Professional Documents

Culture Documents

LCUP CBEA Finals Regfram

LCUP CBEA Finals Regfram

Uploaded by

Eunice MiloCopyright:

Available Formats

You might also like

- Deed of Agreement PDFDocument16 pagesDeed of Agreement PDFVILATUZ100% (2)

- Crisis Comm Plan FinalDocument20 pagesCrisis Comm Plan Finalapi-501130833No ratings yet

- Public Procurement LectureDocument37 pagesPublic Procurement LectureMr DamphaNo ratings yet

- Examples of Credit InstrumentsDocument35 pagesExamples of Credit Instrumentsjessica anne100% (1)

- STRABA-Reflection Paper-The FounderDocument5 pagesSTRABA-Reflection Paper-The FounderEunice Milo100% (1)

- Introduction To Business Combination - Lesson1Document37 pagesIntroduction To Business Combination - Lesson1Eunice MiloNo ratings yet

- CH 10Document22 pagesCH 10Shayne0% (1)

- Exam2 - Midterm Set ADocument3 pagesExam2 - Midterm Set AKeb LimpocoNo ratings yet

- RFBT Quiz 1Document8 pagesRFBT Quiz 1JessaNo ratings yet

- Can A Banker Claim Lien On The Following?Document2 pagesCan A Banker Claim Lien On The Following?chstuNo ratings yet

- Chapter 9: Credit Instruments ObjectivesDocument43 pagesChapter 9: Credit Instruments ObjectiveskatlicNo ratings yet

- Final Commercial LendingDocument10 pagesFinal Commercial Lendingthungocanhng215No ratings yet

- Mercantile Law Bar QDocument106 pagesMercantile Law Bar QMark Joseph DelimaNo ratings yet

- Do's and Don't While Creating Different Types ofDocument28 pagesDo's and Don't While Creating Different Types ofAnit BiswasNo ratings yet

- 5banking Law - NotesDocument80 pages5banking Law - NotesSalman MSDNo ratings yet

- 2019 Pre Week Lecture in MERCANTILE LAW MJRSI 11 15 19 PDFDocument29 pages2019 Pre Week Lecture in MERCANTILE LAW MJRSI 11 15 19 PDFFrankie BacangNo ratings yet

- Latter of Credit and Other FinaciDocument57 pagesLatter of Credit and Other FinaciHaresh RajputNo ratings yet

- Import Export Policy Procedure Assignment 2Document6 pagesImport Export Policy Procedure Assignment 2TsinatNo ratings yet

- Banking Law and PracticeDocument5 pagesBanking Law and PracticeiantseriweNo ratings yet

- Chapter 5Document22 pagesChapter 5syahiir syauqiiNo ratings yet

- Bank LendingNEW11Document11 pagesBank LendingNEW11Loice MutetiNo ratings yet

- Performance BondsDocument37 pagesPerformance BondsChristine Fong100% (2)

- 02 Credit System - PDFDocument49 pages02 Credit System - PDFsharmaine gonzagaNo ratings yet

- BRO Chapter TwoDocument13 pagesBRO Chapter TwoRaghavendra JeevaNo ratings yet

- Payyyyyying Banker and Collllllecting Banker by Chu PersonDocument59 pagesPayyyyyying Banker and Collllllecting Banker by Chu PersonSahirAaryaNo ratings yet

- Module 7 Credit CollectionDocument16 pagesModule 7 Credit CollectionMarion Rodrigueza AtunNo ratings yet

- Lecture Notes SpeccomDocument7 pagesLecture Notes Speccomjolly faith pariñasNo ratings yet

- Zambia Institute of Advanced Legal Education - Suggested Model Answers - 2018Document25 pagesZambia Institute of Advanced Legal Education - Suggested Model Answers - 2018Leonard TemboNo ratings yet

- Chapter Vi: Classification of Credit and Their ResourcesDocument5 pagesChapter Vi: Classification of Credit and Their Resourcesfsfsfsfs asdfsfsNo ratings yet

- RFBT RC ExamDocument9 pagesRFBT RC Examjeralyn juditNo ratings yet

- Câu Trả Lời Ôn Tập Chapter 2Document5 pagesCâu Trả Lời Ôn Tập Chapter 2Đỗ ViệtNo ratings yet

- Letters of CreditDocument6 pagesLetters of CreditUlrich SantosNo ratings yet

- Banking Unit 4Document12 pagesBanking Unit 4PaatrickNo ratings yet

- Report On Letters of CreditDocument49 pagesReport On Letters of CreditJon Raymer OclaritNo ratings yet

- Chapter 4Document79 pagesChapter 4Aliza NazarNo ratings yet

- Đinh Thị Mỹ Duyên - 1911115108 Chapter 2: Payment I. Question & answerDocument4 pagesĐinh Thị Mỹ Duyên - 1911115108 Chapter 2: Payment I. Question & answerPhương OanhNo ratings yet

- Loans and AdvancesDocument9 pagesLoans and AdvancesidealworldNo ratings yet

- Banking AssgnDocument14 pagesBanking AssgnlinaNo ratings yet

- Banking Law & PracticeDocument12 pagesBanking Law & PracticeShams TabrezNo ratings yet

- RFBT - Final Preboard Cpar 92Document17 pagesRFBT - Final Preboard Cpar 92joyhhazelNo ratings yet

- Types of SecuritiesDocument8 pagesTypes of SecuritiesA U R U M MDNo ratings yet

- BAR EXAM Mercantile Law 2012Document34 pagesBAR EXAM Mercantile Law 2012Aling KinaiNo ratings yet

- Banking Law and PracticeDocument5 pagesBanking Law and PracticeJunaid MalikNo ratings yet

- Banker and Customer Relationship PDFDocument25 pagesBanker and Customer Relationship PDFaaditya01No ratings yet

- CÂU HỎI HỢP ĐỒNG CHAPTER 2Document5 pagesCÂU HỎI HỢP ĐỒNG CHAPTER 2Đỗ Khánh HồngNo ratings yet

- 2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Document22 pages2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Martin MartelNo ratings yet

- Chapter 5 DiscussionsDocument5 pagesChapter 5 DiscussionsLeonisa TorinoNo ratings yet

- 3relation Between Banker and CastomerDocument12 pages3relation Between Banker and Castomertanjimalomturjo1No ratings yet

- Lapse and Irregularities in Selection PDFDocument15 pagesLapse and Irregularities in Selection PDFtareqNo ratings yet

- 2010 Banking Mid-Term ExamDocument5 pages2010 Banking Mid-Term ExamRyan UyNo ratings yet

- Banking Products & Services IIDocument39 pagesBanking Products & Services IIAinnur HaziqahNo ratings yet

- Chapter 5 Activities Credit and CollectionDocument4 pagesChapter 5 Activities Credit and CollectionhtagleNo ratings yet

- Letters of CreditDocument12 pagesLetters of CreditMykee NavalNo ratings yet

- Previous Question LawDocument43 pagesPrevious Question LawGourango SarkerNo ratings yet

- 4special LawsDocument21 pages4special LawsPablo EschovalNo ratings yet

- Case Study 2 Banker Acceptance ANSWERDocument3 pagesCase Study 2 Banker Acceptance ANSWERsittal muthuvairuNo ratings yet

- Case Study #5Document2 pagesCase Study #5fhdiufhjdiejNo ratings yet

- Financial GuaranteeDocument2 pagesFinancial Guaranteejeet_singh_deepNo ratings yet

- Questions and Answers:: A Banker Customer CanDocument14 pagesQuestions and Answers:: A Banker Customer CanKhaleda AkhterNo ratings yet

- Letters of Credit NotesDocument3 pagesLetters of Credit NotesattorneyNo ratings yet

- Documentary Credit SystemDocument5 pagesDocumentary Credit SystemVivek Pratap SinghNo ratings yet

- Banking Module 1Document7 pagesBanking Module 1BINDU N.R.100% (1)

- Letters of Credit and Trust Receipt LawDocument9 pagesLetters of Credit and Trust Receipt LawJovi PlatzNo ratings yet

- Quizzer 2 Pdic SBD Ub Week 14 Set ADocument7 pagesQuizzer 2 Pdic SBD Ub Week 14 Set Amariesteinsher0No ratings yet

- Reporting 1 - Related and Supporting IndustriesDocument1 pageReporting 1 - Related and Supporting IndustriesEunice MiloNo ratings yet

- Npo-For ProfitsDocument7 pagesNpo-For ProfitsEunice MiloNo ratings yet

- Outline of Catechetical Program: MembersDocument9 pagesOutline of Catechetical Program: MembersEunice MiloNo ratings yet

- Milo, Eunice G.-Bsa 3-ADocument5 pagesMilo, Eunice G.-Bsa 3-AEunice MiloNo ratings yet

- Accounting Research Method:: Types of Research According To CategoryDocument15 pagesAccounting Research Method:: Types of Research According To CategoryEunice MiloNo ratings yet

- Procurement (Kat) 2. Inbound Logistics. This Includes Del Monte's Operation of Storing Their Acquired RawDocument5 pagesProcurement (Kat) 2. Inbound Logistics. This Includes Del Monte's Operation of Storing Their Acquired RawEunice MiloNo ratings yet

- Assignment #1Document3 pagesAssignment #1Eunice MiloNo ratings yet

- Research ProblemDocument13 pagesResearch ProblemEunice MiloNo ratings yet

- Accounting Research Method: (ResmethDocument13 pagesAccounting Research Method: (ResmethEunice MiloNo ratings yet

- Assignment #4Document2 pagesAssignment #4Eunice MiloNo ratings yet

- Chapter 5 - Process Costing Systems: Multiple ChoiceDocument5 pagesChapter 5 - Process Costing Systems: Multiple ChoiceEunice MiloNo ratings yet

- Just-In-Time and Backflushing: Multiple ChoiceDocument6 pagesJust-In-Time and Backflushing: Multiple ChoiceEunice Milo100% (2)

- Cbea Corp Actg Lecture 03Document7 pagesCbea Corp Actg Lecture 03Eunice MiloNo ratings yet

- Intermediate Accounting 3: Course Outline Financial Statements - General FeaturesDocument17 pagesIntermediate Accounting 3: Course Outline Financial Statements - General FeaturesEunice MiloNo ratings yet

- Th5-Reflection Paper 1Document1 pageTh5-Reflection Paper 1Eunice MiloNo ratings yet

- Date Transaction Units Unit CostDocument1 pageDate Transaction Units Unit CostEunice MiloNo ratings yet

- Volleyball: Prepared By: JOHN DEMVER D. YCODocument51 pagesVolleyball: Prepared By: JOHN DEMVER D. YCOEunice MiloNo ratings yet

- Milo, Eunice G. BSA-2A Final Examination TH 4-Liturgy and Sacraments BaptismDocument2 pagesMilo, Eunice G. BSA-2A Final Examination TH 4-Liturgy and Sacraments BaptismEunice MiloNo ratings yet

- And Then You Question The Quality of Teaching of Your Professors? How About The Quality of Your Studying? The Quality of Time You Spend in Studying?Document1 pageAnd Then You Question The Quality of Teaching of Your Professors? How About The Quality of Your Studying? The Quality of Time You Spend in Studying?Eunice MiloNo ratings yet

- E9-1 Quantity Cost/Unit NRV Total Cost 110 111 112 113 120 121 122Document25 pagesE9-1 Quantity Cost/Unit NRV Total Cost 110 111 112 113 120 121 122Eunice MiloNo ratings yet

- Auditing in A Computerized Information System (Cis) EnvironmentDocument33 pagesAuditing in A Computerized Information System (Cis) EnvironmentEunice MiloNo ratings yet

- Officiating Volleyball Game: Prepared By: JOHN DEMVER D. YCODocument28 pagesOfficiating Volleyball Game: Prepared By: JOHN DEMVER D. YCOEunice MiloNo ratings yet

- 01 Introduction To Cost AccountingDocument18 pages01 Introduction To Cost AccountingEunice MiloNo ratings yet

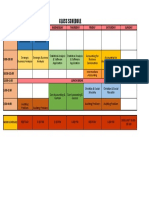

- Class Schedule: Time Monday Tuesday Wednesday Thursday Friday Saturday SundayDocument1 pageClass Schedule: Time Monday Tuesday Wednesday Thursday Friday Saturday SundayEunice MiloNo ratings yet

- STAT - Frequent DistributionDocument2 pagesSTAT - Frequent DistributionEunice MiloNo ratings yet

- 17IB321 - Revitalizing DellDocument2 pages17IB321 - Revitalizing DellRAHUL LALJIBHAI PANCHOLI-IBNo ratings yet

- Rajesh RelanDocument4 pagesRajesh Relanketan phoreNo ratings yet

- PGDFSQMDocument2 pagesPGDFSQMSugathan E. KNo ratings yet

- Terms VS 06 01 2017Document2 pagesTerms VS 06 01 2017nedim cılızNo ratings yet

- Week 1Document18 pagesWeek 1Elle0% (1)

- Value Added TaxASDASDocument7 pagesValue Added TaxASDASJohn Lester LantinNo ratings yet

- Mbpreport 5ef7cb61638c03369c26a355Document18 pagesMbpreport 5ef7cb61638c03369c26a355mannyNo ratings yet

- Acc ExamsDocument55 pagesAcc Examsklimrod89No ratings yet

- Habib Bank LimitedDocument21 pagesHabib Bank LimitedbilalzuberiNo ratings yet

- Corporate Presentation - November 2010Document42 pagesCorporate Presentation - November 2010Kaushal ShahNo ratings yet

- Jindal Saw-AR-2017-18-NET PDFDocument274 pagesJindal Saw-AR-2017-18-NET PDFshahavNo ratings yet

- COMPANY LAW LECTURE NOTES - Tracked - Nov15.2020Document59 pagesCOMPANY LAW LECTURE NOTES - Tracked - Nov15.2020John Quachie100% (1)

- Security's Role in Mergers and Acquisitions M&A - Cyber Security During A Merger or AcquisitionDocument4 pagesSecurity's Role in Mergers and Acquisitions M&A - Cyber Security During A Merger or AcquisitionAli AlwesabiNo ratings yet

- Future & Option Trading: A Quick Information GuideDocument9 pagesFuture & Option Trading: A Quick Information GuideJaisankar KailasamNo ratings yet

- FABM 2 Reviewer PrelimsDocument2 pagesFABM 2 Reviewer Prelimssushi nakiriNo ratings yet

- Event Coordinator ResumeDocument5 pagesEvent Coordinator Resumeiafafzhfg100% (2)

- You Exec - Project Dashboards Collection CompleteDocument25 pagesYou Exec - Project Dashboards Collection CompleteJohn DulayNo ratings yet

- Michelle ProposalDocument22 pagesMichelle Proposalmugwanya richardNo ratings yet

- IPCC CSP V600R005C20LG1016 - IVR Voice File List (Burkina Faso Telecel) - 23 - 11 - 16 (1) Les 3 LanguesDocument67 pagesIPCC CSP V600R005C20LG1016 - IVR Voice File List (Burkina Faso Telecel) - 23 - 11 - 16 (1) Les 3 LanguesrhemaelNo ratings yet

- Availability CheckDocument41 pagesAvailability CheckTek's Notani50% (2)

- IntellectualPropertyRightLaws&Practice PDFDocument303 pagesIntellectualPropertyRightLaws&Practice PDFAaru BNo ratings yet

- Chap III Off Balance Sheet ActivitiesDocument20 pagesChap III Off Balance Sheet ActivitiesGing freex100% (1)

- Group 1 Software Engineering AssignmentDocument5 pagesGroup 1 Software Engineering AssignmentML GisNo ratings yet

- Marketing Management: Unit 3Document71 pagesMarketing Management: Unit 3sangitaNo ratings yet

- mr11 Grir Clearing Account Maintenance PDFDocument9 pagesmr11 Grir Clearing Account Maintenance PDFSowmyaNo ratings yet

- FOREXDocument5 pagesFOREXendouusaNo ratings yet

LCUP CBEA Finals Regfram

LCUP CBEA Finals Regfram

Uploaded by

Eunice MiloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LCUP CBEA Finals Regfram

LCUP CBEA Finals Regfram

Uploaded by

Eunice MiloCopyright:

Available Formats

Name: MILO, EUNICE G.

Score: ____________

CBEA RegFram Sections 2A, 2B

SY 2019-2020 FINAL EXAMS

I. TRUE OR FALSE.

TRUE 1. Warranty against eviction is inherent in a contract of sale; hence it is an

essential element thereof.

FALSE 2. Dacion en pago partakes of the nature of a sale; hence there is more

freedom in fixing the price of the thing conveyed.

TRUE 3. A contract for a piece of work must comply with the Statue of Frauds.

Accordingly, it must be in writing to the enforceable if the price is P500.00 or more.

FALSE 4. A sales contract requires the delivery of the thing sold for its perfection.

TRUE 5. If the consideration received for a thing is another thing and a monetary

consideration and the intention of the parties does not clearly appear, the contract

will be considered a contract of barter if the value of the property consideration is

greater than the monetary consideration.

TRUE 6. In a contract to sell, the full payment of the price is a suspensive condition

which upon fulfilment will require the execution of a contract of sale.

TRUE 7. It is not necessary that the vendor of a thing must be the owner thereof at

the time of sale as long as he can transfer its ownership to the buyer upon delivery.

FALSE 8. The sale of hope or expectancy is a valid even if the thing hoped for does

not come into existence.

TRUE 9. If the sale of a piece of land is made through an agent, the authority of

the agent must be in writing for the sale to be valid.

FALSE 10. The ownership of the thing sold is transferred upon the perfection of the

contract of sale.

II. MULTIPLE CHOICE.

C 1. Where check is drawn by a corporation, company or entity, the following are

responsible

a. The President of the company

b. All the officers of the company

c. Persons who signed the check

d. Only the Treasurer of the company

D 2. Which of the following is true about bouncing checks

a. Deceit is not an essential element of the offense

b. Malice or criminal intent is immaterial.

c. Every element of the crime is still to be proven before the court to warrant

a conviction for violation thereof

d. All of the above

D 3.The following is an element of the violation of BP 22

a. The making, drawing and issuance of any check to apply on account or

for value

b. The knowledge of the maker, drawer, or issuer that at the time of issue he

does not have sufficient funds in, or credit with the drawee-bank for the

payment of such check in full upon its presentment

c. Subsequent dishonour of the check by the drawee-bank for insufficiency

of funds or credit, or dishonour for the same reason had not the drawer,

without any valid cause, ordered the bank to stop payment

d. All of the above

D 4. BP 22 prohibits the act of —

a. Mere act of issuing a worthless check whether as a deposit

b. Mere act of issuing a worthless check as a guarantee or an

accommodation

c. As an evidence of a pre-existing debt

d. All of the above

A 5. BP 22 aims to

a. Put a stop to or curb the practice of issuing checks that are worthless

b. The making of worthless checks and putting them in circulation

c. Prevent the disruption of regular banking transactions

d. All of the above

III. CHOOSE ONLY TWO QUESTIONS TO ANSWER.

1. Differentiate between Universal bank and commercial bank.

2. Can banks acquire its own shares? Explain.

3. Explain the fiduciary duty or nature of banks.

4. Suppose that drawer had kept sufficient funds in the drawee for 100 days from

the date thereon to cover the check he had issued. The next day he withdrew all

funds. When the check was presented later on that day to the drawee bank, it

was dishonoured. Is the drawer liable or not? Explain.

ANSWERS:

1. Differentiate between Universal bank and commercial bank.

Universal Bank- A universal bank is a bank that combines the three main

services of banking under one roof. The three services are wholesale

banking, retail banking, and investment banking. In other words, it is a

retail bank, a wholesale bank, and also an investment bank. As well as

being able to offer an all-encompassing service, universal banks can reap

the synergies that exist when they operate in the three services

simultaneously.

Commercial Bank- A commercial bank is a financial institution that

grants loans, accepts deposits, and offers basic financial products such

as savings accounts and certificates of deposit to individuals and

businesses. It makes money primarily by providing different types of loans

to customers and charging interest. The bank’s funds come from money

deposited by the bank customers in saving accounts, checking accounts,

money market accounts, and certificates of deposit (CDs). The depositors

earn interest on their deposits with the bank. However, the interest paid to

depositors is less than the interest rate charged to borrowers. Some of the

loans offered by a commercial bank include motor vehicle loans,

mortgages, business loans, and personal loans.

2. Explain the fiduciary duty or nature of banks.

The fiduciary nature of banks is referred to a legal obligation of the bank

to act in the best interest of their valued customers’ account. Thus,

obligated party is entrusted with the care of such finances. The bank is

responsible to be loyal and provide reasonable care to the assets under

their control. Every action performed with their customer’s financial assets

must be ensured that it is just entirely for their utmost advantage since the

bank is expected to have more knowledge and actual expertise with those

financial assets being entrusted to them.

You might also like

- Deed of Agreement PDFDocument16 pagesDeed of Agreement PDFVILATUZ100% (2)

- Crisis Comm Plan FinalDocument20 pagesCrisis Comm Plan Finalapi-501130833No ratings yet

- Public Procurement LectureDocument37 pagesPublic Procurement LectureMr DamphaNo ratings yet

- Examples of Credit InstrumentsDocument35 pagesExamples of Credit Instrumentsjessica anne100% (1)

- STRABA-Reflection Paper-The FounderDocument5 pagesSTRABA-Reflection Paper-The FounderEunice Milo100% (1)

- Introduction To Business Combination - Lesson1Document37 pagesIntroduction To Business Combination - Lesson1Eunice MiloNo ratings yet

- CH 10Document22 pagesCH 10Shayne0% (1)

- Exam2 - Midterm Set ADocument3 pagesExam2 - Midterm Set AKeb LimpocoNo ratings yet

- RFBT Quiz 1Document8 pagesRFBT Quiz 1JessaNo ratings yet

- Can A Banker Claim Lien On The Following?Document2 pagesCan A Banker Claim Lien On The Following?chstuNo ratings yet

- Chapter 9: Credit Instruments ObjectivesDocument43 pagesChapter 9: Credit Instruments ObjectiveskatlicNo ratings yet

- Final Commercial LendingDocument10 pagesFinal Commercial Lendingthungocanhng215No ratings yet

- Mercantile Law Bar QDocument106 pagesMercantile Law Bar QMark Joseph DelimaNo ratings yet

- Do's and Don't While Creating Different Types ofDocument28 pagesDo's and Don't While Creating Different Types ofAnit BiswasNo ratings yet

- 5banking Law - NotesDocument80 pages5banking Law - NotesSalman MSDNo ratings yet

- 2019 Pre Week Lecture in MERCANTILE LAW MJRSI 11 15 19 PDFDocument29 pages2019 Pre Week Lecture in MERCANTILE LAW MJRSI 11 15 19 PDFFrankie BacangNo ratings yet

- Latter of Credit and Other FinaciDocument57 pagesLatter of Credit and Other FinaciHaresh RajputNo ratings yet

- Import Export Policy Procedure Assignment 2Document6 pagesImport Export Policy Procedure Assignment 2TsinatNo ratings yet

- Banking Law and PracticeDocument5 pagesBanking Law and PracticeiantseriweNo ratings yet

- Chapter 5Document22 pagesChapter 5syahiir syauqiiNo ratings yet

- Bank LendingNEW11Document11 pagesBank LendingNEW11Loice MutetiNo ratings yet

- Performance BondsDocument37 pagesPerformance BondsChristine Fong100% (2)

- 02 Credit System - PDFDocument49 pages02 Credit System - PDFsharmaine gonzagaNo ratings yet

- BRO Chapter TwoDocument13 pagesBRO Chapter TwoRaghavendra JeevaNo ratings yet

- Payyyyyying Banker and Collllllecting Banker by Chu PersonDocument59 pagesPayyyyyying Banker and Collllllecting Banker by Chu PersonSahirAaryaNo ratings yet

- Module 7 Credit CollectionDocument16 pagesModule 7 Credit CollectionMarion Rodrigueza AtunNo ratings yet

- Lecture Notes SpeccomDocument7 pagesLecture Notes Speccomjolly faith pariñasNo ratings yet

- Zambia Institute of Advanced Legal Education - Suggested Model Answers - 2018Document25 pagesZambia Institute of Advanced Legal Education - Suggested Model Answers - 2018Leonard TemboNo ratings yet

- Chapter Vi: Classification of Credit and Their ResourcesDocument5 pagesChapter Vi: Classification of Credit and Their Resourcesfsfsfsfs asdfsfsNo ratings yet

- RFBT RC ExamDocument9 pagesRFBT RC Examjeralyn juditNo ratings yet

- Câu Trả Lời Ôn Tập Chapter 2Document5 pagesCâu Trả Lời Ôn Tập Chapter 2Đỗ ViệtNo ratings yet

- Letters of CreditDocument6 pagesLetters of CreditUlrich SantosNo ratings yet

- Banking Unit 4Document12 pagesBanking Unit 4PaatrickNo ratings yet

- Report On Letters of CreditDocument49 pagesReport On Letters of CreditJon Raymer OclaritNo ratings yet

- Chapter 4Document79 pagesChapter 4Aliza NazarNo ratings yet

- Đinh Thị Mỹ Duyên - 1911115108 Chapter 2: Payment I. Question & answerDocument4 pagesĐinh Thị Mỹ Duyên - 1911115108 Chapter 2: Payment I. Question & answerPhương OanhNo ratings yet

- Loans and AdvancesDocument9 pagesLoans and AdvancesidealworldNo ratings yet

- Banking AssgnDocument14 pagesBanking AssgnlinaNo ratings yet

- Banking Law & PracticeDocument12 pagesBanking Law & PracticeShams TabrezNo ratings yet

- RFBT - Final Preboard Cpar 92Document17 pagesRFBT - Final Preboard Cpar 92joyhhazelNo ratings yet

- Types of SecuritiesDocument8 pagesTypes of SecuritiesA U R U M MDNo ratings yet

- BAR EXAM Mercantile Law 2012Document34 pagesBAR EXAM Mercantile Law 2012Aling KinaiNo ratings yet

- Banking Law and PracticeDocument5 pagesBanking Law and PracticeJunaid MalikNo ratings yet

- Banker and Customer Relationship PDFDocument25 pagesBanker and Customer Relationship PDFaaditya01No ratings yet

- CÂU HỎI HỢP ĐỒNG CHAPTER 2Document5 pagesCÂU HỎI HỢP ĐỒNG CHAPTER 2Đỗ Khánh HồngNo ratings yet

- 2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Document22 pages2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Martin MartelNo ratings yet

- Chapter 5 DiscussionsDocument5 pagesChapter 5 DiscussionsLeonisa TorinoNo ratings yet

- 3relation Between Banker and CastomerDocument12 pages3relation Between Banker and Castomertanjimalomturjo1No ratings yet

- Lapse and Irregularities in Selection PDFDocument15 pagesLapse and Irregularities in Selection PDFtareqNo ratings yet

- 2010 Banking Mid-Term ExamDocument5 pages2010 Banking Mid-Term ExamRyan UyNo ratings yet

- Banking Products & Services IIDocument39 pagesBanking Products & Services IIAinnur HaziqahNo ratings yet

- Chapter 5 Activities Credit and CollectionDocument4 pagesChapter 5 Activities Credit and CollectionhtagleNo ratings yet

- Letters of CreditDocument12 pagesLetters of CreditMykee NavalNo ratings yet

- Previous Question LawDocument43 pagesPrevious Question LawGourango SarkerNo ratings yet

- 4special LawsDocument21 pages4special LawsPablo EschovalNo ratings yet

- Case Study 2 Banker Acceptance ANSWERDocument3 pagesCase Study 2 Banker Acceptance ANSWERsittal muthuvairuNo ratings yet

- Case Study #5Document2 pagesCase Study #5fhdiufhjdiejNo ratings yet

- Financial GuaranteeDocument2 pagesFinancial Guaranteejeet_singh_deepNo ratings yet

- Questions and Answers:: A Banker Customer CanDocument14 pagesQuestions and Answers:: A Banker Customer CanKhaleda AkhterNo ratings yet

- Letters of Credit NotesDocument3 pagesLetters of Credit NotesattorneyNo ratings yet

- Documentary Credit SystemDocument5 pagesDocumentary Credit SystemVivek Pratap SinghNo ratings yet

- Banking Module 1Document7 pagesBanking Module 1BINDU N.R.100% (1)

- Letters of Credit and Trust Receipt LawDocument9 pagesLetters of Credit and Trust Receipt LawJovi PlatzNo ratings yet

- Quizzer 2 Pdic SBD Ub Week 14 Set ADocument7 pagesQuizzer 2 Pdic SBD Ub Week 14 Set Amariesteinsher0No ratings yet

- Reporting 1 - Related and Supporting IndustriesDocument1 pageReporting 1 - Related and Supporting IndustriesEunice MiloNo ratings yet

- Npo-For ProfitsDocument7 pagesNpo-For ProfitsEunice MiloNo ratings yet

- Outline of Catechetical Program: MembersDocument9 pagesOutline of Catechetical Program: MembersEunice MiloNo ratings yet

- Milo, Eunice G.-Bsa 3-ADocument5 pagesMilo, Eunice G.-Bsa 3-AEunice MiloNo ratings yet

- Accounting Research Method:: Types of Research According To CategoryDocument15 pagesAccounting Research Method:: Types of Research According To CategoryEunice MiloNo ratings yet

- Procurement (Kat) 2. Inbound Logistics. This Includes Del Monte's Operation of Storing Their Acquired RawDocument5 pagesProcurement (Kat) 2. Inbound Logistics. This Includes Del Monte's Operation of Storing Their Acquired RawEunice MiloNo ratings yet

- Assignment #1Document3 pagesAssignment #1Eunice MiloNo ratings yet

- Research ProblemDocument13 pagesResearch ProblemEunice MiloNo ratings yet

- Accounting Research Method: (ResmethDocument13 pagesAccounting Research Method: (ResmethEunice MiloNo ratings yet

- Assignment #4Document2 pagesAssignment #4Eunice MiloNo ratings yet

- Chapter 5 - Process Costing Systems: Multiple ChoiceDocument5 pagesChapter 5 - Process Costing Systems: Multiple ChoiceEunice MiloNo ratings yet

- Just-In-Time and Backflushing: Multiple ChoiceDocument6 pagesJust-In-Time and Backflushing: Multiple ChoiceEunice Milo100% (2)

- Cbea Corp Actg Lecture 03Document7 pagesCbea Corp Actg Lecture 03Eunice MiloNo ratings yet

- Intermediate Accounting 3: Course Outline Financial Statements - General FeaturesDocument17 pagesIntermediate Accounting 3: Course Outline Financial Statements - General FeaturesEunice MiloNo ratings yet

- Th5-Reflection Paper 1Document1 pageTh5-Reflection Paper 1Eunice MiloNo ratings yet

- Date Transaction Units Unit CostDocument1 pageDate Transaction Units Unit CostEunice MiloNo ratings yet

- Volleyball: Prepared By: JOHN DEMVER D. YCODocument51 pagesVolleyball: Prepared By: JOHN DEMVER D. YCOEunice MiloNo ratings yet

- Milo, Eunice G. BSA-2A Final Examination TH 4-Liturgy and Sacraments BaptismDocument2 pagesMilo, Eunice G. BSA-2A Final Examination TH 4-Liturgy and Sacraments BaptismEunice MiloNo ratings yet

- And Then You Question The Quality of Teaching of Your Professors? How About The Quality of Your Studying? The Quality of Time You Spend in Studying?Document1 pageAnd Then You Question The Quality of Teaching of Your Professors? How About The Quality of Your Studying? The Quality of Time You Spend in Studying?Eunice MiloNo ratings yet

- E9-1 Quantity Cost/Unit NRV Total Cost 110 111 112 113 120 121 122Document25 pagesE9-1 Quantity Cost/Unit NRV Total Cost 110 111 112 113 120 121 122Eunice MiloNo ratings yet

- Auditing in A Computerized Information System (Cis) EnvironmentDocument33 pagesAuditing in A Computerized Information System (Cis) EnvironmentEunice MiloNo ratings yet

- Officiating Volleyball Game: Prepared By: JOHN DEMVER D. YCODocument28 pagesOfficiating Volleyball Game: Prepared By: JOHN DEMVER D. YCOEunice MiloNo ratings yet

- 01 Introduction To Cost AccountingDocument18 pages01 Introduction To Cost AccountingEunice MiloNo ratings yet

- Class Schedule: Time Monday Tuesday Wednesday Thursday Friday Saturday SundayDocument1 pageClass Schedule: Time Monday Tuesday Wednesday Thursday Friday Saturday SundayEunice MiloNo ratings yet

- STAT - Frequent DistributionDocument2 pagesSTAT - Frequent DistributionEunice MiloNo ratings yet

- 17IB321 - Revitalizing DellDocument2 pages17IB321 - Revitalizing DellRAHUL LALJIBHAI PANCHOLI-IBNo ratings yet

- Rajesh RelanDocument4 pagesRajesh Relanketan phoreNo ratings yet

- PGDFSQMDocument2 pagesPGDFSQMSugathan E. KNo ratings yet

- Terms VS 06 01 2017Document2 pagesTerms VS 06 01 2017nedim cılızNo ratings yet

- Week 1Document18 pagesWeek 1Elle0% (1)

- Value Added TaxASDASDocument7 pagesValue Added TaxASDASJohn Lester LantinNo ratings yet

- Mbpreport 5ef7cb61638c03369c26a355Document18 pagesMbpreport 5ef7cb61638c03369c26a355mannyNo ratings yet

- Acc ExamsDocument55 pagesAcc Examsklimrod89No ratings yet

- Habib Bank LimitedDocument21 pagesHabib Bank LimitedbilalzuberiNo ratings yet

- Corporate Presentation - November 2010Document42 pagesCorporate Presentation - November 2010Kaushal ShahNo ratings yet

- Jindal Saw-AR-2017-18-NET PDFDocument274 pagesJindal Saw-AR-2017-18-NET PDFshahavNo ratings yet

- COMPANY LAW LECTURE NOTES - Tracked - Nov15.2020Document59 pagesCOMPANY LAW LECTURE NOTES - Tracked - Nov15.2020John Quachie100% (1)

- Security's Role in Mergers and Acquisitions M&A - Cyber Security During A Merger or AcquisitionDocument4 pagesSecurity's Role in Mergers and Acquisitions M&A - Cyber Security During A Merger or AcquisitionAli AlwesabiNo ratings yet

- Future & Option Trading: A Quick Information GuideDocument9 pagesFuture & Option Trading: A Quick Information GuideJaisankar KailasamNo ratings yet

- FABM 2 Reviewer PrelimsDocument2 pagesFABM 2 Reviewer Prelimssushi nakiriNo ratings yet

- Event Coordinator ResumeDocument5 pagesEvent Coordinator Resumeiafafzhfg100% (2)

- You Exec - Project Dashboards Collection CompleteDocument25 pagesYou Exec - Project Dashboards Collection CompleteJohn DulayNo ratings yet

- Michelle ProposalDocument22 pagesMichelle Proposalmugwanya richardNo ratings yet

- IPCC CSP V600R005C20LG1016 - IVR Voice File List (Burkina Faso Telecel) - 23 - 11 - 16 (1) Les 3 LanguesDocument67 pagesIPCC CSP V600R005C20LG1016 - IVR Voice File List (Burkina Faso Telecel) - 23 - 11 - 16 (1) Les 3 LanguesrhemaelNo ratings yet

- Availability CheckDocument41 pagesAvailability CheckTek's Notani50% (2)

- IntellectualPropertyRightLaws&Practice PDFDocument303 pagesIntellectualPropertyRightLaws&Practice PDFAaru BNo ratings yet

- Chap III Off Balance Sheet ActivitiesDocument20 pagesChap III Off Balance Sheet ActivitiesGing freex100% (1)

- Group 1 Software Engineering AssignmentDocument5 pagesGroup 1 Software Engineering AssignmentML GisNo ratings yet

- Marketing Management: Unit 3Document71 pagesMarketing Management: Unit 3sangitaNo ratings yet

- mr11 Grir Clearing Account Maintenance PDFDocument9 pagesmr11 Grir Clearing Account Maintenance PDFSowmyaNo ratings yet

- FOREXDocument5 pagesFOREXendouusaNo ratings yet