Professional Documents

Culture Documents

Tax On Corp. Sample Problems

Tax On Corp. Sample Problems

Uploaded by

WenjunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax On Corp. Sample Problems

Tax On Corp. Sample Problems

Uploaded by

WenjunCopyright:

Available Formats

As a rule, Corporations including business partnership are subject to income tax except those enumerated in Section 30 of

the R.A 10963 (Train Law).

International Carrier

- 2% of the Gross Philippine Billings. GPB means gross revenues realized from carriage or persons, excess baggage,

cargo and mail originating from the Philippines under the following conditions:

o In a continuous and uninterrupted flight, and

o In case of transshipment, that portion of the cost of ticket corresponding to the leg flown from the

Philippines to the point of transshipment.

1. Dragon Fly has the following records of income for the period:

A. Continuous flight from Manila to Beijing = 1,000 tickets at P3,000 per ticket

B. Ticket sold for flight from Manila to Hongkong: Transfer flight from Hongkong to Beijing = 2,000 tickets at P3,000

per ticket

C. Direct flight from Manila to Hongkong = 3,000 tickets at P2,000 per ticket

Compute the income tax.

Offshore Banking Units (OBU)

- These resident foreign corporations are subject to 10% final tax on interest income derived from foreign currency

loans granted to residents.

Exceptions:

a. Income derived by OBU authorized by BSP from foreign currency transactions with nonresidents, other OBU’s,

local commercial banks and foreign banks; and

b. Income of nonresident individuals and nonresident corporations from transactions with offshore banking units is

exempted from Philippine income tax.

2. Aseanbank, Inc., an offshore banking unit and a resident foreign corporation, shows the following income and

expenses during the taxable year:

Interest income on foreign currency transactions from:

Nonresident other offshore banking units $1,000,000

Local commercial banks and foreign banks 1,500,000

Resident corporations and individuals 500,000

Operating expenses 400,000

Compute the income tax.

Tax on Branch Profits Remittance

- They are subject to 15% tax on the amount remitted by branch to its head office excluding:

a. Income from activities that are registered with PEZA.

b. Passive income gains and profits received not directly connected with the conduct of its business in the

Philippines.

3. Astex Corporation, Phils., a branch of a foreign corporation located at Texas, USA doing business in the Philippines,

reported the following during the year:

Net operating income after tax P7,000,000

Tax-exempt dividend income 2,000,000

Total net income P9,000,000

The following year, the branch earmarked for remittance to the head office the P2,000,000 dividend and P5,000,000 of

its net operating income after tax. Compute the income tax.

Regional Operating Headquarters of Multinational Company

- Are branches established in the Philippines by multinational companies, which are engaged in any of the

following services, are subject to 10% tax rate based on their taxable income:

a. General administration and planning;

b. Business planning and coordination;

c. Sourcing and procurement of raw materials and components;

d. Corporate finance advisory services;

e. Marketing control and sales promotion

f. Etc.

4. Ace, Inc. Philippines is engaged in research and development services and product development related to computer

and aircraft parts. During the year, Ace reported the following income and expenses:

Sales P10,000,000

Cost of sales 4,000,000

Operating expenses 2,500,000

Interest income, net of final tax 200,000

Dividend income, tax-exempt 800,000

Compute the income tax.

Nonresident foreign corporations

5. X, a special nonresident foreign corporations reveals its income and expenses within the Philippines as follows:

Gross receipts P5,000,000

Operating expenses 2,000,000

Compute the income tax if X is:

a. Cinematographic film distributor

b. Lessor of aircraft, or

c. Lessor of vessels chartered by Philippine Nationals

A. After 2 years of operation, a domestic corporation reported the following income and expenses:

3rd year 4th year 5th year 6th year

Sales P1,000,000 P2,500,000 P4,000,000 P5,000,000

Cost of sales 600,000 1,200,000 2,400,000 2,700,000

Operating expenses 300,000 1,300,000 1,400,000 1,500,000

Royalty income, net of tax 80,000 160,000 120,000 40,000

Interest income, net of tax 20,000 32,000 16,000 24,000

Dividend income (domestic) 50,000 60,000 70,000 80,000

Rent income 200,000 300,000 100,000 50,000

Quarterly tax paid 10,000 20,000 30,000 40,000

Required: Compute for the following:

1. Income tax still due and payable

2. Final tax

B. A domestic corporation has the following data:

Excess tax credits in 2018 P10,000

For the year 2019 (cumulative amount): 1st Qtr. 2nd Qtr.

Revenue, net of 1% withholding tax P495,000 P792,000

Deductions 480,000 700,000

The corporations deducted its first quarter 1% creditable tax from the first quarter income tax due and the remaining

was reduced by the excess tax credits in 2018.

1. Compute the income tax still due and payable in the first quarter of 2019?

2. Compute the income tax still due and payable in the second quarter of 2019?

C. The following income and expenses are shown by X Corporation:

Within Outside

Gross income P8,000,000 P4,000,000

Business expenses 5,000,000 3,000,000

Sale of land and warehouse (cost P2M) 3,000,000

Compute the taxable income and income tax due assuming X Corporation is:

a. Domestic Corporation

b. Resident Foreign Corporation

You might also like

- PAS 1 Presentation of Financial Statements: Quiz 1: Multiple ChoiceDocument3 pagesPAS 1 Presentation of Financial Statements: Quiz 1: Multiple Choicetrixie mae88% (8)

- Partnership Formation: Name: Date: Professor: Section: Score: QuizDocument5 pagesPartnership Formation: Name: Date: Professor: Section: Score: QuizWenjun100% (3)

- Chapter 13 Part 1Document11 pagesChapter 13 Part 1Danielle Angel MalanaNo ratings yet

- Intermediate Accounting 2 Quiz 2: You AnsweredDocument10 pagesIntermediate Accounting 2 Quiz 2: You AnsweredRayman MamakNo ratings yet

- M6 - Deductions P4 (13C) Students'Document43 pagesM6 - Deductions P4 (13C) Students'micaella pasionNo ratings yet

- Partnership Liquidation: Debit CreditDocument7 pagesPartnership Liquidation: Debit CreditWenjun0% (1)

- Corporate Liquidation & ReorganizationDocument3 pagesCorporate Liquidation & ReorganizationWenjun50% (2)

- Quiz 3 Partnership DissolutionDocument6 pagesQuiz 3 Partnership DissolutionWenjun100% (1)

- Quiz 3 Partnership DissolutionDocument6 pagesQuiz 3 Partnership DissolutionWenjun100% (1)

- Correct!: C. Both Are CorrectDocument27 pagesCorrect!: C. Both Are CorrectNica Jane MacapinigNo ratings yet

- Revenue Regulations No. 3-98 - Fringe Benefit TaxDocument14 pagesRevenue Regulations No. 3-98 - Fringe Benefit TaxNikki BinsinNo ratings yet

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNo ratings yet

- Document 3 PDFDocument50 pagesDocument 3 PDFChristine Jane AbangNo ratings yet

- Chapter 9 Part 1 Input VatDocument25 pagesChapter 9 Part 1 Input VatChristian PelimcoNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Tax 3216Document5 pagesTax 3216Rich William PagaduanNo ratings yet

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- Tax 2 Part 3 Estate TaxDocument25 pagesTax 2 Part 3 Estate TaxShane TorrieNo ratings yet

- Income Tax Practice Questions 1Document8 pagesIncome Tax Practice Questions 1bamberoNo ratings yet

- Quiz - 5B 2Document3 pagesQuiz - 5B 2Jao FloresNo ratings yet

- Quiz On Chapter 13B&CDocument23 pagesQuiz On Chapter 13B&Cdianne caballeroNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- Final Withholding Tax FWT and CapitalDocument40 pagesFinal Withholding Tax FWT and CapitalEdna PostreNo ratings yet

- 5Document19 pages5Dawn JessaNo ratings yet

- Set A Leases Problem SERANADocument6 pagesSet A Leases Problem SERANASherri BonquinNo ratings yet

- Tax LQ1 2Document21 pagesTax LQ1 2Maddy EscuderoNo ratings yet

- Auditing Subsidiaries, Remote Operating Units and Joint VenturesDocument56 pagesAuditing Subsidiaries, Remote Operating Units and Joint VenturesRea De VeraNo ratings yet

- 4.2 Assignment - Principles To Accounting Period and MethodsDocument7 pages4.2 Assignment - Principles To Accounting Period and MethodsRoselyn LumbaoNo ratings yet

- Home Office Chap. 1Document20 pagesHome Office Chap. 1Rei GaculaNo ratings yet

- CE On Agriculture T1 AY2020-2021Document2 pagesCE On Agriculture T1 AY2020-2021Luna MeowNo ratings yet

- Intermediate Accounting 3 - January 24, 2023, F2F DiscussionDocument8 pagesIntermediate Accounting 3 - January 24, 2023, F2F DiscussionZhaira Kim CantosNo ratings yet

- Income Taxation Quiz2Document3 pagesIncome Taxation Quiz2Printing PandaNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- Estate Tax: Estate Tax Is Imposed On The Right To Transfer Property by Death. It Is Levied On TheDocument29 pagesEstate Tax: Estate Tax Is Imposed On The Right To Transfer Property by Death. It Is Levied On TheNikka Adrienne Menchavez0% (1)

- Exercise 4-6 Case StudyDocument13 pagesExercise 4-6 Case Studymariyha PalangganaNo ratings yet

- BAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersDocument8 pagesBAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersShane QuintoNo ratings yet

- Chap. 6 8Document44 pagesChap. 6 82vpsrsmg7jNo ratings yet

- Exercises Tax2Document9 pagesExercises Tax2Helen Faith EstanteNo ratings yet

- VAT - OPT Illustrative ExamplesDocument6 pagesVAT - OPT Illustrative ExamplesFerb CruzadaNo ratings yet

- Exercises - Percentage TaxesDocument2 pagesExercises - Percentage TaxesMaristella GatonNo ratings yet

- 3rd ActivityDocument2 pages3rd Activitydar •No ratings yet

- VatDocument7 pagesVatCharla SuanNo ratings yet

- TAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFDocument7 pagesTAXATION 2 Chapter 6 Introduction To Donation and Donors Tax PDFKim Cristian MaañoNo ratings yet

- TAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationDocument5 pagesTAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationMakoy BixenmanNo ratings yet

- Rice Company Was Incorporated On January 1Document6 pagesRice Company Was Incorporated On January 1Marjorie PalmaNo ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- AssesmentDocument12 pagesAssesmentMaya Keizel A.No ratings yet

- Income Tax For IndividualsDocument11 pagesIncome Tax For IndividualsJoel Christian Mascariña100% (1)

- Review in Business Law and TaxationDocument4 pagesReview in Business Law and TaxationFery AnnNo ratings yet

- Tax6 12Document182 pagesTax6 12Kaizu KunNo ratings yet

- Case Study-Hain Celestial: Student Name Institution Affiliation DateDocument5 pagesCase Study-Hain Celestial: Student Name Institution Affiliation DategeofreyNo ratings yet

- EarningsperShare Finacc5Document3 pagesEarningsperShare Finacc5Miladanica Barcelona BarracaNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- Partnershipsjoint Venture CoownershipDocument4 pagesPartnershipsjoint Venture CoownershipJane TuazonNo ratings yet

- .Arch94-03 - Corporate Income TaxationDocument18 pages.Arch94-03 - Corporate Income TaxationShintaro KisaragiNo ratings yet

- Introduction To Regular Income TaxationDocument45 pagesIntroduction To Regular Income Taxationcarl patNo ratings yet

- Strategic Tax Management - Week 5Document37 pagesStrategic Tax Management - Week 5Arman DalisayNo ratings yet

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateDocument5 pagesPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalNo ratings yet

- TBT CH1Document10 pagesTBT CH1darkNo ratings yet

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocument27 pagesRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane HandumonNo ratings yet

- 3.2 Exercise - RCIT v. MCITDocument1 page3.2 Exercise - RCIT v. MCITGiselle MartinezNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- Acct Chapter 15BDocument20 pagesAcct Chapter 15BEibra Allicra100% (1)

- Awareness of Small Enterprises in Quirino To BMBE Law RationaleDocument8 pagesAwareness of Small Enterprises in Quirino To BMBE Law RationalePrincess Joyce Anne OrpillaNo ratings yet

- Endterm ExamDocument6 pagesEndterm ExamMasTer PanDaNo ratings yet

- Name: Date: Score:: Property of STIDocument3 pagesName: Date: Score:: Property of STICharise OlivaNo ratings yet

- MASTERY TAXATION October-2019 PDFDocument12 pagesMASTERY TAXATION October-2019 PDFJuvelyn Gregorio100% (1)

- LiquidationDocument4 pagesLiquidationWenjunNo ratings yet

- Chapter 2 - Acctg Concepts - PrinciplesDocument19 pagesChapter 2 - Acctg Concepts - PrinciplesWenjunNo ratings yet

- AE21 Prelim ExamDocument2 pagesAE21 Prelim ExamWenjunNo ratings yet

- AE13 MidtermDocument10 pagesAE13 MidtermWenjunNo ratings yet

- Summary of Expenses 2021Document29 pagesSummary of Expenses 2021WenjunNo ratings yet

- AE13 Final ActivityDocument5 pagesAE13 Final ActivityWenjunNo ratings yet

- AE 18 Financial Market Prelim ExamDocument3 pagesAE 18 Financial Market Prelim ExamWenjunNo ratings yet

- Accounting Cycle - Part I - ProblemsDocument2 pagesAccounting Cycle - Part I - ProblemsWenjunNo ratings yet

- Preview (Count - Icons) Icons - Vector Line and Solid Icons Collection Pack For iOS, Android, Websites & AppsDocument64 pagesPreview (Count - Icons) Icons - Vector Line and Solid Icons Collection Pack For iOS, Android, Websites & AppsWenjunNo ratings yet

- For The Year Ended December 31, 2021 With Comparative Figures For December 31, 2020Document8 pagesFor The Year Ended December 31, 2021 With Comparative Figures For December 31, 2020WenjunNo ratings yet

- Accouting Research Chapters 1-3Document17 pagesAccouting Research Chapters 1-3WenjunNo ratings yet

- Midterm Examination in Ae3: Essay: Answer The Following Questions BelowDocument1 pageMidterm Examination in Ae3: Essay: Answer The Following Questions BelowWenjunNo ratings yet

- On The Job Training Daily JournalDocument4 pagesOn The Job Training Daily JournalWenjunNo ratings yet

- Accounting For Special TransactionsDocument11 pagesAccounting For Special Transactionsjohn carloNo ratings yet

- Quiz Printing - Pas 7 - Statement of Cash FlowsDocument1 pageQuiz Printing - Pas 7 - Statement of Cash FlowshasanahNo ratings yet

- Quiz Pas 10 Events After The Reporting PeriodDocument1 pageQuiz Pas 10 Events After The Reporting PeriodWenjunNo ratings yet

- Accounting For Special TransactionsDocument11 pagesAccounting For Special Transactionsjohn carloNo ratings yet

- Quiz - Chapter 2 - Partnership OperationsDocument5 pagesQuiz - Chapter 2 - Partnership OperationsChristian Arnel Jumpay LopezNo ratings yet

- PAS 8 Accounting Policies, Changes in Accounting: Estimates & ErrorsDocument1 pagePAS 8 Accounting Policies, Changes in Accounting: Estimates & ErrorsHassanhor Guro BacolodNo ratings yet

- Salazar Michelle P. Bs Accountancy IiiDocument1 pageSalazar Michelle P. Bs Accountancy IiiWenjunNo ratings yet

- Local Media3594291794869200412Document9 pagesLocal Media3594291794869200412WenjunNo ratings yet

- Good DayDocument2 pagesGood DayWenjunNo ratings yet

- Conceptual Framework For Financial Reporting: QuizDocument4 pagesConceptual Framework For Financial Reporting: QuizWenjunNo ratings yet

- Activity # 13 ResearchDocument3 pagesActivity # 13 ResearchWenjunNo ratings yet

- Ea BrochureDocument6 pagesEa Brochurekhatirudra05No ratings yet

- Finals - II. Deductions & ExemptionsDocument13 pagesFinals - II. Deductions & ExemptionsJovince Daño DoceNo ratings yet

- Taxation - Sample QuestionsDocument9 pagesTaxation - Sample QuestionsCecille TaguiamNo ratings yet

- It MCQDocument31 pagesIt MCQbigbulleye6078No ratings yet

- Salary AnnexureDocument1 pageSalary Annexuredpnair50% (4)

- Fesco Online BillDocument1 pageFesco Online Billmuhammadasif_5839675No ratings yet

- Bill UberDocument3 pagesBill UberSubramaniyaswamy VNo ratings yet

- Ato - ItrDocument90 pagesAto - ItrSweetCherrieNo ratings yet

- Feastival 2019 InvoiceDocument1 pageFeastival 2019 InvoiceAnonymous 31FcJqNo ratings yet

- TRN Certificate MERAKIDocument1 pageTRN Certificate MERAKIGOKUL PRASAD GOPALANNo ratings yet

- Vaishali Dna Wifi 2022Document1 pageVaishali Dna Wifi 2022AbhijeetNo ratings yet

- TAXATION LAW 1 Presentation PDFDocument42 pagesTAXATION LAW 1 Presentation PDFAbbieBallesterosNo ratings yet

- Are World Bank Salaries Tax Free: Click Here To DownloadDocument3 pagesAre World Bank Salaries Tax Free: Click Here To Downloadkovi mNo ratings yet

- Relevant BIR UpdatesDocument49 pagesRelevant BIR UpdatesElsha dela penaNo ratings yet

- GST Handwritten Notes Charts Etc 30032018Document90 pagesGST Handwritten Notes Charts Etc 30032018Prasad Rao60% (5)

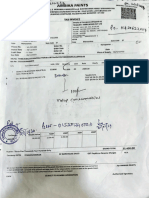

- Ambika Paint GRN CorrectionDocument1 pageAmbika Paint GRN Correctiontanmaychoudhari6767No ratings yet

- Invoice TemplateDocument8 pagesInvoice TemplateBukit Ridan EstateNo ratings yet

- Cricket Is LoveDocument7 pagesCricket Is LoveSuraj JaiswalNo ratings yet

- Dear Mayoor MehraDocument1 pageDear Mayoor MehramayoorNo ratings yet

- Chapter 10 MCQs On IFOSDocument25 pagesChapter 10 MCQs On IFOSShozab AliNo ratings yet

- Inv Ka B1 92887290 102657085633 Mar 2023Document4 pagesInv Ka B1 92887290 102657085633 Mar 2023PrabhuTeja CSGINo ratings yet

- Income TaxDocument4 pagesIncome TaxsebastianksNo ratings yet

- Computation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) - 30362 1Document8 pagesComputation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) - 30362 1Divya Kanwar KanawatNo ratings yet

- 5 Year Financial ProjectionsDocument2 pages5 Year Financial ProjectionsCedric JohnsonNo ratings yet

- Difference Between Direct & Indirect TaxesDocument3 pagesDifference Between Direct & Indirect TaxesLMRP2 LMRP2No ratings yet

- Jio Fiber Tax Invoice TemplateDocument5 pagesJio Fiber Tax Invoice TemplatehhhhNo ratings yet

- An Introduction To Oracle R12 E-Business TaxDocument46 pagesAn Introduction To Oracle R12 E-Business TaxDavid Sparks100% (5)

- Acc-311 ExerciseDocument15 pagesAcc-311 ExerciseArgem Jay PorioNo ratings yet