Professional Documents

Culture Documents

Classifications of Partnership

Classifications of Partnership

Uploaded by

Fely MaataCopyright:

Available Formats

You might also like

- Contracts Essay OutlineDocument11 pagesContracts Essay Outlineisgigles157100% (14)

- Chapter 8Document14 pagesChapter 8Fely Maata100% (1)

- Assignment Prep Airing Journal Entries and Trail BalancesDocument13 pagesAssignment Prep Airing Journal Entries and Trail BalancesChristine NorthrupNo ratings yet

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- Circles - Book For Young Children On The Cycle of LifeDocument18 pagesCircles - Book For Young Children On The Cycle of Lifepeace4llyNo ratings yet

- CorpoDocument16 pagesCorpoErica JoannaNo ratings yet

- Module 5 - With SolutionsDocument12 pagesModule 5 - With SolutionsStella MarieNo ratings yet

- StalasaDocument23 pagesStalasajessa mae zerdaNo ratings yet

- PARCORDocument5 pagesPARCORjelai anselmoNo ratings yet

- Module 2-IM-ACCO-20033-Financial Accounting and Reporting Part 1 PDFDocument15 pagesModule 2-IM-ACCO-20033-Financial Accounting and Reporting Part 1 PDFambot balakajanNo ratings yet

- Vergil Joseph I. Literal, DBA, CPA: Page 1 of 3Document3 pagesVergil Joseph I. Literal, DBA, CPA: Page 1 of 3hsjhsNo ratings yet

- ACCTGDocument2 pagesACCTGGrace Anne AlaptoNo ratings yet

- Lesson 1 ExtendDocument6 pagesLesson 1 ExtendRoel Cababao50% (2)

- Chapter 5 - Corporation - Share TransactionsDocument14 pagesChapter 5 - Corporation - Share Transactionslou-924No ratings yet

- Adjusting Entry - PrepaymentsDocument19 pagesAdjusting Entry - PrepaymentsShayne Aldrae CacaldaNo ratings yet

- Prefinal Review AcfarDocument8 pagesPrefinal Review AcfarBugoy CabasanNo ratings yet

- UM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedDocument2 pagesUM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedJessa BeloyNo ratings yet

- True or FalseDocument8 pagesTrue or FalseKim OlimbaNo ratings yet

- Property Plant and Equipment: Ricky Boy B. LeonardoDocument14 pagesProperty Plant and Equipment: Ricky Boy B. LeonardoRodel Novesteras ClausNo ratings yet

- ACCTG 124 Chapter 7Document5 pagesACCTG 124 Chapter 7John Vincent A DioNo ratings yet

- Chapter 11 SampleDocument6 pagesChapter 11 SamplePattraniteNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Guide Questions For Chapter 2Document5 pagesGuide Questions For Chapter 2Kathleen Mangual0% (1)

- Partnership Notes PrintDocument5 pagesPartnership Notes PrintKayla MirandaNo ratings yet

- Problem 11-4 (Vicente, Kate Iannel C.)Document1 pageProblem 11-4 (Vicente, Kate Iannel C.)Kate Iannel VicenteNo ratings yet

- Fundamentals of Accounting and Business ManagementDocument4 pagesFundamentals of Accounting and Business ManagementSan Juan Ezthie100% (1)

- Conceptual Framework and Accounting Standards - Chapter 2 - NotesDocument5 pagesConceptual Framework and Accounting Standards - Chapter 2 - NotesKhey KheyNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyx100% (1)

- ASC Partnership Schedule of Safe PaymentsDocument3 pagesASC Partnership Schedule of Safe PaymentsMayaNo ratings yet

- Week 4 5 ULOc Lets Analyze Activities SolutionDocument3 pagesWeek 4 5 ULOc Lets Analyze Activities Solutionemem resuentoNo ratings yet

- TOPIC EconDocument44 pagesTOPIC EconChristy HabelNo ratings yet

- Partners HIP - Pretest: - Introduction and FormationDocument38 pagesPartners HIP - Pretest: - Introduction and FormationKristia AnagapNo ratings yet

- Accounting Assumptions: Introduction To Basic AccountingDocument6 pagesAccounting Assumptions: Introduction To Basic AccountingJon Nell Laguador Bernardo100% (1)

- Theories of AccountingDocument4 pagesTheories of AccountingShanine BaylonNo ratings yet

- Cost Accounting Midterm ExamDocument37 pagesCost Accounting Midterm Examshynebright.phNo ratings yet

- Name:: Score: ProfessorDocument6 pagesName:: Score: ProfessorkakaoNo ratings yet

- CHAPTER 2 PartnershipDocument17 pagesCHAPTER 2 PartnershipLAZARO, Jaspher S.No ratings yet

- Partnership OperationDocument2 pagesPartnership OperationCjhay MarcosNo ratings yet

- Exam Questionaire in IntermediateDocument5 pagesExam Questionaire in IntermediateJester IlaganNo ratings yet

- Q and A PartnershipDocument9 pagesQ and A PartnershipFaker MejiaNo ratings yet

- Mod7 Part 2 Manufacturing OperationsDocument24 pagesMod7 Part 2 Manufacturing Operationsmarjorie magsinoNo ratings yet

- Quiz 2 Partnership OperationsDocument4 pagesQuiz 2 Partnership OperationsChelit LadylieGirl FernandezNo ratings yet

- Lesson5-Bsa 2BDocument8 pagesLesson5-Bsa 2BEdraelyn MonatoNo ratings yet

- FDNACCT - Quiz #1 - Set B - Answer KeyDocument4 pagesFDNACCT - Quiz #1 - Set B - Answer KeyIchi HasukiNo ratings yet

- Theories ProblemsDocument9 pagesTheories ProblemsKristine Esplana ToraldeNo ratings yet

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- Partnership OpDocument25 pagesPartnership OpNeri La LunaNo ratings yet

- Jedah Noel - ASSIGNMENT 1 - Partnership FormationDocument2 pagesJedah Noel - ASSIGNMENT 1 - Partnership FormationJeddieh NoelNo ratings yet

- 07 Quiz 1Document3 pages07 Quiz 1Janrey RomanNo ratings yet

- Lecture Discussion - Service Concern - Worksheet To Post Closing Trial BalanceDocument8 pagesLecture Discussion - Service Concern - Worksheet To Post Closing Trial BalanceGarpt KudasaiNo ratings yet

- Exercise #11 (Sue Feria) DehnieceMangawangDocument3 pagesExercise #11 (Sue Feria) DehnieceMangawangPhaelyn YambaoNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- Admission and Retirement of PartnersDocument3 pagesAdmission and Retirement of PartnersJohn Eric MacallaNo ratings yet

- Chpter 1.problem 7.mullesDocument11 pagesChpter 1.problem 7.mullesKim OlimbaNo ratings yet

- Problem 12 Accounting PDFDocument3 pagesProblem 12 Accounting PDFErika RepedroNo ratings yet

- Corpo Prob and AnsDocument16 pagesCorpo Prob and AnsILOVE MATURED FANSNo ratings yet

- Prob 2Document1 pageProb 2Mitch Tokong MinglanaNo ratings yet

- Retained EarningsDocument3 pagesRetained EarningsChristian Marvin VillanuevaNo ratings yet

- CFAS Sample ProblemsDocument5 pagesCFAS Sample ProblemsChristian MartinNo ratings yet

- Question: Problem On Accrual E. Gevera Realty Co. Who Owns A BuildingDocument2 pagesQuestion: Problem On Accrual E. Gevera Realty Co. Who Owns A BuildingKen SannNo ratings yet

- MARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsDocument5 pagesMARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsMoon YoungheeNo ratings yet

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- Accounting: Quantitative Information Primarily Financial inDocument19 pagesAccounting: Quantitative Information Primarily Financial inleeeydoNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- The System Unit: Computing Essentials 2014Document27 pagesThe System Unit: Computing Essentials 2014Fely MaataNo ratings yet

- Exercises 15-21Document51 pagesExercises 15-21Fely MaataNo ratings yet

- Chapter 5-2 PDFDocument23 pagesChapter 5-2 PDFFely MaataNo ratings yet

- Chapter 9Document21 pagesChapter 9Fely Maata100% (2)

- CH3Tax 1 PDFDocument19 pagesCH3Tax 1 PDFIban GuiamalodinNo ratings yet

- Chapter 7Document15 pagesChapter 7Fely MaataNo ratings yet

- Banggawan Chapter 4Document18 pagesBanggawan Chapter 4Fely Maata100% (1)

- Banggawan Chapter 2Document14 pagesBanggawan Chapter 2Fely MaataNo ratings yet

- Chapter 1 PDFDocument23 pagesChapter 1 PDFFely MaataNo ratings yet

- Petty CashDocument3 pagesPetty CashFely MaataNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- Introduction To Cost Accounting FilDocument33 pagesIntroduction To Cost Accounting FilFely MaataNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- JOURNALIZINGDocument50 pagesJOURNALIZINGFely MaataNo ratings yet

- Cosacc Accounting For LaborDocument10 pagesCosacc Accounting For LaborFely MaataNo ratings yet

- Module: 3 Corporate Regulations Indian Contract Act-1872Document11 pagesModule: 3 Corporate Regulations Indian Contract Act-1872Aswath ReddyNo ratings yet

- Notes On Modes of DiscoveryDocument4 pagesNotes On Modes of DiscoveryHani Proxy-AdayoNo ratings yet

- Leal v. IACDocument4 pagesLeal v. IACJuan TagadownloadNo ratings yet

- Lesson A - 5 Extinguishment of Obligations - Part 1 (09-15-2021)Document35 pagesLesson A - 5 Extinguishment of Obligations - Part 1 (09-15-2021)Mark Ramon MatugasNo ratings yet

- Scholars Contract and LOIDocument4 pagesScholars Contract and LOIMisha Madeleine GacadNo ratings yet

- Joint Venture Agreement: S&B Power Corporation, A Corporation Registered and Organized Under TheDocument6 pagesJoint Venture Agreement: S&B Power Corporation, A Corporation Registered and Organized Under TheGreg TayonaNo ratings yet

- 375 Scra 484Document10 pages375 Scra 484flordelei hocateNo ratings yet

- 2 - Kilosbayan, Inc. v. MoratoDocument88 pages2 - Kilosbayan, Inc. v. MoratoFerry FrondaNo ratings yet

- Contract ActDocument92 pagesContract Actkavipurapu srikantNo ratings yet

- Land User Application HMDADocument4 pagesLand User Application HMDAvmandava0720No ratings yet

- Cases IntraDocument2 pagesCases Intrasamridhi chhabraNo ratings yet

- 3 2022-02-21 ComplaintpdfDocument9 pages3 2022-02-21 Complaintpdfsavannahnow.comNo ratings yet

- When To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsDocument10 pagesWhen To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsLyley YAYNo ratings yet

- Divya Topic 5Document6 pagesDivya Topic 5Vishal MoreNo ratings yet

- 2022-01-11 Webb ComplaintDocument13 pages2022-01-11 Webb ComplaintErin FuchsNo ratings yet

- Yu Tek V Gonzales Case DigestDocument2 pagesYu Tek V Gonzales Case DigestLeny WhackedNo ratings yet

- AFFIDAVIT JameenuDocument3 pagesAFFIDAVIT JameenuPrabhakar Chowdary ChintalaNo ratings yet

- Dwnload Full Seeing Sociology An Introduction 3rd Edition Ferrante Test Bank PDFDocument27 pagesDwnload Full Seeing Sociology An Introduction 3rd Edition Ferrante Test Bank PDFtermitnazova0100% (13)

- Halsbury's MistakeDocument73 pagesHalsbury's MistakeMinisterNo ratings yet

- 15.14.5. Am-Phil Food Concepts v. Padilla, October 1, 2014 (Quitclaim)Document2 pages15.14.5. Am-Phil Food Concepts v. Padilla, October 1, 2014 (Quitclaim)JONA PHOEBE MANGALINDANNo ratings yet

- The Karnataka Land Reforms Amendment Act 2020Document3 pagesThe Karnataka Land Reforms Amendment Act 2020SiddharthNo ratings yet

- Cirtek Employees Labor Union-Ffw v. Cirtek Electronics, Inc.Document2 pagesCirtek Employees Labor Union-Ffw v. Cirtek Electronics, Inc.Vian O.No ratings yet

- Employees State Insurance Corporation Vs AK Abdul SC20161403161444281COM77690Document6 pagesEmployees State Insurance Corporation Vs AK Abdul SC20161403161444281COM77690DolphinNo ratings yet

- 9.CIR Vs Pilipinas ShellDocument17 pages9.CIR Vs Pilipinas ShellClyde KitongNo ratings yet

- 9 HagerServiceDocument10 pages9 HagerServiceNedim HadžiaganovićNo ratings yet

- Contract Formation, Construction & Interpretation in ContractingDocument24 pagesContract Formation, Construction & Interpretation in ContractingAli Khan0% (1)

- Charter 1726Document10 pagesCharter 1726A.SinghNo ratings yet

Classifications of Partnership

Classifications of Partnership

Uploaded by

Fely MaataOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Classifications of Partnership

Classifications of Partnership

Uploaded by

Fely MaataCopyright:

Available Formats

Articles 1773 and 1774 of the Civil Code reinforce the prescriptions of Articles 1768 and

1772. In Article 1773, it is stated that whenever an immovable property is contributed, an

inventory of said property should be made, signed by the partners, and attached to the public

instrument. If no such inventory of immovable property is made, the contract of partnership is

void. Again, a public instrument is mentioned, referring to the Contract of Partnership where the

partner who contributed the immovable transfers by way of contribution his immovable property

to the partnership. The inventory required here is actually a listing of the immovable property

particularly identifying it by its Title or Tax Declaration, its area, location, and assessed value at

the time of contribution. The inventory should be signed by the partners and attached to the

notarized contract of partnership. Failure to comply with the requirement of Art. 1773 will result

to the nullity of the contract of partnership. The inventory serves the purpose of identifying the

immovable contributed by a partner and determining its assessed value which in turn, will allow

the partners to determine the amount of contribution of the partner in monetary value. At the

time of dissolution, the property so contributed, if still intact, will be returned to the partner

contributor, making the inventory handy as reference. Article 1774, on the other hand, states that

“any immovable property or interest therein may be acquired in the partnership name. Title so

acquired can be conveyed only in partnership name”. This article reiterates that the immovable

contributed to the partnership, or acquired by the partnership by any manner, should be

transferred to the partnership name, and not to anyone or all of the partners in co-ownership.

Therefore, when a partner contributes an immovable property, the public instrument must

transfer the ownership from the partner to the partnership.

Lesson 4. Classifications of partnership

Partnerships are commonly classified as: according to object - universal or particular;

according to liability - general or limited; according to duration - with a fixed term or at will;

according to representation to others - ordinary or partnership by estoppel; and according to

legality of existence – de jure or de facto.

4.1 Universal Partnership

Universal partnerships may refer to partnership of all present properties or partnership of

all profits.

4.1.1 Universal Partnership of all Present Properties

In this kind of partnership, the partners contribute to the fund all the properties which

actually belong to them, including all the profits that they may earn from the use of such

properties. Once contributed, the properties of the partners become the ownership of the

partnership and are utilized for common enjoyment. The partners may likewise agree that any

other profits are also for common enjoyment, except future inheritance, legacy or donation.

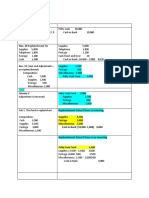

Example: Anna, Mona, and Liza formed AML Partnership. Anna contributed P1Million

which comprises her only property; Mona contributed her BMW and a house and lot which

comprise all her properties; and Liza contributed a parcel of rice land and all her share in the

harvest in the current planting season, which are her only property. AML Partnership is a

universal partnership of all present property.

4.1.2. Universal Partnership of all Gains

In this kind of partnership, the partners contribute all that they may earn through their

work or employment during the existence of the partnership. The properties of the partners

remain to be theirs exclusively, only the usufruct pass to the partnership. (Usufruct is literally

translated as use and fruits of the thing/property).

Example: Anna, Mona, and Liza formed AML Partnership. Anna contributed all the

interests earned by her P1Million deposit in XBank; Mona contributed the use of her BMW as

the service vehicle of the partnership, and the rents earned by her house and lot which is

currently on lease to a foreigner for P50,000.00 monthly; and Liza contributed all her share in the

harvests from her rice land every harvest season. AML Partnership is a universal partnership of

all profits.

Article 1781 (Civil Code) states that when a universal partnership is formed without

specifying its nature, it is presumed that a universal partnership of profits is formed. The reason

for this presumption is that universal partnership of profits is less burdensome than a universal

partnership of all present properties, since the partners retain the ownership of their properties

and only the use and fruits are contributed.

Persons who are prohibited to donate to each other are likewise prohibited to enter into

universal partnerships (Art. 1782, Civil Code). They are the following:

Legally married spouses;

Persons living together as husband and wife but are not legally married;

Persons who are guilty of adultery or concubinage at the time of the donation;

Persons found guilty of the same criminal offense, in consideration thereof;

A person/s and a public officer or his wife, descendants and ascendants, by reason

of his office

4.2 Particular Partnership

Article 1783 (Civil Code) defines particular partnership as that which “has for its object

determinate things, their use or fruits, or specific undertaking, or the exercise of a profession or

vocation”. By this definition, a particular partnership is neither a universal partnership of present

property nor a universal partnership of profits. Examples of this kind of partnership are those

which are formed for the buying and selling of real estate for the common enjoyment of profits

earned, partnerships formed for the construction of a building where the contractors pool their

money, property and industry and divide the profits earned. In these examples, the partnership is

automatically terminated after the completion of the particular undertaking. A professional

partnership is classified under particular undertaking, the purpose being the exercise of a

common profession.

Summary

Among the different kinds of business organizations, partnership strikes in the middle: it

is neither too ambitious nor too beggarly. It is commonly chosen by entrepreneurs because its

limitations make it within the control of the persons composing it. First, the partnership is for

businesses which require average capital; an amount which two or more persons (but not too

many) can comfortably share in by contribution. Second, the business itself is not complex and

capable of being managed by the partners themselves. Lastly, the objective of a partnership is

simple, to divide the profits among the partners. They who shared in the capital, share in the

profits.

Partnerships are founded on the principle of trust. A person has a free choice of the

person he would like to partner with. A person will not partner with someone he does not trust,

not even for the sake of business, most specially because it is business. These principles of

fiduciary relationship and delectus personae are the guiding principles of partnerships.

The more common types of general partnership are universal and particular. The more

aggressive kind is the universal partnership of all present property where the partners contribute

all their properties to the partnership fund for the purpose of common use and enjoyment.

Fiduciary relationship is never better demonstrated than in this kind. What would move a person

to give all he owns for common enjoyment with others? It is because he trusts that he is sharing

his treasures with persons who are capable of developing such treasures into more productivity,

for the common benefit of all partners. It is the essence of partnership: to become a partner, one

must be willing to contribute what he has to a common fund, and each of the partners share in the

income from the pooled resources.

You might also like

- Contracts Essay OutlineDocument11 pagesContracts Essay Outlineisgigles157100% (14)

- Chapter 8Document14 pagesChapter 8Fely Maata100% (1)

- Assignment Prep Airing Journal Entries and Trail BalancesDocument13 pagesAssignment Prep Airing Journal Entries and Trail BalancesChristine NorthrupNo ratings yet

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Sample Problems On CashDocument11 pagesSample Problems On CashFely Maata100% (2)

- Circles - Book For Young Children On The Cycle of LifeDocument18 pagesCircles - Book For Young Children On The Cycle of Lifepeace4llyNo ratings yet

- CorpoDocument16 pagesCorpoErica JoannaNo ratings yet

- Module 5 - With SolutionsDocument12 pagesModule 5 - With SolutionsStella MarieNo ratings yet

- StalasaDocument23 pagesStalasajessa mae zerdaNo ratings yet

- PARCORDocument5 pagesPARCORjelai anselmoNo ratings yet

- Module 2-IM-ACCO-20033-Financial Accounting and Reporting Part 1 PDFDocument15 pagesModule 2-IM-ACCO-20033-Financial Accounting and Reporting Part 1 PDFambot balakajanNo ratings yet

- Vergil Joseph I. Literal, DBA, CPA: Page 1 of 3Document3 pagesVergil Joseph I. Literal, DBA, CPA: Page 1 of 3hsjhsNo ratings yet

- ACCTGDocument2 pagesACCTGGrace Anne AlaptoNo ratings yet

- Lesson 1 ExtendDocument6 pagesLesson 1 ExtendRoel Cababao50% (2)

- Chapter 5 - Corporation - Share TransactionsDocument14 pagesChapter 5 - Corporation - Share Transactionslou-924No ratings yet

- Adjusting Entry - PrepaymentsDocument19 pagesAdjusting Entry - PrepaymentsShayne Aldrae CacaldaNo ratings yet

- Prefinal Review AcfarDocument8 pagesPrefinal Review AcfarBugoy CabasanNo ratings yet

- UM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedDocument2 pagesUM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedJessa BeloyNo ratings yet

- True or FalseDocument8 pagesTrue or FalseKim OlimbaNo ratings yet

- Property Plant and Equipment: Ricky Boy B. LeonardoDocument14 pagesProperty Plant and Equipment: Ricky Boy B. LeonardoRodel Novesteras ClausNo ratings yet

- ACCTG 124 Chapter 7Document5 pagesACCTG 124 Chapter 7John Vincent A DioNo ratings yet

- Chapter 11 SampleDocument6 pagesChapter 11 SamplePattraniteNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Guide Questions For Chapter 2Document5 pagesGuide Questions For Chapter 2Kathleen Mangual0% (1)

- Partnership Notes PrintDocument5 pagesPartnership Notes PrintKayla MirandaNo ratings yet

- Problem 11-4 (Vicente, Kate Iannel C.)Document1 pageProblem 11-4 (Vicente, Kate Iannel C.)Kate Iannel VicenteNo ratings yet

- Fundamentals of Accounting and Business ManagementDocument4 pagesFundamentals of Accounting and Business ManagementSan Juan Ezthie100% (1)

- Conceptual Framework and Accounting Standards - Chapter 2 - NotesDocument5 pagesConceptual Framework and Accounting Standards - Chapter 2 - NotesKhey KheyNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyx100% (1)

- ASC Partnership Schedule of Safe PaymentsDocument3 pagesASC Partnership Schedule of Safe PaymentsMayaNo ratings yet

- Week 4 5 ULOc Lets Analyze Activities SolutionDocument3 pagesWeek 4 5 ULOc Lets Analyze Activities Solutionemem resuentoNo ratings yet

- TOPIC EconDocument44 pagesTOPIC EconChristy HabelNo ratings yet

- Partners HIP - Pretest: - Introduction and FormationDocument38 pagesPartners HIP - Pretest: - Introduction and FormationKristia AnagapNo ratings yet

- Accounting Assumptions: Introduction To Basic AccountingDocument6 pagesAccounting Assumptions: Introduction To Basic AccountingJon Nell Laguador Bernardo100% (1)

- Theories of AccountingDocument4 pagesTheories of AccountingShanine BaylonNo ratings yet

- Cost Accounting Midterm ExamDocument37 pagesCost Accounting Midterm Examshynebright.phNo ratings yet

- Name:: Score: ProfessorDocument6 pagesName:: Score: ProfessorkakaoNo ratings yet

- CHAPTER 2 PartnershipDocument17 pagesCHAPTER 2 PartnershipLAZARO, Jaspher S.No ratings yet

- Partnership OperationDocument2 pagesPartnership OperationCjhay MarcosNo ratings yet

- Exam Questionaire in IntermediateDocument5 pagesExam Questionaire in IntermediateJester IlaganNo ratings yet

- Q and A PartnershipDocument9 pagesQ and A PartnershipFaker MejiaNo ratings yet

- Mod7 Part 2 Manufacturing OperationsDocument24 pagesMod7 Part 2 Manufacturing Operationsmarjorie magsinoNo ratings yet

- Quiz 2 Partnership OperationsDocument4 pagesQuiz 2 Partnership OperationsChelit LadylieGirl FernandezNo ratings yet

- Lesson5-Bsa 2BDocument8 pagesLesson5-Bsa 2BEdraelyn MonatoNo ratings yet

- FDNACCT - Quiz #1 - Set B - Answer KeyDocument4 pagesFDNACCT - Quiz #1 - Set B - Answer KeyIchi HasukiNo ratings yet

- Theories ProblemsDocument9 pagesTheories ProblemsKristine Esplana ToraldeNo ratings yet

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- Partnership OpDocument25 pagesPartnership OpNeri La LunaNo ratings yet

- Jedah Noel - ASSIGNMENT 1 - Partnership FormationDocument2 pagesJedah Noel - ASSIGNMENT 1 - Partnership FormationJeddieh NoelNo ratings yet

- 07 Quiz 1Document3 pages07 Quiz 1Janrey RomanNo ratings yet

- Lecture Discussion - Service Concern - Worksheet To Post Closing Trial BalanceDocument8 pagesLecture Discussion - Service Concern - Worksheet To Post Closing Trial BalanceGarpt KudasaiNo ratings yet

- Exercise #11 (Sue Feria) DehnieceMangawangDocument3 pagesExercise #11 (Sue Feria) DehnieceMangawangPhaelyn YambaoNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- Admission and Retirement of PartnersDocument3 pagesAdmission and Retirement of PartnersJohn Eric MacallaNo ratings yet

- Chpter 1.problem 7.mullesDocument11 pagesChpter 1.problem 7.mullesKim OlimbaNo ratings yet

- Problem 12 Accounting PDFDocument3 pagesProblem 12 Accounting PDFErika RepedroNo ratings yet

- Corpo Prob and AnsDocument16 pagesCorpo Prob and AnsILOVE MATURED FANSNo ratings yet

- Prob 2Document1 pageProb 2Mitch Tokong MinglanaNo ratings yet

- Retained EarningsDocument3 pagesRetained EarningsChristian Marvin VillanuevaNo ratings yet

- CFAS Sample ProblemsDocument5 pagesCFAS Sample ProblemsChristian MartinNo ratings yet

- Question: Problem On Accrual E. Gevera Realty Co. Who Owns A BuildingDocument2 pagesQuestion: Problem On Accrual E. Gevera Realty Co. Who Owns A BuildingKen SannNo ratings yet

- MARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsDocument5 pagesMARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsMoon YoungheeNo ratings yet

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- Accounting: Quantitative Information Primarily Financial inDocument19 pagesAccounting: Quantitative Information Primarily Financial inleeeydoNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- The System Unit: Computing Essentials 2014Document27 pagesThe System Unit: Computing Essentials 2014Fely MaataNo ratings yet

- Exercises 15-21Document51 pagesExercises 15-21Fely MaataNo ratings yet

- Chapter 5-2 PDFDocument23 pagesChapter 5-2 PDFFely MaataNo ratings yet

- Chapter 9Document21 pagesChapter 9Fely Maata100% (2)

- CH3Tax 1 PDFDocument19 pagesCH3Tax 1 PDFIban GuiamalodinNo ratings yet

- Chapter 7Document15 pagesChapter 7Fely MaataNo ratings yet

- Banggawan Chapter 4Document18 pagesBanggawan Chapter 4Fely Maata100% (1)

- Banggawan Chapter 2Document14 pagesBanggawan Chapter 2Fely MaataNo ratings yet

- Chapter 1 PDFDocument23 pagesChapter 1 PDFFely MaataNo ratings yet

- Petty CashDocument3 pagesPetty CashFely MaataNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- Introduction To Cost Accounting FilDocument33 pagesIntroduction To Cost Accounting FilFely MaataNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- JOURNALIZINGDocument50 pagesJOURNALIZINGFely MaataNo ratings yet

- Cosacc Accounting For LaborDocument10 pagesCosacc Accounting For LaborFely MaataNo ratings yet

- Module: 3 Corporate Regulations Indian Contract Act-1872Document11 pagesModule: 3 Corporate Regulations Indian Contract Act-1872Aswath ReddyNo ratings yet

- Notes On Modes of DiscoveryDocument4 pagesNotes On Modes of DiscoveryHani Proxy-AdayoNo ratings yet

- Leal v. IACDocument4 pagesLeal v. IACJuan TagadownloadNo ratings yet

- Lesson A - 5 Extinguishment of Obligations - Part 1 (09-15-2021)Document35 pagesLesson A - 5 Extinguishment of Obligations - Part 1 (09-15-2021)Mark Ramon MatugasNo ratings yet

- Scholars Contract and LOIDocument4 pagesScholars Contract and LOIMisha Madeleine GacadNo ratings yet

- Joint Venture Agreement: S&B Power Corporation, A Corporation Registered and Organized Under TheDocument6 pagesJoint Venture Agreement: S&B Power Corporation, A Corporation Registered and Organized Under TheGreg TayonaNo ratings yet

- 375 Scra 484Document10 pages375 Scra 484flordelei hocateNo ratings yet

- 2 - Kilosbayan, Inc. v. MoratoDocument88 pages2 - Kilosbayan, Inc. v. MoratoFerry FrondaNo ratings yet

- Contract ActDocument92 pagesContract Actkavipurapu srikantNo ratings yet

- Land User Application HMDADocument4 pagesLand User Application HMDAvmandava0720No ratings yet

- Cases IntraDocument2 pagesCases Intrasamridhi chhabraNo ratings yet

- 3 2022-02-21 ComplaintpdfDocument9 pages3 2022-02-21 Complaintpdfsavannahnow.comNo ratings yet

- When To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsDocument10 pagesWhen To Use This Form: Servicesaustralia - Gov.au/centrelinkuploaddocsLyley YAYNo ratings yet

- Divya Topic 5Document6 pagesDivya Topic 5Vishal MoreNo ratings yet

- 2022-01-11 Webb ComplaintDocument13 pages2022-01-11 Webb ComplaintErin FuchsNo ratings yet

- Yu Tek V Gonzales Case DigestDocument2 pagesYu Tek V Gonzales Case DigestLeny WhackedNo ratings yet

- AFFIDAVIT JameenuDocument3 pagesAFFIDAVIT JameenuPrabhakar Chowdary ChintalaNo ratings yet

- Dwnload Full Seeing Sociology An Introduction 3rd Edition Ferrante Test Bank PDFDocument27 pagesDwnload Full Seeing Sociology An Introduction 3rd Edition Ferrante Test Bank PDFtermitnazova0100% (13)

- Halsbury's MistakeDocument73 pagesHalsbury's MistakeMinisterNo ratings yet

- 15.14.5. Am-Phil Food Concepts v. Padilla, October 1, 2014 (Quitclaim)Document2 pages15.14.5. Am-Phil Food Concepts v. Padilla, October 1, 2014 (Quitclaim)JONA PHOEBE MANGALINDANNo ratings yet

- The Karnataka Land Reforms Amendment Act 2020Document3 pagesThe Karnataka Land Reforms Amendment Act 2020SiddharthNo ratings yet

- Cirtek Employees Labor Union-Ffw v. Cirtek Electronics, Inc.Document2 pagesCirtek Employees Labor Union-Ffw v. Cirtek Electronics, Inc.Vian O.No ratings yet

- Employees State Insurance Corporation Vs AK Abdul SC20161403161444281COM77690Document6 pagesEmployees State Insurance Corporation Vs AK Abdul SC20161403161444281COM77690DolphinNo ratings yet

- 9.CIR Vs Pilipinas ShellDocument17 pages9.CIR Vs Pilipinas ShellClyde KitongNo ratings yet

- 9 HagerServiceDocument10 pages9 HagerServiceNedim HadžiaganovićNo ratings yet

- Contract Formation, Construction & Interpretation in ContractingDocument24 pagesContract Formation, Construction & Interpretation in ContractingAli Khan0% (1)

- Charter 1726Document10 pagesCharter 1726A.SinghNo ratings yet