Professional Documents

Culture Documents

Businessnewletter Oct2014 PDF

Businessnewletter Oct2014 PDF

Uploaded by

V.AnnapurnaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Model QuestionsDocument2 pagesModel Questionspuneeth rajuNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quitar Modo Retail SamsungDocument50 pagesQuitar Modo Retail SamsungCambios PereiraNo ratings yet

- Tutorial 7 Trade Receivables (Q)Document3 pagesTutorial 7 Trade Receivables (Q)lious liiNo ratings yet

- Management of FX Exposure-IDocument9 pagesManagement of FX Exposure-IV.AnnapurnaNo ratings yet

- Economic ExposureDocument7 pagesEconomic ExposureV.AnnapurnaNo ratings yet

- Transaction ExposureDocument11 pagesTransaction ExposureV.AnnapurnaNo ratings yet

- Course Purpose-MFS - Major IIIDocument2 pagesCourse Purpose-MFS - Major IIIV.AnnapurnaNo ratings yet

- Forex Management-StructureDocument9 pagesForex Management-StructureV.AnnapurnaNo ratings yet

- Forex ManagementDocument12 pagesForex ManagementV.AnnapurnaNo ratings yet

- Course Course Purpose-MFS-Minor-IDocument2 pagesCourse Course Purpose-MFS-Minor-IV.AnnapurnaNo ratings yet

- Business News Issue 20Document11 pagesBusiness News Issue 20V.AnnapurnaNo ratings yet

- Country Risk AnalysisDocument6 pagesCountry Risk AnalysisV.AnnapurnaNo ratings yet

- NEP 2020-E-Conference, Aug 29, 2020-ReportDocument5 pagesNEP 2020-E-Conference, Aug 29, 2020-ReportV.AnnapurnaNo ratings yet

- Business News Letter - Issue 29Document15 pagesBusiness News Letter - Issue 29V.AnnapurnaNo ratings yet

- Mobilization 1Document4 pagesMobilization 1zNo ratings yet

- FuelUnitInjector SELD0143-20Document15 pagesFuelUnitInjector SELD0143-20guayanecitroNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument22 pagesInstructions / Checklist For Filling KYC FormRohit JadhavNo ratings yet

- Chapter 3: The Basic Accounting Equation and Double Entry SystemDocument3 pagesChapter 3: The Basic Accounting Equation and Double Entry SystemZwelithini MtsamaiNo ratings yet

- Be A Pirate StoryDocument14 pagesBe A Pirate StorySemira FocoNo ratings yet

- Amul IndiaDocument31 pagesAmul IndiaKajol Shukla100% (2)

- Brochure Business Mastery 2016-BM-LV-FS 2 PGDocument1 pageBrochure Business Mastery 2016-BM-LV-FS 2 PGLuis Fernando Parra Zapata Medellín Líderes INo ratings yet

- MKS 112 GEN AZ7 SP 01 A Specification For PaintingDocument31 pagesMKS 112 GEN AZ7 SP 01 A Specification For PaintingĐiệnBiênNhâm100% (2)

- 12 Accountancy English 2020 21Document464 pages12 Accountancy English 2020 21Anuja bisht100% (1)

- WN_OP2023_FPS01_EN (1)[2]Document362 pagesWN_OP2023_FPS01_EN (1)[2]Kamal RameezNo ratings yet

- Chapter - 6: 6.1 ConclusionDocument21 pagesChapter - 6: 6.1 ConclusionTalfa ShamsiNo ratings yet

- Part II Investment in Associate QuizDocument2 pagesPart II Investment in Associate QuizSareta OblanNo ratings yet

- Module-3: Advanced Material Removal Processes: Lecture No-9Document6 pagesModule-3: Advanced Material Removal Processes: Lecture No-9Pradip PatelNo ratings yet

- Assignment Vs Novation - Construction ContractsDocument4 pagesAssignment Vs Novation - Construction ContractsanupjpNo ratings yet

- Final Cibek 2019Document358 pagesFinal Cibek 2019Luka LatinovićNo ratings yet

- Marketing Research: Instructor: Nguyen Quoc Hung, Mba (Ait)Document67 pagesMarketing Research: Instructor: Nguyen Quoc Hung, Mba (Ait)Uyên ỈnNo ratings yet

- Amesys Intelligence SolutionsDocument6 pagesAmesys Intelligence Solutionsjacques_henry666No ratings yet

- Seatwork # 1Document2 pagesSeatwork # 1Joyce Anne GarduqueNo ratings yet

- Case Study IB A222 G2Document7 pagesCase Study IB A222 G2Ashika 06No ratings yet

- IBISWorld Industry Report Paper Bag & Disposable Plastic Product Wholesaling in The US 2018Document36 pagesIBISWorld Industry Report Paper Bag & Disposable Plastic Product Wholesaling in The US 2018uwybkpeyawxubbhxjyNo ratings yet

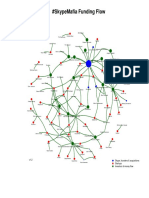

- Skypemafia - Money Plot PDFDocument1 pageSkypemafia - Money Plot PDFMarius Cristian IspasNo ratings yet

- PAS 33 Test BankDocument4 pagesPAS 33 Test BankJake ScotNo ratings yet

- IFRS 16 Leasing & Lease Liability Reclassification (IAS 1) - SAP BlogsDocument18 pagesIFRS 16 Leasing & Lease Liability Reclassification (IAS 1) - SAP BlogsBruce ChengNo ratings yet

- Soil Investigation and Topographical Works Rev ADocument5 pagesSoil Investigation and Topographical Works Rev ARiko Bin ZulkifliNo ratings yet

- New Installment SaleDocument20 pagesNew Installment SaleIbnu Bang BangNo ratings yet

- TTP and Risk Grading - Trade CustomersDocument6 pagesTTP and Risk Grading - Trade CustomersFarhana FarhaNo ratings yet

- Creating A Connection From Microstrategy To Oracle Autonomous Data WarehouseDocument7 pagesCreating A Connection From Microstrategy To Oracle Autonomous Data WarehouseramilanezNo ratings yet

Businessnewletter Oct2014 PDF

Businessnewletter Oct2014 PDF

Uploaded by

V.AnnapurnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Businessnewletter Oct2014 PDF

Businessnewletter Oct2014 PDF

Uploaded by

V.AnnapurnaCopyright:

Available Formats

Issue No.

: 23

SSIM Business News Letter

Vol – 2 Issue No: 23 Oct 6th – Oct 21st, 2014

Compiled by: Mr. S. Saibaba, Assistant Professor & Mrs. V. Annapurna, Asst. Professor

Student Co-ordinators: B. Venkatesh {RP – Jrs. TPS – A},

O.B. Venkata Siva Reddy {RP – Jrs. TPS – A}

Truth Never Damages A Cause IN THIS ISSUE

Corporate.................................. 3

That Is Just

Economy & Policy ..................... 5

In the world, if we analyse closely, we find that Infotech and Logistics ............... 7

it is only truth which ultimately emerges Marketing .................................. 8

victorious. We get into trouble, because we feel

Markets ................................... 11

like losing faith in truth and resort to a means

M&As ...................................... 15

that brings us far from truthfulness. In fact, if is

Money and Banking ................ 15

a human tendency.

Start-Ups ................................ 17

You ought to remember that when you were a

child, you were so innocent that you always Person-in-News ....................... 19

told the truth. As you grew older, you realised

unpleasant situation. It is generally not bad. But

that you might get away with holding back

if you have got into the habit of being too much

some of truth to save yourself from getting into

diplomatic, it means you have developed a

some kind of trouble. In fact, you forgot that

tendency to avoid telling the truth which, in

telling lies or withholding the full story does

fact, results in your failing to tell the truth. You

not usually get you out of trouble. In most

often use this so-called art or skill in the

cases, by doing so, you ,and yourself more into

workplace, i.e. amidst the people whom you

trouble. So much so that you often have to

have to interact with. In that case, you can end

explain at a point why you have been frying to

up not giving someone the help he/she needs.

cover things up.

Maybe you think that he/she may not be able to

In your day-to-day life, you will observe that

handle the truth. But remember the famous line

you become diplomatic to get out of an

written by the great American writer and

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 1

Issue No. : 23

SSIM Business News Letter

educator, Frank Lloyd Wright: "The truth is one of the best ways to get closer to the truth is

more important than the facts." If means, you to ask for feedback. You may get one of your

must not distort or curtail the facts to the extent colleagues or a person very close to you to look

that they are unable to convey the truth. What out for occasions when you tend to do or are

Is needed is your skillful use of diplomacy. doing the very thing which you are focused on

That diplomatic language is alone diplomatic in changing. When you are relying on a number

the real sense of the term which is used to of people for feedback, you must tell them to

convey the truth in a way that you do not shatter be specific. For example, when someone says

the self-confidence of others. that you have done something well, ask him/her

Tell the truth in a way that the person whom why he/she liked your act and what were the

you are speaking to comes to know the truth things you should have done but did not do. It

and gets an opportunity to make amends or will provide you with the truth that pleases

improvements. It does add not only to your people as well as with the information about

performance, but also to others'. Diplomacy is your shortcomings where there is some room

indeed an art of being sensitive and appropriate for improvement.

to every situation. It never implies running A great soul like Mahatma Gandhi, who set a

away from the truth. great store by truth and truthfulness, has said:

You need a lot of feedback from your teachers, "Truth never damages a cause that is just." If

seniors, friends and particularly from your you are aspiring to crack a competitive

parents while you are preparing for a examination, truthfulness will be immensely

competition. If you are thought to be a truthful helpful to you. If will encourage you at every

person everybody, who interacts with you, step.

treats you with respect. If you are a truthful Reproduced from

person, it puts you in a strong position to ask COMPETITION SUCCESS REVIEW,

others for truthful feedback. Remember that APRIL 2013.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 2

: Issue

Issue23 No.No. : 23

SSIM

SSIM BusinessNews

Business NewsLetter

Letter

Corporate

IDFC Alternatives raises $900 mn under India Infra Fund II

IDFC Alternatives Limited, multi-asset class management arm of IDFC Ltd, has announced final closing

for it's about Rs 5,500 crore ($900 million) India Infrastructure Fund II. This

includes a commitment of $90 million from its parent IDFC Limited and remaining

$810 million from third party Limited Partners ("LPs").

In addition to the above commitments to the fund, investors have also

pledged significant additional capital towards co-investment opportunities.

Investors in IIF II include global institutional investors from North America, Europe and the

Middle East, the company said in a statement.

IIF II has attracted the high quality and marquee investors. IIF II has been subscribed during time

when the difficult economic and financial conditions prevailed during the majority of our fund-

raising period. The many existing investors of first fund have re-upped commitments to the second

fund. The new investors including global institutional investors for having placed faith in IDFC as

their infrastructure fund manager of choice. They have also acknowledged India's potential as an

attractive investment opportunity in the infrastructure space.

IIF II is the successor to IDFC Alternatives' debut infrastructure fund - India Infrastructure Fund

("IIF") - which closed in June 2009 with a fund size of $927 million from Indian and international

institutional investors. Aditya Aggarwal, Partner - Infrastructure who co-led the fund raise said IIF

II will continue with a similar investment strategy of investing in core infrastructure assets in India

covering both under construction and operational assets.

Cox & Kings to raise Rs 1,200 cr to reduce debt

Tour operator Cox & Kings plans to raise Rs 1,200 crore this financial year to trim debt. The

company board on Thursday approved plans to raise funds through the issuance of equity shares,

convertible bonds or qualified institutional placement route.

Cox & Kings has a debt of Rs 4,200 crore and over a third of it was drawn to

finance the purchase of UK travel company Holidaybreak in 2011. The

company has been aiming to reduce its finance cost and in June, it sold

Holidaybreak’s camping division to French travel company Homair Vacances

for about Rs 892 crore. Cox & Kings said it would use the proceeds to retire

a portion of its debt before maturity.

In FY14, the company incurred Rs 323 crore in finance cost. The Indian operations contribute

about 25 per cent of the company’s consolidated revenue and the balance comes from overseas

business. In the last financial year, the company reported consolidated earnings before interest,

taxes, depreciation, and amortization of Rs 1,100 crore and Holidaybreak’s share was about Rs

400 crore.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in

3

Issue

Issue

No. : 23 No. : 23

SSIM

SSIM BusinessNews

Business NewsLetter

Letter

Cipla to tweak its global strategy

Indian drug major Cipla is gearing to spruce its global focus. Under the leadership of Subhanu

Saxena, the chief executive officer who took charge last year, Cipla is planning a makeover with

a balanced portfolio across global markets.

At present, Indian and African markets contribute 80 per cent of Cipla's annual revenue. In

comparison, competitor Sun Pharma earns 60 per cent of revenue from the US, the world’s largest

drug market.

Except Cipla, none of the other top five companies depends too much on the Indian market for

revenue. India contributes about 45 per cent to Cipla's revenue, while contribution from Africa is

35 per cent and only 20 per cent from the rest of the world. Cipla earns 10 per cent of its revenues

from the US, the $350-billion drug market.

One of the targets by Saxena is to double the revenue from the US market to 20 per cent by 2020.

He plans to bring another 20 per cent from Europe, especially the UK and Germany. Apparently,

revenue from India will come down to 30 per cent and Africa to 20-25 per cent. “The margins are

pretty good in the US market and we have realised that we can't ignore world's largest pharma

market,” said Saxena.

Cipla plans global expansion in three phases, which includes entering partnerships for the US

and European market, and expanding the respiratory and injectable portfolio. Capacity expansion

of Indore and Goa plants are also on the agenda. Read more…

Future Group, Amazon India announce strategic e-commerce alliance

From being dismissive about the potential of e-commerce in India to joining hands with the sector,

leading 'brick and mortar' retailing entities seem to have had a change of thinking on the former.

Kishore Biyani's Future Group has made a tie-up with Amazon to sell its private labels in the

fashion category. Last month, Tata Group’s Croma entered into an alliance with Snapdeal.

The tie-up of Amazon and Future comes right after Jeff Bezos, founder-head of the former, visited

the country and met Biyani. The partnership will be extended to other categories over time. Future

will use the Amazon platform to sell its private labels such as Lee Cooper, Converse, Indigo

Nation, Scullers and Jealous21, among others. The company has a portfolio of about 40 brands.

mazon India's vice-president and country manager, Amit Agarwal, said the combination was a

“win-win for all”. Biyani said it would help the retailer promote its own private labels. Read

more…

Bajaj Auto Q2 net slides 29% to Rs 591 cr

Bajaj Auto, India’s third-largest two-wheeler manufacturer, posted a 29 per cent year-on-year drop

in net profit for the quarter ended September. The Pune-based company reported a net profit of Rs

591 crore, compared with Rs 837 crore in the corresponding period last

year. The fall in profit was primarily due to a penalty imposed by the

Uttarakhand High Court over non-payment of duties. Bajaj Auto said

following the judgment, it was liable to pay Rs 340 crore as a one-time

penalty and interest.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 4

Issue

Issue

No. : 23 No. : 23 SSIM

SSIM Business News

Business News Letter

Letter

According to the order, the levy of National Calamity Contingent Duty (NCCD) is out of the

purview of the exemptions granted to the company under the scheme of incentives provided to

industries in Uttarakhand. The penalty has been calculated for the past seven and half years, since

April 1, 2007. “This is a one-time charge and going forward, the charge towards NCCD is expected

to be about Rs 3 crore a month,” said a company release. But for the charge of this exceptional

item, profit after tax would have been Rs 853 crore, the second-highest in the company’s history.

Read more…

Symphony Q1 net rises 51% to Rs 21.63 crore

Ahmedabad-based air cooler company Symphony Limited on Tuesday reported a 51 per cent rise

in net profit for the first quarter of 2014-15. The company follows July-June as its financial year.

The company posted a net profit of Rs 21.63 for the first quarter of the current financial year as

against Rs 14.32 crore in the corresponding quarter of previous fiscal (2013-14), a statement

issued by the company said. Gross revenue, the statement added, for the first quarter stood at

Rs 110.40 crore as against gross revenue of Rs 78.05 crore for the same period in the previous

fiscal. Nrupesh Shah, executive director, Symphony Limited, said, “The sustained growth is on

account of strong performance across all business verticals.”

Economy and Policy

What Yahoo! and Nokia's offshore cutbacks tell us about India

Yahoo! just made about $9 billion in cash from Alibaba Group's initial public offering, and

investors are licking their lips at the thought of how Marissa Mayer might spend it. Snapchat?

AOL? Well, here's one area you shouldn't expect her to invest in: offshoring more jobs to India.

The company is cutting about 400 jobs at its office in Bangalore representing more than a third of

its workforce there, Bloomberg News reported. Yahoo! says the cuts were due to "some changes

in the way we operate in Bangalore" and that it's not giving up on the country. "Yahoo! will

continue to have a presence in India, and Bangalore remains an important office," it said in a

statement.

The allure of offshoring information-technology jobs to India isn't what it used to be. Just on

Tuesday, Nokia said it plans to shut down production at a factory near Chennai on November 1.

The plant in the southern city of Sriperumbudur was one of Nokia's largest phone-manufacturing

operations. In a statement, the Finnish tech company blamed the closure on an asset freeze imposed

by India's tax department. Nokia's nightmare highlights one big reason some Western tech

companies are putting the great Indian offshoring experiment on pause. The country is still

grappling with corruption and bureaucracy, which contribute to it being the worst-performing

BRICS economy for IT development, according to a 2014 report from the World Economic Forum.

That creates roadblocks for foreign businesses and local entrepreneurs, alike. Read more…

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in

5

Issue

Issue

No. No. : 23

: 23 SSIM

SSIM Business

BusinessNews

NewsLetter

Letter

Growth to pick up from 5.6% in FY15 to 7% in FY17: Citigroup

India's growth rate is expected to improve to 7 per cent by FY 2017, while inflation and the current

account deficit are likely to moderate in the coming years, a Citigroup report said. According to

the global financial services major, the Indian economy had faced high and sticky inflation in

2008-2013, around 50 per cent depreciation in currency and elevated interest rates, but the

"normalisation" process has begun. "From an undesirable mix of sub-par growth, high inflation,

elevated twin deficits in FY 2013, India is now looking at a pick-up in growth, moderating inflation

and a sharply lower current account deficit," Citigroup said in a research note. According to the

quarterly GDP data released last month, GDP growth accelerated to 5.7 per cent year-on-year in

the first quarter of FY 2015, compared to 4.6 per cent in the fourth quarter of FY14, with

encouraging trends seen across supply and demand side components. The report further noted that

the recovery in growth numbers from 5.6 per cent in FY15 to 7 per cent in FY17 would be

"gradual" and continued policy efforts are needed to meet the RBI's 6 per cent CPI target by

January 2016.

Factory output growth slows to five-month low of 0.4%

Factory output growth slowed to five-month low of 0.4 per cent in August mainly due to

contraction in manufacturing and capital goods. The Index of Industrial Production (IIP) for

August was at 0.4 per cent, the same as in August 2013. Meanwhile, the IIP for July 2014 has now

been revised downward to 0.4 per cent from 0.5 per cent estimated earlier, official data released

by the Central Statistics Office on Friday showed. For the April-August period, factory output saw

2.8 per cent growth as against flat production (nil growth) in the same period last fiscal. According

to the latest data, manufacturing — which accounts for 75 per cent of the index — contracted 1.4

per cent, compared to 0.2 per cent decline a year ago. While capital goods contracted 11.3 percent

(-2.0 per cent), consumer durables contracted 15 per cent (-8.3 per cent). On an overall basis,

consumer goods output contracted 6.9 per cent in August (0.9 per cent decline . The Confederation

of Indian Industry Director-General Chandrajit Banerjee said industrial production continues to be

slow and a visible turnaround is not happening. There is a need to provide a competitive market

for coal and mining sectors, he said.

Sept WPI inflation falls to 5-year low of 2.38%

Wholesale Price Index (WPI)-based inflation dropped to 2.38 per cent in September, the lowest

since October 2009 (1.78 per cent), prompting industry to urge the Reserve Bank of India (RBI)

for a rate cut to propel industrial growth, which fell to a five-

month low in August. WPI inflation stood at 7.05 per cent in

September 2013 and 3.74 per cent in August this year.

For September this year, all three broad categories — primary

products, manufactured items, and fuel & power — saw a fall in

inflation.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 6

IssueNo.

Issue No.: 23

: 23

SSIM

SSIM Business

Business News

News Letter

Letter

Data released on Monday showed in September, Consumer Price Index (CPI)-based inflation fell

to 6.46 per cent, the lowest so far. Since WPI is a lead indicator for CPI, retail price inflation might

decline further in the coming months. However, the festive months of October and November

might come in the way. RBI has set a target of reining in CPI inflation at eight per cent by January

2015 and six per cent by January 2016. Though it has voiced comfort on its January 2015 target,

it expressed apprehension about the January 2016 target. Industry chambers — the Confederation

of Indian Industry, the Federation of Indian Chambers of Commerce and Industry and the

Associated Chambers of Commerce and Industry —urged RBI to focus on growth. The Federation

of Indian Export Organisations asked RBI to cut the policy rate, as growth in exports had fallen to

2.35 per cent in August. Economists are divided on RBI’s course of action. Madan Sabnavis, chief

economist at CARE Ratings, said the central bank might go for a rate cut in the fourth quarter of

2014-15, but might advance this if retail price inflation remained about seven per cent in the next

two months. Read more…

Infotech and Logistics

Infosys CEO Vishal Sikka eyes design, innovation in new IT services strategy

He has his roots in the software product industry, where productivity is not measured by billing

the clients on the basis of works rendered for each hour unlike the information

technology(IT) services industry. Now at helm of India’s second largest IT

services company Infosys as the first non-founder chief executive officer and

managing director, Vishal Sikka has clearly charted out that the reincarnated

Infosys will not be interested in the ‘services of yesterday’, but something

where people will be able to apply ‘design thinking’ leveraging efficiency

tools such as automation and artificial intelligence. During his little over than four months of

working with Infosys, Sikka has in several occasions touched upon the way he would like the

company to be transformed to the next level though the details are expected after the company’s

quarterly earnings on Friday. But in his keynote address at the recently concluded Oracle

OpenWorld in San Francisco, he dwelt upon a few of those aspects what he has envisioned for the

company. “…the main business of Infosys is our services. I see a tremendous opportunity to

rethink the way services are done. In many ways when I took this new role, I thought about the

world of services and I came to the conclusion that myself and us at Infosys, we are not interested

in the services of yesterday,” said Sikka during his first ever address at Oracle OpenWorld. Read

more…

Microsoft gets service tax relief

Software major Microsoft has received major relief on the tax front after the Customs, Excise &

Service Tax Appellate Tribunal (CESTAT) ruled that services rendered to overseas entities were

not liable to service tax.The order has implications for all firms exporting, marketing and providing

technical support services to overseas firms. The ruling will also clear the air on a number of tax

cases involving Indian arms of multinational companies as well as overseas firms. “The business

auxiliary service provided by the assessee to their Singapore parent company was delivered outside

India as such, was used there, and is covered by the provisions of Export of Service Rules and are

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 7

Issue

IssueNo.

No.: 23

: 23 SSIM

SSIM Business News Letter

Business News Letter

not liable to Service Tax,” the tribunal said in an order dated September 23. The ruling was on an

appeal against a service tax demand of around Rs. 400 crore against the software major in 2008.

Tax experts feel this ruling, along with the Vodafone judgment by the Bombay High Court, will

help foreign investors. On October 10, the Bombay High court ruled that Vodafone was not liable

to pay tax of Rs. 3,200 crore in a transfer pricing case dating back to 2009-10. In the Microsoft

matter, the tribunal said the business auxiliary services of market promotion in India for the foreign

principal, made in terms of the agreement dated July 1, 2005, amounted to export of services.

TCS okays merger with CMC

Tata Consultancy Services, the country’s largest software exporter, has approved the merger of its

subsidiary CMC Ltd with itself, subject to regulatory and shareholder approvals. “It makes sense

to merge as CMC compliments the work done by TCS. It’s also a good time to consolidate our

Indian operations,” TCS Chief Executive Officer and Managing Director N Chandrasekaran said

at a press conference. TCS is already doing “significant” amount of work with CMC, while CMC

on its part is doing a lot of work in the domestic market, he said, adding that the combined firm

expects to win “bigger deals”. Following the merger, TCS will consolidate CMC’s operations in a

single company with a rationalised structure, enhanced reach, greater financial strength and

flexibility. Read more…

Marketing

Maruti counters unfair trade practices charges

Maruti Suzuki India Limited (MSIL) has countered the charges levelled

against it by the consumer affairs ministry, saying that accepting pre-launch

bookings for its mid-size Ciaz sedan is in no way an unfair trade practice and

that it does not it violate consumer rights. “The booking is completely

voluntary for customers and entirely at their discretion. The company accepts

a token amount, which is adjusted against the price of the car at the time of

purchase. Customers are free to cancel their booking at any stage; in which case, the token booking

amount is fully refunded,” said a company spokesperson. “Customers who book in advance are

sold the car at the same price, with the same specifications, features, etc as those who have not

pre-booked and purchase the car after its launch. As such, this practice is customer-friendly and

fully safeguards the rights of customers as guaranteed under the Consumer Protection Act, 1986,”

the spokesperson added. The practice of opening bookings for cars prior to their launch has been

followed by several companies for many years in India. Maruti Suzuki’s statement came in

response to the ministry considering legal action against the company. Read more…

Marks & Spencer to double India presence by 2016

UK's top retailer Marks & Spencer (M&S), is keen on expanding its presence in the fast-growing

Indian market by launching around 40 new stores by the end of 2016.

Launching its second flagship store in Hyderabad on Thursday, Venu Nair, managing director of

M&S Reliance India, said all the planned stores would be self-owned. "By 2016, we aim to have

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 8

IssueNo.

Issue No.: :23

23

SSIM

SSIM Business News

Business NewsLetter

Letter

80 stores from the current 42 stores, pan-India. "In south India, the international retailer plans to

roll out four stores by Mar 2015. Of this, two would be coming up in Hyderabad by December

2014. M&S currently operates 10 brick-and-mortar stores in south. M&S opened its first store in

India in 2001. It had signed a joint venture with Reliance Retail to form M&S Reliance India

Private Limited in April 2008. "Hyderabad with seven million population is getting more

westernised and what we offer is something right for this market," Nair said. On the strategy for

sourcing product material, he said "local sourcing in this part of the world is extremely key and

forms an important part of our strategy".

TVS to offer speciality repair services for commercial vehicles

TV Sundram Iyengar & Sons Ltd will offer speciality repair services such as reconditioning and

re-boring of commercial vehicle engines to garage owners and fleet operators in Tamil Nadu. The

service branded as TVS Super Auto Mart is the first in the organised sector in Tamil Nadu,

according to G Srinivasa Raghavan, CEO and Global President, TV Sundram Iyengar & Sons.

Typically, small-time mechanics along highways offer such speciality service to garage owners,

who take commercial vehicles for repairs. Garage owners and fleet customers, however, need to

deal with multiple service providers at different locations. TVS wants to change the market

dynamics by offering the speciality service at nearly 20 per cent lower cost and at reduced time

using technology such as ultra violet that can even detect a small crack in the components.

TVS distributes commercial vehicles representing manufacturers like Ashok Leyland, and is also

involved in parts distribution. Around 150 garage owners have started using the speciality service

since a pilot store was launched in Salem — the commercial vehicle hub of Tamil Nadu — in July.

It spent nearly Rs. 2.5 crore on the first store and plans to open 25-30 stores in the next three years.

Around 60 people are employed in a store, he said. Raghavan added the market for speciality

service for commercial vehicle in Tamil Nadu is estimated at Rs. 700 crore annually. The company

hopes to earn Rs. 100 crore in the next three years. The second store is planned in Chennai and

then one in Madurai. It will open the stores in Karnataka and Kerala next year, he said. TVS plans

to use students passing out of its training academy in Madurai to work in the speciality stores. The

company will provide a 90-day programme to students on all aspects of speciality services, he

said.

Honda plans bike strategy in rural drive

September was a memorable month for Honda Motorcycle and Scooter India with sales touching

an all-time high of 4.38 lakh units, 33 per cent up from last year. In the process, the company’s

sales in the first half of this fiscal totalled 2.2 million units, making it the second largest player

after former ally, Hero MotoCorp. On the face of it, HMSI has reason to celebrate, especially with

its scooter sales now averaging nearly 2.4 lakh units each month. Motorcycles account for 1.8

lakh units (exports take up the balance 18,000 units) but there is still a lot of ground to cover before

it catches up with Hero’s numbers. “Scooters are doing better for sure but bikes are the bigger

market and we need to do something different like providing additional technology across each

segment,” says Keita Muramatsu, President and CEO. The idea is to do something unique which

reflects the Honda DNA, he adds.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in

9

IssueNo.

Issue No.: 23

: 23

SSIM

SSIM Business

BusinessNews

NewsLetter

Letter

The Dream Series was intended to meet market needs in the mass commuter segment where Hero

literally rules the roost. Not everyone within industry circles is convinced, however, that the Yuga

and Neo have made a substantial impact with some insisting that they are pretty much like Hero’s

range. According to them, the Shine and Unicorn are doing a lot better especially from the

viewpoint of reflecting Brand Honda. Opinions could be divided on this issue but the Japanese

automaker is keeping a careful eye on market trends and evaluating customer feedback. It is keen

to grow numbers in India which will eventually emerge its largest-selling market, ahead of

Indonesia and Vietnam, over the next two - three years. Rural markets are an important part of the

growth strategy especially for bikes where a beginning has already been made with the CD 110

Dream at a competitive price tag of Rs. 41,000. This brand was, till recently, part of Hero’s entry

level series which has since been rechristened HF. HMSI will be hoping that the CD brand recall

draws customers to its retail outlets. Read more…

Abbott to launch nutritional products in Indian flavours

Abbott Healthcare Pvt Ltd, a subsidiary of healthcare major Abbott Labs, will be soon launching

its flagship nutritional supplements in Indian flavours such as mix of kesar (saffron) and badam

(almond). The company, which inaugurated its first greenfield manufacturing plant for nutrition

in India at Jhagadia in Gujarat’s Bharuch district on Thursday, is working on developing new

Indianised flavours for its nutrition products like PediaSure for toddlers, Similac for infants,

Ensure for adults, Mama’s Best for pregnant women and lactating mothers and Glucerna for

diabetics.

Research is on to find out different flavours for the Indian consumers at the company’s Bangalore-

based laboratory. Currently, these products are available in vanilla and chocolate flavours.

Abbott will now be manufacturing its flagship nutritional products at the Gujarat plant, which has

a capacity of 40 million pounds per annum. “Most of our products have been made to the taste of

Europeans. So, we plan to introduce these products in Indian flavours with focus on local markets,”

said John Landgraf, executive vice-president, global nutrition, Abbott.

“We have already launched PediaSure in ‘kesar badam’ flavour, which is available in the market.

Work is on in our lab in Bangalore on developing new flavours. However, it will take some time,”

he added. Read more…

Lenovo will be India's 3rd largest smartphone player by year end

Chinese electronics giant Lenovo said it is all set to become India's third largest smartphone

company with the completion of $2.91 billion acquisition of US-based handset maker Motorola

later this year.The company is already the number one player in the PC market in India.

In the Indian smartphone market, Lenovo lags behind Motorola, which is the fourth largest player.

"We will become the third largest smartphone seller in India after the Motorola operations get

integrated with us by the year-end," Lenovo India Managing Director Amar Babu said.

The company also plans to enhance its position in the tablet market in India.

Lenovo today launched its new range of 'Yoga' tablets in India, priced between Rs 20,990 to Rs

47,990. The range - comprising of four devices - will go on sale from tomorrow exclusively on

eCommerce site, Flipkart. The range, comprising three Android and one Windows-powered units,

includes features like full HD, HiFi audio from companies such as Dolby and Wolfson, 8MP rear

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in

10

IssueNo.

Issue No.: 23

: 23

SSIM

SSIM Business

BusinessNews

NewsLetter

Letter

and 1.6MP HD front camera. These units are powered by Intel's Atom chips. The Yoga range,

popular for its Stand, Hold and Tilt modes, will now include a 'Hang' option to allow better usage

of the device. "The Yoga range has become a franchise of its own. It accounts for a good percentage

of our tablet sales," he said. Read more…

CavinKare enters retail business; eyes Rs 100 crore biz

FMCG major CavinKare is expecting around Rs 100 crore from the retail segment, which it entered

today. The ChrysCapital-backed company is looking at setting up around 100 retail outlets known

as Cavin’s Parlour. CK Ranganathan, chairman and managing director, CavinKare Pvt Ltd, said

these would be outlets plus distribution centres from where the stock could be accessed by another

100 small retail outlets in the area. The outlets will be set up and run by distribution partners. Each

outlet would require an investment of around Rs 7 lakh and the break-even period would be a

month only if the margins were decent, according to him. The company would set up 50 Cavin’s

Parlours in the next three months and by March 2015, these would be 100. “By next year, we will

have a significant presence in the south, and in the following year we will go pan-India,” he added.

It is betting big on dairy products and pickles. “The focus will be market places, where people

come for shopping,” said Ranganathan.

Markets

Iron ore output climbs 10%

The domestic production of iron ore has shown a positive trend during the first

half of the current financial year, despite many mines being shut in Goa,

Karnataka, Odisha and Jharkhand. The production touched 77 million tonnes

between April and September, a growth of 10 per cent compared to 70 million

tonnes a year ago, according to data compiled by OreTeam Research, a Delhi-

based firm. For the year ended March, the production touched 152 million tonnes.

The mines ministry is yet to confirm the numbers. “We do not have official data

on the production for the first six months. It is possible the production has gone

up this year mainly in Odisha and in Karnataka to an extent," said Basant Poddar,

senior vice-president, Federation of Indian Mineral Industries.

According to miners and analysts, the production has come largely from Odisha,

Chhattisgarh and Karnataka during the first six months. “Odisha had done a considerable amount

of production before the mines were closed after the Supreme Court order. State-owned NMDC has

geared up for increasing its production both in Chhattisgarh and Karnataka," said Prakash Duvvuri,

head of research at OreTeam.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 11

IssueNo.

Issue No.: 23

: 23

SSIM

SSIM Business

BusinessNews

NewsLetter

Letter

Diamond import for local sales trebles in August

Imports of cut and polished diamonds trebled in August

on concerns on export markets. Traders are importing

more for local sales if export demand doesn't match up.

Gems and Jewellery Export Promotion Council (GJEPC)

data showed imports in the domestic tariff area, or DTA

(where normal duties prevail as against Special Economic

Zones, or SEZs), of Mumbai had jumped to Rs 2,326 crore

($382 million) in August compared with Rs 885 crore

($140 million) a year ago.Imports into DTA shot up four-fold to Rs 12,072 crore ($2,010 million)

during April-August against Rs 3,244 crore ($555 million) a year ago. The imports into DTA has

posed a threat to thousands of cutting and polishing units in SEZs. Since these are primarily meant

to process imported goods, rising import into DTA indicates jewellers' growing optimism on the

domestic market. Read more…

Global food prices slide for 6th month to 4-year low as dairy, sugar fall

In September, global food prices fell to a 50-month low, the sixth consecutive monthly decline,

owing to oversupply resulting from bumper agricultural output in major producing countries,

including India. A steep fall in dairy and sugar prices aided the fall. In a report released on

Thursday, the United Nations' Food and Agricultural Organization (FAO) said, "The FAO Food

Price Index averaged 191.5 points in September, down 5.2 points (2.6 per cent) from August and

12.2 points (six per cent) from the corresponding month a year ago. The September slide, the sixth

consecutive monthly drop, brought the value of the index to its lowest since August 2010."\

Among the sub-indices, those for sugar and dairy prices weakened the most, followed by cereals

and oils; the index for meat remained firm. Among the underlying factors, the dollar's broad

appreciation continued to weigh on all international commodity prices.

For September, the FAO Cereal Price Index averaged

177.9 points, down 4.6 points (2.5 per cent) from

August and 17.1 points (8.8 per cent) from September

2013; this was the fifth consecutive monthly fall in

the index. Good production and large export

availabilities were the primary factors behind falling

wheat and maize prices. Rice prices, which had risen

steadily in recent months, registered a decline in

September, reflecting accrued competition among

exporting countries, ahead of the coming harvests.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 12

SSIM

Business News Letter

IssueNo.

Issue No.: 23

: 23

SSIM Business News Letter

This year, global cereal production is estimated at 2,523 million tones (mt), 65 mt higher than

FAO's forecast in May. The revision in estimate was primarily due to continued upgrades of this

year's coarse grain harvests, especially that of maize. It is expected global cereal production will

fractionally decline from the 2013 peak, with wheat production standing at a record 718.5 mt, and

production of coarse grains virtually on a par with last year's high of 1,308 mt. Read more…

BSE may launch climate change ETF soon

BSE is in talks with asset managers to launch an exchange-traded fund (ETF), based on its climate

change index in the next couple of years, chief executive Ashishkumar Chauhan said on Monday.

BSE launched the S&P Carbonex index in 2012, centred on its popular BSE 100 index, giving

increased weighting to companies depending on carbon footprint scores.

"We continue to prod investors and people who specialise in those kind of investments about

tracking this index and having an ETF," Chauhan said at the Reuters Global Climate Change

Summit. "The investors who look to invest with a longer-term horizon tend to be a little more into

nudging the companies into sustainable activities," Chauhan said. "This is not only a do-good kind

of activity, but also a commercially prudent framework for investors to look at." Globally, asset

managers had put $13.6 trillion into environmental, social and governance (ESG) investing

strategies as at the end of last year, according to green investment tracker Global Sustainable

Investment Alliance. Only a fraction of that amount, however, found its way into India, Asia's

third-largest economy, and other emerging markets which are widely seen as less stringent on

environment protection requirements. That is expected to change with global investors focusing

more closely on companies' environmental track-records and preparedness for climate change to

mitigate risk events. BSE is looking to tap into that demand by also offering derivative products

based on its Carbonex index in the next few years, Chauhan said at the summit.

Sharp rise in gold, silver imports

Gold and silver imports have seen a sharp rise in September, showing a fivefold increase in the

import bill of precious metals.While gold imports have increased 450 per cent to $3.75 billion,

silver import bill was up 225 per cent to $477 million. The total import bill reached $4.2 billion -

up from $830 million in the same month last year. Even import of raw gold has gone up this year.

In September last year, gold imports had fallen significantly low, after the Reserve Bank of India

imposed restrictions, fixing an import cap for the yellow metal at 12 tonnes. However, the imports

have gone up to 90 tonnes in the last month.Market insiders say increase in imports by star and

premier trading houses was the main reason for the very high

import bill. Silver imports have also increased, from 218

tonnes to 690 tonnes. Several trading houses have increased

gold imports, as they could easily export 20 per cent of the

imported quantity after value addition, while the rest will be

consumed by the domestic market, thanks to the festive

demand. Besides, some banks, which were not so active in the

previous months, have also imported gold.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 13

: 23

Issue No.No. : 23

Issue SSIM

SSIM Business

Business News Letter

News Letter

Although banks, unlike star trading houses, don't export gold by themselves, the rule says banks,

too, have to show that 20 per cent of the imported quantity is exported.

Fund house assets dip 5% to Rs. 9.59 lakh cr in Sept

The assets under management of the mutual fund industry slipped by Rs. 53,409 crore last month

to Rs. 9.59 lakh crore, as against Rs. 10.12 lakh crore logged in August. The industry witnessed a

net outflow of Rs. 69,664 crore last month as against Rs. 13,035 crore in August, according to the

Association of Mutual Funds in India data. Redemption from liquid funds, which are short-term

in nature, increased substantially to Rs. 67,318 crore as against Rs. 5,864 crore, while outflow

from income funds moderated slightly to Rs. 10,567 crore ( Rs. 12,696 crore). Fund flows into

equity schemes increased to Rs. 7,789 crore ( Rs. 5,217 crore), even as the Sensex lost 238 points

or 1 per cent last month. Balanced funds attracted investment of Rs. 732 crore ( Rs. 448 crore) in

September. Gold ETFs registered a net outflow of Rs. 47 crore to Rs. 7,277 crore. Income funds

with assets under management of Rs. 4.61 lakh crore accounted for 45 per cent of the mutual fund

industry, while liquid and equity funds followed with assets of Rs. 2.45 lakh crore and Rs. 2.34

lakh crore, respectively. Nilesh Sathe, Director and Chief executive Officer, LIC Nomura Mutual

Fund, said AUM of the MF industry may shrink in the coming months, due to the change in tax

treatment of fixed maturity plans, which account for about 17 per cent of the total AUM. However,

he added, fund flows into equity schemes would continue with the positive vibes in the market

attracting more retail investors.

DCB Bank raises Rs. 250 cr via qualified placement

DCB Bank (formerly Development Credit Bank) raised about Rs. 250 crore of Tier I capital

through a recently concluded qualified institutions placement (QIP). The board of directors of

DCB Bank had approved the issue and allotment of 3.04 crore equity shares of face value Rs. 10

each to eligible qualified institutional buyers (QIBs) at the issue price of Rs. 82.15 an equity share,

aggregating to approximately Rs. 250 crore. In a notice to BSE and NSE, the DCB Bank said

consequent to the issue and allotment of the equity shares through the QIBs, its paid-up equity

share capital stands increased to Rs. 281.20 crore divided into 28.12 crore equity shares of face

value Rs. 10 each, up from the pre-QIP paid-up equity share capital base of Rs. 250.77 crore

divided into 25.07 crore equity shares of face value Rs. 10 each.

As of June 30, 2014, DCB Bank’s Capital Adequacy Ratio (CAR) was 13.63 per cent (of which

Tier I capital was 12.77 per cent and Tier II at 0.86 per cent according to Basel III norms). This

does not consider the impact of the QIP. As a result of the QIP, the shareholding of DCB Bank’s

promoter will be reduced to approximately 16.43 per cent from 18.45 per cent as of June 30, 2014.

Murali Natrajan, Managing Director & CEO of DCB Bank, said, “The capital raised will certainly

help DCB Bank execute plans for growth in the near future. We are mindful of the responsibility

to ensure secure and stable growth of the bank.”

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 14

SSIM

News Letter

Issue

Issue No.

No. : 23

: 23

SSIM Business News Letter

Business

Mergers and Acquisitions

Nihilent acquires US based BI firm GNet Group

Pune-based solution integrations company Nihilent Technologies has acquired US-based business

intelligence (BI) and SharePoint solutions provider GNet Group, for an undisclosed amount. GNet

has deep expertise in business intelligence services, SharePoint and application development.

Nihilent said it will now be able to enhance its expertise in business intelligence and software

application development, especially in the American region. “This acquisition is a result of GNet

Group’s profitability and growth, and its extensive expertise in the business intelligence and

analytics space,” said L C Singh, vice-chairman and CEO of Nihilent. “This acquisition is

important and essential to Nihilent and we have already begun integration operations. This is a

great opportunity for Nihilent to expand into America. Also, our relationship with Microsoft,

through expertise in deploying their CRM and AX solutions will position us to hit the ground

running,” said Minoo Dastur, president and COO, Nihilent Technologies.

VC funding in solar crosses $1 billion

India’s solar industry remains a favourite investment destination for venture capitalists and private

equity (PE) funds even as the sector sees a number of merger and acquisitions. Hyderabad-based

renewable energy company Fourth Partner Energy, which provides solar products and turnkey

services for off-grid solar power installations, raised Rs. 3 crore from venture capital firm, The

Chennai Angels. Boond Engineering and Development, a provider of clean energy products and

services, recently closed an equity investment round led by Opes Impact Fund. These are part of a

number of fundraising deals solar companies clinched in the September quarter. According to

Mercom Capital Group, a research firm, venture capitalist funding in solar has crossed $1 billion

in the first three quarters this year. Globally, total corporate funding in the solar sector, including

venture capital, PE, debt financing, and public market financing, soared to $9.8 billion by the end

of the September quarter, from $6.3 billion in the previous quarter, the report noted. Read more…

Money and Banking

Extend restructuring leeway till April 2016: Banks to RBI

Bankers have urged the Reserve Bank of India (RBI) to continue

regulatory forbearance on loan restructuring for another year. As of

now, the forbearance is scheduled to end on April 1, 2015. In case

RBI sticks to this deadline, the banking system's gross non-

performing assets (NPAs) will rise to 10 per cent from four per cent

in March this year. Public sector banks account for the majority of

stressed assets in the banking system.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 15

Issue No.

Issue : 23

No. : 23 SSIM

SSIM Business

BusinessNews

NewsLetter

Letter

Currently, banks have to make lower provisioning for standard restructured advances - five per

cent, compared with 15 per cent for sub-standard assets (the first level of NPAs - when interest or

principal is due for more than 90 days). RBI had mandated after April 2015, banks had to treat all

restructured standard advances as NPAs and make provisions accordingly. At an interaction with

the RBI governor and deputy governors after the recent monetary policy review, bankers had said

a rise in NPAs had already put pressure on their profitability. They added if the new norms kicked

in from April 2015, it would add pressure on them at a time when lenders, especially public sector

ones, would need a huge amount of capital to comply with Basel-III norms.

"We have requested the same level of provisioning for standard restructured advances be continued

for at least a year. If the higher provisioning norms start from April 2015, it will put further pressure

on profitability," said the chairman and managing director of a public sector bank who attended

the post-policy interaction. Following a 2012 report by RBI Executive Director B Mahapatra on

restructuring of advances, the central bank decided banks wouldn't be given regulatory leeway for

restructuring debt and all such recast would be treated as NPAs from April 1 2015.

As of March this year, stressed assets - NPAs and restructured advances - as proportion of gross

advances, stood at 9.8 per cent, against 10.2 per cent in September last year. At 11.7 per cent of

overall advances, public sector banks recorded the highest stressed advances, followed by old

private banks (5.9 per cent).

Bank credit grew 11% in past year

Credit in the banking system has received a festive boost and surged by 11 per cent in the past one

year. Prior to this, bank credit this year since March had been showing a downward trend and

slipped to single digits in September 2014. Now, once again credit growth has inched up to double

digits from 9.72 per cent recorded at the end of September 19.In the period ended October 3, bank

credit was at Rs 62,69,007 crore from Rs 56,50,107 crore a year ago, up by 11 per cent, suggests

Reserve Bank of India data. On a year-on-year basis, the rate of growth in bank credit in September

has been the slowest since June 2011 because of the economic slowdown. In the past fortnight,

credit growth in the banking system has been two per cent. According to RBI data, over the

fortnight ended October 3, bank credit in the system increased to Rs 62,69,007 crore from Rs

61,46,526 crore in the fortnight ended September 19. Banks had been betting on the festive season

for credit growth to pick up. In order to boost growth, lenders have announced various schemes in

the festive season to woo customers. These schemes are for retail loans and include discounts on

interest rates and processing fees in the auto and home loan space. Read more…

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 16

Issue No.

Issue : 23

No. : 23 SSIM

SSIM BusinessNews

Business NewsLetter

Letter

IndusInd Bank to foray into asset reconstruction business

Private lender IndusInd Bank will foray into the asset reconstruction business by funding

acquisition of bad assets by asset reconstruction companies (ARCs) and also participate in the

reconstruction of these assets. “We are testing waters in the asset reconstruction business by

working with an ARC…So, we will provide the funding and participate in reconstruction of the

asset,” its Managing Director and CEO Romesh Sobti told a Newspaper. The Hinduja Group-

promoted mid-sized bank has already hired people required to drive the business. “We should

begin our first (bad loans) acquisition in a couple of months,” Sobti said. According to him,

because of the availability of well secured assets and ARCs have less capital a bank can enter this

space. In August, in an attempt to strengthen the asset recovery process, the Reserve Bank of India

asked ARCs to pay upfront a minimum of 15 per cent of security receipts (issued against the

underlying bad loan) as against the earlier 5 per cent. This will require ARCs to invest more money

upfront and make the price of the asset more competitive. “We have chosen the deal-by-deal

structure. So, we will collaborate by providing funding to the ARC to acquire (the bad loan) and

then can work on the reconstruction of the asset,” he added.

“I get the security receipts and the income that will accrue from the sale of the asset is the IRR

(internal rate of return) and the market has seen earning an IRR of about 25-30 per cent. So, let us

see,” Sobti said optimistically. In 2008, peer lender Kotak Mahindra Bank group had floated its

ARC unit, Phoenix ARC, in collaboration with a few investors. Ramnath Pradeep, former CMD

of Corporation Bank, in an article in BusinessLine, said, “Banks are better equipped in terms of

manpower, knowledge of the borrower and knowledge of the security (assets). On the other hand,

ARCs deal with the borrowers for the first time.” He added that restructuring of loans, on condition

that the promoters infuse some capital, can be done without banks incurring much loss. Banks can

recover the losses later once the company turns around and/or the economic conditions improve.

That has been the time-tested practice in the country. But none of the public sector lenders are seen

doing this nowadays. In the second quarter of FY15, IndusInd Bank restructured about five bad

loan accounts and sold around Rs. 16 crore of assets to ARCs. According to Sobti, the first quarter

saw more sale to ARCs. However, with a drop in referrals to ARCs in Q2, the industry may see a

drop in NPAs.

Start-Ups

The duo who reshaped the idli, literally

For a large part of his professional life, he was working for overseas clients. But when RU Srinivas

decided to turn an entrepreneur, he wanted to do something for the domestic

market. His argument: not too many people were taking the domestic

consumers seriously enough. And, being a self-confessed foodie, what better

than get into the food business, catering to consumers at home. The dish that

he decided to serve them: the ageless and timeless idli, re-shaped, packaged

and served to eat on the go.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 17

Issue

Issue No.No.

: 23: 23

SSIM

SSIM Business

BusinessNews

NewsLetter

Letter

As to why the focus on the domestic market, a peek into Srinivas’ career provides the insight. He

studied for CA during the day and attended evening college for a B.Com degree, then studied

M.Com by correspondence, went to the US for an MBA and worked in a bank in Boston for three

years as a loan analyst. He returned to India in 1993 and worked for companies that would allow

him to, as he says, “have one foot in India and one foot in the US.” He was largely in the IT/BPO

space with his last job being CEO of Caliber Point, the BPO arm of IT company Hexaware. His

job meant that he had to travel a lot and found that being a vegetarian, food was a major limitation.

“It was beginning to get a little tiresome and I wasn’t enjoying myself as well. I decided to quit

and do something else,” says Srinivas, in his first-floor office in the same house he grew up in, in

what was once a quiet residential part of Chennai. The ground floor serves as his “factory”. But

the trigger, he says, for getting into the food business and deciding to make idlis was a trip to a

restaurant in Chennai, when he had to fork out ₹77 for a plate of idli. He thought that was exorbitant

and without any reason. He realised that a large part of the cost was the real estate and salaries for

the numerous waiters hanging around, all of which were getting billed into his idli. Read more…

Tech marketing is the key for start-ups

The genesis of a start-up is when an entrepreneur sees an opportunity to build and deliver value to

an audience. Tech start-ups owe their existence to the fact that technology today influences all

aspects of lives of people and businesses in fundamental ways. What many entrepreneurs (and

technology visionaries) ignore is that for most people, the specifics of hardware, software and

myriad mechanisms of how they come together are irrelevant (of course, to a degree that varies

enormously). The primary concern is how to avail of technology to solve particular problems in

the context of our everyday lives. This is where technology marketing is the key in ensuring

smooth adoption/use and communicating value. Start-ups do recognise the importance of

marketing.

Many invest in digital and traditional advertising, for example. In most cases, however, marketing

is thought to be a support function, sales enablement is near absent and communication is an

afterthought. Thus many start-ups make a costly mistake of creating products and businesses which

are disconnected to the audience, or at-least are not dynamically harmonized to the realities of the

market. Marketing is central to the business of a start-up. He or she has to get involved and

influence the entire gamut consisting of complexities and dynamics of the tech business today.

Perhaps, the entrepreneur has to be primarily a technology marketer. Start-ups, today, belong to

the world characterised by the convergence of B to B and B to C, daily changes in decision making,

and products and services on a sometimes daily release cycle. The key skills thus are, how to

manage the chaos by using some basic frameworks to get to market quickly and effectively, and

quickly generate audience and decision making profiles to enable technology sales. In addition, it

is becoming critical to optimally leverage the power of the “constant launch” mentality to rise

above the noise. Another interesting aspect is the convergence of B to B and B to C. Technology

decisions that businesses make are increasingly driven by how individuals/end-users use

technology. More and more consumer technology is entering the business environment and the

adoption and value realisation of any technology is dependent on how these individuals experience

technology.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 18

Issue

IssueNo.

No.: :23

23 SSIM

SSIM Business

Business News

News Letter

Letter

Many a tech start-ups have been founded on this very premise. Therefore tech marketing cannot

focus merely at the point where technology is bought or sold. For technology to be of real use

beyond the “bling effect”, its true value has to be communicated simply, effectively, and with clear

regard to how individuals make decisions, whether for their personal lives or their business lives.

As business grows, it is not unusual to see chaos creeping in and incoherence setting in. Tech

marketing, with all its good intent, can end up alienating the customer with multiple messages,

dated product information, and irrelevant content. Read more…

Person-in-News

Nissan appoints Arun Malhotra as MD

Nissan today announced the appointment of Arun Malhotra as

the new Managing Director for Nissan Motor India, the 100%

subsidiary of Nissan Motor Co, Japan. Malhotra will report to

Guillaume Sicard, President - Nissan India Operations. He will

be based in Nissan's Sales & Marketing headquarters in Mumbai.

In this role, Malhotra will be responsible for developing business

strategies to maximize Nissan's overall performance, managing

product introduction and significantly increasing the presence

and accessibility of the Nissan and Datsun brands through

continuing network expansion. Prior to joining Nissan, Malhotra was the chief of International

Sales and Marketing for the automotive and farm sector of Mahindra & Mahindra. With over 30

years of experience Malhotra has worked with Bajaj Auto and Maruti Suzuki. He has a BE in

Mechanical Engineering and an MBA from Indian Institute of Management, Kolkata.

Gautam Roy appointed as CPCL MD

The Chennai Petroleum Corporation Ltd (CPCL) has said that Gautam

Roy, executive director, Indian Oil Corporation Ltd (IOCL) has been

appointed as managing director of CPCL. The company has received a

letter in terms of this from the Ministry of Petroleum and Natural Gas,

Government of India. He has assumed the charge as Managing Director

of CPCL from October 14, 2014, it said. The 56-year old official is a

Chemical Engineer from Jadavpur University, Kolkotta, and has over

three decades of professional experience in Refinery Operations & Management in IOCL. He has

served in diverse capacities in IndianOil's various refineries- Gujarat, Barauni, Mathura and also

at Refineries Headquarters, New Delhi. Prior to this appointment he was executive director (in

charge), Gujarat Refinery.

FOR ANY SUGGESTIONS: saibaba@ssim.ac.in 19

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Model QuestionsDocument2 pagesModel Questionspuneeth rajuNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quitar Modo Retail SamsungDocument50 pagesQuitar Modo Retail SamsungCambios PereiraNo ratings yet

- Tutorial 7 Trade Receivables (Q)Document3 pagesTutorial 7 Trade Receivables (Q)lious liiNo ratings yet

- Management of FX Exposure-IDocument9 pagesManagement of FX Exposure-IV.AnnapurnaNo ratings yet

- Economic ExposureDocument7 pagesEconomic ExposureV.AnnapurnaNo ratings yet

- Transaction ExposureDocument11 pagesTransaction ExposureV.AnnapurnaNo ratings yet

- Course Purpose-MFS - Major IIIDocument2 pagesCourse Purpose-MFS - Major IIIV.AnnapurnaNo ratings yet

- Forex Management-StructureDocument9 pagesForex Management-StructureV.AnnapurnaNo ratings yet

- Forex ManagementDocument12 pagesForex ManagementV.AnnapurnaNo ratings yet

- Course Course Purpose-MFS-Minor-IDocument2 pagesCourse Course Purpose-MFS-Minor-IV.AnnapurnaNo ratings yet

- Business News Issue 20Document11 pagesBusiness News Issue 20V.AnnapurnaNo ratings yet

- Country Risk AnalysisDocument6 pagesCountry Risk AnalysisV.AnnapurnaNo ratings yet

- NEP 2020-E-Conference, Aug 29, 2020-ReportDocument5 pagesNEP 2020-E-Conference, Aug 29, 2020-ReportV.AnnapurnaNo ratings yet

- Business News Letter - Issue 29Document15 pagesBusiness News Letter - Issue 29V.AnnapurnaNo ratings yet

- Mobilization 1Document4 pagesMobilization 1zNo ratings yet

- FuelUnitInjector SELD0143-20Document15 pagesFuelUnitInjector SELD0143-20guayanecitroNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument22 pagesInstructions / Checklist For Filling KYC FormRohit JadhavNo ratings yet

- Chapter 3: The Basic Accounting Equation and Double Entry SystemDocument3 pagesChapter 3: The Basic Accounting Equation and Double Entry SystemZwelithini MtsamaiNo ratings yet

- Be A Pirate StoryDocument14 pagesBe A Pirate StorySemira FocoNo ratings yet

- Amul IndiaDocument31 pagesAmul IndiaKajol Shukla100% (2)

- Brochure Business Mastery 2016-BM-LV-FS 2 PGDocument1 pageBrochure Business Mastery 2016-BM-LV-FS 2 PGLuis Fernando Parra Zapata Medellín Líderes INo ratings yet

- MKS 112 GEN AZ7 SP 01 A Specification For PaintingDocument31 pagesMKS 112 GEN AZ7 SP 01 A Specification For PaintingĐiệnBiênNhâm100% (2)

- 12 Accountancy English 2020 21Document464 pages12 Accountancy English 2020 21Anuja bisht100% (1)

- WN_OP2023_FPS01_EN (1)[2]Document362 pagesWN_OP2023_FPS01_EN (1)[2]Kamal RameezNo ratings yet

- Chapter - 6: 6.1 ConclusionDocument21 pagesChapter - 6: 6.1 ConclusionTalfa ShamsiNo ratings yet

- Part II Investment in Associate QuizDocument2 pagesPart II Investment in Associate QuizSareta OblanNo ratings yet

- Module-3: Advanced Material Removal Processes: Lecture No-9Document6 pagesModule-3: Advanced Material Removal Processes: Lecture No-9Pradip PatelNo ratings yet

- Assignment Vs Novation - Construction ContractsDocument4 pagesAssignment Vs Novation - Construction ContractsanupjpNo ratings yet

- Final Cibek 2019Document358 pagesFinal Cibek 2019Luka LatinovićNo ratings yet

- Marketing Research: Instructor: Nguyen Quoc Hung, Mba (Ait)Document67 pagesMarketing Research: Instructor: Nguyen Quoc Hung, Mba (Ait)Uyên ỈnNo ratings yet

- Amesys Intelligence SolutionsDocument6 pagesAmesys Intelligence Solutionsjacques_henry666No ratings yet

- Seatwork # 1Document2 pagesSeatwork # 1Joyce Anne GarduqueNo ratings yet

- Case Study IB A222 G2Document7 pagesCase Study IB A222 G2Ashika 06No ratings yet

- IBISWorld Industry Report Paper Bag & Disposable Plastic Product Wholesaling in The US 2018Document36 pagesIBISWorld Industry Report Paper Bag & Disposable Plastic Product Wholesaling in The US 2018uwybkpeyawxubbhxjyNo ratings yet

- Skypemafia - Money Plot PDFDocument1 pageSkypemafia - Money Plot PDFMarius Cristian IspasNo ratings yet