Professional Documents

Culture Documents

Perry - Solutions

Perry - Solutions

Uploaded by

Charles TuazonCopyright:

Available Formats

You might also like

- Fin420.540 Jan 2018 Q2-5Document8 pagesFin420.540 Jan 2018 Q2-5Amar AzuanNo ratings yet

- Midterm Examination 2Document4 pagesMidterm Examination 2Nhật Anh OfficialNo ratings yet

- Fin 320 - Individual AssignmentDocument14 pagesFin 320 - Individual AssignmentAnis Umaira Mohd LutpiNo ratings yet

- Kelly's Finance Cheat Sheet V6Document2 pagesKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- ch03 Test ACCT 512 Financial Accounting Theory and IssuesDocument12 pagesch03 Test ACCT 512 Financial Accounting Theory and IssuesSonny MaciasNo ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- Installment SalesDocument13 pagesInstallment SalesMichael BongalontaNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Installment MethodDocument4 pagesInstallment Methodjessica amorosoNo ratings yet

- AFAR Preboards SolutionsDocument27 pagesAFAR Preboards SolutionsIrra May GanotNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- CPA 1 - Financial Accounting Dec 2021Document9 pagesCPA 1 - Financial Accounting Dec 2021Asaba GloriaNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Modal Tetap: Jumlah 62.500.000Document4 pagesModal Tetap: Jumlah 62.500.000RiztiAzizahNur'ainiNo ratings yet

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Chapter Five Format and ExampleDocument8 pagesChapter Five Format and Examplechris mutungaNo ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- In Other Words RE Increased by P250,000 (Income Less Dividends)Document6 pagesIn Other Words RE Increased by P250,000 (Income Less Dividends)Agatha de CastroNo ratings yet

- 04 FAR04-answersDocument12 pages04 FAR04-answersBea GarciaNo ratings yet

- A) 1-Adjustment 1: Closing InventoryDocument12 pagesA) 1-Adjustment 1: Closing InventoryTuba AkbarNo ratings yet

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DDaniel HunksNo ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- Fsa Questions and SolutionsDocument11 pagesFsa Questions and SolutionsAnjali Betala KothariNo ratings yet

- Answer Key - Midterm ExamDocument5 pagesAnswer Key - Midterm ExamSilvermist AriaNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Management 3Document6 pagesManagement 3Romnick TuboNo ratings yet

- Afar SolutionsDocument4 pagesAfar SolutionsSheena BaylosisNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaSophia PerezNo ratings yet

- ACC-132 Quiz 4 Answer KeyDocument3 pagesACC-132 Quiz 4 Answer KeyG18 Yna RecintoNo ratings yet

- Accounting AssignmentDocument5 pagesAccounting AssignmentFelix blayNo ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- Assgnmnt 2 FIN658Document5 pagesAssgnmnt 2 FIN658markNo ratings yet

- Corporate Liquidation and Joint ArrangementDocument7 pagesCorporate Liquidation and Joint ArrangementPaupauNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Fa Pilot Paper AnswerDocument11 pagesFa Pilot Paper Answer刘宝英No ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- NPV Lesson 2Document5 pagesNPV Lesson 2Barack MikeNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- Date Adjusting Entries Dec.31Document18 pagesDate Adjusting Entries Dec.31Cheska Anne Mikka RoxasNo ratings yet

- FAR First Preboard Batch 89 SolutionDocument6 pagesFAR First Preboard Batch 89 SolutionZiee00No ratings yet

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DSarah GoNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- MN30315 January 2023 Exam - SOLUTIONSDocument15 pagesMN30315 January 2023 Exam - SOLUTIONSjoshuachan1411No ratings yet

- CPAR 95 FAR FINAL PB ANSWER KEYDocument7 pagesCPAR 95 FAR FINAL PB ANSWER KEYcaryljoycemaceda3No ratings yet

- Management Accounting Set 2Document6 pagesManagement Accounting Set 2Julia ŚwierczyńskaNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Cash Flow Statement Template in ExcelDocument5 pagesCash Flow Statement Template in ExcelOyewale OyelayoNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Essay FIN202Document5 pagesEssay FIN202thaindnds180468No ratings yet

- Basic Acco VariousDocument26 pagesBasic Acco VariousJasmine Acta100% (1)

- Business Combination Problem 1 Upto 9Document8 pagesBusiness Combination Problem 1 Upto 9jhun nhixNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 1.2 Factors Impacting International Business OperationsDocument37 pages1.2 Factors Impacting International Business OperationsCharles TuazonNo ratings yet

- Student-Reports and OpinionDocument44 pagesStudent-Reports and OpinionCharles TuazonNo ratings yet

- 1.1 Overview of International BusinessDocument27 pages1.1 Overview of International BusinessCharles TuazonNo ratings yet

- Content ServerDocument26 pagesContent ServerCharles TuazonNo ratings yet

- Updated Annual Per Capita Poverty Threshold Poverty Incidence and Magnitude of Poor FamiDocument32 pagesUpdated Annual Per Capita Poverty Threshold Poverty Incidence and Magnitude of Poor FamiCharles TuazonNo ratings yet

- PDF h02 Pre TestDocument8 pagesPDF h02 Pre TestCharles TuazonNo ratings yet

- Dela Cruz - Cloud Computing-1Document4 pagesDela Cruz - Cloud Computing-1Charles TuazonNo ratings yet

- Business Report TopicsDocument4 pagesBusiness Report TopicsCharles TuazonNo ratings yet

- 28S32 High Acres LF 2017.2018-03-01.ARDocument144 pages28S32 High Acres LF 2017.2018-03-01.ARCharles TuazonNo ratings yet

- AFI Infographics - SignedDocument1 pageAFI Infographics - SignedCharles TuazonNo ratings yet

- IAASB Main Agenda (September 2004) Page 2004 1949: Prepared By: Alta Prinsloo (August 2004)Document22 pagesIAASB Main Agenda (September 2004) Page 2004 1949: Prepared By: Alta Prinsloo (August 2004)Charles TuazonNo ratings yet

- HW On INVESTMENT PROPERTY - 1Document2 pagesHW On INVESTMENT PROPERTY - 1Charles TuazonNo ratings yet

- (Final) 11072018 CNPF 17Q Ytd Nine Months 2018Document59 pages(Final) 11072018 CNPF 17Q Ytd Nine Months 2018Charles TuazonNo ratings yet

- Tax1 (T31920)Document82 pagesTax1 (T31920)Charles TuazonNo ratings yet

- AFI Infographics - Q4 2020 - SignedDocument1 pageAFI Infographics - Q4 2020 - SignedCharles TuazonNo ratings yet

- Q3 WRKSHT Perpetual PDFDocument1 pageQ3 WRKSHT Perpetual PDFCharles TuazonNo ratings yet

- Chap 04 Linear RegressionDocument99 pagesChap 04 Linear RegressionCharles TuazonNo ratings yet

- MT Set A PDFDocument6 pagesMT Set A PDFCharles TuazonNo ratings yet

- Gratittude Manufacturing Company Post-Closing Trial Balance DECEMBER 31, 2017Document3 pagesGratittude Manufacturing Company Post-Closing Trial Balance DECEMBER 31, 2017Charles TuazonNo ratings yet

- LQ2 Set B PDFDocument5 pagesLQ2 Set B PDFCharles TuazonNo ratings yet

- Q1 Set B PDFDocument5 pagesQ1 Set B PDFCharles TuazonNo ratings yet

- Sample Problem SolvingDocument2 pagesSample Problem SolvingCharles TuazonNo ratings yet

- Partnership Liquidation: Steps Involved in LiquidationDocument13 pagesPartnership Liquidation: Steps Involved in LiquidationCharles TuazonNo ratings yet

- Business Finance Final Çalışma ÖrneğiDocument8 pagesBusiness Finance Final Çalışma ÖrneğiMustafa EyüboğluNo ratings yet

- Elements of Banking and Finance (FINA 1001) Semester 1 (2020/2021)Document33 pagesElements of Banking and Finance (FINA 1001) Semester 1 (2020/2021)Tia WhoserNo ratings yet

- FABM 1 Lesson 7 The Accounting EquationDocument19 pagesFABM 1 Lesson 7 The Accounting EquationTiffany Ceniza100% (1)

- JBL Annual Report-2015 PDFDocument325 pagesJBL Annual Report-2015 PDFTasnim TabassumNo ratings yet

- Analisis Perbandingan Laporan Keuangan Komersial Dan Laporan Keuangan Fiskal Dalam Rangka Menghitung Pajak Penghasilan TerutangDocument16 pagesAnalisis Perbandingan Laporan Keuangan Komersial Dan Laporan Keuangan Fiskal Dalam Rangka Menghitung Pajak Penghasilan TerutangIra IbrahimNo ratings yet

- Specific Financial Reporting Ac413 May19cDocument5 pagesSpecific Financial Reporting Ac413 May19cAnishahNo ratings yet

- ProblemsDocument2 pagesProblemsJames AguilarNo ratings yet

- Biological Assets: Multiple Choice Questions & Problem Solving QuestionsDocument19 pagesBiological Assets: Multiple Choice Questions & Problem Solving QuestionsAIKO MAGUINSAWANNo ratings yet

- Advanced AccountingDocument33 pagesAdvanced AccountingvijaykumartaxNo ratings yet

- EFim 05 Ed 3Document23 pagesEFim 05 Ed 3bia070386100% (1)

- Worksheet Class Xii Accountancy Chapter 3 Admission of A Partner Module - 2 June Aecs Narora SH Kishore KumarDocument1 pageWorksheet Class Xii Accountancy Chapter 3 Admission of A Partner Module - 2 June Aecs Narora SH Kishore Kumarkratikj368No ratings yet

- AA (F8) - Test (Part I + Part II) - F8 - SolutionDocument12 pagesAA (F8) - Test (Part I + Part II) - F8 - SolutionPham Cam Anh QP0146No ratings yet

- Fin358 Individual Assignment Jay Haiqal 2020209654Document13 pagesFin358 Individual Assignment Jay Haiqal 2020209654nur hazaniNo ratings yet

- Handouts Updates: Reo Taxation: List of Changes by The Create LawDocument3 pagesHandouts Updates: Reo Taxation: List of Changes by The Create LawRandhel SorianoNo ratings yet

- Analisis Fundamentalde EmpresasDocument6 pagesAnalisis Fundamentalde EmpresasJHON JANER RODRIGUEZ MONTERONo ratings yet

- Financial Modeling Forecasting Revenues, Costs, EtcDocument35 pagesFinancial Modeling Forecasting Revenues, Costs, EtcMosxopoly100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 02Document36 pagesMultinational Business Finance 12th Edition Slides Chapter 02Alli TobbaNo ratings yet

- 67188bos54090 Cp10u3Document31 pages67188bos54090 Cp10u3Pawan TalrejaNo ratings yet

- PT Anabatic Technologies TBK Dan Entitas Anaknya/And Its SubsidiariesDocument231 pagesPT Anabatic Technologies TBK Dan Entitas Anaknya/And Its SubsidiariesDhesi Bintang ShafitriNo ratings yet

- 18-00942-Organigramme Vang Feevrier 2019Document1 page18-00942-Organigramme Vang Feevrier 2019Med MehdiNo ratings yet

- Performance Task Week 5Document2 pagesPerformance Task Week 5nats pamplonaNo ratings yet

- Profitability: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseDocument19 pagesProfitability: The Star Logo, and South-Western Are Trademarks Used Herein Under LicensesoniaNo ratings yet

- Pre-Need Manual of Examination - CL2018 - 01Document53 pagesPre-Need Manual of Examination - CL2018 - 01Ipe ClosaNo ratings yet

- PRC4 Vol II MCQs by Sir JahanzaibDocument232 pagesPRC4 Vol II MCQs by Sir JahanzaibAayesha Noor100% (1)

- Audit Perspective in BangladeshDocument13 pagesAudit Perspective in BangladeshK.m. AkhteruzzamanNo ratings yet

- Acctg 112 Reviewer Pas 1 8Document26 pagesAcctg 112 Reviewer Pas 1 8surbanshanrilNo ratings yet

- StockExchange 2022 UzbekistanDocument15 pagesStockExchange 2022 Uzbekistanfarizparmanov1No ratings yet

Perry - Solutions

Perry - Solutions

Uploaded by

Charles TuazonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Perry - Solutions

Perry - Solutions

Uploaded by

Charles TuazonCopyright:

Available Formats

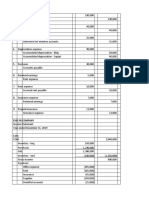

1.

credit sales (1,250,000 x 75%) = 937,500

sales returns on credit (15,000 x 90%)= ( 13,500)

credit sales (net) = 924,000

times percentage doubtful x 1%

doubtful accounts expense P 9,240

2. Assets = Liabilities + Owner’s Equity Assets = Liabilities + Owner’s Equity

75K = 25K + O.E. 150K = 1.5x + x

O.E = 50K (beginning balance) x = 60 K (ending balance)

O.E., beg. 50,000

Additional investment 25,000 (squeeze)

Withdrawal (40,000)

Net Income 25,000

O.E., end 60,000

3. Total Assets 185,000 NCF from Operating Activities 55,000

Total Non current assets (70,000) NCF from Investing Activities

(10,000)

Total Current assets 115,000 NCF from Financing Activities (9,470)

Total Non-Cash Assets (30,000) increase (decrease) in cash 35,530

Cash Balance, End 85,000 85,000 – 35,530 = 49,470 cash balance,

Beg.

4. Down payment (855,000 invoice price x 10%) 85,500

Remaining balance (net of allowance)

(855,000 x 90% balance -5,000 allowance ) 764,500

100%-3% discount =97% x97% 741,565

Installation & Test Runs 15,000

Cost of rewiring 2,500

Insurance while in transit 3,000

Acquisition Cost 847,565

5. Invoice Price (50,000 x 98% x 99%) 48,510

100% - 2% discount = 98% x98% 47,539.80

Partial Payment (10,000.00)

37,539.80

Freight paid by seller 600.00

Amount to be paid by Wiseman Trading 38,139.80

6. Purchase 10,000

Purchase Return (1,000)

Net Purchases 9,000 x 2% = 180

7. Beginning Capital 170,000

Additional Investment 35,000

Withdrawal (5,000)

Expenses paid using personal account 15,000

Ending Capital 215,000

8. Annual Depreciation of Office Equipment =450,000 x 90% / 10 = P40,500

Accumulated Depreciation, end 193,550

Depreciation Expense - Office Equipment ( 40,500)

Accumulated Depreciation,beg. - Office Eqpt. (126,800)

Depreciation Expense – Computer 26,250

Divided by 5/12 months

Annual Depreciation Expense – Computer 63,000

Acquisition Cost = 63,000 annual dep. X 10 yrs. / 0.90 = P700,000

9. Merchandise Inventory, Beg. 450,000

Purchases 1,400,000

Transportation In 10,000

Merchandise Inventory, End (25,000)

Cost of goods sold 1,835,000

x 150%

Sales 2,752,500

Collection from customer w/o disc. (1,312,400)

Collection from customer w disc. (1,352,400/ 98%) (1,380,000)

Accounts Receivable, End P 60,100

10. Mr. Lim required investment = P125,000(ms. Angel investment)/1/3x2/3 =P250,000

Cash 8,000

Accounts Receivable 50,000

Allowance for B.Debts (5,000)

Merchandise Inventory 100,000

Furniture & Fixtures 60,000

213,000 250,000-213,000=P37,000 additional cash

11. Summary of payment:

Repair of Computer 384

Supplies Expense 1,200

Restaurant bill for a client 1,070

Net income overstated 2,654

12. Cash balance per bank 35,500

Deposit in Transit 10,250

Outstanding Checks (3,250)

Correct Cash Balance P42,500

13. Share capital 2,500,000

Share Premium 270,000

Accumulated Profits-free 750,000

Appropriated for Contingencies 500,000

Subscriptions Receivable (20,000)

Total 4,000,000 /25,000 shares = P160 BV/sh

14. Net Income 575,000

less: Share of Preference in NI:

Pref. Sh. Capital 450,000

Subs. Pref. Sh. 200,000

Treasury Share ( 15,000)

Total 635,000

Times x 8% (50,800)

Available for Ordinary shares 524,200 / 6,000 shares = P87.37

15. P1,575,000 / P5 = 315,000 shares

315,000 shares / 900,000 shares = 35%

16.

Assets Liabilities Owner’s Equity

Cash Non-Cash Acc. Payable M.,loan M (50%) G (30%) E (20%)

22,500 322,125 75,000 37,500 82,500 93,375 56,250

(37,500) 37,500

22,500 322,125 75,000 - 120,000 93,375 56,250

232,125 (322,125) (45,000) (27,000) (18,000)

254,625 - 75,000 75,000 66,375 38,250

(75,000) (75,000)

179,625 - 75,000 66,375 38,250

17. Cash Priority Program:

Perry Carl Ang

Capital Balance 10,000 45,000 50,000

Share in NI 24,000 14,400 9,600

34,000 59,400 59,600

Perry, Loan 8,000

Total 42,000 59,400 59,600

Share in loss of sale in non-cash asset (15,000) (9,000) (6,000)

27,000 50,400 53,600

Divided by 50% 30% 20%

54,000 168,000 268,000

(100,000) x 20% = 20,000

54,000 168,000 168,000

(114,000) (114,000) 114k x20% = 22,800

54,000 54,000 54,000 114k x 30% = 34,200

Cash, beg. 50,000

Sale of Non cash asset 90,000

Total 140,000

Payment to creditors (99,000)

Total cash available 41,000

1st 20k for Ang (20,000)

21,000 x 3/5 for Carl = 12,600

x 2/5 for Ang = 8,400

You might also like

- Fin420.540 Jan 2018 Q2-5Document8 pagesFin420.540 Jan 2018 Q2-5Amar AzuanNo ratings yet

- Midterm Examination 2Document4 pagesMidterm Examination 2Nhật Anh OfficialNo ratings yet

- Fin 320 - Individual AssignmentDocument14 pagesFin 320 - Individual AssignmentAnis Umaira Mohd LutpiNo ratings yet

- Kelly's Finance Cheat Sheet V6Document2 pagesKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- ch03 Test ACCT 512 Financial Accounting Theory and IssuesDocument12 pagesch03 Test ACCT 512 Financial Accounting Theory and IssuesSonny MaciasNo ratings yet

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- Installment SalesDocument13 pagesInstallment SalesMichael BongalontaNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Installment MethodDocument4 pagesInstallment Methodjessica amorosoNo ratings yet

- AFAR Preboards SolutionsDocument27 pagesAFAR Preboards SolutionsIrra May GanotNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- CPA 1 - Financial Accounting Dec 2021Document9 pagesCPA 1 - Financial Accounting Dec 2021Asaba GloriaNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Modal Tetap: Jumlah 62.500.000Document4 pagesModal Tetap: Jumlah 62.500.000RiztiAzizahNur'ainiNo ratings yet

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Chapter Five Format and ExampleDocument8 pagesChapter Five Format and Examplechris mutungaNo ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- In Other Words RE Increased by P250,000 (Income Less Dividends)Document6 pagesIn Other Words RE Increased by P250,000 (Income Less Dividends)Agatha de CastroNo ratings yet

- 04 FAR04-answersDocument12 pages04 FAR04-answersBea GarciaNo ratings yet

- A) 1-Adjustment 1: Closing InventoryDocument12 pagesA) 1-Adjustment 1: Closing InventoryTuba AkbarNo ratings yet

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DDaniel HunksNo ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- Fsa Questions and SolutionsDocument11 pagesFsa Questions and SolutionsAnjali Betala KothariNo ratings yet

- Answer Key - Midterm ExamDocument5 pagesAnswer Key - Midterm ExamSilvermist AriaNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Management 3Document6 pagesManagement 3Romnick TuboNo ratings yet

- Afar SolutionsDocument4 pagesAfar SolutionsSheena BaylosisNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaSophia PerezNo ratings yet

- ACC-132 Quiz 4 Answer KeyDocument3 pagesACC-132 Quiz 4 Answer KeyG18 Yna RecintoNo ratings yet

- Accounting AssignmentDocument5 pagesAccounting AssignmentFelix blayNo ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- Assgnmnt 2 FIN658Document5 pagesAssgnmnt 2 FIN658markNo ratings yet

- Corporate Liquidation and Joint ArrangementDocument7 pagesCorporate Liquidation and Joint ArrangementPaupauNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Fa Pilot Paper AnswerDocument11 pagesFa Pilot Paper Answer刘宝英No ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- NPV Lesson 2Document5 pagesNPV Lesson 2Barack MikeNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- Date Adjusting Entries Dec.31Document18 pagesDate Adjusting Entries Dec.31Cheska Anne Mikka RoxasNo ratings yet

- FAR First Preboard Batch 89 SolutionDocument6 pagesFAR First Preboard Batch 89 SolutionZiee00No ratings yet

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DSarah GoNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- MN30315 January 2023 Exam - SOLUTIONSDocument15 pagesMN30315 January 2023 Exam - SOLUTIONSjoshuachan1411No ratings yet

- CPAR 95 FAR FINAL PB ANSWER KEYDocument7 pagesCPAR 95 FAR FINAL PB ANSWER KEYcaryljoycemaceda3No ratings yet

- Management Accounting Set 2Document6 pagesManagement Accounting Set 2Julia ŚwierczyńskaNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Cash Flow Statement Template in ExcelDocument5 pagesCash Flow Statement Template in ExcelOyewale OyelayoNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Essay FIN202Document5 pagesEssay FIN202thaindnds180468No ratings yet

- Basic Acco VariousDocument26 pagesBasic Acco VariousJasmine Acta100% (1)

- Business Combination Problem 1 Upto 9Document8 pagesBusiness Combination Problem 1 Upto 9jhun nhixNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 1.2 Factors Impacting International Business OperationsDocument37 pages1.2 Factors Impacting International Business OperationsCharles TuazonNo ratings yet

- Student-Reports and OpinionDocument44 pagesStudent-Reports and OpinionCharles TuazonNo ratings yet

- 1.1 Overview of International BusinessDocument27 pages1.1 Overview of International BusinessCharles TuazonNo ratings yet

- Content ServerDocument26 pagesContent ServerCharles TuazonNo ratings yet

- Updated Annual Per Capita Poverty Threshold Poverty Incidence and Magnitude of Poor FamiDocument32 pagesUpdated Annual Per Capita Poverty Threshold Poverty Incidence and Magnitude of Poor FamiCharles TuazonNo ratings yet

- PDF h02 Pre TestDocument8 pagesPDF h02 Pre TestCharles TuazonNo ratings yet

- Dela Cruz - Cloud Computing-1Document4 pagesDela Cruz - Cloud Computing-1Charles TuazonNo ratings yet

- Business Report TopicsDocument4 pagesBusiness Report TopicsCharles TuazonNo ratings yet

- 28S32 High Acres LF 2017.2018-03-01.ARDocument144 pages28S32 High Acres LF 2017.2018-03-01.ARCharles TuazonNo ratings yet

- AFI Infographics - SignedDocument1 pageAFI Infographics - SignedCharles TuazonNo ratings yet

- IAASB Main Agenda (September 2004) Page 2004 1949: Prepared By: Alta Prinsloo (August 2004)Document22 pagesIAASB Main Agenda (September 2004) Page 2004 1949: Prepared By: Alta Prinsloo (August 2004)Charles TuazonNo ratings yet

- HW On INVESTMENT PROPERTY - 1Document2 pagesHW On INVESTMENT PROPERTY - 1Charles TuazonNo ratings yet

- (Final) 11072018 CNPF 17Q Ytd Nine Months 2018Document59 pages(Final) 11072018 CNPF 17Q Ytd Nine Months 2018Charles TuazonNo ratings yet

- Tax1 (T31920)Document82 pagesTax1 (T31920)Charles TuazonNo ratings yet

- AFI Infographics - Q4 2020 - SignedDocument1 pageAFI Infographics - Q4 2020 - SignedCharles TuazonNo ratings yet

- Q3 WRKSHT Perpetual PDFDocument1 pageQ3 WRKSHT Perpetual PDFCharles TuazonNo ratings yet

- Chap 04 Linear RegressionDocument99 pagesChap 04 Linear RegressionCharles TuazonNo ratings yet

- MT Set A PDFDocument6 pagesMT Set A PDFCharles TuazonNo ratings yet

- Gratittude Manufacturing Company Post-Closing Trial Balance DECEMBER 31, 2017Document3 pagesGratittude Manufacturing Company Post-Closing Trial Balance DECEMBER 31, 2017Charles TuazonNo ratings yet

- LQ2 Set B PDFDocument5 pagesLQ2 Set B PDFCharles TuazonNo ratings yet

- Q1 Set B PDFDocument5 pagesQ1 Set B PDFCharles TuazonNo ratings yet

- Sample Problem SolvingDocument2 pagesSample Problem SolvingCharles TuazonNo ratings yet

- Partnership Liquidation: Steps Involved in LiquidationDocument13 pagesPartnership Liquidation: Steps Involved in LiquidationCharles TuazonNo ratings yet

- Business Finance Final Çalışma ÖrneğiDocument8 pagesBusiness Finance Final Çalışma ÖrneğiMustafa EyüboğluNo ratings yet

- Elements of Banking and Finance (FINA 1001) Semester 1 (2020/2021)Document33 pagesElements of Banking and Finance (FINA 1001) Semester 1 (2020/2021)Tia WhoserNo ratings yet

- FABM 1 Lesson 7 The Accounting EquationDocument19 pagesFABM 1 Lesson 7 The Accounting EquationTiffany Ceniza100% (1)

- JBL Annual Report-2015 PDFDocument325 pagesJBL Annual Report-2015 PDFTasnim TabassumNo ratings yet

- Analisis Perbandingan Laporan Keuangan Komersial Dan Laporan Keuangan Fiskal Dalam Rangka Menghitung Pajak Penghasilan TerutangDocument16 pagesAnalisis Perbandingan Laporan Keuangan Komersial Dan Laporan Keuangan Fiskal Dalam Rangka Menghitung Pajak Penghasilan TerutangIra IbrahimNo ratings yet

- Specific Financial Reporting Ac413 May19cDocument5 pagesSpecific Financial Reporting Ac413 May19cAnishahNo ratings yet

- ProblemsDocument2 pagesProblemsJames AguilarNo ratings yet

- Biological Assets: Multiple Choice Questions & Problem Solving QuestionsDocument19 pagesBiological Assets: Multiple Choice Questions & Problem Solving QuestionsAIKO MAGUINSAWANNo ratings yet

- Advanced AccountingDocument33 pagesAdvanced AccountingvijaykumartaxNo ratings yet

- EFim 05 Ed 3Document23 pagesEFim 05 Ed 3bia070386100% (1)

- Worksheet Class Xii Accountancy Chapter 3 Admission of A Partner Module - 2 June Aecs Narora SH Kishore KumarDocument1 pageWorksheet Class Xii Accountancy Chapter 3 Admission of A Partner Module - 2 June Aecs Narora SH Kishore Kumarkratikj368No ratings yet

- AA (F8) - Test (Part I + Part II) - F8 - SolutionDocument12 pagesAA (F8) - Test (Part I + Part II) - F8 - SolutionPham Cam Anh QP0146No ratings yet

- Fin358 Individual Assignment Jay Haiqal 2020209654Document13 pagesFin358 Individual Assignment Jay Haiqal 2020209654nur hazaniNo ratings yet

- Handouts Updates: Reo Taxation: List of Changes by The Create LawDocument3 pagesHandouts Updates: Reo Taxation: List of Changes by The Create LawRandhel SorianoNo ratings yet

- Analisis Fundamentalde EmpresasDocument6 pagesAnalisis Fundamentalde EmpresasJHON JANER RODRIGUEZ MONTERONo ratings yet

- Financial Modeling Forecasting Revenues, Costs, EtcDocument35 pagesFinancial Modeling Forecasting Revenues, Costs, EtcMosxopoly100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 02Document36 pagesMultinational Business Finance 12th Edition Slides Chapter 02Alli TobbaNo ratings yet

- 67188bos54090 Cp10u3Document31 pages67188bos54090 Cp10u3Pawan TalrejaNo ratings yet

- PT Anabatic Technologies TBK Dan Entitas Anaknya/And Its SubsidiariesDocument231 pagesPT Anabatic Technologies TBK Dan Entitas Anaknya/And Its SubsidiariesDhesi Bintang ShafitriNo ratings yet

- 18-00942-Organigramme Vang Feevrier 2019Document1 page18-00942-Organigramme Vang Feevrier 2019Med MehdiNo ratings yet

- Performance Task Week 5Document2 pagesPerformance Task Week 5nats pamplonaNo ratings yet

- Profitability: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseDocument19 pagesProfitability: The Star Logo, and South-Western Are Trademarks Used Herein Under LicensesoniaNo ratings yet

- Pre-Need Manual of Examination - CL2018 - 01Document53 pagesPre-Need Manual of Examination - CL2018 - 01Ipe ClosaNo ratings yet

- PRC4 Vol II MCQs by Sir JahanzaibDocument232 pagesPRC4 Vol II MCQs by Sir JahanzaibAayesha Noor100% (1)

- Audit Perspective in BangladeshDocument13 pagesAudit Perspective in BangladeshK.m. AkhteruzzamanNo ratings yet

- Acctg 112 Reviewer Pas 1 8Document26 pagesAcctg 112 Reviewer Pas 1 8surbanshanrilNo ratings yet

- StockExchange 2022 UzbekistanDocument15 pagesStockExchange 2022 Uzbekistanfarizparmanov1No ratings yet