Professional Documents

Culture Documents

Financial Assets PDF

Financial Assets PDF

Uploaded by

Mika0 ratings0% found this document useful (0 votes)

42 views20 pagesOriginal Title

financial assets.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

42 views20 pagesFinancial Assets PDF

Financial Assets PDF

Uploaded by

MikaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 20

FINANCIAL ASSETS

* Cash

»* A contractual right to receive cash or any other

financial asset from another entity

>¢ A contractual right to exchange financial instruments

under favorable conditions, and

of An equity instrument of another entity

CASH AND CASH EQUIVALENT.

1

Prrataenrtt rachis aut katie:

also those that are acceptable by bank

for deposit or immediate encashment

Eee ae te eral a evi

Mice cella eke ALCS

Hmuele ke eculs Anu tee ict re

current exchange rate

Peete eh emis

revenue-earning investment

deposits in foreign investment which

are subject to foreign exchange

restriction, if material, should be

ari mre aeuu tnt)

Ulelate geste areas Corll Meg -Mc=teg (ad (og)

clearly indicated

7S) dat

CeeC ey Marlies

Cec MME LiL

Prt t)

Cash fund - cash set aside for

Current purposes such as petty cash

nC mi tec

PETTY CASH FUND

money set aside to pay small

Certs

two methods of handling:

Mem em CCl

b. Fluctuating fund system

undeposited cash

cash deposited in

Jie nestles jaeeaeall

Nia he =

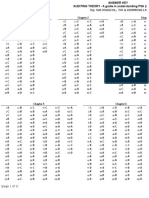

Bank Reconciliation

Balance per book:

Unadjusted balance per book ox

Add: Collected Note Recaiae 1K

Less: NSF

Service Charge ee (00)

AddiLess: Errors 00

‘Adjusted balance per book 2x

date

of acquisition Balance per bank:

Unadjusted balance per bank 10K

Separate line item Add: Deposit in Transit XK

Less: Outstanding Checks (om)

AddiLess: Errors ou

‘Adjusted balance per bank KK

AAA AAAS

TRADE WY) Us ua, yi REGEIVAB:

ACCOUNT RECEIVABLE

- IS AN OPEN ACCOUNT NOT SUPPORTED BY A PROMISSORY NOTE

~ RECOGNIZED INITIALLY AT FAIR VALUE PLUS TRANSACTION

COSTS THAT ARE DIRECTLY ATTRIBUTABLE TO THE ACQUISITION

- SUBSEQUENTLY MEASURED AT NET REALIZABLE VALUE OR

ESTIMATED RECOVERABLE AMOUNT

DEDUCTIBLES:

Y ALLOWANCE FOR FREIGHT CHARGE

v ALLOWANCE FOR SALES RETURN

Y ALLOWANCE FOR SALES DISCOUNT

Y ALLOWANCE FOR DOUBTFUL ACCOUNTS

JUNIOR PHILIPPINE INSTITUTE OF ACCOUNTANTS ~ Co @.PiAHAU SOURCE: INTERMEDIATE ACCOUNTING 1

HOLY ANGEL UNIVERSITY BY VALIK, 2019 EDITION AND IFRS.ORG

Forms Of Receivable Financing

accounts receivables are pledged as

tate ae g

ACCOUNTS collateral security for the payment of

RECEIVABLE the loan

the assignor (borrower) transfers rights to

some of the rights in AR to a lender called the ASSIGNMENT

assignee in consideration for a loan; evidenced (i ACCOUNTS

by a financing agreement and a promissory RECEIVABLE

note both of which the assignor assigns.

AUTEN Ug DISCOUNTING OF

ACCOUNTS RECEIVABLE | NOTES RECEIVABLE

factoring is a sale of ARona to discount the note the

without recourse, notification payee must endorse it: It

basis; factor assumes

responsibility for uncollectible ey DeMwien

factored accounts. In assignment,

assignor retains ownership of the With recourse - the payee

accounts assigned. must pay the bank if the

. maker (one liable) dishonors

Casual Factoring - normal the note

sale of accounts receivable, Without recourse - the

without other deductions payee avoids future liability

Factoring as a continuing even if the maker refuses to

Agreement - finance entitly pay the bank on the date of

purchases all of the accounts maturity

receivable of a certain entity

BIOLO: a Ory Vi Wy SETS

Pas 41 shall be applied to account for the biological assets,

agricultural produce, government grant related to a biological

asset when they relate to agricultural activity.

- shall be measured at cost less accumulated depreciation and

any accumulated impairment loss.

- the entity shall measure the biological asset at fair value less

costs to sell once the FV becomes clearly measurable.

, ;

ai Sie AG) 1 Uy Way

Tae a)

as BR ODI UG

i A is the harvested predict of an

are living ania entity's biological assets. In all

and plants cases, entity shall measure

agricultural produce at the

point of harvest at fair value

less cost to sell

Sw AGRICULTURAL ACTIVITY

management of an entity of the Lente transformation and

harvest of biological assets for sale or for conversion into

agricultural produce or into additional biological assets. Includes

raising livestock, annual or perennial cropping, cultivating,

floriculture. Harvesting from unmanaged sources, such as ocear

fishing and deforestation is not agricultural activity

\

\

JUNIOR PHILIPPINE INSTITUTE OF ACCOUNTANTS ic @uPIAKAU SOURCE: INTERMEDIATE ACCOUNTING 1

HOLY ANGEL UNIVERSITY BY VALIX, 2019 EDITION AND IFRS.ORG

Jal od

= y 77

TINANGIAL ASSETS Al

FAIR. VALUE

the price of an asset when sold in an

orderly transaction between market

participants at the measurement

date

INVESTMENT

are assets not directly identified with the

operating activities of an entity and occupy only

an auxiliary relationship to the central revenue

producing activities of the entity

Purposes of vestments

+ Accretion of wealth

- Capital appreciation

* Ownership control

+ Meeting business requirements

* Protection (e.g. interest in life

insurance)

iN iy

y

JUNIOR PHILIPPINE INSTITUTE OF ACCOUNTANTS > evriaiay _SOURCE:INTERMEDIATE AceOUKTING

HOLY ANGEL UNIVERSITY: BY VALIX, 2019 EDITION AND IFRS.ORG-

NON FINANCIAL ASSETS

* Intangible assets

* Physical assets (Inventories and PPEs)

> Prepaid expenses

> Leased assets

WWE MAO) aL)

ECE RW Me Geer CHUM

ordinary course of business, in the

PSs eee Ch mele ir L a

the form of materials or supplies to be

consumed in the production process or in

Rett ee la ( ty

TOTAAL Re

FOB Destination - seller owns the goods in transit;

seller is responsible for freight charges

FOB Shipping Point - buyer owns the goods in

transit; buyer is responsible for freight

Cd OT oe ag a SDE ae ee 7 Prt ea sus mL

Pree ose sa Oa een PCat)

WPA a oat ea eS

Freight prepaid - freight is paid by the seller

Freight collect - freight is paid by the buyer

CONSIGNMENT

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CPAR AFAR 2016FirstPBDocument29 pagesCPAR AFAR 2016FirstPBMikaNo ratings yet

- 1stPB Afar10.17Document12 pages1stPB Afar10.17MikaNo ratings yet

- Resa AfarDocument14 pagesResa AfarMika100% (1)

- Resa Afar Final PB 2017 With AnswersDocument26 pagesResa Afar Final PB 2017 With AnswersMikaNo ratings yet

- Afar FPB May 2017Document36 pagesAfar FPB May 2017MikaNo ratings yet

- Cpar Manila Gross Income With AnswersDocument9 pagesCpar Manila Gross Income With AnswersMikaNo ratings yet

- 1CRCA 1stPB AFARDocument24 pages1CRCA 1stPB AFARMikaNo ratings yet

- AfarDocument16 pagesAfarMikaNo ratings yet

- Crc-Ace Afar Summary Quizzer 2 2016 Inc AnswersDocument10 pagesCrc-Ace Afar Summary Quizzer 2 2016 Inc AnswersMikaNo ratings yet

- Mas Formulas PDFDocument9 pagesMas Formulas PDFMikaNo ratings yet

- Auditing Theory Salosagcol Summary Auditing Theory Salosagcol SummaryDocument33 pagesAuditing Theory Salosagcol Summary Auditing Theory Salosagcol SummaryMikaNo ratings yet

- GOODLUCK CPA!! - , CPA: Financial Accounting and Reporting " Must Review "Document21 pagesGOODLUCK CPA!! - , CPA: Financial Accounting and Reporting " Must Review "MikaNo ratings yet

- Solman Audtheo Salosagcol 2014 PDFDocument4 pagesSolman Audtheo Salosagcol 2014 PDFMikaNo ratings yet

- Cpar Tax Estate, Trust, Fringe, Gross Income PDFDocument15 pagesCpar Tax Estate, Trust, Fringe, Gross Income PDFMikaNo ratings yet

- Baybayin PDFDocument29 pagesBaybayin PDFMikaNo ratings yet

- Mas Summary 50 Pages PDFDocument50 pagesMas Summary 50 Pages PDFMikaNo ratings yet

- Oblicon Summary PDFDocument21 pagesOblicon Summary PDFMikaNo ratings yet

- Cpar Far MCQ PDFDocument36 pagesCpar Far MCQ PDFMikaNo ratings yet