Professional Documents

Culture Documents

TK Mathew Financial Disclosure

TK Mathew Financial Disclosure

Uploaded by

Andrew Wilson0 ratings0% found this document useful (0 votes)

787 views2 pagesTK Mathew Financial Disclosure

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTK Mathew Financial Disclosure

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

787 views2 pagesTK Mathew Financial Disclosure

TK Mathew Financial Disclosure

Uploaded by

Andrew WilsonTK Mathew Financial Disclosure

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

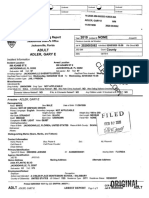

FULL AND PUBLIC DISCLOSURE

Please print or ype your name, me OF FINANCIAL INTERESTS FOR OFFICE USE ONLY:

TAST NANE — FIRST NAME — MIDDLE NAME:

Mathew TK

‘COUNTY

in 2

pF _____ Hillsborough

NAME OF AGENCY

NAME OF OFFICE OR POSITION HELD OR SOUGHT

Tax Collector

(CHECK IF THIS IS A FILING BY A CANDIDATE

PART A~ NET WORTH

Please enter the value of your net worth as of December 31, 2019 or a more current date. [Note: Net worth is not cal-

culated by subtracting your reported liabilities from your reported assets, so please see the instructions on page 3,]

My net worth as of December 31 2019 was $ 318,623

PART B~ ASSETS.

HOUSEHOLD GOODS AND PERSONAL EFFECTS:

Household goods and personal effets may be roported in a lump sum if hei aggrogate value exceeds $1,000, This category includes any of te

following, if not held for investment purposes: jewelry; colections of stamps, guns, and numismatic tems; rt objects; household equipment and

furnishings; clothing; other housahold items: and vehicos for personal use, whether owned of leased.

The agoregate valve of my housahold goods and persona fects (described above) is $ 242,000

[ASSETS INDIVIDUALLY VALUED AT OVER $1,000:

DESCRIPTION OF ASSET VALUE OF ASSET

[Floridacentral Credit Union- 8620 Citrus Park Dr, Tampa

PART C~ LIABILITIES

LIABILITIES IN EXCESS OF $1,000 (See instructions on page 4):

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

Lake View Mortgage PO Box 8068 Virginia Beach VA 23450 [239,000

INavient 830 First Street, NE, Washington, DC 20202 15,771

“JOINT AND SEVERAL LIABILITIES NOT REPORTED ABOVE

NAME: AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

PART D— INCOME

|dentty each separate soures and amount of income which exceeded $1,000 during the yaar, inchiding secondary sources of income, Or attach a complete

‘copy of your 2018 federal incom tax rtum, including all W2s, schedules, and atachments. Ploase redact any social security or account number before

attaching your returns, asthe law requires those documents be posted tothe Commission's website,

Ct eloet to te 2 copy of my 2018 federal income tax return and all W2's, schedules, and alachments

[ifyou check ths box and atach a copy f your 2019 tax alum, you need not complete the remainder of Part 0

PRIMARY SOURCES OF INCOME (See instructions on page §):

NAME OF SOURCE OF INCOME EXCEEDING $1,000. ADDRESS OF SOURCE OF INCOME AMOUNT.

ja [i600

‘SECONDARY SOURCES OF INCOME [Major customers, ents, ot, of businesses owned by reporting person~eee instructions on page Si

NAME OF NAME OF MAJOR SOURCES ADDRESS PRINCIPAL BUSINESS

BUSINESS ENTITY (OF BUSINESS INCOME OF SOURCE ACTIVITY OF SOURCE.

PART E ~ INTERESTS IN SPECIFIED BUSINESSES [Instructions on page 6]

BUSINESS ENTITY #1 BUSINESS ENTITY #2 BUSINESS ENTITY # 3

TAME OF,

BUSINESS ENTITY

‘ADDRESS OF

BUSINESS ENTITY

PRINCIPAL BUSINESS

ACTIVITY,

POSITION FELD

ATH ENTITY

TOWN MORE THANA SS

INTEREST IN THE BUSINESS.

NATURE OF MY.

‘OWNERSHIP INTEREST

PART F- TRAINING

For officers required to complete annual ethics training pursuant to section 112.3142, F.S.

Q_ICERTIFY THAT I HAVE COMPLETED THE REQUIRED TRAINING.

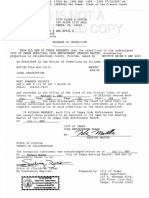

STATE OF FLORIOA,

OATH COUNTY OF HS \\ISINDy BLOW,

|. the person whose name appears atthe ‘Swom to (or aftemed) and subscribed before ne by means of

beginning ofthis form, do depose on osth or affirmation Wysct prance or Lone ncaa tie CL day ot

‘and say thatthe information disclosed on this form

and any attachmonts hereto is tue, accurate,

Personally Known, ‘OR Produced identification YC

Type of deniicaton Produced “EL Drwers License

{EPORTING OFFICIAL OR CANDIDATE

lf certified public accountant licensed under Chapter 473, or attomey in good standing withthe Florida Bar prepared this form for you, he or

‘she must complete the following statement:

1 Prepared the CE Form 6 in accordance with Art. I, Sec. 8, Florida Constitution,

‘Section 772.5744, Fonda Statutes, and the instructions to the form. Upon my reasonable knowledge and belief, the disclosure herein is true

‘and correct.

Signature : Date

Preparation of this form by a CPA or attorney does not relieve the filer of the responsibility to sign the form under 0:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Floridians For Economic Advancement PollDocument8 pagesFloridians For Economic Advancement PollAndrew WilsonNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FL Voters in Charge Limited Casino DOE FormDocument4 pagesFL Voters in Charge Limited Casino DOE FormAndrew WilsonNo ratings yet

- Final Determination - The Henry Willa White FoundationDocument27 pagesFinal Determination - The Henry Willa White FoundationAndrew WilsonNo ratings yet

- 59G-13.081 DRAFT Rate Table July 1 Rates ADT Redesign UpdatesDocument7 pages59G-13.081 DRAFT Rate Table July 1 Rates ADT Redesign UpdatesAndrew WilsonNo ratings yet

- TOLEDO v. PICCOLODocument30 pagesTOLEDO v. PICCOLOAndrew Wilson100% (1)

- 2021 - 0003 Final RoiDocument27 pages2021 - 0003 Final RoiAndrew WilsonNo ratings yet

- Florida Privacy Protection Act PollingDocument1 pageFlorida Privacy Protection Act PollingAndrew WilsonNo ratings yet

- Magic City Casino/Bonita Springs Poker Room v. U.S. Dept. of InteriorDocument56 pagesMagic City Casino/Bonita Springs Poker Room v. U.S. Dept. of InteriorAndrew WilsonNo ratings yet

- 2020-2022 One Sheet Directory 9-15-21Document1 page2020-2022 One Sheet Directory 9-15-21Andrew Wilson0% (1)

- Trulieve Environmental, Social and Governance ReportDocument47 pagesTrulieve Environmental, Social and Governance ReportAndrew WilsonNo ratings yet

- 2021-07-09 PB County Letter To Gysan - LOSOM Iteration 2Document2 pages2021-07-09 PB County Letter To Gysan - LOSOM Iteration 2Andrew WilsonNo ratings yet

- Florida OIR PIP Repeal Impact Final ReportDocument185 pagesFlorida OIR PIP Repeal Impact Final ReportPeter SchorschNo ratings yet

- Greenberg PleaDocument86 pagesGreenberg PleaDaniel Uhlfelder100% (4)

- FL Voters in Charge Three Casinos DOE FormDocument4 pagesFL Voters in Charge Three Casinos DOE FormAndrew WilsonNo ratings yet

- Bartlett, Drew Letter SignedDocument1 pageBartlett, Drew Letter SignedAndrew WilsonNo ratings yet

- Letter To EOG 5.10.21Document2 pagesLetter To EOG 5.10.21Andrew WilsonNo ratings yet

- (20-Mm-2233) Motion To Dismiss (Amended)Document3 pages(20-Mm-2233) Motion To Dismiss (Amended)Andrew WilsonNo ratings yet

- DFS Property Insurance Litigation DataDocument2 pagesDFS Property Insurance Litigation DataAndrew WilsonNo ratings yet

- OIR LetterDocument5 pagesOIR LetterAndrew WilsonNo ratings yet

- Frequency Table: Margin of Error +-5.5% Effective MOE + - 5.75 % Weights OnDocument3 pagesFrequency Table: Margin of Error +-5.5% Effective MOE + - 5.75 % Weights OnAndrew WilsonNo ratings yet

- 13th Circuit Lopez Law Firm OrderDocument2 pages13th Circuit Lopez Law Firm OrderAndrew WilsonNo ratings yet

- Meer FLCD3 Survey PR 08102020 FinalDocument1 pageMeer FLCD3 Survey PR 08102020 FinalAndrew WilsonNo ratings yet

- David Clark Resignation Letter 07.17.20Document1 pageDavid Clark Resignation Letter 07.17.20Andrew WilsonNo ratings yet

- John Martin Release - Leeper ResidencyDocument31 pagesJohn Martin Release - Leeper ResidencyAndrew WilsonNo ratings yet

- (20-MM-2233) Arrest Booking Report 2020-003062 2-5-2020Document8 pages(20-MM-2233) Arrest Booking Report 2020-003062 2-5-2020Andrew WilsonNo ratings yet

- Letter To Governor DeSantis RE: Danny LeeperDocument4 pagesLetter To Governor DeSantis RE: Danny LeeperAndrew WilsonNo ratings yet

- "Opening Up American Again" GuidelinesDocument18 pages"Opening Up American Again" GuidelinesNew York Post88% (24)

- April Griffin Code Violations ReleaseDocument1 pageApril Griffin Code Violations ReleaseAndrew WilsonNo ratings yet