Professional Documents

Culture Documents

Comprehensive Details - 2015-Dec-31 PDF

Comprehensive Details - 2015-Dec-31 PDF

Uploaded by

julian montejoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comprehensive Details - 2015-Dec-31 PDF

Comprehensive Details - 2015-Dec-31 PDF

Uploaded by

julian montejoCopyright:

Available Formats

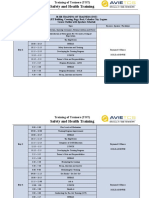

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

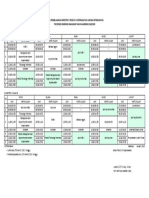

Comprehensive Program Details for Saturday, January 23, 2016

Group Leader Registration 11:00 - 3:30 PM

Tata Hall Program Office

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Sunday, January 24, 2016

Group Leaders Meeting 9:00 - 2:00 PM

Tata Hall 200

First Year Registration 11:00 - 12:00 PM

Tata Hall Program Office

First Year Orientation Meeting 12:00 - 2:00 PM

Tata Hall 100

General Registration 12:00 - 3:00 PM

Tata Hall Program Office

Study Group Meetings 3:30 - 4:45 PM

Living Group Lounges

Opening Session: The State of the World 5:00 - 6:15 PM

Aldrich Hall 112

Instructor: Rawi Abdelal

Dinner 6:30 - 8:00 PM

Living Group Lounges

Study Group Meetings 8:30 - 11:00 PM

Living Group Lounges

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

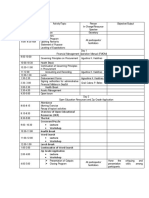

Comprehensive Program Details for Monday, January 25, 2016

Breakfast 7:00 - 8:30 AM

Crimson Commons

Change Management – Why do bad things happen to good leaders? 8:45 - 10:05 AM

Tata Hall 100

A

Instructor: Das Narayandas

Materials: Ron Johnson (516016)

Assignment: In April 2013, Ron Johnson (HBS '84) stepped down after just 18 months as CEO of J.C. Penney. In his brief tenure,

Johnson, an acclaimed retailer respected for his innovation and success in shaping the retail image at Target and

Apple, introduced dramatic departures from J.C. Penney's traditional retail approach, and enacted changes quickly

and simultaneously, with little market testing. Over Johnson's final 12 months as CEO, J.C. Penney shares dropped

more than 50%. The case describes the environments at Target, Apple, and J.C. Penney during Johnson's tenure

and how his experiences may have shaped the strategies that he implemented while CEO at J.C. Penney.

The case traces Ron Johnson's journey through 3 firms. The objective of doing this case is to give us a chance to

reflect on what makes leaders successful and when do leaders fail.

STUDY QUESTIONS:

1. Would you have been able to predict the outcome in JCP? If yes, how? If not, why not?

2. Was Ron Johnson a good hire at JCP? IF yes, why yes? If not, why not?

3. Why was Ron Johnson successful at Target? At Apple?

4. Do you agree with how Ron Johnson introduced change in JCP? If yes, why yes? If no, what would you have

done differently?

5. What are your key takeaways from this case?

Break 10:05 - 10:30 AM

Tata Hall Atrium

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Monday, January 25, 2016 (Continued)

Failing to Scale 10:30 - 11:50 AM

Tata Hall 100

A

Instructor: Ranjay Gulati

Materials: Micromax (415034)

Assignment: Many entrepreneurial ventures fail not because of an inability to attract customers, but because of their failure to

evolve their organizations. In this session we will discuss the Micromax case to elaborate on challenges fast growth

organizations face as they grow. We will end with a short lecture that discusses some of the best practices among

those ventures that break away and achieve fast growth.

Discussion Questions

1. Evaluate Micromax’s progress in developing into a mature company. What are the most critical gaps? Which of

these needs to be addressed first, and why?

2. Why did the professionals have difficulty integrating into Micromax? Is there anything that they could have done

to make the transition smoother? Was there anything the founders or others in the company could have done to

assist them?

3. As the Micromax case illustrates, fast-growing companies often face a tradeoff between the need to get things

done quickly and the importance of developing processes and systems. In your opinion, how can companies best

strike a balance between these two opposing demands? Discuss specific steps that Micromax could take to recover

this balance.

4. Should the founders continue to run Micromax as they had since Mehrotra resigned? Or should they hire a new

professional CEO from the outside? If they took this route, what is required to make the relationship work?

Lunch 12:00 - 1:30 PM

Crimson Commons

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Monday, January 25, 2016 (Continued)

Rent the Runway 1:45 - 3:05 PM

Tata Hall 100

A

Instructor: Tom Nicholas

Materials: Rent the Runway (812077)

Assignment: The case describes the early decisions of the cofounders of Rent the Runway (RTR), a website that rents designer

dresses. After deciding to pursue the idea of developing a website to rent designer dresses, Jenny Fleiss has to

select a cofounder, validate the business model, assemble a team to execute the idea, raise capital and launch the

service. At the end of the case the cofounders are debating whether to grow their startup at a measured pace and

focus on improving operational effectiveness, or raise a new round of venture capital sooner than originally planned.

Raising more venture capital would allow RTR to aggressively expand its inventory and customer acquisition efforts,

in order serve a broader range of customer segments with a wider selection of products, including accessories and

even maternity wear. The case permits an examination of hypothesis driven entrepreneurship, illuminating the

choices and action steps actually taken and the plausible alternate approaches that might have been less risky or

more effective.

Study Questions:

1. Create a timeline of decisions and actions undertaken by Rent the Runway’s cofounders. Pay particular attention

to:

● How they structured the founding team and the extended management team,

● How they pursued discussions with designers,

● How they conducted multiple trunk shows

● Their decision to launch the service in December.

Do you agree with the decision to pursue each action? Which actions were important in validating business model

hypotheses and refining the concept? Can you suggest different actions that the cofounders should have taken?

2. As the case ends in January 2010, the cofounders are considering whether to: (1) stick with their original plan to

pursue operational improvements in 2010 before raising more capital in early 2011 or (2) accelerate fundraising in

order to expand inventory and product range, enabling RTR to serve a broader set of customer segments and usage

occasions. What would you do about this decision?

Class Photo 3:15 - 3:25 PM

Baker Library Steps

Reception 5:45 - 6:30 PM

Tata River View Lounge

Description For those of you who have a faculty reception this evening, you have received the living group location for your

reception. If you need any assistance or have any questions, please stop by the program office and we can direct

you.

For those of you who do not have a faculty reception this evening, please join us for a reception in the Tata River

View Lounge (2nd floor of Tata).

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Monday, January 25, 2016 (Continued)

Dinner 6:30 - 8:00 PM

Crimson Commons

Study Group Meetings 8:30 - 11:00 PM

Living Group Lounges

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Tuesday, January 26, 2016

Breakfast 7:00 - 8:30 AM

Crimson Commons

Leading from Within 8:45 - 10:05 AM

Tata Hall 100

A

Instructor: Ranjay Gulati

Materials: The Focused Leader (R1312B)

The Right Mindset for Success

Assignment: This lecture will focus on the inner journey of leadership. We will examine how leaders not only manage others

around them but also themselves. Using illustrative cases and recent research we will discuss how outstanding

leaders are equally adept at managing others as they are themselves.

Break 10:05 - 10:30 AM

Tata Hall Atrium

Dogfight Over Europe: Ryanair 10:30 - 11:50 AM

Tata Hall 100

A

Instructor: Jan Rivkin

Materials: Dogfight over Europe - Ryanair (A) (700115)

Assignment: As this case opens, two Irish brothers announce that their small, new airline will soon begin to fly passengers

between Dublin and London. For the first time, the brothers will face large competitors such as Aer Lingus and British

Airways on a major route. Will the young venture succeed?

Assignment questions:

1. What is your assessment of Ryanair’s launch strategy?

2. How do you expect Aer Lingus and British Airways to respond? Why?

An additional question may help you approach the first two questions:

3. How costly would it be for Aer Lingus and British Airways to retaliate against Ryanair’s launch rather than

accommodate it?

Lunch 12:00 - 1:30 PM

Crimson Commons

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Tuesday, January 26, 2016 (Continued)

Germany and the Future of Europe 1:45 - 3:05 PM

Tata Hall 100

A

Instructor: Rawi Abdelal

Materials: The German Export Engine (715045)

Assignment: In spring of 2015, Germany’s chancellor Angela Merkel had logged significant successes. Germany was one of the

largest exporters in the world, had maintained low unemployment through the 2008 financial crisis, and was gradually

reforming its welfare state to meet future pension liabilities. Yet it still faced considerable challenges. Within Europe,

the Eurozone financial crisis continued to hold down economic growth, and the burden of leadership to find a solution

seemed to fall on Merkel’s shoulders. Beyond the bounds of the European Union, Russian interventions in Ukraine

worried European leaders, who both wished to punish the Putin regime but also relied heavily on Russia for energy.

Could Germany sustain its recent economic success, while also saving Europe?

Assignment Questions

1. What is the source of Germany’s export success?

2. Evaluate Germany’s response to the Eurozone

Break 3:05 - 3:30 PM

Tata Hall Atrium

The Deeport Negotiation 3:30 - 4:50 PM

Assigned Meeting Location

A

Instructor: Guhan Subramanian

Assignment: This six-party negotiation exercise (based on a real situation) involves the negotiation of a public-private development

project. Confidential instructions will give you important information about your priorities, resources, and needs. After

reading these instructions, think about your strategy and how you will implement it at the bargaining table. In your

negotiation, you may disclose as much or as little information as you see fit, but please do not exchange your

confidential information sheets either during the negotiation or afterward.

Instructions:

● Your Group Leader will distribute your confidential role assignment upon arrival at HBS.

● Please come to the Tata atrium 10 minutes before the scheduled class time to find your assigned negotiation

group and meeting location (on whiteboards and at the program office).

● Then head straight to your assigned meeting location (there is no need to go to the classroom) and once all

parties are present begin the negotiation exercise.

● Please ensure all results sheets are returned to the program office within 10 minutes of the class end time.

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Tuesday, January 26, 2016 (Continued)

Reception 5:45 - 6:30 PM

Spangler Center Williams Room

Description For those of you who have a faculty reception this evening, you have received the living group location for your

reception. If you need any assistance or have any questions, please stop by the program office and we can direct

you.

For those of you who do not have a faculty reception this evening, please join us for a reception in the Spangler

Williams Room.

Dinner 6:30 - 8:00 PM

Spangler Center Williams Room

Study Group Meetings 8:30 - 11:00 PM

Living Group Lounges

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Wednesday, January 27, 2016

Breakfast 7:00 - 8:30 AM

Crimson Commons

Netflix in 2011 8:45 - 10:05 AM

Tata Hall 100

A

Instructor: Jan Rivkin

Materials: Netflix in 2011 (615007)

Assignment: In the emerging video-on-demand business, CEO Reed Hastings would like Netflix to reproduce the enormous

success it enjoyed in the DVD rental industry. But he knows that, to the contrary, the company might fail as its old

rival Blockbuster did in DVD rentals.

Assignment questions:

1. Why was Netflix so successful in the DVD rental business? Why was its service attractive to customers and

profitable?

2. Why was Blockbuster so unsuccessful in responding to Netflix?

3. What are Netflix’s strategic options in the video-on-demand business? Which option should it pursue and why?

Break 10:05 - 10:30 AM

Tata Hall Atrium

Leading, Designing and Aligning Organizations 10:30 - 11:50 AM

Tata Hall 100

A

Instructor: Boris Groysberg

Materials: MOD Pizza - A Winning Recipe (416004)

Assignment: 1. How are Scott and Ally Svenson trying to create value at MOD Pizza?

2. What strikes you as distinctive about the product and service MOD Pizza offers, how the company operates, and

its employment practices?

3. What are the key challenges MOD Pizza is facing? If you were the Svensons, how would you prioritize those –

from the most pressing and important challenges to the least?

4. What advice would you give the Svensons about the challenges and opportunities at MOD Pizza and about their

leadership? Please devise an action plan. Please be specific.

Lunch 12:00 - 1:30 PM

Crimson Commons

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Wednesday, January 27, 2016 (Continued)

Self-Help the Roman Way 1:45 - 3:05 PM

Tata Hall 100

A

Instructor: Frances Frei

Instructor: Emma Dench

Materials: Valerius Maximus, Chapter 3 (Of Severity)

Valerius Maximus, Chapter 5 (Of Justice)

Valerius Maximus, Chapter 8 (Of the Fidelity of Slaves)

Valerius Maximus, Chapter 9 (Of Change of Character or Fortune)

Seneca, On Clemency, Book 1

Assignment: This year we introduced a new course to our MBA students that draws leadership lessons from ancient Rome. In an

effort to share this experience with YPOers we have selected the session from that course that we anticipate to be

most fruitful. The readings include chapters from two ancient texts (see below for detailed context to guide

preparation).

Please read:

● Valerius Maximus. Memorable Doings and Sayings (‘Of severity’, ‘Of justice’, ‘Of the fidelity of slaves’, and ‘Of

change of character or fortune’)

● Seneca, 'On Clemency' (Book 1).

Study Questions

1. What do you think of the Roman leadership therapies offered by Valerius Maximus and Seneca? Do you prefer one

to the other? Which would you expect to have been more effective in ancient times?

2. How (if at all) does a value like clemency or severity translate into our modern world?

3. Which anecdotes resonate for you and which surprise you? What lessons do you take for yourselves and your

organizations?

CONTEXT

In ancient times, how did Romans learn about leadership? In the aristocratic Roman Republic, the Roman people

favored electoral candidates from families that had produced consuls in the past, and boys and young men were

expected to gaze on the portraits of their ancestors that were displayed in their family’s entrance-hall, and be inspired

to follow in their footsteps. In addition, men did not normally embark on a political career until they were in at least

their late twenties, and would typically spend ten or more years as junior officers in the army before they did so. 42

was the minimum legal age for the consulship (not quite as old as you might think: if you made it past the perilous

years of infant and childhood illnesses in ancient Rome, and escaped death in battle, you could reasonably expect to

live into your 70’s or well beyond). Upper-class girls were ideally educated enough to run a household and make

intelligent dinner conversation, but not enough to be intellectually competitive.

The imperial system instituted by Augustus brought many changes. Compared with other ancient peoples, the

Romans became quite generous with their citizenship, so that freed slaves as well as some foreigners were granted

the Roman citizenship. These new citizens sometimes moved rapidly up the socio-economic ladder, and their sons or

grandsons made it into the top ranks of Roman society, becoming eligible to enter the senate. There was quite a bit of

turnover in the senate of the early Empire as many of the older aristocratic families died out, were killed off, or

withdrew from political life. The imperial system also put very young, inexperienced men in leadership roles, whether

that of the emperorship itself or that of the consulship or other high political office.

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Wednesday, January 27, 2016 (Continued)

Our readings (extracts from Valerius Maximus’ Latin ‘Memorable Doings and Sayings’, and Seneca’s Latin ‘On

Clemency’) directly reflect these changes. Valerius Maximus’ compendium provides ready to use examples of virtues

and vices to educate wealthy and ambitious young men from families that did not have famous ancestors of their own.

His compendium must have seemed daringly modern in its inclusion of women, slaves and foreigners amongst its

exemplary stories. These stories helped wealthy and ambitious young men with the rhetorical training that prepared

them for political life conducted in lawsuits and the senate. They also helped to socialize them by teaching them the

norms of Roman society, including some degree of moral complexity and a sense of changing values. To give

ourselves a taste of this work, we will read ‘Of severity’, ‘Of justice’, ‘Of the fidelity of slaves’, and ‘Of change of

character or fortune’.

Seneca was a philosopher who counseled the control of passions, the common humanity of mankind, including

slaves, and a good, self-directed life, endorsing withdrawal and even suicide when necessary to avoid life under

tyranny. He was the young emperor Nero’s tutor and mentor. ‘On Clemency’ is one of a series of lessons addressed

to the young Nero, in the hope that he would take to heart a valuable attribute for someone with a terrifying amount of

power. It is the original ‘mirror for a prince’, the direct ancestor of numerous early self-help treatises written for

powerful individuals.

STRUCTURE

Valerius Maximus, Memorable Doings and Sayings, Book 6.

Valerius Maximus generally introduces the virtue or vice, illustrates it with a number of domestic (Roman) examples,

and then sometimes with a number of ‘external’ (foreign) examples. It is thus a bit of a list, enlivened by theme and

authorial commentary (Valerius Maximus definitely has opinions!).

Chapter 3, ‘Of Severity’ (pages 29-43)

Chapter 5, ‘Of Justice’ (pages 53-65)

Chapter 8, ‘Of the Fidelity of Slaves’ (pages 75-83)

Chapter 9, ‘Of Change of Character or Fortune’ (pages 83-101).

Seneca, On Clemency Book 1

Ch. 1: taking stock of Nero’s power and responsibilities

Ch. 2-8: particular value of clemency for a ruler

Ch. 9-11:Seneca exhorts Nero to learn from example of Augustus

Ch. 12-13: rule by fear vs. rule by kindness

Ch. 14-18: ruling the empire compared with fatherhood/training animals/medicine/managing slaves

Ch. 19-26: clemency and its opposites; learning from bees (N.B. the Romans mistook the ‘queen’ bee for a ‘king’ bee)

Break 3:05 - 3:30 PM

Tata Hall Atrium

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Wednesday, January 27, 2016 (Continued)

Flipkart: Transitioning to a Marketplace Model 3:30 - 4:50 PM

Tata Hall 100

A

Instructor: Das Narayandas

Materials: Flipkart - Transitioning to a Marketplace Model (516017)

Assignment: Founded in 2007 as an online book retailer, Flipkart rapidly became one of the largest e-commerce players in India

valued at almost $15 billion. However, it faced intense competition from other e-commerce players like Amazon and

Snapdeal. Over the years Flipkart was slowly moving from an online retailer to a marketplace model and in early 2015

it made the strategic decision to accelerate this transition where it planned to attract over 100,000 sellers.

Discussion Questions:

1. Is the transition to a full marketplace model the right decision for Flipkart? What would it require to make this

strategy work?

2. Do you see a path to profitability for Flipkart? What should it do differently?

Reception 5:45 - 6:30 PM

Tata River View Lounge

Description For those of you who have a faculty reception this evening, you have received the living group location for your

reception. If you need any assistance or have any questions, please stop by the program office and we can direct

you.

For those of you who do not have a faculty reception this evening, please join us for a reception in the Tata River

View Lounge (2nd floor of Tata).

Dinner 6:30 - 8:00 PM

Off campus

Study Group Meetings 8:30 - 11:00 PM

Living Group Lounges

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Thursday, January 28, 2016

Breakfast 7:00 - 8:30 AM

Crimson Commons

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Thursday, January 28, 2016 (Continued)

Leading for Innovation: Leveraging Culture and Talent Management 8:45 - 10:15 AM

Tata Hall 100

A

Instructor: Boris Groysberg

Materials: Kvadrat - Leading for Innovation (413120)

Assignment: 1. What is Kvadrat’s source of competitive advantage? What is unusual about Kvadrat? How do the organizational

design, the corporate culture, and the human resources practices of Kvadrat support the firm’s value proposition?

What are the strengths and weaknesses of the company’s organizational design?

2. In your own words, how would you describe the culture of Kvadrat? How important is culture to Kvadrat? Is it

scalable and sustainable? What is the role of organizational culture, talent management system, and structure in

managing human capital at Kvadrat?

3. What are the challenges faced by the company?

4. What are the potential business model implications of expansion into Asia? How should they build up the retail

business? What actions are needed to accelerate growth in Soft cells? Does Kvadrat have the right structure and

customer segments to support its growth initiatives?

5. What should Anders Byriel do moving forward? If you were him, what would you do to ensure Kvadrat could grow

in a sustainable way? Please devise an action plan. Please be specific.

Building a Great Company Report:-

As part of the Young Presidents Organization Program, we are happy to generate again the “Building a Great

Company”

report for your company. Back by popular demand, this survey has been administered to groups of executives from

around the world over the course of the past several years, and time and again executives find that it is a valuable

and useful tool for them and their companies. The survey examines the factors that build a great company, and with

the survey results, executives will be able to gage how well their own organizations are doing relative to each factor.

The survey is designed to measure your company’s performance on important drivers from strategy to culture. The

output will be a confidential company report based on your and your colleagues’ ratings. Your company report will be

distributed during the YPO Program, and we will discuss what can be learned—from best practices to action plans

that you can implement when you leave the program.

This survey has been a huge success over the years, as it provides executives with actionable insights on the

opportunities and challenges facing their companies. Former participants have shared examples and stories of using

their individual company reports to make their organizations better in areas ranging from project team work, specific

challenges they faced, and even restructuring their business. They also used the data/analysis extensively in board

meetings and during strategy implementation.

PREPARATION:

You will receive an email with a unique link to the custom survey in early December. The survey will close at

midnight EST on Friday, December 18.

You will need to take this survey and to also distribute it to 10-20 senior executives at your company.

Obtaining multiple responses will allow you to truly capture your company’s performance, challenges and

opportunities. In the report, you will also be able to see how your company compares to the average of other

companies around the globe. (Please note: company names will be kept confidential and all data will be reported in

aggregate). Your company report will be distributed to you privately, so you and your team can discuss action plans

that you can implement to make your company better.

The survey should only take about 20 minutes to complete. If you run multiple companies or a private equity firm,

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Thursday, January 28, 2016 (Continued)

please choose one company on which to focus. Please note, participation in the survey is completely optional, and

you should only take it if you think it would be of value to you.

Break 10:15 - 10:30 AM

Tata Hall Atrium

A

Changes of Character or Fortune 10:30 - 11:50 AM

Tata Hall 100

A

Instructor: Frances Frei

Instructor: Emma Dench

Assignment: In this interactive lecture we will explore changes in fortune of organizations and individuals. Contexts include how

companies like The Container Store struggled after going public, how Whole Foods has struggled in the presence of

increased competition, and how Pill Pack has experienced dramatic growth in an otherwise stagnating industry. We

will also include changes of fortune at a more personal level.

Lunch 12:00 - 1:30 PM

Crimson Commons

Korea and the Transformation of the Asian Economic Landscape 1:45 - 3:05 PM

Tata Hall 100

A

Instructor: Rawi Abdelal

Materials: Korea (715047)

Assignment: In the 66 years from its founding in 1948, South Korea transformed itself from an impoverished, agrarian nation into a

hypermodern and prosperous society. Authoritarian governmental structures gave way to democracy, even as old‐

fashioned corporate governance structures persisted. Yet, with an aging population, and the totalitarian North Korean

government continuing to pursue its nuclear ambitions, past successes were no guarantee for the future.

Assignment Questions

1. How did South Korea become rich? What role, if any, did democratization play?

2. Can South Korea continue to grow?

3. Do the chaebols need to be reformed? If so, how? Can they reform themselves?

4. Is reunification with the North inevitable? Is it desirable?

Break 3:05 - 3:30 PM

Tata Hall Atrium

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Thursday, January 28, 2016 (Continued)

Elective 1: Replacing Yourself as CEO: You’re Probably Already Behind the Curve 3:30 - 4:50 PM

Tata Hall 100

Instructor: John Davis

Materials: Succession Planning Worksheet (899023)

Solve the Succession Crisis by Growing Inside-Outside Leaders (R0711E)

John Davis Bio

Assignment: The single most important question facing owners of companies and their boards is who should lead this company in

the future. Experience and recent studies indicate that successors coming from inside the organization usually

perform better, but not always. Should your successor be from your family or not? Should your successor come from

inside your or outside your organization? Each of these options has its own consequences and its own development

path. How do owners and boards make and guide this decision? How long in advance of succession do you need to

be planning to replace yourself? And what is your role in this process?

Study Q’s:

1. Under what circumstances would you look outside your company for your successor? Outside your family?

2. What are the characteristics of CEO successor candidates that you most want to see? What characteristics would

disqualify a candidate?

3. What programs does your company have in place today to develop and screen people who could be high-potential

candidates for the CEO position?

4. How do you support or get in the way of the CEO succession process at your company?

Elective 2: Indispensable Leadership 3:30 - 4:50 PM

Tata Hall 200

Instructor: Gautam Mukunda

Assignment: When do individuals leaders have huge impacts for organizations? When does it make a huge difference that some

person was in this place, at this time? In this session, Gautam Mukunda will explore the systems which select leaders

and how they can sometimes pick unique people who have a huge impact on the organizations they lead, changing

the fate of companies, and even countries, for better or worse.

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Thursday, January 28, 2016 (Continued)

Elective 3: Analyzing Big Data through studying the NFL. Deflategate, the NFL, and 3:30 - 4:50 PM

the Power of Analytics Hawes Hall 302

Instructor: Marco Iansiti

Materials: Deflategate and the National Football League (616008)

Assignment: Assignment Questions:

1. How unusual is the Patriots historical Win/Loss record? What could explain the historical win/loss performance of

the New England Patriots between 2000 and 2015?

2. Do you think the Patriots are guilty of deflating their footballs during the game in question? How would you analyze

the football pressure data from the Colts Patriots game to investigate your hypothesis? What sequence of events

before and during the Colts – Patriots game appears to best explain your analysis of the data in the case?

3. What should the NFL do going forward about football pressure? How should they change improve the rules?

4. How would you assess the NFL’s capabilities in analytics? How does the NFL’s approach to analytics compare to

your company’s approach? What would best practices look like?

Notes:

- When taken from inside to outside temperatures (and vice versa) it should take a football around 15-20 minutes to

reach room temperature, pressure, and humidity.

- The Deflategate case formula to convert temperature from Fahrenheit (TF) to Kelvin (TK), on page 9, has a typo.

The correct formula is: TK = (5/9) * (TF + 459.67), not TK = 59 * (TF + 459.67).

- Finally, for the purposes of the case analysis, PSI=PSIG.

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Thursday, January 28, 2016 (Continued)

Elective 4: Becoming a “Professional Manager” after selling your business to a Private 3:30 - 4:50 PM

Equity firm Hawes Hall 303

Instructor: Jim Sharpe

Materials: Jim Sharpe Bio

Wayne Ferrari - iAutomation at a Crossroads (813120)

Assignment: Wayne Ferrari has bridged the gap between being an independent entrepreneur and a "professional manager." After

selling his business to a Private Equity (PE) firm, Ferrari takes on the role of CEO and with their support implements a

roll-up strategy to attain growth through acquisition in the mechanical controls distribution industry. Ferrari is faced the

challenging task of integrating them into the core business. Developing an organization that supports a new strategy

of application support for their customer base requires a change in culture and an evolving leadership challenge for

the business. The most immediate challenge is to implement a "pricing" model to be used with all customers that

takes into consideration a variety of customer specific characteristics to set optimal pricing for quotations.

This class presents the challenges of exiting a business and what the founder does next. Describes acquisition

integration challenges in a “roll-up” strategy as a new pricing system is implemented across the company. Taught and

written by WPO member with WPO member protagonist as visitor in classroom to address the issues and describe

the ultimate outcome.

Study Questions:

1. Who should be responsible for the implementation of the Pricing Cube?

2. How would you grade Ferrari in integration of acquisitions?

3. Was selling to Riverside, the Private Equity firm, a good decision by Ferrari?

Closing Reception 5:45 - 6:30 PM

Spangler Center Williams Room

Closing Dinner 6:30 - 8:30 PM

Spangler Center Williams Room

Study Group Meetings 9:00 - 11:00 PM

Living Group Lounges

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Friday, January 29, 2016

Breakfast 7:00 - 8:30 AM

Crimson Commons

CrossFit 8:45 - 10:05 AM

Tata Hall 100

A

Instructor: Tom Nicholas

Materials: Crossfit (A) (815089)

Assignment: CrossFit is one of the most successful fitness franchises in history. Its founder, Greg Glassman, created the business

by breaking the accepted rules of the fitness industry business model and grew the business while breaking the

accepted rule of franchising. The company has no fixed offices, and Greg makes all the decisions but never writes

anything down. By 2012 CrossFit was growing rapidly with over 5000 ‘stores’ in operation. The founders’ exwife had

sold her 50 percent stake in the business to Anthos Capital, a PE firm that is likely to want to maximize the value of

the brand and affiliate network. Greg has to decide if he should welcome his potential new partner or oppose the sale.

The case explores the linkage between the preferences of a founder and the firm’s business model, the potential for

value creation or destruction of a VC or PE firm, and the challenges of growth in a founder centric business. How far

can this model go? Is CrossFit successful because of its nontraditional model or in spite of it?

Study Questions:

1. If you were Glassman would you support or oppose the deal in court? Why? If you were advising Anthos, how

would you maximize the value of your $20 million dollar investment in CrossFit? What governance rights would

you require as a 50% owner of the company? What changes would you recommend to ‘take the company to the

next level’?

2. What are the key elements of CrossFit’s business model? How has CrossFit been successful despite making its

core offering, ‘Workout Of the Day’ freely available on its web site? Do you agree with Glassman’s approach of not

pursuing additional lines of business, and keeping the affiliate fees low? Can CrossFit continue to grow without

raising additional capital? Assume that each employee costs $150,000 annually, the weighted average fees per

affiliate in 2012 are $1,500, and 5% of affiliates close each year.

3. How important is Greg Glassman to the future success of the company? Is his management approach (‘between a

church and a biker gang’) an asset or an impediment to growth? What risks and challenges does CrossFit face as

it continues to grow?

Break 10:05 - 10:30 AM

Tata Hall Atrium

The Deeport Debrief 10:30 - 11:50 AM

Tata Hall 100

A

Instructor: Guhan Subramanian

Assignment: We will use the results from the Deeport exercise to explore the central question in virtually every negotiation that you

encounter: How do you navigate your way from your current position to your desired outcome? Topics include:

managing multiple parties and coalitional dynamics; building a winning coalition & maintaining a blocking coalition;

deal "setup" and moves away from the table; and exploiting patterns of deference.

Copyright 2015 © President & Fellows of Harvard College

Harvard Business School/YPO

Presidents' Program A 2016/01

January 24, 2016 - January 29, 2016

Comprehensive Program Details for Friday, January 29, 2016 (Continued)

Pick up Lunch 11:50 - 12:00 PM

Tata Hall Atrium

Study Group Closing & Lunch 12:00 - 1:30 PM

Living Group Lounges

Bus Departs to Logan Airport 1:45 PM

Esteves Circle

Bus Departs to Logan Airport 2:45 PM

Esteves Circle

Bus Departs to Logan Airport 4:00 PM

Esteves Circle

Copyright 2015 © President & Fellows of Harvard College

You might also like

- Simplified CHSP For Two Storey Residential HouseDocument5 pagesSimplified CHSP For Two Storey Residential HouseMark Roger Huberit IINo ratings yet

- Leading with Obeya: Using a big room to lead successful strategiesFrom EverandLeading with Obeya: Using a big room to lead successful strategiesNo ratings yet

- A Strategic Guide to Continuing Professional Development for Health and Care Professionals: The TRAMm ModelFrom EverandA Strategic Guide to Continuing Professional Development for Health and Care Professionals: The TRAMm ModelRating: 1 out of 5 stars1/5 (1)

- Yellow Book: Presented by-H.V.Sithuruwan Fernando (Engineering Cadet)Document24 pagesYellow Book: Presented by-H.V.Sithuruwan Fernando (Engineering Cadet)piliyandalaleosNo ratings yet

- Hach - Seminar - Flyer 29 July 2021-1Document1 pageHach - Seminar - Flyer 29 July 2021-1Heri Fadli SinagaNo ratings yet

- For The Week of October 12, 2010: Please Inquire!Document14 pagesFor The Week of October 12, 2010: Please Inquire!FLWorksGenevaNo ratings yet

- 19th Annual HR ConferenceDocument2 pages19th Annual HR ConferenceBushra ShaikhNo ratings yet

- Neo Program 11.8.18Document1 pageNeo Program 11.8.18Sally Marie EscoteNo ratings yet

- Sample Schedule - Subject To Change: Leading Change and Organizational RenewalDocument1 pageSample Schedule - Subject To Change: Leading Change and Organizational RenewalAhmed HegazyNo ratings yet

- Program Flow - PLM Yes Slc&gaDocument2 pagesProgram Flow - PLM Yes Slc&gaitsmiicharlesNo ratings yet

- Seneca County 9 27 10 JobLeadsDocument14 pagesSeneca County 9 27 10 JobLeadsFLWorksGenevaNo ratings yet

- MAtrix RSA TRNGDocument3 pagesMAtrix RSA TRNGSam Milca NabelonNo ratings yet

- 02 HR Inspire 3 Course SkedDocument1 page02 HR Inspire 3 Course SkedSangguniangbayan ItogonNo ratings yet

- Tot Course Outline Revised October 2019Document2 pagesTot Course Outline Revised October 2019avie0% (1)

- Agenda, FICCI Higher Education Conference Mar 29-30,2022Document4 pagesAgenda, FICCI Higher Education Conference Mar 29-30,2022Allottee WelfareNo ratings yet

- Agenda Seminar IlmiahDocument1 pageAgenda Seminar IlmiahJulfan EfendiNo ratings yet

- 2017 Sla ScheduleDocument2 pages2017 Sla Scheduleapi-235783972No ratings yet

- Draft Agenda Training and Capacity Development Workshop On Construction & Demolition (C&D) Waste Management For Municipal GovernmentsDocument1 pageDraft Agenda Training and Capacity Development Workshop On Construction & Demolition (C&D) Waste Management For Municipal GovernmentsBiswajit Debnath OffcNo ratings yet

- Inset Program 2021Document4 pagesInset Program 2021Tabata Qbz TawinNo ratings yet

- Content - PLM Yes Ga&slc PDFDocument3 pagesContent - PLM Yes Ga&slc PDFitsmiicharlesNo ratings yet

- School of Management: International ConferenceDocument2 pagesSchool of Management: International ConferenceranjithsteelNo ratings yet

- APs Training of Trainers Module 11-13 June2019Document3 pagesAPs Training of Trainers Module 11-13 June2019Brian JosephNo ratings yet

- Seneca County Job Leads 10 04 10Document10 pagesSeneca County Job Leads 10 04 10FLWorksGenevaNo ratings yet

- Chyron-Ugmc Management Strategic Session Time Table FinalDocument3 pagesChyron-Ugmc Management Strategic Session Time Table FinalMaxwell MaxwellNo ratings yet

- SLAC and INSETDocument1 pageSLAC and INSETLovely Venia JovenNo ratings yet

- Programme SDocument2 pagesProgramme SNcediswaNo ratings yet

- Schedule 08BM2 SY11011Document2 pagesSchedule 08BM2 SY11011Trần Văn HòaNo ratings yet

- Problem and Project Based Learning Workshop PosterDocument1 pageProblem and Project Based Learning Workshop PosterMr. Vikram Arora (Assistant Professor, SSDAP)No ratings yet

- STAR's Handbook Batch 8Document34 pagesSTAR's Handbook Batch 8silvia120092No ratings yet

- Event TimelineDocument2 pagesEvent Timelineashishgupta0613No ratings yet

- 2017 Leadership Academy - Atlanta - April 8: Leader: ChrisDocument1 page2017 Leadership Academy - Atlanta - April 8: Leader: ChrisDepri YantriNo ratings yet

- HR Conclave 2019 BrochureDocument4 pagesHR Conclave 2019 BrochureReshmiNo ratings yet

- BANKAL ES Instructional-Design For INSET 2019Document5 pagesBANKAL ES Instructional-Design For INSET 2019ma.louregie l. bonielNo ratings yet

- Minute-to-Minute Details of The EventDocument2 pagesMinute-to-Minute Details of The EventAyush KapoorNo ratings yet

- Report EDPDocument8 pagesReport EDPPrajakta ShindeNo ratings yet

- Sample Training ProposalDocument6 pagesSample Training ProposalMichelle CasinNo ratings yet

- LEAN IMMERSION North Asia July 2017 AgendaDocument9 pagesLEAN IMMERSION North Asia July 2017 AgendaMoontasirNasimNo ratings yet

- CIPDFoundation Level Schedule 2010 2011 NovDocument2 pagesCIPDFoundation Level Schedule 2010 2011 NovHuma PeeranNo ratings yet

- Jadual Semester IV D4 2018-2019-1Document1 pageJadual Semester IV D4 2018-2019-1Epri ChaNo ratings yet

- ECLA'19 - Module I - ScheduleDocument1 pageECLA'19 - Module I - ScheduleEnrique CeledónNo ratings yet

- Agenda Workshop Policy Review AYON - HR Review-13 SeptDocument3 pagesAgenda Workshop Policy Review AYON - HR Review-13 SeptAaditya khanalNo ratings yet

- FDP On Multivariate AnalysisDocument4 pagesFDP On Multivariate AnalysisRajendra LamsalNo ratings yet

- FY Time Table of Master in Business Administration (PAT.2013) - SPL 29-3-16Document2 pagesFY Time Table of Master in Business Administration (PAT.2013) - SPL 29-3-16MILINDNo ratings yet

- Island Cluster Training of Local Resource Institutes For The 2021 Implementation of The Citizen Satisfaction Index SystemDocument2 pagesIsland Cluster Training of Local Resource Institutes For The 2021 Implementation of The Citizen Satisfaction Index SystemRolly RNo ratings yet

- Virtual Learning Success WorkshopDocument1 pageVirtual Learning Success WorkshopMCris Rodas ReyesNo ratings yet

- Seneca County Job Leads: For The Week of September 20, 2010Document10 pagesSeneca County Job Leads: For The Week of September 20, 2010FLWorksGenevaNo ratings yet

- Institute For Social Innovation:: Bos 10: Day 1:: The StartingblocDocument5 pagesInstitute For Social Innovation:: Bos 10: Day 1:: The Startingbloclawrence6439No ratings yet

- ProgramDocument3 pagesProgramCorey FeaginsNo ratings yet

- Admc MFLHRD FirstDocument1 pageAdmc MFLHRD FirstAnil PintoNo ratings yet

- Kinder Class Program - Sy 2023-2024Document1 pageKinder Class Program - Sy 2023-2024SARAH MENDEZ100% (1)

- MBA and MBA (HR) Foundation Programme Final Schedule 2023Document5 pagesMBA and MBA (HR) Foundation Programme Final Schedule 2023Sabyasachi ChakrabortyNo ratings yet

- PADM2BO - Intro To HRM Course Outline 2023 5Document6 pagesPADM2BO - Intro To HRM Course Outline 2023 5Aneziwe ShangeNo ratings yet

- Final Min To Min For The HR Conclave - 2022Document4 pagesFinal Min To Min For The HR Conclave - 2022Anirban BanikNo ratings yet

- G e T T o K N o W y o U R C o M P A N yDocument2 pagesG e T T o K N o W y o U R C o M P A N yNaveen DikshitNo ratings yet

- Example of A Training PlanDocument4 pagesExample of A Training PlanQueen Naisa AndangNo ratings yet

- UPC Agenda-Week 2019 VFDocument1 pageUPC Agenda-Week 2019 VFCV JoeNo ratings yet

- Training-Modules-TEAM-BUILDING New ImpDocument15 pagesTraining-Modules-TEAM-BUILDING New ImpJobin JohnNo ratings yet

- ACLC Department Faculty Plotting Form 2019 2020 FORMATDocument14 pagesACLC Department Faculty Plotting Form 2019 2020 FORMATCathy GaveroNo ratings yet

- BONARIA Training Agenda v1.3 - Week 1Document10 pagesBONARIA Training Agenda v1.3 - Week 1kk4tg2sykwNo ratings yet

- Jadwal Internalisasi Nilai BerAKHLAKDocument1 pageJadwal Internalisasi Nilai BerAKHLAKmuchlis mahiraNo ratings yet

- Stanford Asian LeadershipDocument1 pageStanford Asian Leadershipderek tsangNo ratings yet

- Talent Liberation: The Blueprint to Performance Management in the New World of WorkFrom EverandTalent Liberation: The Blueprint to Performance Management in the New World of WorkNo ratings yet

- Final SALQA Draft ProgrammeDocument6 pagesFinal SALQA Draft ProgrammeMosameem ARNo ratings yet

- Tithonus' by TennysonDocument10 pagesTithonus' by TennysonMs-CalverNo ratings yet

- Footwear - PattensDocument100 pagesFootwear - PattensThe 18th Century Material Culture Resource Center100% (6)

- CONSTI AnswersDocument8 pagesCONSTI AnswersTrisha KerstinNo ratings yet

- Speech Analysis AssignmentDocument4 pagesSpeech Analysis Assignmentapi-239280560No ratings yet

- Murang A New Court Links and ContactsDocument1 pageMurang A New Court Links and ContactsFaith NyokabiNo ratings yet

- Process of Credit Adjustment in Your Loan AccountDocument2 pagesProcess of Credit Adjustment in Your Loan Accountankit Raghuvanshi100% (1)

- Bipa Newletter 2011Document10 pagesBipa Newletter 2011JP RajendranNo ratings yet

- Balanced GrowthDocument3 pagesBalanced GrowthshyamkakkadNo ratings yet

- Philippine National Railways Case DigestDocument2 pagesPhilippine National Railways Case DigestluckyNo ratings yet

- My First Two Thousand Years - The Autobio - George Sylvester ViereckDocument392 pagesMy First Two Thousand Years - The Autobio - George Sylvester Viereckglencbr100% (1)

- Transferance of SpiritsDocument13 pagesTransferance of SpiritsMiracle Internet Church50% (2)

- Earth SummitDocument5 pagesEarth SummitkeziengangaNo ratings yet

- (Stephen Burt, Hannah Brooks-Motl) Randall JarrellDocument197 pages(Stephen Burt, Hannah Brooks-Motl) Randall JarrellAlene Saury100% (2)

- 6.2 Making My First DecisionsDocument7 pages6.2 Making My First Decisionschuhieungan0729No ratings yet

- Analyzing The External Environment of The FirmDocument16 pagesAnalyzing The External Environment of The FirmPrecious JirehNo ratings yet

- 3 1 2 A LanduseanddevelopmentDocument6 pages3 1 2 A Landuseanddevelopmentapi-276367162No ratings yet

- Villa Rey Transit Vs FerrerDocument2 pagesVilla Rey Transit Vs FerrerRia Kriselle Francia Pabale100% (2)

- Iesba Fact SheetDocument2 pagesIesba Fact Sheetlee0% (1)

- Natural DisastersDocument22 pagesNatural DisastersAnonymous r3wOAfp7j50% (2)

- List of Sotho-Tswana ClansDocument4 pagesList of Sotho-Tswana ClansAnonymous hcACjq850% (2)

- Act 330 Assignment Final EditedDocument14 pagesAct 330 Assignment Final EditedTaufiq RahmanNo ratings yet

- UPDocument178 pagesUPDeepika Darkhorse ProfessionalsNo ratings yet

- 117 Class 12th EnglishDocument2 pages117 Class 12th EnglishPushpendra PatelNo ratings yet

- Planning AnswersDocument51 pagesPlanning AnswersBilly Dentiala IrvanNo ratings yet

- People v. GarciaDocument8 pagesPeople v. GarciaKharol EdeaNo ratings yet

- General Thura Tin OoDocument1 pageGeneral Thura Tin OoMyo Thi HaNo ratings yet

- Holy Eucharist - PotDocument19 pagesHoly Eucharist - PotMargie CalumpitNo ratings yet