Professional Documents

Culture Documents

In The Books of Bush Co. This Transactions Resulted in

In The Books of Bush Co. This Transactions Resulted in

Uploaded by

elsana philipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In The Books of Bush Co. This Transactions Resulted in

In The Books of Bush Co. This Transactions Resulted in

Uploaded by

elsana philipCopyright:

Available Formats

Bush Co. paid P1,400,000 for net assets of VV Company.

It was determined that fair market values of

inventories and plant, property, and equipment were P133,000 and P900,000, respectively

An assumed contingent liability arising from past event with a fair value amounting to P10,000 and such

amount is considered as a reliable measurement.

In the Books of Bush Co. This transactions resulted in

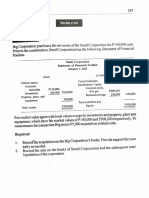

9. KK Inc. was merged into LL Inc. in a combination properly accounted for as acquisition of interests.

Their condensed balance sheets before combinations show

LL KK

Current Assets P2,288,000 P1,627,600

Plant and equipment, net P 4,654,000 P 1,040,000

Patents P 260,000

Total Assets P6,942,000 P2,927,600

Liabilities P2,704,000 P 171,600

Capital Stock, par 100 P2,600,000 P 1,300,000

Additional Paid in capital P390,000 P 390,000

Retained Earning P 1,248,000 P 1,066,000

Per independent appraiser’s report. KK’s assets have fair market values of P1,653,600 for current assets,

P 1,248,000 for plant and equipment and P338,000 for patents. KK’s liabilities are properly valued. LL

purchases KK’s net assets for P3,068,000.

How should the difference between the book value of KK’s net assets and the consideration paid

You might also like

- Reviewer From Prelim To FinalsDocument303 pagesReviewer From Prelim To FinalsRina Mae Sismar Lawi-an67% (3)

- Advac Guerero Chapter 14 CompressDocument29 pagesAdvac Guerero Chapter 14 Compressnon existingNo ratings yet

- Buscommmmmmmm 1Document7 pagesBuscommmmmmmm 1Erico PaderesNo ratings yet

- Advanced Accounting 2Document9 pagesAdvanced Accounting 2Elmin ValdezNo ratings yet

- Chapter 8Document8 pagesChapter 8Kurt dela Torre100% (1)

- Bristle Corporation Acquired 75 Percent of Silver CorporationDocument5 pagesBristle Corporation Acquired 75 Percent of Silver CorporationJamhel Marquez100% (1)

- Afar - Business Combinations - Mergers Ellery de Leon Far Eastern UniversityDocument3 pagesAfar - Business Combinations - Mergers Ellery de Leon Far Eastern UniversityRyan Joseph Agluba Dimacali50% (2)

- Pa2 M-1415Document4 pagesPa2 M-1415Ronnelson PascualNo ratings yet

- AFAR-01 (Partnership Formation & Operation)Document6 pagesAFAR-01 (Partnership Formation & Operation)Jezzie Santos100% (1)

- Cash Received From Customers During The YearDocument5 pagesCash Received From Customers During The Yearelsana philipNo ratings yet

- This Study Resource Was: Business Combination Practical Accounting 2 Date of AcquisitionDocument6 pagesThis Study Resource Was: Business Combination Practical Accounting 2 Date of AcquisitionAnneShannenBambaDabuNo ratings yet

- Business Combination HO Questions1Document8 pagesBusiness Combination HO Questions1Nicole Gole CruzNo ratings yet

- Business Combination Practical Accounting 2 Date of AcquisitionDocument6 pagesBusiness Combination Practical Accounting 2 Date of AcquisitionEdi wow WowNo ratings yet

- P2 Guerrero CH 08 Business CombinationDocument12 pagesP2 Guerrero CH 08 Business CombinationRay Allen PabiteroNo ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- P1 ACC 113 Assignment 1Document4 pagesP1 ACC 113 Assignment 1Danica Mae UbeniaNo ratings yet

- Take Home Quiz Consolidated Business AccountingDocument2 pagesTake Home Quiz Consolidated Business AccountingTheodore BayalasNo ratings yet

- PP CorporationDocument2 pagesPP CorporationWawex DavisNo ratings yet

- AFAR 01 - Partnership FormationDocument2 pagesAFAR 01 - Partnership FormationSamantha Alice LysanderNo ratings yet

- Final Exam - ADV ACCTG 2 - 2nd Sem2011-2012Document26 pagesFinal Exam - ADV ACCTG 2 - 2nd Sem2011-2012R De GuzmanNo ratings yet

- Adfina 10Document1 pageAdfina 10sonly amatosaNo ratings yet

- Guerrero CH14 - ProblemsDocument14 pagesGuerrero CH14 - ProblemsClaireNo ratings yet

- Partnership FormationDocument4 pagesPartnership Formationchokie0% (1)

- Business Combination NotesDocument3 pagesBusiness Combination NotesKenneth Calzado67% (3)

- AFAR-01 (Partnership Formation & Operations)Document6 pagesAFAR-01 (Partnership Formation & Operations)Nathalie Shien DagaragaNo ratings yet

- Statutory Merger Problem 1Document2 pagesStatutory Merger Problem 1Meleen TadenaNo ratings yet

- Accounting For Business Combinations (Testbank)Document2 pagesAccounting For Business Combinations (Testbank)John JackNo ratings yet

- This Study Resource Was: Quiz 14Document7 pagesThis Study Resource Was: Quiz 14kakeguruiNo ratings yet

- AFAR-01 (Partnership Formation & Operations)Document6 pagesAFAR-01 (Partnership Formation & Operations)Shiela NacasiNo ratings yet

- AFAR 01 Partnership Formation OperationsDocument6 pagesAFAR 01 Partnership Formation OperationsMichelle GubatonNo ratings yet

- AFAR-01 (Partnership Formation and Operations)Document6 pagesAFAR-01 (Partnership Formation and Operations)Ruth RodriguezNo ratings yet

- 08 Business CombinationDocument9 pages08 Business CombinationtrishaNo ratings yet

- Afar Drill 3Document7 pagesAfar Drill 3ROMAR A. PIGANo ratings yet

- AdVacc Q1Document5 pagesAdVacc Q1Red Yu100% (1)

- Activity 1 Business CombinationDocument4 pagesActivity 1 Business Combinationnglc srzNo ratings yet

- CPA Board Examination Operation - Advance Accounting: Page 1 of 11Document11 pagesCPA Board Examination Operation - Advance Accounting: Page 1 of 11Janella Patrizia0% (1)

- AP 59 1stPB 5.06Document9 pagesAP 59 1stPB 5.06Rosalina BoronganNo ratings yet

- Accounting For Business CombinationsDocument5 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- Partnership Accounting Practical Accounting 2Document13 pagesPartnership Accounting Practical Accounting 2random17341No ratings yet

- Conso FSDocument60 pagesConso FSAldrinNo ratings yet

- AFAR-01 (Partnership Formation & Operations)Document7 pagesAFAR-01 (Partnership Formation & Operations)Jennelyn CapenditNo ratings yet

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- For Questions 6Document3 pagesFor Questions 6Meghan Kaye LiwenNo ratings yet

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.No ratings yet

- Business CombinationDocument8 pagesBusiness CombinationCORNADO, MERIJOY G.No ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Business Combination AssignmentDocument5 pagesBusiness Combination AssignmentBienvenido JmNo ratings yet

- Date of Acquisition ExercisesDocument2 pagesDate of Acquisition ExercisesMeleen TadenaNo ratings yet

- Acc113 P1 QuizDocument5 pagesAcc113 P1 QuizEDELYN PoblacionNo ratings yet

- Problems SeptDocument3 pagesProblems SeptMARIA THERESA AZURESNo ratings yet

- Week 7 and 8 - Separate and Consolidated FSDocument9 pagesWeek 7 and 8 - Separate and Consolidated FSmariel chiongNo ratings yet

- AFAR-01 (Partnership Formation & Operations)Document6 pagesAFAR-01 (Partnership Formation & Operations)Maricris Alilin100% (1)

- Quiz in Business Combi, Conso and Corpo LiqDocument11 pagesQuiz in Business Combi, Conso and Corpo LiqExequielCamisaCrusperoNo ratings yet

- Business Combination Stock AcquisitionDocument2 pagesBusiness Combination Stock AcquisitionMark Joseph OlinoNo ratings yet

- 2510 Conso RevisedDocument63 pages2510 Conso Revisedjamm6136No ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Years Accounting 123Document7 pagesYears Accounting 123elsana philipNo ratings yet

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity Securitieselsana philipNo ratings yet

- Use The Following Information For The Next Two QuestionsDocument7 pagesUse The Following Information For The Next Two Questionselsana philipNo ratings yet

- Tweak Corporation Determined The Value in Use of The Unit To Be P535Document6 pagesTweak Corporation Determined The Value in Use of The Unit To Be P535elsana philipNo ratings yet

- INVENTORIESDocument5 pagesINVENTORIESelsana philipNo ratings yet

- Accountinf 101675824567Document3 pagesAccountinf 101675824567elsana philipNo ratings yet

- For The Year Ended December 31Document2 pagesFor The Year Ended December 31elsana philipNo ratings yet

- Felicia Co Ae101 AccountingDocument4 pagesFelicia Co Ae101 Accountingelsana philipNo ratings yet

- On December 31 Ae 201 AccountingDocument4 pagesOn December 31 Ae 201 Accountingelsana philipNo ratings yet

- On January 1 Accounintg ProlbemDocument3 pagesOn January 1 Accounintg Prolbemelsana philipNo ratings yet

- Costs of Market Research Activities 75Document3 pagesCosts of Market Research Activities 75elsana philipNo ratings yet

- Loan From BDO BankDocument2 pagesLoan From BDO Bankelsana philipNo ratings yet

- Amount Owed by The Business AccountingDocument3 pagesAmount Owed by The Business Accountingelsana philipNo ratings yet

- The Immaterial Cost of The Leasehold Shall Be Amortized Over The LifeDocument3 pagesThe Immaterial Cost of The Leasehold Shall Be Amortized Over The Lifeelsana philipNo ratings yet

- Illustration: Bonds Issued at Premium - With Transaction CostsDocument2 pagesIllustration: Bonds Issued at Premium - With Transaction Costselsana philipNo ratings yet

- Book To Bank MethodDocument3 pagesBook To Bank Methodelsana philipNo ratings yet

- On March 31 Accounting 101732636556Document3 pagesOn March 31 Accounting 101732636556elsana philipNo ratings yet

- Accounting Question Petty CashDocument2 pagesAccounting Question Petty Cashelsana philipNo ratings yet

- 23 Accounintg AnswersDocument5 pages23 Accounintg Answerselsana philipNo ratings yet

- PROBLEM NO. 2 - Computation of Adjusted Cash and Cash EquivalentDocument1 pagePROBLEM NO. 2 - Computation of Adjusted Cash and Cash Equivalentelsana philipNo ratings yet