDocument6 pagesChina Banking Corporation Vs Commissioner of Internal Revenuemarc bantugNo ratings yet

- RMO No 9-06 TCVD Tax Mapping Annex N-QDocument5 pagesRMO No 9-06 TCVD Tax Mapping Annex N-QGil PinoNo ratings yet

- TOA03 04 Leases Income Tax Employee Benefits CharlenesDocument3 pagesTOA03 04 Leases Income Tax Employee Benefits CharlenesMerliza JusayanNo ratings yet

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- CIR vs. Goodyear 216130Document1 pageCIR vs. Goodyear 216130magenNo ratings yet

- Guidelines: Determine If A Property Is A Capital or Ordinary AssetDocument7 pagesGuidelines: Determine If A Property Is A Capital or Ordinary AssetasdfNo ratings yet

- CusdecFinalSAD KZBB1900232Document5 pagesCusdecFinalSAD KZBB1900232Elan Mae Bastasa SarsonaNo ratings yet

- 2024 Certificate of Tax Residence - Adobe IrelandDocument1 page2024 Certificate of Tax Residence - Adobe IrelandhansonmeetingNo ratings yet

- Costing OverheadDocument5 pagesCosting OverheadbereketNo ratings yet

- Zadar Open 2018 InforegulationsDocument2 pagesZadar Open 2018 InforegulationsparnaliNo ratings yet

- 22.-CREBA, Inc. v. Romulo, G.R No. 160756Document24 pages22.-CREBA, Inc. v. Romulo, G.R No. 160756Christine Rose Bonilla LikiganNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rintu DasNo ratings yet

- Invoice OD219618879639285000 PDFDocument1 pageInvoice OD219618879639285000 PDFSUBHADIP DASNo ratings yet

- The Budget Hole Has Been Known ForDocument110 pagesThe Budget Hole Has Been Known ForThe PitchNo ratings yet

- Abdullah Anti Fire Corporation: QuotationDocument1 pageAbdullah Anti Fire Corporation: QuotationDistinctive learningNo ratings yet

- PBCOM v. CIR Case DigestDocument4 pagesPBCOM v. CIR Case DigestCareenNo ratings yet

- Invoice: Charge DetailsDocument2 pagesInvoice: Charge Detailswa_melianNo ratings yet

- Abc Bill No.1372 Santhosh SDocument1 pageAbc Bill No.1372 Santhosh Ssanthosh srinivasNo ratings yet

- Section 194C: TDS On ContractDocument5 pagesSection 194C: TDS On ContractwaghuleNo ratings yet

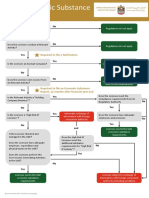

- Flowchart: Required To File A NotificationDocument2 pagesFlowchart: Required To File A NotificationSajidZiaNo ratings yet

Paper 19 PDF

Paper 19 PDF

Uploaded by

Washim Alam50COriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paper 19 PDF

Paper 19 PDF

Uploaded by

Washim Alam50CCopyright:

Available Formats

https://telegram.me/pdf4exams https://telegram.

me/testseries4exams

launch sovereign cryptocurrency named, _ _ _ (HOMEWORK- fill the blanks from

Pillar1 Handout).

➢ On Indian side, CBDT is the the nodal agency for such agreements.

24.5.2 USA’s Foreign Account Tax Compliance Act (FATCA-2010)

िदे शी खाता कर अनप

ु ालन अ ध नयम

➢ USA’s FATCA Act requires foreign financial Institutions (such as Indian Banks, Pakistani

Insurance Companies, Chinese Mutual Funds etc) to report the assets held by

Americans.

➢ This helps US Tax authorities to detect tax avoidance / evasion by Americans who are

hiding income outside USA.

24.5.3 Global Financial Secrecy Index (वै वक व ीि गोपनीिता सच

ू काक)

➢ Prepared by London based Think Tank ‘Tax Justice Network (TJN)’.

➢ It uses 20 indicators to measure the countries on their financial secrecy,

opportunities for Tax Avoidance, BEPS etc.

➢ 2018 Ranking: Switzerland (1st), India (32),

24.6 BLACK MONEY → DEMONETISATION ( वमु करण)

Definition? Demonetization is the wholesale withdrawal of currency notes from

circulation.

➢ RBI Act 1934: Every banknote is a legal tender. However, RBI Central Board can

recommend the Government of India to notify specific currency note(s) should no

longer be treated as legal tenders. Then FinMin → Department of Economic Affairs

makes official gazette notification.

➢ 1946: ₹ 500 Notes demonetized; 1978: ₹ 1000, ₹ 5000, ₹10000 Notes demonetized.

➢ 2016-Nov-8th: Public was ordered to deposit the (old) Mahatma Gandhi series

currency notes ₹ 500 and ₹ 1,000 (henceforth called “Specified Bank Notes: SBN”) into

Banks and post-offices latest by 30th December 2016. And all the banks and post

offices where ordered to deposit such SBN into RBI.

➢ Specified Bank Notes (Cessation of Liabilities) Ordinance:

- From 31st December 2016, RBI Governor not required to honour “I promise to

pay…” or exchange the SBN. Except for NRIs: deadline little bit relaxed, with

certain caveats.

- Public prohibited from keeping SBN, except for research or numismatics or

museum- and that too in limited amount. This ordinance became Act in 2017.

➢ India is not the only country in the world to do demonetisation. Sweden ( 2013),

European Union ( 2016) and even Pakistan (2015) has done it for their currency notes.

24.6.1 Why Demonetise ₹ 500 & 1000?

➢ Demonetization is usually done in the aftermath of hyperinflation, war & regime-

change.

➢ India did it to combat _ _ _ _ _ _ _ _ .

➢ We had 12.04% Cash to GDP ratio, one of the highest in the world. Currency printing &

transportation cost alone was 1.7% of GDP.

➢ “Soil rate” is the rate at which notes are considered to be too damaged to use and

returned to the RBI. For ₹ 500 & 1000 SBN-notes, soil rate was much lower than the

Mrunal’s Economy Pillar#2B: Budget → Revenue Part : Page 163

https://telegram.me/pdf4exams https://telegram.me/testseries4exams

currency notes of ₹ 10 to 100. (implying that 500-1000 SBN were used more for ‘storing

black money’, rather than using in transactions.)

➢ So, experts made mathematical comparison of the foreign countries’ economic

development, soil rates of their foreign currency notes etc. and arrived at a figure ₹ 3

lakh crores of Indian black money is stored in SBN (=2% of GDP).

➢ So if SBN were demonetised, the black money holders will not return their currency

notes into banks (fearing IT-RAIDS) and thus black money will be destroyed.

➢ But in reality, ~99.30% of the SBN were returned back into the banking system, so

hardly ₹ 10,720 crore of black money was destroyed by the demonetisation of 2016.

24.6.2 How did 99.30% SBN returned into banking system?

If the mathematical modelling was correct, then only 80% of the SBN should have returned

back, & 20% SBN (presumed to be Black Money) should not have returned. But, Black

money owners used following tricks to deposit their SBN in bank accounts:

1. Businessmen / Politicians used their drivers, cooks, gardeners, personal staff members

and relatives as Money mules. This is evident from exponential rise in the deposits in

Pradhan Mantri Jan Dhan bank accounts.

2. SBN were given out as “loans” to poor & as advance salaries to workers.

3. Agents who tied up with corrupt bankers who exchanged SBN without KYC verification.

4. SBN deposited in Cooperative Banks as back-dated Fixed Deposits (Because Cooperative

Banks didn’t use Core Bank Solution so it was possible to temper records)

5. SBN deposited in banks and then shown as income from sale of (fictitious) grain stock

etc. So, IT-dept can’t demand tax on it (and most state governments not levy tax on

agricultural income due to vote bank politics).

6. SBN deposited in shell companies & shown as income from (fictitious) sale and

invoices.

7. SBN donationed to trust, temples & political parties with backdated receipts (and

those entities are exempted from Income Tax on their income.)…. And so on

24.6.3 99.30% SBN returned, but Demonetization not failed experiment because:

✓ Those who could not return their SBN, have lost their black money (₹ 10,720 crore)

✓ Those who used poor people are money mules- must have paid some commission to

them. So even if government did not get tax from black money, atleast poor people

benefited. Thus, indirectly demonetization helped in redistribution of wealth.

✓ Further, during Operation Clean money, IT-dept issued notices to the suspicious bank

accounts where large amount of money was deposited. Such shell firms & their benami

properties are being seized.

✓ With Project Insight & Op. Clean Money: IT dept fetched ₹ 1.30 lakh crore in taxes and

penalty, attached ₹ 7000 crore worth Benami properties, ₹ 1600 crore worth foreign

assets & de-registered ~3.40 lakh shell firms. (says the Int-Budget-2019).

✓ The number of PAN card registration, IT returns, registrations under excise / VAT /

GST have greatly increased in the aftermath of demonetisation which proves that

crooked people have learned lesson. More than 1 cr. new income tax assesses added in

2017.

✓ Tax collection has increased from ~₹ 6 lakh crores (2013) to ~₹ 12 lakh crores (2018).

24.6.4 Demonetization: Impact as per Economic survey 2016-17

Mrunal’s Economy Pillar#2B: Budget → Revenue Part : Page 164

https://telegram.me/pdf4exams https://telegram.me/testseries4exams

Area Short Term Challenges Long Term Benefits

Banking Administrative challenges Growth in the deposits → more loans can be

on the bankers to exchange given @cheaper interest rate, Less Cash

the banned notes, long economy & associated benefits.

queues of people

Real Sale of houses declined Prices & rents of houses should decline.

Estate Migrants will benefit.

Economy Job loss in cash-intensive Less-cash economy, digitization and

at large sectors like diamond formalization of economy, Bizmen getting

polishing, farm laborer, GST registrations → further surveillance →

MSME forced to show their employees on paper →

EPFO & ESIC benefits to worker.

Growth Slow down improvement

rate

SELF-Study for Mains: Economic survey 2016-17 Vol1ch3, table 2 “impact of demoneti..”

24.7 ECONOMIC SURVEY ON TAXATION AND FISCAL CAPACITY ( ि ीय मता)

The Economic Surveys of 2015, 2016, 2017 have repeatedly observed that

- Democracy is a contract. Taxation is the economic glue that binds government and

citizens into this contract.

- But, when ever government delivers poor quality of service in public schools, hospital

etc. → middle class and rich citizens will “EXIT” towards the private school and

hospitals → Then they also feel ‘moral right’ to evade / avoid taxes, because they

are no longer using public services. Result? hardly _ _ _ _ _ _ _ _ _ _ _ _ are

taxpayers (23% is desirable, as per our level of development against BRICS nations.)

- Govt gets less taxes → poor fiscal capacity → poor services → vicious cycle continues

and results in decline of govt’s accountability towards citizens.

24.7.1 The reasons for low Tax: GDP in India:

1) Lack of civic sense among people that paying taxes is their basic duty.

Mrunal’s Economy Pillar#2B: Budget → Revenue Part : Page 165

You might also like

- PPR 100 Pipes and Fittings Updated Price List 07 March 2023Document1 pagePPR 100 Pipes and Fittings Updated Price List 07 March 2023Sj interiorNo ratings yet

- Lab 3-2 PHM Reliable Catering Weekly Payroll ReportDocument1 pageLab 3-2 PHM Reliable Catering Weekly Payroll ReportAitor AguadoNo ratings yet

- 22 Wealth MultipliersDocument19 pages22 Wealth MultipliersShantrece MarshallNo ratings yet

- Project For Taxation LawDocument11 pagesProject For Taxation Lawtanmaya guptaNo ratings yet

- Impact of Black-MoneyDocument26 pagesImpact of Black-MoneyDevikaSharma100% (2)

- VAT On Merchandise Purchased and SoldDocument5 pagesVAT On Merchandise Purchased and SoldBernadette Solis100% (1)

- So Why Were Rs 500 and Rs 1000 Bank Notes Demonetized?: Currency Legal Tender National CurrencyDocument19 pagesSo Why Were Rs 500 and Rs 1000 Bank Notes Demonetized?: Currency Legal Tender National CurrencyAbhay SharmaNo ratings yet

- Case Study 1Document6 pagesCase Study 1mashila arasanNo ratings yet

- DemonetisationDocument44 pagesDemonetisationPriya SonuNo ratings yet

- Bes172 p4 Blackmoney 2 Demonetization Soil RateDocument40 pagesBes172 p4 Blackmoney 2 Demonetization Soil Rateroy lexterNo ratings yet

- Demonetisation:: Why Was Demonetization DoneDocument3 pagesDemonetisation:: Why Was Demonetization DoneRadhika JaiswalNo ratings yet

- Case Study On Economic Event-Demonetization: Sanjana Menon B 2017155Document7 pagesCase Study On Economic Event-Demonetization: Sanjana Menon B 2017155Sanjana MenonNo ratings yet

- PEM ReportDocument6 pagesPEM Reportxx69dd69xxNo ratings yet

- Master of Business Administration: Third Semester MF0012Document21 pagesMaster of Business Administration: Third Semester MF0012Rajesh PhulwaniNo ratings yet

- DemonetisationDocument20 pagesDemonetisationMukti BarolaNo ratings yet

- Demonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaDocument15 pagesDemonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaShalvi RanjanNo ratings yet

- Economics Projec1Document9 pagesEconomics Projec1Kalyani SreekumarNo ratings yet

- Demonetization FILEDocument13 pagesDemonetization FILEDamanjot KaurNo ratings yet

- Demonetisation in India: A Study of Its' Impact On Various Key SectorsDocument8 pagesDemonetisation in India: A Study of Its' Impact On Various Key SectorsHimanshuNo ratings yet

- Notes On Ruppe and DigitalisationDocument23 pagesNotes On Ruppe and DigitalisationsanjayNo ratings yet

- Sample Research Paper PDFDocument27 pagesSample Research Paper PDFSANYA JAINNo ratings yet

- 8EF2 - HDT - Budget3 - EF3 - BoP - PartA @ PDFDocument45 pages8EF2 - HDT - Budget3 - EF3 - BoP - PartA @ PDFMohanNo ratings yet

- Simranjeet Kaur 3051Document11 pagesSimranjeet Kaur 3051Mani JattNo ratings yet

- Isha SinghDocument10 pagesIsha Singhskguddu2003No ratings yet

- Demonetisation EconomicsDocument17 pagesDemonetisation Economics125117059No ratings yet

- Demonitisation (Report)Document41 pagesDemonitisation (Report)onlinebaijnathNo ratings yet

- DemonetisationDocument6 pagesDemonetisationRENUKA THOTENo ratings yet

- Canvass: Capturing News With An Analytical EdgeDocument6 pagesCanvass: Capturing News With An Analytical EdgeRanjith RoshanNo ratings yet

- Demon Et IzationDocument16 pagesDemon Et Izationashlesha tripathiNo ratings yet

- Black Market and The Indian EconomyDocument6 pagesBlack Market and The Indian EconomyMehak LIfez TrailingNo ratings yet

- Sept 2020 QuizDocument63 pagesSept 2020 QuizFirozAlamAhmedNo ratings yet

- Demonetization ProjectDocument8 pagesDemonetization ProjectFloydCorreaNo ratings yet

- 8 EF2 - HDT - Budget3 - EF3 - BoP - PartA PDFDocument45 pages8 EF2 - HDT - Budget3 - EF3 - BoP - PartA PDFShivrajNo ratings yet

- Topic No-01 How To Increase Foreign Remittance Inflow To BangladeshDocument2 pagesTopic No-01 How To Increase Foreign Remittance Inflow To BangladeshSakib IqbalNo ratings yet

- Demonetisation Explained and NotificationsDocument31 pagesDemonetisation Explained and Notificationsaanchal singhNo ratings yet

- Effects of Demonetization On Banks - Law Times JournalDocument4 pagesEffects of Demonetization On Banks - Law Times JournalKhanak ChauhanNo ratings yet

- DEMONYDocument2 pagesDEMONYSRIKRISHNANo ratings yet

- Black Money SandeshDocument43 pagesBlack Money SandeshRohan PhapaleNo ratings yet

- DemonetizationDocument60 pagesDemonetizationHenna LitinNo ratings yet

- ConclusionDocument12 pagesConclusionPrithvish ShettyNo ratings yet

- Aditya Eco Sem 2 Assign 2 FinalDocument7 pagesAditya Eco Sem 2 Assign 2 Finaludit rajNo ratings yet

- Impact of DemonetizationDocument7 pagesImpact of DemonetizationPartha Sarathi BarmanNo ratings yet

- Issues & Challenges - Impact of Demonetizaion On Indian EconomyDocument4 pagesIssues & Challenges - Impact of Demonetizaion On Indian EconomyPS FITNESSNo ratings yet

- Demonetization: Success & Failures: Presented By:-Harshvardhan Bartwal (Prof. R.C. Dangwal) DeanDocument17 pagesDemonetization: Success & Failures: Presented By:-Harshvardhan Bartwal (Prof. R.C. Dangwal) DeanDheeraj rawatNo ratings yet

- Project On Contemporary Economical Issue: "Demonetisation"Document12 pagesProject On Contemporary Economical Issue: "Demonetisation"SammyNo ratings yet

- DemonetisationDocument2 pagesDemonetisationAaditi VNo ratings yet

- Project TitleDocument9 pagesProject Titlemondalsomen75No ratings yet

- Paper 3Document6 pagesPaper 3Washim Alam50CNo ratings yet

- Tute 2 2021 IFIMDocument3 pagesTute 2 2021 IFIMptrip2323No ratings yet

- Eco Term PaperDocument16 pagesEco Term PaperRoshaniNo ratings yet

- Set 3Document144 pagesSet 3Arham TanvirNo ratings yet

- Text DemonetisationDocument5 pagesText Demonetisation20-CMB-01 Mudasir ShabirNo ratings yet

- Black Money in IndiaDocument18 pagesBlack Money in IndiaSamarth DNo ratings yet

- Demonstration Instrument: A Blow and Outcome On The Indian PopulaceDocument4 pagesDemonstration Instrument: A Blow and Outcome On The Indian PopulaceAnonymous lPvvgiQjRNo ratings yet

- Unit 4 DBDocument12 pagesUnit 4 DBDeepika. BabuNo ratings yet

- Sir Fareed Lec 6 Economy.Document22 pagesSir Fareed Lec 6 Economy.Fozia NazarNo ratings yet

- 01demonetization in IndiaDocument17 pages01demonetization in IndiaDheeraj rawatNo ratings yet

- Impact of Demonetization On Indian Economy: Anjali Ahuja Sakshi AnandDocument3 pagesImpact of Demonetization On Indian Economy: Anjali Ahuja Sakshi AnandHEMANTH KUMARNo ratings yet

- DemonetisationDocument18 pagesDemonetisationDarshita PajvaniNo ratings yet

- Demonitisation and GSTDocument3 pagesDemonitisation and GSTnakulshali1No ratings yet

- How to Uplift the Uae Economy Without Oil RevenueFrom EverandHow to Uplift the Uae Economy Without Oil RevenueNo ratings yet

- A Comprehensive Assessment of Tax Capacity in Southeast AsiaFrom EverandA Comprehensive Assessment of Tax Capacity in Southeast AsiaNo ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- .) - ) ' - Ab Cde ) B F G HB - Ib Jik L) Mdik - Inb MF B Dlmfo) B - Im L - PLQDocument4 pages.) - ) ' - Ab Cde ) B F G HB - Ib Jik L) Mdik - Inb MF B Dlmfo) B - Im L - PLQWashim Alam50CNo ratings yet

- Read 6Document2 pagesRead 6Washim Alam50CNo ratings yet

- Read 2Document2 pagesRead 2Washim Alam50CNo ratings yet

- Read 5Document2 pagesRead 5Washim Alam50CNo ratings yet

- Read 4Document1 pageRead 4Washim Alam50CNo ratings yet

- Read 3Document2 pagesRead 3Washim Alam50CNo ratings yet

- WWW - Visionias.in: 3 ©vision IASDocument2 pagesWWW - Visionias.in: 3 ©vision IASWashim Alam50CNo ratings yet

- 45.8 E P PM-EAC?: Mrunal's Economy Pillar#4: Sectors of Economy Page 310Document3 pages45.8 E P PM-EAC?: Mrunal's Economy Pillar#4: Sectors of Economy Page 310Washim Alam50CNo ratings yet

- G.S. Paper Ii - : Social JusticeDocument3 pagesG.S. Paper Ii - : Social JusticeWashim Alam50CNo ratings yet

- Report 6Document5 pagesReport 6Washim Alam50CNo ratings yet

- Report 3Document4 pagesReport 3Washim Alam50CNo ratings yet

- WWW - Visionias.in: 6 ©vision IASDocument2 pagesWWW - Visionias.in: 6 ©vision IASWashim Alam50CNo ratings yet

- Report 1Document3 pagesReport 1Washim Alam50CNo ratings yet

- 45.4 P C: L / S: Mrunal's Economy Pillar#4: Sectors of Economy Page 307Document3 pages45.4 P C: L / S: Mrunal's Economy Pillar#4: Sectors of Economy Page 307Washim Alam50CNo ratings yet

- Report 2Document3 pagesReport 2Washim Alam50CNo ratings yet

- Report 5Document4 pagesReport 5Washim Alam50CNo ratings yet

- 48.6 P #4: I: Cpi, Wpi, Iip &: Mrunal's Economy Pillar#4: Sectors of Economy Page 332Document2 pages48.6 P #4: I: Cpi, Wpi, Iip &: Mrunal's Economy Pillar#4: Sectors of Economy Page 332Washim Alam50CNo ratings yet

- 45.5 P C N A: S: Position Planning Commission NITI AayogDocument3 pages45.5 P C N A: S: Position Planning Commission NITI AayogWashim Alam50CNo ratings yet

- Economic System आ थक णाल →: Mrunal's Economy Pillar#4: Sectors of Economy → Page 305Document2 pagesEconomic System आ थक णाल →: Mrunal's Economy Pillar#4: Sectors of Economy → Page 305Washim Alam50CNo ratings yet

- Mrunal's Economy Pillar#4: Sectors of Economy Page 302Document3 pagesMrunal's Economy Pillar#4: Sectors of Economy Page 302Washim Alam50CNo ratings yet

- Table 1: Tax Morale Is Affected by Two Types of Fairness: Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 166Document3 pagesTable 1: Tax Morale Is Affected by Two Types of Fairness: Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 166Washim Alam50CNo ratings yet

- 30.4 B C A I G: Figure 1: Oil Barrel Prices in U$D. Source: ES2018-19, Vol2Ch6Document3 pages30.4 B C A I G: Figure 1: Oil Barrel Prices in U$D. Source: ES2018-19, Vol2Ch6Washim Alam50CNo ratings yet

- Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 136Document3 pagesMrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 136Washim Alam50CNo ratings yet

- 24 T B M & A I: Axation Lack Oney Llied SsuesDocument3 pages24 T B M & A I: Axation Lack Oney Llied SsuesWashim Alam50CNo ratings yet

- Release, Waiver and Quitclaim: Know All Men by These PresentsDocument1 pageRelease, Waiver and Quitclaim: Know All Men by These PresentsPj CuarterosNo ratings yet

- ASSESSMENT OF INTERNAL REVENUE TAXES 2024 InitialDocument31 pagesASSESSMENT OF INTERNAL REVENUE TAXES 2024 InitialRey Jay BICARNo ratings yet

- Taxes Corporations Trusts: Michael Wenzel (2002)Document3 pagesTaxes Corporations Trusts: Michael Wenzel (2002)nabilNo ratings yet

- EXE. Chapter 4 (Part 1)Document1 pageEXE. Chapter 4 (Part 1)Hằng HằngNo ratings yet

- Order FL0231309238: Mode of Payment: NONCODDocument1 pageOrder FL0231309238: Mode of Payment: NONCODSAIKAT PAULNo ratings yet

- Phil Gold Processing & Refining Corp: RF Monthly-Lgm 3Document1 pagePhil Gold Processing & Refining Corp: RF Monthly-Lgm 3bonemarkcosNo ratings yet

- China Banking Corporation Vs Commissioner of Internal RevenueDocument6 pagesChina Banking Corporation Vs Commissioner of Internal Revenuemarc bantugNo ratings yet

- RMO No 9-06 TCVD Tax Mapping Annex N-QDocument5 pagesRMO No 9-06 TCVD Tax Mapping Annex N-QGil PinoNo ratings yet

- TOA03 04 Leases Income Tax Employee Benefits CharlenesDocument3 pagesTOA03 04 Leases Income Tax Employee Benefits CharlenesMerliza JusayanNo ratings yet

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- CIR vs. Goodyear 216130Document1 pageCIR vs. Goodyear 216130magenNo ratings yet

- Guidelines: Determine If A Property Is A Capital or Ordinary AssetDocument7 pagesGuidelines: Determine If A Property Is A Capital or Ordinary AssetasdfNo ratings yet

- CusdecFinalSAD KZBB1900232Document5 pagesCusdecFinalSAD KZBB1900232Elan Mae Bastasa SarsonaNo ratings yet

- 2024 Certificate of Tax Residence - Adobe IrelandDocument1 page2024 Certificate of Tax Residence - Adobe IrelandhansonmeetingNo ratings yet

- Costing OverheadDocument5 pagesCosting OverheadbereketNo ratings yet

- Zadar Open 2018 InforegulationsDocument2 pagesZadar Open 2018 InforegulationsparnaliNo ratings yet

- 22.-CREBA, Inc. v. Romulo, G.R No. 160756Document24 pages22.-CREBA, Inc. v. Romulo, G.R No. 160756Christine Rose Bonilla LikiganNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rintu DasNo ratings yet

- Invoice OD219618879639285000 PDFDocument1 pageInvoice OD219618879639285000 PDFSUBHADIP DASNo ratings yet

- The Budget Hole Has Been Known ForDocument110 pagesThe Budget Hole Has Been Known ForThe PitchNo ratings yet

- Abdullah Anti Fire Corporation: QuotationDocument1 pageAbdullah Anti Fire Corporation: QuotationDistinctive learningNo ratings yet

- PBCOM v. CIR Case DigestDocument4 pagesPBCOM v. CIR Case DigestCareenNo ratings yet

- Invoice: Charge DetailsDocument2 pagesInvoice: Charge Detailswa_melianNo ratings yet

- Abc Bill No.1372 Santhosh SDocument1 pageAbc Bill No.1372 Santhosh Ssanthosh srinivasNo ratings yet

- Section 194C: TDS On ContractDocument5 pagesSection 194C: TDS On ContractwaghuleNo ratings yet

- Flowchart: Required To File A NotificationDocument2 pagesFlowchart: Required To File A NotificationSajidZiaNo ratings yet