Professional Documents

Culture Documents

Transfer and Donors Tax PDF

Transfer and Donors Tax PDF

Uploaded by

Mika0 ratings0% found this document useful (0 votes)

2 views22 pagesOriginal Title

transfer and donors tax.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

2 views22 pagesTransfer and Donors Tax PDF

Transfer and Donors Tax PDF

Uploaded by

MikaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 22

TRANSFER TAXES

ESTATE TAX

THE LAW THAT GOVERNS THE IMPOSITION OF ESTATE TAX

It is a well-settled rule that estate taxation is governed by the statute

in force at the time of death of the decedent. The estate tax accrues as of

the death of the decedent and the accrual of the tax is distinct from the

obligation to pay the same. Upon the death of the decedent, succession

takes place and the right of the State to tax the privilege to transmit the

estate vests instantly upon death.

ESTATE TAX

a 0 eS

Rate Graduated 5%-20% on thene! 6% based on the net value of

Valve of the estate the estate

Deductions

Family Home 1M 10M

Stondard IM 5M

Funeral Expenses 5% of Gross Estate > 200K none

Judicial Expenses allowed none

Medical Expense 00K none

Time of Filing 6 months from date of death —_—_‘| year from date of death

Payment by installments No provisions 2years in cose of insufficient

cash without civil penalty &

interest

CPA Certification 2M 5M

Withdrawal on deposits of none 6% Final Tax

decedent

Notice of Death Within 2 months repeaied

ESTATE TAX

RATE OF ESTATE TAX

The transfer of the net estate of every decedent, whether resident or non-

resident of the Philippines, as determined in accordance with the NIRC, shall be

subject to an estate tax at the rate of six percent (6%).

ESTATE TAX

What are included in gross estate?

For resident alien decedents/citizens:

a) Real or immovable property, wherever located

b) Tangible personal property, wherever located

c) Intangible personal property, wherever located

For non-resident decedent/non-citizens:

a) Real or immovable property located in the Philippines.

b) Tangible personal property located in the Philippines

¢) Intangible personal property - with a situs in the Philippines

ESTATE TAX

What are excluded from gross estate?

» GSIS proceeds/ benefits

» Accruals from SSS

» Proceeds of life insurance where the beneficiary is imevocably appointed

» Proceeds of life insurance under a group insurance taken by employer (not taken out upon his

life)

» War damage payments

» Transfer by way of bona fide sales

» Transfer of property to the National Government or to any of its political subdivisions

» Separate property of the surviving spouse

» Properties held in trust by the decedent

ESTATE TAX

What will be used as basis in the valuation of property?

» The properties subject to Estate Tax shall be appraised based on its fair

market value at the time of the decedent's death.

» The appraised value of the real estate shall be whichever is higher of the fair

market value, as determined by the Commissioner (zonal value) or the fair

market value, as shown in the schedule of values fixed by the Provincial or

City Assessor.

» If there is no zonal value, the taxable base is the fair market value that

appears in the latest tax dectaration.

» If there is an improvement, the value of improvement is the construction cost

per building permit or the fair market value per latest tax declaration

ESTATE TAX

What are the allowable deductions for Estate Tax Purposes?

For a citizen or resident alien

1, Standard deduction — A deduction in the amount of Five Million Pesos (P5,000,000.00) shall be allowed

as an additional deduction without need of substantiation.

2. Claims against the estate,

3. Claims of the deceased against insolvent persons where the value of the decedent's interest therein is

included in the value of the gross estate

4. Unpaid mortgages, taxes and casualty losses

5. Property previously taxed

6. Transfers for public use

7. The family home - fair market value but not to exceed P10,000,000.00

8. Amount received by heirs under Republic Act No. 4917

Net share of the surviving spouse in the conjugal partnership or community property

ESTATE TAX

What are the allowable deductions for Estate Tax Purposes?

For a non-resident alien

1, Standard deduction - P500,000.00

2. Proportion of the following deductions

a, Claims against the estate,

b. Claims of the deceased against insolvent persons where the _ value of the

decedent's interest therein is included in the value of the gross estate

c. Unpaid mortgages, taxes and casualty losses

3. Property previously taxed

4, Transfers for public use

Net share of the surviving spouse in the conjugal partnership or community

property

ESTATE TAA

CITIZEN OR RESIDENT

Gross estate: Conjugal Exclusive Total

Less:

Rea! property

Personal property

Deductions:

Standard deduction (P5 M)

Glsiny cgcins! he estate debt instrument wes netarized: statement showing disposition of proceeds of

Claims of the deceased against insolvent persons

Unpaid morigages. taxes ond casualty losses

Properties previous'y faxed [vanishing deduction)

Transters for public use

Family home (not to exceed P10 M)

‘Amount received by heirs under RA 4917, provided such amount is included in gross estate of decedent

Shore of the surviving spouse (50% of net conjugal estate)

Net Taxable Estate

@ Estate tax (6%)

ESTATE TAA

NON RESIDENT

Gross estate: Conjugal = Exclusive Total

Real property

Personal properly

less: Deductions:

Standard deduction (P500 K)

Proportion of the follawing:

+ Glgims agains! tne estate. deb} instrument was potorized: statement showing disposition of proceeds of

+ Cloims of the deceased against insolvent persons

+ Unpaid mortgages. taxes and casually losses

Properties previously toxed (vanishing deduction)

Transfers for public use

Shore of the surviving spouse (50% of net conjugal estate)

Net Taxable Estate

+ Estate tax (6%)

ESTATE TAX

When to file and pay?

File estate tax return and pay tax within one (1) year from date of

death.

How about installment Payments?

If case the available cash of the estate is insufficient to pay the total

estate tax due, payment by installment shall be allowed within to (2) years

from the statutory date forits payment without civil penalty and interest.

When is CPA Certification required?

If gross estate exceeds P5 million, attach to estate taxreturn a

certified statement of assets and itemized deductions.

ESTATE TAX

+ Tax clearance is required before any transfer of shares may be made in the

name of new owners, however,

+ Ifa bank has knowledge of the death of a person, who maintained a bank

deposit account alone, or jointly with another, it shall allow any withdrawal

from the said deposit account, subject toa final withholding tax of six

percent (6%), without such certification from the CIR.

DONOR'S TAX

Rate

Relative Graduated 2%- 15% 6%

First P100,000 of net giftisexempt —P250,000-Exempt

2% on P100,001 to P200,000

15% on omount over P10 M

‘Stranger 30% 6%

Exemption

Dowries or gifts on. allowed none

account of mariage

DONOR’S TAX

THE LAW THAT GOVERNS THE IMPOSITION OF DONOR'’S TAX

» The donor’s tax is not a property tax, but is a tax imposed on the transfer of property by way of gift inter

vivos. (Lladoc vs. Commissioner of Internal Revenue, L-19201, June 16, 1965, 14 SCRA, 292)

» The donor's tax shall not apply unless and until there is a completed gift. The transfer of property by gift is

perfected from the moment the donor knows of the acceptance by the donee: it is completed by the delivery,

cither actually or constructively, of the donated property to the donee.

> Thus, the law in force at the time of the perfection/completion of the donation shall govern the imposition of

the donor's tax.

DONOR’S TAX

Donations or gifts with at least P250,000 worth will be

charged a donor’s tax of 6% flat rate. This will be charged

regardless of the relationship between the donor and the donee.

DONOR’S TAX

TRANSFER FOR LESS THAN ADEQUATE AND FULL CONSIDERATION

Where property, other than real property referred to in Section 24(D), is transferred for

less than an adequate and full consideration in money or money's worth, then the amount

by which the fair market value of the property exceeded the value of the consideration

shall, for the purpose of the tax imposed, be deemed a gift, and shall be included in

computing the amount of gifts made during the calendar year: Provided, however, that a

sale, exchange, or other transfer of property made in the ordinary course of business (a

transaction which is a bona fide, at arm’s length, and free from any donative intent) will be

considered as made for an adequate and full consideration in money or money’s worth.

DONOR’S TAX

EXEMPTION OF CERTAIN GIFTS;

» Gifts Made by a Resident or by a Nonresident not a Citizen of the Philippines

» Gifts made to or for the use of the National Government or any entity created by any of its agencies

which is not conducted for profit, or to any political subdivision of the said Government; and

» Gifts in favor of an educational and/or charitable, religious, cultural or social welfare corporation,

institution, accredited nongovernment organization, trust or philanthropic organization or research

institution or organization:

SAMPLE COMPUTATION

ILLUSTRATION:

DONATIONS MADE ON:

JANUARY 30, 2018 — P2,000,000

MARCH 30, 2018 = — 1,000,000

AUGUST 15, 2018 = 500,000

SOLUTION/COMPUTATION:

DATE OF DONATION AMOUNT

1. JANUARY 30, 2018 P2,000,000

JANUARY 30, 2018 DONATION

LESS: EXEMPT GIFT

a

2,000,000

250,000

1,750,000

DONOR’S TAX

P_ 105,000

Continuation...

DATE OF DONATION AMOUNT DONOR'S TAX

2. MARCH 30, 2018 1,000,000

MARCH 30, 2018 DONATION 1,000,000

ADD: JANUARY 30, 2018 DONATION 2,000,000

LESS: EXEMPT GIFT 250.000)

TOTAL 2,750,000

‘TAX DUE THEREON 165,000

LESS: TAX DUE/PAID ON JANUARY DONATION 105,000

TAX DUE/PAYABLE ON THE MARCH DONATION P 60,000

a

Continuation...

DATE OF DONATION AMOUNT DONOR'S TAX

3. AUGUST 15,2018 500,000.

AUGUST 15, 2018 DONATION 500,000

ADD: JANUARY 2018 DONATION 2,000,000

MARCH 2018 DONATION 1,000,000

LESS: EXEMPT GIFT (250,000)

TOTAL 3.250.000

TAX DUE THEREON 195,000

LESS: TAX DUE/PAID ON JAN/MARCH DONATION 165,000

TAX DUE/PAYABLE ON THE AUGUST DONATION P 30,000

a

You might also like

- 98 Instructions FSTDocument3 pages98 Instructions FSTChristopher Dunlap97% (31)

- The Book on Advanced Tax Strategies: Cracking the Code for Savvy Real Estate InvestorsFrom EverandThe Book on Advanced Tax Strategies: Cracking the Code for Savvy Real Estate InvestorsRating: 4.5 out of 5 stars4.5/5 (3)

- Probate Made Simple: The essential guide to saving money and getting the most out of your solicitorFrom EverandProbate Made Simple: The essential guide to saving money and getting the most out of your solicitorNo ratings yet

- Estate TaxDocument15 pagesEstate TaxDustin PascuaNo ratings yet

- Higher Education Department: Maryhill College, IncDocument4 pagesHigher Education Department: Maryhill College, Incpat patNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Property & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsFrom EverandProperty & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”From Everand2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”No ratings yet

- Crypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationFrom EverandCrypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Our Future in Danger? Agenda 2030: The truth about The Great Reset, WEF, WHO, Davos, Blackrock, and the G20 globalist future Economic Crisis - Food Shortages - Global HyperinflationFrom EverandOur Future in Danger? Agenda 2030: The truth about The Great Reset, WEF, WHO, Davos, Blackrock, and the G20 globalist future Economic Crisis - Food Shortages - Global HyperinflationNo ratings yet

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksFrom EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksNo ratings yet

- The Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceFrom EverandThe Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceNo ratings yet

- JK Lasser's New Rules for Estate, Retirement, and Tax PlanningFrom EverandJK Lasser's New Rules for Estate, Retirement, and Tax PlanningNo ratings yet

- The King Takes Your Castle: City Laws That Restrict Your Property RightsFrom EverandThe King Takes Your Castle: City Laws That Restrict Your Property RightsNo ratings yet

- Unclaimed Money - Step by Step Guide how you claim your moneyFrom EverandUnclaimed Money - Step by Step Guide how you claim your moneyNo ratings yet

- Fixing Everything: Government Spending, Taxes, Entitlements, Healthcare, Pensions, Immigration, Tort Reform, Crime…From EverandFixing Everything: Government Spending, Taxes, Entitlements, Healthcare, Pensions, Immigration, Tort Reform, Crime…No ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Overcoming Delinquent Property Taxes A Complete Guide to Resolving Tax Debt and Protecting Your PropertyFrom EverandOvercoming Delinquent Property Taxes A Complete Guide to Resolving Tax Debt and Protecting Your PropertyNo ratings yet

- Estate Planning and Administration: How to Maximize Assets, Minimize Taxes, and Protect Loved OnesFrom EverandEstate Planning and Administration: How to Maximize Assets, Minimize Taxes, and Protect Loved OnesNo ratings yet

- Administering the California Special Needs Trust: A Guide for Trustees and Those Who Advise ThemFrom EverandAdministering the California Special Needs Trust: A Guide for Trustees and Those Who Advise ThemRating: 5 out of 5 stars5/5 (1)

- SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower AwardFrom EverandSEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower AwardNo ratings yet

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012From EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No ratings yet

- A Stiptick for a Bleeding Nation A safe and speedy way to restore publick credit, and pay the national debtsFrom EverandA Stiptick for a Bleeding Nation A safe and speedy way to restore publick credit, and pay the national debtsNo ratings yet

- Find Your Freedom: Financial Planning for a Life on PurposeFrom EverandFind Your Freedom: Financial Planning for a Life on PurposeRating: 5 out of 5 stars5/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- MASS SPECC Annual Report PDFDocument66 pagesMASS SPECC Annual Report PDFDustin PascuaNo ratings yet

- Train Law - ESTATE TaxationDocument4 pagesTrain Law - ESTATE TaxationDustin PascuaNo ratings yet

- Client Name: Believer Trading Corporation Date: 8 January 2018Document3 pagesClient Name: Believer Trading Corporation Date: 8 January 2018Dustin PascuaNo ratings yet

- The Audit Plan For London Borough of Lewisham Pension Fund: Year Ended 31 March 2017Document15 pagesThe Audit Plan For London Borough of Lewisham Pension Fund: Year Ended 31 March 2017Dustin PascuaNo ratings yet

- STAMPS Office AssignmentsDocument1 pageSTAMPS Office AssignmentsDustin PascuaNo ratings yet

- CC - 79!3!4 en FinalDocument21 pagesCC - 79!3!4 en FinalDustin PascuaNo ratings yet

- Alpine Shire Council Strategy Doc 2016 FINALDocument10 pagesAlpine Shire Council Strategy Doc 2016 FINALDustin PascuaNo ratings yet

- Differential Analysis Solution To MAS by Roque PDFDocument11 pagesDifferential Analysis Solution To MAS by Roque PDFDustin PascuaNo ratings yet

- Fund and Other InvestmentDocument1 pageFund and Other InvestmentAllen Lacap MedinaNo ratings yet

- CBDT E-Receipt For E-Tax PaymentDocument1 pageCBDT E-Receipt For E-Tax PaymentSreedhar RaoNo ratings yet

- 86d5d10 2149smartDocument1 page86d5d10 2149smartShailesh JainNo ratings yet

- Payslip 2022 2023 9 Inf0047318 ISSINDIADocument1 pagePayslip 2022 2023 9 Inf0047318 ISSINDIAManohar NMNo ratings yet

- 2020 WB 3309 GreenTraderTax HighlightsFromGreens2020TraderTaxGuideDocument53 pages2020 WB 3309 GreenTraderTax HighlightsFromGreens2020TraderTaxGuideChrisMNo ratings yet

- Time For The Income-Tax Act, 1961: Subiect: Extension of Lines Electronic Filing of Various Fomms UnderDocument3 pagesTime For The Income-Tax Act, 1961: Subiect: Extension of Lines Electronic Filing of Various Fomms UnderRambabu TatikondaNo ratings yet

- Screenshot 2023-08-19 at 1.54.03 PMDocument3 pagesScreenshot 2023-08-19 at 1.54.03 PMsL readNo ratings yet

- Taxguru - In-Dual GST Model GST Structure in IndiaDocument9 pagesTaxguru - In-Dual GST Model GST Structure in IndiahumanNo ratings yet

- Federal Democratic Republic of Ethiopia Ethiopian Revenue and Customs AuthorityDocument1 pageFederal Democratic Republic of Ethiopia Ethiopian Revenue and Customs Authorityashe100% (1)

- Zudio Bill28 NovDocument4 pagesZudio Bill28 Novsachin gautamNo ratings yet

- Room 206Document2 pagesRoom 206Hotel EkasNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- SalariesDocument6 pagesSalariesrichaNo ratings yet

- Module 3Document5 pagesModule 3sheldonNo ratings yet

- Education Authority PunjabDocument1 pageEducation Authority PunjabMuhammad JamilNo ratings yet

- Tax Invoice Sulemaan Sayyedshaikh: Pay BillDocument3 pagesTax Invoice Sulemaan Sayyedshaikh: Pay Billsia hairnbeautyNo ratings yet

- Selina Solution Concise Maths Class 10 Chapter 1Document13 pagesSelina Solution Concise Maths Class 10 Chapter 1honeyrani6d16No ratings yet

- GST Case StudyDocument2 pagesGST Case Studyvishnu bhadauriaNo ratings yet

- Credit Note: Reconnect Energy Solutions Pvt. LTDDocument1 pageCredit Note: Reconnect Energy Solutions Pvt. LTDVindyanchal KumarNo ratings yet

- Part 1-Donor'S TaxDocument2 pagesPart 1-Donor'S TaxAllen KateNo ratings yet

- Festival Advance For 37 Employees Working in Thiruvaiyaru (H), C&M Sub-DivisionDocument2 pagesFestival Advance For 37 Employees Working in Thiruvaiyaru (H), C&M Sub-DivisionThiruvaiyaru HighwaysNo ratings yet

- RPT Statement of AccountDocument1 pageRPT Statement of AccountFretzie QuinaleNo ratings yet

- Taxation During Commonwealth PeriodDocument18 pagesTaxation During Commonwealth PeriodLEIAN ROSE GAMBOA100% (2)

- طرق قياس النشاط الاقتصادي 1Document7 pagesطرق قياس النشاط الاقتصادي 1MassilNo ratings yet

- PROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-231Document3 pagesPROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-2312022107419No ratings yet

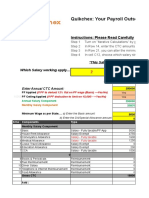

- Quikchex CTC Calculator AprilDocument8 pagesQuikchex CTC Calculator Aprilravipati46No ratings yet

- Invoice AYAS21220001204Document1 pageInvoice AYAS21220001204Varun RameshNo ratings yet

- ProformaDocument2 pagesProformaWORLD STARNo ratings yet