Professional Documents

Culture Documents

Co. Residential Status: Conditions When Poem in India Is Not Applicable To A Company

Co. Residential Status: Conditions When Poem in India Is Not Applicable To A Company

Uploaded by

Rahul PambharCopyright:

Available Formats

You might also like

- Independent Directors Are Watchdogs of A Company: By: Aman Degra (17bal008)Document3 pagesIndependent Directors Are Watchdogs of A Company: By: Aman Degra (17bal008)Aman DegraNo ratings yet

- On Corporate Governance Under Companies ActDocument14 pagesOn Corporate Governance Under Companies ActPawan Kmuar Yadav100% (1)

- Facility Layout of Bank Final..... Present2Document22 pagesFacility Layout of Bank Final..... Present2Rahul PambharNo ratings yet

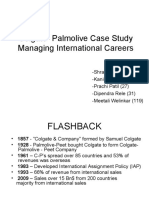

- Colgate-Palmolive Case Study Managing International CareersDocument9 pagesColgate-Palmolive Case Study Managing International CareersrushishastriNo ratings yet

- Residential Status of A CompanyDocument18 pagesResidential Status of A CompanyNaveenNo ratings yet

- Tax 1 (I) - Guiding Principles For POEMDocument11 pagesTax 1 (I) - Guiding Principles For POEMRACHITNo ratings yet

- Subject: Guiding Principles For Determination of Place of Effective Management (POEM) of A CompanyDocument14 pagesSubject: Guiding Principles For Determination of Place of Effective Management (POEM) of A CompanyKashif AnsariNo ratings yet

- Place of Effective Management (POEM)Document17 pagesPlace of Effective Management (POEM)Gaurav GaurNo ratings yet

- Place of Effective Manangement (PoEM)Document14 pagesPlace of Effective Manangement (PoEM)LEKHA DHILIP KUMARNo ratings yet

- Adctx02 - 21 Paper 1Document7 pagesAdctx02 - 21 Paper 1Soumya swarup MohantyNo ratings yet

- IIM-R - Business Taxes Lecture 13 & 14Document37 pagesIIM-R - Business Taxes Lecture 13 & 14AanshikaNo ratings yet

- CBDT - Detailed POEM Guidelines - January 2017Document10 pagesCBDT - Detailed POEM Guidelines - January 2017bharath289No ratings yet

- Place of Effective Management 1705112727Document4 pagesPlace of Effective Management 1705112727nirmalseervi.mkdNo ratings yet

- Tax 1 (H) - Concept of POEMDocument11 pagesTax 1 (H) - Concept of POEMRACHITNo ratings yet

- 3.new Concepts in Co's Act 2013Document31 pages3.new Concepts in Co's Act 2013Sai PhaniNo ratings yet

- Pil RP AkshayDocument13 pagesPil RP AkshayAbhilasha PantNo ratings yet

- Individual Assignment On: "Comments On - Requirements of CorporateDocument5 pagesIndividual Assignment On: "Comments On - Requirements of CorporateMostafa haqueNo ratings yet

- Confederation of Indian Industry (CII)Document13 pagesConfederation of Indian Industry (CII)Hitesh KothariNo ratings yet

- Lecture 3 - Residential Status of CompaniesDocument10 pagesLecture 3 - Residential Status of CompaniesDiya RawatNo ratings yet

- Place of Effective ManagementDocument34 pagesPlace of Effective ManagementRIcky Chopra International CounselsNo ratings yet

- Pe in India Checking The Rule SeguridadDocument5 pagesPe in India Checking The Rule SeguridadrishikaNo ratings yet

- Cii CodeDocument6 pagesCii Codetanmayjoshi969315100% (1)

- Clause 49 - Listing AgreementDocument36 pagesClause 49 - Listing AgreementMadhuram Sharma100% (1)

- Doing Business in IndiaDocument19 pagesDoing Business in IndiaAparna SinghNo ratings yet

- Budget2017 18sudha 170215110415Document89 pagesBudget2017 18sudha 170215110415Taxpert mukeshNo ratings yet

- What Is A Joint Venture?Document8 pagesWhat Is A Joint Venture?Ronak GalaNo ratings yet

- Auditing-Ii Tybbi-Vi: Prof. Samiullah Shaikh Assistant Pro Essor Imcost (Thane)Document10 pagesAuditing-Ii Tybbi-Vi: Prof. Samiullah Shaikh Assistant Pro Essor Imcost (Thane)Samiullah ShaikhNo ratings yet

- RCICDocument33 pagesRCICRIcky Chopra International CounselsNo ratings yet

- 1518759148pdfjoiner PDFDocument40 pages1518759148pdfjoiner PDFAlkaNo ratings yet

- Taxation 2Document14 pagesTaxation 2iemhardikNo ratings yet

- Types of Business Entities in IndiaDocument13 pagesTypes of Business Entities in IndiaDipali MahalleNo ratings yet

- ResidenceDocument14 pagesResidenceguru1barkiNo ratings yet

- Naresh Chandra CommiteeDocument23 pagesNaresh Chandra CommiteeAnu Vanu88% (8)

- Corporate Governance: Sonu George Mathew GIADocument19 pagesCorporate Governance: Sonu George Mathew GIASONU GEORGENo ratings yet

- Lms SFM CGDocument10 pagesLms SFM CGKanishka ChhabriaNo ratings yet

- Role - Board of DirectorsDocument5 pagesRole - Board of DirectorsAtif RehmanNo ratings yet

- CH 2 Clause 49Document27 pagesCH 2 Clause 49AKRUTI JENA 19111304No ratings yet

- Non Resident TaxationDocument123 pagesNon Resident Taxationguru1barkiNo ratings yet

- Becg Unit-4.Document12 pagesBecg Unit-4.Bhaskaran Balamurali100% (2)

- 52313bosfinal 19 p7 Mod4 cp1Document84 pages52313bosfinal 19 p7 Mod4 cp1Chandan SinglaNo ratings yet

- The Framework For Foreign Direct Investment (FDI) in IndiaDocument6 pagesThe Framework For Foreign Direct Investment (FDI) in IndiaSameer KumarNo ratings yet

- Corporate Governance CaseDocument26 pagesCorporate Governance Casekajal malhotra0% (1)

- CII Ethics MeeDocument26 pagesCII Ethics MeeDivyangi SinghNo ratings yet

- Mahindra & Mahindra Financial Services LTD.: Team 28Document8 pagesMahindra & Mahindra Financial Services LTD.: Team 28roller worldNo ratings yet

- Study Material-Overview of The Companies Act, 2013-AM-IX-CL-IDocument6 pagesStudy Material-Overview of The Companies Act, 2013-AM-IX-CL-IannnooonnyyyymmousssNo ratings yet

- Chapter 7 Company AuditDocument32 pagesChapter 7 Company AuditMAYA MORENo ratings yet

- Unit 3 Corporate LawDocument14 pagesUnit 3 Corporate Lawprachee goyalNo ratings yet

- AUDI314 Class Notes (September 10, 2021)Document2 pagesAUDI314 Class Notes (September 10, 2021)HatterlessNo ratings yet

- Want To Set Up Business in IndiaDocument10 pagesWant To Set Up Business in IndiaSourav KumarNo ratings yet

- Company Registration in ChinaDocument10 pagesCompany Registration in ChinaParas MittalNo ratings yet

- Geeta Saar 99 Internal AuditDocument4 pagesGeeta Saar 99 Internal Auditcharanjeet singh chawlaNo ratings yet

- Narayan Murthy CommitteeDocument3 pagesNarayan Murthy CommitteeAnwar KhanNo ratings yet

- Business Setup in IndiaDocument10 pagesBusiness Setup in IndiaCompany Legal GroupNo ratings yet

- Independent DirectorDocument28 pagesIndependent DirectorVasvi Aren100% (1)

- Code of Corporate Governance As Issued by Bangladesh Securities Exchange Commission in 2006 and Subsequent Modifications To Highlight Measures Aimed at Better Financial ManagementDocument4 pagesCode of Corporate Governance As Issued by Bangladesh Securities Exchange Commission in 2006 and Subsequent Modifications To Highlight Measures Aimed at Better Financial ManagementMahin KhanNo ratings yet

- Corporate Tax PlanningDocument18 pagesCorporate Tax PlanningSANDEEP KUMARNo ratings yet

- Corporate Governance and Insider TradingDocument10 pagesCorporate Governance and Insider TradingSrijesh SinghNo ratings yet

- Law NotesDocument16 pagesLaw NotesUmar FarooqNo ratings yet

- Role of CFODocument3 pagesRole of CFOTara GilaniNo ratings yet

- Establishment of Branch Office Outside India: Contributed by CA. Sudha G. BhushanDocument5 pagesEstablishment of Branch Office Outside India: Contributed by CA. Sudha G. BhushanTaxpert mukeshNo ratings yet

- Assignment 4: Submitted By: Shams Ur Rehman 9772Document5 pagesAssignment 4: Submitted By: Shams Ur Rehman 9772Yasir KhanNo ratings yet

- Medicines, Drugs, PharmaceuticalDocument3 pagesMedicines, Drugs, PharmaceuticalRahul PambharNo ratings yet

- Pharmaceutical Manufacturers and ImpoterDocument6 pagesPharmaceutical Manufacturers and ImpoterRahul PambharNo ratings yet

- Pharmaceutical MNFDocument4 pagesPharmaceutical MNFRahul PambharNo ratings yet

- How To Use The Brazilian Catalogue of Importers (CIB)Document3 pagesHow To Use The Brazilian Catalogue of Importers (CIB)Rahul PambharNo ratings yet

- Pharmaceutical Ingredients, Medical Consumables, Pharmaceutical Process Instruments and Laboratory Instruments ImporterDocument1 pagePharmaceutical Ingredients, Medical Consumables, Pharmaceutical Process Instruments and Laboratory Instruments ImporterRahul PambharNo ratings yet

- Pharmaceuticals CompanyDocument14 pagesPharmaceuticals CompanyRahul Pambhar100% (1)

- Select Chamber of Commerce and FIEsDocument7 pagesSelect Chamber of Commerce and FIEsRahul PambharNo ratings yet

- Pharmaceutical Manufacturers in ArgentinaDocument2 pagesPharmaceutical Manufacturers in ArgentinaRahul PambharNo ratings yet

- Pharma - Med Importers ListDocument2 pagesPharma - Med Importers ListRahul PambharNo ratings yet

- Laboratories in Argentina ListDocument2 pagesLaboratories in Argentina ListRahul PambharNo ratings yet

- How To Use The Brazilian Suppliers WebsiteDocument2 pagesHow To Use The Brazilian Suppliers WebsiteRahul PambharNo ratings yet

- Trading Companies MontenegroDocument3 pagesTrading Companies MontenegroRahul PambharNo ratings yet

- N Heptanol SpecsDocument1 pageN Heptanol SpecsRahul PambharNo ratings yet

- 21 Choong Y. Lee PDFDocument8 pages21 Choong Y. Lee PDFRahul PambharNo ratings yet

- Aloha Case StudyDocument5 pagesAloha Case StudyRahul PambharNo ratings yet

- 1511002267gls Private University - Ugc Initial Information Report 2015Document143 pages1511002267gls Private University - Ugc Initial Information Report 2015Rahul PambharNo ratings yet

- 2017 11 06 AE Lansetal PDFDocument8 pages2017 11 06 AE Lansetal PDFRahul PambharNo ratings yet

- Equivalent PayscalesDocument2 pagesEquivalent PayscalespikluNo ratings yet

- Date Particulars Withdrawals Deposits Balance: 29-MAY-2020 by Transfer Loan Payment TRF FR 0078027564060 110000 1698.37Document1 pageDate Particulars Withdrawals Deposits Balance: 29-MAY-2020 by Transfer Loan Payment TRF FR 0078027564060 110000 1698.37Rahul PambharNo ratings yet

- Activity Resource Usage Model & Tactical Decision MakingDocument34 pagesActivity Resource Usage Model & Tactical Decision MakingRahul PambharNo ratings yet

- AB Thorsten Case StudyDocument6 pagesAB Thorsten Case StudyRahul PambharNo ratings yet

- VOIS - CARE Advisor - JDDocument1 pageVOIS - CARE Advisor - JDRahul PambharNo ratings yet

- EssayDocument7 pagesEssayGiana ObejasNo ratings yet

- GBF Unit - IVDocument50 pagesGBF Unit - IVKaliyapersrinivasanNo ratings yet

- Quiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditDocument2 pagesQuiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditEzra Mikah G. CaalimNo ratings yet

- The Great Vatican-Jesuit Global Depression of 2009-2012Document25 pagesThe Great Vatican-Jesuit Global Depression of 2009-2012GrnEydGuy100% (1)

- Collateral Management AgendaDocument17 pagesCollateral Management AgendaSpikeNo ratings yet

- Chapter 4 DerivativesDocument38 pagesChapter 4 DerivativesTamrat KindeNo ratings yet

- Ratio AnalysisDocument57 pagesRatio AnalysisASEEM860No ratings yet

- Mergers and Acquisitions: Rizki Nur Sa'diyah 041711333143 Dina Indriana 042024253016 Darojatum Muthi'atur R 042024253030Document28 pagesMergers and Acquisitions: Rizki Nur Sa'diyah 041711333143 Dina Indriana 042024253016 Darojatum Muthi'atur R 042024253030rizki nurNo ratings yet

- COA CIRCULAR NO. 2021 014 December 22 2021Document14 pagesCOA CIRCULAR NO. 2021 014 December 22 2021juanNo ratings yet

- Financial Management Strategy FinalDocument24 pagesFinancial Management Strategy FinalsayedhossainNo ratings yet

- Corp Law Outline 5 - 2020Document4 pagesCorp Law Outline 5 - 2020Effy SantosNo ratings yet

- TSL Further Proof 159 Notice Rev1 ManishaDocument20 pagesTSL Further Proof 159 Notice Rev1 Manishamanishaghadage47817No ratings yet

- KTU MBA First Three Trimesters-Syllabus For WebsiteDocument24 pagesKTU MBA First Three Trimesters-Syllabus For WebsiteSreenath NairNo ratings yet

- Financial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedDocument9 pagesFinancial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedPremier PublishersNo ratings yet

- Bank of Baroda Health Insurance FormDocument2 pagesBank of Baroda Health Insurance FormAnkur Agarwal100% (1)

- Status of Ecommerce in NepalDocument4 pagesStatus of Ecommerce in NepalSuraj Thapa100% (1)

- Estimation of Doubtful Accounts (Chapter 5)Document12 pagesEstimation of Doubtful Accounts (Chapter 5)chingNo ratings yet

- IAS 17 Leases STDocument11 pagesIAS 17 Leases STDesmanto HermanNo ratings yet

- Banque de FranceDocument10 pagesBanque de FranceBianca GabrielaNo ratings yet

- Customer Relationship Management (CRM)Document28 pagesCustomer Relationship Management (CRM)Chirag SabhayaNo ratings yet

- Sa1 Ae 121 - TheoriesDocument6 pagesSa1 Ae 121 - TheoriesMariette Alex AgbanlogNo ratings yet

- Growth StrategyDocument25 pagesGrowth StrategyJoyce Anne P. BandaNo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of Accountschristine anglaNo ratings yet

- CH 4 4-35 SpreadsheetDocument34 pagesCH 4 4-35 Spreadsheetcherishwisdom_997598No ratings yet

- Module 7 - Tax ExercisesDocument3 pagesModule 7 - Tax ExercisesjessafesalazarNo ratings yet

- Investors Guide in The Agricultural Sector in MoroccoDocument88 pagesInvestors Guide in The Agricultural Sector in MoroccoElhanid MohamedNo ratings yet

- Maths McqsDocument10 pagesMaths McqsafeeraNo ratings yet

- MAS2 BSAIS 2D Interest Rate and Return PPT 2Document172 pagesMAS2 BSAIS 2D Interest Rate and Return PPT 2Henry RufinoNo ratings yet

- 3.3b. 7 Scenarios Worksheet and PromptDocument3 pages3.3b. 7 Scenarios Worksheet and Promptkartik lakhotiyaNo ratings yet

Co. Residential Status: Conditions When Poem in India Is Not Applicable To A Company

Co. Residential Status: Conditions When Poem in India Is Not Applicable To A Company

Uploaded by

Rahul PambharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Co. Residential Status: Conditions When Poem in India Is Not Applicable To A Company

Co. Residential Status: Conditions When Poem in India Is Not Applicable To A Company

Uploaded by

Rahul PambharCopyright:

Available Formats

Co.

Residential status

Place of effective management (POEM) means a place where key management and commercial

decisions that are necessary for the conduct of the business of an entity as a whole are, in

substance made.

The final guidelines on POEM contain some unique features. One of the unique features is test of

Active Business Outside India (ABOI). The guidelines prescribe that a company shall be said to

engaged in 'active business outside India' if passive income is not more than 50% of its total

income. Further, there are certain additional cumulative conditions to be satisfied regarding

location of total assets, employees and payroll expenses.

The place of effective management in case of a company engaged in active business outside

India shall be presumed to be outside India if the majority meetings of the board of directors of

the company are held outside India.

In cases of companies other than those that are engaged in active business outside India, the

determination of POEM would be a two stage process, namely:—

First stage would be identification or ascertaining the person or persons who actually make the

key management and commercial decision for conduct of the company's business as a whole.

Second stage would be determination of place where these decisions are in fact being made.

The POEM ( Place of Effective Management ) was defined to mean a place where key

management and commercial decisions that are necessary for the conduct of the business of an

entity as a whole are in substance made. In order to bring clarity about the applicability criteria

of certain Income tax provisions.

The POEM in case of a Company engaged in active business outside India shall be presumed to

be outside India if the majority meetings of the board of directors of the company are held

outside India.

CONDITIONS WHEN POEM IN INDIA IS NOT APPLICABLE TO A COMPANY:

o Company is engaged in active business outside India and

o Majority of Board Meeting are held Outside India.

Active Business Outside India:

A Company is said to be active business outside India if its passive income is not more than 50%

of the total income of such Company and

♦ Assets in India are < 50% of the total assets

(Assets will be taken as average of opening and closing)

♦ Employees in India < 50% of the total employees

(No. of employees will be taken as average of opening and closing)

♦ Payroll Expenses in India < 50% of the total payroll expenses.

Passive Income means Income in relation to transactions of purchase and sale with Associated

Enterprises (AEs) or Income generated from Royalty, Dividend, Interest, Rental or Capital

Gains.

MANAGEMENT POWER EXERCISED IN INDIA:-

If on the basis of facts and circumstances it s established that the Board of directors of the

company are standing aside and not exercising the powers of management and such powers are

being exercised by either the holding company or an other persons resident in India, then the

place of effective management shall be considered to be in India.

PRIOR APPROVAL OF PRINCIPAL CIT/CIT REQUIRED:-

In case the Assessing Officer proposes to hold a foreign company, on the basis of its POEM, as

being resident in India then any such finding shall be given by the Assessing Officer after

seeking prior approval of the collegium of their members consisting of the Principal CITS or

CITS, as the case may be, to be constituted by the Principal Chief Commissioner of the region

concerned.

You might also like

- Independent Directors Are Watchdogs of A Company: By: Aman Degra (17bal008)Document3 pagesIndependent Directors Are Watchdogs of A Company: By: Aman Degra (17bal008)Aman DegraNo ratings yet

- On Corporate Governance Under Companies ActDocument14 pagesOn Corporate Governance Under Companies ActPawan Kmuar Yadav100% (1)

- Facility Layout of Bank Final..... Present2Document22 pagesFacility Layout of Bank Final..... Present2Rahul PambharNo ratings yet

- Colgate-Palmolive Case Study Managing International CareersDocument9 pagesColgate-Palmolive Case Study Managing International CareersrushishastriNo ratings yet

- Residential Status of A CompanyDocument18 pagesResidential Status of A CompanyNaveenNo ratings yet

- Tax 1 (I) - Guiding Principles For POEMDocument11 pagesTax 1 (I) - Guiding Principles For POEMRACHITNo ratings yet

- Subject: Guiding Principles For Determination of Place of Effective Management (POEM) of A CompanyDocument14 pagesSubject: Guiding Principles For Determination of Place of Effective Management (POEM) of A CompanyKashif AnsariNo ratings yet

- Place of Effective Management (POEM)Document17 pagesPlace of Effective Management (POEM)Gaurav GaurNo ratings yet

- Place of Effective Manangement (PoEM)Document14 pagesPlace of Effective Manangement (PoEM)LEKHA DHILIP KUMARNo ratings yet

- Adctx02 - 21 Paper 1Document7 pagesAdctx02 - 21 Paper 1Soumya swarup MohantyNo ratings yet

- IIM-R - Business Taxes Lecture 13 & 14Document37 pagesIIM-R - Business Taxes Lecture 13 & 14AanshikaNo ratings yet

- CBDT - Detailed POEM Guidelines - January 2017Document10 pagesCBDT - Detailed POEM Guidelines - January 2017bharath289No ratings yet

- Place of Effective Management 1705112727Document4 pagesPlace of Effective Management 1705112727nirmalseervi.mkdNo ratings yet

- Tax 1 (H) - Concept of POEMDocument11 pagesTax 1 (H) - Concept of POEMRACHITNo ratings yet

- 3.new Concepts in Co's Act 2013Document31 pages3.new Concepts in Co's Act 2013Sai PhaniNo ratings yet

- Pil RP AkshayDocument13 pagesPil RP AkshayAbhilasha PantNo ratings yet

- Individual Assignment On: "Comments On - Requirements of CorporateDocument5 pagesIndividual Assignment On: "Comments On - Requirements of CorporateMostafa haqueNo ratings yet

- Confederation of Indian Industry (CII)Document13 pagesConfederation of Indian Industry (CII)Hitesh KothariNo ratings yet

- Lecture 3 - Residential Status of CompaniesDocument10 pagesLecture 3 - Residential Status of CompaniesDiya RawatNo ratings yet

- Place of Effective ManagementDocument34 pagesPlace of Effective ManagementRIcky Chopra International CounselsNo ratings yet

- Pe in India Checking The Rule SeguridadDocument5 pagesPe in India Checking The Rule SeguridadrishikaNo ratings yet

- Cii CodeDocument6 pagesCii Codetanmayjoshi969315100% (1)

- Clause 49 - Listing AgreementDocument36 pagesClause 49 - Listing AgreementMadhuram Sharma100% (1)

- Doing Business in IndiaDocument19 pagesDoing Business in IndiaAparna SinghNo ratings yet

- Budget2017 18sudha 170215110415Document89 pagesBudget2017 18sudha 170215110415Taxpert mukeshNo ratings yet

- What Is A Joint Venture?Document8 pagesWhat Is A Joint Venture?Ronak GalaNo ratings yet

- Auditing-Ii Tybbi-Vi: Prof. Samiullah Shaikh Assistant Pro Essor Imcost (Thane)Document10 pagesAuditing-Ii Tybbi-Vi: Prof. Samiullah Shaikh Assistant Pro Essor Imcost (Thane)Samiullah ShaikhNo ratings yet

- RCICDocument33 pagesRCICRIcky Chopra International CounselsNo ratings yet

- 1518759148pdfjoiner PDFDocument40 pages1518759148pdfjoiner PDFAlkaNo ratings yet

- Taxation 2Document14 pagesTaxation 2iemhardikNo ratings yet

- Types of Business Entities in IndiaDocument13 pagesTypes of Business Entities in IndiaDipali MahalleNo ratings yet

- ResidenceDocument14 pagesResidenceguru1barkiNo ratings yet

- Naresh Chandra CommiteeDocument23 pagesNaresh Chandra CommiteeAnu Vanu88% (8)

- Corporate Governance: Sonu George Mathew GIADocument19 pagesCorporate Governance: Sonu George Mathew GIASONU GEORGENo ratings yet

- Lms SFM CGDocument10 pagesLms SFM CGKanishka ChhabriaNo ratings yet

- Role - Board of DirectorsDocument5 pagesRole - Board of DirectorsAtif RehmanNo ratings yet

- CH 2 Clause 49Document27 pagesCH 2 Clause 49AKRUTI JENA 19111304No ratings yet

- Non Resident TaxationDocument123 pagesNon Resident Taxationguru1barkiNo ratings yet

- Becg Unit-4.Document12 pagesBecg Unit-4.Bhaskaran Balamurali100% (2)

- 52313bosfinal 19 p7 Mod4 cp1Document84 pages52313bosfinal 19 p7 Mod4 cp1Chandan SinglaNo ratings yet

- The Framework For Foreign Direct Investment (FDI) in IndiaDocument6 pagesThe Framework For Foreign Direct Investment (FDI) in IndiaSameer KumarNo ratings yet

- Corporate Governance CaseDocument26 pagesCorporate Governance Casekajal malhotra0% (1)

- CII Ethics MeeDocument26 pagesCII Ethics MeeDivyangi SinghNo ratings yet

- Mahindra & Mahindra Financial Services LTD.: Team 28Document8 pagesMahindra & Mahindra Financial Services LTD.: Team 28roller worldNo ratings yet

- Study Material-Overview of The Companies Act, 2013-AM-IX-CL-IDocument6 pagesStudy Material-Overview of The Companies Act, 2013-AM-IX-CL-IannnooonnyyyymmousssNo ratings yet

- Chapter 7 Company AuditDocument32 pagesChapter 7 Company AuditMAYA MORENo ratings yet

- Unit 3 Corporate LawDocument14 pagesUnit 3 Corporate Lawprachee goyalNo ratings yet

- AUDI314 Class Notes (September 10, 2021)Document2 pagesAUDI314 Class Notes (September 10, 2021)HatterlessNo ratings yet

- Want To Set Up Business in IndiaDocument10 pagesWant To Set Up Business in IndiaSourav KumarNo ratings yet

- Company Registration in ChinaDocument10 pagesCompany Registration in ChinaParas MittalNo ratings yet

- Geeta Saar 99 Internal AuditDocument4 pagesGeeta Saar 99 Internal Auditcharanjeet singh chawlaNo ratings yet

- Narayan Murthy CommitteeDocument3 pagesNarayan Murthy CommitteeAnwar KhanNo ratings yet

- Business Setup in IndiaDocument10 pagesBusiness Setup in IndiaCompany Legal GroupNo ratings yet

- Independent DirectorDocument28 pagesIndependent DirectorVasvi Aren100% (1)

- Code of Corporate Governance As Issued by Bangladesh Securities Exchange Commission in 2006 and Subsequent Modifications To Highlight Measures Aimed at Better Financial ManagementDocument4 pagesCode of Corporate Governance As Issued by Bangladesh Securities Exchange Commission in 2006 and Subsequent Modifications To Highlight Measures Aimed at Better Financial ManagementMahin KhanNo ratings yet

- Corporate Tax PlanningDocument18 pagesCorporate Tax PlanningSANDEEP KUMARNo ratings yet

- Corporate Governance and Insider TradingDocument10 pagesCorporate Governance and Insider TradingSrijesh SinghNo ratings yet

- Law NotesDocument16 pagesLaw NotesUmar FarooqNo ratings yet

- Role of CFODocument3 pagesRole of CFOTara GilaniNo ratings yet

- Establishment of Branch Office Outside India: Contributed by CA. Sudha G. BhushanDocument5 pagesEstablishment of Branch Office Outside India: Contributed by CA. Sudha G. BhushanTaxpert mukeshNo ratings yet

- Assignment 4: Submitted By: Shams Ur Rehman 9772Document5 pagesAssignment 4: Submitted By: Shams Ur Rehman 9772Yasir KhanNo ratings yet

- Medicines, Drugs, PharmaceuticalDocument3 pagesMedicines, Drugs, PharmaceuticalRahul PambharNo ratings yet

- Pharmaceutical Manufacturers and ImpoterDocument6 pagesPharmaceutical Manufacturers and ImpoterRahul PambharNo ratings yet

- Pharmaceutical MNFDocument4 pagesPharmaceutical MNFRahul PambharNo ratings yet

- How To Use The Brazilian Catalogue of Importers (CIB)Document3 pagesHow To Use The Brazilian Catalogue of Importers (CIB)Rahul PambharNo ratings yet

- Pharmaceutical Ingredients, Medical Consumables, Pharmaceutical Process Instruments and Laboratory Instruments ImporterDocument1 pagePharmaceutical Ingredients, Medical Consumables, Pharmaceutical Process Instruments and Laboratory Instruments ImporterRahul PambharNo ratings yet

- Pharmaceuticals CompanyDocument14 pagesPharmaceuticals CompanyRahul Pambhar100% (1)

- Select Chamber of Commerce and FIEsDocument7 pagesSelect Chamber of Commerce and FIEsRahul PambharNo ratings yet

- Pharmaceutical Manufacturers in ArgentinaDocument2 pagesPharmaceutical Manufacturers in ArgentinaRahul PambharNo ratings yet

- Pharma - Med Importers ListDocument2 pagesPharma - Med Importers ListRahul PambharNo ratings yet

- Laboratories in Argentina ListDocument2 pagesLaboratories in Argentina ListRahul PambharNo ratings yet

- How To Use The Brazilian Suppliers WebsiteDocument2 pagesHow To Use The Brazilian Suppliers WebsiteRahul PambharNo ratings yet

- Trading Companies MontenegroDocument3 pagesTrading Companies MontenegroRahul PambharNo ratings yet

- N Heptanol SpecsDocument1 pageN Heptanol SpecsRahul PambharNo ratings yet

- 21 Choong Y. Lee PDFDocument8 pages21 Choong Y. Lee PDFRahul PambharNo ratings yet

- Aloha Case StudyDocument5 pagesAloha Case StudyRahul PambharNo ratings yet

- 1511002267gls Private University - Ugc Initial Information Report 2015Document143 pages1511002267gls Private University - Ugc Initial Information Report 2015Rahul PambharNo ratings yet

- 2017 11 06 AE Lansetal PDFDocument8 pages2017 11 06 AE Lansetal PDFRahul PambharNo ratings yet

- Equivalent PayscalesDocument2 pagesEquivalent PayscalespikluNo ratings yet

- Date Particulars Withdrawals Deposits Balance: 29-MAY-2020 by Transfer Loan Payment TRF FR 0078027564060 110000 1698.37Document1 pageDate Particulars Withdrawals Deposits Balance: 29-MAY-2020 by Transfer Loan Payment TRF FR 0078027564060 110000 1698.37Rahul PambharNo ratings yet

- Activity Resource Usage Model & Tactical Decision MakingDocument34 pagesActivity Resource Usage Model & Tactical Decision MakingRahul PambharNo ratings yet

- AB Thorsten Case StudyDocument6 pagesAB Thorsten Case StudyRahul PambharNo ratings yet

- VOIS - CARE Advisor - JDDocument1 pageVOIS - CARE Advisor - JDRahul PambharNo ratings yet

- EssayDocument7 pagesEssayGiana ObejasNo ratings yet

- GBF Unit - IVDocument50 pagesGBF Unit - IVKaliyapersrinivasanNo ratings yet

- Quiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditDocument2 pagesQuiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditEzra Mikah G. CaalimNo ratings yet

- The Great Vatican-Jesuit Global Depression of 2009-2012Document25 pagesThe Great Vatican-Jesuit Global Depression of 2009-2012GrnEydGuy100% (1)

- Collateral Management AgendaDocument17 pagesCollateral Management AgendaSpikeNo ratings yet

- Chapter 4 DerivativesDocument38 pagesChapter 4 DerivativesTamrat KindeNo ratings yet

- Ratio AnalysisDocument57 pagesRatio AnalysisASEEM860No ratings yet

- Mergers and Acquisitions: Rizki Nur Sa'diyah 041711333143 Dina Indriana 042024253016 Darojatum Muthi'atur R 042024253030Document28 pagesMergers and Acquisitions: Rizki Nur Sa'diyah 041711333143 Dina Indriana 042024253016 Darojatum Muthi'atur R 042024253030rizki nurNo ratings yet

- COA CIRCULAR NO. 2021 014 December 22 2021Document14 pagesCOA CIRCULAR NO. 2021 014 December 22 2021juanNo ratings yet

- Financial Management Strategy FinalDocument24 pagesFinancial Management Strategy FinalsayedhossainNo ratings yet

- Corp Law Outline 5 - 2020Document4 pagesCorp Law Outline 5 - 2020Effy SantosNo ratings yet

- TSL Further Proof 159 Notice Rev1 ManishaDocument20 pagesTSL Further Proof 159 Notice Rev1 Manishamanishaghadage47817No ratings yet

- KTU MBA First Three Trimesters-Syllabus For WebsiteDocument24 pagesKTU MBA First Three Trimesters-Syllabus For WebsiteSreenath NairNo ratings yet

- Financial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedDocument9 pagesFinancial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedPremier PublishersNo ratings yet

- Bank of Baroda Health Insurance FormDocument2 pagesBank of Baroda Health Insurance FormAnkur Agarwal100% (1)

- Status of Ecommerce in NepalDocument4 pagesStatus of Ecommerce in NepalSuraj Thapa100% (1)

- Estimation of Doubtful Accounts (Chapter 5)Document12 pagesEstimation of Doubtful Accounts (Chapter 5)chingNo ratings yet

- IAS 17 Leases STDocument11 pagesIAS 17 Leases STDesmanto HermanNo ratings yet

- Banque de FranceDocument10 pagesBanque de FranceBianca GabrielaNo ratings yet

- Customer Relationship Management (CRM)Document28 pagesCustomer Relationship Management (CRM)Chirag SabhayaNo ratings yet

- Sa1 Ae 121 - TheoriesDocument6 pagesSa1 Ae 121 - TheoriesMariette Alex AgbanlogNo ratings yet

- Growth StrategyDocument25 pagesGrowth StrategyJoyce Anne P. BandaNo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of Accountschristine anglaNo ratings yet

- CH 4 4-35 SpreadsheetDocument34 pagesCH 4 4-35 Spreadsheetcherishwisdom_997598No ratings yet

- Module 7 - Tax ExercisesDocument3 pagesModule 7 - Tax ExercisesjessafesalazarNo ratings yet

- Investors Guide in The Agricultural Sector in MoroccoDocument88 pagesInvestors Guide in The Agricultural Sector in MoroccoElhanid MohamedNo ratings yet

- Maths McqsDocument10 pagesMaths McqsafeeraNo ratings yet

- MAS2 BSAIS 2D Interest Rate and Return PPT 2Document172 pagesMAS2 BSAIS 2D Interest Rate and Return PPT 2Henry RufinoNo ratings yet

- 3.3b. 7 Scenarios Worksheet and PromptDocument3 pages3.3b. 7 Scenarios Worksheet and Promptkartik lakhotiyaNo ratings yet