Professional Documents

Culture Documents

Jyske Bank Case Analysis

Jyske Bank Case Analysis

Uploaded by

Ruchika SinghCopyright:

Available Formats

You might also like

- Roush Performance: How To Design A Sales Force Compensation PlanDocument2 pagesRoush Performance: How To Design A Sales Force Compensation PlanRuchika SinghNo ratings yet

- CASE 6 QUESTIONS - People, Service, and Profit at Jyske BankDocument3 pagesCASE 6 QUESTIONS - People, Service, and Profit at Jyske BankAnonymous 1CJrzysV100% (1)

- Test Bank For Sociology For The 21st Century Census Update 5th Edition Tim CurryDocument10 pagesTest Bank For Sociology For The 21st Century Census Update 5th Edition Tim CurryNathan Cook100% (30)

- Strategic Plan For Coffee eDocument14 pagesStrategic Plan For Coffee eCarla Flor LosiñadaNo ratings yet

- Kinko'solutinDocument5 pagesKinko'solutintmalkawiNo ratings yet

- Performance Appraisal System of AB Bank LTDDocument67 pagesPerformance Appraisal System of AB Bank LTDMahmud Abdullah100% (1)

- Case 4 Garrick Oil and LubricantsDocument1 pageCase 4 Garrick Oil and LubricantsRuchika SinghNo ratings yet

- Ajit NewspaperDocument27 pagesAjit NewspaperNadeem YousufNo ratings yet

- Auca Press 1Document15 pagesAuca Press 1Dev DuttNo ratings yet

- Jyske Bank MOSDocument10 pagesJyske Bank MOSPallavi GhaiNo ratings yet

- As of The Mid - 1990s, What Was JYSKE Bank's Competitive Positioning, That Is, What Did It Do For Customers Relative To Its Competitors?Document7 pagesAs of The Mid - 1990s, What Was JYSKE Bank's Competitive Positioning, That Is, What Did It Do For Customers Relative To Its Competitors?rana mumeNo ratings yet

- Jyske BankDocument7 pagesJyske BankRashed Rony100% (1)

- Case Presentation ON Jyske Bank: Submitted by - Sidhant Anand Yogesh Singla Venkat Bhanu Prakash JastiDocument19 pagesCase Presentation ON Jyske Bank: Submitted by - Sidhant Anand Yogesh Singla Venkat Bhanu Prakash JastiUtkarsh VardhanNo ratings yet

- Mid-1990's Competitive Positioning (Tangible) New Competitive Positioning (Tangible)Document3 pagesMid-1990's Competitive Positioning (Tangible) New Competitive Positioning (Tangible)Bogs MartinezNo ratings yet

- Jyske BankDocument2 pagesJyske BankWazed Arvi KhanNo ratings yet

- People, Service, and Profit at Jyske BankDocument31 pagesPeople, Service, and Profit at Jyske Bankrana mumeNo ratings yet

- People, Service, and Profit At: Jyske BankDocument12 pagesPeople, Service, and Profit At: Jyske BankArushiRajvanshiNo ratings yet

- Bank CaseDocument8 pagesBank CaseRachitNo ratings yet

- Bank CaseDocument8 pagesBank CaseRachitNo ratings yet

- Bank CaseDocument8 pagesBank CaseRachitNo ratings yet

- Service Marketing: Banking SectorDocument24 pagesService Marketing: Banking Sectormuffadal0307No ratings yet

- Core Banking Article ReviewDocument4 pagesCore Banking Article Reviewbiresaw birhanuNo ratings yet

- Jyske Bank Case Facilitation AnswersDocument8 pagesJyske Bank Case Facilitation AnswersJoey LiaoNo ratings yet

- Peoplesbank (1) NewDocument16 pagesPeoplesbank (1) NewUditha JayamalNo ratings yet

- 2 RB-1Document8 pages2 RB-1Priya RajNo ratings yet

- Case StudyDocument26 pagesCase StudyAnkit RanjanNo ratings yet

- 32 July 1 August 2007 Aba Bank MarkenngDocument8 pages32 July 1 August 2007 Aba Bank MarkenngDaud SulaimanNo ratings yet

- Retail Banking in Singapore - Competitive Landscape2c Opportunities 26 TrendsDocument31 pagesRetail Banking in Singapore - Competitive Landscape2c Opportunities 26 TrendsAbhijeet DashNo ratings yet

- Customer Expectation and Satisfaction:: Channel AmplificationDocument12 pagesCustomer Expectation and Satisfaction:: Channel AmplificationAbhinandan JakharNo ratings yet

- Gap Analysis of Services Offered in Retail BankingDocument90 pagesGap Analysis of Services Offered in Retail BankingSrija KeerthiNo ratings yet

- Banking On Customer Centricity Transforming Banks Into Customer-Centric OrganizationsDocument16 pagesBanking On Customer Centricity Transforming Banks Into Customer-Centric OrganizationsPaul AllenNo ratings yet

- Arzoo Project ReportDocument74 pagesArzoo Project ReportArzoo SharmaNo ratings yet

- Sip Project in Axis BankDocument12 pagesSip Project in Axis BankSwarup DeshbhratarNo ratings yet

- Mission/ Vision Statement: Business PhillosophyDocument77 pagesMission/ Vision Statement: Business Phillosophybilal_juttttNo ratings yet

- Case-Commerce Bank: Submitted By, Debarghya Das PRN No.18021141033Document5 pagesCase-Commerce Bank: Submitted By, Debarghya Das PRN No.18021141033Rocking Heartbroker DebNo ratings yet

- Superior Customer Experiance Vs Customer Service (JK)Document109 pagesSuperior Customer Experiance Vs Customer Service (JK)Dawit TesfayeNo ratings yet

- 2012 KPMG Nigeria Banking Industry Customer Satisfaction Survey Final PDFDocument32 pages2012 KPMG Nigeria Banking Industry Customer Satisfaction Survey Final PDFShadowfax_uNo ratings yet

- EY Global Consumer Banking Survey 2014Document48 pagesEY Global Consumer Banking Survey 2014ohmygodNo ratings yet

- Axis BankDocument13 pagesAxis BankAbhishek Paunikar0% (1)

- Assignment On The Culture of Mutual Trust Bank LimitedDocument2 pagesAssignment On The Culture of Mutual Trust Bank LimitedMobarok HossainNo ratings yet

- S.K.Somaiya College of Arts, Science & Commerce: Subject: Customer Relationship ManagementDocument15 pagesS.K.Somaiya College of Arts, Science & Commerce: Subject: Customer Relationship ManagementNidhi NagdaNo ratings yet

- Customer Relationship Management Strategies of PNB and Dena BanksDocument17 pagesCustomer Relationship Management Strategies of PNB and Dena BanksRohit Semlani100% (1)

- Group 3, 7th PresentorDocument28 pagesGroup 3, 7th PresentorAllan EbitnerNo ratings yet

- Varsha Project FinalizedDocument77 pagesVarsha Project FinalizedaskarbyaaribyaariNo ratings yet

- Banking On Customer Centricity PDFDocument16 pagesBanking On Customer Centricity PDFLeandro DuranNo ratings yet

- Final Project Report Scdl50Document36 pagesFinal Project Report Scdl50rahulNo ratings yet

- ACCY936 - Management Information Systems Business Report Commonwealth Bank of AustraliaDocument13 pagesACCY936 - Management Information Systems Business Report Commonwealth Bank of AustraliaMuskaan BashaniNo ratings yet

- Dashen Bank InternshipDocument5 pagesDashen Bank InternshipShewit Desta100% (1)

- Guest SlidesDocument474 pagesGuest Slidesnikaro1989No ratings yet

- Peppers Rogers Customer Experience in Retail Banking ArticleDocument30 pagesPeppers Rogers Customer Experience in Retail Banking ArticleSameer_Khan_60No ratings yet

- Focusing On Your Customer Sept 2011Document8 pagesFocusing On Your Customer Sept 2011EY VenezuelaNo ratings yet

- Vineet Project Report Part 2Document15 pagesVineet Project Report Part 2Shreya BatraNo ratings yet

- 177 PresentationDocument29 pages177 PresentationCzarina Ella GallegosNo ratings yet

- National BankDocument60 pagesNational BankMridhaDeAlamNo ratings yet

- 1.1 BackgroundDocument43 pages1.1 BackgroundKrishna KunwarNo ratings yet

- Grand Project ReportDocument127 pagesGrand Project ReportVinay VinayNo ratings yet

- Internship On Nepal Bank LimitedDocument12 pagesInternship On Nepal Bank Limitedsabita100% (2)

- Introduction and Design of The Study: Chapter - IDocument12 pagesIntroduction and Design of The Study: Chapter - IDrSankar CNo ratings yet

- Project Report On Effectiveness of Customer Relationship Management Programme in SBI - 151239135Document74 pagesProject Report On Effectiveness of Customer Relationship Management Programme in SBI - 151239135SudeshNo ratings yet

- Banking ServicesDocument27 pagesBanking ServicesChintan JainNo ratings yet

- Persenting By:: M S Shrikanth (09sje371)Document21 pagesPersenting By:: M S Shrikanth (09sje371)prave_enNo ratings yet

- The Customer Driven Company (Review and Analysis of Whiteley's Book)From EverandThe Customer Driven Company (Review and Analysis of Whiteley's Book)No ratings yet

- The 7 Fundamentals of Loyalty: A Guide to Building Strong Customer RelationshipsFrom EverandThe 7 Fundamentals of Loyalty: A Guide to Building Strong Customer RelationshipsNo ratings yet

- Super7 Operations: The Next Step for Lean in Financial ServicesFrom EverandSuper7 Operations: The Next Step for Lean in Financial ServicesNo ratings yet

- Ecosystem Services To The SocietyDocument2 pagesEcosystem Services To The SocietyRuchika SinghNo ratings yet

- CF Assignment Maruti SuzukiDocument6 pagesCF Assignment Maruti SuzukiRuchika SinghNo ratings yet

- Types of Doji PatternDocument3 pagesTypes of Doji PatternRuchika SinghNo ratings yet

- Review 3 - Journal Submission Format: Team Number Title (New)Document28 pagesReview 3 - Journal Submission Format: Team Number Title (New)Ruchika SinghNo ratings yet

- Selling Process & Selling Skills - Group 6Document10 pagesSelling Process & Selling Skills - Group 6Ruchika SinghNo ratings yet

- Berger Pant IndividualDocument17 pagesBerger Pant IndividualRuchika SinghNo ratings yet

- Training and Territory AllocationDocument17 pagesTraining and Territory AllocationRuchika SinghNo ratings yet

- SMBD Case Study 1Document2 pagesSMBD Case Study 1Ruchika SinghNo ratings yet

- Ethics in Sales and Business DevelopmentDocument10 pagesEthics in Sales and Business DevelopmentRuchika SinghNo ratings yet

- RUCHIKA SINGH PORTFOLIO 1955xlsxDocument14 pagesRUCHIKA SINGH PORTFOLIO 1955xlsxRuchika SinghNo ratings yet

- Consumer Behaviour Parle GDocument5 pagesConsumer Behaviour Parle GRuchika SinghNo ratings yet

- Supply Chain Performance: Achieving Strategic Fit and ScopeDocument19 pagesSupply Chain Performance: Achieving Strategic Fit and ScopeRuchika SinghNo ratings yet

- Before Ai in Finance Sector: Customer ServiceDocument2 pagesBefore Ai in Finance Sector: Customer ServiceRuchika SinghNo ratings yet

- Case 7 Hasseur CaseDocument3 pagesCase 7 Hasseur CaseRuchika SinghNo ratings yet

- Group 13 (Candlestick)Document17 pagesGroup 13 (Candlestick)Ruchika SinghNo ratings yet

- EthnocentrismDocument7 pagesEthnocentrismRuchika SinghNo ratings yet

- Godrej Consumer ProductsDocument6 pagesGodrej Consumer ProductsRuchika SinghNo ratings yet

- Post Graduate Diploma in Management (Term-IV Batch 2019-21)Document7 pagesPost Graduate Diploma in Management (Term-IV Batch 2019-21)Ruchika SinghNo ratings yet

- Report of Monument and PatternsDocument23 pagesReport of Monument and PatternsMAHEEN FATIMANo ratings yet

- Top Picks - Axis-November2021Document79 pagesTop Picks - Axis-November2021Tejesh GoudNo ratings yet

- Rizal Life Works BL Guide Quiz 12 and PrelimDocument15 pagesRizal Life Works BL Guide Quiz 12 and PrelimCarla Mae Alcantara100% (1)

- Bahasa Indonesia SMA Kelas XI (Bahasa) - Nurita Bayu Kusmayati-2009Document290 pagesBahasa Indonesia SMA Kelas XI (Bahasa) - Nurita Bayu Kusmayati-2009Deasy Murdiana100% (1)

- TTSB Company Profile (Full Set - 1 of 3)Document18 pagesTTSB Company Profile (Full Set - 1 of 3)zaihasren0% (1)

- St. Martin vs. LWVDocument2 pagesSt. Martin vs. LWVBaby T. Agcopra100% (5)

- Mary Mock Demurrer To 2nd Amended ComplaintDocument19 pagesMary Mock Demurrer To 2nd Amended ComplaintrongottschalkNo ratings yet

- Chelsea Vs Newcastle - Google SearchDocument1 pageChelsea Vs Newcastle - Google SearchfortniteplayerzerobuildNo ratings yet

- Ifma Fmpv3-0 F-B Ch2Document87 pagesIfma Fmpv3-0 F-B Ch2Mohamed IbrahimNo ratings yet

- Idioms and Collocations RevisionDocument3 pagesIdioms and Collocations RevisionNgọc TâmNo ratings yet

- Case Comment On Uttam V Saubhag SinghDocument8 pagesCase Comment On Uttam V Saubhag SinghARJU JAMBHULKARNo ratings yet

- Mindmap For Hands Held HighDocument1 pageMindmap For Hands Held Highapi-523333030No ratings yet

- E-Health Care Management Project ReportDocument41 pagesE-Health Care Management Project Reportvikas guptaNo ratings yet

- Akshay Akshay Akshay Akshay Akshay Akshay Akshay Akshay Akshay Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Shrena Shrena Shrena Shrena Shrena Shrena Shrena Shrena ShrenaDocument31 pagesAkshay Akshay Akshay Akshay Akshay Akshay Akshay Akshay Akshay Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Shrena Shrena Shrena Shrena Shrena Shrena Shrena Shrena Shrenaashish_phadNo ratings yet

- Freeman v. Grain Processing Corp., No. 13-0723 (Iowa June 13, 2014)Document63 pagesFreeman v. Grain Processing Corp., No. 13-0723 (Iowa June 13, 2014)RHTNo ratings yet

- Opening SalvoDocument6 pagesOpening SalvoMark James MarmolNo ratings yet

- Building The Divided City - Class, Race and Housing in Inner London 1945-1997Document31 pagesBuilding The Divided City - Class, Race and Housing in Inner London 1945-1997Harold Carter100% (1)

- Critical Analysis On Legal Research in Civil Law Countries and Common Law CountriesDocument6 pagesCritical Analysis On Legal Research in Civil Law Countries and Common Law CountriesAnonymous XuOGlMi100% (1)

- Check My TripDocument3 pagesCheck My TripBabar WaheedNo ratings yet

- Modul Berbicara 1Document49 pagesModul Berbicara 1Alif Satuhu100% (1)

- Assignment 01 MemberManagementDocument9 pagesAssignment 01 MemberManagementDinh Huu Khang (K16HCM)No ratings yet

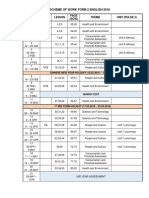

- Scheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Document2 pagesScheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Subramaniam Periannan100% (2)

- Agreements BBG enDocument26 pagesAgreements BBG enRajasheker ReddyNo ratings yet

- Times Leader 04-01-2013Document28 pagesTimes Leader 04-01-2013The Times LeaderNo ratings yet

- Manual For Conflict AnalysisDocument38 pagesManual For Conflict AnalysisNadine KadriNo ratings yet

- Ajay Singh's Empowering Leadership - Reviving SpiceJet From The BrinkDocument17 pagesAjay Singh's Empowering Leadership - Reviving SpiceJet From The BrinkSachinNo ratings yet

- Benjamin Franklin: Huge Pain in My... ExcerptDocument27 pagesBenjamin Franklin: Huge Pain in My... ExcerptDisney PublishingNo ratings yet

Jyske Bank Case Analysis

Jyske Bank Case Analysis

Uploaded by

Ruchika SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jyske Bank Case Analysis

Jyske Bank Case Analysis

Uploaded by

Ruchika SinghCopyright:

Available Formats

JYSKE BANK CASE ANALYSIS

The case talks about JYSKE BANK, which is the third largest bank in Denmark and has been

formed through the merger of 4 Danish Banks, having their operations in Jutland. The case

talks about JYSKE BANK being the market leader in customer satisfaction through their

model called JYSKE FORSKELLE, and the practices they adopted to satisfy the customer to

their best.

The model’s name JYSKE FORSKELLE has the meaning of JYSKE differences. That

means, although initially the bank followed the traditional banking approach then it felt to

bring some differences from its core values in customer services comparing to its

competitors. The main goal of this difference was changing product oriented JYSKE BANK

to customer oriented bank.

JYSKE bank had introduced the 5 dimensions of service quality in its core values of

operations. This relationship between core values and 5 basic service quality dimensions are:

Core Value Service Quality Dimension

Effective and sustainable Reliability

Open and honest Assurance

Common-sense Responsiveness

Genuine interest and Equal respect Empathy

Physical innovations in service Tangible

Academy of management led these values to revaluate how the Bank has with their

customers. The manager knew that if these values, they changed their conservative attitude of

the past and a service, which should be distributed and innovative Bank wished to remain

faithful to the customers within a competitive banking sector.

Tangible aspect of jyske bank:-

Reorganizing around account team and primary point of contact so that their customers are

well-served and understood, Redesigning branches with modern architect, warm colors,

original art and round tables, letting customers sit next to bankers, providing coffee for

customers, juice and play area for kids in order to make customers feel more welcome.

Besides, the bank focuses on every detail like employees’ photo on business card.

Intangible aspect of jyske bank:

Training employees in team building and customer service (caring, asking,

listening).Changing management style to thinking strategically and leading change through

coaching, selection of new hirers for social abilities, values and attitudes, using IT tools and

creating Jyske “way of life”. Designing support system and technology for employees and

Making efficient internal communication with video of Jyske differences, Jyske fun.

GAP MODEL OF JYSKE BANK:

1. Customer Gap:

• The customer gap was very less as the bank was able to provide customers with

their superior services.

• They had only targeted the premium customers to whom the price was not matter.

As a result of which they were able to provide the customers high quality services

and were able to achieve minimum customer gap and highly satisfied customers.

2. Providers gap :

• The listening gap was very less, as with the introduction of Jyske Forkselle, the

bank had come out with IT tool to first figure out the customers problem and

expectations

• The bank was successfully able to close this gap. The bank provided its customers

with the best in class service in terms of the customer solutions and also provided

customers with the best infrastructure facilities to make them feel at home.

• The communication gap was very low. The bank provided the customers with all

the possible information that the customer required and also provided the customer

with all the solutions.

CONCLUSION:

At last after studying the case and I can say that, JYSKE bank’s present competitive

market positioning is pretty right and it is going well. But beside that it must handle daily

customer encounters properly and if any failure occurred then JYSKE must fulfill service

recovery expectations of each customer by following service recovery strategies properly.

You might also like

- Roush Performance: How To Design A Sales Force Compensation PlanDocument2 pagesRoush Performance: How To Design A Sales Force Compensation PlanRuchika SinghNo ratings yet

- CASE 6 QUESTIONS - People, Service, and Profit at Jyske BankDocument3 pagesCASE 6 QUESTIONS - People, Service, and Profit at Jyske BankAnonymous 1CJrzysV100% (1)

- Test Bank For Sociology For The 21st Century Census Update 5th Edition Tim CurryDocument10 pagesTest Bank For Sociology For The 21st Century Census Update 5th Edition Tim CurryNathan Cook100% (30)

- Strategic Plan For Coffee eDocument14 pagesStrategic Plan For Coffee eCarla Flor LosiñadaNo ratings yet

- Kinko'solutinDocument5 pagesKinko'solutintmalkawiNo ratings yet

- Performance Appraisal System of AB Bank LTDDocument67 pagesPerformance Appraisal System of AB Bank LTDMahmud Abdullah100% (1)

- Case 4 Garrick Oil and LubricantsDocument1 pageCase 4 Garrick Oil and LubricantsRuchika SinghNo ratings yet

- Ajit NewspaperDocument27 pagesAjit NewspaperNadeem YousufNo ratings yet

- Auca Press 1Document15 pagesAuca Press 1Dev DuttNo ratings yet

- Jyske Bank MOSDocument10 pagesJyske Bank MOSPallavi GhaiNo ratings yet

- As of The Mid - 1990s, What Was JYSKE Bank's Competitive Positioning, That Is, What Did It Do For Customers Relative To Its Competitors?Document7 pagesAs of The Mid - 1990s, What Was JYSKE Bank's Competitive Positioning, That Is, What Did It Do For Customers Relative To Its Competitors?rana mumeNo ratings yet

- Jyske BankDocument7 pagesJyske BankRashed Rony100% (1)

- Case Presentation ON Jyske Bank: Submitted by - Sidhant Anand Yogesh Singla Venkat Bhanu Prakash JastiDocument19 pagesCase Presentation ON Jyske Bank: Submitted by - Sidhant Anand Yogesh Singla Venkat Bhanu Prakash JastiUtkarsh VardhanNo ratings yet

- Mid-1990's Competitive Positioning (Tangible) New Competitive Positioning (Tangible)Document3 pagesMid-1990's Competitive Positioning (Tangible) New Competitive Positioning (Tangible)Bogs MartinezNo ratings yet

- Jyske BankDocument2 pagesJyske BankWazed Arvi KhanNo ratings yet

- People, Service, and Profit at Jyske BankDocument31 pagesPeople, Service, and Profit at Jyske Bankrana mumeNo ratings yet

- People, Service, and Profit At: Jyske BankDocument12 pagesPeople, Service, and Profit At: Jyske BankArushiRajvanshiNo ratings yet

- Bank CaseDocument8 pagesBank CaseRachitNo ratings yet

- Bank CaseDocument8 pagesBank CaseRachitNo ratings yet

- Bank CaseDocument8 pagesBank CaseRachitNo ratings yet

- Service Marketing: Banking SectorDocument24 pagesService Marketing: Banking Sectormuffadal0307No ratings yet

- Core Banking Article ReviewDocument4 pagesCore Banking Article Reviewbiresaw birhanuNo ratings yet

- Jyske Bank Case Facilitation AnswersDocument8 pagesJyske Bank Case Facilitation AnswersJoey LiaoNo ratings yet

- Peoplesbank (1) NewDocument16 pagesPeoplesbank (1) NewUditha JayamalNo ratings yet

- 2 RB-1Document8 pages2 RB-1Priya RajNo ratings yet

- Case StudyDocument26 pagesCase StudyAnkit RanjanNo ratings yet

- 32 July 1 August 2007 Aba Bank MarkenngDocument8 pages32 July 1 August 2007 Aba Bank MarkenngDaud SulaimanNo ratings yet

- Retail Banking in Singapore - Competitive Landscape2c Opportunities 26 TrendsDocument31 pagesRetail Banking in Singapore - Competitive Landscape2c Opportunities 26 TrendsAbhijeet DashNo ratings yet

- Customer Expectation and Satisfaction:: Channel AmplificationDocument12 pagesCustomer Expectation and Satisfaction:: Channel AmplificationAbhinandan JakharNo ratings yet

- Gap Analysis of Services Offered in Retail BankingDocument90 pagesGap Analysis of Services Offered in Retail BankingSrija KeerthiNo ratings yet

- Banking On Customer Centricity Transforming Banks Into Customer-Centric OrganizationsDocument16 pagesBanking On Customer Centricity Transforming Banks Into Customer-Centric OrganizationsPaul AllenNo ratings yet

- Arzoo Project ReportDocument74 pagesArzoo Project ReportArzoo SharmaNo ratings yet

- Sip Project in Axis BankDocument12 pagesSip Project in Axis BankSwarup DeshbhratarNo ratings yet

- Mission/ Vision Statement: Business PhillosophyDocument77 pagesMission/ Vision Statement: Business Phillosophybilal_juttttNo ratings yet

- Case-Commerce Bank: Submitted By, Debarghya Das PRN No.18021141033Document5 pagesCase-Commerce Bank: Submitted By, Debarghya Das PRN No.18021141033Rocking Heartbroker DebNo ratings yet

- Superior Customer Experiance Vs Customer Service (JK)Document109 pagesSuperior Customer Experiance Vs Customer Service (JK)Dawit TesfayeNo ratings yet

- 2012 KPMG Nigeria Banking Industry Customer Satisfaction Survey Final PDFDocument32 pages2012 KPMG Nigeria Banking Industry Customer Satisfaction Survey Final PDFShadowfax_uNo ratings yet

- EY Global Consumer Banking Survey 2014Document48 pagesEY Global Consumer Banking Survey 2014ohmygodNo ratings yet

- Axis BankDocument13 pagesAxis BankAbhishek Paunikar0% (1)

- Assignment On The Culture of Mutual Trust Bank LimitedDocument2 pagesAssignment On The Culture of Mutual Trust Bank LimitedMobarok HossainNo ratings yet

- S.K.Somaiya College of Arts, Science & Commerce: Subject: Customer Relationship ManagementDocument15 pagesS.K.Somaiya College of Arts, Science & Commerce: Subject: Customer Relationship ManagementNidhi NagdaNo ratings yet

- Customer Relationship Management Strategies of PNB and Dena BanksDocument17 pagesCustomer Relationship Management Strategies of PNB and Dena BanksRohit Semlani100% (1)

- Group 3, 7th PresentorDocument28 pagesGroup 3, 7th PresentorAllan EbitnerNo ratings yet

- Varsha Project FinalizedDocument77 pagesVarsha Project FinalizedaskarbyaaribyaariNo ratings yet

- Banking On Customer Centricity PDFDocument16 pagesBanking On Customer Centricity PDFLeandro DuranNo ratings yet

- Final Project Report Scdl50Document36 pagesFinal Project Report Scdl50rahulNo ratings yet

- ACCY936 - Management Information Systems Business Report Commonwealth Bank of AustraliaDocument13 pagesACCY936 - Management Information Systems Business Report Commonwealth Bank of AustraliaMuskaan BashaniNo ratings yet

- Dashen Bank InternshipDocument5 pagesDashen Bank InternshipShewit Desta100% (1)

- Guest SlidesDocument474 pagesGuest Slidesnikaro1989No ratings yet

- Peppers Rogers Customer Experience in Retail Banking ArticleDocument30 pagesPeppers Rogers Customer Experience in Retail Banking ArticleSameer_Khan_60No ratings yet

- Focusing On Your Customer Sept 2011Document8 pagesFocusing On Your Customer Sept 2011EY VenezuelaNo ratings yet

- Vineet Project Report Part 2Document15 pagesVineet Project Report Part 2Shreya BatraNo ratings yet

- 177 PresentationDocument29 pages177 PresentationCzarina Ella GallegosNo ratings yet

- National BankDocument60 pagesNational BankMridhaDeAlamNo ratings yet

- 1.1 BackgroundDocument43 pages1.1 BackgroundKrishna KunwarNo ratings yet

- Grand Project ReportDocument127 pagesGrand Project ReportVinay VinayNo ratings yet

- Internship On Nepal Bank LimitedDocument12 pagesInternship On Nepal Bank Limitedsabita100% (2)

- Introduction and Design of The Study: Chapter - IDocument12 pagesIntroduction and Design of The Study: Chapter - IDrSankar CNo ratings yet

- Project Report On Effectiveness of Customer Relationship Management Programme in SBI - 151239135Document74 pagesProject Report On Effectiveness of Customer Relationship Management Programme in SBI - 151239135SudeshNo ratings yet

- Banking ServicesDocument27 pagesBanking ServicesChintan JainNo ratings yet

- Persenting By:: M S Shrikanth (09sje371)Document21 pagesPersenting By:: M S Shrikanth (09sje371)prave_enNo ratings yet

- The Customer Driven Company (Review and Analysis of Whiteley's Book)From EverandThe Customer Driven Company (Review and Analysis of Whiteley's Book)No ratings yet

- The 7 Fundamentals of Loyalty: A Guide to Building Strong Customer RelationshipsFrom EverandThe 7 Fundamentals of Loyalty: A Guide to Building Strong Customer RelationshipsNo ratings yet

- Super7 Operations: The Next Step for Lean in Financial ServicesFrom EverandSuper7 Operations: The Next Step for Lean in Financial ServicesNo ratings yet

- Ecosystem Services To The SocietyDocument2 pagesEcosystem Services To The SocietyRuchika SinghNo ratings yet

- CF Assignment Maruti SuzukiDocument6 pagesCF Assignment Maruti SuzukiRuchika SinghNo ratings yet

- Types of Doji PatternDocument3 pagesTypes of Doji PatternRuchika SinghNo ratings yet

- Review 3 - Journal Submission Format: Team Number Title (New)Document28 pagesReview 3 - Journal Submission Format: Team Number Title (New)Ruchika SinghNo ratings yet

- Selling Process & Selling Skills - Group 6Document10 pagesSelling Process & Selling Skills - Group 6Ruchika SinghNo ratings yet

- Berger Pant IndividualDocument17 pagesBerger Pant IndividualRuchika SinghNo ratings yet

- Training and Territory AllocationDocument17 pagesTraining and Territory AllocationRuchika SinghNo ratings yet

- SMBD Case Study 1Document2 pagesSMBD Case Study 1Ruchika SinghNo ratings yet

- Ethics in Sales and Business DevelopmentDocument10 pagesEthics in Sales and Business DevelopmentRuchika SinghNo ratings yet

- RUCHIKA SINGH PORTFOLIO 1955xlsxDocument14 pagesRUCHIKA SINGH PORTFOLIO 1955xlsxRuchika SinghNo ratings yet

- Consumer Behaviour Parle GDocument5 pagesConsumer Behaviour Parle GRuchika SinghNo ratings yet

- Supply Chain Performance: Achieving Strategic Fit and ScopeDocument19 pagesSupply Chain Performance: Achieving Strategic Fit and ScopeRuchika SinghNo ratings yet

- Before Ai in Finance Sector: Customer ServiceDocument2 pagesBefore Ai in Finance Sector: Customer ServiceRuchika SinghNo ratings yet

- Case 7 Hasseur CaseDocument3 pagesCase 7 Hasseur CaseRuchika SinghNo ratings yet

- Group 13 (Candlestick)Document17 pagesGroup 13 (Candlestick)Ruchika SinghNo ratings yet

- EthnocentrismDocument7 pagesEthnocentrismRuchika SinghNo ratings yet

- Godrej Consumer ProductsDocument6 pagesGodrej Consumer ProductsRuchika SinghNo ratings yet

- Post Graduate Diploma in Management (Term-IV Batch 2019-21)Document7 pagesPost Graduate Diploma in Management (Term-IV Batch 2019-21)Ruchika SinghNo ratings yet

- Report of Monument and PatternsDocument23 pagesReport of Monument and PatternsMAHEEN FATIMANo ratings yet

- Top Picks - Axis-November2021Document79 pagesTop Picks - Axis-November2021Tejesh GoudNo ratings yet

- Rizal Life Works BL Guide Quiz 12 and PrelimDocument15 pagesRizal Life Works BL Guide Quiz 12 and PrelimCarla Mae Alcantara100% (1)

- Bahasa Indonesia SMA Kelas XI (Bahasa) - Nurita Bayu Kusmayati-2009Document290 pagesBahasa Indonesia SMA Kelas XI (Bahasa) - Nurita Bayu Kusmayati-2009Deasy Murdiana100% (1)

- TTSB Company Profile (Full Set - 1 of 3)Document18 pagesTTSB Company Profile (Full Set - 1 of 3)zaihasren0% (1)

- St. Martin vs. LWVDocument2 pagesSt. Martin vs. LWVBaby T. Agcopra100% (5)

- Mary Mock Demurrer To 2nd Amended ComplaintDocument19 pagesMary Mock Demurrer To 2nd Amended ComplaintrongottschalkNo ratings yet

- Chelsea Vs Newcastle - Google SearchDocument1 pageChelsea Vs Newcastle - Google SearchfortniteplayerzerobuildNo ratings yet

- Ifma Fmpv3-0 F-B Ch2Document87 pagesIfma Fmpv3-0 F-B Ch2Mohamed IbrahimNo ratings yet

- Idioms and Collocations RevisionDocument3 pagesIdioms and Collocations RevisionNgọc TâmNo ratings yet

- Case Comment On Uttam V Saubhag SinghDocument8 pagesCase Comment On Uttam V Saubhag SinghARJU JAMBHULKARNo ratings yet

- Mindmap For Hands Held HighDocument1 pageMindmap For Hands Held Highapi-523333030No ratings yet

- E-Health Care Management Project ReportDocument41 pagesE-Health Care Management Project Reportvikas guptaNo ratings yet

- Akshay Akshay Akshay Akshay Akshay Akshay Akshay Akshay Akshay Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Shrena Shrena Shrena Shrena Shrena Shrena Shrena Shrena ShrenaDocument31 pagesAkshay Akshay Akshay Akshay Akshay Akshay Akshay Akshay Akshay Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Ashis Shrena Shrena Shrena Shrena Shrena Shrena Shrena Shrena Shrenaashish_phadNo ratings yet

- Freeman v. Grain Processing Corp., No. 13-0723 (Iowa June 13, 2014)Document63 pagesFreeman v. Grain Processing Corp., No. 13-0723 (Iowa June 13, 2014)RHTNo ratings yet

- Opening SalvoDocument6 pagesOpening SalvoMark James MarmolNo ratings yet

- Building The Divided City - Class, Race and Housing in Inner London 1945-1997Document31 pagesBuilding The Divided City - Class, Race and Housing in Inner London 1945-1997Harold Carter100% (1)

- Critical Analysis On Legal Research in Civil Law Countries and Common Law CountriesDocument6 pagesCritical Analysis On Legal Research in Civil Law Countries and Common Law CountriesAnonymous XuOGlMi100% (1)

- Check My TripDocument3 pagesCheck My TripBabar WaheedNo ratings yet

- Modul Berbicara 1Document49 pagesModul Berbicara 1Alif Satuhu100% (1)

- Assignment 01 MemberManagementDocument9 pagesAssignment 01 MemberManagementDinh Huu Khang (K16HCM)No ratings yet

- Scheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Document2 pagesScheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Subramaniam Periannan100% (2)

- Agreements BBG enDocument26 pagesAgreements BBG enRajasheker ReddyNo ratings yet

- Times Leader 04-01-2013Document28 pagesTimes Leader 04-01-2013The Times LeaderNo ratings yet

- Manual For Conflict AnalysisDocument38 pagesManual For Conflict AnalysisNadine KadriNo ratings yet

- Ajay Singh's Empowering Leadership - Reviving SpiceJet From The BrinkDocument17 pagesAjay Singh's Empowering Leadership - Reviving SpiceJet From The BrinkSachinNo ratings yet

- Benjamin Franklin: Huge Pain in My... ExcerptDocument27 pagesBenjamin Franklin: Huge Pain in My... ExcerptDisney PublishingNo ratings yet