Professional Documents

Culture Documents

Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest Returns

Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest Returns

Uploaded by

santu0 ratings0% found this document useful (0 votes)

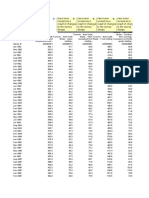

29 views6 pagesThe document lists the performance of various multi cap mutual funds over different time periods ranging from 1 week to 2 years. It provides the fund name, assets under management, Crisil rank, and percentage returns for each time period. The majority of the funds listed showed negative returns for the 3 month, 6 month, 1 year and 2 year periods, with some positive returns for the 1 month time frame.

Original Description:

Original Title

Historic Returns - multi cap fund,multi cap fund Performance Tracker Mutual funds with highest returns - Moneycontrol.com

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists the performance of various multi cap mutual funds over different time periods ranging from 1 week to 2 years. It provides the fund name, assets under management, Crisil rank, and percentage returns for each time period. The majority of the funds listed showed negative returns for the 3 month, 6 month, 1 year and 2 year periods, with some positive returns for the 1 month time frame.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

29 views6 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest Returns

Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest Returns

Uploaded by

santuThe document lists the performance of various multi cap mutual funds over different time periods ranging from 1 week to 2 years. It provides the fund name, assets under management, Crisil rank, and percentage returns for each time period. The majority of the funds listed showed negative returns for the 3 month, 6 month, 1 year and 2 year periods, with some positive returns for the 1 month time frame.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 6

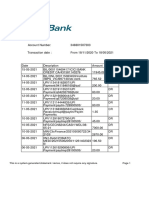

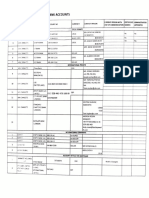

Historic Returns - multi cap fund,multi cap fund Performance Track

Scheme Name Plan Category Name

LIC MF Multicap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

DSP Equity Fund - Regular Plan - GrowthMulti Cap Fund Regular Multi Cap Fund

JM Multicap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Canara Robeco Equity Diversified - Regular Plan - GrowthMulti Cap Regular Multi Cap Fund

Union Multi Cap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

UTI Equity Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Edelweiss Multi-Cap Fund - Regular Plan - GrowthMulti Cap Fund Regular Multi Cap Fund

Kotak Standard Multicap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

PGIM India Diversified Equity Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

IDBI Diversified Equity Fund - Regular Plan - GrowthMulti Cap Fund Regular Multi Cap Fund

BNP Paribas Multi Cap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Aditya Birla Sun Life Equity Fund - Regular Plan - GrowthMulti Cap Regular Multi Cap Fund

SBI Magnum MultiCap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Motilal Oswal Multicap 35 Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

ICICI Prudential Multicap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

HDFC Equity Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Nippon India Multicap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Invesco India Multicap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Baroda Multi Cap Fund - Plan A - GrowthMulti Cap Fund Regular Multi Cap Fund

IDFC Multi Cap Fund - Regular Plan - GrowthMulti Cap Fund Regular Multi Cap Fund

L&T Equity Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Principal Multi Cap Growth Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

HSBC Multi Cap Equity Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Taurus Starshare (Multi Cap) Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Franklin India Equity Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

DSP A.C.E. Fund - Series 2 - GrowthMulti Cap Fund Regular Multi Cap Fund

Edelweiss Maiden Opportunities Fund - Series I - GrowthMulti Cap Regular Multi Cap Fund

DSP 3 Years Close Ended Equity Fund - Regular Plan - GrowthMulti Regular Multi Cap Fund

DSP A.C.E. Fund - Series 1 - GrowthMulti Cap Fund Regular Multi Cap Fund

Kotak India Growth Fund - Series VII - GrowthMulti Cap Fund Regular Multi Cap Fund

IDFC Equity Opportunity - Series 6 - GrowthMulti Cap Fund Regular Multi Cap Fund

Axis Multicap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Parag Parikh Long Term Equity Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Tata Multicap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

Sundaram Multi Cap Fund Series I - GrowthMulti Cap Fund Regular Multi Cap Fund

Sundaram Multi Cap Fund Series II - GrowthMulti Cap Fund Regular Multi Cap Fund

Kotak India Growth Fund - Series IV - GrowthMulti Cap Fund Regular Multi Cap Fund

Mahindra Badhat Yojana - Regular Plan - GrowthMulti Cap Fund Regular Multi Cap Fund

Axis Capital Builder Fund - Series 4 - GrowthMulti Cap Fund Regular Multi Cap Fund

Aditya Birla Sun Life Resurgent India Fund - Series 5 - GrowthMulti Regular Multi Cap Fund

Axis Capital Builder Fund - Series 1 - GrowthMulti Cap Fund Regular Multi Cap Fund

UTI Focussed Equity Fund - Series VI - (1150 D) - GrowthMulti Cap Regular Multi Cap Fund

UTI Focussed Equity Fund-Series I - (1100 D) - GrowthMulti Cap Fu Regular Multi Cap Fund

UTI Focussed Equity Fund - Series V - (1102 D) - GrowthMulti Cap F Regular Multi Cap Fund

UTI Focussed Equity Fund - Series IV - (1104 D) - GrowthMulti Cap Regular Multi Cap Fund

SBI Equity Opportunities Fund – Series I - GrowthMulti Cap Fund Regular Multi Cap Fund

Quant Active Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

SBI Equity Opportunities Fund – Series IV - GrowthMulti Cap Fund Regular Multi Cap Fund

Aditya Birla Sun Life Resurgent India Fund - Series 4 - GrowthMulti Regular Multi Cap Fund

HDFC Equity Opportunities Fund - Series II - 1100D June - GrowthMRegular Multi Cap Fund

Shriram Multicap Fund - Regular Plan - GrowthMulti Cap Fund Regular Multi Cap Fund

Kotak India Growth Fund - Series V - GrowthMulti Cap Fund Regular Multi Cap Fund

Essel Multi Cap Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

IDFC Equity Opportunity - Series 5 - Regular Plan - GrowthMulti Ca Regular Multi Cap Fund

HDFC Equity Opportunities Fund - Series II - 1126D May - GrowthMRegular Multi Cap Fund

Aditya Birla Sun Life Resurgent India Fund - Series 2 - GrowthMulti Regular Multi Cap Fund

Aditya Birla Sun Life Resurgent India Fund - Series 3 - GrowthMulti Regular Multi Cap Fund

Aditya Birla Sun Life Resurgent India Fund - Series 7 - GrowthMulti Regular Multi Cap Fund

Aditya Birla Sun Life Resurgent India Fund - Series 6 - GrowthMulti Regular Multi Cap Fund

Nippon India Capital Builder Fund IV - Series B - GrowthMulti Cap Regular Multi Cap Fund

Nippon India India Opportunities Fund - Series A - GrowthMulti Ca Regular Multi Cap Fund

IDFC Equity Opportunity - Series 4 - Regular Plan - GrowthMulti Ca Regular Multi Cap Fund

Nippon India Capital Builder Fund IV - Series D - GrowthMulti Cap Regular Multi Cap Fund

Nippon India Capital Builder Fund IV - Series C - GrowthMulti Cap F Regular Multi Cap Fund

ITI Multi Cap Fund - Regular Plan - GrowthMulti Cap Fund Regular Multi Cap Fund

Sundaram Equity Fund - GrowthMulti Cap Fund Regular Multi Cap Fund

d,multi cap fund Performance Tracker| Mutual funds with highest returns - Moneycontrol.com

Crisil Rank AuM (Cr) 1W 1M 3M 6M YTD 1Y 2Y

5 238.52 -1% 15% -22% -17% 4% -12% -5%

5 2,748.08 -3% 14% -23% -18% 5% -13% -6%

5 107.36 -3% 11% -24% -22% 4% -14% -6%

4 1,601.32 -1% 15% -18% -13% 6% -11% -2%

4 252.86 -1% 18% -22% -16% 8% -15% -6%

4 8,102.05 -2% 12% -23% -15% 5% -15% -6%

4 426.04 -2% 15% -24% -20% 6% -19% -10%

4 22,870.61 -2% 16% -26% -20% 6% -19% -7%

3 107.35 -2% 21% -21% -15% 10% -14% -8%

3 234.07 -2% 15% -22% -19% 5% -15% -10%

3 480.92 -2% 15% -25% -18% 5% -15% -10%

3 8,492.16 2% 21% -25% -18% 9% -18% -10%

3 6,541.91 -3% 15% -26% -21% 6% -20% -10%

3 9,128.67 -3% 13% -26% -23% 5% -21% -14%

3 4,155.53 -5% 16% -28% -23% 7% -25% -11%

3 16,041.82 -3% 18% -28% -23% 7% -27% -11%

3 6,776.10 -5% 12% -33% -27% 4% -32% -15%

2 677.71 -2% 18% -23% -16% 8% -16% -13%

2 617.00 -2% 14% -22% -17% 5% -18% -11%

2 4,093.25 -3% 16% -25% -20% 5% -19% -11%

2 1,817.01 0% 19% -23% -19% 10% -20% -12%

2 517.90 -2% 15% -24% -18% 6% -22% -13%

1 275.84 -2% 17% -25% -19% 8% -23% -13%

1 159.64 -1% 18% -25% -21% 7% -24% -14%

1 7,598.41 -4% 15% -27% -21% 7% -27% -13%

- 88.96 -3% 0% 2% 4% -2% 11% 6%

- 284.13 -3% 17% -17% -10% 5% -1% -9%

- 30.72 -1% 10% -10% -8% -1% -2% -1%

- 564.32 -1% 10% -11% -8% 0% -3% -1%

- 30.04 4% 23% -12% -5% 7% -4% -

- 127.13 1% 22% -14% -10% 12% -4% -

- 5,057.95 -1% 12% -17% -14% 3% -6% 0%

- 2,448.13 -2% 19% -16% -12% 9% -10% -1%

- 1,366.98 2% 22% -19% -16% 8% -11% -

- 71.29 -3% 17% -24% -18% 7% -11% -

- 42.03 -3% 17% -24% -18% 7% -11% -

- 327.68 -2% 16% -15% -11% 9% -12% -9%

- 246.49 -1% 18% -21% -15% 8% -12% -7%

- 736.43 -2% 14% -22% -18% 6% -13% -

- 217.67 0% 11% -17% -14% 3% -14% -10%

- 370.97 -1% 11% -22% -18% 5% -14% -7%

- 243.24 -4% 18% -23% -13% 8% -14% -9%

- 74.93 -4% 18% -23% -13% 8% -15% -9%

- 469.96 -4% 18% -24% -15% 8% -15% -10%

- 267.15 -4% 18% -24% -14% 8% -15% -9%

- 25.19 -2% 17% -23% -17% 7% -16% -10%

- 7.60 -2% 23% -21% -17% 12% -16% -8%

- 12.80 -2% 17% -24% -19% 8% -18% -13%

- 213.80 0% 6% -18% -15% 2% -18% -12%

- 603.91 -2% 3% -19% -15% 0% -19% -8%

- 45.55 -3% 12% -22% -20% 4% -19% -

- 264.56 -1% 19% -27% -20% 10% -20% -

- 148.90 -2% 16% -25% -21% 6% -20% -

- 420.86 -3% 16% -26% -21% 6% -21% -12%

- 939.97 -3% 4% -22% -17% -1% -23% -11%

- 70.27 2% 16% -28% -24% 7% -24% -18%

- 117.12 2% 19% -27% -21% 7% -25% -16%

- 70.41 0% 18% -25% -22% 8% -25% -22%

- 347.06 0% 21% -28% -25% 11% -31% -24%

- 223.64 -2% 15% -32% -23% 6% -31% -20%

- 436.98 -5% 14% -34% -27% 4% -32% -

- 125.08 -4% 18% -33% -27% 9% -33% -26%

- 37.78 -3% 21% -37% -29% 13% -38% -28%

- 82.31 -3% 21% -37% -29% 13% -39% -30%

- 89.03 -3% 18% -27% -21% 10% - -

- 435.12 -3% 17% -26% -21% 7% - -

3Y 5Y 10Y

-1% 0% 5%

0% 5% 8%

-1% 5% 6%

3% 5% 9%

0% 1% -

2% 4% 10%

-1% 4% -

-1% 5% 10%

-2% 3% -

-2% 2% -

-3% 3% 9%

-2% 4% 9%

-2% 4% 8%

-5% 5% -

-5% 2% 8%

-4% 1% 7%

-6% -1% 8%

-4% 2% 12%

-4% 1% 5%

-4% 1% 10%

-4% 1% 8%

-3% 4% 8%

-5% 1% 8%

-6% -1% 5%

-5% 1% 8%

- - -

- - -

1% 8% -

- - -

- - -

- - -

- - -

5% 7% -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

-4% 1% -

- - -

- - -

-2% 2% -

0% 5% 7%

-1% - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

-9% - -

-5% - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

You might also like

- Aggressive Model PortfolioDocument6 pagesAggressive Model PortfolioNirmaljyoti SharmaNo ratings yet

- Air Way BillDocument1 pageAir Way BillcsmcargoNo ratings yet

- Point To Point Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument6 pagesPoint To Point Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolRanjan SharmaNo ratings yet

- Scheme Name Plan Category NameDocument8 pagesScheme Name Plan Category NamePriyamGhoshNo ratings yet

- Historic Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnsDocument6 pagesHistoric Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnssantuNo ratings yet

- Historic Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsA.J NATIONAL SECURENo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsAayushNo ratings yet

- Historic Returns - Top Ranked Funds Top Ranked Mutual Funds Tracker ToolDocument3 pagesHistoric Returns - Top Ranked Funds Top Ranked Mutual Funds Tracker ToolAnkur VijayvargiyaNo ratings yet

- Axis Midcap Presentation 1Document5 pagesAxis Midcap Presentation 1Imransk401No ratings yet

- Mutual Fund FinderDocument37 pagesMutual Fund FindersrushtiNo ratings yet

- Historic Returns - Small Cap Fund, Small Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Small Cap Fund, Small Cap Fund Performance Tracker Mutual Funds With Highest ReturnsvishnuuuuuuhuuNo ratings yet

- Historic Returns - Small Cap Fund, Small Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Small Cap Fund, Small Cap Fund Performance Tracker Mutual Funds With Highest Returnspromila09No ratings yet

- Historic ReturnsDocument3 pagesHistoric ReturnsNatal KumarNo ratings yet

- Annual Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument3 pagesAnnual Returns - Mutual Fund Screener Mutual Fund Screening and Analysis Toolashish singhNo ratings yet

- Rajnandani Saraf - Assignment 3Document29 pagesRajnandani Saraf - Assignment 3sarafrajnandani413No ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest Returnsakash bangaNo ratings yet

- Historic Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnsDocument21 pagesHistoric Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest Returnsmagi9999No ratings yet

- Historic Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnsDocument6 pagesHistoric Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnsAayushNo ratings yet

- Equity Mutual Funds Best Equity Mutual Funds Mutual Fund RankingDocument3 pagesEquity Mutual Funds Best Equity Mutual Funds Mutual Fund Rankingneerajmca12No ratings yet

- Historic Returns - Mid Cap Fund, Mid Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Mid Cap Fund, Mid Cap Fund Performance Tracker Mutual Funds With Highest ReturnsAayushNo ratings yet

- Historic Returns - Flexi Cap Fund, Flexi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument2 pagesHistoric Returns - Flexi Cap Fund, Flexi Cap Fund Performance Tracker Mutual Funds With Highest Returnsvadlamudi krishnaprasadNo ratings yet

- Historic Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsArsh AgarwalNo ratings yet

- Scheme Name Plan Category NameDocument3 pagesScheme Name Plan Category NameVIREN GOHILNo ratings yet

- Nav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument9 pagesNav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsHariSharanPanjwaniNo ratings yet

- MF Daily Score Card 03102018ONDocument324 pagesMF Daily Score Card 03102018ONsanjaydeNo ratings yet

- Mutual Funds Price ListDocument6 pagesMutual Funds Price ListMohammad Nowaiser MaruhomNo ratings yet

- Risk Ratios - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument6 pagesRisk Ratios - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsHariSharanPanjwaniNo ratings yet

- S No. Return: Name of The Mutual Fund SchemeDocument4 pagesS No. Return: Name of The Mutual Fund SchemeHarsh KandeleNo ratings yet

- MF Daily Score Card 01022018Document322 pagesMF Daily Score Card 01022018Sumit TutejaNo ratings yet

- Sip Watch JuneDocument4 pagesSip Watch JuneAditya KachruNo ratings yet

- Fund Comparison With PeersDocument22 pagesFund Comparison With PeersArmstrong CapitalNo ratings yet

- MF Daily Score Card 14052018OUDocument326 pagesMF Daily Score Card 14052018OUsanjaydeNo ratings yet

- SIP Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument2 pagesSIP Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsSaurabhNo ratings yet

- Financial Services Individual AssisgnmentDocument96 pagesFinancial Services Individual AssisgnmentSajal AgarwalNo ratings yet

- Mutual Funds Dialy ScoreDocument372 pagesMutual Funds Dialy ScorePrince VamsiNo ratings yet

- Historic Returns - Small Cap Fund, Small Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Small Cap Fund, Small Cap Fund Performance Tracker Mutual Funds With Highest ReturnsAkhilesh Kumar SinghNo ratings yet

- Equity Mutual Funds Best Equity Mutual Funds Mutual Fund RankingDocument3 pagesEquity Mutual Funds Best Equity Mutual Funds Mutual Fund RankingYOGESH PATELNo ratings yet

- Fperformance Tracker 6th August 2020Document199 pagesFperformance Tracker 6th August 2020Narendar KumarNo ratings yet

- Historical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument6 pagesHistorical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolNeha BhallaNo ratings yet

- Alternative InvestmentsDocument88 pagesAlternative InvestmentsPrem savla100% (1)

- Wealth Builder Funds 29 Aug 2020 1916Document30 pagesWealth Builder Funds 29 Aug 2020 1916Ankit GoelNo ratings yet

- MF News: Total AUM of MF Industry Declines by 6.87% in May 2011Document6 pagesMF News: Total AUM of MF Industry Declines by 6.87% in May 2011Bhagirathsinh ValaNo ratings yet

- Fund Performance ScorecardDocument25 pagesFund Performance ScorecardSatish DakshinamoorthyNo ratings yet

- Mutual Fund Historical Data 10022024 - Ver1Document78 pagesMutual Fund Historical Data 10022024 - Ver1kanishq.rajendraNo ratings yet

- Rank Returns - Fund of Funds, Fund of Fund Performance Tracker Mutual Funds With Highest ReturnsDocument4 pagesRank Returns - Fund of Funds, Fund of Fund Performance Tracker Mutual Funds With Highest ReturnsVaibhav BorateNo ratings yet

- Historic Returns - Aggressive Hybrid Fund, Aggressive Hybrid Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Aggressive Hybrid Fund, Aggressive Hybrid Fund Performance Tracker Mutual Funds With Highest ReturnsPranjay ChauhanNo ratings yet

- Historical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument12 pagesHistorical Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolSHARIQUE TANVEERNo ratings yet

- Best Mid Cap Fund of 2021 Detailed Comparison Fund ReviewsDocument119 pagesBest Mid Cap Fund of 2021 Detailed Comparison Fund ReviewsgixNo ratings yet

- Historic Returns - ElssDocument15 pagesHistoric Returns - ElssghodababuNo ratings yet

- PMS Pitch - String of Pearls PDFDocument40 pagesPMS Pitch - String of Pearls PDFSatish Kumar SubudhiNo ratings yet

- CrisilDocument2 pagesCrisilPranavi NayakNo ratings yet

- Crisil CRP RatesDocument14 pagesCrisil CRP Ratesgurudev001No ratings yet

- People D'NT Know What They D'NT KnowDocument32 pagesPeople D'NT Know What They D'NT KnowMukesh KumarNo ratings yet

- Trend Following in Focus - September 2018Document8 pagesTrend Following in Focus - September 2018Clement VitaliNo ratings yet

- Aggressive Recommended Basket 02 Mar 16Document25 pagesAggressive Recommended Basket 02 Mar 16nnsriniNo ratings yet

- Best Mutual Fund StudyDocument10 pagesBest Mutual Fund Studyakshayshona0No ratings yet

- Hedge Fund Indices MayDocument3 pagesHedge Fund Indices Mayj.fred a. voortmanNo ratings yet

- Sandeep Kothari Infinite Game FIL With The Masters June2023Document36 pagesSandeep Kothari Infinite Game FIL With The Masters June2023SiddharthNo ratings yet

- AMFIDocument922 pagesAMFIJoseph Rohit FernandoNo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument5 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnssantuNo ratings yet

- The Portfolio Management Revolution Maximize Your Profits TodayFrom EverandThe Portfolio Management Revolution Maximize Your Profits TodayNo ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument5 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnssantuNo ratings yet

- Historic Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnsDocument6 pagesHistoric Returns - Elss, Elss Fund Performance Tracker Mutual Funds With Highest ReturnssantuNo ratings yet

- IRDA Latest Claim Settlement Ratio 2019 List Best Death Claim Settlement Ratio Life Insurance Companies PicDocument4 pagesIRDA Latest Claim Settlement Ratio 2019 List Best Death Claim Settlement Ratio Life Insurance Companies PicsantuNo ratings yet

- 12) DCC-GARCH-Hedging-Stocks-Commodity-IndicesDocument20 pages12) DCC-GARCH-Hedging-Stocks-Commodity-IndicessantuNo ratings yet

- Arima-X: Things To CheckDocument19 pagesArima-X: Things To ChecksantuNo ratings yet

- RetailDocument224 pagesRetailsantuNo ratings yet

- Worksheet in Credit-Scoring-CASEDocument215 pagesWorksheet in Credit-Scoring-CASEsantuNo ratings yet

- 15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC BankDocument2 pages15 Ratios For Fundamental Analysis of Banking Sector Ratios HDFC BanksantuNo ratings yet

- Impact of The Scam:: Sr. No. Psbs Exposure in INR CroresDocument2 pagesImpact of The Scam:: Sr. No. Psbs Exposure in INR CroressantuNo ratings yet

- Particulars Bank 2016 2017Document4 pagesParticulars Bank 2016 2017santuNo ratings yet

- SBI and BOBDocument4 pagesSBI and BOBsantuNo ratings yet

- Projectbyviveksaha 130303153621 Phpapp02Document66 pagesProjectbyviveksaha 130303153621 Phpapp02Aditya KudtarkarNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument10 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any Signatureuma pasumarthiNo ratings yet

- Q3 2019 IJGlobal League TablesDocument76 pagesQ3 2019 IJGlobal League TablesmayorladNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument15 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureASHISH PANDEYNo ratings yet

- Venmo 20Document5 pagesVenmo 20ebiznz1No ratings yet

- Acct Statement XX4917 13112023Document154 pagesAcct Statement XX4917 13112023shrinil.vNo ratings yet

- Account STMTDocument23 pagesAccount STMTshaikhNo ratings yet

- MINUTES OF TENDER OPENING MEETING 4-28 2022-2023 WebsiteDocument35 pagesMINUTES OF TENDER OPENING MEETING 4-28 2022-2023 WebsiteaceroadmarkingNo ratings yet

- Screenshot 2022-02-10 at 10.17.19Document9 pagesScreenshot 2022-02-10 at 10.17.19luizbila11No ratings yet

- Fund ListDocument4 pagesFund ListSatyabrota DasNo ratings yet

- Mutual Fund ProjectDocument85 pagesMutual Fund ProjectChetra PuthranNo ratings yet

- List of Banks KenyaDocument7 pagesList of Banks Kenyaedmund ndegwaNo ratings yet

- SHARIAH SCHOLARS Boards Country and OrgnDocument175 pagesSHARIAH SCHOLARS Boards Country and Orgnprofinvest786No ratings yet

- Aibea: Indian Banks' Association Indian Banks' AssociationDocument22 pagesAibea: Indian Banks' Association Indian Banks' AssociationMAYUR KEWATNo ratings yet

- Data 1Document6 pagesData 1abhinash biswal0% (1)

- Non MunicipalDocument569 pagesNon Municipalzinash DadneNo ratings yet

- 11 Lakh Classified DBDocument246 pages11 Lakh Classified DBasidique5_292665351No ratings yet

- Adobe Scan Aug 03, 2022Document1 pageAdobe Scan Aug 03, 2022Nkire Hachilam DavidNo ratings yet

- Treasury Management - Assignment No. 1 - Rohit AggarwalDocument2 pagesTreasury Management - Assignment No. 1 - Rohit AggarwalRohit AggarwalNo ratings yet

- U) HZFT CF - SM8"DF// 0 F.JZ sJU"v#f VG (58Fjf/F LCTGL Ju"V$Gl Vgi Huifvmgl EztlDocument22 pagesU) HZFT CF - SM8"DF// 0 F.JZ sJU"v#f VG (58Fjf/F LCTGL Ju"V$Gl Vgi Huifvmgl Eztlparesh4trivediNo ratings yet

- Series PoDocument35 pagesSeries PoAishwaryaAyrawhsiaKohliNo ratings yet

- MS Nov 14 2006 ETF QuarterlyDocument268 pagesMS Nov 14 2006 ETF Quarterlyapi-3838885100% (1)

- SFMS Designated Branches/Nodal Officers SR - No. Name of The Bank SFMS Designated Branch IFSC Code Contact Person/Nodal Officer Contact NoDocument4 pagesSFMS Designated Branches/Nodal Officers SR - No. Name of The Bank SFMS Designated Branch IFSC Code Contact Person/Nodal Officer Contact NoPiyush GargNo ratings yet

- Led BillsDocument2 pagesLed BillsRinkesh TandelNo ratings yet

- Isinwise 10.04.19Document3,498 pagesIsinwise 10.04.19AmanNo ratings yet

- HDFC Mutual Funds1Document38 pagesHDFC Mutual Funds1ritik bumbakNo ratings yet

- BDODocument22 pagesBDOkateyNo ratings yet

- Batch Download 20Document75 pagesBatch Download 20atum capitalNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument31 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancetrbogamingg5No ratings yet