Professional Documents

Culture Documents

Star Family Health Optima 2020 PDF

Star Family Health Optima 2020 PDF

Uploaded by

Rajat GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Star Family Health Optima 2020 PDF

Star Family Health Optima 2020 PDF

Uploaded by

Rajat GuptaCopyright:

Available Formats

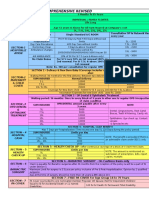

Star Family Health Optima Insurance Plan

Age at Entry - Adult 18 years to 65 years

Age at Entry - Dependent Children 16 Days to 25 years - Renewal till Age 25 years only

Policy Type Family Floater

Pricing Zone Based

Sum Insured Options 3Lac/4Lac/5Lac/10Lac/15Lac/20Lac and 25Lac

Family Size 2A/2A+1C/2A+2C/2A+3C/1A+1C/1A+2C/1A+3C

Family includes Proposer/Spouse/Three Dependent Kids

Policy Period 1 Year

Renewal Guarantee Life Long

Renewal Grace Period 120 days- To continue policy without loss of continuity benefits(Waiting Period PED Coverage)

Zones Classification of Zone determines Premium

Zone - 1 Delhi(including NCR), Mumbai (including Thane), Ahmedabad, Baroda and Surat

Zone - 1A Chennai, Bangalore, Pune, Nashik, Ernakulum, Trivandrum and Rest of Gujarat

Zone - 2 Coimbatore, Indore and Rest of Kerala

Zone - 3 Rest of India (Other than covered under Zone-1, Zone - 1A & Zone - 2)

Hospitalisation in-patient hospitalisation - Minimum period of 24 hours

Room Rent, Boarding and Nursing Expenses for 3, 4 Lac SI –(any zone) Rs. 5000 per day

Single Standard A/C Room - Single Occupancy A/C room with attached washroom, Couch for attendant, TV and

5,10,15,20& 25 Lac SI - Policy Purchased from any zone

Telephone

Lump sum benefit on choosing PNH - 3 Lac SI - Rs. 3000; 4 Lac SI - Rs. 4000; 5Lac and above SI - Rs. 5000/policy

Treatment at Preferred Network Hospitals

year

Per day benefit on Treatment in Shared Accommodation 3 Lac - 15 Lac - Rs. 800 20Lac & 25 Lac - Rs. 1000 - Benefit not extended for state in ICU/High dependency unit

ICU Charges Actual

Medical Professional Fees including specialist's fee Surgeon, Anaesthetist, Medical Practioner, Consultant, Specialist Fees - Actual

Anaesthesia, Blood, Oxygen, OT Charges, Surgical Appliances, Medicines and Drugs, Diagnostic Materials, X-ray,

Other Medical Expenses

Diagnostic Imaging, Dialysis, Chemotherapy, Radiotherapy, Pacemaker, Stent etc. - Actual

Road Ambulance Charges Rs. 750 per hospitalisation - Rs. 1500 per policy year

Air Ambulance - for 5 Lac and above SI 10% of SI

Emergency Domestic Medical Evacuation 1Lac to 4Lac - Rs.5000 / 5 Lac to 15Lac - Rs.7500 / 20Lac & 25Lac - Rs. 10000

Pre - Hospitalisation Expenses 60 days Prior to Hospitalisation - Actual - Relevant to the Hospitalisation

90 days from Discharge - Actual - Consultant fees, Diagnostic Charges, Medicines and drugs - relevant to

Post - Hospitalisation Expenses

Hospitalisation

Day Care All Day Care Procedures covered - 24 hours of hospitalisation not required

1&2 Lac SI - 12000/12000

3Lac SI - 25000 / 35000

Sub-limit for Day Care Procedure for Cataract - SI/Per Episode / Per Policy

4Lac SI - 30000 /45000

Period

5 Lac SI - 40000/60000

10Lac & above SI - 50000/75000

Cover starts from 16th day of Child Birth till the end of current policy year - 10% of SI - Max 50000 - Child birth

New-Born Baby cover - Mother covered at least 1 year in policy

Intimation Endorsement required

10% of SI - Max.Rs. 1Lac; Not available for Donor screening and Post-Donation Complications - Provided Claim

Organ Donor Expenses on Organ Transplantation

for transplantation Payable

AYUSH Treatment Coverage Limits 1Lac-4Lac - Rs. 10000; 5 Lac-15Lac - Rs. 15000; 20Lac&25Lac - Rs. 20000

Assisted Reproduction (Infertility) Treatment - After 3 years Waiting Period Inpatient / Day Care - 5 Lac Rs. 100000 ; 10 Lac and above Rs. 200000 ; For every continuous block of three years

for 5 Lac & above SI

1. Patient could not be moved to hospital 2. Non-availability of Rooms in hospital 3. Treatment provided at home

Domiciliary Hospitalisation Benefit

for more than 3 days - Considered as Hospitalisation

Recharge Sum Insured Benefit For 3Lac SI-Rs. 75000; For 4 Lac SI-Zone Rs. 100000; For 5 Lac & above SI-Rs. 150000

Three times in a Policy Year - 100% of SI restored Cannot be used for illness/disease for which claims made

Automatic Restoration Benefit already in the Current Policy Year + Hospitalisations out of Accidents; Provided on Complete exhaustion of Basic

SI and Accumulated NCB

No Claim Bonus- Max Accumulation 25% of SI for first year and later 10% of SI - every claim free year - Max Accumulation 100% of SI

Insured riding two wheeler / riding as pillion rider in two wheeler wearing helmet - meeting with Road Traffic

25% Additional Two Wheeler Road Traffic Accident Sum Insured

Accident - 25% SI-Max 5 Lac

3 Lac SI - Rs. 750; 4Lac SI-Rs. 1000; 5Lac - Rs. 1500; 10 Lac SI - Rs. 2000; 15Lac SI Rs. 2500; 20 Lac SI Rs. 3000; 25

Free Annual Health Check-up - on every Claim free year

Lac SI - Rs. 3500

Insured hospitalised for life threatening emergency in a city away from his residence - one immediate family

Compassionate Air Travel Benefit - for 10 Lac and above SI

member's air travel cost reimbursed up to Rs. 5000

Medical records forwarded to e_medicalopinion@starhealth.in or sent by post - Medical opinion will be sent to

Free Second Medical Opinion the insured based on the medical records submitted; Opinion for medical reasons and not for medico-legal

purposes.

Cost of Embalming, Coffin Charges and Transportation cost of Mortal Remains up to Rs. 5000 - During an

Repatriation of Mortal Remains

admissible Claim

20% Co-pay applied on Every Claim

Co-pay-for Clients-Age at Entry above60 Years

No Co-pay applicable

Co-pay for Hospitalisation on Package Treatment Cost

Any Hospitalisation - Except Hospitalisation arising out of Accidents

30 days waiting Period

Like - Cataract, Prolapse of intervertebral Disc(Non-Accidental), Varicose-Veins & Ulcers, Hernia, Fistula/Fissure,

24 months waiting Period Congenital internal Disease, - For full list refer Product Boucher

48 months waiting Period Pre-Existing Diseases(PED) declared in Proposal, Accepted and Endorsed in Policy

Like - Congenital External Defects, Dental Treatments(Non-Accidental), Venereal Diseases, Psychiatric treatments,

Permanent Exclusions Intentional Self-Injury, Pregnancy and Child Birth related treatment (Except ART Coverage), Weight control,

Cosmetic Treatments, Plastic Surgery - for full list refer Product Boucher

Heart diseases, Cancer, Kidney Diseases, Major CNS ailments(CVA, Parkinson's Disease, Alzheimer's Disease),

Declined Risks (Not Eligible for persons with) Cirrhosis of Liver, Chronic Obstructive Pulmonary Disease (COPD), Auto immune/Connective tissue disorders

requiring long term steroids and immunosuppressant’s

Filled in Proposal form, Recent P.P. Size Colour Photo (1- for 3 years to 50 years; 2-for More than 50 years old),

Documentary Requirements Age Proof for More than 45 years Old, Bank Details of Proposer when Premium is more than Rs. 25000

NO PRE ACCEPATANCE MEDICAL SCREENING FOR SI 4 Lakh AND ABOVE,

However with PED -Medical Opinion through lab portal by the Corporate Office Doctor - Accepted at Operating

Acceptance Limits

Office and person Above Age 50 years opt for below 4 lakh Sum Insured Medical screening required.

Pre-Acceptance Medical Screening - Age above 50 Years - Sum Insured up to Height/Weight/BMI, Blood Pressure, Random Blood Sugar, Serum Creatinine, ECG, Urine-Routine Analysis

5 Lac

Pre-Acceptance Medical Screening - Age above 50 Years - Sum Insured more All the above Tests Plus X-Ray(Chest) and TMT

than 5 Lac

Tax Benefits - Sec-80D Rs. 25000 - for Age up to 59 years; Rs. 30000 - for Age 60 years and above clients

Strictly for internal training purpose only. Refer to Boucher for more information

You might also like

- @anesthesia - Books Short Answer Questions in Anaesthesia PDFDocument347 pages@anesthesia - Books Short Answer Questions in Anaesthesia PDFVivek Sinha83% (6)

- Product One PagerDocument1 pageProduct One PagervamsiklNo ratings yet

- Prucash PremierDocument14 pagesPrucash PremierJaboh LabohNo ratings yet

- Health InsuranceDocument40 pagesHealth InsuranceSubhadeep SahaNo ratings yet

- Case Study On Breech BirthDocument58 pagesCase Study On Breech BirthAgronaSlaughter100% (2)

- Roduct BookletDocument11 pagesRoduct BookletDeepak MoreNo ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- FHO - One Pager - Version 1.0 - Oct 2020Document2 pagesFHO - One Pager - Version 1.0 - Oct 2020naval730107100% (1)

- FHO - Revised - One PagerDocument1 pageFHO - Revised - One Pagersurya100% (1)

- Youngstar - One Pager PDFDocument1 pageYoungstar - One Pager PDFRicky100% (1)

- FHO - One Pager - Version 1.1 - MayDocument2 pagesFHO - One Pager - Version 1.1 - MaySakshi Jain50% (2)

- Family Health Optima Insurance PlanDocument16 pagesFamily Health Optima Insurance PlanvedavathiNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - May - 22Document2 pagesStar Health Assure - One Pager - Version 1.0 - May - 22ksreddy618100% (1)

- Star Health - Red CarpetDocument3 pagesStar Health - Red CarpetPradeep NadarNo ratings yet

- Star Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Document1 pageStar Comprehensive Insurance Policy - One Pager - Version - 1.1 - (June) - 21Viki for gmail GmailNo ratings yet

- Arogya Sanjeevani - One Pager PDFDocument1 pageArogya Sanjeevani - One Pager PDFstar health Vadavalli50% (2)

- Star Cancer Care Platinum One PagerDocument2 pagesStar Cancer Care Platinum One Pagerricky aliaNo ratings yet

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document3 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Shihb100% (1)

- Star Outpatient Care Insurance Policy - One Pager - Version - 1.1 - May - 22Document1 pageStar Outpatient Care Insurance Policy - One Pager - Version - 1.1 - May - 22harsha sim100% (1)

- Star Women Care - One Pager - Version 1.0 - March - 22 (2)Document2 pagesStar Women Care - One Pager - Version 1.0 - March - 22 (2)tupai67% (3)

- Care Supreme One PagerDocument3 pagesCare Supreme One PagersamsunggranddousromNo ratings yet

- Comp One Pager With Premium ChartDocument3 pagesComp One Pager With Premium ChartnithinNo ratings yet

- Arogya Sanjeevani - One Pager PDFDocument1 pageArogya Sanjeevani - One Pager PDFstar health Vadavalli0% (1)

- Succession PlanningDocument19 pagesSuccession PlanningManish JainNo ratings yet

- Best Ulip Plan: SMART POWER (Sample Illustration)Document1 pageBest Ulip Plan: SMART POWER (Sample Illustration)Tricolor C ANo ratings yet

- 01 Brochure - New India Asha KiranDocument2 pages01 Brochure - New India Asha Kiranranjitha satheeNo ratings yet

- Canara Mediclaim BrochureDocument5 pagesCanara Mediclaim Brochurepankarvi6No ratings yet

- (Products) Bajaj Allianz Life Insurance Company LimitedDocument4 pages(Products) Bajaj Allianz Life Insurance Company LimitedFrancis SimethyNo ratings yet

- Relative Agy CirDocument2 pagesRelative Agy CirtsrajanNo ratings yet

- Even Earlier Protection: For Your Unborn BabyDocument21 pagesEven Earlier Protection: For Your Unborn BabyPARVEEN KAUR A/P MONHEN SINGH MoeNo ratings yet

- Icici Pru Project QCDocument70 pagesIcici Pru Project QCNaina VermaNo ratings yet

- Business Succession Planning Training Course OutlineDocument3 pagesBusiness Succession Planning Training Course OutlineancynaveenNo ratings yet

- Health Pro Infinity BrochureDocument5 pagesHealth Pro Infinity BrochureRK0% (1)

- Training and Development in BHARTI AXA Life InsuranceDocument75 pagesTraining and Development in BHARTI AXA Life Insuranceankitasachaan89No ratings yet

- SampleDocument5 pagesSamplenadiaNo ratings yet

- LIC All Plans AvailableDocument40 pagesLIC All Plans AvailableAjit SinhaNo ratings yet

- AXA-HOPEMedic2 XtraBrochure (Agency) (Sep2018)Document60 pagesAXA-HOPEMedic2 XtraBrochure (Agency) (Sep2018)E-Qie BalNo ratings yet

- Return Policy Enagic, USADocument1 pageReturn Policy Enagic, USADonalyn Calica SecuyaNo ratings yet

- Allianz Care Individual BrochureDocument20 pagesAllianz Care Individual BrochureLeonard YangNo ratings yet

- PSL - CA Certificate FormatDocument2 pagesPSL - CA Certificate Formatc pradeepNo ratings yet

- Star Fho One Page Feb 2020Document2 pagesStar Fho One Page Feb 2020suryaNo ratings yet

- FHO One Pager Version 1.0 Oct 2020Document2 pagesFHO One Pager Version 1.0 Oct 2020Darsh TalwadiaNo ratings yet

- Star Senior Citizen Red Carpet Health Insurance Plan (10 Jan-19)Document1 pageStar Senior Citizen Red Carpet Health Insurance Plan (10 Jan-19)Harsh VardhanNo ratings yet

- Revised SCRC One Pager (1) - Converted-Converted - 231107 - 125444Document1 pageRevised SCRC One Pager (1) - Converted-Converted - 231107 - 125444Vageesh VedamoorthyNo ratings yet

- SCRC - One PagerDocument1 pageSCRC - One Pagermpjegan90No ratings yet

- Senior Citizen Red Carpet - Snap Shot of The Features & Benefits - SHAHLIP1910V031819 - Launched On 10th JAN2019Document2 pagesSenior Citizen Red Carpet - Snap Shot of The Features & Benefits - SHAHLIP1910V031819 - Launched On 10th JAN2019Ganesh UnNo ratings yet

- Family Health Optima Insurance PlanDocument16 pagesFamily Health Optima Insurance Planujjal deyNo ratings yet

- FHO One Pager Version 1.5 September 2021Document1 pageFHO One Pager Version 1.5 September 2021manu.vm1990No ratings yet

- Family Health Optima Insurance PlanDocument1 pageFamily Health Optima Insurance PlanChetan tripathiNo ratings yet

- Benefits Silver GoldDocument4 pagesBenefits Silver GoldMitra LalNo ratings yet

- Star Diabetes Safe Health Insurance PlanDocument1 pageStar Diabetes Safe Health Insurance PlanRajat GuptaNo ratings yet

- Employee Benefits ManualDocument34 pagesEmployee Benefits Manualprkhalane2No ratings yet

- MEDICLASSIC Gold One PagerDocument1 pageMEDICLASSIC Gold One Pagerjaluku jinNo ratings yet

- Wa0011.Document5 pagesWa0011.Aparna AnilNo ratings yet

- Youngstar - One PagerDocument1 pageYoungstar - One Pagersahilbajaj12No ratings yet

- One Pager For YOUNG STARDocument1 pageOne Pager For YOUNG STARVivek Sharma100% (1)

- Ujjivan PolicyDocument1 pageUjjivan Policypavankalyanraj0123No ratings yet

- Young Star - One Pager - Version 1.2 - August 2021Document1 pageYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelNo ratings yet

- Medi Classic PresentationDocument24 pagesMedi Classic PresentationS S Biradar LicNo ratings yet

- InsuranceDocument21 pagesInsuranceGanesh PandianNo ratings yet

- Benefits ManualDocument34 pagesBenefits ManualRupayan DuttaNo ratings yet

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- Ma's Spices Product Booklet Without PriceDocument16 pagesMa's Spices Product Booklet Without PriceRajat GuptaNo ratings yet

- Umang ContestDocument3 pagesUmang ContestRajat GuptaNo ratings yet

- Max Heartbeat (Version 3) - Prospectus PDFDocument36 pagesMax Heartbeat (Version 3) - Prospectus PDFRajat GuptaNo ratings yet

- RHI Group Health Insurance - Single Rater Product - Contractual & WorkersDocument3 pagesRHI Group Health Insurance - Single Rater Product - Contractual & WorkersRajat GuptaNo ratings yet

- Leaflet - HDFC Developed World Indexes Fund of Funds NFO - 0Document4 pagesLeaflet - HDFC Developed World Indexes Fund of Funds NFO - 0Rajat GuptaNo ratings yet

- HDFC Balanced Advantage Fund Leaflet (As On 30th Nov 2022)Document6 pagesHDFC Balanced Advantage Fund Leaflet (As On 30th Nov 2022)Rajat GuptaNo ratings yet

- Sound Investment+Time+Patience Wealth Creation - HDFC Top 100 Fund Leaflet (As On 31st Oct 2022)Document2 pagesSound Investment+Time+Patience Wealth Creation - HDFC Top 100 Fund Leaflet (As On 31st Oct 2022)Rajat GuptaNo ratings yet

- Max Heartbeat (Version 3) - Prospectus PDFDocument36 pagesMax Heartbeat (Version 3) - Prospectus PDFRajat GuptaNo ratings yet

- Star PREMIUM CHART 18%Document5 pagesStar PREMIUM CHART 18%Rajat GuptaNo ratings yet

- Premium For CARE With NCB SUPER-3 PDFDocument3 pagesPremium For CARE With NCB SUPER-3 PDFRajat GuptaNo ratings yet

- Oriental Happy Family Brochure PDFDocument10 pagesOriental Happy Family Brochure PDFRajat GuptaNo ratings yet

- Max Bupa Health Companion Insurance Brochure PDFDocument2 pagesMax Bupa Health Companion Insurance Brochure PDFRajat GuptaNo ratings yet

- Apollo Munich Health-Wallet-Brochure - NEW - 8x8 PDFDocument9 pagesApollo Munich Health-Wallet-Brochure - NEW - 8x8 PDFRajat GuptaNo ratings yet

- Life Planner Business Opportunity COP - v5 - LR - 1 PDFDocument19 pagesLife Planner Business Opportunity COP - v5 - LR - 1 PDFRajat Gupta100% (1)

- Star Diabetes Safe Health Insurance PlanDocument1 pageStar Diabetes Safe Health Insurance PlanRajat GuptaNo ratings yet

- Leader Payout PDFDocument2 pagesLeader Payout PDFRajat GuptaNo ratings yet

- MAX Health Companion Zon3 PremiumDocument6 pagesMAX Health Companion Zon3 PremiumRajat GuptaNo ratings yet

- 9 Feb 2019 Quotation of Max Bupa (Heart Beat Gold) (1) .OdsDocument2 pages9 Feb 2019 Quotation of Max Bupa (Heart Beat Gold) (1) .OdsRajat GuptaNo ratings yet

- Corona Rakshak - One Pager - Version 1.0 - July - 20Document1 pageCorona Rakshak - One Pager - Version 1.0 - July - 20Rajat GuptaNo ratings yet

- Corona Kavach STAR One PagerDocument1 pageCorona Kavach STAR One PagerRajat GuptaNo ratings yet

- Loa Request Details PDFDocument35 pagesLoa Request Details PDFRajat GuptaNo ratings yet

- Max Bupa Health Companion Zone1Document7 pagesMax Bupa Health Companion Zone1Rajat GuptaNo ratings yet

- CARE SMART SELECT NCB SUPER - Jan 2020Document2 pagesCARE SMART SELECT NCB SUPER - Jan 2020Rajat GuptaNo ratings yet

- Objectives of Aph:: To Define About APH. To List The Causes of APHDocument42 pagesObjectives of Aph:: To Define About APH. To List The Causes of APHReena TyagiNo ratings yet

- Bahan Utk VCDocument58 pagesBahan Utk VCTias DiahNo ratings yet

- Ob PesiDocument3 pagesOb Pesiapi-302732994No ratings yet

- ACERWC Declaration On Ending Child Marriage in Africa PDFDocument6 pagesACERWC Declaration On Ending Child Marriage in Africa PDFsofiabloemNo ratings yet

- Peritoneal LavageDocument6 pagesPeritoneal Lavagemaymay737No ratings yet

- Covid19 MNCH GuidelineDocument35 pagesCovid19 MNCH GuidelineTaposh Sikder FcpsNo ratings yet

- Case Study On Ob Ward PreeclampsiaDocument12 pagesCase Study On Ob Ward PreeclampsiaNimrod83% (6)

- Operatif DeliveryDocument13 pagesOperatif DeliveryPepo AryabarjaNo ratings yet

- Birthing Into Birth Advocacy: Jennifer Clancy, M.ADocument5 pagesBirthing Into Birth Advocacy: Jennifer Clancy, M.Aapi-265871935No ratings yet

- Process Labor BirthDocument4 pagesProcess Labor Birthapi-318891098No ratings yet

- Nursing Care PlanDocument4 pagesNursing Care Planalyssa marie salcedoNo ratings yet

- Obstetric EmergenciesDocument76 pagesObstetric EmergenciesN. Siva100% (1)

- Breech Presentation Literature ReviewDocument6 pagesBreech Presentation Literature Reviewfrvkuhrif100% (1)

- Perineal Techniques During The Second Stage of Labour For Reducing Perineal Trauma (Review)Document118 pagesPerineal Techniques During The Second Stage of Labour For Reducing Perineal Trauma (Review)Ppds ObgynNo ratings yet

- Dona 1 CmcaDocument29 pagesDona 1 CmcaKyra MercadoNo ratings yet

- Sample Nurse Writing CVDocument2 pagesSample Nurse Writing CVMichael Rommel Dela Cruz83% (6)

- Physiological Changes Postpartum PeriodDocument2 pagesPhysiological Changes Postpartum PeriodEurielle MioleNo ratings yet

- Procedure Manual For Obstetrics and Gynecological Nursing: Government College of Nursing Somajiguda, Hyderabad, T.SDocument119 pagesProcedure Manual For Obstetrics and Gynecological Nursing: Government College of Nursing Somajiguda, Hyderabad, T.SBlessy Madhuri100% (5)

- Copar-RU Maternal and Child HealthDocument16 pagesCopar-RU Maternal and Child HealthMichelle ThereseNo ratings yet

- Araullo University OB WARD CLASSDocument40 pagesAraullo University OB WARD CLASSAlyza ShamaineNo ratings yet

- Cesarean SectionDocument14 pagesCesarean Sectionمؤمن شطناويNo ratings yet

- Who Guidelines For Safe Surgery 04222k9 PDFDocument158 pagesWho Guidelines For Safe Surgery 04222k9 PDFEngelbert Carr BaldomanNo ratings yet

- Bernabe Ncm109 LabDocument4 pagesBernabe Ncm109 LabKarl LintanNo ratings yet

- Neerland2018 (Physiolo)Document11 pagesNeerland2018 (Physiolo)Noah Borketey-laNo ratings yet

- DECE Assignments Jan - July 2023 (English)Document10 pagesDECE Assignments Jan - July 2023 (English)Charu SharmaNo ratings yet

- College of Nursing: Batangas State UniversityDocument11 pagesCollege of Nursing: Batangas State UniversityArcon AlvarNo ratings yet

- Childhood and Adolescence: Voyages in Development, 7e: Chapter 4: Birth and TheDocument65 pagesChildhood and Adolescence: Voyages in Development, 7e: Chapter 4: Birth and TheNUR HUMAIRA ROSLINo ratings yet

- Final MCNDocument3 pagesFinal MCNKyla R. PinedaNo ratings yet