Professional Documents

Culture Documents

Supply Outward - 34

Supply Outward - 34

Uploaded by

DIVYANSHI PHOTO STATECopyright:

Available Formats

You might also like

- Herbalife International India, Pvt. LTDDocument1 pageHerbalife International India, Pvt. LTDZeelan Basha S.M.No ratings yet

- Jai Maa Sharda Trading Company: Tax InvoiceDocument1 pageJai Maa Sharda Trading Company: Tax Invoiceskarmy224208No ratings yet

- Exide Invertor Battery BillDocument1 pageExide Invertor Battery BillrsshardaranaNo ratings yet

- Jai BabaDocument1 pageJai BabaShivam KumarNo ratings yet

- No of Case MRP KG/LTR: Total 2 20.000 427.47-8,121.90 730.97 730.97 9,583.84Document2 pagesNo of Case MRP KG/LTR: Total 2 20.000 427.47-8,121.90 730.97 730.97 9,583.84Prashant Kumar SwarnakarNo ratings yet

- Screenshot 2024-04-18 at 6.06.49 AMDocument1 pageScreenshot 2024-04-18 at 6.06.49 AMsyed.saad1355No ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceomsaimotorslakhaura68097No ratings yet

- Tyre InvoiceDocument2 pagesTyre Invoiceresidency.saharaNo ratings yet

- SupplyOutward GST 22 23 816Document1 pageSupplyOutward GST 22 23 816nikunjsingh04No ratings yet

- Lucky ScootyDocument1 pageLucky ScootyPramodKumarNo ratings yet

- File JEETDocument1 pageFile JEETrohitNo ratings yet

- Syed HasanDocument1 pageSyed Hasanhardeepcok123No ratings yet

- Narang Traders: Shop No. 781, Dharampura Bazar, Near Union Bank, PatialaDocument2 pagesNarang Traders: Shop No. 781, Dharampura Bazar, Near Union Bank, Patialark63747464No ratings yet

- OPera GoaDocument1 pageOPera GoaJaTiN RaYNo ratings yet

- InvoiceDocument1 pageInvoicerahul prasadNo ratings yet

- Nadim Khan Up16ak9563Document1 pageNadim Khan Up16ak9563Sandeep KumarNo ratings yet

- InvoiceDocument1 pageInvoicewasu sheebuNo ratings yet

- AJAYDocument2 pagesAJAYrauniyar97No ratings yet

- Sales GST 282Document1 pageSales GST 282ashish.asati1No ratings yet

- SalespersonDocument1 pageSalespersonShantanu KesarwaniNo ratings yet

- Rahman Industries LTD: Tax InvoiceDocument1 pageRahman Industries LTD: Tax InvoiceRashid KhanNo ratings yet

- STEELTUBESDocument1 pageSTEELTUBESRahul KumarNo ratings yet

- BIKEDocument1 pageBIKEgauravashNo ratings yet

- Invoice PrintDocument2 pagesInvoice Printvijayrathor7353eNo ratings yet

- Print Invoice Old - PHPDocument1 pagePrint Invoice Old - PHPDishank RastogiNo ratings yet

- Adobe Scan Apr 11, 2022Document13 pagesAdobe Scan Apr 11, 2022Vishal BadhanNo ratings yet

- Sainik Emporium 05-06Document2 pagesSainik Emporium 05-06Jay SharmaNo ratings yet

- M/S Debnath HardwareDocument1 pageM/S Debnath Hardwareudayanabs92No ratings yet

- Invoice - No - 1181 - DT - 03112022 Original For RecipientDocument1 pageInvoice - No - 1181 - DT - 03112022 Original For RecipientAshwani SharmaNo ratings yet

- InvoiceDocument1 pageInvoiceRajat saxenaNo ratings yet

- KD Traders Bill Ai Bno. 35Document2 pagesKD Traders Bill Ai Bno. 35Jotdeep SinghNo ratings yet

- Filebest 1Document2 pagesFilebest 1vivek.arora88No ratings yet

- Singla Enterprises: Original For RecipientDocument2 pagesSingla Enterprises: Original For Recipientjaikishan456321No ratings yet

- 364598damage Stock Return Cfa Report SCT0058140333060309456Document1 page364598damage Stock Return Cfa Report SCT0058140333060309456rauniyar97No ratings yet

- 84 A S EnterprisesDocument1 page84 A S EnterprisesAditya PandeyNo ratings yet

- SangeetaDocument1 pageSangeetahardeepcok123No ratings yet

- InvoiceDocument1 pageInvoiceRaj mishraNo ratings yet

- ScootyDocument1 pageScootygauravashNo ratings yet

- Herbalife International India, Pvt. LTDDocument2 pagesHerbalife International India, Pvt. LTDrk4322016No ratings yet

- 142Document1 page142Taranjot SinghNo ratings yet

- Makkar Motors Invoice PDFDocument1 pageMakkar Motors Invoice PDFMehra SaabNo ratings yet

- Sales - 187Document1 pageSales - 187Shrey GuptaNo ratings yet

- SukralaDocument1 pageSukralavivek.arora88No ratings yet

- InvoiceDocument2 pagesInvoiceBhanupratapNo ratings yet

- A40479Damage Stock Return Cfa Report 54005073770300Document1 pageA40479Damage Stock Return Cfa Report 54005073770300rauniyar97No ratings yet

- MaheshbiilDocument1 pageMaheshbiilSOURAAVNo ratings yet

- Invoice 455 CHANDAN KUMAR THAKURDocument1 pageInvoice 455 CHANDAN KUMAR THAKURSurjit PrasadNo ratings yet

- InvoiceDocument1 pageInvoiceSaurabhSinghNo ratings yet

- Sales GST 259Document1 pageSales GST 259ashish.asati1No ratings yet

- Maheshwari Mining PVT LTD: SL No. 1Document1 pageMaheshwari Mining PVT LTD: SL No. 1Karthii AjuNo ratings yet

- Mobile BillDocument1 pageMobile BillVDPMR EWORKSNo ratings yet

- RMTC - Sales RMTC 0963 23Document1 pageRMTC - Sales RMTC 0963 23Rockey GujjarNo ratings yet

- Invoice - No - 1146 - DT - 27102022 Original For RecipientDocument1 pageInvoice - No - 1146 - DT - 27102022 Original For RecipientAshwani SharmaNo ratings yet

- BILL NO 1163 A R Aman BhogDocument1 pageBILL NO 1163 A R Aman Bhogharshrajofficial5No ratings yet

- TahirDocument1 pageTahirhardeepcok123No ratings yet

- Description of Goods Amount Per Rate Quantity Hsn/Sac: Authorised SignatoryDocument2 pagesDescription of Goods Amount Per Rate Quantity Hsn/Sac: Authorised Signatorygaurav tanwarNo ratings yet

- SPC 00742 24-25aggarwal Rice MillsDocument1 pageSPC 00742 24-25aggarwal Rice Millssanjeev_goyal18No ratings yet

- Vishnu Saran & Co. Bill No 5045Document1 pageVishnu Saran & Co. Bill No 5045gopukrishna37No ratings yet

- File 4 Invoice AjayDocument1 pageFile 4 Invoice Ajayfixer_007722No ratings yet

- Summer TrainingDocument49 pagesSummer TrainingDIVYANSHI PHOTO STATENo ratings yet

- NotesDocument26 pagesNotesDIVYANSHI PHOTO STATENo ratings yet

- PYTHONDocument2 pagesPYTHONDIVYANSHI PHOTO STATENo ratings yet

- NEUTRACEUTICALDocument45 pagesNEUTRACEUTICALDIVYANSHI PHOTO STATENo ratings yet

- Summer TrainingDocument11 pagesSummer TrainingDIVYANSHI PHOTO STATENo ratings yet

- Format of Application For Grant of Financial Assistance From Student Welfare FundDocument2 pagesFormat of Application For Grant of Financial Assistance From Student Welfare FundDIVYANSHI PHOTO STATENo ratings yet

- CORONILDocument32 pagesCORONILDIVYANSHI PHOTO STATENo ratings yet

- Smart Note TrackerDocument11 pagesSmart Note TrackerDIVYANSHI PHOTO STATENo ratings yet

- Data WarehousingDocument26 pagesData WarehousingDIVYANSHI PHOTO STATENo ratings yet

- Shri Ramswaroop Memorial University Lucknow-Deva Road, Uttar PradeshDocument80 pagesShri Ramswaroop Memorial University Lucknow-Deva Road, Uttar PradeshDIVYANSHI PHOTO STATENo ratings yet

- Pratyush Saxena Profile Management of HR in Innvolveconsulting PVT Ltd.Document86 pagesPratyush Saxena Profile Management of HR in Innvolveconsulting PVT Ltd.DIVYANSHI PHOTO STATENo ratings yet

- Pratyush Saxena Profile Management of HRDocument86 pagesPratyush Saxena Profile Management of HRDIVYANSHI PHOTO STATENo ratings yet

- Tata Steel Financial AnalysisDocument40 pagesTata Steel Financial AnalysisDIVYANSHI PHOTO STATENo ratings yet

- 4 - 29 - 2017 10 - 43 - 32 Am - Final Project ReportDocument67 pages4 - 29 - 2017 10 - 43 - 32 Am - Final Project ReportDIVYANSHI PHOTO STATENo ratings yet

- Amul Milk by AnuragDocument94 pagesAmul Milk by AnuragDIVYANSHI PHOTO STATENo ratings yet

- Keywords: Cost Effective, Low Cost Housing, Cheap MaterialsDocument62 pagesKeywords: Cost Effective, Low Cost Housing, Cheap MaterialsDIVYANSHI PHOTO STATENo ratings yet

- The National Academies Press: Globalization of Technology: International Perspectives (1988)Document225 pagesThe National Academies Press: Globalization of Technology: International Perspectives (1988)DIVYANSHI PHOTO STATENo ratings yet

- Traffic Analysis: Basic Concepts and Applications: November 2018Document29 pagesTraffic Analysis: Basic Concepts and Applications: November 2018DIVYANSHI PHOTO STATENo ratings yet

- Project HarDocument5 pagesProject HarDIVYANSHI PHOTO STATENo ratings yet

- Advance Construction Equipments and TechniquesDocument57 pagesAdvance Construction Equipments and TechniquesDIVYANSHI PHOTO STATENo ratings yet

- PRAKASHVEER Resume PDFDocument2 pagesPRAKASHVEER Resume PDFDIVYANSHI PHOTO STATENo ratings yet

- 36D2981v1 Eeb CPPP Roadmap UnderDocument148 pages36D2981v1 Eeb CPPP Roadmap UnderDIVYANSHI PHOTO STATENo ratings yet

- Front Page-Ajit PDFDocument1 pageFront Page-Ajit PDFDIVYANSHI PHOTO STATENo ratings yet

- GE6102 - The Contemporary World Week05 PRELIMSDocument8 pagesGE6102 - The Contemporary World Week05 PRELIMSJohnrylNo ratings yet

- Di-2 21245513Document1 pageDi-2 21245513VrindapareekNo ratings yet

- What Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeDocument4 pagesWhat Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeBenazir HitoishiNo ratings yet

- International Finance and Polices: Dr. Bui Thanh LongDocument55 pagesInternational Finance and Polices: Dr. Bui Thanh LongThanh Long BuiNo ratings yet

- Economic Survey StatisticsDocument128 pagesEconomic Survey Statisticsraj.kausNo ratings yet

- MCQ QuizDocument13 pagesMCQ QuizSharNo ratings yet

- Philippine-China Trade RelationsDocument2 pagesPhilippine-China Trade RelationsRalph Adrian MielNo ratings yet

- SBN-807: Increasing Personnel Economic Relief Assistance (PERA) To P3,000Document4 pagesSBN-807: Increasing Personnel Economic Relief Assistance (PERA) To P3,000Ralph RectoNo ratings yet

- Foreign Trade: Impact of External Debt in Economy of PakistanDocument14 pagesForeign Trade: Impact of External Debt in Economy of PakistanSyed Mortaza MehdiNo ratings yet

- Fundamentals of Economics PDFDocument3 pagesFundamentals of Economics PDFSinu Thankam SajanNo ratings yet

- Volume 1 12 The Dollar's Descent Orderly or Not October 30 2009Document12 pagesVolume 1 12 The Dollar's Descent Orderly or Not October 30 2009Denis OuelletNo ratings yet

- 2022 IndexofEconomicFreedom-QatarDocument2 pages2022 IndexofEconomicFreedom-QatarUmar Shaheen ANo ratings yet

- Below Mentioned Are The Some Objectives of The StudyDocument14 pagesBelow Mentioned Are The Some Objectives of The StudyŠu B ḦaNo ratings yet

- مذكرة سويسي هالةDocument137 pagesمذكرة سويسي هالةHameid Abd ErhmaneNo ratings yet

- New Microsoft PowerPoint Presentation TAXDocument10 pagesNew Microsoft PowerPoint Presentation TAXramesh BNo ratings yet

- PIMM Panama PostDocument3 pagesPIMM Panama PostPIMM100% (2)

- Qarkullimi I Llogarisë Account TurnoverDocument7 pagesQarkullimi I Llogarisë Account TurnoverYllka HoxhaNo ratings yet

- Payrolls in US RiseDocument1 pagePayrolls in US RiseDuong Le Tu UyenNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument22 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancepriyuNo ratings yet

- Arrow - Dry Bulk Outlook - Apr-20Document22 pagesArrow - Dry Bulk Outlook - Apr-20Sahil FarazNo ratings yet

- International Economics I (: Econ 2081)Document36 pagesInternational Economics I (: Econ 2081)Gidisa LachisaNo ratings yet

- 1 Business Economics Sem VI Marathi Sample QuestionsDocument76 pages1 Business Economics Sem VI Marathi Sample QuestionsShubham Patil OfficialNo ratings yet

- FILE - 20220513 - 151826 - Chapter 5 Protection - DoneDocument40 pagesFILE - 20220513 - 151826 - Chapter 5 Protection - DoneHuyền TràNo ratings yet

- Ireland and The Impacts of BrexitDocument62 pagesIreland and The Impacts of BrexitSeabanNo ratings yet

- Visitor Receipts Report 2020Document2 pagesVisitor Receipts Report 2020ELPOS KENWARD DE JESUSNo ratings yet

- Rcep AssignmentDocument5 pagesRcep AssignmentNageeta BaiNo ratings yet

- IbrdDocument2 pagesIbrdIswarya PurushothamanNo ratings yet

- Tax Invoice: Mythri Metallizing Private LimitedDocument3 pagesTax Invoice: Mythri Metallizing Private LimitedAnupriya OberoiNo ratings yet

- Chap 2 - Indonesia - SolutionDocument2 pagesChap 2 - Indonesia - SolutionLuvnica Verma100% (5)

- Economy Finance and Trade CanadaDocument14 pagesEconomy Finance and Trade CanadaMartin Elias Prasca GutierrezNo ratings yet

Supply Outward - 34

Supply Outward - 34

Uploaded by

DIVYANSHI PHOTO STATEOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Supply Outward - 34

Supply Outward - 34

Uploaded by

DIVYANSHI PHOTO STATECopyright:

Available Formats

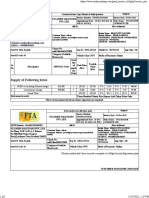

GSTIN : 09DCOPD0219R1Z5 Original Copy

Pre Authenticated by

for ARUSH PETROCHAM

TAX INVOICE

ARUSH PETROCHAM

REGD OFF- 4C/3A1 RAMANANAD NAGGER, ALLAHPUR ALLAHABAD 211006

BO HOUSE NO -17 DR BN VERMA ROAD, KAISERBASGH LUCKNOW 226018

PAN : DCOPD0219R

Tel. : 8840451782 email : smoothplushr@gmail.com

Book No. : 1 Reverse Charge : N

Serial No. : 34 GR/RR No. :

Date of Invoice : 19-09-2020 ( 03:16 PM ) Transport : by Party

Place of Supply : Uttar Pradesh (09) E-Way Bill No. :

Billed to : Shipped to :

M/S Anubhav Traders Provision Store M/S Anubhav Traders Provision Store

Darshan Nagger Darshan Nagger

Faizabad Faizabad

Party PAN : Party PAN :

Party E-Mail ID : Party E-Mail ID :

Party Mobile No : Party Mobile No :

Party AadhaarNo : Party AadhaarNo :

State : Uttar Pradesh (09) State : Uttar Pradesh (09)

GSTIN / UIN : 09AEDPH2832Q1Z6 GSTIN / UIN : 09AEDPH2832Q1Z6

S.N. Description of Goods HSN/SAC Qty. Unit List Price Discount Price Amount( ` )

Code

1. SM HH 900 Ml (V15G) 2710 100.00 Nos 75.00 0.00 % 75.00 7,500.00

2. SM Calcium GreaseLR 1 Kg (Gross Wt) 2710 30.00 Nos 60.00 0.00 % 60.00 1,800.00

9,300.00

Add : CGST @ 9.00 % 837.00

Add : SGST @ 9.00 % 837.00

Grand Total 130.00 Nos ` 10,974.00

HSN/SAC Tax Rate Taxable Amt. CGST SGST Total Tax

2710 18% 9,300.00 837.00 837.00 1,674.00

Rupees Ten Thousand Nine Hundred Seventy Four Only

Terms & Conditions Receiver's Signature :

E.& O.E.

1. Goods once sold will not be taken back.

2. Interest @ 18% p.a. will be charged if the payment For ARUSH PETROCHAM

is not made with in the stipulated time.

3. Subject to 'ALLAHABAD' Jurisdiction only.

Authorised Signatory

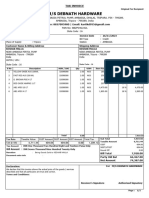

GSTIN : 09DCOPD0219R1Z5 Duplicate Copy

Pre Authenticated by

for ARUSH PETROCHAM

TAX INVOICE

ARUSH PETROCHAM

REGD OFF- 4C/3A1 RAMANANAD NAGGER, ALLAHPUR ALLAHABAD 211006

BO HOUSE NO -17 DR BN VERMA ROAD, KAISERBASGH LUCKNOW 226018

PAN : DCOPD0219R

Tel. : 8840451782 email : smoothplushr@gmail.com

Book No. : 1 Reverse Charge : N

Serial No. : 34 GR/RR No. :

Date of Invoice : 19-09-2020 ( 03:16 PM ) Transport : by Party

Place of Supply : Uttar Pradesh (09) E-Way Bill No. :

Billed to : Shipped to :

M/S Anubhav Traders Provision Store M/S Anubhav Traders Provision Store

Darshan Nagger Darshan Nagger

Faizabad Faizabad

Party PAN : Party PAN :

Party E-Mail ID : Party E-Mail ID :

Party Mobile No : Party Mobile No :

Party AadhaarNo : Party AadhaarNo :

State : Uttar Pradesh (09) State : Uttar Pradesh (09)

GSTIN / UIN : 09AEDPH2832Q1Z6 GSTIN / UIN : 09AEDPH2832Q1Z6

S.N. Description of Goods HSN/SAC Qty. Unit List Price Discount Price Amount( ` )

Code

1. SM HH 900 Ml (V15G) 2710 100.00 Nos 75.00 0.00 % 75.00 7,500.00

2. SM Calcium GreaseLR 1 Kg (Gross Wt) 2710 30.00 Nos 60.00 0.00 % 60.00 1,800.00

9,300.00

Add : CGST @ 9.00 % 837.00

Add : SGST @ 9.00 % 837.00

Grand Total 130.00 Nos ` 10,974.00

HSN/SAC Tax Rate Taxable Amt. CGST SGST Total Tax

2710 18% 9,300.00 837.00 837.00 1,674.00

Rupees Ten Thousand Nine Hundred Seventy Four Only

Terms & Conditions Receiver's Signature :

E.& O.E.

1. Goods once sold will not be taken back.

2. Interest @ 18% p.a. will be charged if the payment For ARUSH PETROCHAM

is not made with in the stipulated time.

3. Subject to 'ALLAHABAD' Jurisdiction only.

Authorised Signatory

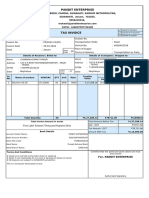

GSTIN : 09DCOPD0219R1Z5 Triplicate Copy

Pre Authenticated by

for ARUSH PETROCHAM

TAX INVOICE

ARUSH PETROCHAM

REGD OFF- 4C/3A1 RAMANANAD NAGGER, ALLAHPUR ALLAHABAD 211006

BO HOUSE NO -17 DR BN VERMA ROAD, KAISERBASGH LUCKNOW 226018

PAN : DCOPD0219R

Tel. : 8840451782 email : smoothplushr@gmail.com

Book No. : 1 Reverse Charge : N

Serial No. : 34 GR/RR No. :

Date of Invoice : 19-09-2020 ( 03:16 PM ) Transport : by Party

Place of Supply : Uttar Pradesh (09) E-Way Bill No. :

Billed to : Shipped to :

M/S Anubhav Traders Provision Store M/S Anubhav Traders Provision Store

Darshan Nagger Darshan Nagger

Faizabad Faizabad

Party PAN : Party PAN :

Party E-Mail ID : Party E-Mail ID :

Party Mobile No : Party Mobile No :

Party AadhaarNo : Party AadhaarNo :

State : Uttar Pradesh (09) State : Uttar Pradesh (09)

GSTIN / UIN : 09AEDPH2832Q1Z6 GSTIN / UIN : 09AEDPH2832Q1Z6

S.N. Description of Goods HSN/SAC Qty. Unit List Price Discount Price Amount( ` )

Code

1. SM HH 900 Ml (V15G) 2710 100.00 Nos 75.00 0.00 % 75.00 7,500.00

2. SM Calcium GreaseLR 1 Kg (Gross Wt) 2710 30.00 Nos 60.00 0.00 % 60.00 1,800.00

9,300.00

Add : CGST @ 9.00 % 837.00

Add : SGST @ 9.00 % 837.00

Grand Total 130.00 Nos ` 10,974.00

HSN/SAC Tax Rate Taxable Amt. CGST SGST Total Tax

2710 18% 9,300.00 837.00 837.00 1,674.00

Rupees Ten Thousand Nine Hundred Seventy Four Only

Terms & Conditions Receiver's Signature :

E.& O.E.

1. Goods once sold will not be taken back.

2. Interest @ 18% p.a. will be charged if the payment For ARUSH PETROCHAM

is not made with in the stipulated time.

3. Subject to 'ALLAHABAD' Jurisdiction only.

Authorised Signatory

You might also like

- Herbalife International India, Pvt. LTDDocument1 pageHerbalife International India, Pvt. LTDZeelan Basha S.M.No ratings yet

- Jai Maa Sharda Trading Company: Tax InvoiceDocument1 pageJai Maa Sharda Trading Company: Tax Invoiceskarmy224208No ratings yet

- Exide Invertor Battery BillDocument1 pageExide Invertor Battery BillrsshardaranaNo ratings yet

- Jai BabaDocument1 pageJai BabaShivam KumarNo ratings yet

- No of Case MRP KG/LTR: Total 2 20.000 427.47-8,121.90 730.97 730.97 9,583.84Document2 pagesNo of Case MRP KG/LTR: Total 2 20.000 427.47-8,121.90 730.97 730.97 9,583.84Prashant Kumar SwarnakarNo ratings yet

- Screenshot 2024-04-18 at 6.06.49 AMDocument1 pageScreenshot 2024-04-18 at 6.06.49 AMsyed.saad1355No ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceomsaimotorslakhaura68097No ratings yet

- Tyre InvoiceDocument2 pagesTyre Invoiceresidency.saharaNo ratings yet

- SupplyOutward GST 22 23 816Document1 pageSupplyOutward GST 22 23 816nikunjsingh04No ratings yet

- Lucky ScootyDocument1 pageLucky ScootyPramodKumarNo ratings yet

- File JEETDocument1 pageFile JEETrohitNo ratings yet

- Syed HasanDocument1 pageSyed Hasanhardeepcok123No ratings yet

- Narang Traders: Shop No. 781, Dharampura Bazar, Near Union Bank, PatialaDocument2 pagesNarang Traders: Shop No. 781, Dharampura Bazar, Near Union Bank, Patialark63747464No ratings yet

- OPera GoaDocument1 pageOPera GoaJaTiN RaYNo ratings yet

- InvoiceDocument1 pageInvoicerahul prasadNo ratings yet

- Nadim Khan Up16ak9563Document1 pageNadim Khan Up16ak9563Sandeep KumarNo ratings yet

- InvoiceDocument1 pageInvoicewasu sheebuNo ratings yet

- AJAYDocument2 pagesAJAYrauniyar97No ratings yet

- Sales GST 282Document1 pageSales GST 282ashish.asati1No ratings yet

- SalespersonDocument1 pageSalespersonShantanu KesarwaniNo ratings yet

- Rahman Industries LTD: Tax InvoiceDocument1 pageRahman Industries LTD: Tax InvoiceRashid KhanNo ratings yet

- STEELTUBESDocument1 pageSTEELTUBESRahul KumarNo ratings yet

- BIKEDocument1 pageBIKEgauravashNo ratings yet

- Invoice PrintDocument2 pagesInvoice Printvijayrathor7353eNo ratings yet

- Print Invoice Old - PHPDocument1 pagePrint Invoice Old - PHPDishank RastogiNo ratings yet

- Adobe Scan Apr 11, 2022Document13 pagesAdobe Scan Apr 11, 2022Vishal BadhanNo ratings yet

- Sainik Emporium 05-06Document2 pagesSainik Emporium 05-06Jay SharmaNo ratings yet

- M/S Debnath HardwareDocument1 pageM/S Debnath Hardwareudayanabs92No ratings yet

- Invoice - No - 1181 - DT - 03112022 Original For RecipientDocument1 pageInvoice - No - 1181 - DT - 03112022 Original For RecipientAshwani SharmaNo ratings yet

- InvoiceDocument1 pageInvoiceRajat saxenaNo ratings yet

- KD Traders Bill Ai Bno. 35Document2 pagesKD Traders Bill Ai Bno. 35Jotdeep SinghNo ratings yet

- Filebest 1Document2 pagesFilebest 1vivek.arora88No ratings yet

- Singla Enterprises: Original For RecipientDocument2 pagesSingla Enterprises: Original For Recipientjaikishan456321No ratings yet

- 364598damage Stock Return Cfa Report SCT0058140333060309456Document1 page364598damage Stock Return Cfa Report SCT0058140333060309456rauniyar97No ratings yet

- 84 A S EnterprisesDocument1 page84 A S EnterprisesAditya PandeyNo ratings yet

- SangeetaDocument1 pageSangeetahardeepcok123No ratings yet

- InvoiceDocument1 pageInvoiceRaj mishraNo ratings yet

- ScootyDocument1 pageScootygauravashNo ratings yet

- Herbalife International India, Pvt. LTDDocument2 pagesHerbalife International India, Pvt. LTDrk4322016No ratings yet

- 142Document1 page142Taranjot SinghNo ratings yet

- Makkar Motors Invoice PDFDocument1 pageMakkar Motors Invoice PDFMehra SaabNo ratings yet

- Sales - 187Document1 pageSales - 187Shrey GuptaNo ratings yet

- SukralaDocument1 pageSukralavivek.arora88No ratings yet

- InvoiceDocument2 pagesInvoiceBhanupratapNo ratings yet

- A40479Damage Stock Return Cfa Report 54005073770300Document1 pageA40479Damage Stock Return Cfa Report 54005073770300rauniyar97No ratings yet

- MaheshbiilDocument1 pageMaheshbiilSOURAAVNo ratings yet

- Invoice 455 CHANDAN KUMAR THAKURDocument1 pageInvoice 455 CHANDAN KUMAR THAKURSurjit PrasadNo ratings yet

- InvoiceDocument1 pageInvoiceSaurabhSinghNo ratings yet

- Sales GST 259Document1 pageSales GST 259ashish.asati1No ratings yet

- Maheshwari Mining PVT LTD: SL No. 1Document1 pageMaheshwari Mining PVT LTD: SL No. 1Karthii AjuNo ratings yet

- Mobile BillDocument1 pageMobile BillVDPMR EWORKSNo ratings yet

- RMTC - Sales RMTC 0963 23Document1 pageRMTC - Sales RMTC 0963 23Rockey GujjarNo ratings yet

- Invoice - No - 1146 - DT - 27102022 Original For RecipientDocument1 pageInvoice - No - 1146 - DT - 27102022 Original For RecipientAshwani SharmaNo ratings yet

- BILL NO 1163 A R Aman BhogDocument1 pageBILL NO 1163 A R Aman Bhogharshrajofficial5No ratings yet

- TahirDocument1 pageTahirhardeepcok123No ratings yet

- Description of Goods Amount Per Rate Quantity Hsn/Sac: Authorised SignatoryDocument2 pagesDescription of Goods Amount Per Rate Quantity Hsn/Sac: Authorised Signatorygaurav tanwarNo ratings yet

- SPC 00742 24-25aggarwal Rice MillsDocument1 pageSPC 00742 24-25aggarwal Rice Millssanjeev_goyal18No ratings yet

- Vishnu Saran & Co. Bill No 5045Document1 pageVishnu Saran & Co. Bill No 5045gopukrishna37No ratings yet

- File 4 Invoice AjayDocument1 pageFile 4 Invoice Ajayfixer_007722No ratings yet

- Summer TrainingDocument49 pagesSummer TrainingDIVYANSHI PHOTO STATENo ratings yet

- NotesDocument26 pagesNotesDIVYANSHI PHOTO STATENo ratings yet

- PYTHONDocument2 pagesPYTHONDIVYANSHI PHOTO STATENo ratings yet

- NEUTRACEUTICALDocument45 pagesNEUTRACEUTICALDIVYANSHI PHOTO STATENo ratings yet

- Summer TrainingDocument11 pagesSummer TrainingDIVYANSHI PHOTO STATENo ratings yet

- Format of Application For Grant of Financial Assistance From Student Welfare FundDocument2 pagesFormat of Application For Grant of Financial Assistance From Student Welfare FundDIVYANSHI PHOTO STATENo ratings yet

- CORONILDocument32 pagesCORONILDIVYANSHI PHOTO STATENo ratings yet

- Smart Note TrackerDocument11 pagesSmart Note TrackerDIVYANSHI PHOTO STATENo ratings yet

- Data WarehousingDocument26 pagesData WarehousingDIVYANSHI PHOTO STATENo ratings yet

- Shri Ramswaroop Memorial University Lucknow-Deva Road, Uttar PradeshDocument80 pagesShri Ramswaroop Memorial University Lucknow-Deva Road, Uttar PradeshDIVYANSHI PHOTO STATENo ratings yet

- Pratyush Saxena Profile Management of HR in Innvolveconsulting PVT Ltd.Document86 pagesPratyush Saxena Profile Management of HR in Innvolveconsulting PVT Ltd.DIVYANSHI PHOTO STATENo ratings yet

- Pratyush Saxena Profile Management of HRDocument86 pagesPratyush Saxena Profile Management of HRDIVYANSHI PHOTO STATENo ratings yet

- Tata Steel Financial AnalysisDocument40 pagesTata Steel Financial AnalysisDIVYANSHI PHOTO STATENo ratings yet

- 4 - 29 - 2017 10 - 43 - 32 Am - Final Project ReportDocument67 pages4 - 29 - 2017 10 - 43 - 32 Am - Final Project ReportDIVYANSHI PHOTO STATENo ratings yet

- Amul Milk by AnuragDocument94 pagesAmul Milk by AnuragDIVYANSHI PHOTO STATENo ratings yet

- Keywords: Cost Effective, Low Cost Housing, Cheap MaterialsDocument62 pagesKeywords: Cost Effective, Low Cost Housing, Cheap MaterialsDIVYANSHI PHOTO STATENo ratings yet

- The National Academies Press: Globalization of Technology: International Perspectives (1988)Document225 pagesThe National Academies Press: Globalization of Technology: International Perspectives (1988)DIVYANSHI PHOTO STATENo ratings yet

- Traffic Analysis: Basic Concepts and Applications: November 2018Document29 pagesTraffic Analysis: Basic Concepts and Applications: November 2018DIVYANSHI PHOTO STATENo ratings yet

- Project HarDocument5 pagesProject HarDIVYANSHI PHOTO STATENo ratings yet

- Advance Construction Equipments and TechniquesDocument57 pagesAdvance Construction Equipments and TechniquesDIVYANSHI PHOTO STATENo ratings yet

- PRAKASHVEER Resume PDFDocument2 pagesPRAKASHVEER Resume PDFDIVYANSHI PHOTO STATENo ratings yet

- 36D2981v1 Eeb CPPP Roadmap UnderDocument148 pages36D2981v1 Eeb CPPP Roadmap UnderDIVYANSHI PHOTO STATENo ratings yet

- Front Page-Ajit PDFDocument1 pageFront Page-Ajit PDFDIVYANSHI PHOTO STATENo ratings yet

- GE6102 - The Contemporary World Week05 PRELIMSDocument8 pagesGE6102 - The Contemporary World Week05 PRELIMSJohnrylNo ratings yet

- Di-2 21245513Document1 pageDi-2 21245513VrindapareekNo ratings yet

- What Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeDocument4 pagesWhat Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeBenazir HitoishiNo ratings yet

- International Finance and Polices: Dr. Bui Thanh LongDocument55 pagesInternational Finance and Polices: Dr. Bui Thanh LongThanh Long BuiNo ratings yet

- Economic Survey StatisticsDocument128 pagesEconomic Survey Statisticsraj.kausNo ratings yet

- MCQ QuizDocument13 pagesMCQ QuizSharNo ratings yet

- Philippine-China Trade RelationsDocument2 pagesPhilippine-China Trade RelationsRalph Adrian MielNo ratings yet

- SBN-807: Increasing Personnel Economic Relief Assistance (PERA) To P3,000Document4 pagesSBN-807: Increasing Personnel Economic Relief Assistance (PERA) To P3,000Ralph RectoNo ratings yet

- Foreign Trade: Impact of External Debt in Economy of PakistanDocument14 pagesForeign Trade: Impact of External Debt in Economy of PakistanSyed Mortaza MehdiNo ratings yet

- Fundamentals of Economics PDFDocument3 pagesFundamentals of Economics PDFSinu Thankam SajanNo ratings yet

- Volume 1 12 The Dollar's Descent Orderly or Not October 30 2009Document12 pagesVolume 1 12 The Dollar's Descent Orderly or Not October 30 2009Denis OuelletNo ratings yet

- 2022 IndexofEconomicFreedom-QatarDocument2 pages2022 IndexofEconomicFreedom-QatarUmar Shaheen ANo ratings yet

- Below Mentioned Are The Some Objectives of The StudyDocument14 pagesBelow Mentioned Are The Some Objectives of The StudyŠu B ḦaNo ratings yet

- مذكرة سويسي هالةDocument137 pagesمذكرة سويسي هالةHameid Abd ErhmaneNo ratings yet

- New Microsoft PowerPoint Presentation TAXDocument10 pagesNew Microsoft PowerPoint Presentation TAXramesh BNo ratings yet

- PIMM Panama PostDocument3 pagesPIMM Panama PostPIMM100% (2)

- Qarkullimi I Llogarisë Account TurnoverDocument7 pagesQarkullimi I Llogarisë Account TurnoverYllka HoxhaNo ratings yet

- Payrolls in US RiseDocument1 pagePayrolls in US RiseDuong Le Tu UyenNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument22 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancepriyuNo ratings yet

- Arrow - Dry Bulk Outlook - Apr-20Document22 pagesArrow - Dry Bulk Outlook - Apr-20Sahil FarazNo ratings yet

- International Economics I (: Econ 2081)Document36 pagesInternational Economics I (: Econ 2081)Gidisa LachisaNo ratings yet

- 1 Business Economics Sem VI Marathi Sample QuestionsDocument76 pages1 Business Economics Sem VI Marathi Sample QuestionsShubham Patil OfficialNo ratings yet

- FILE - 20220513 - 151826 - Chapter 5 Protection - DoneDocument40 pagesFILE - 20220513 - 151826 - Chapter 5 Protection - DoneHuyền TràNo ratings yet

- Ireland and The Impacts of BrexitDocument62 pagesIreland and The Impacts of BrexitSeabanNo ratings yet

- Visitor Receipts Report 2020Document2 pagesVisitor Receipts Report 2020ELPOS KENWARD DE JESUSNo ratings yet

- Rcep AssignmentDocument5 pagesRcep AssignmentNageeta BaiNo ratings yet

- IbrdDocument2 pagesIbrdIswarya PurushothamanNo ratings yet

- Tax Invoice: Mythri Metallizing Private LimitedDocument3 pagesTax Invoice: Mythri Metallizing Private LimitedAnupriya OberoiNo ratings yet

- Chap 2 - Indonesia - SolutionDocument2 pagesChap 2 - Indonesia - SolutionLuvnica Verma100% (5)

- Economy Finance and Trade CanadaDocument14 pagesEconomy Finance and Trade CanadaMartin Elias Prasca GutierrezNo ratings yet